In a world where wellness and fitness are paramount, Lululemon Athletica Inc. revolutionizes how we approach athletic apparel. Known for its innovative designs and commitment to quality, this Canadian company crafts not just clothing but a lifestyle, empowering individuals to pursue their fitness goals. With a robust market presence and a reputation for excellence, the question remains: do Lululemon’s fundamentals align with its market valuation and growth potential in an ever-evolving industry?

Table of contents

Company Description

Lululemon Athletica Inc. is a prominent player in the apparel retail industry, specializing in high-quality athletic wear and accessories for both men and women. Founded in 1998 and headquartered in Vancouver, Canada, the company operates over 574 stores across key markets including the U.S., Canada, and China. Lululemon focuses on two main segments: company-operated stores and direct-to-consumer sales, offering a diverse range of products such as yoga pants, running shorts, and fitness accessories. With a market cap of approximately $19.37B, the company’s commitment to innovation and community engagement positions it as a leader in shaping the athletic lifestyle sector, making it a go-to brand for health-conscious consumers.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Lululemon Athletica Inc., focusing on the income statement, financial ratios, and dividend payout policy.

Income Statement

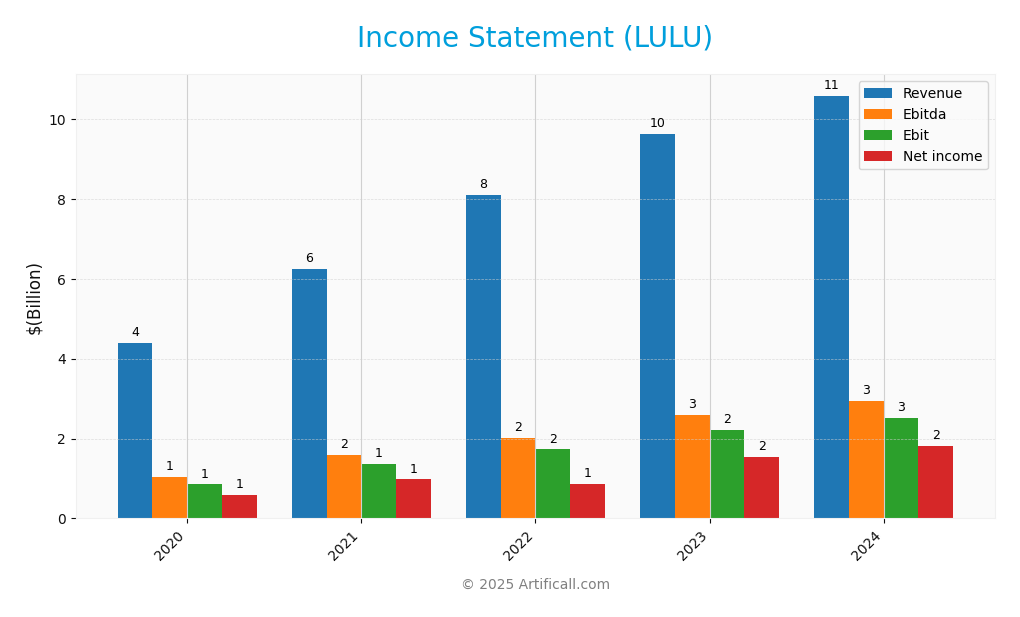

The following table presents Lululemon Athletica Inc.’s income statement, showcasing key financial metrics over the years to provide insights into the company’s performance.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 4.40B | 6.26B | 8.12B | 9.62B | 10.59B |

| Cost of Revenue | 1.94B | 2.65B | 3.62B | 4.01B | 4.32B |

| Operating Expenses | 1.64B | 2.28B | 3.16B | 3.48B | 3.77B |

| Gross Profit | 2.46B | 3.61B | 4.49B | 5.61B | 6.27B |

| EBITDA | 1.04B | 1.60B | 2.02B | 2.59B | 2.95B |

| EBIT | 0.85B | 1.37B | 1.72B | 2.21B | 2.51B |

| Interest Expense | 0.00B | 0.00B | 0.00B | 0.00B | 0.00B |

| Net Income | 0.59B | 0.98B | 1.55B | 1.81B | 1.81B |

| EPS | 4.52 | 7.49 | 6.68 | 12.20 | 14.67 |

| Filing Date | 2021-03-30 | 2022-03-29 | 2023-03-28 | 2024-03-21 | 2025-03-27 |

Over the reported period, Lululemon experienced a consistent upward trend in both Revenue and Net Income, reflecting robust business growth. The company’s Revenue surged from 4.40B in 2021 to 10.59B in 2025, while Net Income rose from 0.59B to 1.81B, suggesting effective cost management and operational efficiency. The margins have remained relatively stable, with slight improvements in EBITDA and EBIT margins in the most recent year, indicating that growth was steady and profitability was enhanced. In 2025, the company maintained its momentum, achieving significant revenue growth with stable net income, suggesting resilience in its business model despite potential market challenges.

Financial Ratios

The following table presents the financial ratios for Lululemon Athletica Inc. over the most recent fiscal years.

| Ratios | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|

| Net Margin | 15.59% | 10.54% | 16.12% | 17.14% |

| ROE | 20.07% | 27.13% | 32.43% | 36.18% |

| ROIC | 15.38% | 16.82% | 18.43% | 19.67% |

| P/E | 73.78 | 45.19 | 39.40 | 27.98 |

| P/B | 16.98 | 12.27 | 14.43 | 11.74 |

| Current Ratio | 2.41 | 2.12 | 2.49 | 2.16 |

| Quick Ratio | 1.17 | 1.15 | 1.68 | 1.38 |

| D/E | 0.32 | 0.34 | 0.33 | 0.36 |

| Debt-to-Assets | 19.08% | 19.09% | 19.79% | 20.73% |

| Interest Coverage | N/A | N/A | N/A | N/A |

| Asset Turnover | 1.27 | 1.45 | 1.36 | 1.39 |

| Fixed Asset Turnover | 3.61 | 3.62 | 3.42 | 3.31 |

| Dividend Yield | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

The most recent fiscal year’s ratios for Lululemon indicate strong financial health. The net margin has improved to 17.14%, showing effective cost management, while the ROE of 36.18% reflects a solid return on shareholder equity. However, the high P/E ratio at 27.98 may suggest that the stock is overvalued, warranting caution for potential investors.

Evolution of Financial Ratios

Over the past five years, Lululemon’s financial ratios have generally shown positive trends, with increasing profitability evident in the net margin and ROE. However, the P/E ratio has significantly decreased from 73.78 to 27.98, indicating a more favorable valuation relative to earnings compared to previous years.

Distribution Policy

Lululemon Athletica Inc. (LULU) currently does not pay dividends, a strategy likely driven by its focus on reinvestment for growth and innovation. The company prioritizes funding for research and development and expansion, aligning with its high-growth phase. Notably, Lululemon does engage in share buybacks, which can enhance shareholder value by reducing share dilution. Overall, this distribution approach appears to support sustainable long-term value creation for shareholders.

Sector Analysis

Lululemon Athletica Inc. operates in the apparel retail sector, specializing in athletic wear for both men and women. The company competes with brands like Nike and Under Armour while leveraging its strong brand loyalty and innovative product offerings.

Strategic Positioning

Lululemon Athletica Inc. (LULU) holds a significant position in the athletic apparel market, boasting a market cap of approximately 19.37B. The company has successfully captured a notable market share through its innovative product offerings and strong brand loyalty. However, it faces competitive pressure from both established brands and emerging players in the apparel sector. Technological disruptions, notably in e-commerce and direct-to-consumer sales, compel Lululemon to continuously adapt its strategies to maintain its competitive edge. As the market evolves, effective risk management will be crucial in navigating these challenges.

Revenue by Segment

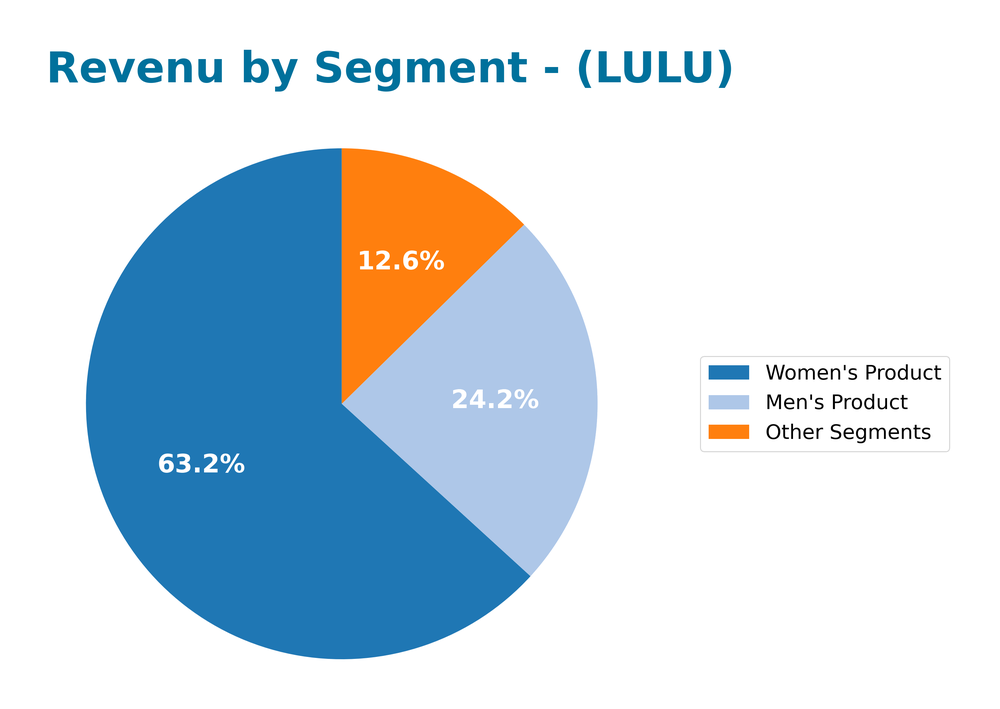

The following chart illustrates Lululemon Athletica Inc.’s revenue by segment for the fiscal year 2024, highlighting the contributions of each product line to overall sales.

In FY 2024, Lululemon’s revenue from Women’s Products was the most significant at 6.69B, followed by Men’s Products at 2.56B and Other Segments at 1.34B. This distribution shows a sustained growth trend in the Women’s segment, though the Men’s segment is also gaining traction with a notable increase from 2.25B in FY 2023. Overall, the company continues to strengthen its market position, but potential margin risks may arise if the growth in the Men’s Products does not accelerate further.

Key Products

Lululemon Athletica Inc. offers a variety of products that cater to the athletic and wellness lifestyle of consumers. Below is a table summarizing their key products:

| Product | Description |

|---|---|

| Align Pants | High-rise, lightweight, and breathable yoga pants made from Lululemon’s signature Nulu fabric. |

| ABC Pants | Designed for men, these versatile pants provide comfort and style for both athletic and casual wear. |

| Swiftly Tech Tops | Seamless, moisture-wicking tops designed for runners, offering both functionality and comfort. |

| Define Jacket | A fitted, lightweight jacket perfect for layering during workouts or casual outings. |

| Energy Bra | A supportive sports bra ideal for low to medium-impact activities, featuring a comfortable design. |

| Wunder Under Pants | Classic leggings that provide coverage and support for various fitness activities. |

| On My Level Bag | A sleek, functional bag designed for carrying essentials to and from the gym or for daily use. |

| Rest Day Hoodie | A cozy, oversized hoodie for relaxation and post-workout comfort, made from soft materials. |

These products reflect Lululemon’s commitment to quality and performance, catering to a wide range of athletic pursuits and lifestyles.

Main Competitors

No verified competitors were identified from available data. However, I can provide an overview of Lululemon Athletica Inc.’s estimated market share and competitive position. Lululemon is a significant player in the athletic apparel market, with a market cap of approximately 19.37B and a focus on high-quality products designed for various athletic activities. It operates mainly in North America but has also expanded its presence in international markets.

Competitive Advantages

Lululemon Athletica Inc. (LULU) benefits from strong brand loyalty and a robust direct-to-consumer model, which allows it to engage with customers personally and efficiently. The company is well-positioned for future growth through potential product line expansions and entry into emerging markets, particularly in Asia and Europe. Innovations in smart apparel and strategic partnerships could further enhance its competitive edge, making it a compelling choice for investors seeking growth in the athletic apparel segment.

SWOT Analysis

This analysis aims to identify the strengths, weaknesses, opportunities, and threats related to Lululemon Athletica Inc. to inform investment decisions.

Strengths

- Strong brand recognition

- Diverse product range

- Robust direct-to-consumer sales

Weaknesses

- High price point compared to competitors

- Dependence on North American market

- Limited product diversification

Opportunities

- Expansion into international markets

- Growth in e-commerce

- Increasing consumer interest in athleisure

Threats

- Intense competition in the apparel sector

- Economic downturn impacts discretionary spending

- Supply chain disruptions

Overall, Lululemon’s strengths position it well in the market, while its weaknesses highlight potential vulnerabilities. The opportunities for growth are substantial, but investors should remain cautious of the competitive landscape and economic factors that could impact performance.

Stock Analysis

Over the past year, Lululemon Athletica Inc. (LULU) has experienced significant price movements, reflecting a bearish trading dynamic that has resulted in a substantial decline in its stock value.

Trend Analysis

Analyzing LULU’s stock performance over the past year, I observe a price change of -66.53%, indicating a bearish trend. The stock has shown notable acceleration in its decline, with the highest price recorded at 511.29 and the lowest at 159.87. The standard deviation of 91.29 suggests considerable volatility in its price movements, further emphasizing the uncertainty surrounding the stock.

Volume Analysis

In the last three months, LULU’s trading volumes have averaged approximately 25.6M shares, with a notable shift in buyer-seller dynamics. The average buy volume stands at 7.58M, while the average sell volume is significantly higher at 18.03M, indicating a seller-dominant market environment. Despite this, the overall volume trend remains bullish, but the recent acceleration status shows deceleration, which may suggest waning investor interest or a cautious sentiment among market participants.

Analyst Opinions

Recent analyst recommendations for Lululemon Athletica Inc. (LULU) indicate a strong consensus towards a “buy” rating. Analysts have highlighted the company’s impressive return on equity and assets, with scores of 5 in both categories, reflecting robust operational efficiency. The discounted cash flow analysis also supports a positive outlook, earning a score of 5. However, concerns over the debt-to-equity ratio, which scored a 2, suggest some caution. Overall, the prevailing sentiment is bullish as investors seek to capitalize on LULU’s growth potential in the athleisure market.

Stock Grades

Lululemon Athletica Inc. (LULU) has received several stock ratings from reputable grading companies recently, reflecting a mix of sentiments among analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2025-10-17 |

| BTIG | Maintain | Buy | 2025-10-08 |

| Jefferies | Maintain | Underperform | 2025-10-06 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-30 |

| Needham | Downgrade | Hold | 2025-09-25 |

| Baird | Downgrade | Neutral | 2025-09-23 |

| B of A Securities | Maintain | Neutral | 2025-09-12 |

| HSBC | Downgrade | Hold | 2025-09-11 |

| Keybanc | Downgrade | Sector Weight | 2025-09-09 |

| UBS | Maintain | Neutral | 2025-09-05 |

The overall trend indicates a cautious sentiment among analysts, with several downgrades observed, particularly from firms like Needham and Baird. Despite this, BTIG maintains a consistent “Buy” rating, suggesting some confidence in LULU’s potential amid varied perspectives.

Target Prices

The current consensus among analysts for Lululemon Athletica Inc. suggests a balanced outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 205 | 120 | 168.71 |

Analysts expect Lululemon’s stock to reach a target consensus of approximately 168.71, reflecting a positive sentiment with a range from 120 to 205.

Consumer Opinions

Consumer sentiment around Lululemon Athletica Inc. (LULU) reveals a mix of admiration for its quality and concerns regarding pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional quality and durability!” | “Prices are too high for casual wear.” |

| “Loved the innovative designs!” | “Customer service could be improved.” |

| “Great fit and comfort for workouts!” | “Limited sizes available in stores.” |

| “Sustainable materials make me a fan!” | “Some items didn’t last as long as expected.” |

Overall, consumer feedback highlights Lululemon’s strong quality and innovative designs as major strengths, while high pricing and customer service issues are recurring weaknesses.

Risk Analysis

In this section, I present a concise table that outlines the key risks associated with Lululemon Athletica Inc. (LULU), helping investors to navigate potential challenges.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in consumer demand and preferences | High | High |

| Supply Chain | Disruptions in global supply chains affecting inventory | Medium | High |

| Competition | Increased competition from both established and emerging brands | High | Medium |

| Regulatory | Changes in trade policies impacting import costs | Medium | Medium |

| Economic | Economic downturns affecting discretionary spending | Medium | High |

I emphasize that the most likely and impactful risks involve market fluctuations and supply chain disruptions, particularly given the current economic climate and changing consumer behaviors.

Should You Buy Lululemon Athletica Inc.?

Lululemon Athletica Inc. (LULU) boasts a strong financial profile with a net margin of 17.14%, a return on invested capital (ROIC) of 12.4%, and a weighted average cost of capital (WACC) of 8.15%. The company benefits from a solid brand reputation in the athleisure market, though it faces competition from emerging brands and market fluctuations.

Given the favorable net margin and ROIC exceeding WACC, along with a positive long-term trend in revenue, I find that LULU appears favorable for long-term investors, particularly if current buyer volumes increase. However, the recent bearish trend and seller dominance in volume warrant caution and suggest that it may be prudent to wait for a bullish reversal before making significant additions to your portfolio.

Specific risks include heightened competition within the athleisure sector and potential supply chain disruptions that could impact profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Lululemon: Stock Price Is Down, But Moat Remains Intact (NASDAQ:LULU) – Seeking Alpha (Nov 13, 2025)

- Why Is Wall Street So Bearish on Lululemon Athletica? There’s 1 Key Reason. – The Motley Fool (Nov 14, 2025)

- Savant Capital LLC Sells 3,401 Shares of lululemon athletica inc. $LULU – MarketBeat (Nov 16, 2025)

- Is International Growth Enough to Keep lululemon Stock in Motion? – Yahoo Finance (Nov 11, 2025)

- National Pension Service Sells 18,154 Shares of lululemon athletica inc. $LULU – MarketBeat (Nov 16, 2025)

For more information about Lululemon Athletica Inc., please visit the official website: lululemon.com