In a world where digital security is paramount, CyberArk Software Ltd. stands at the forefront of safeguarding sensitive information and privileged access. With its innovative software solutions, including the Privileged Access Manager and Cloud Entitlements Manager, CyberArk not only leads the software infrastructure industry but also plays a critical role in protecting organizations across various sectors, from finance to healthcare. As we analyze its current market position and growth potential, the pressing question remains: do CyberArk’s fundamentals support its lofty valuation in today’s competitive landscape?

Table of contents

Company Description

CyberArk Software Ltd. is a leading provider of software-based security solutions, specializing in privileged access management and identity security. Founded in 1999 and headquartered in Petah Tikva, Israel, the company operates across key markets in the U.S., Europe, the Middle East, and Africa. CyberArk’s product suite includes the Privileged Access Manager, Endpoint Privilege Manager, and Cloud Entitlements Manager, along with Identity and Access Management solutions. With a market capitalization of approximately $24.2B, CyberArk serves diverse industries, including financial services, healthcare, and telecommunications. As a frontrunner in cybersecurity, CyberArk is strategically positioned to shape the industry’s future through innovation and robust security frameworks.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of CyberArk Software Ltd., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

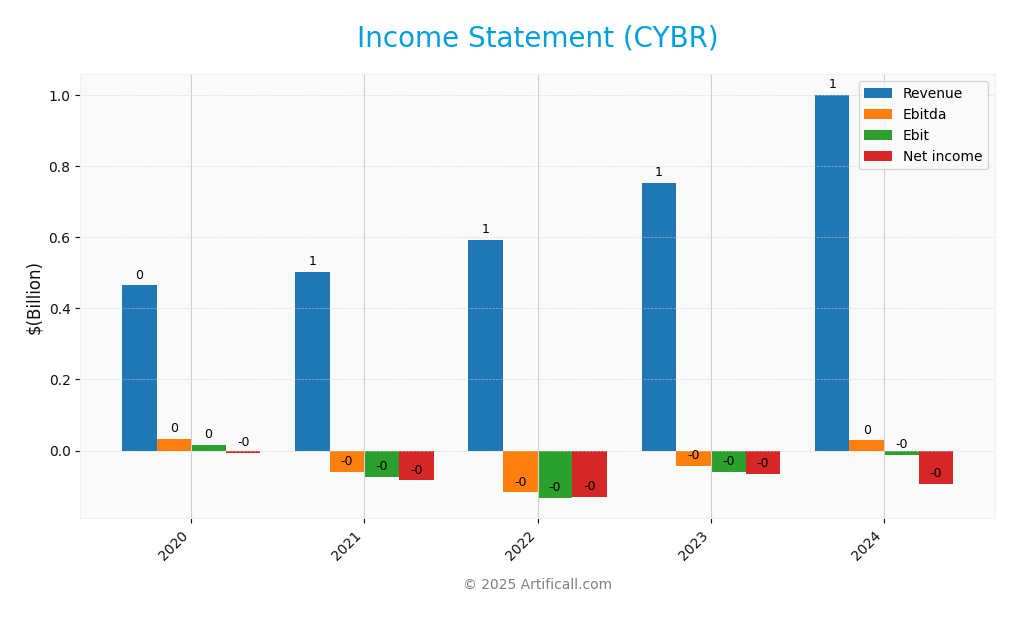

The following table summarizes CyberArk Software Ltd.’s income statement over the past four fiscal years, highlighting key financial metrics.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 464M | 503M | 592M | 752M | 1B |

| Cost of Revenue | 83M | 93M | 126M | 156M | 208M |

| Operating Expenses | 376M | 488M | 618M | 712M | 865M |

| Gross Profit | 382M | 410M | 466M | 596M | 792M |

| EBITDA | 33M | -59M | -118M | -44M | 29M |

| EBIT | 17M | -73M | -134M | -61M | -13M |

| Interest Expense | 17M | 18M | 3M | 1M | 4M |

| Net Income | -6M | -84M | -130M | -66M | -93M |

| EPS | -0.15 | -2.12 | -3.21 | -1.60 | -2.12 |

| Filing Date | 2021-03-11 | 2022-03-10 | 2023-03-02 | 2024-03-13 | 2025-03-12 |

In the analysis of CyberArk’s income statement, I observe a consistent growth trend in revenue, rising from 464M in 2020 to 1B in 2024. However, net income remains negative, reflecting ongoing operational challenges, with losses worsening from -6M in 2020 to -93M in 2024. Gross profit margins have remained relatively stable, but operating expenses have increased significantly, impacting profitability. In 2024, EBITDA turned positive at 29M, indicating a potential turnaround in operational efficiency despite continued net losses. The recent year’s performance suggests a cautious optimism as the company navigates its path to profitability.

Financial Ratios

The table below provides a summary of key financial ratios for CyberArk Software Ltd. (CYBR) over the last available years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -1.24% | -16.69% | -22.03% | -8.84% | -9.34% |

| ROE | -0.81% | -11.55% | -19.22% | -8.39% | -3.94% |

| ROIC | 0.46% | -5.79% | -10.55% | -8.28% | -16.70% |

| WACC | 6.00% | 6.00% | 6.00% | 6.00% | 6.00% |

| P/E | N/A | N/A | -40.36 | -137.21 | -157.49 |

| P/B | 8.83 | 9.46 | 7.76 | 11.52 | 6.21 |

| Current Ratio | 4.30 | 3.12 | 2.43 | 1.08 | 1.48 |

| Quick Ratio | 4.30 | 3.12 | 2.43 | 1.08 | 1.48 |

| D/E | 0.74 | 0.73 | 0.85 | 0.76 | 0.01 |

| Debt-to-Assets | 0.34 | 0.31 | 0.32 | 0.30 | 0.01 |

| Interest Coverage | 0.34 | -4.34 | -46.92 | -194.77 | -17.90 |

| Asset Turnover | 0.30 | 0.30 | 0.33 | 0.37 | 0.30 |

| Fixed Asset Turnover | 25.05 | 24.92 | 25.21 | 15.45 | 51.11 |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Interpretation of Financial Ratios

In 2024, CyberArk’s financial ratios indicate significant challenges. The negative net margin and ROE reflect ongoing losses, with the P/E and P/B ratios signaling market skepticism about future profitability. The current ratio shows adequate short-term liquidity, but the high D/E and low interest coverage ratio raise concerns about financial stability and debt management.

Evolution of Financial Ratios

Over the past five years, CyberArk’s financial ratios have shown a deteriorating trend, especially in profitability metrics such as net margin and return on equity. While liquidity ratios like the current and quick ratios have decreased, they remain above 1, which suggests a degree of short-term financial health despite the overall negative performance.

Distribution Policy

CyberArk Software Ltd. (CYBR) does not pay dividends, aligning with its strategy focused on reinvestment for growth and innovation. The company has shown negative net income, indicating a phase of high investment in research and development rather than returning capital to shareholders. However, it does engage in share buybacks, which may support share price by reducing the overall share count. This approach, while not yielding immediate returns, could foster long-term shareholder value if managed wisely.

Sector Analysis

CyberArk Software Ltd. operates in the Software – Infrastructure industry, focusing on security solutions for privileged access management. Key competitors include Okta and BeyondTrust, while its advantages lie in robust identity management and a comprehensive SaaS offering.

Strategic Positioning

CyberArk Software Ltd. (CYBR) holds a significant position in the Software – Infrastructure sector, with a market capitalization of approximately $24.2B. The company specializes in security solutions, particularly in privileged access management, which is essential for mitigating risks associated with cyber threats. Currently, it faces competitive pressure from other cybersecurity firms that are innovating rapidly amidst technological disruptions. Although CYBR maintains a strong market share in its niche, continuous advancements in AI and cloud security require strategic adaptation to sustain its competitive edge.

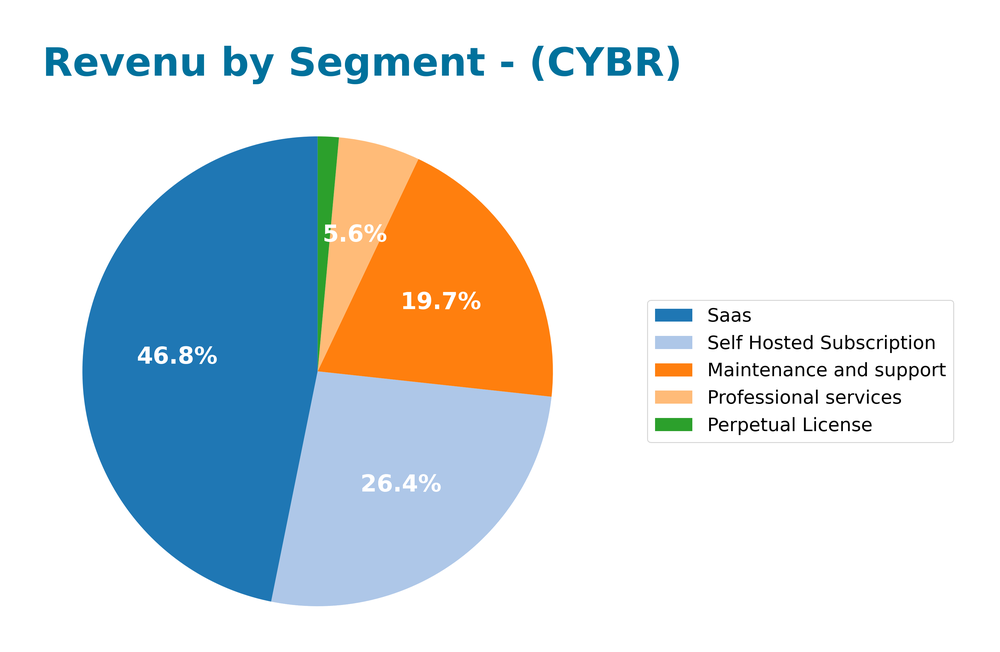

Revenue by Segment

The following chart illustrates CyberArk Software Ltd.’s revenue distribution by segment for the fiscal year ending December 31, 2024.

In 2024, CyberArk’s revenue from segments showed a significant increase in “SaaS” at 468M and “Self Hosted Subscription” at 265M, indicating a strategic shift towards cloud solutions. However, “Maintenance and support” dropped to 197M, reflecting potential challenges in customer retention. Notably, the “Professional services” segment also saw growth to 56M. The overall trend reveals strong demand for subscription-based services, yet the decline in traditional segments may signal emerging concentration risks as the company adapts to evolving market dynamics.

Key Products

CyberArk Software Ltd. offers a range of key products that provide security solutions across various sectors. Below is a table summarizing these products:

| Product | Description |

|---|---|

| Privileged Access Manager | A solution for risk-based credential security and session management to safeguard against privileged access attacks. |

| Vendor Privileged Access Manager | Combines features of Privileged Access Manager and Remote Access for secure, fast access for third-party vendors. |

| Endpoint Privilege Manager | A SaaS solution designed to secure privileges on endpoints, minimizing risks associated with endpoint security. |

| Cloud Entitlements Manager | A SaaS solution that enforces least privilege access across cloud environments, reducing excessive privilege risks. |

| Workforce Identity | Identity and Access Management as a Service, offering adaptive multi-factor authentication, single sign-on, and more. |

| Customer Identity Services | Provides authentication and authorization services, including MFA and user management for customer access to applications. |

| Secrets Manager Credential Providers | Manages and provides credentials for third-party solutions, enhancing security for integrations. |

| Secrets Manager Conjur | Tailored for cloud-native applications, helping manage secrets effectively in cloud environments. |

These products are crucial in the ever-evolving landscape of cybersecurity, helping organizations mitigate risks associated with privileged access and identity management.

Main Competitors

No verified competitors were identified from available data. CyberArk Software Ltd. is positioned within the software infrastructure industry and holds a significant market share, particularly in the privileged access management sector. The company is known for its robust security solutions that cater to various sectors, including financial services, healthcare, and technology, indicating a strong competitive position in its niche market.

Competitive Advantages

CyberArk Software Ltd. (CYBR) boasts a robust portfolio of security solutions designed to protect against privileged access attacks, a critical area of concern for organizations today. Its comprehensive offerings, including Privileged Access Manager and Endpoint Privilege Manager, position the company as a leader in the cybersecurity space. As businesses increasingly shift to cloud environments, CyberArk’s Cloud Entitlements Manager presents a significant growth opportunity. Looking ahead, the company is likely to expand its services into emerging markets and develop new products, further solidifying its competitive edge in the software infrastructure industry.

SWOT Analysis

The following SWOT analysis provides an overview of CyberArk Software Ltd.’s strategic positioning in the market.

Strengths

- Strong market position

- Innovative product offerings

- Diverse client base

Weaknesses

- High reliance on specific industries

- Limited brand recognition compared to competitors

- No dividends paid

Opportunities

- Growing demand for cybersecurity solutions

- Expansion into emerging markets

- Increasing regulatory requirements

Threats

- Intense competition in the cybersecurity sector

- Rapid technological changes

- Economic downturns impacting client budgets

Overall, CyberArk displays a solid foundation with innovative solutions and a diverse clientele, but it must address its weaknesses to capitalize on emerging opportunities. Strategic investments in marketing and diversification could enhance its competitive edge and resilience against market threats.

Stock Analysis

Over the past year, CyberArk Software Ltd. (CYBR) has exhibited significant price movements, characterized by a bullish trend with a remarkable price change of 119.07%. This analysis will delve into the trading dynamics and the current state of the stock.

Trend Analysis

Analyzing the stock’s performance over the past year reveals a substantial price increase of 119.07%, indicating a bullish trend. However, it’s important to note that the trend is currently in a state of deceleration, despite the overall positive movement. The highest price recorded during this period is 520.78, while the lowest was 211.72, showcasing notable volatility with a standard deviation of 81.66.

Volume Analysis

Examining trading volumes over the last three months, the total volume reached 363.1M, with buyer-driven activity dominating at 63.04%. The volume trend is increasing, suggesting a strong interest from investors. In the recent period, buyer volume was 22.4M compared to seller volume of 9.5M, reflecting a strongly buyer-dominant sentiment, indicated by a buyer dominance percentage of 70.26%. This increasing volume coupled with buyer dominance signals robust market participation.

Analyst Opinions

Recent analyst recommendations for CyberArk Software Ltd. (CYBR) have been cautious, with a consensus leaning towards a sell rating. Notably, the overall score is rated C- by analysts, reflecting concerns about its financial health. Key arguments include low scores in return on equity and return on assets, indicating inefficiency in utilizing shareholder capital. Analysts suggest that the company’s high debt-to-equity ratio poses additional risks. With these factors in mind, I advise investors to closely monitor CYBR’s performance before making any investment decisions.

Stock Grades

CyberArk Software Ltd. (CYBR) has received consistent ratings from several reputable grading companies, indicating a stable outlook from analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | maintain | Outperform | 2024-10-22 |

| Keybanc | maintain | Overweight | 2024-10-18 |

| Mizuho | maintain | Outperform | 2024-10-17 |

| BTIG | maintain | Buy | 2024-10-09 |

| Barclays | maintain | Overweight | 2024-10-07 |

| Wedbush | maintain | Outperform | 2024-10-01 |

| Jefferies | maintain | Buy | 2024-09-24 |

| DA Davidson | maintain | Buy | 2024-08-09 |

| Rosenblatt | maintain | Buy | 2024-08-09 |

| Susquehanna | maintain | Positive | 2024-08-09 |

The overall trend in grades for CyberArk shows a strong consensus among analysts, with multiple firms maintaining their positive ratings. This suggests that investor sentiment remains favorable, with expectations for continued performance in the cybersecurity sector.

Target Prices

The consensus among analysts for CyberArk Software Ltd. (CYBR) indicates a positive outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 520 | 440 | 474.67 |

Overall, analysts expect CyberArk’s stock to trend towards a consensus target of approximately 474.67, reflecting a balanced view between the high and low targets.

Consumer Opinions

Consumer sentiment towards CyberArk Software Ltd. (CYBR) reflects a mix of appreciation for its innovative security solutions and concerns over service complexities.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional security features that are easy to implement.” | “Customer support can be slow and unresponsive.” |

| “The platform has significantly improved our security posture.” | “Steep learning curve for new users.” |

| “Great value for the price, especially for mid-sized firms.” | “Some functionalities are overly complex.” |

Overall, consumer feedback highlights CyberArk’s robust security solutions as a key strength, while the complexity of its services and customer support responsiveness are recurring weaknesses.

Risk Analysis

In assessing the risk landscape for CyberArk Software Ltd. (CYBR), I’ve compiled a table summarizing key risks to consider.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for cybersecurity solutions. | High | High |

| Regulatory Risk | Changes in data protection regulations may affect operations. | Medium | High |

| Competition Risk | Increasing competition from larger tech firms. | High | Medium |

| Technology Risk | Rapid technological changes may outpace company adaptability. | Medium | High |

| Operational Risk | Potential for service disruptions impacting customer trust. | Medium | Medium |

The most pressing risks for CYBR involve market fluctuations and regulatory changes, both of which could significantly impact the company’s performance and stock valuation. Cybersecurity is a rapidly evolving field, and staying ahead is crucial.

Should You Buy CyberArk Software Ltd.?

CyberArk Software Ltd. is currently facing significant profitability challenges, with a negative net margin of -9.34%. The company’s debt levels are low, with a debt-to-equity ratio of 0.0124, indicating a relatively strong position in terms of debt management. The fundamentals show an overall decline in performance, reflected in the C- rating.

The decision to buy CyberArk may be influenced by several key financial indicators. The net margin is negative, which suggests that the company is currently unprofitable. Additionally, the return on invested capital (ROIC) is -16.70%, which is significantly lower than the weighted average cost of capital (WACC) of 8.35%, leading to value destruction. The long-term trend is bullish, but it is essential to note that recent buyer volume is higher than seller volume, indicating some buying interest.

A. Favorable signals The company has low debt levels, with a debt-to-equity ratio of 0.0124, suggesting that it is not overly leveraged. Furthermore, the recent buyer volume exceeds seller volume, which may imply growing interest among investors.

B. Unfavorable signals The net margin stands at -9.34%, indicating that the company is not currently generating profits. The ROIC of -16.70% is significantly less than the WACC of 8.35%, which results in value destruction. Additionally, the overall fundamentals show a declining trend, and the company’s rating is C-, reflecting poor performance.

C. Conclusion Given the negative net margin and ROIC lower than WACC, it might be prudent to wait for better financial performance before considering an investment in CyberArk. The current metrics suggest ongoing challenges that could hinder future growth, and the potential for a bullish reversal is unclear at this time.

There is a risk associated with the current financial situation, including the negative net margin and value destruction due to the ROIC being lower than WACC.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- CyberArk Software Ltd. (CYBR) is Attracting Investor Attention: Here is What You Should Know – Yahoo Finance (Oct 23, 2025)

- CyberArk (NASDAQ: CYBR) approves Palo Alto Networks deal: $45 cash + 2.2005 shares – Stock Titan (Nov 13, 2025)

- CyberArk Shareholders Approve Merger with Palo Alto Networks – The Globe and Mail (Nov 14, 2025)

- What Does the Market Think About CyberArk Software Ltd? – Benzinga (Nov 12, 2025)

- CyberArk (CYBR) Acquisition by Palo Alto Networks Approved by Sh – GuruFocus (Nov 13, 2025)

For more information about CyberArk Software Ltd., please visit the official website: cyberark.com