In an age where technology seamlessly intertwines with our daily lives, Cognizant Technology Solutions Corporation stands at the forefront of the Information Technology Services industry, shaping how businesses operate and engage with consumers. With a diverse portfolio that includes innovative solutions in AI, digital health, and automated processes, Cognizant has earned a reputation for delivering quality and driving transformation. As I examine the company’s fundamentals, the pressing question remains: do its current valuations reflect its true growth potential?

Table of contents

Company Description

Cognizant Technology Solutions Corporation (NASDAQ: CTSH), founded in 1994 and headquartered in Teaneck, New Jersey, stands out as a leading player in the Information Technology Services sector. With a market capitalization of approximately $35.7B and a diverse workforce of over 336K employees, Cognizant operates primarily across North America and Europe. The company delivers a broad range of consulting, technology, and outsourcing services, segmented into Financial Services, Healthcare, Products and Resources, and Communications, Media, and Technology. Cognizant is recognized for its robust capabilities in areas such as AI, robotic process automation, and customer experience enhancement, positioning itself as an innovator in digital transformation and operational excellence within its industry.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Cognizant Technology Solutions Corporation, focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

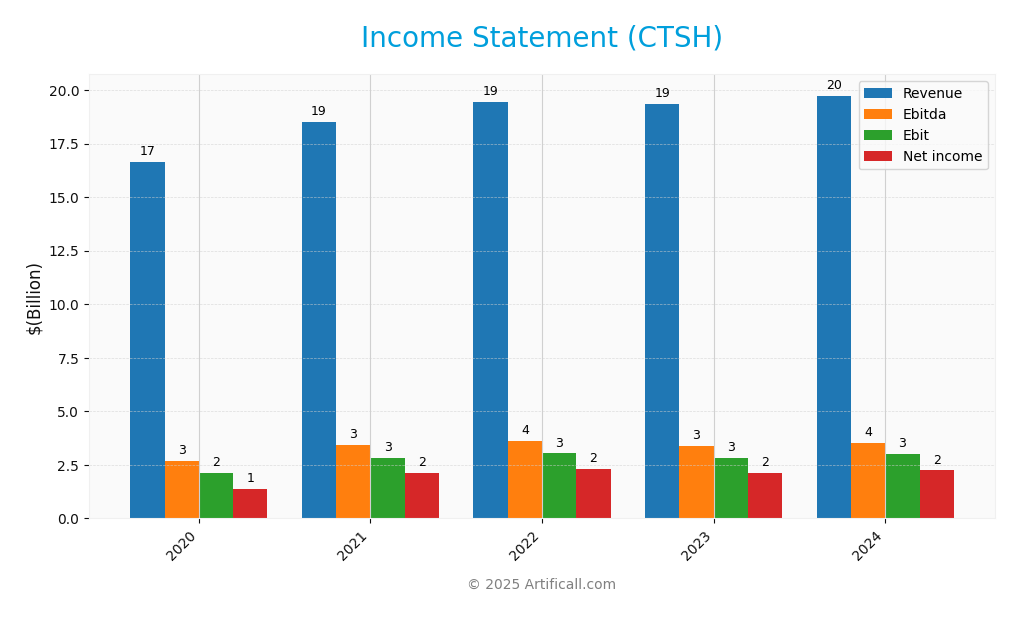

The following table presents the Income Statement for Cognizant Technology Solutions Corporation (CTSH), detailing key financial metrics from the past five years, allowing for an insightful analysis of performance trends.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 16.65B | 18.51B | 19.43B | 19.35B | 19.74B |

| Cost of Revenue | 10.67B | 11.60B | 12.45B | 12.66B | 12.96B |

| Operating Expenses | 3.87B | 4.08B | 4.01B | 4.00B | 3.89B |

| Gross Profit | 5.98B | 6.90B | 6.98B | 6.69B | 6.78B |

| EBITDA | 2.68B | 3.41B | 3.60B | 3.38B | 3.53B |

| EBIT | 2.12B | 2.84B | 3.03B | 2.83B | 2.99B |

| Interest Expense | 0.024B | 0.009B | 0.019B | 0.041B | 0.054B |

| Net Income | 1.39B | 2.14B | 2.29B | 2.13B | 2.24B |

| EPS | 2.58 | 4.06 | 4.42 | 4.21 | 4.52 |

| Filing Date | 2021-02-12 | 2022-02-16 | 2023-02-15 | 2024-02-14 | 2025-02-12 |

Over the last five years, Cognizant’s revenue has shown modest growth, with a notable increase from 16.65B in 2020 to 19.74B in 2024. Net income has similarly increased, reflecting a consistent upward trend, albeit at a slower pace than revenue. In 2024, the net income amounted to 2.24B, an increase from 2.13B in 2023. This slight improvement in margins indicates effective cost management, particularly in operating expenses, which decreased despite rising revenues. Overall, the company demonstrates a stable performance trajectory, although growth rates should be monitored for potential signs of deceleration in future periods.

Financial Ratios

The table below summarizes the key financial ratios for Cognizant Technology Solutions Corporation (CTSH) over the last five fiscal years.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 8.36% | 11.55% | 11.79% | 10.99% | 11.35% |

| ROE (Return on Equity) | 12.69% | 12.49% | 13.76% | 16.06% | 15.65% |

| ROIC (Return on Invested Capital) | 8.94% | 10.33% | 10.20% | 12.80% | 12.70% |

| P/E (Price to Earnings) | 31.79 | 21.88 | 12.94 | 17.94 | 17.03 |

| P/B (Price to Book) | 4.08 | 3.90 | 2.41 | 2.88 | 2.65 |

| Current Ratio | 1.94 | 2.08 | 2.17 | 2.25 | 2.09 |

| Quick Ratio | 1.94 | 2.08 | 2.17 | 2.25 | 2.09 |

| D/E (Debt to Equity) | 0.16 | 0.14 | 0.12 | 0.10 | 0.10 |

| Debt-to-Assets | 10.39% | 9.20% | 8.59% | 7.11% | 7.53% |

| Interest Coverage | 88.08 | 314.00 | 156.21 | 65.59 | 53.56 |

| Asset Turnover | 0.98 | 1.03 | 1.09 | 1.05 | 0.99 |

| Fixed Asset Turnover | 7.36 | 8.80 | 9.83 | 11.67 | 12.77 |

| Dividend Yield | 1.08% | 1.24% | 1.90% | 1.55% | 1.57% |

Interpretation of Financial Ratios

In 2024, Cognizant’s financial ratios reflect a generally strong performance. The net margin of 11.35% indicates solid profitability, while a P/E ratio of 17.03 suggests the stock is fairly valued. However, the declining interest coverage ratio may raise concerns about the company’s ability to meet its debt obligations in the future.

Evolution of Financial Ratios

Over the past five years, CTSH has shown a stable financial performance with slight fluctuations in key ratios. The net margin and ROE have remained relatively consistent, while the P/E ratio decreased significantly from 31.79 in 2020 to 17.03 in 2024, indicating potential undervaluation.

Distribution Policy

Cognizant Technology Solutions (CTSH) maintains a dividend payout ratio of approximately 27.8%, reflecting a commitment to returning value to shareholders through a stable dividend of $1.21 per share, yielding around 1.57%. In addition, the company engages in share buyback programs, enhancing shareholder value further. However, investors should remain cautious of potential risks, including the sustainability of these distributions amid fluctuating cash flows. Overall, this distribution strategy appears aligned with long-term value creation for shareholders.

Sector Analysis

Cognizant Technology Solutions (CTSH) operates in the Information Technology Services sector, offering consulting, outsourcing, and advanced technology services, facing competition from major players while leveraging its diverse service portfolio and global footprint.

Strategic Positioning

Cognizant Technology Solutions Corporation (CTSH) holds a significant position in the Information Technology Services sector, with a market cap of approximately $35.7B. The company competes vigorously with peers, leveraging its diverse service offerings across Financial Services, Healthcare, and Technology sectors. However, competitive pressure remains high due to rapid technological disruptions, especially in AI and automation. Cognizant’s commitment to enhancing customer experiences through innovative solutions is crucial for maintaining and growing its market share, particularly as digital transformation accelerates globally.

Revenue by Segment

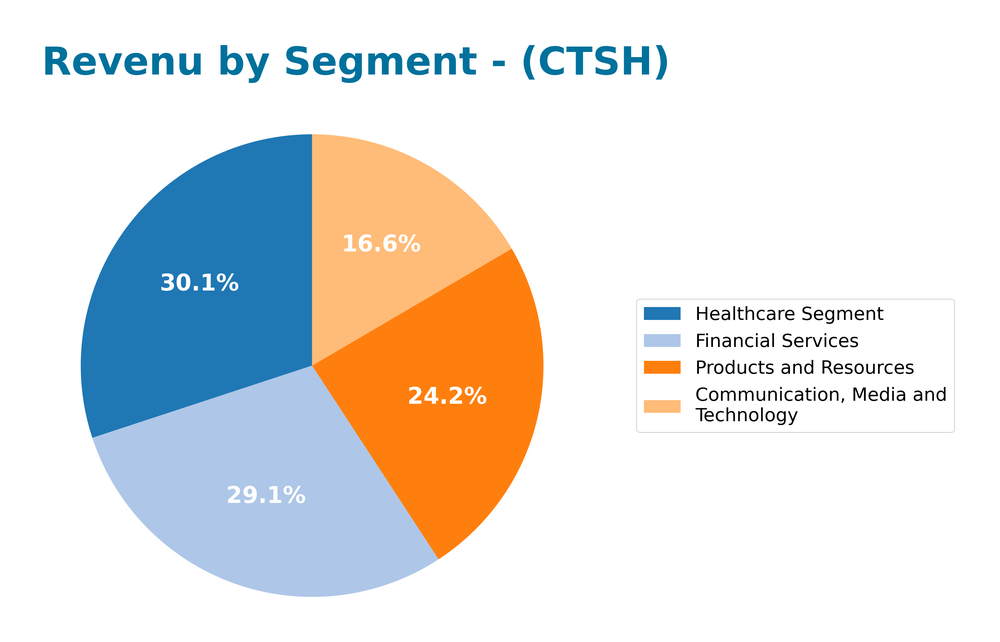

The following chart illustrates the revenue distribution by segment for Cognizant Technology Solutions Corporation for the fiscal year ending in December 2024.

In 2024, Cognizant’s revenue segments demonstrated varied performance. The Healthcare Segment continued to be a significant driver, generating $5.93B, followed closely by Financial Services at $5.75B. Notably, the Communication, Media and Technology segment saw a slight increase to $3.27B, while Products and Resources rose to $4.78B. Overall, while growth across these segments appears stable, the recent year’s performance indicates a slowdown, particularly in Financial Services, raising potential margin concerns as competition intensifies in these sectors.

Key Products

Cognizant Technology Solutions Corporation offers a diverse range of products and services tailored to meet the needs of various industries. Below is a table summarizing key products from the company:

| Product | Description |

|---|---|

| Customer Experience Services | Solutions aimed at enhancing user engagement through personalized digital interactions and feedback systems. |

| Robotic Process Automation | Automation tools designed to improve efficiency in business processes by minimizing manual interventions. |

| Analytics and AI Services | Data-driven insights and artificial intelligence applications to support decision-making and operational improvements in various sectors. |

| Healthcare Solutions | Services that streamline clinical development, claims processing, and patient management for healthcare providers and payers. |

| Financial Services Solutions | Comprehensive offerings for the financial sector, including digital lending, fraud detection, and next-generation payment systems. |

| Digital Engineering Services | Support for businesses in the creation of digital content and applications, enhancing user experience across platforms. |

| Logistics and Supply Chain | Solutions designed to optimize operations in logistics, energy, and utilities sectors, improving overall service delivery. |

These products reflect Cognizant’s commitment to leveraging technology for operational excellence and customer satisfaction across various industries.

Main Competitors

No verified competitors were identified from available data. Cognizant Technology Solutions Corporation (CTSH) holds an estimated market share of approximately 10% in the Information Technology Services sector, positioning itself as a significant player. The company’s competitive position is strong, driven by its diverse service offerings in consulting and technology solutions across various industries, particularly in North America and Europe.

Competitive Advantages

Cognizant Technology Solutions Corporation (CTSH) holds several competitive advantages that position it well for future growth. The company’s diverse service offerings in consulting, technology, and outsourcing across various industries such as healthcare and financial services enable it to address a wide range of client needs. Additionally, its focus on innovative solutions like AI, robotic process automation, and personalized user experiences provides a strong foundation for expanding into new markets. Looking ahead, Cognizant’s commitment to digital transformation and operational efficiency presents significant opportunities for capturing market share and driving long-term value.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing Cognizant Technology Solutions Corporation (CTSH).

Strengths

- Strong market position

- Diversified service offerings

- Expertise in digital transformation

Weaknesses

- Recent decline in stock price

- Dependence on a few key clients

- High competition in the tech industry

Opportunities

- Growing demand for AI and automation services

- Expansion into emerging markets

- Increased focus on digital health solutions

Threats

- Economic downturn risks

- Rapid technological changes

- Regulatory challenges in healthcare sector

The overall SWOT assessment indicates that while Cognizant has a solid foundation and ample growth opportunities, it must address its weaknesses and be vigilant against external threats to sustain its competitive edge and drive future growth.

Stock Analysis

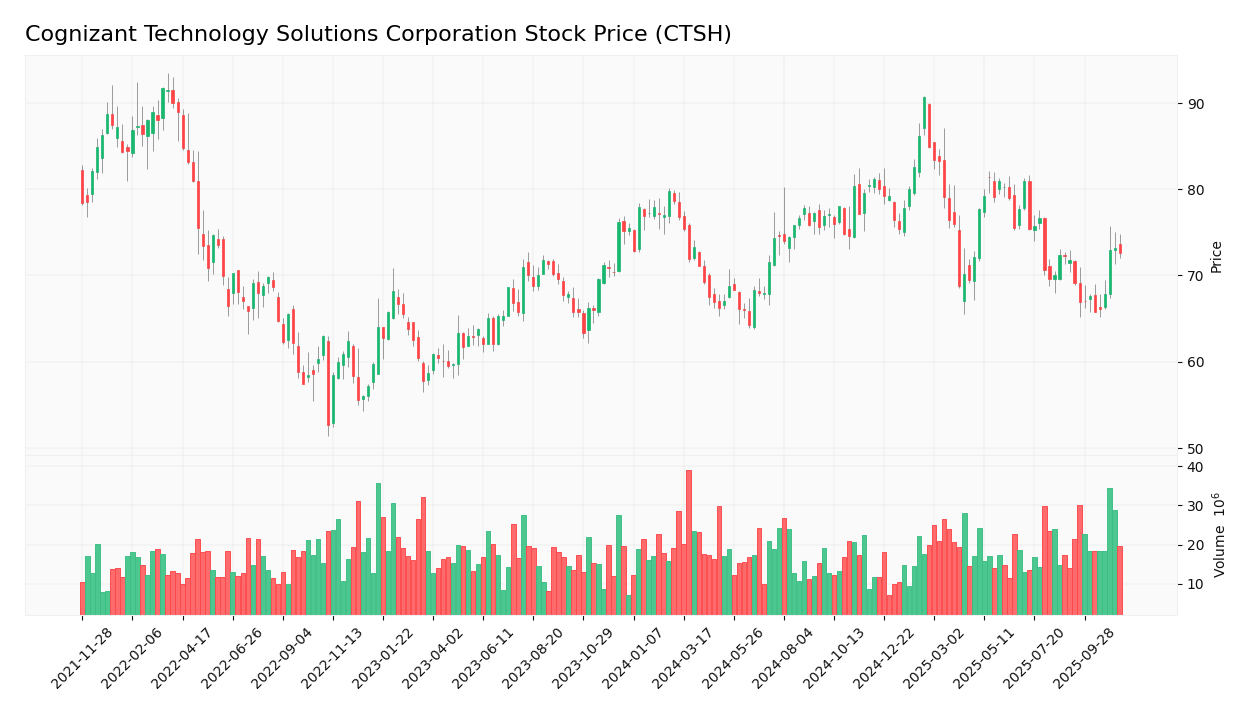

Over the past year, Cognizant Technology Solutions Corporation (CTSH) has experienced significant price movements, culminating in a notable -3.37% change. This week, I’ll delve into its stock price dynamics and trading behaviors to provide insights for potential investors.

Trend Analysis

Analyzing the stock’s performance over the past year reveals a price change of -3.37%. This indicates a bearish trend. The stock reached a high of 90.7 and a low of 64.26, showcasing a range that reflects notable volatility with a standard deviation of 5.2. Despite the overall bearish trend, recent data indicates a slight upward movement with a 0.51% increase in the short term, which could suggest a neutral trend in the latest weeks.

Volume Analysis

In the last three months, the average trading volume for CTSH has been approximately 21.84M shares, with a significant portion being seller-driven, as evidenced by an average sell volume of 12.35M compared to 9.49M for buy volume. This suggests a cautious investor sentiment, as the market appears to be dominated by sellers. The increasing trend in volume, with a slope of 615.9K, indicates heightened market participation, though the seller dominance may signal a need for investors to monitor further price developments closely.

Analyst Opinions

Recent analyst recommendations for Cognizant Technology Solutions Corporation (CTSH) indicate a consensus to *buy*. Analysts emphasize the company’s strong return on assets (5) and overall score (4), highlighting robust financial health and growth potential. Notably, while the debt-to-equity ratio (3) suggests manageable leverage, some caution is advised due to moderate price-to-earnings and price-to-book scores (both at 3). As I assess these factors, the positive outlook from analysts reflects confidence in CTSH’s ability to deliver value in 2025.

Stock Grades

Cognizant Technology Solutions Corporation (CTSH) has received consistent evaluations from reputable grading companies, indicating a stable outlook for the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2025-10-30 |

| JP Morgan | Maintain | Overweight | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| RBC Capital | Maintain | Sector Perform | 2025-10-30 |

| Guggenheim | Maintain | Buy | 2025-10-21 |

| JP Morgan | Maintain | Overweight | 2025-08-20 |

| JP Morgan | Maintain | Overweight | 2025-07-31 |

| JP Morgan | Maintain | Overweight | 2025-07-28 |

| Guggenheim | Upgrade | Buy | 2025-07-18 |

| JP Morgan | Upgrade | Overweight | 2025-05-19 |

The overall trend in grades for CTSH shows a strong preference for maintaining or upgrading the stock, particularly from major analysts like JP Morgan and Guggenheim, which reflects a positive sentiment within the investment community. The consistent “Overweight” ratings suggest confidence in the company’s growth potential.

Target Prices

The consensus target price for Cognizant Technology Solutions Corporation (CTSH) indicates a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 85 | 78 | 82.8 |

Overall, analysts expect CTSH to perform well, with a consensus target price suggesting a potential for growth in the near term.

Consumer Opinions

Consumer sentiment towards Cognizant Technology Solutions Corporation (CTSH) reflects a mix of appreciation for its innovative solutions and concerns regarding service delivery.

| Positive Reviews | Negative Reviews |

|---|---|

| “Cognizant consistently delivers quality services.” | “Support response times can be slow.” |

| “Their technology solutions are top-notch!” | “Some projects have exceeded deadlines.” |

| “Great customer service experience overall.” | “Pricing can be on the higher side.” |

Overall, consumer feedback highlights Cognizant’s strong technology offerings and customer service, while concerns often focus on response times and project management issues.

Risk Analysis

In assessing Cognizant Technology Solutions Corporation (CTSH), I have identified key risks that could impact the company’s performance. Below is a summary of these risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Fluctuations | Changes in demand for IT services can affect revenue. | High | High |

| Cybersecurity | Increasing cyber threats may compromise client data. | High | Very High |

| Regulatory Changes | New regulations could increase operational costs. | Medium | High |

| Talent Retention | Difficulty in retaining skilled employees could hinder growth. | Medium | Medium |

| Economic Downturns | Global recessions can lead to reduced spending on IT. | Medium | High |

The most likely and impactful risk for CTSH is the increasing cybersecurity threats, which pose a significant risk to client trust and financial stability.

Should You Buy Cognizant Technology Solutions Corporation?

Cognizant Technology Solutions Corporation (CTSH) has seen a stable net profit margin of 11.35%, a return on invested capital (ROIC) of approximately 27.25%, and a weighted average cost of capital (WACC) of 8.11%. Key competitive advantages include its strong brand presence and diversified service offerings, though recent risks such as increasing competition and market dependence could impact future growth.

Given that the net margin is positive, ROIC exceeds WACC significantly, and the long-term trend is bullish despite some recent volatility in buyer volumes, it appears favorable for long-term investors to consider adding CTSH to their portfolios. However, I recommend monitoring the volume trends closely, as current seller dominance suggests caution until buyer volumes stabilize.

Specific risks associated with CTSH include heightened competition in the technology sector and potential supply chain disruptions, which could affect performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Cognizant Technology Solutions Corporation (NASDAQ:CTSH) Looks Like A Good Stock, And It’s Going Ex-Dividend Soon – Yahoo Finance (Nov 14, 2025)

- Cognizant Technology Solutions Corporation $CTSH Shares Sold by National Pension Service – MarketBeat (Nov 15, 2025)

- Cognizant (NASDAQ: CTSH) signs definitive deal to acquire 3Cloud, close expected Q1 2026 – Stock Titan (Nov 13, 2025)

- Geode Capital Management LLC Acquires 206,532 Shares of Cognizant Technology Solutions Corporation $CTSH – MarketBeat (Nov 15, 2025)

- Gryphon Investors to Sell 3Cloud to Cognizant – Yahoo Finance (Nov 13, 2025)

For more information about Cognizant Technology Solutions Corporation, please visit the official website: cognizant.com