In a world where data breaches and cyber threats loom large, Rubrik, Inc. emerges as a pivotal force, safeguarding critical information for businesses and individuals alike. With a stronghold in the Software – Infrastructure sector, Rubrik’s innovative data security solutions are reshaping how companies protect their digital assets. As it continues to redefine industry standards with cutting-edge technology, one must ponder: do Rubrik’s current fundamentals and growth trajectory align with its market valuation?

Table of contents

Company Description

Rubrik, Inc. is a leading provider of data security solutions, specializing in comprehensive data protection services for enterprises across various sectors. Founded in 2013 and headquartered in Palo Alto, California, Rubrik offers a range of products including enterprise data protection, cloud data protection, and cyber recovery solutions, serving markets such as finance, healthcare, and technology. With a robust market capitalization of approximately $13.7B and a workforce of 3,200 employees, Rubrik positions itself as a pivotal player in the Software – Infrastructure industry. The company’s focus on innovation and security not only enhances its competitive edge but also plays a significant role in shaping the future landscape of data management and protection.

Fundamental Analysis

In this section, I will analyze Rubrik, Inc.’s income statement, financial ratios, and dividend payout policy to provide insights for potential investors.

Income Statement

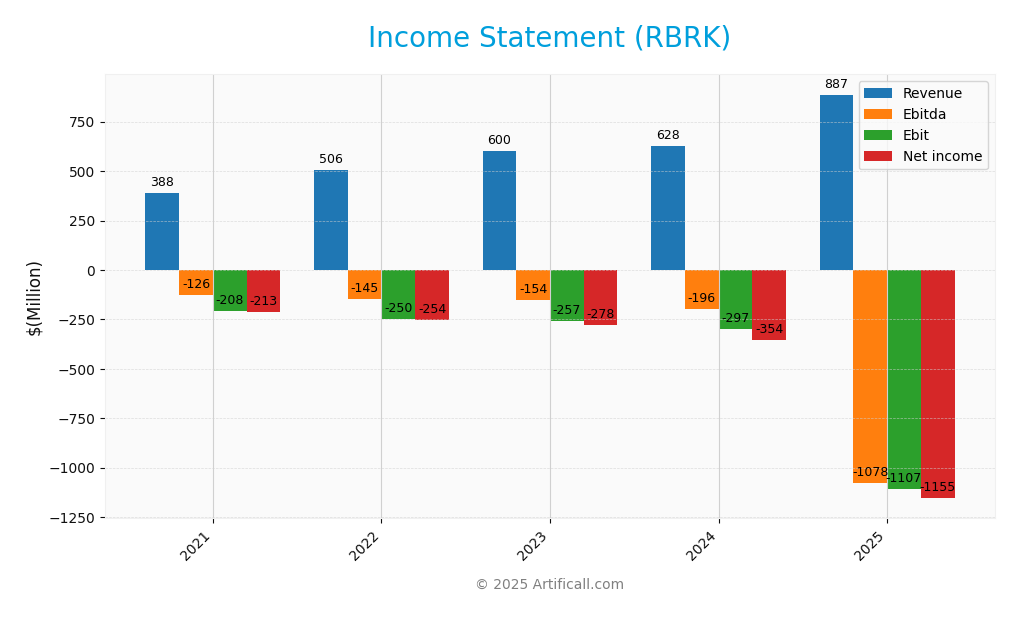

The following table summarizes the income statement for Rubrik, Inc. (RBRK) over the last five fiscal years, illustrating key financial metrics and performance trends.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 388M | 506M | 600M | 628M | 887M |

| Cost of Revenue | 171M | 236M | 280M | 238M | 266M |

| Operating Expenses | 426M | 520M | 582M | 696M | 1.75B |

| Gross Profit | 217M | 270M | 320M | 389M | 621M |

| EBITDA | -126M | -145M | -154M | -196M | -1.08B |

| EBIT | -208M | -250M | -257M | -297M | -1.11B |

| Interest Expense | 0 | 0 | 12M | 30M | 41M |

| Net Income | -213M | -254M | -278M | -354M | -1.15B |

| EPS | -1.21 | -1.45 | -1.58 | -2.01 | -7.48 |

| Filing Date | 2021-03-20 | 2022-03-20 | 2023-03-20 | 2024-01-31 | 2025-03-20 |

Over the five-year period, Rubrik, Inc. has shown a consistent upward trend in revenue, from 388M in 2021 to 887M in 2025, indicating a solid growth trajectory. However, net income has worsened significantly, transitioning from -213M in 2021 to a drastic -1.15B in 2025, primarily due to escalating operating expenses that surged to 1.75B. The widening losses have impacted EPS negatively, reflecting operational challenges despite revenue growth. The latest year marks a substantial increase in operating costs, which raises concerns about the company’s profitability and operational efficiency moving forward. Caution is advised for potential investors as these trends may indicate underlying issues that need addressing.

Financial Ratios

The table below summarizes the financial ratios for Rubrik, Inc. (ticker: RBRK) over the last available years.

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -54.95% | -50.26% | -46.30% | -56.40% | -130.26% |

| ROE | -266.79% | 243.15% | 74.54% | 50.27% | 208.55% |

| ROIC | -87.16% | -135.49% | -80.86% | -152.53% | -236.15% |

| WACC | N/A | N/A | N/A | N/A | N/A |

| P/E | N/A | -62.21 | -17.47 | -9.24 | -20.42 |

| P/B | 81.50 | -62.21 | -17.47 | -9.24 | -20.42 |

| Current Ratio | 1.56 | 0.98 | 1.17 | 0.84 | 1.13 |

| Quick Ratio | 1.54 | 0.97 | 1.14 | 0.83 | 1.13 |

| D/E | 0.07 | 0.06 | -0.58 | -0.44 | -0.60 |

| Debt-to-Assets | 0.01 | 0.06 | 0.28 | 0.35 | 0.23 |

| Interest Coverage | 0 | 0 | -22.34 | -10.12 | -27.49 |

| Asset Turnover | 0.76 | 0.98 | 0.78 | 0.72 | 0.62 |

| Fixed Asset Turnover | 11.37 | 7.69 | 7.23 | 8.08 | 16.67 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2025, Rubrik’s ratios depict significant challenges. The net margin is deeply negative, indicating ongoing losses, while the return on equity (ROE) is remarkably high due to a negative equity base. The current and quick ratios show sufficient liquidity, but the debt-to-equity and interest coverage ratios raise concerns about financial leverage and the ability to service debt.

Evolution of Financial Ratios

Over the last five years, Rubrik’s financial ratios indicate a downward trend in profitability, with net margins worsening significantly. Although liquidity ratios showed some stability, the increasing debt levels and negative equity signal growing financial distress, necessitating careful monitoring and risk assessment moving forward.

Distribution Policy

Rubrik, Inc. (RBRK) currently does not pay dividends, which aligns with its strategy of reinvesting in growth and research and development. The company is in a high-growth phase, prioritizing future expansion over immediate shareholder returns. Notably, RBRK engages in share buybacks, which can enhance shareholder value. However, the lack of dividends and the negative net income raise concerns about the sustainability of this approach for long-term value creation.

Sector Analysis

Rubrik, Inc. operates in the Software – Infrastructure sector, providing comprehensive data security solutions. Its key products serve various industries, facing competition from established players.

Strategic Positioning

Rubrik, Inc. occupies a pivotal role in the Software – Infrastructure sector, boasting a market capitalization of approximately $13.7B. The company has established a notable market share in enterprise data protection solutions, particularly as businesses increasingly prioritize data security. However, competitive pressure is mounting from emerging tech firms and established players enhancing their offerings. Additionally, the rapid pace of technological disruption demands continuous innovation, compelling me to monitor Rubrik’s adaptability closely. As I analyze its performance, I remain cautious about potential market fluctuations and their impact on investment strategies.

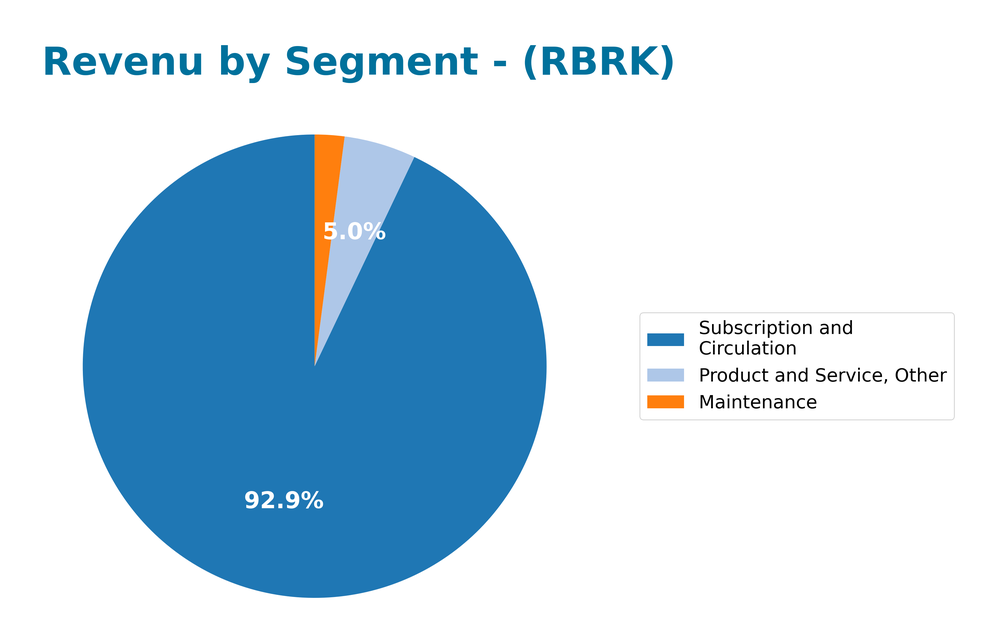

Revenue by Segment

The following chart illustrates Rubrik, Inc.’s revenue distribution across different segments for the fiscal year 2025.

In FY 2025, Rubrik’s revenue segmentation reveals a strong performance driven primarily by the Subscription and Circulation segment, which generated 828.74M. Notably, the Maintenance segment contributed 18.41M, while Product and Service, Other generated 44.64M. The Subscription segment’s dominance indicates a solid recurring revenue model; however, the slower growth in the Maintenance segment could signal potential margin risks. Overall, the company must focus on maintaining robust growth in its core offerings while managing the relative stagnation in ancillary services.

Key Products

Rubrik, Inc. offers a range of innovative data security solutions designed to meet the needs of various industries. Below is a table detailing some of their key products:

| Product | Description |

|---|---|

| Enterprise Data Protection | Provides comprehensive backup and recovery solutions for on-premises and cloud environments. |

| Unstructured Data Protection | Secures and manages unstructured data across various platforms, ensuring data integrity and access. |

| Cloud Data Protection | Offers tailored solutions for protecting data stored in cloud services, enhancing security and compliance. |

| SaaS Data Protection | Focuses on securing software-as-a-service applications, providing backup and recovery options. |

| Data Threat Analytics | Utilizes advanced analytics to detect and respond to potential data threats in real-time. |

| Cyber Recovery Solutions | Ensures rapid recovery from cyber incidents, minimizing downtime and data loss. |

These products are crucial for businesses across multiple sectors, including finance, healthcare, and technology, in maintaining data security and compliance.

Main Competitors

No verified competitors were identified from available data. However, Rubrik, Inc. operates in the software infrastructure sector and holds a significant market position with an estimated market cap of approximately 13.75B. The company specializes in data security solutions, serving various sectors including finance, healthcare, and technology. Its competitive position is bolstered by a diverse product range that addresses critical data protection needs in an increasingly digital world.

Competitive Advantages

Rubrik, Inc. boasts significant competitive advantages in the data security solutions sector, particularly through its comprehensive offerings in enterprise and cloud data protection. With a focus on serving diverse industries such as healthcare, finance, and technology, the company is well-positioned to capitalize on the growing need for robust cybersecurity measures. Looking ahead, Rubrik plans to expand its product portfolio, including innovative solutions in cyber recovery and data threat analytics. This proactive approach not only enhances its market presence but also opens up new opportunities in emerging markets, solidifying its competitive edge.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing Rubrik, Inc. (RBRK) to aid in strategic decision-making.

Strengths

- Strong market position

- Diverse product offerings

- High demand for data security

Weaknesses

- No dividends issued

- Limited brand recognition

- High competition

Opportunities

- Growing market for cloud solutions

- Expansion into new sectors

- Increasing cybersecurity threats

Threats

- Market volatility

- Technological advancements by competitors

- Regulatory changes

Overall, Rubrik, Inc. displays solid strengths and opportunities that can be leveraged for growth. However, it must address its weaknesses and remain vigilant against external threats to sustain its competitive edge and optimize its strategic direction.

Stock Analysis

Over the past year, Rubrik, Inc. (RBRK) has experienced significant price movements, culminating in a bullish trend with a notable increase of 82.89%.

Trend Analysis

The stock’s price change of +82.89% over the past year indicates a bullish trend. However, in the recent period from September 7, 2025, to November 23, 2025, the stock has seen a decline of -23.57%, suggesting a deceleration in the upward momentum. The highest price reached during the year was 97.91, while the lowest was 28.65. The standard deviation of 21.88 reflects moderate volatility in the stock’s price.

Volume Analysis

In the last three months, the total trading volume for RBRK was approximately 1.03B, with buyer-driven activity comprising 52.0% of the total. Despite this, recent activity has shown a seller-dominant behavior, with seller volume at 132.81M compared to buyer volume of 74.40M, indicating a decrease in buyer dominance to 35.91%. The overall volume trend is increasing, suggesting that investor participation is growing, but the current sentiment leans towards selling.

Analyst Opinions

Recent analyst recommendations for Rubrik, Inc. (RBRK) suggest a cautious outlook. Analysts have issued a “hold” rating, reflecting concerns over the company’s financial metrics. The overall score of 2 indicates weaknesses in discounted cash flow and return on equity, as noted by analysts. Notably, the debt-to-equity and price-to-earnings ratios also raised red flags. While some analysts remain optimistic about potential growth, the consensus leans towards a “hold” for 2025, urging investors to monitor developments closely.

Stock Grades

Rubrik, Inc. (RBRK) has recently seen some positive movements in stock ratings from reliable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Outperform | 2025-11-17 |

| CIBC | Maintain | Outperform | 2025-09-11 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| Keybanc | Maintain | Overweight | 2025-09-10 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-09-10 |

| Rosenblatt | Maintain | Buy | 2025-09-10 |

| Barclays | Maintain | Overweight | 2025-09-10 |

| Wedbush | Maintain | Outperform | 2025-06-12 |

| CIBC | Maintain | Outperform | 2025-06-09 |

| Wedbush | Maintain | Outperform | 2025-06-06 |

Overall, there is a clear positive trend in the grades for RBRK, with Mizuho’s recent upgrade to “Outperform” being a notable highlight. The consistent ratings of “Outperform” and “Overweight” from other firms suggest strong investor confidence in the company’s performance.

Target Prices

The target consensus for Rubrik, Inc. (RBRK) indicates a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 50 | 38 | 45.5 |

Analysts expect the stock to reach a consensus target price of 45.5, suggesting a balanced view between the high and low estimates.

Consumer Opinions

Consumer sentiment about Rubrik, Inc. (RBRK) reveals a mixed landscape, reflecting both satisfaction and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Rubrik’s data management solutions are top-notch and reliable.” | “Customer support can be slow to respond.” |

| “Their platform is user-friendly and efficient.” | “Pricing seems high compared to competitors.” |

| “Excellent security features that give peace of mind.” | “Some features are difficult to navigate.” |

Overall, consumer feedback highlights Rubrik’s reliable data management and user-friendly platform as strengths, while customer support and pricing are frequently cited as weaknesses.

Risk Analysis

In evaluating Rubrik, Inc. (RBRK), it’s essential to consider various risks that could impact its performance. The following table outlines key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Intense competition from established cloud service providers. | High | High |

| Regulatory Changes | Potential changes in data privacy regulations affecting operations. | Medium | High |

| Technology Risks | Risks related to cybersecurity threats and data breaches. | High | High |

| Economic Downturn | A slowdown in the economy could reduce IT spending. | Medium | Medium |

| Operational Risks | Challenges in scaling operations and maintaining service quality. | Medium | Medium |

Currently, the most likely and impactful risks for Rubrik include heightened market competition and cybersecurity threats, which can significantly affect its market share and reputation.

Should You Buy Rubrik, Inc.?

Rubrik, Inc. is currently facing significant challenges, with a negative net margin of -1.30 and a return on invested capital (ROIC) of -2.36, indicating value destruction. The company’s debt levels are relatively moderate with a debt-to-equity ratio of -0.60; however, it has received a rating of C, reflecting concerns about its financial stability.

A. Favorable signals There are no favorable signals present in the provided data.

B. Unfavorable signals The company’s net margin is negative, which is a significant concern for profitability. Additionally, the long-term trend has shown a recent decline, and the recent seller volume has surpassed the buyer volume, suggesting a lack of interest from buyers.

C. Conclusion Given the negative net margin, the unfavorable long-term trend, and the recent seller dominance, it might be prudent to wait for more positive indicators before considering an investment in Rubrik, Inc.

The risks associated with this investment include the company’s ongoing negative profitability, potential overvaluation, and the lack of buyer interest in the current market.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Mizuho Upgrades Rubrik (RBRK) – Nasdaq (Nov 17, 2025)

- Rubrik: Dominating Cloud Data Resilience — Still An Undervalued Growth Play (NYSE:RBRK) – Seeking Alpha (Nov 16, 2025)

- Fiera Capital Corp Acquires 4,690 Shares of Rubrik, Inc. $RBRK – MarketBeat (Nov 15, 2025)

- A Fresh Look at Rubrik (RBRK) Valuation Following Strategic Partnership With Cognizant – Yahoo Finance (Oct 29, 2025)

- N2K Networks launches Data Security Decoded with Rubrik (NYSE: RBRK); drops twice monthly – Stock Titan (Nov 04, 2025)

For more information about Rubrik, Inc., please visit the official website: rubrik.com