Uber Technologies, Inc. is revolutionizing the way we navigate our cities and access everyday services, seamlessly integrating mobility, delivery, and logistics into our lives. With its innovative applications and market-leading position, Uber connects millions to ride services, restaurant meals, and essential goods. As the company continues to expand its reach and diversify its offerings, one must consider whether its impressive growth trajectory and strong fundamentals still justify its current market valuation.

Table of contents

Company Description

Uber Technologies, Inc. is a leading technology company founded in 2009 and headquartered in San Francisco, California. Operating across the U.S., Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific, Uber connects consumers with independent providers of various services through its innovative applications. The company primarily operates in three segments: Mobility, which offers ridesharing solutions; Delivery, which facilitates meal and goods delivery; and Freight, which connects carriers and shippers. With a market cap of approximately $189B, Uber is well-positioned in the software industry, continually shaping the future of transportation and logistics through its commitment to innovation and ecosystem development.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Uber Technologies, Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

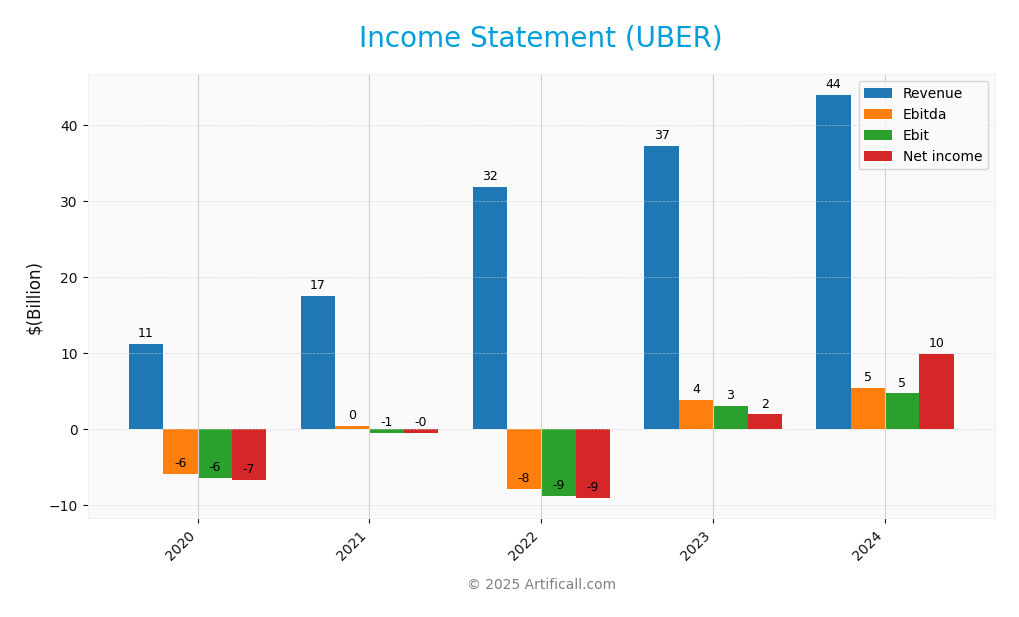

The following table summarizes Uber Technologies, Inc.’s income statement over the past five years, showcasing key financial metrics that are crucial for evaluating the company’s financial health.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 11.14B | 17.46B | 31.88B | 37.28B | 43.98B |

| Cost of Revenue | 5.15B | 9.35B | 19.66B | 22.46B | 26.65B |

| Operating Expenses | 10.85B | 11.94B | 14.05B | 13.71B | 14.53B |

| Gross Profit | 5.99B | 8.10B | 12.22B | 14.82B | 17.33B |

| EBITDA | -5.91B | -0.54B | -7.91B | 3.78B | 5.39B |

| EBIT | -6.49B | -0.54B | -8.86B | 2.95B | 4.65B |

| Interest Expense | 0.46B | 0.48B | 0.57B | 0.63B | 0.52B |

| Net Income | -6.76B | -0.50B | -9.14B | 1.89B | 9.86B |

| EPS | -3.85 | -0.26 | -4.64 | 0.90 | 4.71 |

| Filing Date | 2021-03-01 | 2022-02-24 | 2023-02-21 | 2024-02-15 | 2025-02-14 |

Over the five-year period, Uber has experienced substantial growth in both Revenue and Net Income, with Revenue increasing from 11.14B in 2020 to 43.98B in 2024. Net Income shifted dramatically from a loss of 6.76B in 2020 to a profit of 9.86B in 2024, indicating a successful turnaround. The gross profit margin has shown stability, suggesting effective cost management despite rising operating expenses. In 2024, the company demonstrated a remarkable performance with a significant increase in EBITDA and a robust EPS of 4.71, reflecting strong operational efficiency and a solid growth trajectory.

Financial Ratios

The following table presents the financial ratios for Uber Technologies, Inc. (UBER) over the last few fiscal years, allowing for a clear comparison of performance metrics.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -60.6% | -2.8% | -28.7% | 5.1% | 22.4% |

| ROE | -55.1% | -3.4% | -124.5% | 16.8% | 45.7% |

| ROIC | -17.2% | -6.8% | -7.6% | 3.4% | 16.4% |

| WACC | 8.0% | 8.0% | 8.0% | 8.0% | 8.0% |

| P/E | N/A | N/A | N/A | 66.4 | 12.8 |

| P/B | 7.3 | 5.5 | N/A | 11.1 | 5.9 |

| Current Ratio | 1.4 | 1.0 | 1.0 | 1.2 | 1.1 |

| Quick Ratio | 1.4 | 1.0 | 1.0 | 1.2 | 1.1 |

| D/E | 0.8 | 0.8 | 1.6 | 1.1 | 0.5 |

| Debt-to-Assets | 31.2% | 29.9% | 36.5% | 30.6% | 22.3% |

| Interest Coverage | -10.6 | -7.9 | 0.8 | 1.8 | 5.4 |

| Asset Turnover | 0.33 | 0.45 | 0.99 | 0.96 | 0.86 |

| Fixed Asset Turnover | 3.6 | 5.4 | 9.0 | 11.2 | 14.1 |

| Dividend Yield | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

Interpretation of Financial Ratios

In the most recent year, Uber’s financial ratios indicate a significant recovery, particularly in net margin (22.4%) and ROE (45.7%), showcasing strong profitability and efficient use of equity capital. However, the substantial increase in the P/E ratio to 12.8 may raise concerns about valuation, especially given its recent history of losses.

Evolution of Financial Ratios

Over the past five years, Uber has shown a remarkable turnaround in profitability, transitioning from negative margins and returns to positive figures. The company’s debt ratios have improved, indicating better financial health, while the current and quick ratios remain stable, reflecting adequate liquidity management.

Distribution Policy

Uber Technologies, Inc. does not currently pay dividends, as it is in a high-growth phase focusing on reinvestment and strategic acquisitions. This approach allows the company to enhance its market position and innovate, which aligns with long-term shareholder value creation. Additionally, Uber engages in share buybacks, signaling confidence in its future prospects. Overall, this strategy appears to support sustainable long-term value for shareholders, provided the growth momentum continues.

Sector Analysis

Uber Technologies, Inc. operates in the Software – Application industry, providing innovative mobility, delivery, and freight solutions amid fierce competition from companies like Lyft and DoorDash. Its competitive advantages include a strong brand presence and diverse service offerings.

Strategic Positioning

Uber Technologies, Inc. holds a substantial market share in the ride-sharing and delivery sectors, driven by a diversified business model that includes Mobility, Delivery, and Freight. As of 2025, the company is navigating competitive pressures from both traditional transportation services and new market entrants leveraging advanced technologies. This environment necessitates continuous innovation to mitigate risks associated with technological disruption. With a market cap of approximately $189B, Uber remains a key player, but must strategically adapt to maintain its position amidst evolving consumer preferences and regulatory challenges.

Revenue by Segment

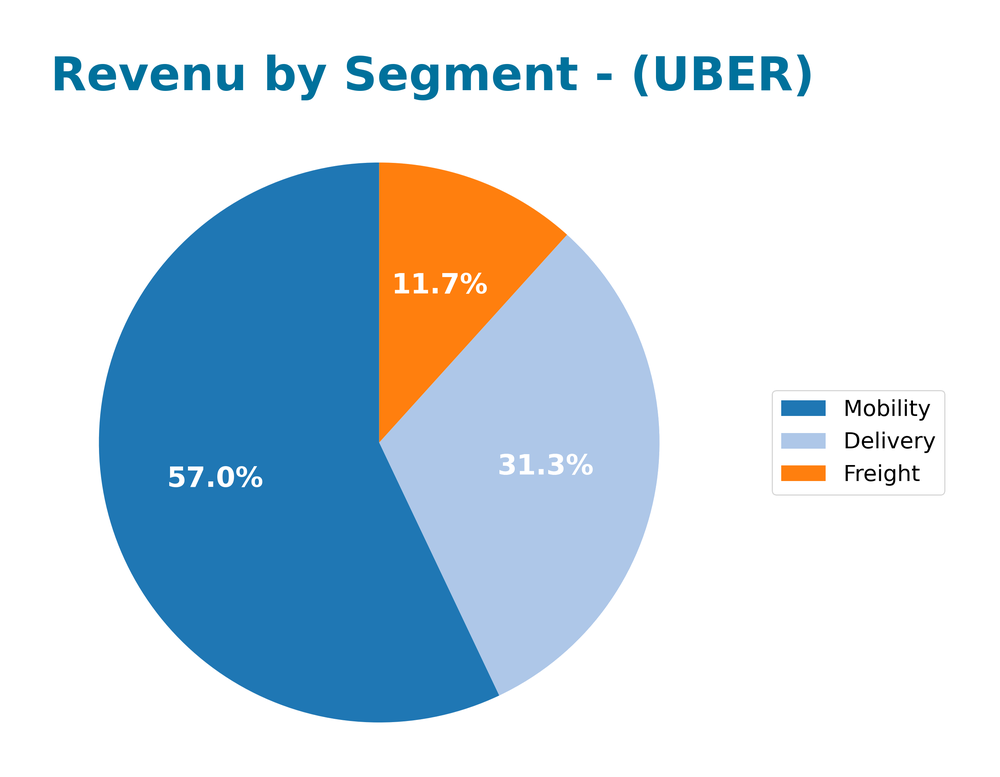

The following chart illustrates Uber’s revenue by segment for the fiscal year 2024, highlighting the performance of key business areas.

In FY 2024, Uber’s revenue segments showed significant growth, with Mobility leading at 25.1B, followed by Delivery at 13.8B and Freight at 5.1B. Notably, the Delivery segment witnessed a robust increase from 12.2B in FY 2023, indicating a shift in consumer preference towards delivery services. Overall, while all segments contributed positively, the growth rate in Mobility appears to have moderated compared to previous years, suggesting potential margin pressures or increased competition. The performance signals the need for strategic focus, particularly on sustaining growth in Mobility amid evolving market dynamics.

Key Products

Uber Technologies, Inc. offers a diverse range of services across various segments. Below is an overview of their key products:

| Product | Description |

|---|---|

| Uber Rides | A ridesharing service connecting riders with drivers using various vehicle types, including cars and bikes. |

| Uber Eats | A food delivery service that allows users to order meals from local restaurants for delivery or pickup. |

| Uber Freight | A logistics platform that connects shippers with carriers, providing transparent pricing and shipment booking. |

| Uber for Business | Tailored services for companies to manage employee transportation and meal deliveries efficiently. |

| Uber Connect | A service allowing users to send packages and documents quickly and easily with nearby drivers. |

These products reflect Uber’s commitment to innovation and versatility in the transportation and delivery sectors, making them a notable player in the technology industry.

Main Competitors

No verified competitors were identified from available data. However, Uber Technologies, Inc. operates in a highly competitive landscape within the technology sector, particularly in the ride-sharing and delivery services markets. The company is estimated to hold a significant market share, bolstered by its diverse service offerings across various regions including North America, Europe, and Asia Pacific.

Competitive Advantages

Uber Technologies, Inc. maintains a strong competitive edge through its diversified service offerings across the Mobility, Delivery, and Freight segments. The company’s proprietary technology enables seamless connections between consumers and service providers, fostering customer loyalty. Looking ahead, Uber is poised to capitalize on emerging markets and expand its product lines, including advanced logistics solutions and innovative delivery options. This positions Uber well to tap into the growing demand for convenience and efficiency in transportation and delivery services, enhancing its market presence and revenue potential.

SWOT Analysis

This SWOT analysis aims to highlight the critical internal and external factors affecting Uber Technologies, Inc. (UBER).

Strengths

- Strong brand recognition

- Diverse service offerings

- Expanding international presence

Weaknesses

- Regulatory challenges

- High operational costs

- Dependence on gig economy

Opportunities

- Growth in delivery services

- Expansion into new markets

- Development of autonomous vehicles

Threats

- Intense competition

- Market volatility

- Economic downturn impacts

Overall, Uber’s strengths position it well for growth, but the company must navigate regulatory and competitive challenges. Strategic focus on innovation and cost management will be crucial for maintaining its market leadership.

Stock Analysis

Over the past year, Uber Technologies, Inc. (ticker: UBER) has experienced significant price movements, culminating in a notable bullish trend. The trading dynamics indicate a strong upward trajectory in the stock price, despite recent fluctuations.

Trend Analysis

Analyzing the stock’s performance over the past year, Uber has shown a remarkable price increase of 47.77%. This significant percentage change confirms a bullish trend. However, it is important to note that the trend is currently experiencing deceleration, with notable price highs reaching 98.51 and lows at 57.58. The standard deviation of 10.77 suggests moderate volatility in price movements.

Volume Analysis

In examining trading volumes over the last three months, the overall activity appears to be seller-driven, with a decreasing volume trend. Total trading volume stands at approximately 11.9B, with buyer volume at 6.85B (57.58%) and seller volume at 4.96B. In the recent period, buyer volume has decreased to 352.94M, while seller volume has increased to 593.50M, indicating a seller-dominant market sentiment. This shift suggests waning investor participation and a cautious outlook among traders.

Analyst Opinions

Recent recommendations for Uber Technologies, Inc. (UBER) indicate a cautious yet optimistic outlook. Analysts maintain a consensus rating of “buy,” with a B+ rating reflecting strong fundamentals. Notably, the return on equity and assets scores received a perfect 5, showcasing effective asset utilization and profitability. Analysts suggest that despite some concerns regarding debt levels (score of 2), the overall financial health remains robust. I align with this consensus, considering Uber’s growth potential and market position in the ride-sharing and food delivery sectors.

Stock Grades

The current stock ratings for Uber Technologies, Inc. (UBER) indicate a consistent level of confidence from various reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | maintain | Buy | 2025-11-05 |

| UBS | maintain | Buy | 2025-11-05 |

| Barclays | maintain | Overweight | 2025-11-05 |

| BMO Capital | maintain | Outperform | 2025-11-05 |

| TD Cowen | maintain | Buy | 2025-11-05 |

| Bernstein | maintain | Outperform | 2025-11-05 |

| Truist Securities | maintain | Buy | 2025-11-05 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-05 |

| Wells Fargo | maintain | Overweight | 2025-11-05 |

| Guggenheim | maintain | Buy | 2025-11-05 |

Overall, the trend in Uber’s stock grades remains positive, with multiple firms maintaining their ratings. The consistent “Buy” and “Overweight” recommendations suggest that analysts are optimistic about Uber’s future performance in the market.

Target Prices

The consensus among analysts for Uber Technologies, Inc. indicates a positive outlook for the stock.

| Target High | Target Low | Consensus |

|---|---|---|

| 140 | 106 | 115.18 |

Overall, analysts expect Uber’s stock to perform within a range that reflects confidence in its future growth potential.

Consumer Opinions

Consumer sentiment towards Uber Technologies, Inc. reflects a dynamic mix of appreciation for convenience and criticism regarding service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Uber provides an excellent user experience and is incredibly convenient.” | “Frequent surge pricing can be frustrating and unpredictable.” |

| “The app is user-friendly and easy to navigate.” | “Driver quality varies significantly, leading to inconsistent experiences.” |

| “Great for getting around town quickly without the hassle of parking.” | “Customer service could be improved; response times are often slow.” |

Overall, consumer feedback highlights Uber’s convenience and user-friendly app as key strengths, while concerns about surge pricing and inconsistent driver quality are recurring weaknesses.

Risk Analysis

In evaluating Uber Technologies, Inc. (UBER), it is essential to understand the various risks that could impact its performance and stock value.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory | Increased scrutiny on gig economy regulations. | High | High |

| Competition | Rising competition from other ride-sharing services. | High | Medium |

| Technological | Cybersecurity threats and data breaches. | Medium | High |

| Market Volatility | Fluctuations in demand due to economic downturns. | Medium | Medium |

| Operational | Issues related to driver supply and retention. | High | Medium |

Recent data indicates that regulatory changes could significantly affect UBER’s operational model, making it a critical risk factor to monitor closely.

Should You Buy Uber Technologies, Inc.?

Uber Technologies, Inc. has demonstrated a positive net margin of 22.41% and a return on invested capital (ROIC) of 16.35%, which exceeds its weighted average cost of capital (WACC) of 9%. However, while the company’s fundamentals have improved, the recent trend shows a bearish movement in the stock price.

A. Favorable signals The company has a strong net margin of 22.41%, indicating effective profitability. Additionally, the ROIC of 16.35% demonstrates value creation, as it is higher than the WACC. The rating of B+ suggests a relatively strong position in the market.

B. Unfavorable signals The recent trend analysis indicates a bearish slope in stock prices, suggesting a lack of momentum. Furthermore, the recent buyer volume of 352.94M is lower than the seller volume of 593.50M, which implies weaker demand from investors.

C. Conclusion Given the positive net margin and the favorable ROIC compared to WACC, Uber Technologies, Inc. might appear favorable for long-term investors. However, due to the recent bearish trend and the current seller dominance, it would be prudent to wait for a more favorable buying environment.

High debt levels and the recent stock price decline present risks that could affect future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Frank Rimerman Advisors LLC Acquires 6,123 Shares of Uber Technologies, Inc. $UBER – MarketBeat (Nov 18, 2025)

- New Zealand’s top court rules that Uber drivers are employees – Reuters (Nov 17, 2025)

- Uber Misses on Profit Even as Rideshare, Delivery Trips Soar – Bloomberg.com (Nov 04, 2025)

- Uber Technologies, Inc. $UBER Stock Position Trimmed by Y.D. More Investments Ltd – MarketBeat (Nov 16, 2025)

- Uber Technologies, Inc. $UBER Stock Holdings Reduced by Raiffeisen Bank International AG – MarketBeat (Nov 17, 2025)

For more information about Uber Technologies, Inc., please visit the official website: uber.com