In a world where vehicles are constantly changing hands, Copart, Inc. revolutionizes the auto remarketing landscape with its innovative online auction platform. As a key player in the auto dealership industry, Copart seamlessly connects sellers with buyers, offering a diverse range of services from salvage estimation to vehicle inspection. Known for its cutting-edge technology and commitment to quality, the company continually shapes how cars are bought and sold. As we delve into Copart’s financials, we must ask: do its fundamentals still support its current market valuation and growth trajectory?

Table of contents

Company Description

Copart, Inc. (Ticker: CPRT) is a leading provider of online auctions and vehicle remarketing services, incorporated in 1982 and headquartered in Dallas, Texas. Operating primarily in the United States, Canada, the UK, and several European and Middle Eastern countries, Copart specializes in processing and selling vehicles over the internet using advanced auction-style sales technology. Its diverse offerings include services for vehicle sellers, insurance companies, and individual buyers, encompassing salvage estimation, transportation, and flexible processing programs. With a strong market presence, Copart plays a pivotal role in shaping the vehicle remarketing industry through innovation and a robust online ecosystem.

Fundamental Analysis

In this section, I will analyze Copart, Inc.’s income statement, financial ratios, and dividend payout policy to provide insights into its financial health.

Income Statement

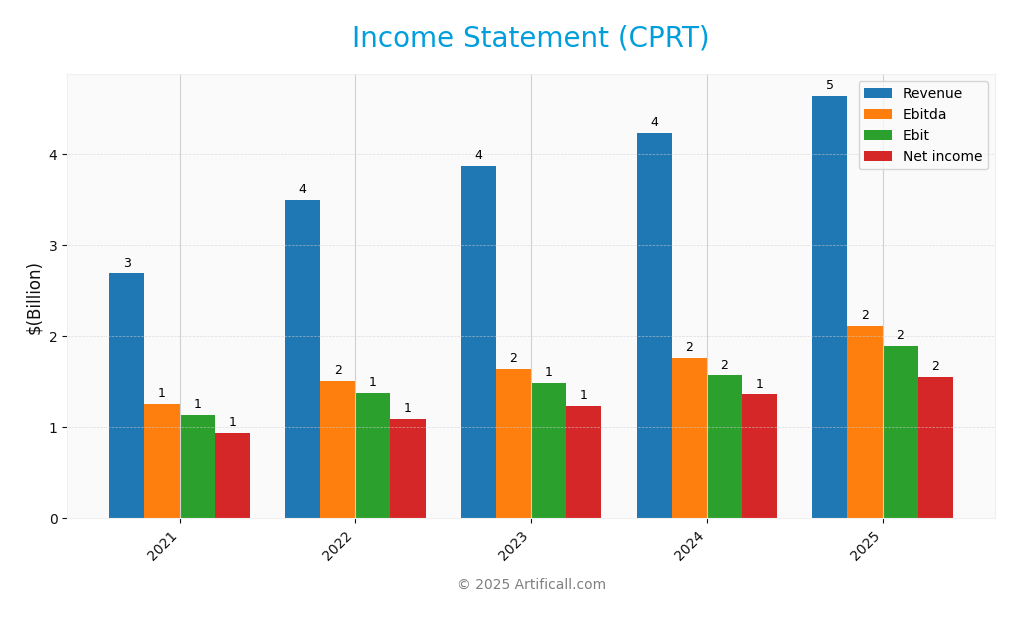

Below is the income statement for Copart, Inc. (CPRT) over the past five fiscal years, providing insight into the company’s financial performance.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 2.69B | 3.50B | 3.87B | 4.24B | 4.65B |

| Cost of Revenue | 1.35B | 1.89B | 2.13B | 2.33B | 2.55B |

| Operating Expenses | 206M | 231M | 250M | 335M | 403M |

| Gross Profit | 1.34B | 1.61B | 1.74B | 1.91B | 2.10B |

| EBITDA | 1.26B | 1.51B | 1.65B | 1.76B | 2.11B |

| EBIT | 1.14B | 1.37B | 1.49B | 1.57B | 1.90B |

| Interest Expense | 20M | 17M | 0 | 0 | 0 |

| Net Income | 936M | 1.09B | 1.24B | 1.36B | 1.55B |

| EPS | 0.99 | 1.15 | 1.30 | 1.42 | 1.61 |

| Filing Date | 2021-09-27 | 2022-09-27 | 2023-09-28 | 2024-09-30 | 2025-09-26 |

Over the last five years, Copart, Inc. has shown a consistent upward trend in both Revenue and Net Income, increasing from 2.69B and 936M in 2021 to 4.65B and 1.55B in 2025, respectively. The gross profit margin has remained stable, reflecting efficient cost management despite rising operating expenses. In the most recent year, the company experienced substantial growth, with net income rising by 14% year-over-year, indicating robust operational performance and effective cost control measures.

Financial Ratios

Below is a summary table of the financial ratios for Copart, Inc. (CPRT) over the last few fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 34.78% | 31.14% | 31.99% | 32.17% | 33.41% |

| ROE | 21.04% | 16.16% | 20.67% | 18.39% | 16.88% |

| ROIC | 19.23% | 16.45% | 20.12% | 18.01% | 15.88% |

| P/E | 37.08 | 28.07 | 34.05 | 36.89 | 28.19 |

| P/B | 9.84 | 6.62 | 7.04 | 6.68 | 4.76 |

| Current Ratio | 4.04 | 5.00 | 6.62 | 7.03 | 8.25 |

| Quick Ratio | 3.94 | 4.86 | 6.54 | 6.96 | 8.19 |

| D/E | 0.15 | 0.03 | 0.02 | 0.02 | 0.01 |

| Debt-to-Assets | 0.11 | 0.02 | 0.02 | 0.01 | 0.01 |

| Interest Coverage | 56.13 | 82.39 | 0 | 0 | 0 |

| Asset Turnover | 0.59 | 0.66 | 0.57 | 0.50 | 0.46 |

| Fixed Asset Turnover | 1.11 | 1.35 | 1.31 | 1.29 | 1.26 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

The most recent ratios for 2025 indicate a strong net margin of 33.41%, reflecting effective cost management and solid profitability. The current and quick ratios are exceptionally high at 8.25 and 8.19, suggesting excellent liquidity. However, the interest coverage ratio is currently at 0, indicating potential concerns regarding debt servicing capabilities. The P/E ratio is also relatively high at 28.19, which could imply overvaluation.

Evolution of Financial Ratios

Over the past five years, Copart’s financial ratios have generally shown stability, with a positive trend in net margin and liquidity ratios. However, the decline in ROE and ROIC suggests some potential inefficiency in capital utilization, which investors should monitor closely.

Distribution Policy

Copart, Inc. (CPRT) does not pay dividends, reflecting its strategy to reinvest profits into growth initiatives and acquisitions. This approach aligns with its high-growth phase, enabling the company to expand its market share effectively. Additionally, Copart has engaged in share buybacks, signaling confidence in its intrinsic value. Overall, the absence of dividends, combined with strategic reinvestment, supports sustainable long-term value creation for shareholders.

Sector Analysis

Copart, Inc. operates in the online vehicle auction industry, offering innovative remarketing solutions while facing competition from traditional dealerships and emerging digital platforms. Its strengths lie in a robust technology platform and a vast network of buyers and sellers.

Strategic Positioning

Copart, Inc. (CPRT) holds a significant position in the online vehicle auction market, boasting a market cap of approximately $39.76B. The company has effectively leveraged its proprietary technology for virtual bidding, which sets it apart from traditional vehicle remarketing services. However, competitive pressure remains intense, with rivals increasing their digital offerings. Technological disruption is a constant threat, necessitating continuous innovation to maintain market share. Currently, Copart’s services cater to a diverse clientele, including insurance companies and individual sellers, which helps mitigate risks associated with market fluctuations.

Revenue by Segment

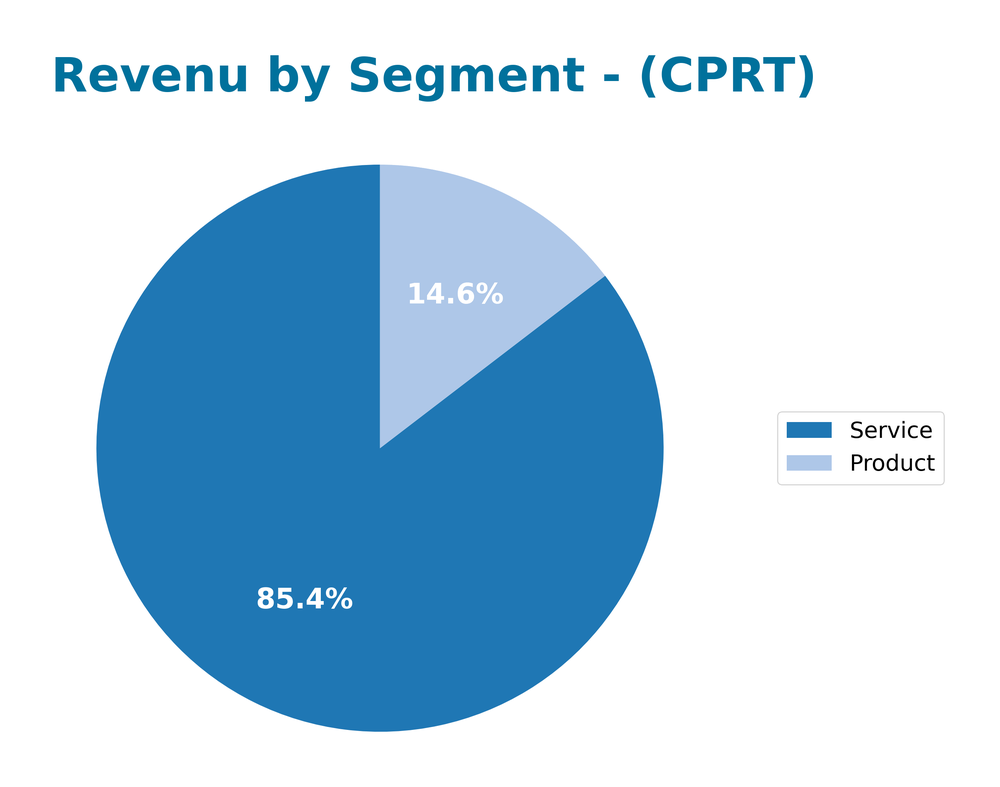

The pie chart below illustrates the revenue distribution by segment for Copart, Inc. in the fiscal year 2025, highlighting both product and service contributions.

In FY 2025, Copart demonstrated robust growth in its Service segment, generating 3.97B, up from 3.56B in FY 2024, reflecting a strong demand for its services. The Product segment also saw a slight increase to 678M from 676M. The overall trend indicates that Copart’s business is increasingly driven by its Service offerings, which now represent a significant portion of total revenues. However, while the growth trajectory remains positive, the recent year’s performance suggests potential margin pressures as the company expands its service capabilities, necessitating careful monitoring of operational efficiencies moving forward.

Key Products

Copart, Inc. offers a diverse range of services and products designed to facilitate online vehicle auctions and remarketing. Below is a table summarizing the key products available.

| Product | Description |

|---|---|

| Online Auctions | Virtual bidding platform allowing users to buy and sell vehicles through an auction-style format. |

| CashForCars.com | Service that enables individuals to sell their vehicles quickly and easily for cash. |

| U-Pull-It Service | Allows buyers to remove valuable parts from vehicles and sell the remaining parts and car body. |

| Copart 360 | Online technology for posting high-quality images of vehicles to enhance visibility and attract bidders. |

| Membership Tiers | Different levels of membership that provide various benefits for users purchasing vehicles through Copart. |

| Vehicle Inspection Stations | Locations where vehicles can be inspected prior to auction, providing transparency to potential buyers. |

| Title Processing | Services to assist buyers and sellers with the necessary paperwork for vehicle title transfer. |

| Flexible Vehicle Processing | Customizable programs for vehicle handling, catering to the needs of different sellers and types of vehicles. |

These products cater to a wide range of customers, including licensed vehicle dismantlers, rebuilders, and individual sellers, making Copart a comprehensive platform for vehicle remarketing.

Main Competitors

No verified competitors were identified from available data. However, Copart, Inc. holds a significant position in the online vehicle auction and remarketing sector. With a market cap of approximately 40B, Copart is known for its innovative auction technology and comprehensive services, maintaining a strong competitive edge in its industry.

Competitive Advantages

Copart, Inc. (CPRT) holds significant competitive advantages in the online vehicle auction and remarketing sector. Its robust technology platform allows for seamless virtual bidding, attracting a diverse clientele including insurers, dealers, and individual sellers across multiple countries. The company’s strong market presence in the U.S., Canada, and Europe positions it well for future growth. Looking ahead, opportunities lie in expanding its services into emerging markets and enhancing its technological offerings, which could drive higher engagement and transaction volumes. With a solid foundation and innovative outlook, Copart is poised for continued success in the evolving automotive industry.

SWOT Analysis

The purpose of this analysis is to evaluate the internal and external factors affecting Copart, Inc. (CPRT) to inform strategic decision-making.

Strengths

- Strong market position

- Advanced technology platform

- Diverse service offerings

Weaknesses

- Dependence on vehicle sales cycles

- Limited international presence

- No dividends offered

Opportunities

- Expansion into new markets

- Increasing demand for online auctions

- Partnerships with insurance companies

Threats

- Economic downturns

- Regulatory changes

- Competitive pressures

Overall, the SWOT assessment highlights Copart’s robust strengths and opportunities that can drive growth. However, it is crucial to remain vigilant about potential threats and weaknesses that could impact performance and strategize accordingly.

Stock Analysis

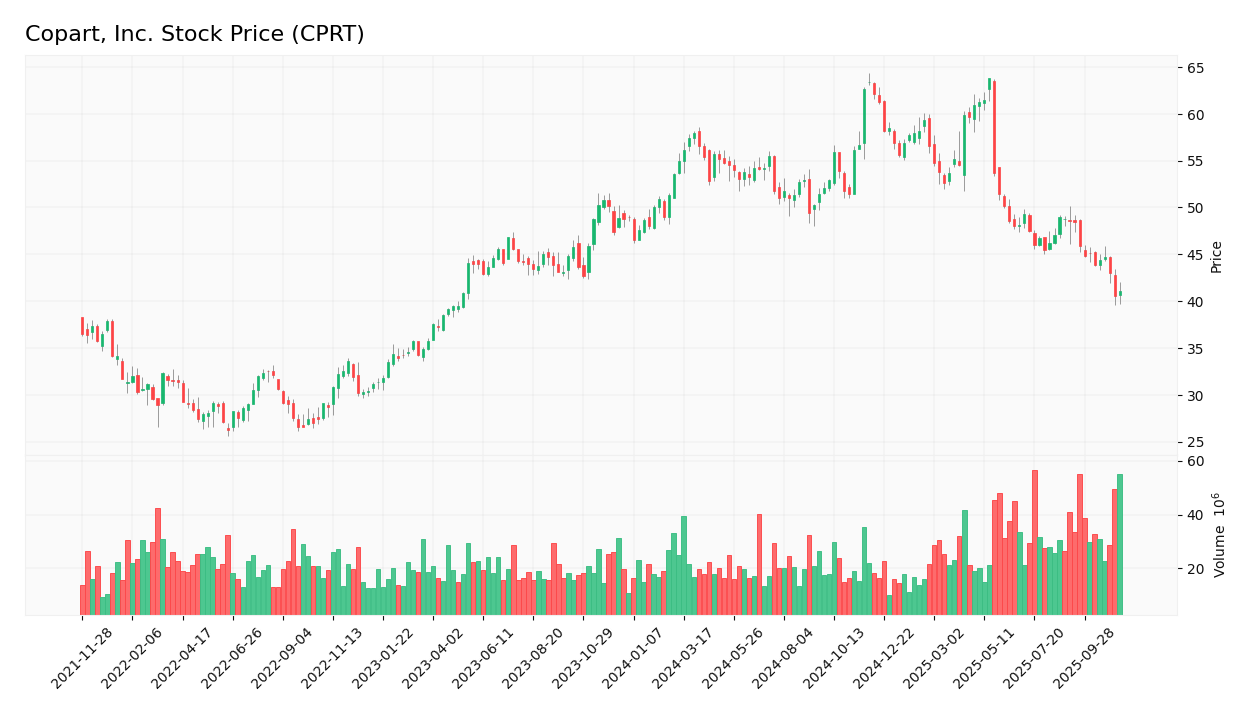

In analyzing Copart, Inc. (CPRT), I’ve observed significant price movements and trading dynamics over the past year, marked by a notable decline in stock value.

Trend Analysis

Over the past three months, CPRT has experienced a percentage change of -15.84%. This indicates a bearish trend, reflecting a decrease in stock price from a high of 63.84 to a low of 40.51. The trend is showing signs of deceleration, with a standard deviation of 5.07, suggesting some volatility in price movements. Investors should be cautious, as the downward momentum could continue if market conditions do not improve.

Volume Analysis

Examining trading volumes over the last three months, the average volume was approximately 37.02M, with a predominant seller-driven activity. The average buy volume was 11.26M, while the average sell volume was 25.75M, indicating a seller-dominant market sentiment. Notably, the volume trend is bullish, showing an acceleration with a trend slope of 623K, which may suggest increasing market participation despite the overall bearish price trend.

Analyst Opinions

Recent analyst recommendations for Copart, Inc. (CPRT) indicate a consensus rating of “buy.” Analysts maintain a positive outlook, citing strong return on equity and assets, which are crucial indicators of financial health. Notably, the overall score stands at 3 out of 5, reflecting solid potential for growth. However, some concerns arise from the debt-to-equity and price-to-earnings ratios, both rated 2. Analysts like those from FMP suggest that while risks exist, the company’s fundamentals support a bullish stance for investors in 2025.

Stock Grades

I have reviewed the stock grades for Copart, Inc. (CPRT) from reliable grading companies. Below is a summary of the most recent ratings:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HSBC | upgrade | Buy | 2025-09-04 |

| Stephens & Co. | maintain | Equal Weight | 2025-09-05 |

| Baird | maintain | Outperform | 2025-07-17 |

| JP Morgan | maintain | Neutral | 2025-05-23 |

| Baird | maintain | Outperform | 2025-02-21 |

The overall trend in grades shows a mix of maintenance and an upgrade from HSBC, indicating a cautiously optimistic outlook on CPRT. Notably, Baird has consistently rated the stock as “Outperform,” reflecting a strong sentiment in its performance potential.

Target Prices

The consensus among analysts for Copart, Inc. (CPRT) indicates a balanced outlook on the stock’s future performance.

| Target High | Target Low | Consensus |

|---|---|---|

| 62 | 32 | 47 |

Overall, analysts expect Copart to have a target price around 47, reflecting a mix of optimism and caution in their projections.

Consumer Opinions

Consumer sentiment towards Copart, Inc. (CPRT) reveals a dynamic mix of praise and criticism, reflecting the company’s impact on its clientele.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent service and quick transactions!” | “High fees that can add up quickly.” |

| “User-friendly platform with great support.” | “Occasional issues with auction delays.” |

| “Wide selection of vehicles available.” | “Some cars don’t match the descriptions.” |

| “Reliable for buying salvage vehicles.” | “Limited customer service hours.” |

Overall, consumer feedback highlights strengths in service efficiency and platform usability, while concerns about fees and customer support persist.

Risk Analysis

In evaluating Copart, Inc. (CPRT), it’s crucial to understand potential risks that could affect investment outcomes. Below is a summarized table of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in the stock market can affect share prices. | High | High |

| Regulatory Changes | New laws affecting the automotive or auction industry. | Medium | High |

| Competition | Increased competition may impact market share and profitability. | High | Medium |

| Economic Downturn | A recession could reduce demand for Copart’s services. | Medium | High |

| Technology Risks | Cybersecurity threats or system failures could disrupt operations. | Medium | Medium |

The most pressing risks for CPRT include high market volatility and regulatory changes that could significantly impact operations. Recent shifts in economic conditions emphasize the need for a careful approach to investment.

Should You Buy Copart, Inc.?

Copart, Inc. (CPRT) has demonstrated strong financial performance, with a net margin of 33.4%, a return on invested capital (ROIC) exceeding the weighted average cost of capital (WACC) at 8.97%, and a long-term positive trend despite recent bearish price actions. The company benefits from robust competitive advantages in the online vehicle auction space, although it faces risks from competition and market fluctuations.

Given the current metrics, Copart appears favorable for long-term investors. With a positive net margin, ROIC greater than WACC, and a long-term trend indicating a positive trajectory, I would recommend considering this stock for long-term addition to your portfolio. However, it’s essential to monitor volume trends, as current seller volumes suggest a cautious approach until buyer volumes return.

Specific risks related to Copart include heightened competition within the online auction industry and potential disruptions in the supply chain, which could impact profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Copart, Inc. (CPRT) Registers a Bigger Fall Than the Market: Important Facts to Note – Yahoo Finance (Nov 14, 2025)

- KBC Group NV Has $7.63 Million Position in Copart, Inc. $CPRT – MarketBeat (Nov 16, 2025)

- Copart (NASDAQ: CPRT) to release first-quarter results Nov 20; call at 5:30 p.m. ET – Stock Titan (Nov 12, 2025)

- Barclays Initiates Coverage of Copart (CPRT) with Underweight Recommendation – Nasdaq (Nov 13, 2025)

- Police & Firemen s Retirement System of New Jersey Has $6.60 Million Stock Position in Copart, Inc. $CPRT – MarketBeat (Nov 16, 2025)

For more information about Copart, Inc., please visit the official website: copart.com