Fastenal Company doesn’t just supply industrial and construction materials; it empowers businesses and projects across multiple sectors by ensuring they have the necessary tools to succeed. As a prominent player in the industrial distribution space, Fastenal offers a vast array of fasteners and related supplies, demonstrating a commitment to quality and innovation that resonates throughout its extensive network. As we delve into the company’s latest financials, it begs the question: do its fundamentals still justify its current market valuation and growth trajectory?

Table of contents

Company Description

Fastenal Company, founded in 1967 and headquartered in Winona, Minnesota, is a key player in the industrial distribution sector. The company specializes in the wholesale distribution of industrial and construction supplies, including fasteners, bolts, nuts, screws, and an array of miscellaneous hardware. With a robust presence in the United States, Canada, and Mexico, Fastenal operates through a network of 3,209 in-market locations and 15 distribution centers. It serves diverse markets ranging from manufacturing and construction to agriculture and government entities. Fastenal’s strategic focus on innovation and extensive distribution network positions it as a leader in shaping supply chain efficiency in the industrial sector.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Fastenal Company, focusing on its income statement, financial ratios, and dividend payout policy.

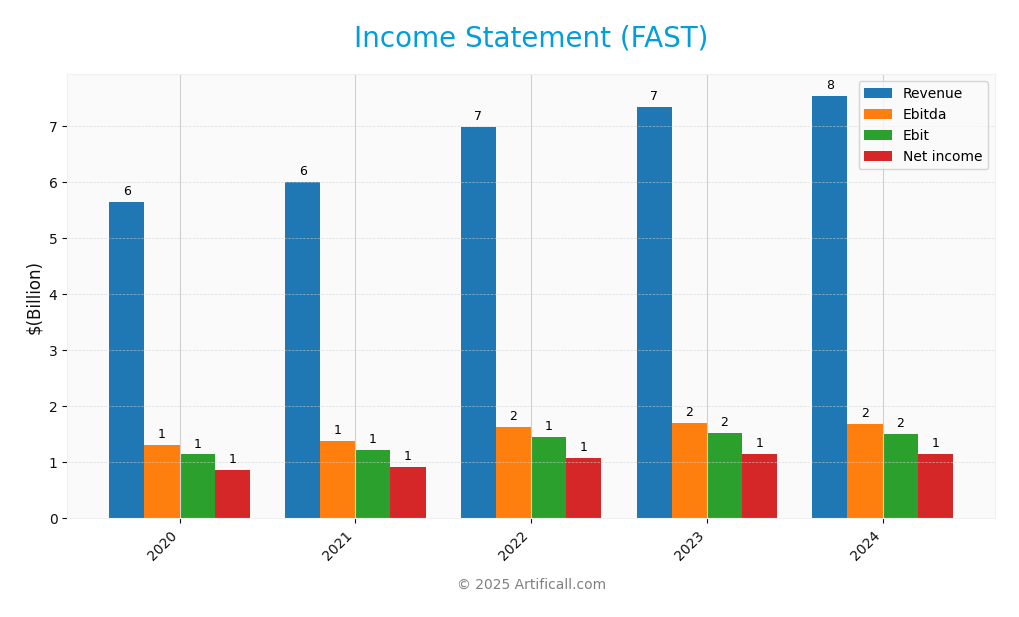

Income Statement

Below is the income statement for Fastenal Company, providing a comprehensive overview of their financial performance over the past five fiscal years.

| Item | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 5.65B | 6.01B | 6.98B | 7.35B | 7.55B |

| Cost of Revenue | 3.08B | 3.23B | 3.76B | 3.99B | 4.14B |

| Operating Expenses | 1.43B | 1.56B | 1.76B | 1.83B | 1.89B |

| Gross Profit | 2.57B | 2.78B | 3.22B | 3.35B | 3.40B |

| EBITDA | 1.30B | 1.39B | 1.63B | 1.71B | 1.69B |

| EBIT | 1.14B | 1.22B | 1.45B | 1.53B | 1.52B |

| Interest Expense | 9.70M | 9.60M | 14.30M | 10.80M | 7.30M |

| Net Income | 859M | 925M | 1.09B | 1.15B | 1.15B |

| EPS | 0.75 | 0.80 | 0.95 | 1.01 | 1.00 |

| Filing Date | 2021-02-08 | 2022-02-07 | 2023-02-07 | 2024-02-06 | 2025-02-06 |

Over the five-year period, Fastenal Company has demonstrated consistent revenue growth, increasing from 5.65B in 2020 to 7.55B in 2024. Net income has also shown stability, hovering around the 1.15B mark in both 2023 and 2024. Operating expenses grew at a modest pace, suggesting effective cost management, while gross profit margins remained relatively stable. In the most recent year, revenue growth slightly accelerated, but net income saw no substantial increase, indicating a potential plateau in profitability. It’s essential to monitor how the company manages its expenses to maintain strong margins moving forward.

Financial Ratios

The table below summarizes the key financial ratios for Fastenal Company (FAST) over the last five years.

| Financial Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 15.2% | 15.4% | 15.6% | 15.7% | 15.2% |

| ROE | 15.4% | 16.2% | 18.2% | 17.2% | 16.1% |

| ROIC | 12.4% | 13.2% | 13.5% | 13.9% | 13.4% |

| P/E | 32.6 | 39.8 | 25.0 | 32.1 | 35.8 |

| P/B | 10.3 | 12.1 | 8.6 | 11.1 | 11.4 |

| Current Ratio | 4.1 | 4.2 | 4.0 | 4.6 | 4.7 |

| Quick Ratio | 1.9 | 2.0 | 1.8 | 2.3 | 2.3 |

| D/E | 0.24 | 0.21 | 0.25 | 0.16 | 0.13 |

| Debt-to-Assets | 0.16 | 0.15 | 0.18 | 0.12 | 0.10 |

| Interest Coverage | 117.7 | 125.5 | 101.7 | 141.5 | 206.8 |

| Asset Turnover | 1.4 | 1.4 | 1.5 | 1.6 | 1.6 |

| Fixed Asset Turnover | 4.4 | 4.8 | 5.6 | 5.7 | 5.6 |

| Dividend Yield | 2.9% | 1.7% | 2.6% | 2.7% | 2.2% |

Interpretation of Financial Ratios

In 2024, Fastenal’s financial ratios indicate a solid performance, particularly in net margin (15.2%) and interest coverage (206.8), which suggest strong profitability and ability to cover interest expenses. However, the P/E ratio of 35.8 may indicate that the stock is overvalued relative to its earnings, which could be a concern for investors.

Evolution of Financial Ratios

Over the past five years, Fastenal has shown steady improvement in net margin and ROIC, reflecting operational efficiency. However, the P/E ratio has fluctuated significantly, suggesting varying market perceptions of the company’s valuation. The current ratio remains robust, indicating strong liquidity management.

Distribution Policy

Fastenal Company (FAST) currently maintains a dividend policy, with a dividend payout ratio of approximately 77.6% and an annual yield of around 2.17%. The trend in dividend per share has shown consistency, reflecting the company’s commitment to returning value to shareholders. While they also engage in share buybacks, potential risks include the sustainability of distributions against free cash flow and the implications of excessive repurchases. Overall, this approach appears aligned with long-term value creation for shareholders, provided the company maintains adequate cash flow coverage.

Sector Analysis

Fastenal Company operates in the industrial distribution sector, specializing in fasteners and construction supplies, with a competitive edge through extensive market reach and a diversified product portfolio.

Strategic Positioning

Fastenal Company (FAST) holds a significant position in the industrial distribution sector, with a market capitalization of approximately $46.4B. The company commands a robust market share in fasteners and related supplies, competing effectively against major players. Its extensive network of 3,209 locations facilitates efficient distribution, providing a competitive edge. However, the industry faces technological disruptions, such as automation and e-commerce, which could intensify competitive pressures. Fastenal’s ability to innovate and adapt will be crucial in maintaining its market position amidst these challenges.

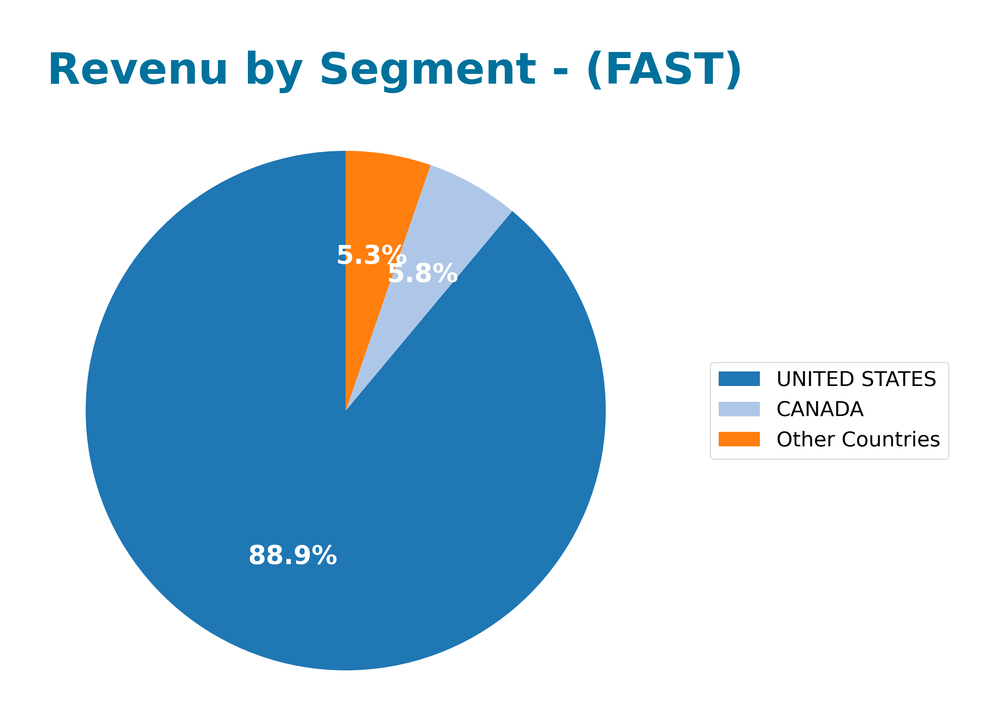

Revenue by Segment

The following chart illustrates the revenue distribution by segment for Fastenal Company, covering the most recent fiscal year’s performance.

In the latest fiscal year, Fastenal’s revenue from the United States segment dominated at 3.44B, while Canada contributed 223M and Other Countries brought in 205M. Over the years, the U.S. segment has consistently driven overall performance, showing steady growth. However, it’s worth noting that growth in Canada has slowed compared to previous years, which could indicate potential market saturation or increased competition. As we analyze the latest results, the concentration risk in the U.S. market remains a critical factor, emphasizing the need for diversification strategies.

Key Products

Fastenal Company specializes in the wholesale distribution of industrial and construction supplies. Below is a table summarizing some of their key products.

| Product | Description |

|---|---|

| Fasteners | A variety of threaded fasteners including bolts, nuts, and screws used in manufacturing and construction. |

| Concrete Anchors | Essential for securing materials to concrete surfaces, vital in both new construction and repairs. |

| Metal Framing Systems | Provide structural support for walls and ceilings in commercial and industrial buildings. |

| Wire Ropes | Used in lifting and rigging applications, important for construction and industrial operations. |

| Maintenance Supplies | Includes items like pins, machinery keys, and rivets for ongoing maintenance and repair tasks. |

Each of these products is crucial for various sectors, including manufacturing, construction, and maintenance, serving a diverse clientele ranging from agricultural businesses to government entities.

Main Competitors

In the competitive landscape of the industrial distribution sector, Fastenal Company (ticker: FAST) operates alongside several well-established players. However, I was unable to identify specific competitors with verifiable names from the available data.

Fastenal Company holds a significant market share in the wholesale distribution of industrial and construction supplies, primarily serving the North American market. The company’s competitive position remains strong due to its extensive network of over 3,200 locations and a diverse product portfolio, which caters to various sectors including manufacturing, construction, and governmental entities.

Competitive Advantages

Fastenal Company (ticker: FAST) boasts a robust competitive edge through its extensive distribution network, with over 3,200 locations and 15 distribution centers. This infrastructure allows for rapid delivery and a wide reach across various industries, including manufacturing and construction. Looking ahead, Fastenal is poised to capitalize on emerging markets and introduce innovative products, enhancing its market share. The company’s focus on high-quality fasteners and related supplies positions it favorably against competitors, while ongoing investments in technology and e-commerce will further streamline operations and improve customer experience.

SWOT Analysis

The SWOT analysis provides a strategic overview of Fastenal Company’s strengths, weaknesses, opportunities, and threats.

Strengths

- Strong market presence

- Diverse product range

- Established distribution network

Weaknesses

- Dependence on industrial sector

- Vulnerability to economic downturns

- Limited international presence

Opportunities

- Growth in construction sector

- Expansion into emerging markets

- Increasing demand for e-commerce

Threats

- Intense competition

- Supply chain disruptions

- Regulatory changes

The overall SWOT assessment reveals that while Fastenal Company has significant strengths and opportunities, it must address existing weaknesses and external threats to enhance its market position and strategic direction.

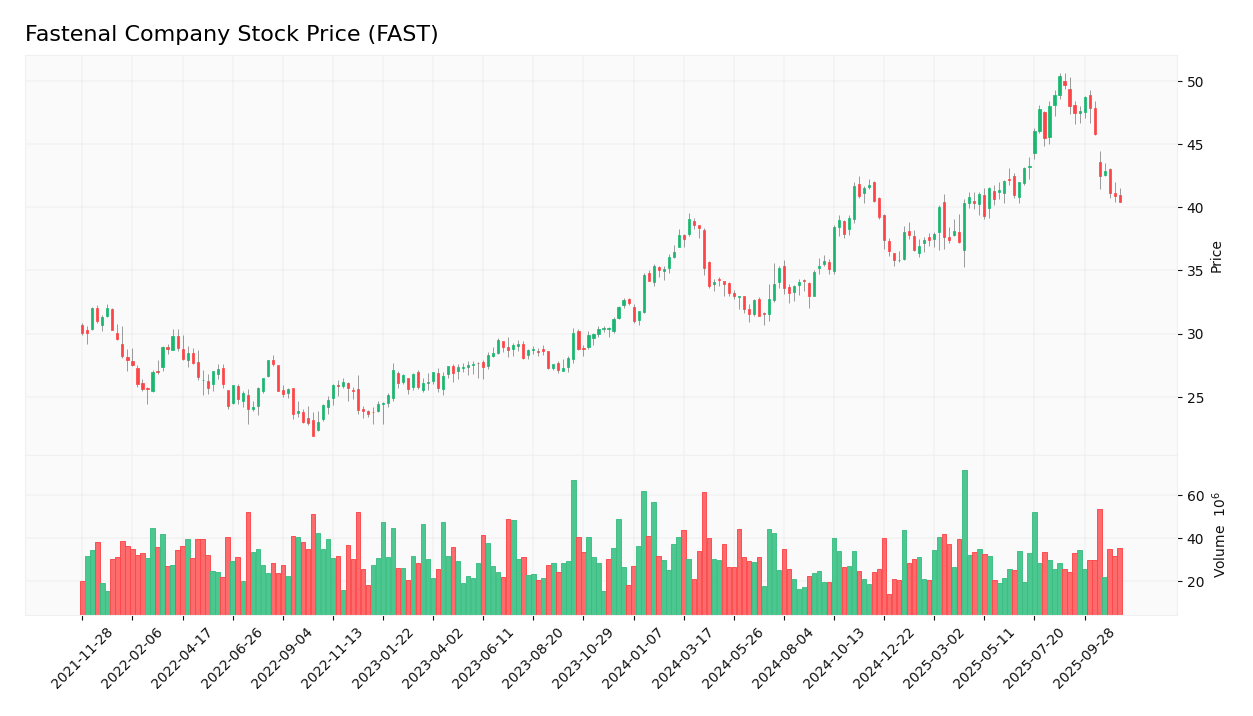

Stock Analysis

Over the past year, Fastenal Company (ticker: FAST) has experienced notable price movements, culminating in a bullish trend despite recent fluctuations. The stock has exhibited strong trading dynamics, highlighted by significant highs and lows.

Trend Analysis

Analyzing the stock’s performance over the past twelve months, I observe a price increase of 23.81%. This percentage change indicates a bullish trend. However, it’s important to note that the recent trend from August 31, 2025, to November 16, 2025, shows a decline of 18.55%, reflecting a trend slope of -0.89 and an acceleration status of deceleration. The highest price recorded during the year was 50.39, while the lowest was 30.99, with a standard deviation of 4.81, indicating some volatility in the stock’s price.

Volume Analysis

Examining the trading volumes over the last three months, the average volume stands at approximately 31.6M, with a significant portion driven by seller activity. The average buy volume has been around 6.8M, while sell volume averages approximately 24.8M, suggesting a seller-dominant market sentiment. Additionally, the overall volume trend is bearish, with a decreasing slope of -32K, indicating a reduction in market participation and investor confidence.

Analyst Opinions

Recent analyst recommendations for Fastenal Company (FAST) suggest a cautious outlook, with a consensus rating of “Hold.” Analysts, including those from reputable firms, cite strong return metrics like a 5 in return on equity and return on assets, but express concerns regarding a low score of 1 in price-to-earnings and price-to-book ratios. The overall score stands at 3, indicating a balanced view amidst uncertainties in market conditions. As an investor, I recommend closely monitoring these metrics before making any decisions.

Stock Grades

Recent evaluations of Fastenal Company’s stock (ticker: FAST) provide insightful perspectives from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wolfe Research | Downgrade | Underperform | 2025-11-13 |

| Barclays | Maintain | Equal Weight | 2025-11-13 |

| Barclays | Maintain | Equal Weight | 2025-10-14 |

| JP Morgan | Maintain | Neutral | 2025-09-04 |

| Baird | Upgrade | Outperform | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-07-15 |

| Stephens & Co. | Maintain | Equal Weight | 2025-07-15 |

| JP Morgan | Maintain | Neutral | 2025-07-15 |

| Loop Capital | Maintain | Hold | 2025-07-08 |

| JP Morgan | Maintain | Neutral | 2025-05-27 |

Overall, the trend indicates a recent downgrade from Wolfe Research, which may signal some caution in investor sentiment. However, several firms have maintained their ratings, suggesting a mixed outlook for Fastenal’s performance moving forward.

Target Prices

The consensus target price for Fastenal Company (FAST) reflects a balanced outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 86 | 40 | 63.25 |

Analysts generally expect Fastenal’s stock to reach around 63.25, with a potential upside to 86 and a downside to 40.

Consumer Opinions

Consumer sentiment around Fastenal Company (FAST) reflects a blend of satisfaction and concern, showcasing the diverse perspectives of its clientele.

| Positive Reviews | Negative Reviews |

|---|---|

| “Fastenal offers a wide range of quality products.” | “Customer service can be slow at times.” |

| “I appreciate their fast shipping options.” | “Prices are higher compared to competitors.” |

| “Their online platform is user-friendly.” | “Occasional stock shortages on popular items.” |

Overall, consumer feedback indicates that Fastenal excels in product range and shipping efficiency, while facing challenges with customer service responsiveness and pricing competitiveness.

Risk Analysis

In this section, I present a table outlining the key risks associated with investing in Fastenal Company (FAST) to help you make informed decisions.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in market conditions affecting stock prices. | High | High |

| Supply Chain Disruptions | Potential disruptions in the supply chain impacting product availability. | Medium | High |

| Regulatory Changes | New regulations affecting operational practices and costs. | Medium | Medium |

| Competitive Pressure | Increased competition could lead to reduced market share. | Medium | Medium |

Fastenal operates in a competitive market, where supply chain disruptions could significantly hinder its operations. Given the current economic climate, market volatility remains a high-risk factor that investors should closely monitor.

Should You Buy Fastenal Company?

Fastenal Company has a strong market presence with flagship products in the industrial supply sector, offering a wide range of fasteners, tools, and other supplies. As of the latest data, Fastenal reports a net margin of 15.25%, a return on invested capital (ROIC) of 22.11%, and a weighted average cost of capital (WACC) of 7.85%, indicating robust profitability and efficient capital management. However, the company is currently facing risks from increasing competition and supply chain challenges.

Given the favorable financial indicators—particularly the positive net margin, a ROIC significantly above the WACC, a positive long-term trend, and buyer volumes that have recently been low—I would suggest exercising caution for long-term investment. While the fundamentals are strong, the current bearish volume trend indicates that it may be prudent to wait for a more favorable buying environment before making a commitment to add this stock to your portfolio.

Specifically, the risks associated with Fastenal include heightened competition and potential supply chain disruptions, which could affect future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Is Fastenal Company (NASDAQ:FAST) Potentially Undervalued? – Yahoo Finance (Nov 14, 2025)

- Thoroughbred Financial Services LLC Increases Holdings in Fastenal Company $FAST – MarketBeat (Nov 16, 2025)

- Fastenal (FAST) Down 3.5% Since Last Earnings Report: Can It Rebound? – Nasdaq (Nov 12, 2025)

- Beacon Harbor Wealth Advisors Inc. Takes Position in Fastenal Company $FAST – MarketBeat (Nov 16, 2025)

- Bernstein Initiates Coverage of Fastenal (FAST) with Underperform Recommendation – Nasdaq (Nov 13, 2025)

For more information about Fastenal Company, please visit the official website: fastenal.com