In the competitive landscape of the healthcare sector, two giants stand out: Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD). Both companies operate within the drug manufacturing industry, focusing on innovative therapies that address critical medical needs. Their overlapping market presence and distinct approaches to innovation make them compelling subjects for comparison. As an investor, understanding which of these companies could enhance your portfolio is essential. Let’s delve into their strategies and performance to identify the more intriguing investment opportunity.

Table of contents

Company Overview

Amgen Inc. Overview

Amgen Inc. (AMGN) is a leading biotechnology company that focuses on discovering, developing, manufacturing, and delivering human therapeutics globally. Founded in 1980 and headquartered in Thousand Oaks, California, Amgen aims to address critical medical needs in areas such as oncology, inflammation, bone health, cardiovascular diseases, nephrology, and neuroscience. The company’s robust portfolio includes established products like Enbrel for autoimmune diseases and Neulasta for cancer treatment. With a market capitalization of approximately $181.3B, Amgen maintains a strong position in the healthcare sector, providing solutions through both direct consumer channels and partnerships with healthcare providers.

Gilead Sciences, Inc. Overview

Gilead Sciences, Inc. (GILD) is an innovative biopharmaceutical company dedicated to developing and commercializing medicines that address unmet medical needs. Established in 1987 and based in Foster City, California, Gilead’s product range includes treatments for HIV/AIDS, liver diseases, and hematological oncology, such as Biktarvy and Veklury. With a market cap around $155.1B, the company is recognized for its commitment to advancing healthcare through strategic collaborations and rigorous research and development efforts.

Both Amgen and Gilead operate within the drug manufacturing sector, yet their business models differ. Amgen emphasizes chronic disease management with a diverse therapeutic portfolio, while Gilead focuses on specific viral and oncology treatments, showcasing distinct strategic priorities and market approaches.

Income Statement Comparison

The following table summarizes the income statement metrics for Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD) for the most recent fiscal year, providing a clear comparison of their financial performances.

| Metric | Amgen Inc. (AMGN) | Gilead Sciences, Inc. (GILD) |

|---|---|---|

| Revenue | 33.42B | 28.75B |

| EBITDA | 13.36B | 4.43B |

| EBIT | 7.76B | 1.67B |

| Net Income | 4.09B | 0.48B |

| EPS | 7.62 | 0.38 |

Interpretation of Income Statement

In the latest fiscal year, Amgen experienced robust revenue growth, climbing to 33.42B, reflecting a significant increase from the previous year’s 28.19B. Conversely, Gilead’s revenue also grew but at a slower pace, reaching 28.75B from 27.12B. While Amgen’s net income decreased to 4.09B from 6.72B, Gilead’s net income rose slightly to 0.48B from 0.46B. Amgen’s EBITDA margin has contracted, indicating potential challenges in cost management, while Gilead’s performance remains stable but requires careful monitoring given its lower profitability. Overall, Amgen’s financials suggest a need for strategic adjustments to maintain growth momentum.

Financial Ratios Comparison

The following table provides a comparative overview of the most recent revenue and financial ratios for Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD).

| Metric | AMGN | GILD |

|---|---|---|

| ROE | 11.26% | 1.43% |

| ROIC | 18.52% | 8.71% |

| P/E | 34.48 | 239.97 |

| P/B | 24.73 | 5.96 |

| Current Ratio | 1.26 | 1.60 |

| Quick Ratio | 0.95 | 1.45 |

| D/E | 10.36 | 1.38 |

| Debt-to-Assets | 0.66 | 0.40 |

| Interest Coverage | 2.30 | 1.70 |

| Asset Turnover | 0.36 | 0.49 |

| Fixed Asset Turnover | 5.11 | 5.31 |

| Payout Ratio | 118.14% | 672.37% |

| Dividend Yield | 3.43% | 3.77% |

Interpretation of Financial Ratios

Amgen displays stronger ROE and ROIC compared to Gilead, indicating superior profitability and efficient capital use. However, Gilead’s lower P/E and P/B suggest it may be undervalued relative to its fundamentals. Both companies have manageable current and quick ratios, but Gilead’s significantly higher payout ratio raises concerns about sustainability. Investors should weigh these factors cautiously while considering potential risks.

Dividend and Shareholder Returns

Amgen Inc. (AMGN) currently pays a dividend of $8.93 per share, yielding approximately 3.43%. With a payout ratio of 117.14%, sustainability could be a concern, especially given its reliance on free cash flow for coverage. In contrast, Gilead Sciences, Inc. (GILD) also pays a dividend of $3.14 per share, providing a yield of about 3.40%. GILD’s payout ratio is 67.24%, indicating a more balanced approach to shareholder returns. Both companies engage in share buybacks, reinforcing their commitment to return capital to shareholders, yet AMGN’s higher payout ratio raises potential risks for long-term value creation.

Strategic Positioning

Amgen Inc. (AMGN) holds a market cap of $181.3B, focusing on a wide array of therapeutic areas, including oncology and inflammation, giving it a strong competitive edge. Gilead Sciences, Inc. (GILD), with a market cap of $155.1B, specializes in antiviral treatments, particularly for HIV and COVID-19, which keeps it relevant amid rising competitive pressures. Both companies face technological disruptions from emerging biopharmaceutical innovations but remain resilient through strategic collaborations and a robust product pipeline.

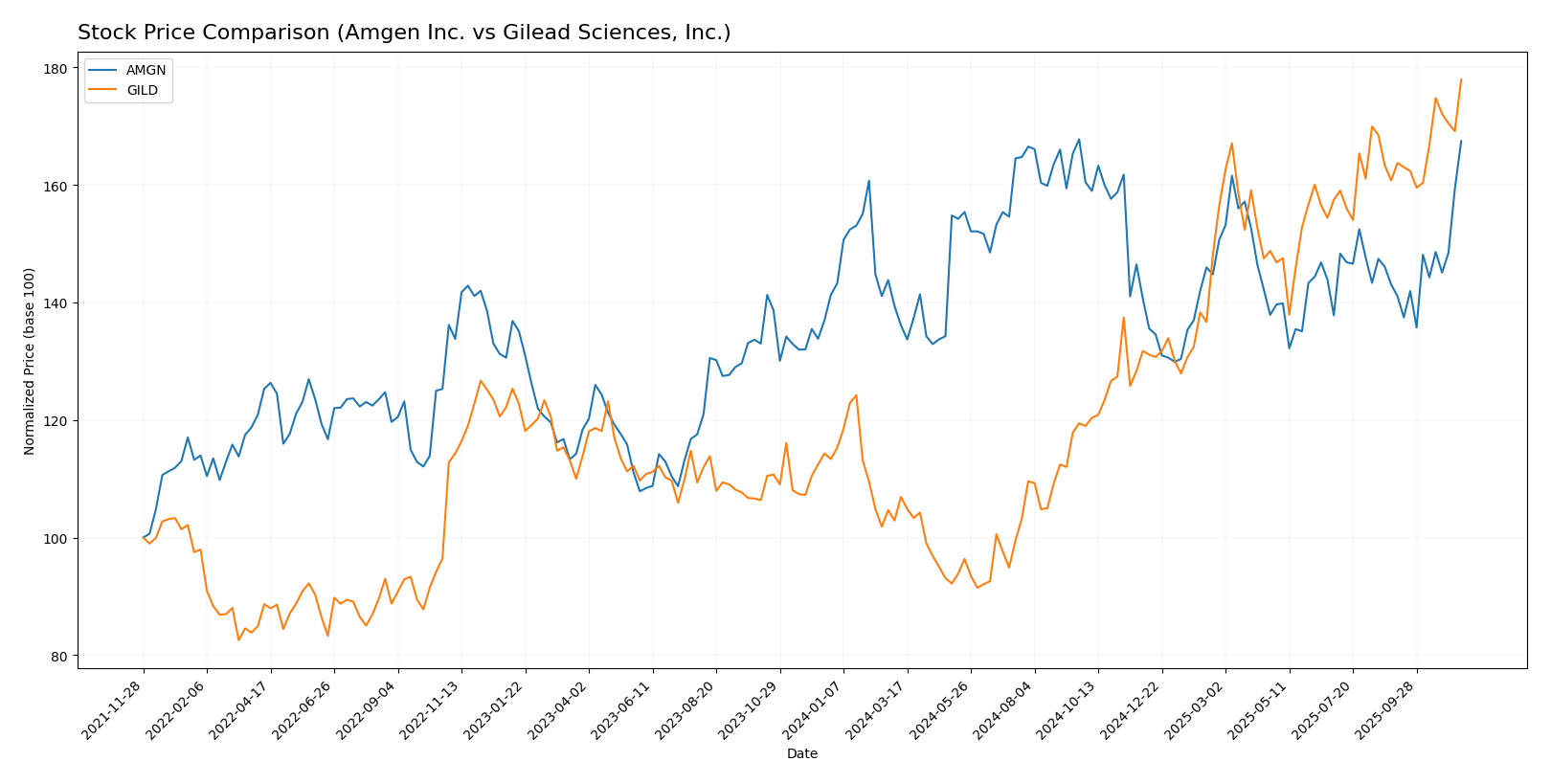

Stock Comparison

In this section, I will analyze the weekly stock price movements of Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD) over the past year, highlighting key price dynamics and trends that may guide your investment decisions.

Trend Analysis

Amgen Inc. (AMGN): Over the past year, the stock has experienced a percentage change of +18.5%. However, it is classified as a bearish trend due to the negative interpretation of the trend direction, despite the positive price movement. The highest price reached was 337.38, while the lowest was 261.22, indicating volatility with a standard deviation of 20.51. The recent trend shows a percentage change of +17.04%, with a standard deviation of 17.2, suggesting that while the stock has gained, the overall bearish classification remains due to market sentiment.

Gilead Sciences, Inc. (GILD): In contrast, GILD has enjoyed a robust bullish trend with a percentage change of +56.94% over the same period. This significant increase indicates strong market performance, with notable highs at 125.02 and lows at 64.27, and a standard deviation of 18.13, reflecting some volatility. The recent trend analysis shows a percentage increase of +10.67%, accompanied by a standard deviation of 4.1. This suggests continued strength, with the trend maintaining its bullish momentum.

Both stocks demonstrate notable price movements, but GILD stands out with a clear bullish trajectory, while AMGN’s recent gains are overshadowed by its overall bearish classification.

Analyst Opinions

Recent analyst recommendations show a mixed sentiment towards Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD). AMGN has received a B+ rating with a consensus leaning towards a hold due to its strong cash flow and solid returns, despite some concerns over its price-to-earnings ratio. In contrast, GILD boasts an A- rating, with analysts recommending a buy, highlighting its robust financial metrics and favorable debt-to-equity ratio. Overall, the consensus for GILD is buy, while AMGN is more neutral, suggesting caution.

Stock Grades

In the current market landscape, maintaining a close eye on stock ratings can provide valuable insights for traders and investors. Here are the latest grades for Amgen Inc. and Gilead Sciences, Inc., based on reliable grading companies.

Amgen Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | maintain | Overweight | 2025-11-14 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-06 |

| Wells Fargo | maintain | Overweight | 2025-11-05 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-05 |

| B of A Securities | maintain | Underperform | 2025-09-26 |

| Piper Sandler | maintain | Overweight | 2025-08-25 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-06 |

| Citigroup | maintain | Neutral | 2025-08-06 |

| UBS | maintain | Neutral | 2025-08-06 |

| B of A Securities | maintain | Underperform | 2025-07-23 |

Gilead Sciences, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | maintain | Buy | 2025-11-13 |

| Truist Securities | maintain | Buy | 2025-11-03 |

| JP Morgan | maintain | Overweight | 2025-10-31 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-31 |

| RBC Capital | maintain | Sector Perform | 2025-10-31 |

| Needham | maintain | Buy | 2025-10-31 |

| Wells Fargo | maintain | Overweight | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-23 |

| Citigroup | maintain | Buy | 2025-10-08 |

| JP Morgan | maintain | Overweight | 2025-09-16 |

Overall, both Amgen and Gilead show a trend of maintaining their existing grades across multiple reputable analysts, indicating a stable market perception. Amgen displays a mix of grades, with some underperforming indications, while Gilead maintains a stronger buy sentiment. This information can assist in making informed investment decisions.

Target Prices

The consensus target prices for Amgen Inc. and Gilead Sciences, Inc. provide a snapshot of analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Amgen Inc. | 381 | 300 | 332 |

| Gilead Sciences, Inc. | 147 | 105 | 127 |

Amgen’s consensus target price of 332 is slightly below its current price of 336.74, indicating a cautious outlook. Meanwhile, Gilead’s target consensus of 127 suggests potential upside from its current price of 125.02, reflecting a generally positive sentiment among analysts.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD) based on recent financial data.

| Criterion | Amgen Inc. (AMGN) | Gilead Sciences, Inc. (GILD) |

|---|---|---|

| Diversification | Strong product pipeline across various therapeutic areas | Focused on specific therapeutic areas like HIV and oncology |

| Profitability | High net profit margin (23.8%) | Lower net profit margin (2.1%) |

| Innovation | Robust R&D investments and pipeline | Recent product launches in oncology and COVID-19 |

| Global presence | Established in multiple countries with a wide distribution network | Significant international presence but more focused geographically |

| Market Share | Major player in the biotech sector with strong sales | Competitive in specific markets but facing challenges in key areas |

| Debt level | High debt-to-equity ratio (10.36) | Moderate debt-to-equity ratio (1.38) |

Key takeaways indicate that Amgen exhibits stronger profitability and a more diversified portfolio, while Gilead has focused strengths but is currently facing greater challenges in profitability and market share. Both companies have significant debt, which warrants careful consideration for investors.

Risk Analysis

In the following table, I outline the various risks associated with Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD) for the most recent fiscal year.

| Metric | Amgen Inc. (AMGN) | Gilead Sciences, Inc. (GILD) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and regulatory risks, with Gilead experiencing higher exposure to market fluctuations and operational challenges. Recent developments, such as Gilead’s ongoing drug approvals and market competition, emphasize these risks.

Which one to choose?

When comparing Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD), I find that GILD presents a stronger overall profile. GILD’s recent performance shows a bullish trend, with a price increase of 56.94% and an A- rating from analysts, reflecting solid fundamentals. In contrast, AMGN has a bearish trend despite a respectable B+ rating and a 18.5% price change. GILD demonstrates superior profit margins (net profit margin of 20.89% vs. 12.24% for AMGN) and lower debt ratios, indicating better financial health and lower risk.

For growth-focused investors, GILD appears to be the more compelling choice, while those valuing stability may still consider AMGN, which maintains a substantial dividend yield of approximately 3.43%. However, both companies face industry risks, including competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Amgen Inc. and Gilead Sciences, Inc. to enhance your investment decisions: