Imagine a world where your devices understand you as effortlessly as a conversation with a friend. SoundHound AI, Inc. is redefining the landscape of voice artificial intelligence, delivering innovative solutions that enhance customer interactions across various industries. With its flagship Houndify platform, SoundHound empowers brands to create sophisticated conversational voice assistants, positioning itself as a powerhouse in the tech sector. As we examine this intriguing investment opportunity, one must consider whether the company’s strong fundamentals align with its current market valuation and robust growth prospects.

Table of contents

Company Description

SoundHound AI, Inc. (NASDAQ: SOUN) is a pioneering technology company specializing in voice artificial intelligence (AI) solutions. Founded in 2022 and headquartered in Santa Clara, California, the company operates primarily in the U.S. market, offering a robust suite of products through its Houndify platform. This platform empowers brands to create conversational voice assistants that integrate advanced capabilities like automatic speech recognition and natural language understanding. With approximately 842 employees, SoundHound positions itself as a leader in the Software – Application industry, driving innovation in customer engagement. By focusing on high-quality conversational experiences, SoundHound plays a crucial role in shaping the future of voice technology across various sectors.

Fundamental Analysis

In this section, I will analyze SoundHound AI, Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

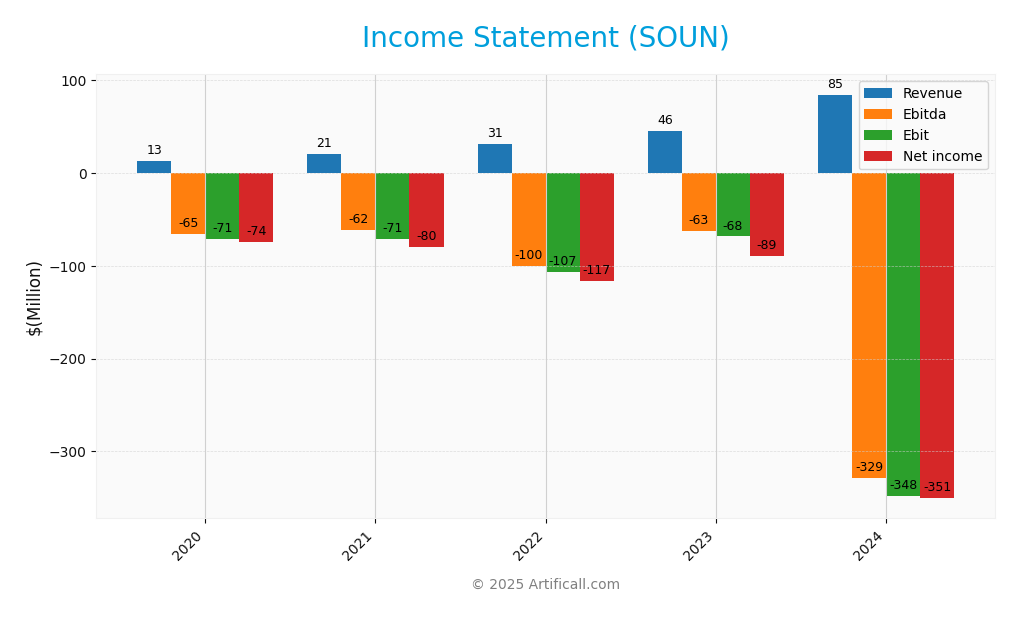

The following table summarizes the income statement of SoundHound AI, Inc. (SOUN) for the fiscal years 2020 to 2024, highlighting key financial metrics.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 13.02M | 21.20M | 31.13M | 45.87M | 84.69M |

| Cost of Revenue | 5.86M | 6.59M | 9.60M | 11.31M | 43.31M |

| Operating Expenses | 73.16M | 79.94M | 127.20M | 103.17M | 382.74M |

| Gross Profit | 7.15M | 14.62M | 21.53M | 34.57M | 41.38M |

| EBITDA | -65.36M | -61.65M | -99.71M | -62.63M | -329.09M |

| EBIT | -71.40M | -70.74M | -106.93M | -68.29M | -347.76M |

| Interest Expense | 2.27M | 8.34M | 6.89M | 16.73M | 12.17M |

| Net Income | -77.59M | -79.54M | -116.71M | -88.94M | -350.68M |

| EPS | 0.00 | -0.40 | -0.74 | -0.40 | -1.04 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2025-03-11 |

Over the period from 2020 to 2024, SoundHound AI, Inc. displayed a significant upward trend in revenue, increasing from 13M to 84M. However, the company continues to struggle with substantial net losses, which widened dramatically in the most recent fiscal year to approximately 351M. The operating expenses surged, reflecting increased investment in research and development, which may indicate a strategy to capture more market share. Despite higher revenues, the negative EBITDA and net income suggest ongoing challenges in achieving profitability, highlighting the importance of risk management in decision-making for potential investors.

Financial Ratios

The table below presents key financial ratios for SoundHound AI, Inc. over the last few years, allowing us to analyze its financial health and operational performance.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -5.72% | -3.75% | -3.75% | -1.94% | -4.14% |

| ROE | -0.27 | 0.23 | 3.19 | -3.16 | -1.92 |

| ROIC | -1.69 | -2.54 | 180.64 | -0.55 | -0.68 |

| WACC | N/A | N/A | N/A | N/A | N/A |

| P/E | -1.76 | -18.86 | -2.39 | -5.47 | -19.15 |

| P/B | -0.47 | -4.37 | -7.62 | 17.26 | 36.76 |

| Current Ratio | 2.00 | 0.31 | 0.46 | 4.69 | 3.77 |

| Quick Ratio | 2.00 | 0.31 | 0.46 | 4.69 | 3.77 |

| D/E | -0.06 | -0.21 | 1.16 | 3.20 | 0.02 |

| Debt-to-Assets | 0.26 | 1.49 | 1.16 | 0.60 | 0.01 |

| Interest Coverage | -29.09 | -7.83 | -15.33 | -4.10 | -28.05 |

| Asset Turnover | 0.20 | 0.43 | 0.82 | 0.30 | 0.15 |

| Fixed Asset Turnover | 1.25 | 1.29 | 2.69 | 6.82 | 14.28 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In the most recent year, SoundHound AI, Inc. shows significant weaknesses across most ratios. The negative net margin (-4.14%) indicates a lack of profitability, while the return on equity (ROE) of -1.92 suggests poor returns on shareholder investment. The high P/B ratio (36.76) raises concerns about potential overvaluation. Furthermore, the interest coverage ratio of -28.05 indicates severe difficulties in covering interest expenses, which is a major red flag for investors.

Evolution of Financial Ratios

Over the past five years, SoundHound’s financial ratios reveal a concerning trend. While there were brief improvements in some areas, such as current and quick ratios peaking in 2023, most profitability metrics, including net margin and ROE, have remained persistently negative or unstable. This raises questions about the company’s financial sustainability and operational effectiveness moving forward.

Distribution Policy

SoundHound AI, Inc. (SOUN) does not pay dividends, reflecting its focus on reinvesting capital for growth rather than returning cash to shareholders. The company is in a high-growth phase, prioritizing research and development and strategic acquisitions, which aligns with long-term value creation. Additionally, SOUN has not engaged in share buybacks, indicating a cautious approach to capital allocation. This strategy may ultimately support sustainable shareholder value, though it carries inherent risks related to cash flow management.

Sector Analysis

SoundHound AI, Inc. operates in the Software – Application industry, focusing on voice AI solutions. Its competitive edge lies in innovative products like the Houndify platform, facing rivals in a rapidly evolving market.

Strategic Positioning

SoundHound AI, Inc. holds a strong position in the voice AI market, with a market cap of approximately 4.88B. The company’s Houndify platform is gaining traction, but it faces significant competitive pressure from established players in the software application industry. Technological disruption is rapid, and while SoundHound’s innovative features set it apart, ongoing advancements from competitors could impact its market share. As I analyze the competitive landscape, it’s essential to monitor these dynamics closely to assess potential risks and opportunities in my investment strategy.

Revenue by Segment

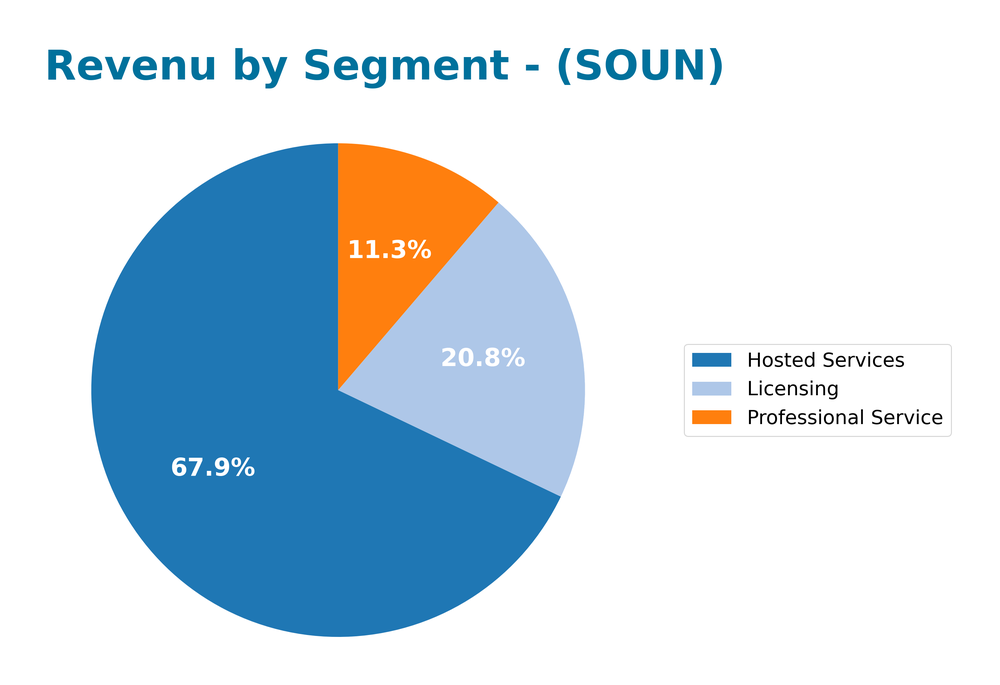

The pie chart illustrates SoundHound AI, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting key performance across its various business lines.

In 2024, SoundHound experienced notable growth in its revenue segments. Hosted Services led the way with $57.25M, representing a significant increase from $18.36M in 2023. Licensing saw a slight decline to $17.58M, while Professional Services grew to $9.49M, up from $8.28M. The shift indicates a strong focus on Hosted Services, which could drive future growth. However, the decrease in Licensing raises potential concentration risks, warranting close monitoring as the company navigates its product offerings. Overall, revenue growth accelerated, particularly in Hosted Services, signaling a positive trend for investors.

Key Products

SoundHound AI, Inc. offers a range of innovative products that leverage voice AI technology to enhance customer interactions across various industries. Below is a table summarizing the key products:

| Product | Description |

|---|---|

| Houndify | A comprehensive voice AI platform that provides tools for building custom voice assistants with features like automatic speech recognition and natural language understanding. |

| Houndify SDK | A software development kit that allows developers to integrate voice recognition and natural language processing into their applications easily. |

| Voice AI Solutions | Tailored solutions for businesses to implement voice technology in customer service, enabling seamless conversational experiences. |

| Embedded Voice | Solutions that allow devices to have built-in voice capabilities, enhancing user interaction without the need for a separate application. |

| Conversational AI | Custom AI models that can be trained for specific domains, enabling businesses to create unique conversational experiences. |

These products reflect SoundHound’s commitment to providing cutting-edge technology that empowers businesses to engage their customers more effectively.

Main Competitors

No verified competitors were identified from available data. However, SoundHound AI, Inc. operates in the software application industry, focusing on voice artificial intelligence. With a market capitalization of approximately 4.88B and a significant role in delivering high-quality conversational experiences, SoundHound holds a competitive position within this niche sector.

Competitive Advantages

SoundHound AI, Inc. holds significant competitive advantages in the burgeoning voice AI market. Its proprietary Houndify platform allows businesses to create customized conversational voice assistants, enhancing user engagement across various industries. With a market cap of approximately 4.88B and a robust product suite, the company is well-positioned for future growth. Upcoming opportunities include expanding into new markets and developing innovative features that cater to evolving consumer demands. This strategic focus on adaptability and user-centric design will likely bolster SoundHound’s market presence and drive sustained revenue growth.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing SoundHound AI, Inc. (SOUN) in the current market landscape.

Strengths

- Strong AI technology

- Established market presence

- Diverse product offerings

Weaknesses

- High beta value

- No dividends paid

- Relatively high competition

Opportunities

- Growing demand for voice AI

- Expansion into new markets

- Strategic partnerships

Threats

- Rapid technological changes

- Economic downturn risks

- Increasing competition

In summary, SoundHound AI, Inc. possesses robust strengths and significant opportunities, which position it well for growth. However, the company must navigate its weaknesses and external threats to ensure sustainable success and strategic advancement.

Stock Analysis

Over the past year, SoundHound AI, Inc. (SOUN) has experienced significant price movements, culminating in a remarkable bullish trend. The stock has demonstrated notable trading dynamics, reflecting investor interest and market sentiment.

Trend Analysis

Analyzing the overall trend for SOUN over the past two years, I observe a substantial price change of +449.53%. This indicates a strong bullish trend, although the acceleration status is currently decelerating. The stock reached a notable high of 23.95 and a low of 1.7, showcasing significant volatility as evidenced by a standard deviation of 5.04. In the recent trend analysis from September 7, 2025, to November 23, 2025, the stock experienced a price change of -18.3%, which suggests a neutral trend during this period.

Volume Analysis

Examining the trading volumes over the last three months, SOUN shows an overall total volume of approximately 21.53B, with buyer volume accounting for 58.73% of total activity. The volume trend is increasing, indicating heightened market participation. However, in the recent period, the buyer volume of 1.34B was outpaced by seller volume of 1.81B, suggesting a slightly seller-dominant activity, which could reflect cautious investor sentiment amidst recent price corrections.

Analyst Opinions

Recent analyst recommendations for SoundHound AI, Inc. (SOUN) indicate a cautious stance, with a consensus rating of “sell.” Analysts have highlighted concerns regarding the company’s financial health, reflected in a low overall score of C- due to poor performance in key areas such as return on equity and price-to-earnings ratios. The debt-to-equity ratio received a relatively better score, but overall, the analysts suggest that investors should reconsider their positions in the stock. Given the current analysis, I advise exercising caution with any investments in SoundHound AI.

Stock Grades

SoundHound AI, Inc. (SOUN) has received a mix of grades from several reputable grading firms, indicating a cautious but steady outlook on the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

| Piper Sandler | Downgrade | Neutral | 2025-07-14 |

| HC Wainwright & Co. | Maintain | Buy | 2025-05-12 |

| Wedbush | Maintain | Outperform | 2025-05-09 |

The overall trend suggests that while there are some upgrades to “Buy,” there have also been downgrades, notably from Piper Sandler. This indicates a mixed sentiment among analysts, with some maintaining optimism while others express caution.

Target Prices

The consensus target price for SoundHound AI, Inc. (SOUN) reflects a strong agreement among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 17 | 17 | 17 |

Overall, analysts anticipate a target price of 17, indicating a uniform expectation for the stock’s performance.

Consumer Opinions

Consumer sentiment regarding SoundHound AI, Inc. (SOUN) reflects a mix of enthusiasm for its innovative technology and concerns about user experience and customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| “The voice recognition is impressive!” | “Customer service is slow to respond.” |

| “Great features for music discovery.” | “The app crashes frequently.” |

| “Easy to use interface.” | “Limited compatibility with devices.” |

| “Regular updates keep improving functionality.” | “High subscription costs compared to competitors.” |

Overall, consumer feedback highlights strong appreciation for SoundHound’s technology and features, while concerns about customer support and app stability frequently surface.

Risk Analysis

In analyzing SoundHound AI, Inc. (SOUN), it’s essential to understand the potential risks that could impact its performance. Below is a summary of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in the tech sector affecting stock price | High | High |

| Regulatory Risk | Changes in AI regulations impacting operations | Medium | High |

| Competition | Increasing competition from established firms | High | Medium |

| Technology Risk | Potential technical failures or data breaches | Medium | High |

| Economic Downturn | Broader economic challenges reducing demand | Medium | High |

SOUN faces high market volatility and intense competition, both likely to significantly impact its stock performance. The tech sector’s rapid evolution further complicates risk management.

Should You Buy SoundHound AI, Inc.?

SoundHound AI, Inc. exhibits a negative net margin of -4.14%, indicating persistent losses. The company’s debt levels are minimal, with a debt-to-assets ratio of 0.0079, suggesting a strong balance sheet position. However, the overall fundamentals show a concerning trend, with a C- rating, highlighting the need for improvement in various financial aspects.

Given the negative net margin, the unfavorable long-term trend, and the recent seller volume outpacing buyer volume, it would be prudent to wait for more favorable market conditions before considering any investment in SoundHound AI, Inc.

A. Favorable signals There are no favorable signals.

B. Unfavorable signals The net margin is negative at -4.14%, which indicates ongoing losses. The long-term trend is negative, suggesting a decline in performance. Additionally, recent seller volume has surpassed buyer volume, indicating a lack of demand from investors.

C. Conclusion Considering these unfavorable factors, it might be more prudent to wait for a potential turnaround in the company’s performance before making any investment decisions in SoundHound AI, Inc.

Specific risks include the ongoing negative net margin, the negative long-term trend, and the recent seller-dominant market behavior.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- SoundHound AI (SOUN) Stock Tumbles 40% In A Month Despite Earnings Beat, CEO Optimism – Benzinga (Nov 18, 2025)

- AI Analyst Flags Risks on SoundHound AI Stock (SOUN) Outlook – TipRanks (Nov 17, 2025)

- SoundHound vs. C3.ai: Which AI Stock Has More Upside Now? – Zacks Investment Research (Nov 14, 2025)

- SoundHound AI Inc. (SOUN) Well-Positioned for High Growth – DA Davidson – StreetInsider (Nov 18, 2025)

- SoundHound AI (NASDAQ:SOUN) Shares Down 6.1% – Time to Sell? – MarketBeat (Nov 18, 2025)

For more information about SoundHound AI, Inc., please visit the official website: soundhound.com