Transforming the way businesses manage their workforce, Paychex, Inc. is at the forefront of the staffing and employment services industry. With its comprehensive suite of human capital management solutions, it empowers small to medium-sized enterprises across the U.S., Europe, and India to streamline payroll, benefits, and HR compliance. Recognized for its innovation and quality, Paychex continues to shape the future of work. As we dive into the investment analysis, I’ll explore whether its robust fundamentals still justify its current market valuation.

Table of contents

Company Description

Paychex, Inc. is a prominent player in the Staffing & Employment Services industry, specializing in integrated human capital management solutions tailored for small to medium-sized businesses. Founded in 1971 and headquartered in Rochester, NY, Paychex operates primarily in the United States, Europe, and India. The company offers a comprehensive range of services, including payroll processing, HR solutions, regulatory compliance, and insurance services. With a workforce of approximately 16.5K employees, Paychex is recognized for its innovative cloud-based HR administration software and commitment to customer service. As a leader in its sector, Paychex continues to shape the landscape of human capital management through technological advancements and strategic partnerships that enhance operational efficiency for its clients.

Fundamental Analysis

In this section, I will analyze Paychex, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

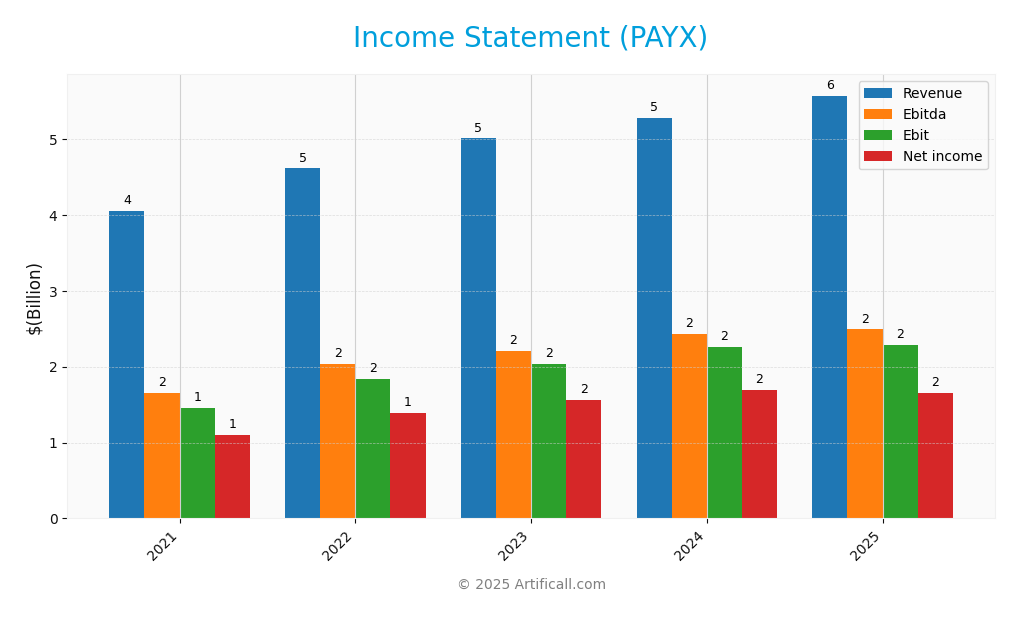

The following table provides a comprehensive overview of Paychex, Inc.’s income statement for the fiscal years 2021 to 2025, highlighting key financial metrics.

| Income Statement Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 4.06B | 4.61B | 5.01B | 5.28B | 5.57B |

| Cost of Revenue | 1.27B | 1.36B | 1.45B | 1.48B | 1.54B |

| Operating Expenses | 1.32B | 1.42B | 1.52B | 1.62B | 1.82B |

| Gross Profit | 2.79B | 3.26B | 3.55B | 3.80B | 4.03B |

| EBITDA | 1.65B | 2.03B | 2.21B | 2.43B | 2.49B |

| EBIT | 1.46B | 1.84B | 2.03B | 2.26B | 2.28B |

| Interest Expense | 35M | 36M | 37M | 37M | 105M |

| Net Income | 1.10B | 1.39B | 1.56B | 1.69B | 1.66B |

| EPS | 3.05 | 3.86 | 4.32 | 4.69 | 4.60 |

| Filing Date | 2021-07-16 | 2022-07-15 | 2023-07-14 | 2024-07-11 | 2025-07-11 |

Paychex, Inc. has shown a steady growth trend in both Revenue and Net Income over the reviewed period, with Revenue increasing from 4.06B in 2021 to 5.57B in 2025. Net Income has similarly risen from 1.10B to 1.66B, demonstrating robust operational performance. The margins have remained relatively stable, with slight improvements in EBITDA and EBIT margins, indicating efficient cost management. In 2025, while revenue growth continued, there was a slight decrease in EPS compared to 2024, suggesting increased expenses, particularly in interest, that could affect profitability moving forward. Careful monitoring of these factors is essential for potential investors.

Financial Ratios

The following table summarizes the financial ratios for Paychex, Inc. (PAYX) over the last five fiscal years:

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 27.05% | 30.20% | 31.10% | 32.03% | 29.74% |

| ROE | 16.17% | 18.56% | 18.01% | 20.02% | 18.69% |

| ROIC | 18.00% | 19.30% | 18.50% | 22.50% | 22.50% |

| P/E | 33.12 | 32.06 | 24.28 | 25.61 | 34.32 |

| P/B | 12.33 | 14.47 | 10.83 | 11.39 | 13.78 |

| Current Ratio | 1.25 | 1.25 | 1.30 | 1.37 | 1.28 |

| Quick Ratio | 1.25 | 1.25 | 1.30 | 1.37 | 1.28 |

| D/E | 0.30 | 0.29 | 0.25 | 0.23 | 1.22 |

| Debt-to-Assets | 9.72% | 9.15% | 8.21% | 8.34% | 30.32% |

| Interest Coverage | 40.80 | 50.27 | 55.40 | 58.29 | 20.95 |

| Asset Turnover | 0.44 | 0.48 | 0.47 | 0.51 | 0.34 |

| Fixed Asset Turnover | 8.13 | 9.61 | 10.94 | 11.51 | 9.68 |

| Dividend Yield | 2.50% | 2.24% | 3.11% | 3.04% | 2.55% |

Interpretation of Financial Ratios

In 2025, Paychex’s financial ratios show a mixed performance. While the net margin remains healthy at 29.74%, the P/E ratio of 34.32 indicates that the stock may be overvalued compared to its earnings. The significant rise in the debt-to-assets ratio to 30.32% raises concerns about financial leverage. However, the interest coverage ratio of 20.95 suggests that the company can comfortably meet its interest obligations.

Evolution of Financial Ratios

Over the past five years, Paychex has experienced fluctuations in its financial ratios. Notably, the net margin has seen a decline from 31.10% in 2023 to 29.74% in 2025, while the debt-to-equity ratio surged significantly in 2025, indicating a shift towards higher leverage. The interest coverage ratio, however, shows strong resilience, reflecting sound financial management.

Distribution Policy

Paychex, Inc. (PAYX) has consistently paid dividends, with a current annual yield of approximately 2.5%. The dividend per share has shown a steady upward trend, reflecting a commitment to returning value to shareholders. However, the payout ratio stands at around 87%, indicating that a significant portion of earnings is being distributed. This leaves less flexibility for reinvestment or to cover potential downturns. Additionally, the company engages in share buybacks, which can amplify returns but also risks over-leveraging. Overall, while the current distribution strategy provides immediate returns, it raises questions about long-term sustainability amidst high payout levels.

Sector Analysis

Paychex, Inc. operates within the Staffing & Employment Services industry, providing integrated human capital management solutions, primarily targeting small to medium-sized businesses. It faces competition from other HR service providers while leveraging its comprehensive service offerings and strong market presence.

Strategic Positioning

Paychex, Inc. holds a significant position in the staffing and employment services market, with a market cap of approximately 40.4B. The company’s key products, particularly in human capital management solutions, command a solid market share. However, competitive pressure remains high from emerging tech disruptors offering automated HR solutions. Paychex’s beta of 0.894 indicates lower volatility compared to the market, which is favorable for risk management. To maintain its edge, the company must continuously innovate and adapt to technological advancements while ensuring comprehensive service delivery to small and medium-sized enterprises.

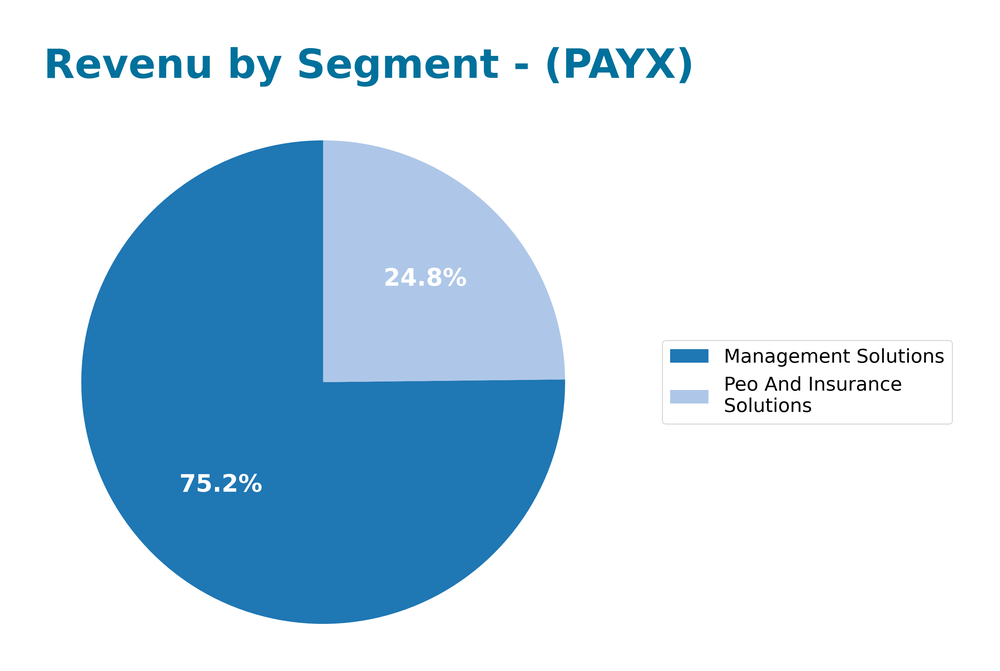

Revenue by Segment

The following chart illustrates Paychex, Inc.’s revenue distribution by segment for the fiscal year 2025, showcasing the performance of its various business lines.

In FY 2025, Paychex generated $4.07B from Management Solutions and $1.34B from PEO and Insurance Solutions. Management Solutions continues to dominate revenue generation, reflecting a strong growth trend from $3.73B in FY 2023. Meanwhile, PEO and Insurance Solutions also saw a robust increase compared to prior years. The overall growth indicates healthy demand, but I advise caution as concentration risk in Management Solutions may pose challenges if sector dynamics shift.

Key Products

Below is a table summarizing the key products offered by Paychex, Inc. These products are designed to provide comprehensive solutions for small to medium-sized businesses in various aspects of human capital management.

| Product | Description |

|---|---|

| Payroll Processing Services | Streamlined payroll processing that ensures accurate calculations, timely payments, and compliance with tax regulations for businesses of all sizes. |

| HR Solutions | Comprehensive HR services including employee benefits administration, compliance guidance, and risk management outsourcing, tailored for diverse business needs. |

| Employee Payment Services | Flexible payment options for employees, including direct deposit, pay cards, and payroll tax administration to simplify wage distribution. |

| Cloud-based HR Software | Innovative software for managing employee benefits, time and attendance tracking, recruiting, and onboarding processes, facilitating efficient HR operations. |

| Retirement Services | Administration of retirement plans, including compliance support, online access for participants, and ongoing management of employer contributions. |

| Insurance Services | A range of insurance offerings, such as workers’ compensation, property and casualty coverage, and health plans including dental, vision, and life insurance. |

| Payment Processing Services | Solutions for managing payments, invoicing, and tax preparation, enhancing financial operations for small businesses. |

These products highlight Paychex’s commitment to supporting businesses in managing their workforce effectively while ensuring compliance and operational efficiency.

Main Competitors

No verified competitors were identified from available data. Paychex, Inc. holds an estimated market share in the staffing and employment services sector, primarily serving small to medium-sized businesses in the United States, Europe, and India. The company is well-positioned in its niche, providing a comprehensive range of human capital management solutions.

Competitive Advantages

Paychex, Inc. stands out in the staffing and employment services industry due to its comprehensive suite of integrated human capital management solutions tailored for small to medium-sized businesses. The company’s established market presence in the U.S., Europe, and India, combined with its strong focus on regulatory compliance and risk management, enhances its attractiveness to clients. Looking ahead, Paychex has opportunities to expand into emerging markets and innovate its cloud-based HR software offerings, ensuring it remains competitive and responsive to the evolving needs of its clientele.

SWOT Analysis

This SWOT analysis aims to provide a clear overview of Paychex, Inc.’s current position and strategic outlook.

Strengths

- Strong market position

- Diverse service offerings

- Stable dividend history

Weaknesses

- High dependency on US market

- Limited brand recognition outside the US

- Vulnerability to economic downturns

Opportunities

- Expansion into international markets

- Growing demand for HR tech solutions

- Opportunities in cloud-based services

Threats

- Intense competition in staffing services

- Regulatory changes affecting HR practices

- Economic fluctuations impacting client budgets

The overall SWOT assessment indicates that while Paychex has solid strengths and opportunities for growth, it must address its weaknesses and remain vigilant against potential threats. This strategic awareness should guide its future initiatives and investment decisions.

Stock Analysis

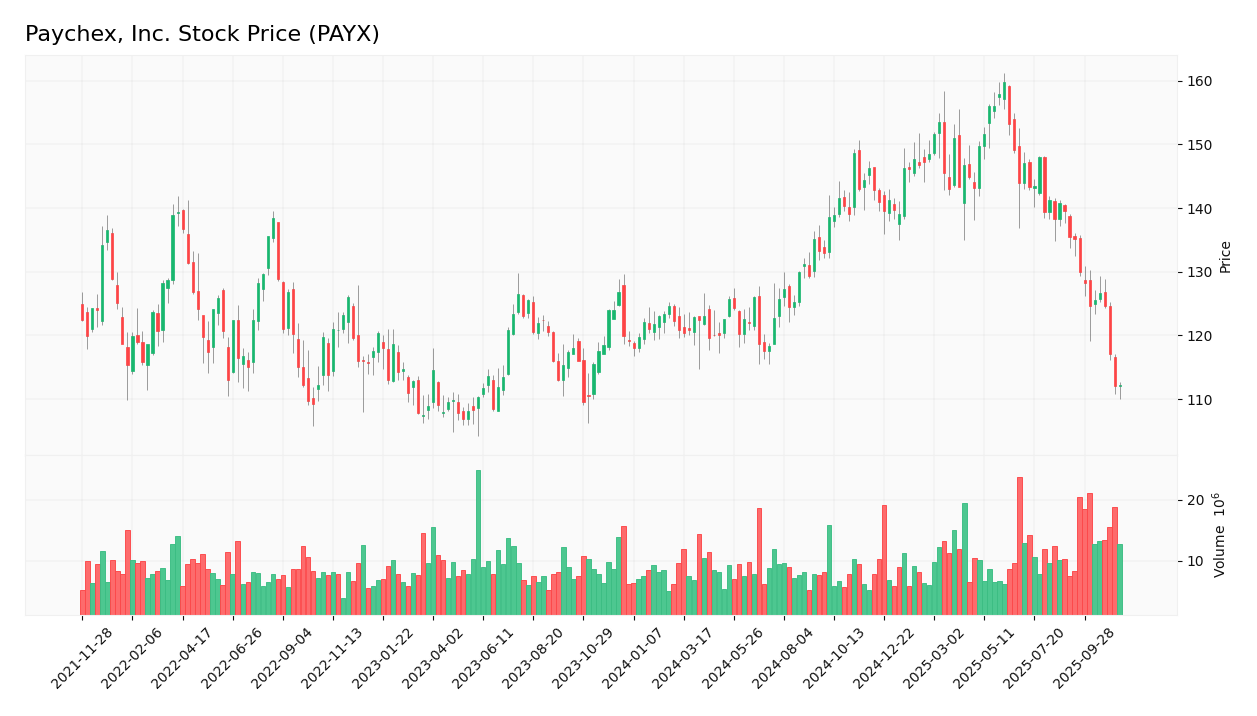

In the past year, Paychex, Inc. (PAYX) has experienced notable price movements, highlighted by a significant decline of 6.47%. Despite this drop, the overall trend analysis suggests a bullish outlook due to a recent acceleration in the stock’s performance.

Trend Analysis

Over the past two years, PAYX has seen a price change of -6.47%. This percentage change indicates a bearish trend, as it falls below the -2% threshold. The stock has reached notable highs at 159.78 and lows at 111.96, and the trend shows signs of deceleration as indicated by the standard deviation of 12.17. More recently, from August 31, 2025, to November 16, 2025, the stock has experienced a sharper decline of 19.62%, further confirming the bearish sentiment in the short term.

Volume Analysis

Analyzing trading volumes over the last three months, the average volume stands at approximately 14.37M, with a significant portion of this activity being seller-driven. The average sell volume at 11.16M greatly exceeds the average buy volume of 3.21M, indicating a seller-dominant market sentiment. Despite the recent increase in volume, characterized by an acceleration in activity (trend slope of 416K), the overall sentiment suggests caution among investors.

Analyst Opinions

Recent analyst recommendations for Paychex, Inc. (PAYX) show a consensus rating of “Buy.” Analysts, including those from notable firms, have rated the stock with a B+ overall score, highlighting strong return on equity (5) and return on assets (5). However, concerns about its price-to-earnings (2) and price-to-book (1) ratios suggest some caution. The discounted cash flow score is solid at 4, indicating a favorable outlook on the company’s future cash generation. Overall, the positive sentiment reflects confidence in PAYX’s growth potential amidst careful risk management.

Stock Grades

Paychex, Inc. (PAYX) has received consistent ratings from several reputable grading companies, reflecting a stable outlook in the market.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-10-20 |

| BMO Capital | Maintain | Market Perform | 2025-10-01 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-01 |

| Stifel | Maintain | Hold | 2025-09-22 |

| UBS | Maintain | Neutral | 2025-09-17 |

| Citigroup | Maintain | Neutral | 2025-08-21 |

| JP Morgan | Maintain | Underweight | 2025-08-14 |

| Morgan Stanley | Maintain | Equal Weight | 2025-06-27 |

| Jefferies | Maintain | Hold | 2025-06-26 |

| Stifel | Maintain | Hold | 2025-06-26 |

The overall trend in grades for Paychex indicates a cautious but stable position among analysts, with several firms maintaining their ratings without significant changes. This stability suggests a steady outlook for investors considering Paychex as part of their portfolio.

Target Prices

The current consensus among analysts for Paychex, Inc. indicates a range of target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 165 | 128 | 142.56 |

Overall, analysts expect Paychex to reach a target consensus of approximately 142.56, reflecting a positive outlook with a significant upside potential.

Consumer Opinions

Consumer sentiment regarding Paychex, Inc. (PAYX) reflects a mix of satisfaction and concerns, showcasing the diverse experiences of its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “Paychex offers excellent payroll solutions.” | “Customer service response times are slow.” |

| “The platform is user-friendly and efficient.” | “Pricing can be higher than competitors.” |

| “Great integration with accounting software.” | “Occasional technical issues with the app.” |

Overall, consumer feedback indicates that while Paychex excels in usability and integration features, there are notable concerns regarding customer service and pricing competitiveness.

Risk Analysis

In evaluating Paychex, Inc. (PAYX), it’s essential to consider various risks that could affect its performance. Below is a summary of key risks to watch:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in market demand for payroll services. | High | High |

| Regulatory Risk | Changes in labor laws affecting payroll processing. | Medium | High |

| Competition | Increased competition from fintech payroll solutions. | High | Medium |

| Economic Conditions | Economic downturn affecting small business clients. | Medium | High |

| Technology Risk | Cybersecurity threats to sensitive payroll data. | High | High |

The most significant risks for Paychex include market fluctuations and regulatory changes, both of which can profoundly impact its client base and overall growth. With the rise of fintech solutions, monitoring competitive dynamics is essential.

Should You Buy Paychex, Inc.?

Paychex, Inc. has demonstrated a solid net margin of 29.74% and a robust return on invested capital (ROIC) of 30.25%, significantly exceeding its weighted average cost of capital (WACC) of 7.4%. The company is well-positioned with competitive advantages, including a strong market presence in payroll and HR solutions. However, recent risks include a noticeable decline in buyer volume and a negative long-term trend in stock price.

Based on the most current figures, Paychex’s net margin is positive, and its ROIC significantly exceeds the WACC, indicating strong profitability and efficient capital use. Despite these favorable indicators, the overall long-term trend is negative, and there is a seller-dominant market with higher volumes of selling than buying. Therefore, I recommend waiting for a bullish reversal and an increase in buyer volumes before considering adding Paychex to your portfolio.

Specific risks related to Paychex include increased competition in the HR tech space, potential supply chain disruptions, and valuation concerns given the current market climate.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- KBC Group NV Purchases 5,102 Shares of Paychex, Inc. $PAYX – MarketBeat (Nov 16, 2025)

- Investor Optimism Abounds Paychex, Inc. (NASDAQ:PAYX) But Growth Is Lacking – 富途牛牛 (Nov 16, 2025)

- Paychex, Inc. Stock (PAYX) Opinions on Recent Price Drop and Analyst Upgrade – Quiver Quantitative (Nov 14, 2025)

- M&G PLC Sells 6,098 Shares of Paychex, Inc. $PAYX – MarketBeat (Nov 15, 2025)

- Paychex, Inc. $PAYX Shares Sold by Wealth Alliance LLC – MarketBeat (Nov 14, 2025)

For more information about Paychex, Inc., please visit the official website: paychex.com