In a world increasingly driven by technology, GLOBALFOUNDRIES Inc. stands at the forefront of the semiconductor industry, powering countless innovations that touch our daily lives. Renowned for its cutting-edge manufacturing capabilities, the company plays a critical role in producing essential components like microprocessors and mobile application processors, shaping the very devices we depend on. As we explore the potential of GFS, we must consider whether its impressive fundamentals still align with its market valuation and growth trajectory.

Table of contents

Company Description

GLOBALFOUNDRIES Inc. is a prominent semiconductor foundry headquartered in Malta, NY, founded in 2009. The company specializes in manufacturing integrated circuits that power a wide array of electronic devices, positioning itself as a key player in the semiconductor industry. With a diverse product portfolio, GLOBALFOUNDRIES produces microprocessors, mobile application processors, and various other semiconductor devices, alongside offering wafer fabrication services. The firm operates primarily in North America and has established its presence on the NASDAQ exchange with a market capitalization of approximately $18.3B. Through its innovative technologies and manufacturing capabilities, GLOBALFOUNDRIES is shaping the future of electronics, driving advancements in technology and sustainability within the semiconductor landscape.

Fundamental Analysis

In this section, I will analyze GLOBALFOUNDRIES Inc.’s income statement, financial ratios, and dividend payout policy to provide insight into its financial health.

Income Statement

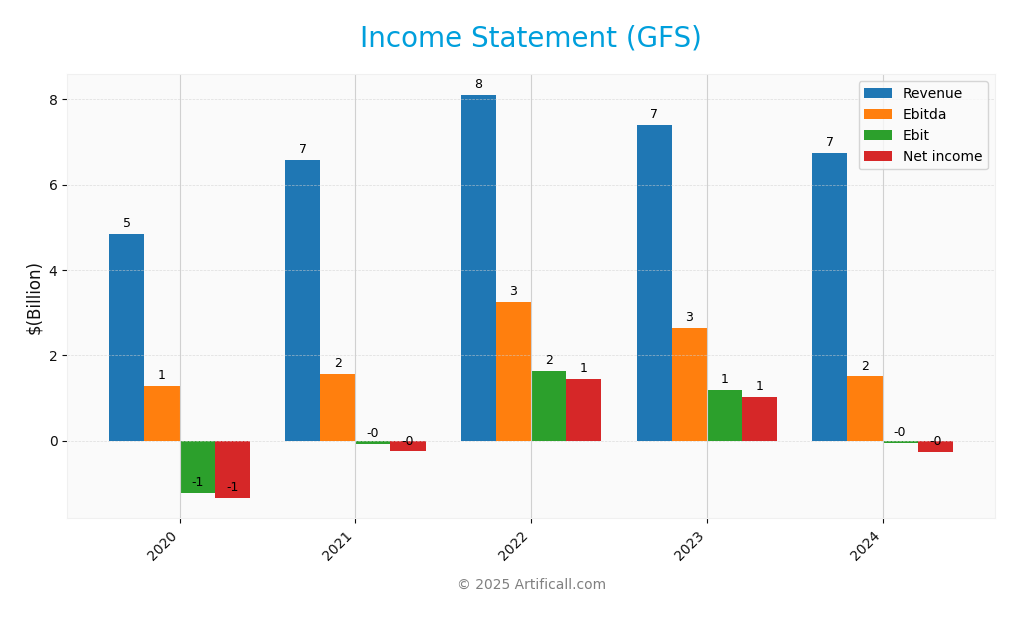

The following table summarizes the income statement for GLOBALFOUNDRIES Inc. over the last five fiscal years, providing key insights into the company’s financial performance.

| Item | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.85B | 6.59B | 8.11B | 7.39B | 6.75B |

| Cost of Revenue | 5.56B | 5.57B | 5.87B | 5.29B | 5.10B |

| Operating Expenses | 0.94B | 1.07B | 1.07B | 0.97B | 1.87B |

| Gross Profit | -0.71B | 1.03B | 2.24B | 2.10B | 1.65B |

| EBITDA | 1.29B | 1.56B | 3.25B | 2.64B | 1.50B |

| EBIT | -1.23B | -0.07B | 1.62B | 1.19B | -0.06B |

| Interest Expense | 0.15B | 0.11B | 0.12B | 0.14B | 0.15B |

| Net Income | -1.35B | -0.25B | 1.45B | 1.02B | -0.27B |

| EPS | -2.54 | -0.50 | 2.69 | 1.85 | -0.48 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2024-03-20 |

Analyzing the income statement reveals a concerning trend for GLOBALFOUNDRIES Inc. The company’s revenue peaked in 2022 at 8.11B but declined to 6.75B in 2024, reflecting a significant revenue drop of approximately 17%. Net income also turned negative in 2024 after a profitable year in 2023, illustrating the volatility in earnings. The operating expenses surged in 2024, which likely contributed to this decline. Overall, the company’s margins have been under pressure, and while EBITDA remains positive, the negative EBIT and net income indicate ongoing challenges that investors should monitor closely.

Financial Ratios

The following table summarizes the financial ratios for GLOBALFOUNDRIES Inc. (GFS) over the last five years:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -27.85% | -3.86% | 17.86% | 13.80% | -3.93% |

| ROE | -18.75% | -3.15% | 14.67% | 9.16% | -2.45% |

| ROIC | -20.56% | -2.53% | 12.41% | 8.32% | -2.57% |

| P/E | -18.27 | -129.37 | 20.06 | 32.80 | -89.54 |

| P/B | 3.44 | 4.09 | 2.93 | 3.01 | 2.20 |

| Current Ratio | 1.58 | 1.67 | 1.73 | 2.04 | 2.11 |

| Quick Ratio | 1.09 | 1.32 | 1.33 | 1.56 | 1.57 |

| D/E | 0.39 | 0.25 | 0.25 | 0.25 | 0.22 |

| Debt-to-Assets | 22.74% | 13.39% | 14.07% | 15.26% | 13.81% |

| Interest Coverage | -9.73 | -0.60 | 9.97 | 8.24 | -1.48 |

| Asset Turnover | 0.39 | 0.44 | 0.45 | 0.41 | 0.40 |

| Fixed Asset Turnover | 0.59 | 0.76 | 0.77 | 0.73 | 0.82 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

The most recent year’s ratios indicate concerns for GLOBALFOUNDRIES Inc. The negative net margin of -3.93% and P/E ratio of -89.54 suggest profitability issues. Although the current and quick ratios are healthy (2.11 and 1.57, respectively), the interest coverage ratio of -1.48 raises red flags about the company’s ability to meet its debt obligations.

Evolution of Financial Ratios

Over the past five years, there has been a significant decline in profitability, as evidenced by the drop in net margin from -27.85% in 2020 to -3.93% in 2024. However, liquidity ratios have improved, reflecting better short-term financial health despite ongoing profitability challenges.

Distribution Policy

GLOBALFOUNDRIES Inc. (GFS) does not pay dividends, reflecting its strategy to reinvest profits into growth initiatives, particularly in research and development. The company is in a high growth phase, prioritizing capital expenditures to expand its operational capabilities. Despite the lack of dividends, GFS engages in share buybacks, which can enhance shareholder value. This approach aligns with long-term value creation, provided the company effectively manages growth and operational efficiency.

Sector Analysis

GLOBALFOUNDRIES Inc. operates in the semiconductor industry, providing essential manufacturing services for a wide array of integrated circuits. Its competitive advantages include advanced fabrication technologies and a robust client base, while key competitors are leading foundries like TSMC and Samsung.

Strategic Positioning

GLOBALFOUNDRIES Inc. (GFS) holds a significant position in the semiconductor foundry market, boasting a market cap of approximately 18.3B USD. With a focus on high-demand products like microprocessors and mobile application processors, GFS competes against major players such as TSMC and Intel. The competitive landscape is intense, driven by rapid technological advancements and increasing demand for semiconductors across industries. Additionally, GFS faces pressure from emerging technologies that challenge traditional manufacturing methods. This dynamic environment necessitates a robust strategy to maintain its market share and respond to ongoing disruptions.

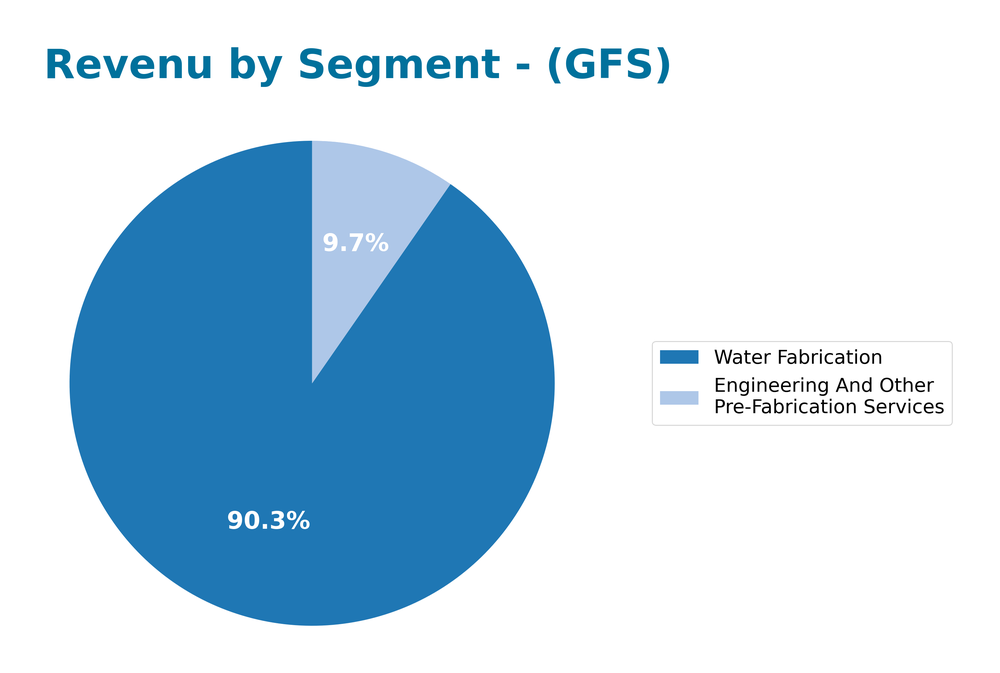

Revenue by Segment

The following chart illustrates the revenue distribution by segment for GLOBALFOUNDRIES Inc. over the last four fiscal years, highlighting trends and performance in their key business areas.

In the most recent fiscal year, 2024, GLOBALFOUNDRIES reported $652M from Engineering And Other Pre-Fabrication Services and $6.1B from Water Fabrication. The Water Fabrication segment remains the primary revenue driver, although it has shown a decline from $6.8B in 2023. Meanwhile, Engineering And Other Pre-Fabrication Services has experienced growth, increasing from $572M in 2023 to $652M in 2024. This suggests a potential shift in focus towards enhancing service offerings, but the decline in Water Fabrication raises concerns about margin stability and market concentration risks.

Key Products

GLOBALFOUNDRIES Inc. specializes in a range of semiconductor products that are crucial for various electronic applications. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| Microprocessors | High-performance chips designed for computing tasks in personal computers and servers. |

| Mobile Application Processors | Processors optimized for smartphones and tablets, enabling seamless multitasking and graphics. |

| Baseband Processors | Chips that handle communication functions in mobile devices, ensuring connectivity and data transfer. |

| Network Processors | Specialized processors for managing data traffic in networking equipment, enhancing performance. |

| Radio Frequency Modems | Components that facilitate wireless communication, crucial for mobile and IoT applications. |

| Microcontrollers | Integrated circuits that control various devices, from household appliances to industrial machinery. |

| Power Management Units | Solutions that optimize power usage in electronic devices, extending battery life and efficiency. |

| Microelectromechanical Systems | Miniaturized systems combining mechanical and electronic components for sensors and actuators. |

These products reflect the diverse capabilities of GLOBALFOUNDRIES in the semiconductor industry, catering to a wide array of technological needs.

Main Competitors

No verified competitors were identified from available data. However, I can provide insights into GLOBALFOUNDRIES Inc. (GFS). As a prominent player in the semiconductor foundry industry, GFS holds a significant market share, contributing to its competitive position. The company operates primarily in the global market, specializing in manufacturing integrated circuits for various electronic devices, which positions it as a strong contender in its sector.

Competitive Advantages

GLOBALFOUNDRIES Inc. (GFS) holds a strong position in the semiconductor industry, primarily due to its advanced manufacturing capabilities and extensive portfolio of integrated circuits. With a market cap of approximately $18.3B, the company benefits from significant scale and the ability to meet diverse customer needs. Looking ahead, GFS is poised to expand into new markets and develop innovative products, particularly in the fields of artificial intelligence and IoT. This strategic focus on next-generation technologies presents substantial growth opportunities, enhancing its competitive edge in a rapidly evolving landscape.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing GLOBALFOUNDRIES Inc. (GFS) as it navigates the semiconductor industry.

Strengths

- strong market position

- diverse product range

- robust production capabilities

Weaknesses

- no dividend payouts

- high beta volatility

- reliance on specific markets

Opportunities

- growing demand for semiconductors

- expansion into new markets

- advancements in technology

Threats

- intense competition

- supply chain disruptions

- regulatory challenges

The overall SWOT assessment indicates that while GLOBALFOUNDRIES has significant strengths and opportunities in a growing market, it must carefully manage its weaknesses and remain vigilant against external threats. This strategic focus can help ensure long-term sustainability and growth in a competitive landscape.

Stock Analysis

In the past year, GLOBALFOUNDRIES Inc. (GFS) has experienced significant price movements that reflect a bearish trend in the stock market. The stock has seen notable fluctuations, with a considerable decline in its price, which warrants a closer examination of its trading dynamics.

Trend Analysis

Over the past year, GFS has exhibited a price change of -45.23%, indicating a bearish trend. This decline has been characterized by acceleration, as evidenced by the standard deviation of 7.7, which suggests increased volatility in the stock’s price. The highest price recorded was 60.6, while the lowest was 31.54. Recently, the stock has shown a slight decrease of -1.02% from August 31, 2025, to November 16, 2025, with a trend slope of 0.13, indicating a neutral trend in the short term, despite the overall bearish sentiment.

Volume Analysis

In the last three months, the average trading volume for GFS has been approximately 16.02M, with average buy volume at 7.15M and average sell volume at 8.87M. This volume analysis indicates a seller-dominant behavior among investors, as sell volume exceeds buy volume. However, the overall volume trend remains bullish, with an acceleration of 505.51K in volume. This suggests that market participation is increasing, albeit with a prevailing sentiment leaning towards selling.

Analyst Opinions

Recent analyst recommendations for GLOBALFOUNDRIES Inc. (GFS) indicate a cautious stance, with a consensus rating of “hold.” Analysts note a C+ rating overall, highlighting solid discounted cash flow potential but low scores in return on equity and assets, as per the analysis from reputable sources. While the price-to-book ratio appears favorable, the concerns regarding profitability metrics have led analysts to advise investors to exercise caution. As such, the general sentiment leans towards holding rather than buying or selling at this time.

Stock Grades

Recent evaluations of GLOBALFOUNDRIES Inc. (GFS) reveal a mix of grades from reputable grading companies. Here’s a summary of the current stock ratings:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | maintain | Outperform | 2025-11-13 |

| Citigroup | maintain | Neutral | 2025-11-13 |

| JP Morgan | maintain | Neutral | 2025-11-13 |

| Wedbush | maintain | Outperform | 2025-11-13 |

| B of A Securities | downgrade | Underperform | 2025-10-13 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-06 |

| Wedbush | maintain | Outperform | 2025-08-06 |

| UBS | maintain | Neutral | 2025-08-06 |

| UBS | maintain | Neutral | 2025-07-28 |

| Citigroup | maintain | Neutral | 2025-07-07 |

The overall trend shows a stable outlook with several companies maintaining their grades, particularly those rating GFS as “Outperform.” However, the downgrade from B of A Securities to “Underperform” suggests some caution may be warranted for potential investors.

Target Prices

The target consensus for GLOBALFOUNDRIES Inc. (GFS) indicates a strong expectation among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 37 | 37 | 37 |

Overall, analysts are unified in their expectations, projecting a target price of $37 for GFS.

Consumer Opinions

Consumer sentiment towards GLOBALFOUNDRIES Inc. (GFS) reflects a mix of optimism and concern, showcasing the company’s strengths while revealing areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative technology that drives growth.” | “Customer service could be more responsive.” |

| “High-quality products that meet expectations.” | “Pricing is higher compared to competitors.” |

| “Strong commitment to sustainability.” | “Delivery times have been inconsistent.” |

Overall, consumer feedback indicates that while GFS is praised for its innovation and product quality, concerns about customer service and pricing persist as recurring weaknesses.

Risk Analysis

In this section, I will outline the key risks associated with investing in GLOBALFOUNDRIES Inc. (GFS) to help you make informed decisions.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in semiconductor demand and pricing. | High | High |

| Supply Chain Issues | Disruptions in supply chains affecting production. | Medium | High |

| Regulatory Risks | Changes in trade policies impacting operations. | Medium | Medium |

| Technological Change | Rapid advancements requiring constant innovation. | High | Medium |

| Competition | Increasing competition from other foundries. | High | High |

The most significant risks for GFS include market volatility and competition, which can severely impact profitability. Recent trends show heightened competition in the semiconductor sector, emphasizing the need for robust risk management strategies.

Should You Buy GLOBALFOUNDRIES Inc.?

GLOBALFOUNDRIES Inc. has faced significant challenges recently, reflected in its financial metrics. The company has a net margin of -3.93%, which indicates a loss, while its Return on Invested Capital (ROIC) is currently not positive, and its Weighted Average Cost of Capital (WACC) stands at 10.22%. Despite its flagship products in semiconductor manufacturing, the company also faces a bearish long-term trend and seller-dominant volumes.

Given the current financial situation, I would recommend waiting for GLOBALFOUNDRIES to improve its fundamentals. The negative net margin and ongoing losses make it unsuitable for long-term investment at this time. Additionally, the long-term trend remains negative, indicating more potential risks ahead.

Specific risks for GLOBALFOUNDRIES include intense competition in the semiconductor industry, supply chain challenges, and market dependence on fluctuating demand.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- GlobalFoundries Inc. (GFS) Surpasses Q3 Earnings and Revenue Estimates – Nasdaq (Nov 12, 2025)

- GlobalFoundries Downgrade: Strong Cash, Weak Growth, Tough Timing (NASDAQ:GFS) – Seeking Alpha (Nov 13, 2025)

- GlobalFoundries Inc. Just Recorded A 52% EPS Beat: Here’s What Analysts Are Forecasting Next – simplywall.st (Nov 15, 2025)

- GlobalFoundries (NASDAQ: GFS) sets Physical AI update webinar for Dec. 3, 2025 – Stock Titan (Nov 14, 2025)

- GLOBALFOUNDRIES Inc. (NASDAQ:GFS) Q3 2025 Earnings Call Transcript – Insider Monkey (Nov 13, 2025)

For more information about GLOBALFOUNDRIES Inc., please visit the official website: globalfoundries.com