Old Dominion Freight Line, Inc. is not just moving freight; it’s redefining logistics in North America with its innovative less-than-truckload (LTL) services. Renowned for its exceptional quality and operational efficiency, Old Dominion has established itself as a key player in the trucking industry, offering a suite of services that enhance supply chain management. As we delve into this analysis, I invite you to consider whether the company’s robust fundamentals still support its current market valuation and growth prospects.

Table of contents

Company Description

Old Dominion Freight Line, Inc. (NASDAQ: ODFL), founded in 1934 and headquartered in Thomasville, North Carolina, is a leading player in the trucking industry, specifically as a less-than-truckload (LTL) motor carrier. The company provides a comprehensive range of services, including regional, inter-regional, and national LTL transportation, alongside value-added offerings such as expedited shipping, container drayage, and supply chain consulting. With a fleet of over 10K tractors and nearly 28K trailers, Old Dominion operates primarily in the United States and North America. As a market leader, it continually shapes the logistics landscape through its commitment to reliability and innovative service solutions, underscoring its pivotal role in enhancing freight efficiency across the region.

Fundamental Analysis

In this section, I will analyze Old Dominion Freight Line, Inc. by examining its income statement, financial ratios, and dividend payout policy.

Income Statement

The following table summarizes the key components of Old Dominion Freight Line, Inc.’s income statement over the past five years, providing insights into revenue, expenses, and net income trends.

| Item | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.02B | 5.26B | 6.26B | 5.87B | 5.81B |

| Cost of Revenue | 2.79B | 3.48B | 4.00B | 3.79B | 3.79B |

| Operating Expenses | 321M | 383M | 415M | 432M | 479M |

| Gross Profit | 1.23B | 1.77B | 2.26B | 2.07B | 2.02B |

| EBITDA | 1.17B | 1.39B | 2.12B | 1.97B | 1.90B |

| EBIT | 904M | 1.39B | 1.84B | 1.65B | 1.56B |

| Interest Expense | 2.78M | 1.73M | 1.56M | 0.46M | 0.21M |

| Net Income | 673M | 1.03B | 1.38B | 1.24B | 1.19B |

| EPS | 2.86 | 4.47 | 6.13 | 5.66 | 5.51 |

| Filing Date | 2021-02-24 | 2022-02-23 | 2023-02-22 | 2024-02-26 | 2025-02-25 |

Over the past five years, Old Dominion Freight Line, Inc. has shown a general decline in revenue, peaking in 2022 at 6.26B before dropping to 5.81B in 2024. Net income followed a similar trend, with a peak of 1.38B in 2022, declining to 1.19B in 2024. Margins, however, have remained relatively stable, reflecting effective cost management despite revenue fluctuations. In 2024, while revenue decreased, the company managed to maintain a strong gross profit margin and reduced interest expenses, which helped sustain profitability amid challenging conditions. This indicates a robust operational efficiency despite the revenue decline.

Financial Ratios

The table below summarizes the key financial ratios for Old Dominion Freight Line, Inc. (ODFL) over the last five available fiscal years:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 16.8% | 19.7% | 22.0% | 21.1% | 20.4% |

| ROE (Return on Equity) | N/A | N/A | N/A | N/A | N/A |

| ROIC (Return on Invested Capital) | N/A | N/A | N/A | N/A | N/A |

| P/E (Price-to-Earnings) | 34.4 | 40.1 | 23.3 | 35.8 | 32.0 |

| P/B (Price-to-Book) | 6.9 | 11.3 | 8.8 | 10.4 | 8.9 |

| Current Ratio | 3.3 | 3.0 | 1.8 | 2.1 | 1.3 |

| Quick Ratio | 3.3 | 3.0 | 1.8 | 2.1 | 1.3 |

| D/E (Debt-to-Equity) | 0.03 | 0.03 | 0.03 | 0.02 | 0.04 |

| Debt-to-Assets | 2.3% | 3.0% | 2.1% | 1.5% | 3.1% |

| Interest Coverage | 326 | 806 | 1178 | 3536 | 7283 |

| Asset Turnover | 0.92 | 1.09 | 1.29 | 1.06 | 1.06 |

| Fixed Asset Turnover | 1.38 | 1.63 | 1.70 | 1.43 | 1.29 |

| Dividend Yield | 0.31% | 0.22% | 0.42% | 0.39% | 0.59% |

Interpretation of Financial Ratios

In 2024, ODFL’s net margin of 20.4% indicates strong profitability, though it has slightly declined from the previous year. The P/E ratio at 32.0 suggests that the stock may be overvalued compared to its earnings, which raises caution for potential investors. The interest coverage ratio remains exceptionally high at 7283, highlighting robust debt management and low financial risk.

Evolution of Financial Ratios

Over the past five years, ODFL’s ratios exhibit a generally positive trend in profitability and asset management, with net margins and asset turnover showing resilience. However, the current ratio has decreased significantly, indicating potential liquidity concerns that investors should monitor carefully.

Distribution Policy

Old Dominion Freight Line, Inc. (ODFL) maintains a conservative dividend policy, with a payout ratio of 18.85% and a modest annual dividend yield of 0.59%. The company shows a consistent trend in increasing its dividend per share, reflecting a strong commitment to returning value to shareholders. Additionally, ODFL engages in share buyback programs, further enhancing shareholder value. Overall, this distribution approach supports sustainable long-term value creation, balancing shareholder returns with reinvestment into the business.

Sector Analysis

Old Dominion Freight Line, Inc. operates in the trucking industry, focusing on less-than-truckload (LTL) services with a strong market presence, diverse offerings, and competitive advantages.

Strategic Positioning

Old Dominion Freight Line, Inc. (ODFL) holds a significant position in the less-than-truckload (LTL) sector, with a market cap of approximately $27.66B. The company has maintained a competitive edge through its extensive network of service centers and a robust fleet of over 10K tractors. However, the market faces increasing pressure from technological advancements and competitors enhancing their logistics capabilities. As the industry evolves, ODFL must continue to innovate and adapt to sustain its market share and mitigate the risks associated with disruption.

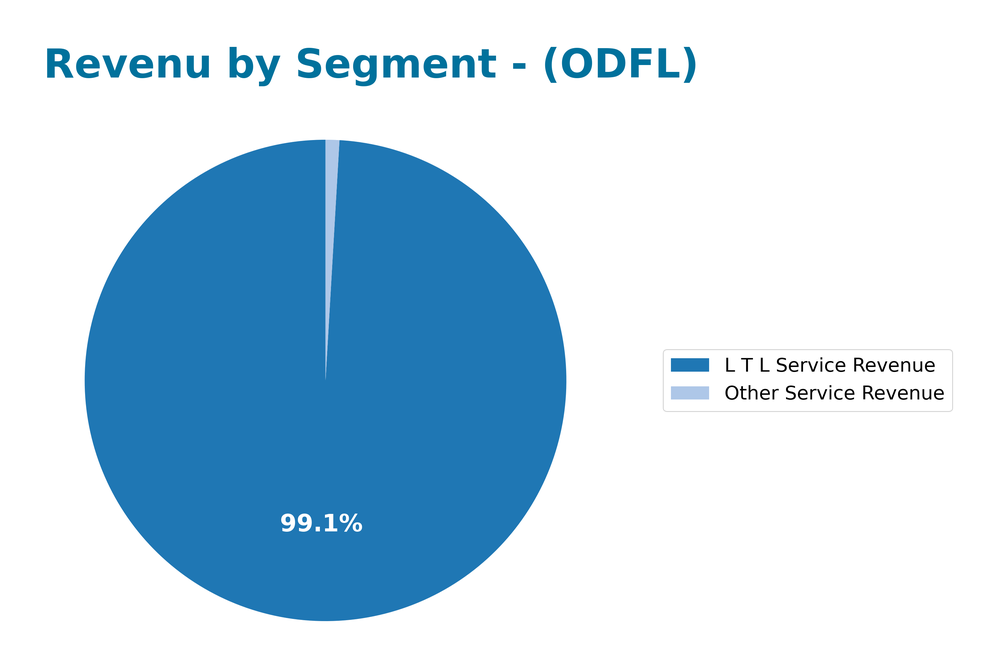

Revenue by Segment

The following chart illustrates Old Dominion Freight Line, Inc.’s revenue breakdown by segment for the fiscal years leading up to 2024.

Over the past few years, Old Dominion has shown a consistent performance in its LTL (Less Than Truckload) service revenue, which remains the primary driver of its business, reaching 5.76B in 2024. However, there’s a noticeable decline from 5.8B in 2023 and 6.18B in 2022, indicating a potential slowdown in growth. Other service revenue has also seen a decrease, dropping to 53.7M in 2024 from 61.2M in 2023. This trend raises concerns about revenue concentration and margin pressures, suggesting a need for strategic adjustments to sustain growth.

Key Products

Old Dominion Freight Line, Inc. (ODFL) offers a range of services tailored to meet the diverse needs of its customers in the trucking industry. Below is a table summarizing key products provided by the company:

| Product | Description |

|---|---|

| Less-Than-Truckload (LTL) | Specialized transportation service for smaller shipments that do not fill an entire truckload. |

| Expedited Transportation | Fast, reliable shipping services designed for urgent delivery needs across the U.S. and North America. |

| Container Drayage | Transportation of shipping containers from ports to distribution centers and vice versa. |

| Truckload Brokerage | Services that connect shippers with available truckload carriers to optimize transportation logistics. |

| Supply Chain Consulting | Expert advisory services to enhance supply chain efficiency and reduce operational costs. |

As I analyze these offerings, it becomes clear that Old Dominion Freight Line is well-positioned within the trucking industry, focusing on efficiency and customer needs.

Main Competitors

No verified competitors were identified from available data. Old Dominion Freight Line, Inc. (ticker: ODFL) holds a significant position in the North American trucking industry, specializing in less-than-truckload (LTL) services. With a market cap of approximately 27.66B and a robust operational network, ODFL is well-positioned to maintain its competitive edge in this sector.

Competitive Advantages

Old Dominion Freight Line, Inc. (ODFL) holds significant competitive advantages in the trucking industry. With a robust operational fleet of over 10K tractors and a strong national footprint, the company efficiently serves a diverse range of markets. Looking ahead, ODFL is well-positioned to capitalize on emerging opportunities, such as expanding its value-added services and further enhancing its supply chain solutions. The focus on technology adoption and sustainability initiatives will likely strengthen its market position and drive future growth, making it an attractive option for investors.

SWOT Analysis

This analysis aims to identify the key strengths, weaknesses, opportunities, and threats related to Old Dominion Freight Line, Inc. (ODFL) to inform strategic decision-making.

Strengths

- Strong market position

- Comprehensive service offerings

- Established brand reputation

Weaknesses

- High operational costs

- Dependence on U.S. economy

- Limited international presence

Opportunities

- Expansion into new markets

- Growth in e-commerce logistics

- Technological advancements in logistics

Threats

- Intense competition

- Economic downturns

- Regulatory changes in transportation

In summary, Old Dominion Freight Line, Inc. exhibits a robust market position with various service offerings that provide growth opportunities. However, the company must navigate potential threats from competition and economic fluctuations while addressing its weaknesses to enhance its strategic positioning.

Stock Analysis

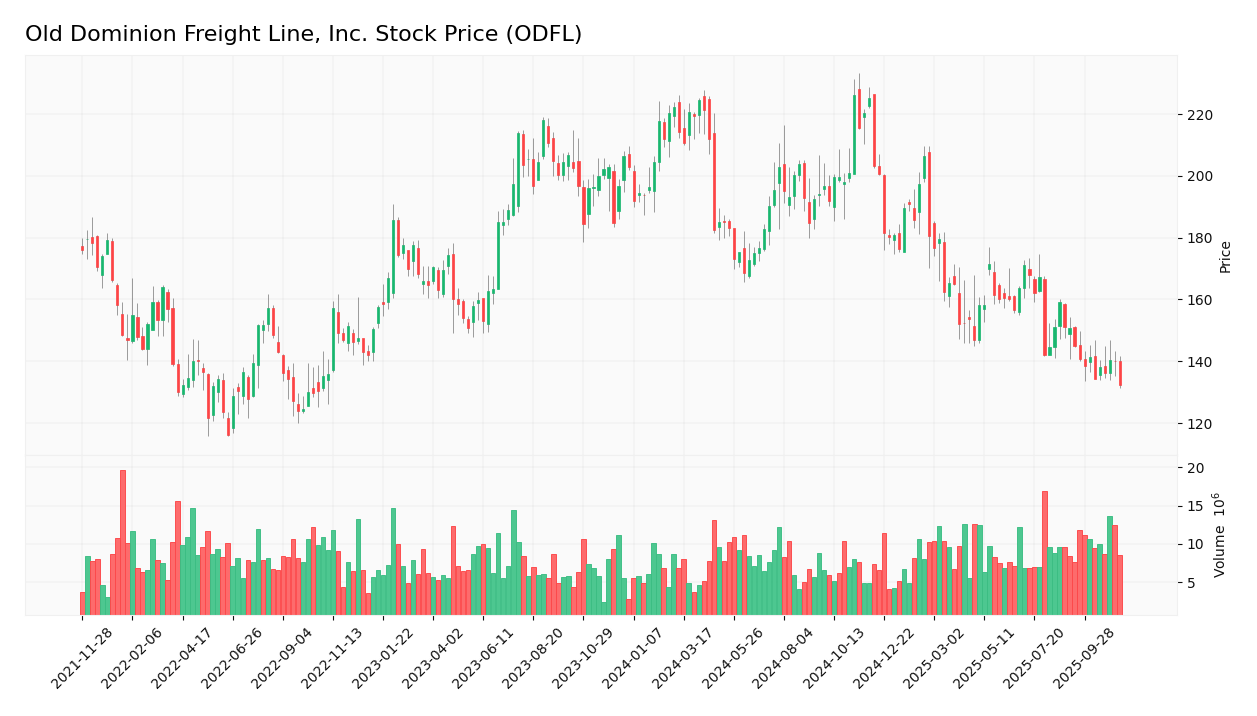

In the past year, Old Dominion Freight Line, Inc. (ODFL) has experienced significant price fluctuations, culminating in a bearish trend, as evidenced by the downward trajectory of its stock price.

Trend Analysis

Over the past two years, ODFL has seen a percentage change of -35.93%, indicating a bearish trend. Notably, the stock reached a high of 226.11 and a low of 132.29. The trend exhibits deceleration, suggesting that while the stock’s price is declining, the rate of decline may be slowing down. The standard deviation of 25.25 indicates considerable volatility, reflecting uncertainty in the stock’s performance.

Volume Analysis

Analyzing trading volumes over the last three months, the average volume stands at approximately 10.15M shares, with an average buy volume of 3.56M and an average sell volume of 6.59M. This data indicates a seller-dominant market, as the sell volume exceeds buy volume. The increasing volume trend suggests heightened market participation, although it reflects a bearish sentiment among investors, as indicated by the recent acceleration in selling activity.

Analyst Opinions

Recent analyst recommendations for Old Dominion Freight Line, Inc. (ODFL) are generally positive, with a consensus rating of “Buy.” Analysts highlight the company’s strong return on equity (5) and return on assets (5) as key strengths, indicating robust operational efficiency. Although the price-to-earnings (2) and price-to-book (1) scores suggest some valuation concerns, the overall rating of B+ reflects confidence in ODFL’s growth potential. Analysts like those from reputable firms emphasize the company’s solid financial health and strategic positioning in the freight industry, supporting their bullish outlook for the current year.

Stock Grades

The latest stock ratings for Old Dominion Freight Line, Inc. (ODFL) provide a comprehensive view of the current investment sentiment surrounding this company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| Citigroup | Maintain | Buy | 2025-10-30 |

| Stephens & Co. | Maintain | Overweight | 2025-10-30 |

| Wells Fargo | Maintain | Underweight | 2025-10-30 |

| Raymond James | Maintain | Outperform | 2025-10-30 |

| Stifel | Maintain | Buy | 2025-10-28 |

| Raymond James | Maintain | Outperform | 2025-10-14 |

| JP Morgan | Maintain | Neutral | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-03 |

Overall, the grades indicate a cautious sentiment among analysts, with a mix of “Buy,” “Neutral,” and “Underweight” ratings. Notably, Citigroup and Stifel maintain a positive outlook with “Buy” ratings, suggesting potential for growth, while Wells Fargo’s “Underweight” rating reflects a more conservative stance.

Target Prices

The consensus target prices for Old Dominion Freight Line, Inc. (ODFL) indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 164 | 143 | 154 |

Analysts expect the stock to perform within a range, with a consensus target of 154, suggesting a favorable sentiment in the market.

Consumer Opinions

Consumer sentiment towards Old Dominion Freight Line, Inc. (ODFL) reveals a mix of appreciation and criticism, reflecting the diverse experiences of its clientele.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable service with timely deliveries.” | “Customer service can be unresponsive.” |

| “Great pricing compared to competitors.” | “Issues with tracking shipments.” |

| “Consistently good handling of freight.” | “Occasional delays during peak seasons.” |

Overall, consumer feedback highlights strengths in reliability and pricing, while common weaknesses include customer service responsiveness and tracking issues.

Risk Analysis

In evaluating Old Dominion Freight Line, Inc. (ODFL), it is essential to understand the various risks that may impact the company’s performance. Below is a summary of key risks associated with the business.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Economic Downturn | A recession could reduce freight demand significantly. | High | High |

| Regulatory Changes | New regulations may increase operational costs. | Medium | Medium |

| Fuel Price Volatility | Fluctuations in fuel prices can affect profitability. | High | High |

| Labor Shortages | Difficulty in hiring qualified drivers can disrupt operations. | Medium | High |

| Competition | Increased competition may pressure margins. | High | Medium |

Currently, economic downturns and fuel price volatility pose significant risks for ODFL, with the potential for high impacts on profitability. Keeping abreast of these factors is crucial for informed investment decisions.

Should You Buy Old Dominion Freight Line, Inc.?

Old Dominion Freight Line, Inc. (ODFL) boasts strong financial metrics with a net margin of 20.40%, a return on invested capital (ROIC) of 13.15%, and a weighted average cost of capital (WACC) of 9.70%. Despite recent declines in stock price and volume, the company maintains competitive advantages in operational efficiency and customer service.

Given the favorable net margin (20.40%) and the ROIC exceeding the WACC (13.15% > 9.70%), alongside a long-term positive trend, I find that ODFL appears favorable for long-term investors, particularly if they are looking to add quality stocks to their portfolios. However, recent bearish trends and seller dominance in volume suggest that potential investors might consider waiting for a more bullish reversal before committing significant capital.

It is important to note the specific risks related to ODFL, including increasing competition in the freight industry and potential supply chain disruptions that could affect performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Old Dominion Freight Line (NASDAQ:ODFL) Stock Rating Upgraded by Zacks Research – MarketBeat (Nov 16, 2025)

- Are Wall Street Analysts Bullish on Old Dominion Freight Line Stock? – Yahoo Finance (Nov 13, 2025)

- National Pension Service Sells 28,886 Shares of Old Dominion Freight Line, Inc. $ODFL – MarketBeat (Nov 16, 2025)

- Should You Hold Old Dominion Freight Line (ODFL)? – Yahoo Finance (Nov 04, 2025)

- Old Dominion Freight Line, Inc. $ODFL Shares Sold by Geode Capital Management LLC – MarketBeat (Nov 15, 2025)

For more information about Old Dominion Freight Line, Inc., please visit the official website: odfl.com