Every day, millions around the globe reach for a Coca-Cola product, making Coca-Cola Europacific Partners PLC a key player in the non-alcoholic beverage landscape. With a diverse portfolio that includes iconic brands like Coca-Cola, Fanta, and Monster Energy, CCEP stands as a paragon of innovation and quality in its industry. As we explore the current investment landscape, I ask: do CCEP’s fundamentals still align with its ambitious growth trajectory and market valuation?

Table of contents

Company Description

Coca-Cola Europacific Partners PLC (CCEP), founded in 1986 and headquartered in Uxbridge, UK, stands as a prominent player in the non-alcoholic beverage industry. With a diverse portfolio that includes well-known brands such as Coca-Cola, Fanta, and Monster Energy, CCEP produces, distributes, and sells a wide range of ready-to-drink beverages, including soft drinks, waters, and teas. Serving around 600M consumers, the company has established itself as a leader in its sector, operating primarily in Europe. CCEP’s strategic emphasis on innovation and sustainability positions it to shape industry trends and consumer preferences effectively, reinforcing its role as a key player in the beverage ecosystem.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Coca-Cola Europacific Partners PLC, covering the income statement, financial ratios, and dividend payout policy.

Income Statement

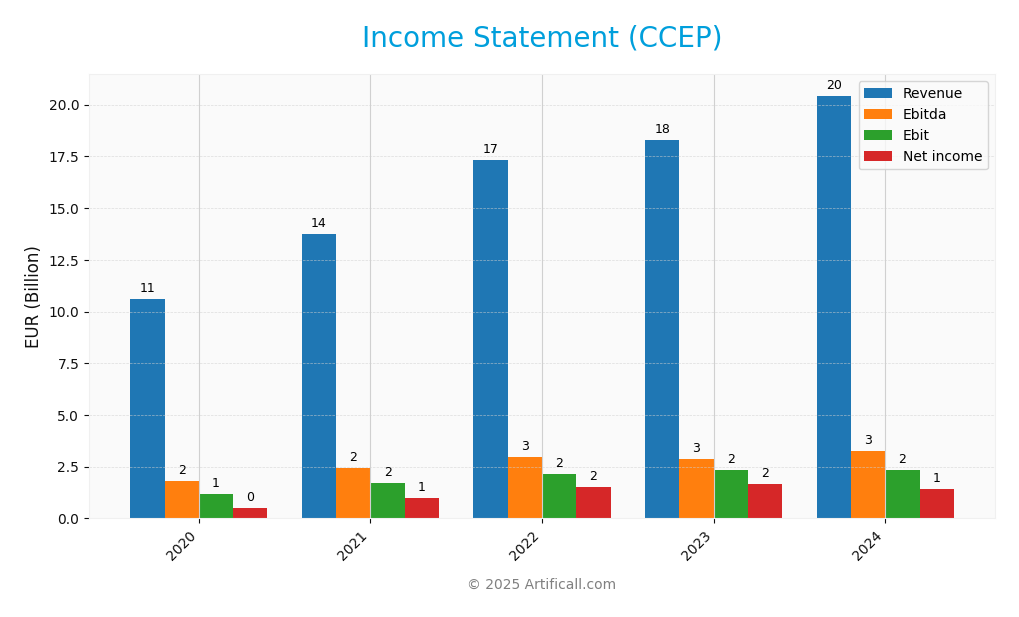

The following table summarizes the income statement of Coca-Cola Europacific Partners PLC (CCEP) for the fiscal years 2020 to 2024, highlighting key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 10.61B | 13.76B | 17.32B | 18.30B | 20.44B |

| Cost of Revenue | 6.87B | 8.60B | 11.10B | 11.58B | 13.16B |

| Operating Expenses | 2.98B | 3.57B | 4.14B | 4.39B | 5.15B |

| Gross Profit | 3.74B | 5.09B | 6.22B | 6.73B | 7.28B |

| EBITDA | 1.80B | 2.44B | 2.97B | 2.88B | 3.27B |

| EBIT | 1.19B | 1.72B | 2.15B | 2.35B | 2.34B |

| Interest Expense | 164M | 153M | 131M | 162M | 242M |

| Net Income | 498M | 982M | 1.51B | 1.67B | 1.42B |

| EPS | 1.09 | 2.15 | 3.30 | 3.63 | 3.08 |

| Filing Date | 2021-03-12 | 2022-03-15 | 2023-03-17 | 2024-03-15 | 2025-03-21 |

Over the analyzed period, CCEP has shown a steady increase in Revenue, jumping from 10.61B in 2020 to 20.44B in 2024. However, Net Income has fluctuated, peaking at 1.67B in 2023 before declining to 1.42B in 2024. While the Gross Profit margin has remained relatively stable, the recent year’s drop in EPS indicates pressure on profitability, possibly due to higher operating and interest expenses. This trend warrants a cautious approach, as increased costs could impact future earnings and margins.

Financial Ratios

The following table presents the financial ratios of Coca-Cola Europacific Partners PLC (CCEP) over the last five years, allowing for a clear visualization of trends and performance metrics.

| Financial Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 4.70% | 7.14% | 8.71% | 9.12% | 6.94% |

| ROE | 12.8% | 10.6% | 11.0% | 11.5% | 11.7% |

| ROIC | 9.1% | 8.8% | 9.5% | 9.5% | 9.3% |

| P/E | 37.3 | 22.8 | 15.7 | 16.6 | 24.1 |

| P/B | 3.08 | 3.19 | 3.17 | 3.47 | 4.02 |

| Current Ratio | 0.98 | 0.95 | 0.89 | 0.91 | 0.81 |

| Quick Ratio | 0.82 | 0.76 | 0.71 | 0.72 | 0.62 |

| D/E | 1.19 | 1.87 | 1.60 | 1.43 | 1.33 |

| Debt-to-Assets | 37.4% | 45.2% | 40.6% | 38.9% | 36.4% |

| Interest Coverage | 4.95 | 9.91 | 15.92 | 14.44 | 8.81 |

| Asset Turnover | 0.55 | 0.47 | 0.59 | 0.63 | 0.66 |

| Fixed Asset Turnover | 2.75 | 2.62 | 3.33 | 3.42 | 3.18 |

| Dividend Yield | 2.08% | 2.84% | 3.23% | 3.03% | 2.66% |

Interpretation of Financial Ratios

In the most recent year (2024), CCEP’s net margin of 6.94% indicates a slight decrease from the previous year, although still showing profitability. The P/E ratio at 24.1 suggests the stock may be overvalued relative to earnings, while the current and quick ratios below 1 point to potential liquidity concerns. The interest coverage ratio of 8.81 remains strong, indicating the company can comfortably cover its interest expenses.

Evolution of Financial Ratios

Over the past five years, CCEP’s financial ratios display a mixed trend. While profitability ratios like net margin and ROE have generally improved, liquidity ratios have decreased, indicating growing concerns in short-term financial health. The P/E ratio has fluctuated, reflecting changing market sentiment and valuation perceptions.

Distribution Policy

Coca-Cola Europacific Partners PLC (CCEP) maintains a dividend payout ratio of 64.17%, with a consistent annual dividend yield of approximately 2.66%. The company has shown a stable trend in its dividend per share, which currently stands at €1.98. Furthermore, CCEP engages in share buyback programs, reinforcing its commitment to returning value to shareholders. However, potential risks include the sustainability of its distributions amidst fluctuating profit margins. Overall, this distribution strategy supports a long-term value creation approach for shareholders.

Sector Analysis

Coca-Cola Europacific Partners PLC (CCEP) is a leading player in the non-alcoholic beverage sector, known for its diverse product portfolio and strong market presence. The company faces competition from major brands while leveraging its extensive distribution network and brand recognition to maintain a competitive edge.

Strategic Positioning

Coca-Cola Europacific Partners PLC (CCEP) holds a significant position in the non-alcoholic beverage market, with a market cap of approximately $41.5B. The company competes effectively, leveraging a diverse portfolio that includes brands like Coca-Cola, Monster Energy, and Costa Coffee. However, competitive pressure remains high, particularly from emerging brands and health-conscious alternatives. Technological disruption, such as advancements in sustainable packaging and e-commerce, poses both challenges and opportunities for growth. As an investor, I remain cautious about market fluctuations and the impact of shifting consumer preferences on CCEP’s performance.

Key Products

Coca-Cola Europacific Partners PLC offers a diverse range of non-alcoholic beverages that cater to various consumer preferences. Below is a table highlighting some of their key products.

| Product | Description |

|---|---|

| Coca-Cola | The flagship carbonated soft drink with a classic taste. |

| Diet Coke | A low-calorie version of Coca-Cola, appealing to health-conscious consumers. |

| Coca-Cola Zero Sugar | A zero-calorie alternative to classic Coca-Cola with no sugar and no calories. |

| Fanta | A fruit-flavored carbonated soft drink available in multiple flavors. |

| Sprite | A lemon-lime flavored soft drink known for its refreshing taste. |

| Monster Energy | A popular energy drink brand targeting active consumers and athletes. |

| POWERADE | A sports drink designed for hydration and energy replenishment during physical activities. |

| Costa Coffee | A range of coffee beverages including ready-to-drink options suitable for coffee lovers. |

| Minute Maid | A brand offering a variety of fruit juices and juice drinks. |

| Schweppes | A brand known for its tonic waters and sparkling beverages, enhancing mixed drinks. |

| Honest | A line of organic teas and juices, catering to health-conscious consumers. |

| Capri-Sun | A juice drink packaged in pouches, popular among children and families. |

| Tropico | A brand offering tropical-flavored soft drinks and juices in various formats. |

These products reflect the company’s commitment to meeting the diverse taste preferences of consumers across different markets.

Main Competitors

In the competitive landscape of the non-alcoholic beverage industry, Coca-Cola Europacific Partners PLC (CCEP) faces several notable competitors. However, I was unable to identify any reliable competitors with verifiable names based on the available data.

Coca-Cola Europacific Partners holds a significant position in the market, with a market capitalization of approximately $41.5B. Its diverse product portfolio and extensive distribution network enable it to maintain a strong competitive edge within the sector.

Competitive Advantages

Coca-Cola Europacific Partners PLC (CCEP) holds significant competitive advantages within the beverage industry, particularly through its extensive brand portfolio and strong distribution network. With established names like Coca-Cola, Fanta, and Monster Energy, the company has a solid market presence. Looking ahead, CCEP is poised to explore new product lines, including healthier beverage options and ready-to-drink innovations, which align with consumer trends towards wellness. Additionally, expanding into emerging markets presents opportunities for growth, allowing CCEP to leverage its expertise to capture a larger share of the global beverage market.

SWOT Analysis

The SWOT analysis provides an overview of Coca-Cola Europacific Partners PLC’s strengths, weaknesses, opportunities, and threats to inform strategic decisions.

Strengths

- Strong brand portfolio

- Diverse product range

- Established market presence

Weaknesses

- Dependence on Coca-Cola brand

- High competition

- Vulnerability to commodity price fluctuations

Opportunities

- Growth in healthy beverage segment

- Expansion into new markets

- E-commerce growth

Threats

- Regulatory pressures

- Changing consumer preferences

- Economic downturns

The overall SWOT assessment indicates that while Coca-Cola Europacific Partners PLC has a robust position in the market with significant strengths, it must address its weaknesses and navigate external threats carefully. Focusing on emerging opportunities can drive growth and enhance its competitive edge.

Stock Analysis

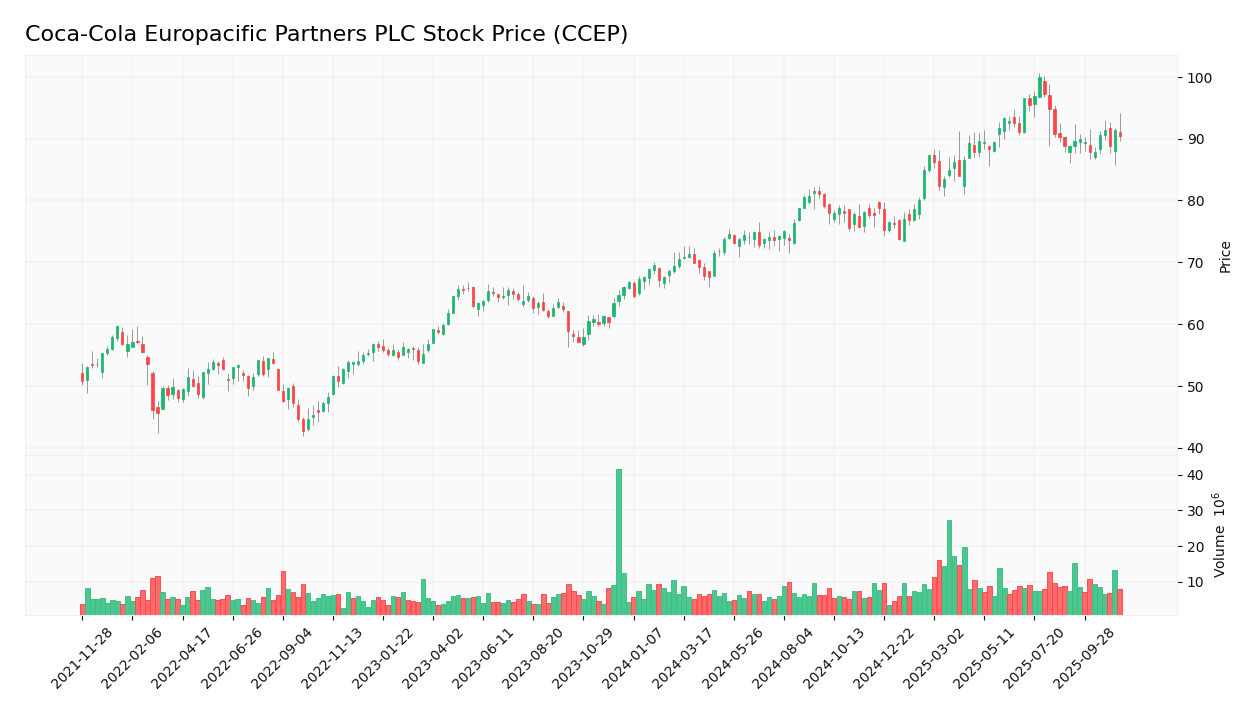

Over the past year, Coca-Cola Europacific Partners PLC (CCEP) has experienced significant price movements, culminating in a notable bullish trend. The stock has exhibited dynamic trading patterns, reflecting both investor interest and market sentiment.

Trend Analysis

Analyzing the overall price performance over the past year, CCEP has shown a remarkable increase of 37.03%. This considerable percentage change categorizes the stock within a bullish trend. However, it’s important to note that the trend is experiencing deceleration, indicating a potential slowing in momentum. The highest price recorded was 100.04, while the lowest was 64.61, with a standard deviation of 8.89 reflecting some volatility in price movements.

In recent weeks, CCEP’s price change is recorded at 1.69%, which falls within the neutral range, suggesting stability within the current price action despite the longer-term bullish trend.

Volume Analysis

Examining the trading volumes over the last three months, the average volume has been approximately 9.2M, with buyer-driven activity clearly dominating—69.08% of the volume being attributed to purchases. This bullish volume trend suggests a strong investor sentiment favoring buying, although the acceleration status indicates a deceleration in this volume growth. The average buy volume was 6.36M compared to an average sell volume of 2.84M, confirming that market participation leans towards buyers.

Analyst Opinions

Recent analyst recommendations for Coca-Cola Europacific Partners PLC (CCEP) indicate a consensus “buy” for 2025. Analysts have rated the stock with a B+ overall, highlighting strong scores in discounted cash flow (5) and return on equity (4). However, concerns about debt-to-equity (1) and price-to-earnings (2) ratios suggest caution. Notably, analysts emphasize CCEP’s robust cash flow generation as a key factor for potential growth, despite some risks. Overall, the sentiment remains optimistic amidst a landscape of calculated risks.

Stock Grades

Coca-Cola Europacific Partners PLC (CCEP) has received consistent ratings from reputable grading companies, indicating a stable outlook in the market. Below is a summary of the latest stock grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-08-08 |

| Barclays | maintain | Overweight | 2025-07-15 |

| UBS | maintain | Buy | 2025-07-02 |

| Barclays | maintain | Overweight | 2025-05-01 |

| UBS | maintain | Buy | 2025-04-30 |

| Barclays | maintain | Overweight | 2025-04-11 |

| Barclays | maintain | Overweight | 2025-03-27 |

| Barclays | maintain | Overweight | 2025-03-06 |

| Evercore ISI Group | maintain | Outperform | 2025-02-18 |

| UBS | maintain | Buy | 2025-02-17 |

The overall trend in grades for CCEP shows a strong preference for maintaining either an “Overweight” or “Buy” rating, suggesting that analysts are optimistic about the stock’s performance moving forward.

Target Prices

The consensus target price for Coca-Cola Europacific Partners PLC (CCEP) indicates a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 98 | 46.22 | 74.69 |

Analysts generally expect the stock to perform well, with a consensus target price suggesting a moderate upside potential from current levels.

Consumer Opinions

Consumer sentiment regarding Coca-Cola Europacific Partners PLC (CCEP) reflects a mix of appreciation for its product quality and concerns about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Coca-Cola products are always refreshing and enjoyable.” | “Prices have increased too much recently.” |

| “The variety of flavors keeps things interesting!” | “Customer service could be improved.” |

| “I love the sustainability initiatives CCEP is taking.” | “Some products are hard to find in stores.” |

Overall, consumer feedback indicates that while CCEP is praised for its product quality and sustainability efforts, concerns about pricing and customer service persist.

Risk Analysis

In evaluating Coca-Cola Europacific Partners PLC (CCEP), it is crucial to understand the potential risks that could affect its performance. The table below outlines the key risks associated with this company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in consumer demand and preferences | High | High |

| Regulatory Risk | Changes in health regulations impacting product sales | Medium | High |

| Supply Chain Risk | Disruptions in sourcing raw materials | Medium | Medium |

| Currency Risk | Exposure to foreign exchange fluctuations | High | Medium |

| Competitive Risk | Aggressive competition from other beverage companies | Medium | High |

In summary, market and regulatory risks are particularly noteworthy due to their high probability and significant impact, especially as health trends evolve. Awareness and proactive management of these factors are essential for maintaining CCEP’s market position.

Should You Buy Coca-Cola Europacific Partners PLC?

Coca-Cola Europacific Partners PLC (CCEP) has demonstrated a solid net profit margin of 6.94% and a return on invested capital (ROIC) of 6.62%, which exceeds its weighted average cost of capital (WACC) of 4.88%. The company benefits from its strong brand recognition and distribution network, although it faces risks from increasing competition and potential supply chain disruptions.

Based on the current financial metrics, CCEP appears favorable for long-term investors, as the company has maintained a positive long-term trend, and buyer volumes have been strong. This indicates a good opportunity for long-term investment.

However, I would advise caution due to industry competition and market dependence, which could affect future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- SG Americas Securities LLC Acquires 286,543 Shares of Coca-Cola Europacific Partners $CCEP – MarketBeat (Nov 16, 2025)

- Coca-Cola Europacific Partners reports recent share buybacks on multiple exchanges – Investing.com (Nov 12, 2025)

- Coca-Cola Europacific Partners (AMS:CCEP) Is Increasing Its Dividend To €1.25 – Yahoo Finance (Nov 07, 2025)

- Transactions in Own Shares – Actusnews (Nov 14, 2025)

- (CCEP) Volatility Zones as Tactical Triggers – news.stocktradersdaily.com (Nov 16, 2025)

For more information about Coca-Cola Europacific Partners PLC, please visit the official website: cocacolaep.com