In the heart of the Permian Basin, Diamondback Energy, Inc. is not just drilling for oil; it’s redefining the landscape of energy production. Renowned for its innovative techniques and substantial reserves, this independent oil and gas powerhouse has become a pivotal player in the industry. With a robust portfolio that emphasizes growth and sustainability, I find myself questioning: do Diamondback’s impressive fundamentals and market strategies still justify its current valuation, or is there untapped potential waiting to be explored?

Table of contents

Company Description

Diamondback Energy, Inc. (NASDAQ: FANG), founded in 2007 and headquartered in Midland, Texas, is a prominent player in the oil and gas exploration and production industry. The company focuses on the acquisition, development, and exploitation of unconventional oil and natural gas reserves, primarily in the prolific Permian Basin across West Texas and New Mexico. With approximately 524.7K gross acres and estimated proved reserves of 1.79B barrels of crude oil equivalent, Diamondback operates over 5,289 producing wells and manages extensive midstream infrastructure, including 866 miles of pipelines. As a leader in its sector, Diamondback is strategically positioned to drive innovation and efficiency within the energy landscape, contributing to the ongoing evolution of sustainable energy practices.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Diamondback Energy, Inc. by examining its income statement, key financial ratios, and dividend payout policy.

Income Statement

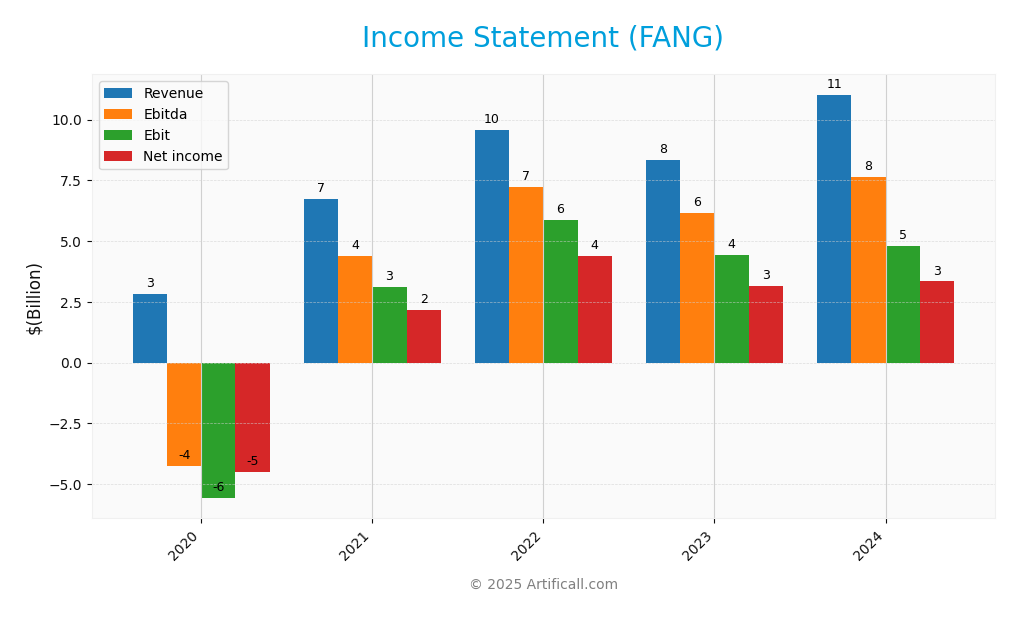

Below is the income statement for Diamondback Energy, Inc. (FANG) over the past few years, detailing key financial metrics that can aid in your investment decisions.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 2.81B | 6.75B | 9.57B | 8.34B | 11.02B |

| Cost of Revenue | 2.18B | 2.48B | 2.87B | 3.54B | 6.05B |

| Operating Expenses | 6.11B | 0.27B | 0.19B | 0.23B | 0.58B |

| Gross Profit | 0.64B | 4.27B | 6.70B | 4.80B | 4.97B |

| EBITDA | -4.27B | 4.37B | 7.23B | 6.17B | 7.64B |

| EBIT | -5.58B | 3.10B | 5.88B | 4.42B | 4.79B |

| Interest Expense | 0.20B | 0.20B | 0.16B | 0.18B | 0.29B |

| Net Income | -4.52B | 2.18B | 4.39B | 3.14B | 3.34B |

| EPS | -28.59 | 12.35 | 24.61 | 17.34 | 15.53 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-26 |

In the analysis of Diamondback Energy’s income statement, we observe a notable increase in revenue from 2.81B in 2020 to 11.02B in 2024, indicating a robust growth trajectory. However, net income saw fluctuations, rising from a loss in 2020 to a peak of 4.39B in 2022, then stabilizing around 3.34B in 2024. The gross profit margin has remained relatively stable, yet the recent year’s operating expenses have increased, impacting overall profitability. The decline in EPS from 24.61 in 2022 to 15.53 in 2024 warrants a cautious approach as the company navigates through potentially changing market conditions, emphasizing the importance of ongoing risk management in investment decisions.

Financial Ratios

The table below summarizes key financial ratios for Diamondback Energy, Inc. (FANG) over the last five available years.

| Financial Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -1.61 | 0.32 | 0.46 | 0.38 | 0.30 |

| ROE | N/A | 15.00 | 29.07 | 37.97 | N/A |

| ROIC | N/A | 15.20 | 23.90 | 30.40 | N/A |

| P/E | N/A | 8.73 | 5.51 | 8.88 | 10.48 |

| P/B | 0.87 | 1.58 | 1.61 | 1.68 | 0.93 |

| Current Ratio | 0.49 | 1.01 | 0.81 | 0.77 | 0.44 |

| Quick Ratio | 0.46 | 0.96 | 0.77 | 0.74 | 0.41 |

| D/E | 0.67 | 0.56 | 0.43 | 0.41 | 0.33 |

| Debt-to-Assets | 0.34 | 0.30 | 0.24 | 0.23 | 0.18 |

| Interest Coverage | -27.24 | 20.01 | 40.68 | 26.11 | 15.11 |

| Asset Turnover | 0.16 | 0.29 | 0.36 | 0.29 | 0.16 |

| Fixed Asset Turnover | 0.17 | 0.33 | 0.40 | 0.31 | 0.17 |

| Dividend Yield | 3.09% | 1.64% | 6.51% | 5.17% | 4.51% |

Interpretation of Financial Ratios

In the most recent year (2024), FANG’s net margin of 30.3% indicates solid profitability, but a declining trend from prior years raises concerns. The P/E ratio of 10.48 suggests the stock may be undervalued, yet the current ratio of 0.44 indicates potential liquidity issues. Furthermore, the interest coverage ratio of 15.11 is strong, reflecting good ability to meet interest obligations.

Evolution of Financial Ratios

Over the past five years, FANG’s ratios demonstrate a strong recovery from a challenging 2020, with significant improvements in profitability and overall leverage. However, the recent decline in the current ratio and net margin suggests caution moving forward, indicating potential liquidity and profitability challenges.

Distribution Policy

Diamondback Energy, Inc. (FANG) maintains a strong distribution strategy, with a current annual dividend yield of approximately 4.51% and a payout ratio of around 47%. The company has demonstrated a consistent trend in dividend payments, which are well-supported by free cash flow. However, potential risks include unsustainable distributions during market downturns and the possibility of excessive share buybacks. Overall, this distribution policy appears to support long-term value creation for shareholders while balancing risk management.

Sector Analysis

Diamondback Energy, Inc. is a prominent player in the Oil & Gas Exploration & Production sector, focusing on the Permian Basin. Its competitive advantages include extensive reserves and midstream infrastructure.

Strategic Positioning

Diamondback Energy, Inc. (FANG) holds a significant position in the oil and gas exploration and production market, particularly in the Permian Basin. With a market cap of approximately $43.4B, it commands a robust market share driven by its extensive acreage of about 524.7K gross acres and substantial reserves of 1.79B barrels of crude oil equivalent. The competitive landscape is marked by strong pressure from both established players and emerging technologies in energy extraction. However, Diamondback’s focus on unconventional resources and midstream infrastructure positions it favorably against technological disruptions that can affect traditional extraction methods.

Revenue by Segment

The following pie chart illustrates the revenue distribution by segment for Diamondback Energy, Inc. during the fiscal year 2023.

In 2023, the Upstream Services Segment generated $8.34B, indicating a significant contribution to the overall revenue. Notably, the Midstream Services Segment was absent from the latest data, reflecting a potential shift in focus or investment strategy. Compared to 2022, where Upstream Services recorded $9.57B, the decline suggests a slowdown in growth, which may raise concerns about margin risks and dependence on upstream operations. The lack of diversification in revenue streams could impact the company’s resilience against market fluctuations.

Key Products

Below is a table summarizing the key products offered by Diamondback Energy, Inc. (FANG), an independent oil and natural gas company primarily focused on operations in the Permian Basin.

| Product | Description |

|---|---|

| Crude Oil | Diamondback explores and produces crude oil primarily from the Spraberry and Wolfcamp formations in the Midland Basin. |

| Natural Gas | The company extracts natural gas from its extensive acreage in the Permian Basin, contributing to its overall energy portfolio. |

| Midstream Infrastructure | Diamondback owns and operates a network of crude oil and natural gas gathering pipelines, enhancing its operational efficiency. |

| Mineral Interests | The company holds significant mineral interests across approximately 930,871 gross acres, providing a strong foundation for future exploration and development. |

| Royalty Interests | With royalty interests in 6,455 wells, Diamondback benefits from additional revenue streams without direct operational expenses. |

This overview reflects Diamondback’s strategic focus on maximizing its resource potential in one of the most prolific oil-producing regions in the United States.

Main Competitors

In the competitive landscape of the oil and gas exploration sector, Diamondback Energy, Inc. is positioned among several key players. However, reliable competitor data is not available at this time.

I estimate that Diamondback Energy holds a significant market share within the Permian Basin, a region known for its extensive oil reserves. The company’s focus on unconventional and onshore oil and natural gas resources places it in a strong competitive position, although the absence of verified competitors limits a more comprehensive analysis of its market dominance.

Competitive Advantages

Diamondback Energy, Inc. (FANG) holds a strong position in the oil and gas sector due to its extensive holdings in the Permian Basin, which is noted for its high production efficiency. The company’s strategic focus on the Spraberry and Wolfcamp formations allows it to leverage advanced drilling technologies, enhancing its operational capabilities. Looking ahead, Diamondback is poised for growth through potential expansions in its midstream operations and new exploration projects, capitalizing on increasing global energy demands and opportunities in renewable energy integration. This positions FANG favorably within an evolving market landscape.

SWOT Analysis

This SWOT analysis provides a strategic overview of Diamondback Energy, Inc. (FANG) to help investors assess its position in the market.

Strengths

- Strong asset base in Permian Basin

- Low beta of 0.616 indicating stability

- Consistent dividend payouts

Weaknesses

- High dependency on oil prices

- Environmental regulations impacting operations

- Limited geographical diversification

Opportunities

- Growing demand for energy

- Expansion potential in midstream assets

- Technological advancements in extraction

Threats

- Volatility in oil prices

- Regulatory risks

- Competition from renewable energy sources

The overall SWOT assessment indicates that while Diamondback Energy has solid strengths and opportunities for growth, it must navigate significant weaknesses and external threats. A strategic focus on diversifying its operations and optimizing costs can mitigate risks and enhance long-term value for investors.

Stock Analysis

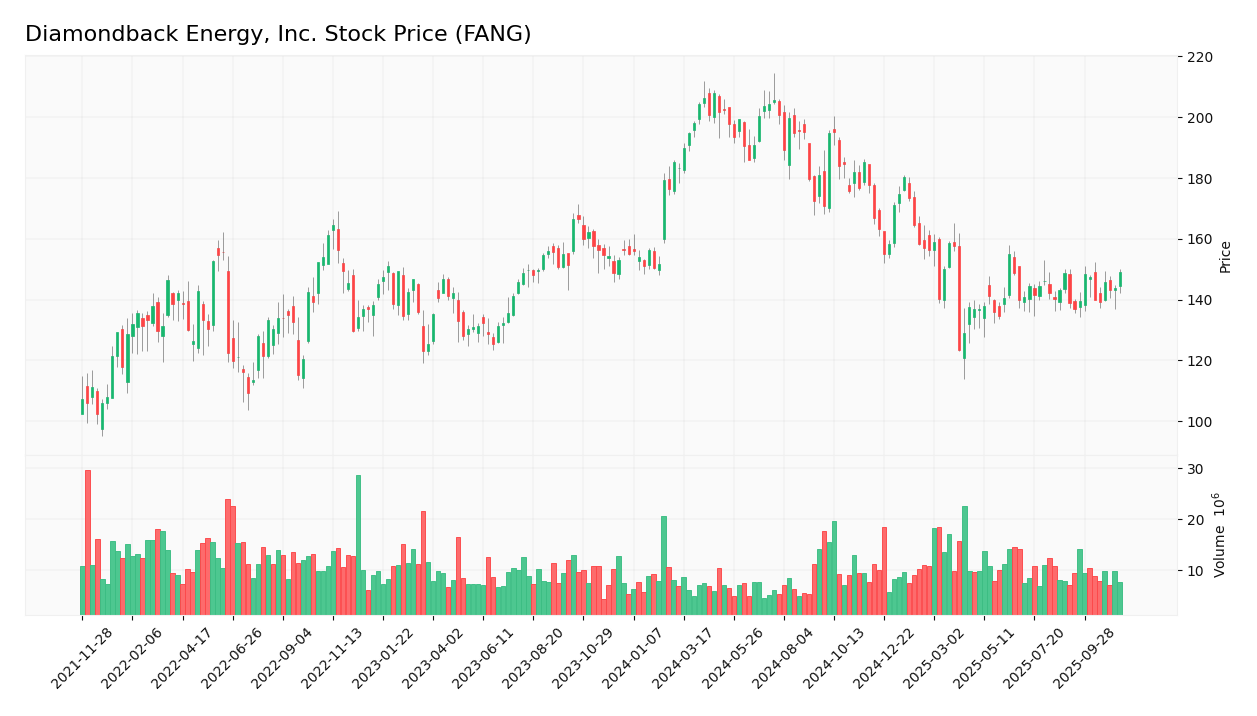

Over the past year, Diamondback Energy, Inc. (FANG) has experienced significant price movements, reflecting a bearish trend with notable fluctuations in its stock price.

Trend Analysis

Analyzing the stock’s performance over the past year, the percentage change is -4.6%. This indicates a bearish trend as it falls below the -2% threshold. The highest price reached during this period was 207.76, while the lowest was 123.37. Additionally, the trend shows acceleration, suggesting that the price movement is becoming more pronounced. The standard deviation of 23.61 indicates considerable volatility in the stock’s price.

Volume Analysis

In examining trading volumes over the last three months, the average volume stands at approximately 9.15M, with a buyer-dominant behavior indicated by an average buy volume of 5.78M compared to an average sell volume of 3.36M. This suggests that investor sentiment is leaning towards buying, even as the overall trend is bearish. However, the volume trend is bullish, although there is a slight deceleration indicated by a decrease in the trend slope of -81K. The strong buyer volume proportion of 63.23% further reinforces this positive sentiment among investors.

Analyst Opinions

Recent analyst recommendations for Diamondback Energy, Inc. (FANG) predominantly lean towards a “buy” rating. Analysts highlight the company’s strong performance metrics, including an A- rating and robust scores in discounted cash flow, return on equity, and return on assets. However, concerns regarding its debt-to-equity ratio have tempered some enthusiasm. Analysts suggest that the solid fundamentals and growth potential outweigh the risks. The consensus for 2025 remains a “buy,” indicating confidence in the company’s future performance and value creation.

Stock Grades

The latest stock ratings for Diamondback Energy, Inc. (FANG) reflect a generally positive outlook from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | maintain | Positive | 2024-10-18 |

| Wells Fargo | maintain | Overweight | 2024-10-18 |

| Truist Securities | maintain | Buy | 2024-10-16 |

| Keybanc | maintain | Overweight | 2024-10-16 |

| Piper Sandler | maintain | Overweight | 2024-10-15 |

| Scotiabank | maintain | Sector Outperform | 2024-10-10 |

| BMO Capital | upgrade | Outperform | 2024-10-04 |

| Benchmark | maintain | Buy | 2024-10-03 |

| Barclays | upgrade | Overweight | 2024-10-02 |

| Wells Fargo | maintain | Overweight | 2024-10-01 |

Overall, the trend in grades is quite stable, with several firms maintaining their positive outlooks. Notably, BMO Capital and Barclays have upgraded their ratings, indicating growing confidence in Diamondback Energy’s performance.

Target Prices

The consensus target price for Diamondback Energy, Inc. (FANG) indicates a balanced outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 222 | 162 | 183 |

Analysts expect the stock to perform within a range, reflecting a cautious yet optimistic sentiment in the energy sector.

Consumer Opinions

Consumer sentiment about Diamondback Energy, Inc. (FANG) reveals a mix of enthusiasm and concern among its stakeholders.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great dividends and solid financial performance!” | “Environmental concerns persist with operations.” |

| “Strong growth potential in shale production.” | “High debt levels could be risky.” |

| “Management is responsive and transparent.” | “Volatility in oil prices affects share stability.” |

Overall, consumer feedback indicates that while Diamondback Energy is praised for its financial performance and growth potential, concerns about environmental impact and debt management are common drawbacks.

Risk Analysis

In assessing the investment potential of Diamondback Energy, Inc. (FANG), it’s crucial to consider various risks that could impact the company’s performance.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in oil prices can significantly affect revenue. | High | High |

| Regulatory Risk | Changes in environmental regulations may increase operational costs. | Medium | High |

| Operational Risk | Production disruptions due to equipment failures or labor strikes. | Medium | Medium |

| Geopolitical Risk | Instability in oil-producing regions can impact supply chains. | Medium | High |

| Financial Risk | Rising interest rates could increase borrowing costs for expansion. | Medium | Medium |

The most significant risks for Diamondback Energy are market and regulatory risks, as recent volatility in oil prices and tightening regulations could substantially impact profitability and operational efficiency.

Should You Buy Diamondback Energy, Inc.?

Diamondback Energy, Inc. (FANG) has demonstrated strong financial performance, with a net margin of 30.28%, a return on invested capital (ROIC) of 7.27%, and a weighted average cost of capital (WACC) of 5.58%. The company benefits from its cost-effective operations in the energy sector, although it faces recent challenges, including a bearish overall trend and declining buyer volumes.

Based on the current net margin and a favorable ROIC compared to WACC, coupled with a long-term trend that is currently negative, I recommend waiting for more favorable conditions, such as a bullish reversal in stock price and an increase in buyer volumes before considering a long-term investment.

Specific risks related to Diamondback Energy include heightened competition within the energy sector and potential volatility in oil prices that could affect profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Diamondback Energy, Inc. (NASDAQ:FANG) Receives Average Rating of “Buy” from Analysts – MarketBeat (Nov 16, 2025)

- Diamondback Energy Q3 Earnings Beat Estimates, Revenues Rise Y/Y – Yahoo Finance (Nov 11, 2025)

- Diamondback Energy to sell unit’s assets for $670 million, tops profit estimates – Reuters (Nov 04, 2025)

- Palmetto Grain Brokerage – – Palmetto Grain Brokerage (Nov 12, 2025)

- Diamondback Energy, Inc. $FANG Stock Position Reduced by Tobam – MarketBeat (Nov 14, 2025)

For more information about Diamondback Energy, Inc., please visit the official website: diamondbackenergy.com