Transforming the landscape of technology, Quantum Computing, Inc. is at the forefront of revolutionizing how we harness computational power. Through its innovative software tools and applications, the company empowers developers to create quantum-ready solutions, bridging the gap between classical and quantum computing. With a strong commitment to excellence and a reputation for pushing boundaries, I now find myself questioning whether its current market valuation reflects the robust growth potential that lies ahead.

Table of contents

Company Description

Quantum Computing, Inc. (ticker: QUBT), founded in 2018 and headquartered in Leesburg, Virginia, specializes in delivering innovative software tools and applications tailored for quantum computers. The company stands out in the computer hardware industry by offering its flagship product, Qatalyst, which accelerates quantum application development for both conventional and quantum computing environments. With a focus on commercial and government clients, Quantum Computing, Inc. operates primarily in the United States, providing access to various quantum processing units including DWave, Rigetti, and IonQ. As a challenger in the quantum computing sector, the company is strategically positioned to drive the evolution of this transformative technology, shaping the future of computing through its commitment to innovation and application readiness.

Fundamental Analysis

In this section, I will analyze Quantum Computing, Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

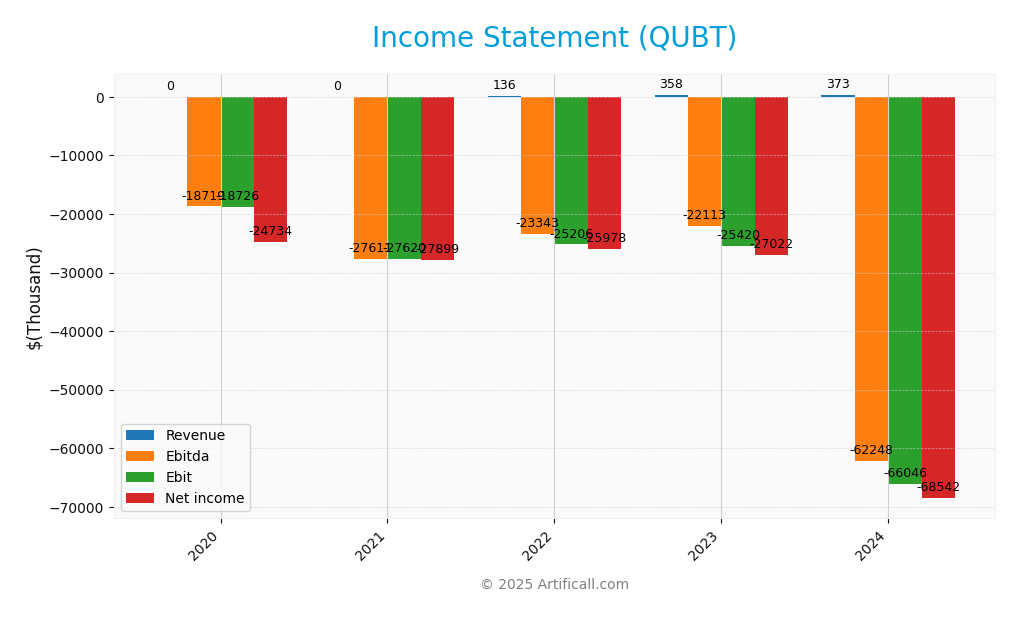

The following table presents the Income Statement for Quantum Computing, Inc. (Ticker: QUBT) over the last five fiscal years, summarizing key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 0 | 0 | 136K | 358K | 373K |

| Cost of Revenue | 6.6K | 8.9K | 1.9M | 3.5M | 4.1M |

| Operating Expenses | 17.3M | 17.1M | 26.9M | 23.1M | 22.3M |

| Gross Profit | -6.6K | -8.9K | -1.8M | -3.1M | -3.7M |

| EBITDA | -18.7M | -27.6M | -23.3M | -22.1M | -62.2M |

| EBIT | -18.7M | -27.6M | -25.2M | -25.4M | -66.0M |

| Interest Expense | 6.0M | 0.3M | 0.8M | 1.6M | 2.5M |

| Net Income | -24.7M | -27.9M | -25.9M | -27.0M | -68.5M |

| EPS | -0.88 | -0.96 | -0.48 | -0.42 | -0.73 |

| Filing Date | 2021-03-18 | 2022-03-15 | 2023-03-30 | 2024-04-01 | 2025-03-20 |

Over the past five years, Quantum Computing, Inc. has shown modest revenue growth from 0 in 2020 to 373K in 2024. However, this growth has not translated into profitability as net income has significantly worsened, dropping from -24.7M in 2020 to -68.5M in 2024. The company’s cost of revenue and operating expenses remain high, leading to negative gross profits and EBITDA. The most recent year reflects a significant increase in net losses, indicating that growth has not only slowed but that challenges in cost management persist, raising concerns about the sustainability of their current financial trajectory.

Financial Ratios

The table below summarizes the key financial ratios for Quantum Computing, Inc. (QUBT) over the last available years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 0.00% | 0.00% | -191.01% | -75.48% | -183.76% |

| ROE | -169.71% | -1.72% | -34.69% | -39.33% | -63.89% |

| ROIC | -118.74% | -1.06% | -33.90% | -36.72% | -17.41% |

| WACC | N/A | N/A | N/A | N/A | N/A |

| P/E | N/A | -3.56 | -3.25 | -2.25 | -22.67 |

| P/B | 27.07 | 6.14 | 1.13 | 0.89 | 14.48 |

| Current Ratio | 22.98 | 15.93 | 1.19 | 0.55 | 17.36 |

| Quick Ratio | 21.98 | 15.93 | 1.19 | 0.54 | 17.36 |

| D/E | 0.01 | 0.00 | 0.11 | 0.04 | 0.01 |

| Debt-to-Assets | 0.01 | 0.00 | 0.09 | 0.04 | 0.01 |

| Interest Coverage | -2.89 | -61.46 | -37.10 | -16.38 | -10.39 |

| Asset Turnover | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed Asset Turnover | 0.00 | 0.00 | 0.06 | 0.09 | 0.04 |

| Dividend Yield | 0.00% | 0.00% | 0.93% | 1.42% | 0.01% |

Interpretation of Financial Ratios

In the most recent year (2024), Quantum Computing, Inc. exhibits concerning financial health with a net margin of -183.76%, indicating significant losses. Both the return on equity (ROE) and return on invested capital (ROIC) are deeply negative at -63.89% and -17.41%, respectively, signaling inefficiencies in generating profit. High current and quick ratios suggest liquidity, but the high P/E ratio reflects a lack of earnings. Investors should be cautious given the company’s negative profitability metrics.

Evolution of Financial Ratios

Over the past five years, Quantum Computing, Inc.’s financial ratios have generally deteriorated, particularly in profitability metrics such as net margin, ROE, and ROIC, which have all moved further into negative territory. The current ratio has fluctuated significantly, indicating varying liquidity levels, while the P/B ratio has shown volatility, reflecting changing investor perceptions of value.

Distribution Policy

Quantum Computing, Inc. (QUBT) does not pay dividends, reflecting its focus on reinvesting capital to fund growth and innovation in the competitive tech sector. The company is in a high-growth phase, prioritizing research and development, which aligns with long-term shareholder value creation. Additionally, QUBT engages in share buybacks, signaling confidence in its future prospects. However, given its current net losses and negative cash flows, this strategy carries risks that investors should carefully evaluate. Overall, the lack of dividends combined with a buyback program may support long-term value creation if executed judiciously.

Sector Analysis

Quantum Computing, Inc. operates in the Computer Hardware industry, specializing in software tools for quantum computers, with competitive advantages in its proprietary Qatalyst platform and partnerships with major quantum processing unit providers.

Strategic Positioning

Quantum Computing, Inc. (QUBT) operates in the competitive landscape of computer hardware, focusing on software tools for quantum computing. With a market cap of $1.69B, the company is gaining traction in its niche, offering its Qatalyst application accelerator and quantum processing units from partners like D-Wave and Rigetti. Despite the significant technological disruption in the quantum sector, QUBT’s innovative solutions position it favorably against competitors. However, the high beta of 3.766 indicates considerable market volatility, emphasizing the need for cautious investment strategies.

Revenue by Segment

The chart illustrates Quantum Computing, Inc.’s revenue distribution by segment for the fiscal year 2024.

In FY 2024, the only reported segment is “Services Member,” which generated $346K in revenue. This indicates a concentrated business model focused on specific services rather than a diversified revenue stream. Given the limited data, it’s essential to consider the risks associated with such concentration; while services may show potential for growth, reliance on a singular segment could pose margin risks if demand fluctuates.

Key Products

Quantum Computing, Inc. offers a range of innovative products designed to harness the power of quantum computing for various applications. Below is a summary of their key products:

| Product | Description |

|---|---|

| Qatalyst | A quantum application accelerator that allows developers to create and run quantum-ready applications on conventional computers, with seamless transition to quantum systems. |

| Quantum Processing Units | Offers access to multiple quantum processing units, including DWave, Rigetti, and IonQ, enabling businesses to leverage different quantum technologies for their specific needs. |

| Quantum Software Development Kits | Tools for developers to build, test, and optimize quantum applications, ensuring compatibility with various quantum architectures and enhancing application performance. |

These products position Quantum Computing, Inc. at the forefront of the quantum computing industry, catering to both commercial and government sectors while focusing on innovation and practicality.

Main Competitors

No verified competitors were identified from available data. Quantum Computing, Inc. currently holds an estimated market share that reflects its focus on providing software tools and applications for quantum computing, particularly in the U.S. market. The company operates within the technology sector, specializing in quantum computing solutions for both commercial and government entities, positioning itself as a niche player in the rapidly evolving quantum technology landscape.

Competitive Advantages

Quantum Computing, Inc. (QUBT) stands out in the technology sector due to its innovative software tools designed for quantum computing applications. The company’s flagship product, Qatalyst, accelerates the development of quantum-ready applications, offering a unique bridge between classical and quantum computing. As more industries seek to leverage quantum technology, QUBT is well-positioned to tap into new markets and opportunities, such as government contracts and partnerships with leading quantum hardware providers. With a growing focus on commercial applications, the future outlook appears promising for sustained growth and market expansion.

SWOT Analysis

This SWOT analysis aims to evaluate the current position of Quantum Computing, Inc. (QUBT) and its potential strategic directions.

Strengths

- Innovative technology

- Strong market potential

- Diverse client base

Weaknesses

- High volatility

- Limited brand recognition

- Dependence on niche market

Opportunities

- Growing demand for quantum computing

- Partnerships with government entities

- Expansion into new markets

Threats

- Intense competition

- Rapid technological changes

- Regulatory challenges

The overall SWOT assessment indicates that while Quantum Computing, Inc. possesses significant strengths and opportunities, it must navigate inherent weaknesses and external threats. This suggests that a focused strategy on brand development and market expansion, alongside effective risk management, will be crucial for sustained growth.

Stock Analysis

Over the past year, Quantum Computing, Inc. (QUBT) has experienced significant price movements, culminating in a remarkable increase of 1261.84%. This surge underscores a notable bullish trend, even as recent dynamics indicate a slight decline in momentum.

Trend Analysis

Examining the stock’s performance over the last two years, the overall percentage change of +1261.84% clearly indicates a bullish trend. However, in the recent period from September 7, 2025, to November 23, 2025, the stock has seen a decline of -17.7%, suggesting a shift in momentum. Despite this recent downturn, the overall trend remains bullish, with notable highs of 24.62 and lows of 0.5. The acceleration status is currently showing deceleration, which warrants cautious observation moving forward.

Volume Analysis

Over the last three months, the total trading volume for QUBT has reached approximately 8.82B, with buyer-driven activity comprising 64.96% of this volume. The recent trend indicates increasing volume, though recent data from September 7 to November 23, 2025, reflects a seller-dominant environment, with only 38.5% of the activity being buyer-driven. This shift may suggest a cooling of investor sentiment, with market participants becoming more cautious in their engagements.

Analyst Opinions

Recent analyst recommendations for Quantum Computing, Inc. (QUBT) suggest a cautious stance. The overall rating stands at C+, with analysts emphasizing the company’s strong debt-to-equity ratio as a positive indicator. However, concerns arise from low scores in return on equity and price-to-earnings ratios. Analysts suggest a hold position for now, advising that investors wait for improved financial performance before considering a buy. As of 2025, the consensus leans towards a hold rather than a buy or sell, reflecting caution in the current market environment.

Stock Grades

Reliable grades for Quantum Computing, Inc. (QUBT) indicate a consistent positive outlook from recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Lake Street | Maintain | Buy | 2025-11-17 |

| Ascendiant Capital | Maintain | Buy | 2025-10-03 |

| Ascendiant Capital | Maintain | Buy | 2025-06-06 |

| Ascendiant Capital | Maintain | Buy | 2025-04-28 |

| Ascendiant Capital | Maintain | Buy | 2024-11-13 |

| Ascendiant Capital | Maintain | Buy | 2023-11-24 |

Overall, the trend in grades for QUBT remains strong, with multiple maintain ratings at “Buy” from credible firms, suggesting a solid confidence in the stock’s performance moving forward.

Target Prices

The current consensus among analysts for Quantum Computing, Inc. (QUBT) indicates a range of potential target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 40 | 10 | 22 |

Overall, analysts expect QUBT to experience significant price variability, with a consensus target suggesting potential growth opportunities.

Consumer Opinions

Consumer sentiment surrounding Quantum Computing, Inc. (QUBT) is a blend of optimism and skepticism, reflecting a diverse range of experiences among users.

| Positive Reviews | Negative Reviews |

|---|---|

| Innovative technology that promises to reshape industries. | Customer support can be slow to respond. |

| User-friendly interface makes it easy to navigate. | Some features are still in beta, causing frustration. |

| Strong potential for long-term growth in the market. | High volatility makes it a risky investment. |

Overall, consumer feedback indicates a strong appreciation for the innovative aspects of QUBT’s technology, while concerns about customer support and market volatility persist.

Risk Analysis

In evaluating the investment in Quantum Computing, Inc. (QUBT), it’s crucial to understand the potential risks involved. Below is a table summarizing key risks associated with this investment.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in the tech sector can greatly affect QUBT’s stock price. | High | High |

| Regulatory Risk | Changes in government policies regarding technology and funding could impact operations. | Medium | High |

| Competitive Risk | Rapid advancements by competitors in quantum computing may outpace QUBT. | High | Medium |

The most significant risks for QUBT include high market volatility and competitive pressures, particularly as the quantum computing sector evolves rapidly. As of late 2023, the sector is attracting substantial investments, increasing both opportunity and competition.

Should You Buy Quantum Computing, Inc.?

Quantum Computing, Inc. (QUBT) exhibits a negative net margin of -183.76%, indicating poor profitability. The company has minimal debt levels, reflected in a debt-to-equity ratio of 0.011, which suggests a strong balance sheet. However, overall fundamentals have been declining, as seen in the negative long-term trend of the stock performance. The current rating for QUBT is C+.

Given the negative net margin, the unfavorable long-term trend, and recent seller volume exceeding buyer volume, it would be prudent to wait for more favorable conditions before considering an investment in this stock.

A. Favorable signals There are no favorable signals to note at this time.

B. Unfavorable signals The company has a negative net margin of -183.76%, which indicates ongoing financial challenges. Additionally, the long-term trend is negative, suggesting a lack of upward momentum in the stock price. Moreover, recent seller volume has surpassed buyer volume, highlighting a seller-dominant market environment.

C. Conclusion Considering the absence of favorable signals and the presence of unfavorable signals, it might be best to wait for an improvement in the company’s financial situation and market conditions before making any investment decisions.

The company faces significant risks, including its negative net margin, the ongoing decline in fundamentals, and the current seller dominance in the market.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Quantum Computing Inc: Stock price soars on earnings beat in volatile year for quantum stocks – Fast Company (Nov 17, 2025)

- Quantum Computing (QUBT) Stock Surges On Q3 Earnings, Company To Unveil Neurawave Computer This Week – Benzinga (Nov 17, 2025)

- With Quantum Computing (QUBT) Stock Up Over 15%, Let’s Look at Who Owns It – TipRanks (Nov 17, 2025)

- Quantum Computing Inc (QUBT) Q3 2025 Earnings Call Highlights: Record Revenue and Strategic … – Yahoo Finance (Nov 15, 2025)

- Quantum Computing Inc. Reports Third Quarter 2025 Financial Results – PR Newswire (Nov 14, 2025)

For more information about Quantum Computing, Inc., please visit the official website: quantumcomputinginc.com