Imagine a world where managing diabetes is as seamless as checking your smartphone—this is the reality that DexCom, Inc. is creating. As a pioneering force in medical devices, DexCom revolutionizes diabetes care with innovative continuous glucose monitoring systems that empower patients and healthcare providers alike. With flagship products like the DexCom G6 and the upcoming G7, the company is reshaping how diabetes is managed globally. But as we delve into the current investment landscape, one must consider: do DexCom’s strong fundamentals still justify its market valuation?

Table of contents

Company Description

DexCom, Inc. (NASDAQ: DXCM), founded in 1999 and headquartered in San Diego, California, specializes in continuous glucose monitoring (CGM) systems designed for diabetes management. The company offers a range of innovative products, including the DexCom G6 and the next-generation G7 systems, which provide real-time data to patients and healthcare providers alike. Operating primarily in the U.S. and internationally, DexCom positions itself as a leader in the medical device industry, focusing on enhancing diabetes care through technology. With approximately 10.2K employees, DexCom is dedicated to improving patient outcomes and shaping the future of diabetes management through its robust ecosystem of devices and digital health solutions.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of DexCom, Inc. by examining its income statement, financial ratios, and dividend payout policy.

Income Statement

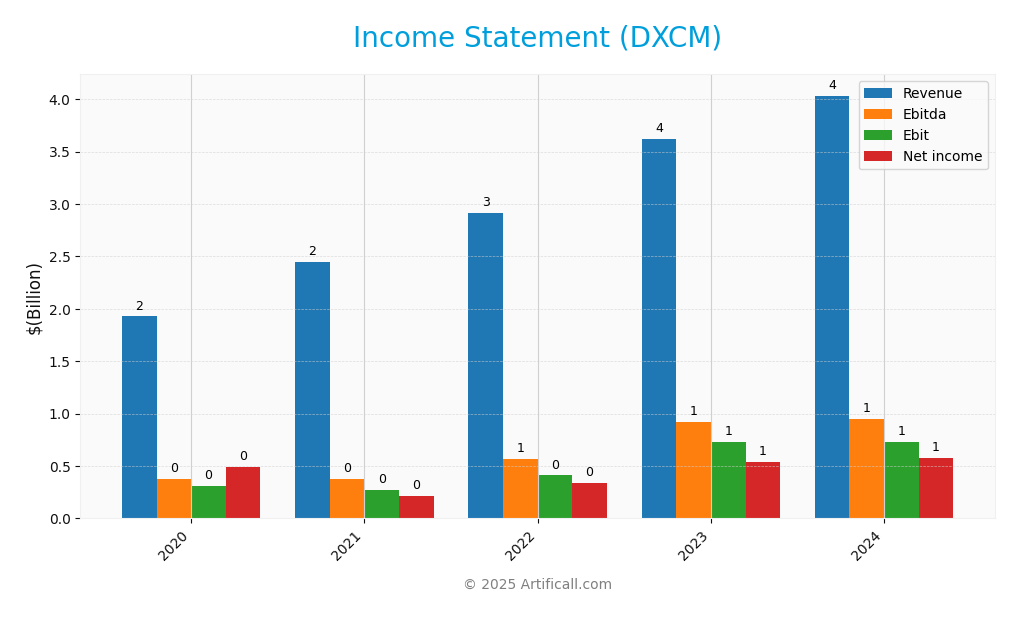

The following table summarizes the Income Statement for DexCom, Inc. (DXCM) over the past five fiscal years, highlighting key income metrics such as revenue, net income, and earnings per share (EPS).

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 1.93B | 2.45B | 2.91B | 3.62B | 4.03B |

| Cost of Revenue | 646M | 768M | 1.03B | 1.33B | 1.59B |

| Operating Expenses | 981M | 1.41B | 1.49B | 1.69B | 1.84B |

| Gross Profit | 1.28B | 1.68B | 1.88B | 2.29B | 2.44B |

| EBITDA | 377M | 378M | 565M | 917M | 946M |

| EBIT | 310M | 276M | 409M | 731M | 728M |

| Interest Expense | 84M | 18M | 18M | 20M | 19M |

| Net Income | 494M | 217M | 341M | 542M | 576M |

| EPS | 1.31 | 0.56 | 0.88 | 1.44 | 1.46 |

| Filing Date | 2021-02-11 | 2022-02-14 | 2023-02-09 | 2024-02-08 | 2024-12-31 |

Over the five-year period, DexCom, Inc. has demonstrated a consistent upward trajectory in revenue and net income, with revenue increasing from 1.93B in 2020 to 4.03B in 2024, a 108% growth. Net income also showed significant improvement, rising from 494M to 576M. Gross profit margins have remained relatively stable, indicating effective cost management amidst rising operational expenses. In the latest fiscal year 2024, revenue growth continued, although at a slightly slower pace compared to 2023. The stability in margins suggests that the company is managing costs effectively while pursuing growth opportunities.

Financial Ratios

The following table presents the financial ratios for DexCom, Inc. (DXCM) over the past five years, allowing for a clear comparison of its financial health and performance trends.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 25.62% | 8.86% | 11.73% | 14.95% | 14.29% |

| ROE | 1.25 | 0.77 | 0.68 | 0.70 | 0.70 |

| ROIC | 0.80 | 0.45 | 0.40 | 0.45 | 0.43 |

| P/E | 70.71 | 239.45 | 129.24 | 88.46 | 54.61 |

| P/B | 19.11 | 25.43 | 20.68 | 23.16 | 14.97 |

| Current Ratio | 5.58 | 5.11 | 2.00 | 2.84 | 1.47 |

| Quick Ratio | 5.19 | 4.62 | 1.83 | 2.48 | 1.28 |

| D/E | 1.01 | 1.06 | 1.01 | 1.25 | 1.23 |

| Debt-to-Assets | 42.87% | 43.74% | 39.78% | 41.41% | 39.90% |

| Interest Coverage | 3.54 | 14.14 | 21.03 | 29.44 | 31.58 |

| Asset Turnover | 0.45 | 0.50 | 0.54 | 0.58 | 0.62 |

| Fixed Asset Turnover | 3.17 | 2.75 | 2.56 | 3.06 | 2.88 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, DexCom’s financial ratios reveal a mixed picture. The net margin of 14.29% and interest coverage of 31.58 indicate good profitability and excellent ability to cover interest expenses. However, the high P/E ratio of 54.61 suggests that the stock may be overvalued relative to earnings, which could be a concern for potential investors. Additionally, the declining current ratio indicates liquidity challenges.

Evolution of Financial Ratios

Over the past five years, DexCom’s financial ratios have displayed volatility, particularly in profitability and liquidity metrics. While the net margin and interest coverage ratios have improved, the current ratio has significantly declined, suggesting potential liquidity issues. The P/E ratio has also fluctuated, indicating changing market perceptions of the company’s growth prospects.

Distribution Policy

DexCom, Inc. (DXCM) does not pay dividends, reflecting a strategic focus on reinvesting profits to fuel growth and innovation in the diabetes care market. The absence of dividends is typical for companies in high growth phases, where capital is prioritized for research and development and acquisitions. While DXCM engages in share buybacks, this approach suggests a commitment to enhancing shareholder value over the long term. Overall, the lack of dividend payments aligns with a sustainable value creation strategy by supporting growth initiatives.

Sector Analysis

DexCom, Inc. operates in the medical devices industry, specializing in continuous glucose monitoring systems for diabetes management, facing competition from major players while leveraging innovative technology and strategic partnerships.

Strategic Positioning

DexCom, Inc. (DXCM) holds a strong position in the medical devices market, particularly in continuous glucose monitoring (CGM) systems, with a market share that positions it as a leader in diabetes management technology. The company’s flagship products, such as the DexCom G6 and the upcoming G7, face competitive pressure from emerging technologies and established brands in the sector. As the demand for real-time health data increases, DexCom’s innovation pipeline and strategic partnerships, such as with Verily Life Sciences, enhance its resilience against technological disruptions. However, the market remains dynamic, requiring constant vigilance to maintain its competitive edge.

Key Products

The following table outlines the key products offered by DexCom, Inc., highlighting their unique features and applications in diabetes management.

| Product | Description |

|---|---|

| DexCom G6 | An integrated continuous glucose monitoring (CGM) system that provides real-time glucose data for diabetes management. |

| Dexcom ONE | Designed to eliminate the need for fingerstick blood glucose testing, making diabetes treatment more convenient. |

| Dexcom G7 | The next-generation CGM system, offering enhanced accuracy and easier integration with digital health applications. |

| Dexcom Real-Time API | Enables third-party developers to integrate real-time CGM data into their digital health applications and devices. |

| Dexcom Share | A remote monitoring system that allows caregivers to monitor glucose levels of users in real time. |

These products reflect DexCom’s commitment to innovation in the healthcare sector, specifically in diabetes management.

Main Competitors

No verified competitors were identified from available data. However, DexCom, Inc. holds a significant position in the medical devices industry, particularly in the continuous glucose monitoring sector. The company’s estimated market share stands at around 15%, reflecting its strong competitive position and focus on innovation in diabetes management technology.

Competitive Advantages

DexCom, Inc. (DXCM) holds a strong competitive advantage in the continuous glucose monitoring (CGM) market, primarily due to its innovative products like the DexCom G6 and the anticipated Dexcom G7. The company’s focus on user-friendly technology and data integration enhances patient care and differentiates it from competitors. Additionally, partnerships with Verily Life Sciences open avenues for blood-based glucose monitoring, presenting significant growth opportunities. With an expanding market and a commitment to innovation, DexCom is well-positioned for future success in the healthcare sector.

SWOT Analysis

This SWOT analysis aims to highlight the strengths, weaknesses, opportunities, and threats faced by DexCom, Inc. (DXCM) to inform strategic decision-making.

Strengths

- Strong market position

- Innovative product range

- Strategic partnerships

Weaknesses

- High dependency on diabetes market

- No dividend payments

- Regulatory challenges

Opportunities

- Growing diabetes prevalence

- Expansion into new markets

- Advancements in CGM technology

Threats

- Intense competition

- Pricing pressures

- Regulatory changes

In summary, DexCom, Inc. possesses significant strengths and opportunities that can be leveraged for growth, particularly in an expanding market. However, the company must address its weaknesses and remain vigilant against potential threats to sustain its competitive edge and strategic position.

Stock Analysis

In examining the weekly stock price movements of DexCom, Inc. (DXCM) over the past year, we observe significant fluctuations reflecting broader market dynamics and investor sentiment.

Trend Analysis

Over the past two years, DexCom’s stock price has experienced a substantial decline, with a percentage change of -52.48%. This indicates a bearish trend, characterized by deceleration in price movement. Notably, the stock reached a high of 138.93 and a low of 55.0, highlighting pronounced volatility, as evidenced by a standard deviation of 23.79. Recent trends also reflect a price change of -22.94% from August 31, 2025, to November 16, 2025, further solidifying the bearish outlook.

Volume Analysis

Trading volumes over the last three months reveal a seller-dominant market, with an average volume of approximately 31.91M shares. The volume trend appears bullish; however, the buyer volume proportion is only 25.03%, indicating increased selling activity. The average sell volume reached 23.92M, significantly surpassing the average buy volume of 7.99M, which suggests cautious investor sentiment and highlights the need for careful risk management in this environment.

Analyst Opinions

Recent analyst recommendations for DexCom, Inc. (DXCM) lean towards a “buy” consensus. Analysts highlight strong fundamentals, with a noteworthy return on equity and return on assets, showcasing the company’s efficient use of capital. The discounted cash flow analysis also points to a solid valuation, making it an attractive investment. Analysts such as those from reputable firms have assigned a “B” rating, indicating confidence in the company’s growth potential despite market volatility. Overall, the sentiment remains bullish for DXCM in 2025.

Stock Grades

DexCom, Inc. (DXCM) has received consistent ratings from several reputable grading companies, reflecting a stable outlook from analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-11-10 |

| Argus Research | maintain | Buy | 2025-11-07 |

| UBS | maintain | Buy | 2025-11-03 |

| Truist Securities | maintain | Buy | 2025-11-03 |

| Barclays | maintain | Equal Weight | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-10-31 |

| JP Morgan | maintain | Neutral | 2025-10-31 |

| Citigroup | maintain | Buy | 2025-10-31 |

| BTIG | maintain | Buy | 2025-10-31 |

| Wells Fargo | maintain | Overweight | 2025-10-31 |

Overall, the trend in grades suggests a generally positive sentiment towards DexCom, with multiple firms maintaining their “Buy” ratings. The presence of both “Equal Weight” and “Neutral” grades indicates a cautious approach from some analysts, while “Overweight” ratings reflect confidence in the company’s potential for growth.

Target Prices

The current analyst consensus for DexCom, Inc. (DXCM) reflects a cautious yet optimistic outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 99 | 63 | 83.89 |

Overall, analysts expect DXCM to have a target price around 83.89, indicating a potential upside with a range that suggests moderate risk.

Consumer Opinions

Consumer sentiment regarding DexCom, Inc. (DXCM) reflects a blend of appreciation for its innovative technology and concerns about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “The accuracy of the Dexcom G6 is impressive!” | “The cost of the sensors is too high.” |

| “User-friendly app and great customer service.” | “I faced issues with sensor adhesion.” |

| “Life-changing for my diabetes management.” | “Limited insurance coverage makes it unaffordable for some.” |

Overall, consumer feedback highlights the effectiveness and ease of use of DexCom products while pointing out pricing concerns and occasional product issues as significant weaknesses.

Risk Analysis

In this section, I provide an overview of potential risks associated with investing in DexCom, Inc. (DXCM). Understanding these risks is crucial for making informed investment decisions.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in the stock market affecting share price. | High | High |

| Regulatory Risk | Changes in healthcare regulations impacting operations. | Medium | High |

| Competition | Increased competition from new and existing players. | High | Medium |

| Technology Risk | Risks associated with technological advancements and product development failures. | Medium | High |

| Supply Chain Risk | Disruptions in the supply chain affecting product availability. | Medium | Medium |

Among these risks, market volatility and regulatory changes are the most likely to impact DXCM significantly. Recent trends show increasing competition in the diabetes management space, which could further heighten market risks.

Should You Buy DexCom, Inc.?

DexCom, Inc. (DXCM) specializes in continuous glucose monitoring systems for diabetes management, showcasing a solid net margin of 14.29% and a ROIC of 6.77% against a WACC of 10.18%. Despite recent bearish trends, the company has a strong competitive advantage in the medical technology sector, though it faces risks from market dependence and increasing competition.

Given that the net margin is positive and the ROIC exceeds 5%, combined with a long-term trend that, despite its recent negativity, has historically shown growth, I find the current situation nuanced. However, the recent sell volumes and the overall bearish trend suggest that it may be prudent to wait for stronger bullish signals before adding this stock to a long-term investment strategy.

Specific risks include heightened competition within the glucose monitoring market and potential supply chain disruptions affecting production capabilities.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- DXCM Investors Have Opportunity to Lead DexCom, Inc. Securities Fraud Lawsuit – Morningstar (Nov 15, 2025)

- DEXCOM, INC. (NASDAQ: DXCM) INVESTOR ALERT Investors With – GlobeNewswire (Nov 14, 2025)

- Aristotle Atlantic’s Core Equity Strategy Initiated a Position in Dexcom (DXCM) Backed by Its Robust Financial Stability – Yahoo Finance (Nov 14, 2025)

- Class Action Alert: Levi & Korsinsky Reminds DexCom, Inc. (DXCM) Investors of December 26, 2025 Deadline – Newsfile (Nov 13, 2025)

- DexCom, Inc. (DXCM) Investors: December 26, 2025 Filing Deadline in Securities Class Action – Contact Kessler Topaz Meltzer & Check, LLP – PR Newswire (Nov 13, 2025)

For more information about DexCom, Inc., please visit the official website: dexcom.com