Every day, businesses across the globe harness the power of data to make informed decisions, and at the heart of this transformation is Snowflake Inc. With its cutting-edge cloud-based data platform, Snowflake has revolutionized how organizations consolidate and analyze vast amounts of information. As a key player in the software application industry, its innovative solutions empower companies to unlock actionable insights and drive growth. As we delve into this analysis, I invite you to consider whether Snowflake’s robust fundamentals continue to justify its current market valuation and growth trajectory.

Table of contents

Company Description

Snowflake Inc. is a leading player in the cloud-based data platform sector, providing innovative solutions that enable organizations to aggregate and analyze their data efficiently. Founded in 2012 and headquartered in Bozeman, Montana, the company has rapidly established itself as a key provider of data cloud services across various industries, including finance, healthcare, and retail. With a market capitalization of approximately $84.7B, Snowflake empowers businesses to create data-driven applications and derive actionable insights from a unified data source. As a pioneer in the application software industry, Snowflake is at the forefront of shaping data management practices, emphasizing scalability, performance, and ease of use.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Snowflake Inc., examining the income statement, financial ratios, and dividend payout policy.

Income Statement

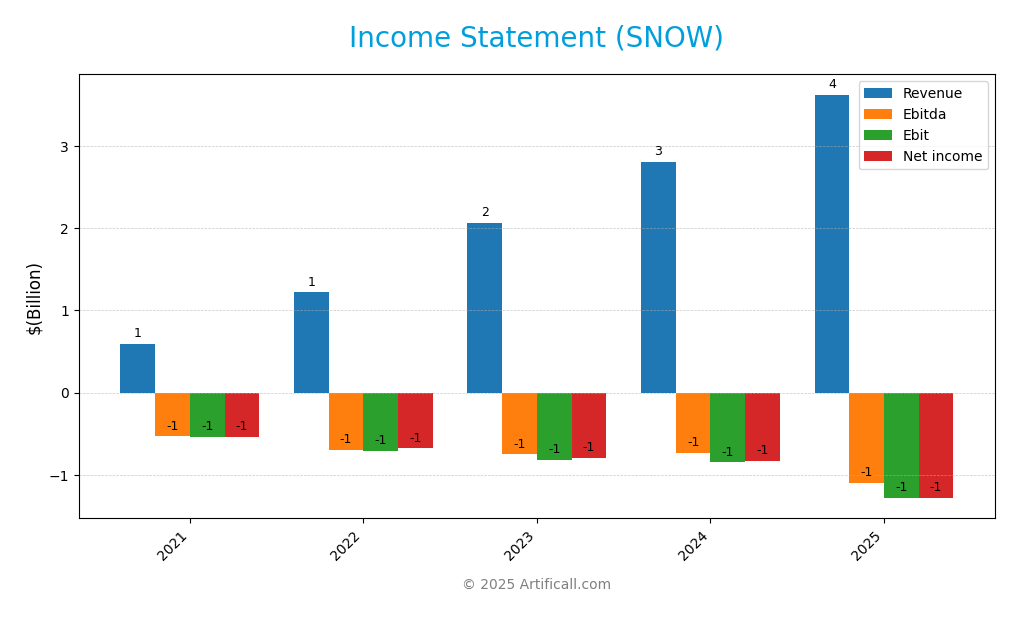

The following table presents the income statement of Snowflake Inc. (SNOW) over the last five fiscal years, highlighting key financial metrics.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 592M | 1.22B | 2.07B | 2.81B | 3.63B |

| Cost of Revenue | 243M | 458M | 718M | 899M | 1.21B |

| Operating Expenses | 893M | 1.48B | 2.19B | 2.99B | 3.87B |

| Gross Profit | 349M | 761M | 1.35B | 1.91B | 2.41B |

| EBITDA | -534M | -694M | -752M | -729M | -1.10B |

| EBIT | -544M | -715M | -816M | -849M | -1.28B |

| Interest Expense | 0 | 0 | 0 | 0 | 3M |

| Net Income | -539M | -680M | -797M | -836M | -1.29B |

| EPS | -1.87 | -2.26 | -2.50 | -2.55 | -3.86 |

| Filing Date | 2021-03-31 | 2022-03-30 | 2023-03-29 | 2024-03-26 | 2025-03-21 |

Over the past five years, Snowflake has shown significant revenue growth, increasing from 592M in 2021 to 3.63B in 2025, which reflects a compound annual growth rate (CAGR) of around 78%. However, net income has consistently remained negative, with the latest figure reaching -1.29B, indicating challenges in profitability despite revenue growth. The gross profit margin has stabilized, but operating expenses have increased sharply, outpacing revenue growth, leading to a deeper EBITDA loss in 2025 compared to prior years. This pattern suggests that while the company is expanding its top line, it must focus on managing costs more effectively to improve overall margins and move toward profitability.

Financial Ratios

The following table summarizes the key financial ratios for Snowflake Inc. (SNOW) over the last five fiscal years:

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -91.1% | -55.8% | -38.6% | -29.8% | -35.4% |

| ROE | -10.9% | -13.5% | -14.6% | -16.1% | -42.9% |

| ROIC | -10.6% | -13.6% | -14.3% | -19.5% | -25.3% |

| WACC | N/A | N/A | N/A | N/A | N/A |

| P/E | -150.6 | -121.8 | -62.6 | -76.7 | -47.0 |

| P/B | 16.4 | 16.4 | 9.1 | 12.4 | 20.1 |

| Current Ratio | 5.4 | 3.3 | 2.5 | 1.8 | 1.7 |

| Quick Ratio | 5.4 | 3.3 | 2.5 | 1.8 | 1.7 |

| D/E | 0.041 | 0.031 | 0.033 | 0.056 | 0.895 |

| Debt-to-Assets | 0.035 | 0.031 | 0.033 | 0.035 | 0.297 |

| Interest Coverage | N/A | N/A | N/A | 0.0 | -527.7 |

| Asset Turnover | 0.1 | 0.2 | 0.3 | 0.3 | 0.4 |

| Fixed Asset Turnover | 2.3 | 4.1 | 5.3 | 5.6 | 5.5 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In the most recent fiscal year (2025), Snowflake’s ratios reflect ongoing challenges. The negative net margin of -35.4% alongside a significantly high P/E ratio indicates substantial losses relative to its market value. While the current ratio of 1.7 suggests adequate liquidity, the debt-to-equity ratio of 0.895 raises concerns about leverage. Overall, these figures could pose risks for potential investors.

Evolution of Financial Ratios

Over the past five years, Snowflake’s financial ratios show a trend of deteriorating profitability, with consistently negative margins and increasing leverage. However, liquidity ratios have remained relatively stable, indicating some resilience in the company’s operational capacity despite financial losses.

Distribution Policy

Snowflake Inc. (SNOW) does not pay dividends, reflecting its focus on reinvesting in growth opportunities during its high growth phase. With a negative net income of -3.86 per share, the company prioritizes research and development and strategic acquisitions. Notably, Snowflake engages in share buybacks, which may help support share price stability. This approach aims to create long-term shareholder value, though it entails risks associated with sustainability and capital allocation.

Sector Analysis

Snowflake Inc. is a key player in the cloud-based data platform industry, offering innovative solutions for data consolidation and analytics amid competition from established firms like AWS and Microsoft Azure.

Strategic Positioning

Snowflake Inc. holds a significant position in the cloud-based data platform market, boasting a market cap of approximately $84.7B. Despite competitive pressures from established players like AWS and Microsoft Azure, Snowflake continues to innovate, maintaining a strong market share in data analytics and management. The company has successfully leveraged its unique architecture to mitigate technological disruptions, allowing it to provide scalable solutions that cater to a diverse range of industries. As a result, Snowflake remains well-positioned for future growth in an increasingly data-driven landscape.

Revenue by Segment

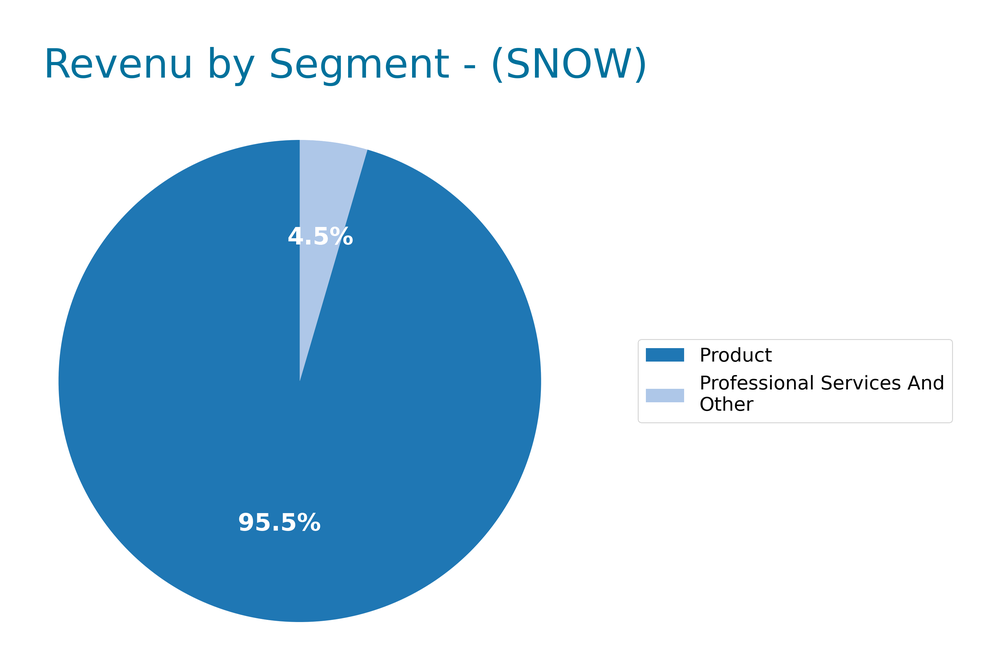

The chart illustrates Snowflake Inc.’s revenue breakdown by segment for the fiscal year ending January 31, 2025, highlighting key trends in product and service revenue.

In FY 2025, Snowflake reported a significant revenue of 3.46B from its Product segment, continuing a robust growth trajectory from 2.67B in FY 2024. The Professional Services and Other segment also saw an increase to 164M, although it remains a smaller part of the overall revenue pie. Notably, the Product segment has consistently driven growth, reflecting strong demand in the cloud data warehousing space. However, the growth rate appears to be moderating as the company matures, which could indicate an increasing focus on margin optimization and potential concentration risks in client dependencies.

Key Products

Below is a table outlining the key products offered by Snowflake Inc., which highlight the company’s capabilities in the cloud-based data platform sector.

| Product | Description |

|---|---|

| Data Cloud | A comprehensive cloud-based platform that consolidates data from various sources into a single source of truth, enabling businesses to drive insights and make data-driven decisions. |

| Snowflake Data Warehouse | An elastic data warehouse that allows users to manage and analyze large volumes of data seamlessly while ensuring high performance and scalability. |

| Snowflake Data Marketplace | A platform that connects organizations to share and access live, ready-to-query data sets, enabling collaboration and innovation across industries. |

| Snowpipe | An automated data ingestion service that allows real-time loading of data into Snowflake from various sources without manual intervention. |

| Secure Data Sharing | A feature that enables organizations to share data securely and in real-time with partners and customers, enhancing collaboration while maintaining control over data access. |

Snowflake Inc. continues to advance its offerings, ensuring it stays competitive in the rapidly evolving technology landscape.

Main Competitors

No verified competitors were identified from available data. Snowflake Inc. operates within the cloud-based data platform sector, which is characterized by significant competition from various established players. Snowflake’s estimated market share indicates a strong competitive position, particularly in North America, where it continues to grow and innovate in providing comprehensive data solutions.

Competitive Advantages

Snowflake Inc. (ticker: SNOW) holds distinct competitive advantages in the cloud-based data platform industry. Its ability to consolidate diverse data into a unified source empowers businesses to derive actionable insights, fostering data-driven decision-making. With a strong market presence and a robust platform, Snowflake is poised to expand into new verticals and enhance its offerings with innovative products. The ongoing shift towards data-centric applications provides substantial growth opportunities, positioning Snowflake as a leader in the evolving technology landscape.

SWOT Analysis

This analysis aims to provide a clear overview of Snowflake Inc.’s strengths, weaknesses, opportunities, and threats to assist in strategic decision-making.

Strengths

- Strong market position

- Advanced technology platform

- High customer retention

Weaknesses

- No dividend payments

- Dependency on cloud infrastructure

- Competitive industry

Opportunities

- Growing demand for data analytics

- Expansion into new markets

- Partnerships with major tech firms

Threats

- Intense competition

- Economic downturns

- Regulatory challenges

The overall SWOT assessment indicates that while Snowflake Inc. possesses a robust competitive advantage and significant growth potential, it must navigate competitive pressures and economic uncertainties. A focus on leveraging strengths and addressing weaknesses can enhance its market strategy moving forward.

Stock Analysis

Over the past year, Snowflake Inc. (SNOW) has exhibited significant price movements, culminating in a notable bullish trend characterized by a 27.89% increase. This analysis will delve into the stock’s price trajectory and trading dynamics, providing insights into current market behavior.

Trend Analysis

In examining the overall trend for Snowflake Inc. over the past year, the stock has experienced a price change of +27.89%, indicating a bullish trend. The price has fluctuated between a notable high of 274.88 and a low of 108.56. The trend shows signs of acceleration, supported by a standard deviation of 41.8, which suggests that the price movements have been relatively volatile. In the recent period from September 7, 2025, to November 23, 2025, the stock recorded a price change of +12.82% with a standard deviation of 16.57, further affirming the bullish sentiment.

Volume Analysis

Analyzing trading volumes over the last three months, total volume reached approximately 3.3B shares, with buyer-driven activity accounting for about 53.91% (1.78B shares) compared to seller volume at 1.49B shares. However, the volume trend has been decreasing, indicating a potential cooling in market participation. In the more recent period, from September 7, 2025, to November 23, 2025, buyer volume was 120.12M and seller volume was 133.68M, leading to a buyer dominance of 47.33%. This neutral buyer behavior suggests a balance between buying and selling pressure among investors, reflecting cautious sentiment in the market.

Analyst Opinions

Recent analyst recommendations for Snowflake Inc. (SNOW) indicate caution, with a consensus rating of “sell” for 2025. Analysts have criticized the company’s performance, reflected in its C- rating from market analysts. Key concerns include low scores in return on equity and return on assets, which signal challenges in profitability and efficiency. Analysts suggest that investors approach with caution, given the company’s high debt-to-equity ratio and underwhelming price-to-earnings metrics.

Stock Grades

Snowflake Inc. has recently received consistent grades from several reputable grading companies, indicating a stable outlook for the stock. Below is a summary of the current stock ratings.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2025-11-17 |

| B of A Securities | Maintain | Buy | 2025-11-17 |

| BTIG | Maintain | Buy | 2025-11-12 |

| JMP Securities | Maintain | Market Outperform | 2025-10-28 |

| Wedbush | Maintain | Outperform | 2025-10-20 |

| Rosenblatt | Maintain | Buy | 2025-10-17 |

| UBS | Maintain | Buy | 2025-10-08 |

| Mizuho | Maintain | Outperform | 2025-08-28 |

| Baird | Maintain | Outperform | 2025-08-28 |

| Raymond James | Maintain | Outperform | 2025-08-28 |

The overall trend in grades for Snowflake Inc. remains positive, with multiple firms maintaining their ratings. Notably, the majority of the ratings are concentrated around “Buy” and “Outperform,” suggesting a favorable sentiment among analysts towards the company’s prospects.

Target Prices

The current consensus among analysts for Snowflake Inc. (SNOW) indicates a positive outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 325 | 205 | 261.18 |

Overall, analysts expect Snowflake’s stock to have a target price around 261.18, reflecting a range of optimistic to cautious sentiments in the market.

Consumer Opinions

Consumer sentiment around Snowflake Inc. (SNOW) reveals a mix of enthusiasm for its innovative solutions and concerns about pricing and support.

| Positive Reviews | Negative Reviews |

|---|---|

| “Snowflake’s platform is a game-changer for data analytics!” | “Support response times are longer than expected.” |

| “The ease of integration with existing systems is impressive.” | “Pricing can be a bit steep for small businesses.” |

| “Great scalability and performance for large datasets.” | “User interface could be more intuitive.” |

| “Excellent customer service and resources available.” | “Complexity in initial setup can be overwhelming.” |

Overall, consumer feedback indicates that while Snowflake excels in scalability and integration, users often express concerns regarding pricing and the complexity of setup.

Risk Analysis

In evaluating Snowflake Inc. (SNOW), it is crucial to understand the potential risks that could impact its performance. Below is a summary of key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in cloud services demand | High | High |

| Competition | Aggressive competition from established firms | High | High |

| Regulatory Risk | Changes in data privacy regulations | Medium | High |

| Technology Risk | Risks related to cybersecurity breaches | Medium | High |

| Economic Risk | Macroeconomic downturn affecting budgets | Medium | Medium |

The most significant risks for Snowflake Inc. center around high market competition and the volatility in demand for cloud services. As companies increasingly rely on data analytics, any slowdown in growth could dramatically impact performance.

Should You Buy Snowflake Inc.?

Snowflake Inc. is currently experiencing a negative net margin of -35.45%, indicating a lack of profitability. The company’s total debt stands at 2.69B, and its overall rating is C-, suggesting some concerns regarding its financial health. The fundamentals have shown a long-term bullish trend in stock performance, despite recent fluctuations in buyer and seller volumes.

A. Favorable signals There are no favorable signals present in the data.

B. Unfavorable signals The net margin of -35.45% indicates a lack of profitability, which is a significant concern. Moreover, the company’s ROIC, which is -25.32%, is less than the WACC of 8.66%, indicating value destruction. Furthermore, the recent seller volume of 133.68M exceeds the recent buyer volume of 120.12M, reflecting a bearish sentiment in the market.

C. Conclusion Given the negative net margin, the value destruction revealed by the ROIC being less than the WACC, and the recent seller volume surpassing buyer volume, it would be more prudent to wait for improved financial performance and stronger buyer sentiment before considering an investment in Snowflake Inc.

The high total debt introduces additional risks, along with the negative profitability that could lead to further valuation corrections if market conditions do not improve.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Snowflake Inc. (SNOW) Sees a More Significant Dip Than Broader Market: Some Facts to Know – Yahoo Finance (Nov 17, 2025)

- 2,534 Shares in Snowflake Inc. $SNOW Bought by Meridian Wealth Management LLC – MarketBeat (Nov 18, 2025)

- Snowflake Inc. Stock (SNOW) Opinions on AI Launches and Acquisitions – Quiver Quantitative (Nov 16, 2025)

- Snowflake (NYSE: SNOW) brings NVIDIA CUDA-X ML libraries to AI Data Cloud with 200x gains – Stock Titan (Nov 18, 2025)

- B of A Securities Maintains Snowflake (SNOW) Buy Recommendation – Nasdaq (Nov 17, 2025)

For more information about Snowflake Inc., please visit the official website: snowflake.com