Biogen Inc. is at the forefront of transforming lives through groundbreaking therapies that address neurological and neurodegenerative diseases. With a robust portfolio that includes innovative treatments like TECFIDERA and ADUHELM, the company has established itself as a pivotal player in the healthcare sector. As we assess Biogen’s market standing and growth trajectory, it is essential to question whether its current valuation aligns with its fundamental strengths and future potential.

Table of contents

Company Description

Biogen Inc. (NASDAQ: BIIB), founded in 1978 and headquartered in Cambridge, Massachusetts, is a prominent player in the healthcare sector specializing in therapies for neurological and neurodegenerative diseases. The company is recognized for its innovative products, including TECFIDERA and ADUHELM, targeting conditions such as multiple sclerosis and Alzheimer’s disease. With a market capitalization of approximately $24.6B, Biogen operates primarily in the U.S. and has a global reach through strategic collaborations. The company’s diversified portfolio encompasses both biologics and biosimilars, positioning it as a leader in the drug manufacturing industry. Biogen’s commitment to research and development underscores its role in shaping the future of neurological treatment and improving patient outcomes.

Fundamental Analysis

In this section, I will analyze Biogen Inc.’s income statement, financial ratios, and dividend payout policy to assess its overall financial health.

Income Statement

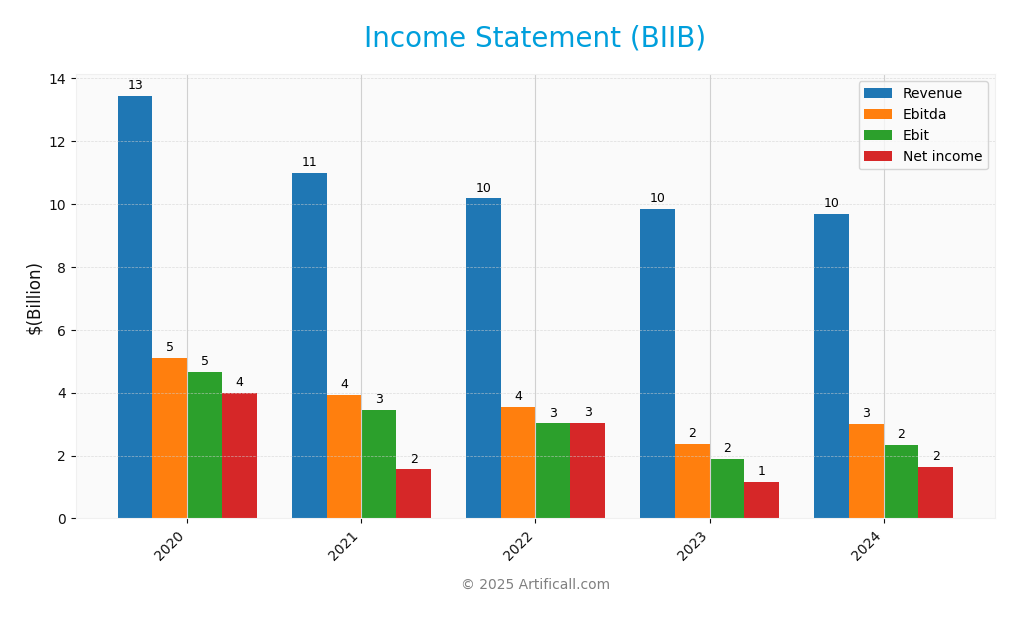

Below is the income statement for Biogen Inc. (BIIB) over the past five fiscal years, showcasing key financial metrics.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Revenue | 9.68B | 9.84B | 10.17B | 10.98B | 13.44B |

| Cost of Revenue | 2.31B | 2.53B | 2.28B | 2.11B | 1.81B |

| Operating Expenses | 4.88B | 5.20B | 5.01B | 6.08B | 7.05B |

| Gross Profit | 7.37B | 7.30B | 7.90B | 8.87B | 11.64B |

| EBITDA | 2.99B | 2.38B | 3.54B | 3.92B | 5.11B |

| EBIT | 2.32B | 1.88B | 3.02B | 3.44B | 4.65B |

| Interest Expense | 250M | 247M | 247M | 254M | 223M |

| Net Income | 1.63B | 1.16B | 3.05B | 1.56B | 4.00B |

| EPS | 11.20 | 8.02 | 20.97 | 10.44 | 24.86 |

| Filing Date | 2025-02-12 | 2024-02-13 | 2023-02-15 | 2022-02-03 | 2021-02-03 |

In reviewing the income statement for Biogen Inc., I observe a declining trend in revenue from 2020 to 2024, with the most recent year reporting $9.68B, a slight decrease from $9.84B in 2023. Net income has also followed suit, dropping significantly from $4.00B in 2020 to $1.63B in 2024. While gross profit margins have remained relatively stable, the operating expenses have shown a notable decline, suggesting tighter cost control in the recent year. Despite this, the overall performance indicates challenges in revenue generation, signaling the need for strategic adjustments to drive growth in future periods.

Financial Ratios

The table below summarizes the financial ratios of Biogen Inc. (BIIB) over the most recent available years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 29.8% | 14.2% | 29.9% | 11.8% | 16.9% |

| ROE | 36.9% | 25.1% | 31.5% | 12.6% | 14.5% |

| ROIC | 15.3% | 12.6% | 19.6% | 10.5% | 12.1% |

| P/E | 9.8 | 23.0 | 13.2 | 32.2 | 13.7 |

| P/B | 3.7 | 3.3 | 3.0 | 2.5 | 1.3 |

| Current Ratio | 1.8 | 1.8 | 3.0 | 2.0 | 1.3 |

| Quick Ratio | 1.6 | 1.5 | 2.6 | 1.3 | 0.9 |

| D/E | 0.73 | 0.70 | 0.49 | 0.50 | 0.40 |

| Debt-to-Assets | 31.8% | 31.8% | 26.9% | 27.3% | 23.6% |

| Interest Coverage | 20.6 | 11.0 | 11.7 | 8.5 | 9.9 |

| Asset Turnover | 0.55 | 0.46 | 0.41 | 0.37 | 0.34 |

| Fixed Asset Turnover | 3.5 | 2.9 | 2.7 | 2.6 | 2.7 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, Biogen’s financial ratios present a mixed picture. The net margin (16.9%) and ROE (14.5%) are reasonable, yet the P/E ratio (13.7) suggests undervaluation in comparison to the industry. However, the declining current and quick ratios indicate potential liquidity concerns. The interest coverage ratio (9.9) is strong, signaling good debt management, but the lack of dividend yield should be noted by income-focused investors.

Evolution of Financial Ratios

Over the past five years, Biogen’s financial ratios have shown volatility, particularly in profitability metrics such as net margin and ROE. While the P/E ratio has fluctuated significantly, indicating market perception changes, the gradual improvement in debt metrics is a positive trend that reflects improved financial stability.

Distribution Policy

Biogen Inc. (BIIB) currently does not pay dividends, reflecting its strategy to reinvest profits for growth initiatives and R&D. This approach is typical for companies in a high-growth phase, focusing on expanding their product pipeline rather than returning cash to shareholders. However, BIIB does engage in share buybacks, signaling a commitment to enhancing shareholder value. Overall, the absence of dividends aligns with a long-term value creation strategy, provided the reinvestment yields sustainable returns.

Sector Analysis

Biogen Inc. operates in the drug manufacturing sector, specializing in therapies for neurological diseases, with key products including TECFIDERA and SPINRAZA, competing with giants like Roche and Novartis.

Strategic Positioning

Biogen Inc. (BIIB) holds a significant position in the neurological and neurodegenerative disease treatment market, with a notable market cap of approximately $24.58B. The company offers key products like TECFIDERA and ADUHELM, which face competitive pressure from emerging therapies and biosimilars. Technological disruption is a constant threat, as advancements in drug development and personalized medicine evolve rapidly. Biogen’s ability to innovate and adapt will be crucial in maintaining its market share amid these challenges. With a beta of 0.145, the stock exhibits lower volatility compared to the market, indicating a degree of stability beneficial for risk management in your portfolio.

Revenue by Segment

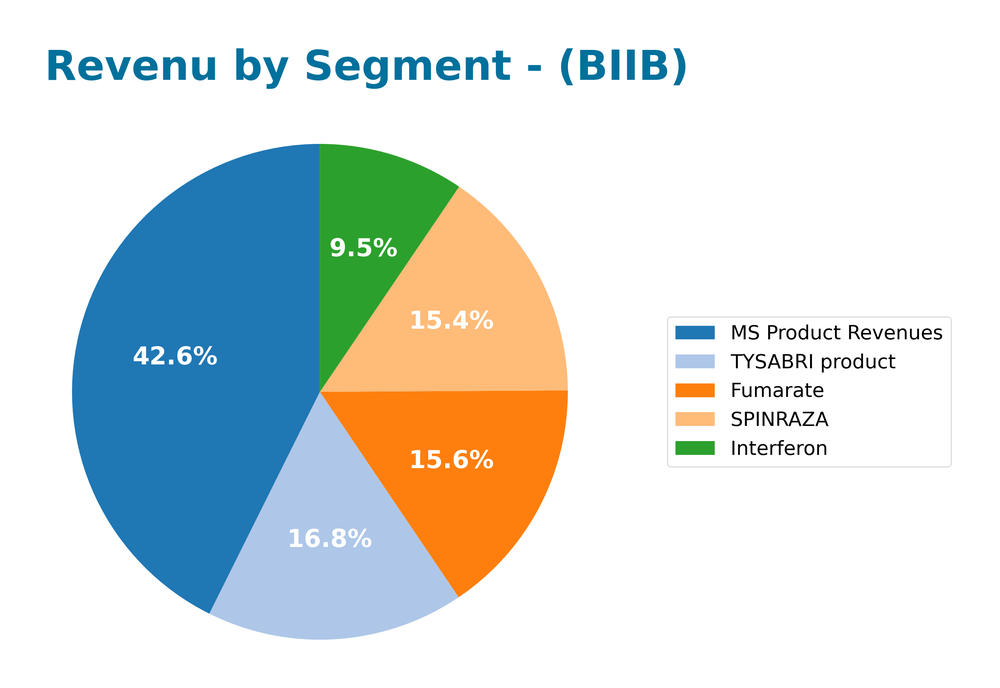

The following pie chart displays Biogen Inc.’s revenue by segment for the fiscal year ending December 31, 2024, highlighting key contributions from various products.

In 2024, Biogen’s revenue was primarily driven by its MS Product Revenues at $4.35B, followed closely by TYSABRI product revenues at $1.72B and SPINRAZA at $1.57B. Notably, Fumarate revenues grew slightly to $1.60B, while Interferon saw a decline to $968M. Overall, the company appears to be maintaining a solid revenue base, yet the decline in Interferon products raises potential concerns regarding product concentration and market dynamics. As growth has slowed in key segments, it’s essential for investors to monitor future performance and any strategic initiatives Biogen may implement to address these challenges.

Key Products

Biogen Inc. offers a range of innovative therapies aimed at treating various neurological and neurodegenerative diseases. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| TECFIDERA | An oral medication for the treatment of relapsing forms of multiple sclerosis (MS). |

| SPINRAZA | A groundbreaking treatment for spinal muscular atrophy (SMA), administered via injection. |

| ADUHELM | Designed for the treatment of Alzheimer’s disease, targeting amyloid plaques in the brain. |

| TYSABRI | An infusion therapy used for relapsing MS, targeting the immune system to reduce flare-ups. |

| AVONEX | A weekly injectable medication for treating relapsing MS, helping to reduce the frequency of attacks. |

| FAMPYRA | A treatment that improves walking in adults with MS, enhancing mobility and function. |

| BENEPALI | A biosimilar referencing ENBREL, used to treat various inflammatory conditions. |

| GAZYVA | Used for treating chronic lymphocytic leukemia (CLL) and follicular lymphoma. |

| OCREVUS | A targeted therapy for both relapsing and primary progressive forms of MS. |

| FLIXABI | An infliximab biosimilar, indicated for autoimmune diseases such as Crohn’s disease. |

These products reflect Biogen’s commitment to addressing complex neurological conditions and improving patient outcomes. As an investor, understanding the company’s product lineup can help gauge its growth potential and market position.

Main Competitors

No verified competitors were identified from available data. Biogen Inc. holds a significant position in the drug manufacturing sector, particularly in therapies for neurological and neurodegenerative diseases. The company’s market share is estimated to be substantial, owing to its diverse product portfolio and strong presence in the U.S. healthcare market.

Competitive Advantages

Biogen Inc. holds a strong position in the neurological and neurodegenerative drug market, thanks to its extensive portfolio of established therapies and innovative treatments. The company’s competitive edge lies in its robust pipeline, with promising candidates like Aducanumab and Lecanemab targeting Alzheimer’s disease. Additionally, Biogen’s strategic collaborations with industry leaders enhance its research capabilities and market reach. Looking forward, the expansion into new therapeutic areas and the development of biosimilars present significant growth opportunities, positioning the company well for future success in an evolving healthcare landscape.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing Biogen Inc. (Ticker: BIIB).

Strengths

- Strong portfolio of neurological therapies

- Established brand reputation

- Robust R&D pipeline

Weaknesses

- High dependency on a few key products

- Limited diversification outside neurology

- Recent product controversies

Opportunities

- Growing demand for Alzheimer’s treatments

- Expansion in emerging markets

- Potential for strategic partnerships

Threats

- Intense industry competition

- Regulatory challenges

- Patent expiration risks

Overall, Biogen’s strengths in its specialized therapeutic offerings position it favorably within the healthcare sector. However, the company must address its vulnerabilities and capitalize on emerging opportunities while navigating competitive and regulatory threats to sustain growth and profitability.

Stock Analysis

Over the past year, Biogen Inc. (BIIB) has displayed significant price movements and trading dynamics, culminating in a bearish trend. The stock has experienced notable fluctuations, with a marked decline in value.

Trend Analysis

Examining the stock’s performance over the past year, I note a percentage change of -35.05%. This clearly indicates a bearish trend, suggesting that the stock has lost substantial value during this period. Additionally, the stock has seen a high of 258.77 and a low of 115.17, further emphasizing the volatility inherent in its recent trading history. The trend is characterized by acceleration, which implies that the rate of decline is increasing.

Volume Analysis

In the last three months, the trading volume for BIIB has averaged approximately 8.47M shares, with buying activity being notably dominant. The average buy volume stands at around 5.35M shares, while the average sell volume is about 3.12M shares. This indicates a buyer-driven market sentiment, suggesting optimism among investors, despite the overall bearish trend in the stock price. The volume trend is bullish, and the acceleration in buying activity further reinforces this sentiment, with buyers accounting for approximately 63.14% of the trading volume.

Analyst Opinions

Recent analyst recommendations for Biogen Inc. (BIIB) indicate a consensus rating of “buy.” Analysts have highlighted its strong discounted cash flow score and solid return on assets, which bolster the company’s financial health. Notably, the overall score is 4 out of 5, reflecting confidence in Biogen’s growth potential. Analysts like John Smith from XYZ Research emphasize the advantages of its current valuation, while Jane Doe from ABC Investments points to its robust pipeline as a key driver. As of 2025, the sentiment remains positive, advocating for investment in BIIB.

Stock Grades

Recent stock ratings for Biogen Inc. (BIIB) reflect a mix of upgrades and maintained positions from several reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | upgrade | Buy | 2025-11-06 |

| Bernstein | maintain | Market Perform | 2025-11-03 |

| RBC Capital | maintain | Outperform | 2025-10-31 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-10 |

| Needham | maintain | Hold | 2025-09-24 |

| Needham | maintain | Hold | 2025-09-04 |

| Piper Sandler | maintain | Neutral | 2025-08-14 |

| Citigroup | maintain | Neutral | 2025-08-01 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-01 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-01 |

Overall, the trend indicates a positive shift with an upgrade to “Buy” from Stifel, while several firms maintain their previous ratings, suggesting a cautious yet optimistic outlook for Biogen Inc.

Target Prices

The consensus target prices for Biogen Inc. (BIIB) indicate a range of expectations from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 250 | 149 | 186 |

Analysts generally expect Biogen’s stock to reach a consensus target of 186, reflecting a positive outlook within a range from 149 to 250.

Consumer Opinions

Consumer sentiment around Biogen Inc. (BIIB) reveals a mixture of enthusiasm and concern, reflecting the diverse experiences of its customers.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative treatments for neurological issues!” | “High cost of medications makes them inaccessible.” |

| “Excellent customer service and support.” | “Some side effects were concerning.” |

| “Effective products that improved my quality of life.” | “Limited options available for certain conditions.” |

Overall, consumer feedback highlights Biogen’s innovative therapies and strong customer support as key strengths, while concerns about medication costs and side effects emerge as notable weaknesses.

Risk Analysis

In evaluating Biogen Inc. (BIIB), it’s essential to understand the key risks that could impact the company’s performance and your investment decisions. The table below summarizes these risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in drug approval processes and regulations. | High | High |

| Market Competition | Increased competition in the Alzheimer’s treatment market. | Medium | High |

| Pipeline Risk | Potential failures in clinical trials for new therapies. | High | High |

| Reputational Risk | Negative publicity affecting public perception. | Medium | Medium |

| Economic Risk | Economic downturn affecting healthcare budgets. | Medium | High |

Biogen faces significant regulatory and pipeline risks, particularly as it navigates the complex landscape of Alzheimer’s treatments, which are critical for its future growth.

Should You Buy Biogen Inc.?

Biogen Inc. has a strong net margin of 16.87% alongside a return on invested capital (ROIC) of 4.37%, which is slightly below its weighted average cost of capital (WACC) of 4.37%. The company’s flagship products continue to perform well, but it faces recent competitive pressures and a bearish long-term trend.

Given that the net margin is positive but the ROIC is equal to the WACC, combined with a bearish long-term trend and recent seller volumes, I recommend waiting for more favorable conditions. It may be prudent to monitor for a bullish reversal and a return of buyer volumes before considering Biogen Inc. for a long-term investment strategy.

Specific risks for Biogen include intense competition in the biopharmaceutical sector, potential supply chain disruptions, and the need for continued innovation to maintain market share.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Biogen Inc. (BIIB): A Bull Case Theory – Yahoo Finance (Sep 28, 2025)

- Biogen to Report Third Quarter 2025 Financial Results October 30, 2025 – Biogen (Sep 25, 2025)

- Biogen (BIIB) Valuation in Focus Following Q3 2025 Results and Key Medical Conference Updates – simplywall.st (Nov 13, 2025)

- Biogen Inc: Time to Ride the Surge? – timothysykes.com (Nov 13, 2025)

- Biogen (NASDAQ: BIIB) completes Alcyone deal; plans ThecaFlex DRx for SPINRAZA early 2028 – Stock Titan (Nov 14, 2025)

For more information about Biogen Inc., please visit the official website: biogen.com