In a world where public safety and accountability increasingly intersect, Axon Enterprise, Inc. revolutionizes how law enforcement operates. With its advanced TASER devices and innovative cloud-based software solutions, Axon has become a cornerstone in the Aerospace & Defense sector, enhancing the capabilities of agencies globally. As the company continues to set the standard for quality and innovation, I invite you to explore whether its fundamentals still align with its market valuation and growth prospects.

Table of contents

Company Description

Axon Enterprise, Inc. is a leading player in the Aerospace & Defense industry, focused on developing cutting-edge public safety technology. Founded in 1993 and headquartered in Scottsdale, Arizona, Axon designs, manufactures, and sells conducted energy devices (CEDs) under the TASER brand, alongside a suite of hardware and cloud-based software solutions. Its flagship products include TASER 7, body cameras, and digital evidence management systems, catering primarily to law enforcement agencies across the U.S. and internationally. With a market cap of approximately $43.7B, Axon is not just a product innovator; its strategic partnerships, such as with Fusus, position it at the forefront of integrating technology for real-time situational awareness in public safety.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Axon Enterprise, Inc., covering the income statement, financial ratios, and dividend payout policy.

Income Statement

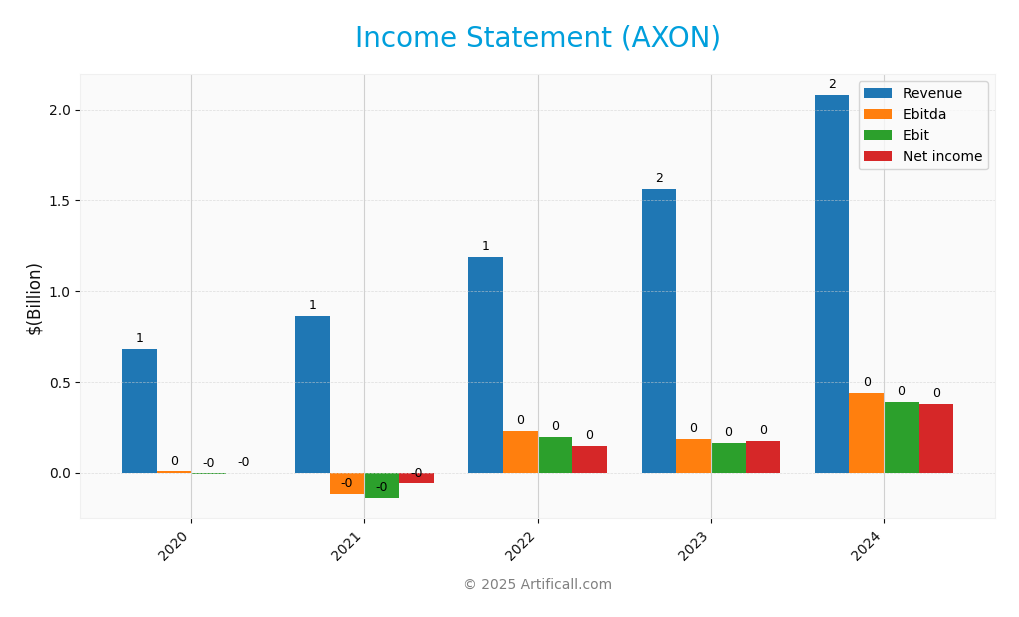

The following table presents the Income Statement of Axon Enterprise, Inc. for the fiscal years 2020 to 2024, highlighting key financial metrics and trends over the period.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 681M | 863M | 1.19B | 1.56B | 2.08B |

| Cost of Revenue | 265M | 332M | 461M | 605M | 841M |

| Operating Expenses | 430M | 698M | 635M | 796M | 1.18B |

| Gross Profit | 416M | 531M | 729M | 955M | 1.24B |

| EBITDA | 6M | -141M | 228M | 183M | 437M |

| EBIT | -6M | -141M | 197M | 164M | 389M |

| Interest Expense | 0.1M | 0 | 0 | 7M | 7M |

| Net Income | -2M | -60M | 147M | 176M | 377M |

| EPS | -0.03 | -0.91 | 2.07 | 2.35 | 4.98 |

| Filing Date | 2021-02-26 | 2022-02-25 | 2023-02-28 | 2024-02-27 | 2025-02-28 |

Over the observed period, Axon Enterprise, Inc. has shown a consistent upward trend in Revenue, increasing from 681M in 2020 to 2.08B in 2024, indicative of robust growth strategies. Net Income has also improved significantly, transitioning from a loss of 2M in 2020 to a profit of 377M in 2024. Despite rising Operating Expenses, Gross Profit margins have remained stable, with EBITDA seeing substantial growth this past year. The most recent year reflects strong performance with an EPS of 4.98, suggesting effective cost management and operational efficiency.

Financial Ratios

The following table summarizes the key financial ratios for Axon Enterprise, Inc. over the last five years:

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -0.25 | -0.07 | 0.124 | 0.113 | 0.181 |

| ROE | -0.17 | -0.05 | 0.09 | 0.11 | 0.13 |

| ROIC | -0.04 | -0.01 | 0.07 | 0.09 | 0.13 |

| P/E | -4391.04 | -173.15 | 80.17 | 109.04 | 119.40 |

| P/B | 7.75 | 9.92 | 9.30 | 11.89 | 19.34 |

| Current Ratio | 3.83 | 2.65 | 3.00 | 3.14 | 2.30 |

| Quick Ratio | 3.48 | 2.39 | 2.66 | 2.79 | 2.04 |

| D/E | 0.00 | 0.02 | 0.56 | 0.44 | 0.31 |

| Debt-to-Assets | 0.00 | 0.01 | 0.25 | 0.21 | 0.16 |

| Interest Coverage | -141.5 | 0 | 0 | 22.79 | 8.25 |

| Asset Turnover | 0.49 | 0.51 | 0.42 | 0.46 | 0.47 |

| Fixed Asset Turnover | 5.33 | 6.24 | 7.01 | 6.59 | 8.42 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, Axon displays a strong net margin of 18.1%, indicating healthy profitability. However, the P/E ratio of 119.4 suggests the stock might be overvalued relative to earnings. The current and quick ratios indicate solid liquidity, while the interest coverage ratio of 8.25 reflects an adequate ability to meet interest obligations, although it has decreased from a very high level in 2023.

Evolution of Financial Ratios

Over the past five years, Axon’s financial ratios reveal a recovery from earlier losses, with net margins and ROE improving significantly. However, the P/E ratio has escalated, indicating increased investor expectations, which may pose potential valuation risks moving forward.

Distribution Policy

Axon Enterprise, Inc. does not currently pay dividends, as indicated by a dividend payout ratio of 0. The company is in a high-growth phase, focusing on reinvesting earnings into research and development and strategic acquisitions. Additionally, Axon engages in share buybacks, reflecting a commitment to returning value to shareholders. This approach aligns with long-term value creation, but investors should monitor the sustainability of these strategies in the evolving market landscape.

Sector Analysis

Axon Enterprise, Inc. operates in the Aerospace & Defense sector, specializing in conducted energy devices and digital evidence management solutions for law enforcement, facing competition from various defense technology firms.

Strategic Positioning

Axon Enterprise, Inc. (AXON) holds a strong position in the Aerospace & Defense sector, particularly in the law enforcement technology market. With a market capitalization of approximately $43.7B, Axon is a key player in the conducted energy devices (CEDs) segment, primarily through its TASER brand. The company faces competitive pressure from both traditional and emerging technology firms, necessitating continuous innovation. Its recent partnership with Fusus, Inc. enhances its capabilities amid increasing technological disruption, allowing Axon to remain a leader in digital evidence management and real-time operational awareness for law enforcement agencies.

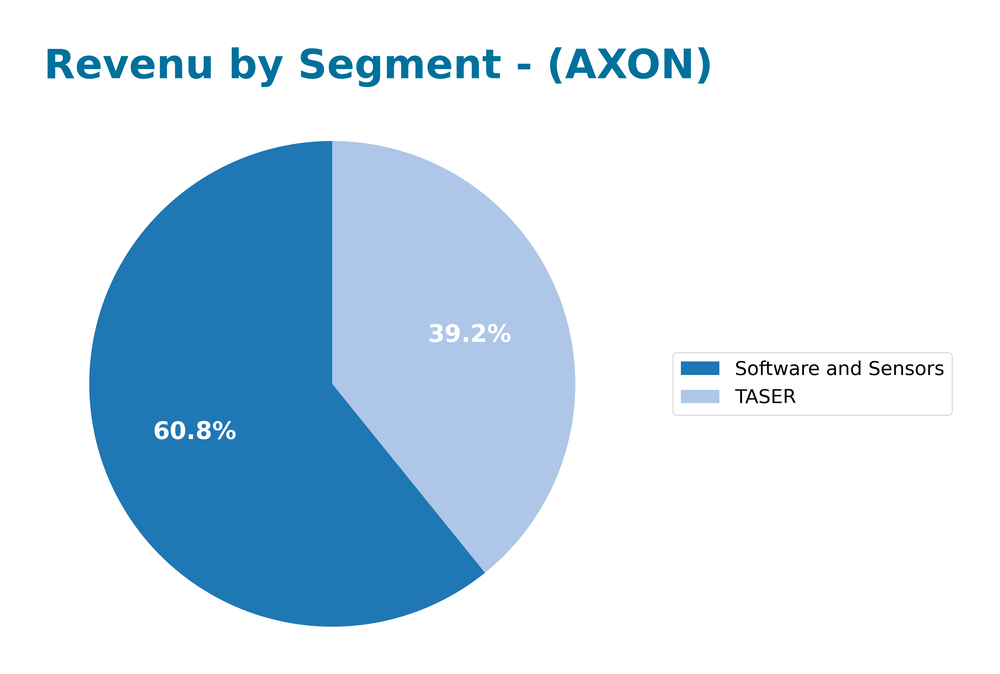

Revenue by Segment

The following chart illustrates the revenue distribution by segment for Axon Enterprise, Inc. during the fiscal year 2023.

In 2023, Axon reported significant revenue growth in its primary segments: Software and Sensors at $951M and TASER at $613M. The Software and Sensors segment has shown a robust upward trajectory, increasing from $658M in 2022 to $951M, indicating a shift towards more software-centric offerings. Conversely, the TASER segment, while still a key revenue driver, has shown slower growth compared to software. This trend reflects Axon’s strategic focus on expanding its software capabilities, which may present both an opportunity for higher margins and a risk of over-reliance on software sales as market dynamics evolve.

Key Products

Below is a table summarizing the key products offered by Axon Enterprise, Inc., highlighting their functionalities and significance in the market.

| Product | Description |

|---|---|

| TASER 7 | A next-generation conducted energy device designed for law enforcement with improved performance and features. |

| TASER X26P | A compact, lightweight conducted energy weapon that provides law enforcement with an effective non-lethal option. |

| TASER X2 | A dual-shot conducted energy device, allowing officers to deploy two cartridges for increased effectiveness. |

| Axon Body Cameras | On-officer body cameras that capture high-definition video, enhancing transparency and accountability in law enforcement. |

| Axon Fleet | A comprehensive in-car system that integrates video and data management for police vehicles. |

| Axon Evidence | A digital evidence management software that allows for secure storage, management, and sharing of digital evidence. |

| Axon Signal | A suite of enabled devices that enhance situational awareness and streamline investigative workflows for agencies. |

| TASER Consumer Devices | Non-lethal self-defense devices available to the public, providing personal safety options. |

| Extended Warranties | Hardware extended warranty options for various Axon products, ensuring longevity and support for users. |

This comprehensive lineup of products positions Axon as a leader in the law enforcement technology sector, focusing on safety, efficiency, and accountability.

Main Competitors

No verified competitors were identified from available data. However, I can provide insights into Axon Enterprise, Inc.’s estimated market share and competitive position. Axon operates in the Aerospace & Defense sector, focusing on law enforcement technologies and solutions. With a market cap of approximately 43.7B, Axon is a significant player in its niche, leveraging its innovative products and strategic partnerships to maintain a strong competitive position in the U.S. and international markets.

Competitive Advantages

Axon Enterprise, Inc. (AXON) holds significant competitive advantages in the aerospace and defense sector through its innovative product offerings, including the TASER brand and advanced digital evidence management systems. The company’s strategic partnerships, such as with Fusus, enhance its operational capabilities, allowing for real-time situational awareness and streamlined workflows for law enforcement agencies. Looking ahead, Axon is poised to capitalize on the growing demand for public safety technologies and expand into new markets, particularly with the potential launch of next-generation software solutions and enhanced hardware products.

SWOT Analysis

This SWOT analysis evaluates Axon Enterprise, Inc. to help investors understand its strategic position.

Strengths

- Strong brand recognition

- Diverse product offerings

- Established partnerships

Weaknesses

- High dependency on government contracts

- Limited dividend payouts

- Market volatility

Opportunities

- Expansion in international markets

- Growing demand for law enforcement technology

- Innovation in cloud-based solutions

Threats

- Intense competition in aerospace & defense

- Regulatory changes affecting operations

- Economic downturns impacting funding

Overall, Axon Enterprise, Inc. presents a robust strengths profile, with significant opportunities for growth despite certain weaknesses and external threats. Investors should consider these factors when assessing the company’s strategic direction and potential for returns.

Stock Analysis

Over the past year, Axon Enterprise, Inc. (AXON) has exhibited significant price movements, culminating in a bullish trend, despite recent fluctuations. The stock has shown resilience with notable highs and lows, reflecting the dynamic trading environment it operates within.

Trend Analysis

Analyzing the price trend over the past year reveals a remarkable percentage change of +114.02%. This substantial increase indicates a bullish trend overall. However, in the recent analysis period from August 31, 2025, to November 16, 2025, the stock experienced a decline of -25.82%, suggesting a short-term bearish sentiment. The standard deviation of 190.06 indicates considerable volatility over the longer term, while the recent period’s standard deviation of 61.85 suggests reduced volatility. Notable highs reached 842.5 and lows at 244.21 indicate a wide trading range, with the overall trend showing signs of deceleration.

Volume Analysis

In examining trading volumes over the last three months, the average volume stood at approximately 3.11M, with a recent average volume of about 3.47M. The data indicates seller dominance, as the average sell volume (approximately 2.81M) significantly outweighs the average buy volume (around 0.67M). Despite this seller-driven activity, the overall volume trend remains bullish, with an increasing volume slope of 16.08K. This suggests that while current sentiment may lean toward selling, there is still underlying market participation indicating potential future interest.

Analyst Opinions

Recent analyst recommendations for Axon Enterprise, Inc. (AXON) indicate a cautious stance. The overall rating stands at C+, with analysts highlighting concerns over its high debt-to-equity ratio and low price-to-earnings score. Notably, while the discounted cash flow and return metrics are favorable, the consensus leans towards holding rather than buying, primarily due to the company’s financial leverage. Analysts suggest waiting for more favorable market conditions before making significant investment decisions in AXON. For the current year, the consensus remains a cautious hold.

Stock Grades

Here are the most recent stock ratings for Axon Enterprise, Inc. (AXON) from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-11-06 |

| Piper Sandler | maintain | Overweight | 2025-11-05 |

| Goldman Sachs | maintain | Buy | 2025-11-05 |

| UBS | maintain | Neutral | 2025-11-05 |

| JMP Securities | maintain | Market Outperform | 2025-09-29 |

| Needham | maintain | Buy | 2025-09-24 |

| B of A Securities | maintain | Buy | 2025-08-06 |

| Northland Capital Markets | maintain | Outperform | 2025-08-05 |

| Craig-Hallum | upgrade | Buy | 2025-08-05 |

| UBS | maintain | Neutral | 2025-08-05 |

Overall, the trend in grades for AXON indicates a strong consensus among analysts, with many maintaining their positive outlook. Notably, there are several “Overweight” and “Buy” ratings, suggesting continued confidence in the company’s performance.

Target Prices

The current consensus target price for Axon Enterprise, Inc. (AXON) reflects positive analyst expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 900 | 753 | 843.29 |

Analysts anticipate the stock will trend towards the consensus target of 843.29, indicating a generally favorable outlook for Axon.

Consumer Opinions

Consumer sentiment about Axon Enterprise, Inc. is largely mixed, reflecting both satisfaction and concerns among users.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative products that enhance safety.” | “Customer service could be improved.” |

| “Reliable technology that meets our needs.” | “Pricing is on the higher side.” |

| “Solid performance and ease of use.” | “Occasional software glitches.” |

Overall, consumer feedback highlights Axon’s innovative technology and reliability as key strengths, while concerns around customer service and pricing are common weaknesses noted by users.

Risk Analysis

In assessing Axon Enterprise, Inc. (AXON), it’s vital to understand the potential risks that could impact its performance. Below is a summary of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Increased competition from emerging tech firms. | High | High |

| Regulatory Changes | Changes in laws affecting public safety technology. | Medium | High |

| Cybersecurity Threats | Rising risk of cyberattacks on sensitive data. | High | Medium |

| Economic Downturn | Potential recession impacting funding for law enforcement. | Medium | High |

| Supply Chain Issues | Disruptions in the supply chain affecting production. | Low | Medium |

Synthesis: The most significant risks for Axon involve high market competition and potential regulatory changes, both of which could drastically affect its market position and profitability.

Should You Buy Axon Enterprise, Inc.?

Axon Enterprise, Inc. has showcased flagship products that focus on law enforcement technology, including body cameras and software solutions. As of the latest data, the company has a net margin of 18.1%, a return on invested capital (ROIC) exceeding the weighted average cost of capital (WACC) of 9.96%, and a favorable long-term trend. However, there are risks related to competition and market dependence that potential investors should consider.

Given that Axon has a positive net margin (18.1%) and a ROIC that exceeds WACC, alongside a long-term bullish trend, this presents a favorable signal for long-term investors. However, the recent trend shows a decline in buyer volume, which suggests that it may be wise to wait for a return of stronger buyer interest before making a purchase.

Specific risks involve intense competition in the tech services sector for law enforcement, as well as potential valuation challenges in a rapidly evolving market.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Applying chart zones and confluence areas to Axon Enterprise Inc. – 2025 Investor Takeaways & Weekly Consistent Profit Watchlists – newser.com (Nov 16, 2025)

- Investors Heavily Search Axon Enterprise, Inc (AXON): Here is What You Need to Know – Yahoo Finance (Nov 12, 2025)

- Taser-maker Axon Enterprise misses profit estimates amid tariff woes, shares tumble – Reuters (Nov 04, 2025)

- Axon reports Q3 2025 revenue of $711 million, up 31% year over year – PR Newswire (Nov 04, 2025)

- AXON’s Connected Devices Growth Picks Up: More Upside to Come? – Nasdaq (Nov 13, 2025)

For more information about Axon Enterprise, Inc., please visit the official website: axon.com