In the rapidly evolving semiconductor industry, two giants stand out: NVIDIA Corporation (NVDA) and Intel Corporation (INTC). Both companies are at the forefront of innovation, competing in overlapping markets such as gaming, data centers, and AI solutions. While NVIDIA is renowned for its graphics processing units and AI capabilities, Intel remains a key player in traditional computing and chip manufacturing. In this analysis, I will help you determine which company holds the most promise for investors looking to enhance their portfolios.

Table of contents

Company Overview

NVIDIA Corporation Overview

NVIDIA Corporation (Ticker: NVDA) is a global leader in visual computing technologies, primarily focused on graphics processing units (GPUs) for gaming and professional markets. Founded in 1993 and headquartered in Santa Clara, California, NVIDIA has positioned itself at the forefront of the semiconductor industry, with a market capitalization of approximately 4.63T. The company’s mission revolves around enhancing the way people interact with technology through innovations in AI, gaming, and high-performance computing. NVIDIA’s diverse product offerings range from gaming GPUs to data center solutions, catering to a broad spectrum of sectors, including automotive and cloud computing.

Intel Corporation Overview

Intel Corporation (Ticker: INTC), established in 1968 and also based in Santa Clara, California, is a pioneer in semiconductor manufacturing and design. With a market capitalization of around 156.21B, Intel’s mission is to drive innovation in computing technologies and solutions across various markets. The company operates through multiple segments, including Client Computing and Data Center, providing a variety of products such as CPUs, chipsets, and memory solutions. Intel’s strategic focus encompasses enhancing computing performance for personal devices, cloud services, and autonomous driving technologies.

Key Similarities and Differences

Both NVIDIA and Intel operate in the semiconductor sector and provide cutting-edge technology solutions. However, NVIDIA primarily specializes in graphics and AI computing, while Intel focuses on a broader range of computing products, including CPUs and memory. NVIDIA’s strength lies in its gaming and AI applications, whereas Intel’s diverse portfolio spans various computing needs, from consumer devices to enterprise solutions.

Income Statement Comparison

The following table highlights the income statement metrics for NVIDIA Corporation and Intel Corporation for their most recent fiscal years. This comparison provides insights into their financial performance and operational efficiency.

| Metric | NVIDIA Corporation | Intel Corporation |

|---|---|---|

| Revenue | 130.5B | 53.1B |

| EBITDA | 86.1B | 1.2B |

| EBIT | 84.3B | -10.2B |

| Net Income | 72.9B | -18.8B |

| EPS | 2.97 | -4.38 |

Interpretation of Income Statement

In the most recent fiscal year, NVIDIA exhibited remarkable growth, with revenue soaring to 130.5B, significantly boosting net income to 72.9B. This reflects strong operational efficiency, as indicated by a high EBITDA margin. In contrast, Intel faced challenges, experiencing a revenue decline and reporting a net loss of 18.8B. Their margins are under pressure due to high operating expenses and R&D investments. Overall, NVIDIA’s performance underscores its market strength, while Intel’s results highlight the need for strategic adjustments to regain profitability.

Financial Ratios Comparison

The following table compares the most recent financial ratios between NVIDIA Corporation (NVDA) and Intel Corporation (INTC).

| Metric | NVDA | INTC |

|---|---|---|

| ROE | 27.23% | -17.54% |

| ROIC | 25.89% | -8.06% |

| P/E | 39.90 | -4.63 |

| P/B | 36.66 | 0.88 |

| Current Ratio | 4.44 | 1.33 |

| Quick Ratio | 3.88 | 0.98 |

| D/E | 0.13 | 0.50 |

| Debt-to-Assets | 0.09 | 0.26 |

| Interest Coverage | 329.77 | -14.17 |

| Asset Turnover | 1.17 | 0.27 |

| Fixed Asset Turnover | 16.16 | 0.49 |

| Payout Ratio | 1.14% | -8.53% |

| Dividend Yield | 0.03% | 1.84% |

Interpretation of Financial Ratios

NVIDIA showcases strong financial health with high profitability ratios like ROE (27.23%) and ROIC (25.89%), indicating effective use of equity and capital. In contrast, Intel shows negative profitability and high debt levels, reflected in its negative P/E ratio and low interest coverage (-14.17). This suggests significant operational challenges and financial risk. Investors should weigh these disparities carefully when considering investments in either company.

Dividend and Shareholder Returns

NVIDIA Corporation (NVDA) pays a modest dividend with a payout ratio of approximately 1.1%, yielding around 0.03%. The company has engaged in share buybacks, indicating a commitment to returning value to shareholders. However, its increasing free cash flow must be monitored to ensure sustainability.

On the other hand, Intel Corporation (INTC) has a higher dividend yield of about 1.8%, with a payout ratio exceeding 180%, raising concerns about sustainability amid recent losses. Intel also participates in share repurchases, which may provide short-term support but could strain resources in the long run.

Ultimately, both companies’ approaches to returns highlight the importance of assessing both dividends and buybacks in relation to their long-term viability.

Strategic Positioning

NVIDIA (NVDA) holds a dominant market share in the gaming and AI sectors, benefiting from robust demand for its GPUs and data center solutions. With a market cap of $4.63T, it faces increasing competitive pressure from Intel (INTC), which, despite its significant market presence, has struggled to keep pace with NVIDIA’s innovation in AI technologies. Both companies are navigating technological disruptions, but NVIDIA’s focus on high-performance computing and gaming positions it favorably against Intel’s broader product range.

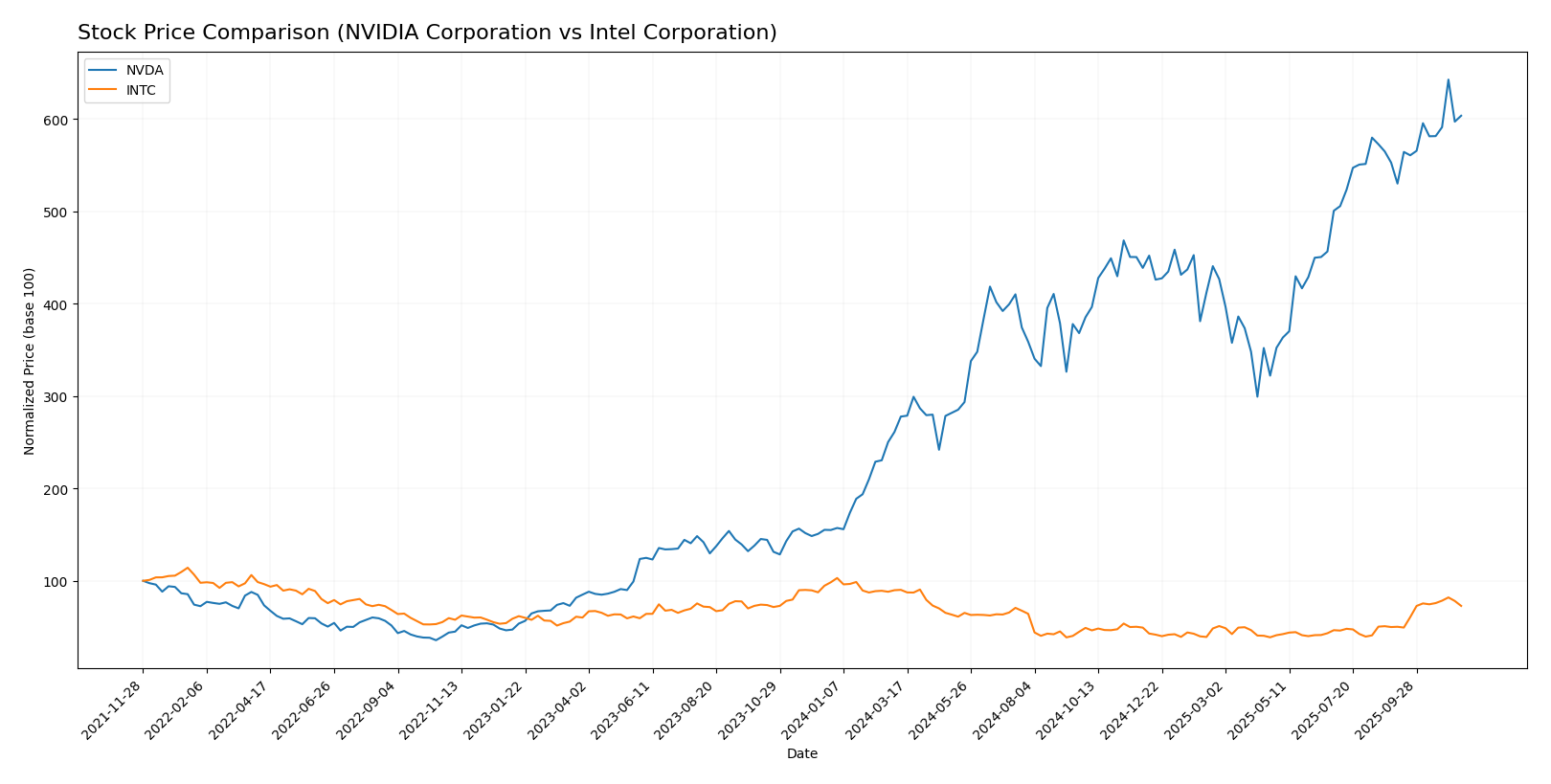

Stock Comparison

In analyzing the weekly stock price movements of NVIDIA Corporation (NVDA) and Intel Corporation (INTC) over the past year, we observe significant price fluctuations and trading dynamics that highlight the contrasting fortunes of these two companies.

Trend Analysis

For NVIDIA Corporation (NVDA), the overall price change over the past year stands at an impressive +289.45%, indicating a bullish trend. The stock has experienced notable acceleration, with a highest price of 202.49 and a lowest price of 48.83. Recent movements from August 31, 2025, to November 16, 2025, also reflect a positive trajectory, showing a +9.18% change during this period, further affirming the bullish nature of the stock’s trend.

In contrast, Intel Corporation (INTC) has faced challenges, with an overall price decline of -26.0%, categorizing it as a bearish trend. This stock also shows acceleration in its downward movement, with a highest price of 50.25 and a lowest of 18.89 over the past year. However, there has been a notable recovery of +45.87% in the recent period from August 31, 2025, to November 16, 2025. Despite this recent uptick, the overall bearish trend remains a significant concern.

In summary, NVDA exhibits a strong bullish trend with significant gains and positive momentum, whereas INTC, despite recent recovery, remains in a bearish pattern overall.

Analyst Opinions

Recent analyst recommendations indicate a clear divide between NVIDIA (NVDA) and Intel (INTC). Analysts rate NVIDIA with a B+, emphasizing strong return on equity and assets, supporting a consensus buy for 2025. In contrast, Intel receives a C+, with concerns about its discounted cash flow and overall performance, leading to a consensus hold. Noteworthy analysts suggest that while NVIDIA’s growth potential remains robust, Intel faces significant challenges in enhancing its competitive edge. Caution is advised for investors considering Intel, while NVIDIA appears to be a more favorable option.

Stock Grades

I have compiled the most recent stock grades from reliable grading companies for NVIDIA Corporation (NVDA) and Intel Corporation (INTC). Below are the details of their ratings:

NVIDIA Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | maintain | Overweight | 2025-11-14 |

| Wells Fargo | maintain | Overweight | 2025-11-14 |

| Morgan Stanley | maintain | Overweight | 2025-11-14 |

| Susquehanna | maintain | Positive | 2025-11-13 |

| Oppenheimer | maintain | Outperform | 2025-11-13 |

| Citigroup | maintain | Buy | 2025-11-10 |

| Rosenblatt | maintain | Buy | 2025-11-03 |

| Loop Capital | maintain | Buy | 2025-11-03 |

| Goldman Sachs | maintain | Buy | 2025-11-03 |

| DA Davidson | maintain | Buy | 2025-10-29 |

Intel Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | maintain | Buy | 2025-11-04 |

| Barclays | maintain | Equal Weight | 2025-10-27 |

| Mizuho | maintain | Neutral | 2025-10-24 |

| Wedbush | maintain | Neutral | 2025-10-24 |

| Wells Fargo | maintain | Equal Weight | 2025-10-24 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-24 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-24 |

| Truist Securities | maintain | Hold | 2025-10-24 |

| Rosenblatt | maintain | Sell | 2025-10-24 |

| JP Morgan | maintain | Underweight | 2025-10-24 |

Overall, both companies have maintained strong grades, particularly NVIDIA, which continues to receive “Overweight” ratings from several firms. Intel shows a mixed sentiment with a range of grades, indicating some caution among analysts. As always, I recommend monitoring these trends closely to manage your investment risks effectively.

Target Prices

Analysts have provided target prices for NVIDIA Corporation (NVDA) and Intel Corporation (INTC), indicating their expectations for future performance.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NVIDIA Corporation | 350 | 200 | 251.33 |

| Intel Corporation | 52 | 20 | 35.22 |

For NVIDIA, the consensus target price of 251.33 suggests a significant upside potential compared to the current price of 190.17. Meanwhile, Intel’s target consensus of 35.22 is slightly above its current price of 35.52, indicating mixed sentiment from analysts.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of NVIDIA Corporation (NVDA) and Intel Corporation (INTC) based on the most recent data.

| Criterion | NVIDIA (NVDA) | Intel (INTC) |

|---|---|---|

| Diversification | High (multiple sectors: gaming, automotive, data center) | Moderate (primarily CPUs and GPUs) |

| Profitability | Strong (net profit margin: 55.8%) | Weak (net profit margin: -35.3%) |

| Innovation | Leading in AI and GPU technologies | Slower in new product releases |

| Global presence | Extensive (operations in US, Taiwan, China) | Significant (global market but facing challenges) |

| Market Share | Dominant in GPU market | Competitive but declining in CPU market |

| Debt level | Low (debt-to-equity ratio: 0.13) | High (debt-to-equity ratio: 0.50) |

In summary, NVIDIA exhibits strong profitability, innovation, and a diverse portfolio, making it a compelling option for investors. In contrast, Intel shows weaknesses in profitability and innovation, raising concerns for long-term growth.

Risk Analysis

The following table outlines the key risks associated with NVIDIA Corporation (NVDA) and Intel Corporation (INTC), providing a comparative view of their respective vulnerabilities.

| Metric | NVIDIA (NVDA) | Intel (INTC) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | High |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | High | Moderate |

Both companies face significant market risks, particularly NVIDIA due to its reliance on volatile semiconductor demand. Intel’s operational risks remain high due to ongoing restructuring efforts and competitive pressures.

Which one to choose?

When comparing NVIDIA Corporation (NVDA) and Intel Corporation (INTC), the fundamental metrics clearly favor NVIDIA. NVDA boasts a gross profit margin of 75% and a net profit margin of 55.8%, highlighting its strong profitability. In contrast, INTC has a gross profit margin of 32.7% and a net loss margin of 35.3%, indicating financial challenges. Additionally, NVDA’s current ratio is 4.44, suggesting strong liquidity, while INTC’s is only 1.33, raising concerns about short-term obligations.

The stock trend for NVDA is bullish with a 289.45% price change over the past year, while INTC’s trend is bearish, down 26%. Analysts have rated NVDA as B+ compared to INTC’s C+, indicating a preference for NVDA among market experts.

Investors focused on growth may prefer NVDA for its strong performance and future potential, while those seeking stability might consider INTC, albeit with caution due to its ongoing struggles.

Specific risks include competitive pressures in the semiconductor industry, which can impact both companies’ profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of NVIDIA Corporation and Intel Corporation to enhance your investment decisions: