In a world increasingly reliant on energy solutions, Baker Hughes Company stands at the forefront, shaping the landscape of the oil and gas equipment and services industry. With a comprehensive portfolio that includes cutting-edge technologies and innovative services, Baker Hughes not only enhances energy efficiency but also drives advancements across the industrial spectrum. As we delve into the investment analysis, the pivotal question remains: do Baker Hughes’ strong fundamentals and market position still justify its current valuation and growth trajectory?

Table of contents

Company Description

Baker Hughes Company (ticker: BKR), founded in 1987 and headquartered in Houston, Texas, is a prominent player in the Oil & Gas Equipment & Services industry. With a market cap of approximately $48.1B, Baker Hughes operates through four segments: Oilfield Services, Oilfield Equipment, Turbomachinery & Process Solutions, and Digital Solutions. The company provides a comprehensive range of technologies and services that cater to various sectors of the energy and industrial value chain, serving both onshore and offshore markets. Its strategic focus on innovation and sustainability positions Baker Hughes as a key contributor to shaping the future of the energy landscape.

Fundamental Analysis

In this section, I will analyze Baker Hughes Company’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

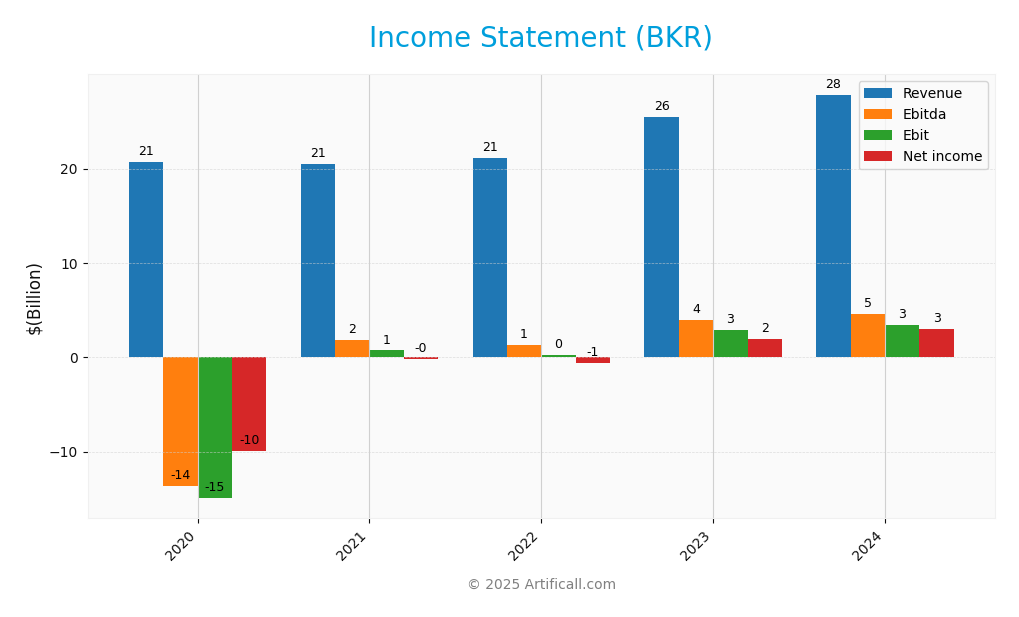

The following table presents the income statement for Baker Hughes Company (BKR), highlighting key financial metrics over the last five fiscal years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 20.70B | 20.50B | 21.16B | 25.51B | 27.83B |

| Cost of Revenue | 17.51B | 16.45B | 16.76B | 20.26B | 21.92B |

| Operating Expenses | 19.18B | 2.74B | 3.22B | 2.93B | 2.76B |

| Gross Profit | 3.99B | 4.05B | 4.40B | 5.25B | 5.84B |

| EBITDA | -13.62B | 1.83B | 1.34B | 3.96B | 4.60B |

| EBIT | -14.94B | 0.73B | 0.27B | 2.87B | 3.46B |

| Interest Expense | 0.26B | 0.30B | 0.25B | 0.22B | 0.20B |

| Net Income | -9.94B | -0.22B | -0.60B | 1.94B | 2.98B |

| EPS | -14.73 | -0.27 | -0.61 | 1.93 | 3.00 |

| Filing Date | 2021-02-25 | 2022-02-11 | 2023-02-14 | 2024-02-05 | 2025-02-04 |

Over the past five years, Baker Hughes has shown a significant revenue increase from 20.70B in 2020 to 27.83B in 2024, reflecting robust demand and operational improvements. Notably, net income transitioned from substantial losses to a positive outcome of 2.98B in 2024, indicating a successful turnaround. The gross profit margin has remained stable, suggesting that cost management practices are effective. In 2024, the company’s performance continued to improve, with a solid increase in EBITDA and EBIT, though interest expenses remained manageable. This positive trajectory is encouraging for potential investors, although maintaining vigilance regarding market conditions remains prudent.

Financial Ratios

The following table summarizes the key financial ratios for Baker Hughes Company (BKR) over the last five available years.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -48.0% | -1.1% | -2.8% | 7.6% | 10.7% |

| ROE | N/A | N/A | N/A | N/A | N/A |

| ROIC | N/A | N/A | N/A | N/A | N/A |

| P/E | -1.42 | -90.53 | N/A | 17.73 | 13.77 |

| P/B | 1.09 | 1.34 | 2.02 | 2.24 | 2.43 |

| Current Ratio | 1.61 | 1.65 | 1.32 | 1.25 | 1.32 |

| Quick Ratio | 1.18 | 1.21 | 0.90 | 0.86 | 0.94 |

| D/E | 0.59 | 0.45 | 0.46 | 0.39 | 0.36 |

| Debt-to-Assets | 20.1% | 19.0% | 19.5% | 16.3% | 15.7% |

| Interest Coverage | -60.52 | 4.38 | 4.70 | 10.73 | 15.56 |

| Asset Turnover | 0.54 | 0.58 | 0.62 | 0.69 | 0.73 |

| Fixed Asset Turnover | 3.86 | 4.20 | 4.66 | 5.21 | 5.43 |

| Dividend Yield | 3.47% | 2.99% | 2.49% | 2.28% | 2.04% |

Interpretation of Financial Ratios

In 2024, Baker Hughes exhibited a net margin of 10.7%, a significant improvement from the prior years. The P/E ratio of 13.77 indicates that the stock is relatively attractively priced compared to its earnings. However, the quick ratio of 0.94 suggests potential liquidity concerns, as it falls below 1. This may warrant further investigation into their short-term financial health and operational efficiency.

Evolution of Financial Ratios

Over the past five years, Baker Hughes has shown a positive trajectory in profitability, with net margins recovering from significant losses to a healthy 10.7% in 2024. However, liquidity ratios have fluctuated, indicating ongoing challenges in efficiently managing short-term obligations.

Distribution Policy

Baker Hughes Company (BKR) pays dividends, with a current annual yield of approximately 2.04%. The dividend payout ratio stands at 28.06%, indicating a sustainable distribution aligned with free cash flow. The company has also engaged in share buyback programs, enhancing shareholder value. However, potential risks include maintaining dividend sustainability amid market fluctuations and ensuring buybacks do not detract from growth initiatives. Overall, BKR’s distribution policy appears supportive of long-term shareholder value creation.

Sector Analysis

Baker Hughes Company operates in the Oil & Gas Equipment & Services sector, providing innovative technologies and services across the energy value chain, competing with industry giants. Its strengths lie in diverse offerings, strategic partnerships, and a strong market presence.

Strategic Positioning

Baker Hughes Company (BKR) holds a significant position in the oil and gas equipment and services industry, with a market cap of approximately $48.1B. The company operates across four segments, providing diverse technological solutions. Competitive pressure remains high as rivals innovate rapidly, particularly in digital solutions and sustainable energy technologies. However, Baker Hughes’ established presence and comprehensive service offerings help mitigate these challenges. In an era marked by technological disruption, their focus on digital solutions and efficiency improvements is crucial for maintaining market share and driving future growth.

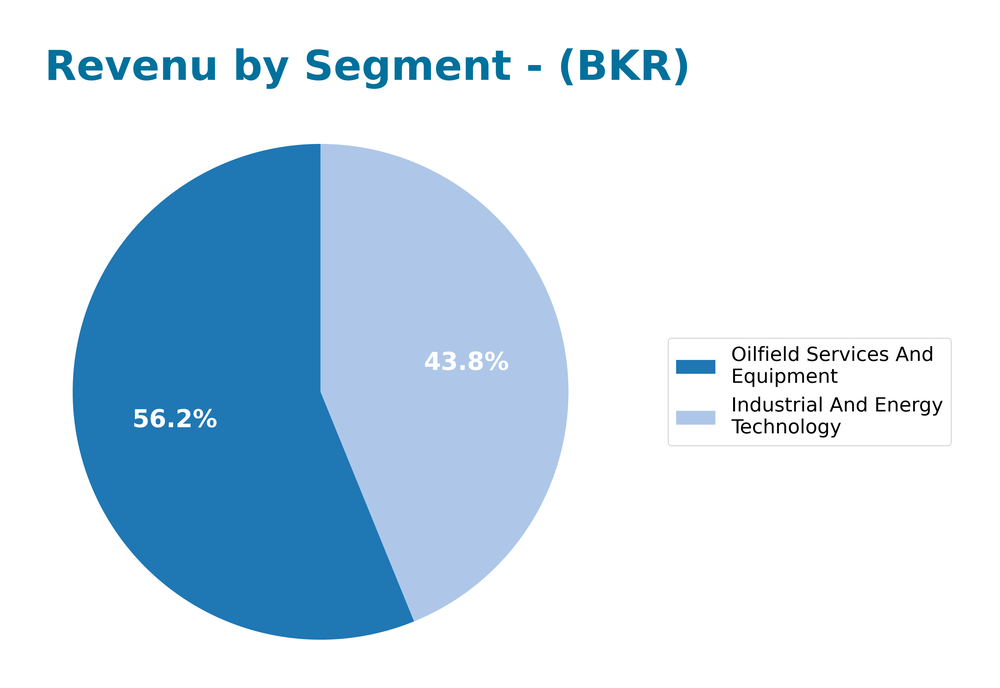

Revenue by Segment

The following chart illustrates Baker Hughes Company’s revenue breakdown by segment for the fiscal year 2024, highlighting trends and shifts in performance.

In 2024, Baker Hughes generated $15.63B from Oilfield Services and Equipment and $12.20B from Industrial and Energy Technology. Notably, while Oilfield Services saw a slight increase from $15.36B in 2023, Industrial and Energy Technology experienced a substantial growth from $10.15B. This shift indicates a growing emphasis on energy technology, potentially reflecting market trends towards renewable sources and efficiency. However, the overall growth rate in Oilfield Services has begun to show signs of deceleration, which may pose margin risks if market conditions continue to fluctuate.

Key Products

Baker Hughes Company offers a wide range of innovative technologies and services that cater to the energy and industrial sectors. Below is a summary of their key products:

| Product | Description |

|---|---|

| Oilfield Services (OFS) | Provides exploration, drilling, completion, and production services, along with chemical solutions and artificial lift technologies. |

| Oilfield Equipment (OFE) | Supplies subsea and surface wellheads, pressure control systems, and flexible pipe systems for both offshore and onshore applications. |

| Turbomachinery & Process Solutions (TPS) | Offers mechanical-drive equipment, compressors, power-generation solutions, and pumps tailored for the oil and gas industry. |

| Digital Solutions (DS) | Delivers sensor-based process measurements, condition monitoring, asset management, and pipeline integrity solutions. |

Each of these product segments plays a crucial role in supporting the energy sector’s efficiency and safety.

Main Competitors

In the competitive landscape of the Oil & Gas Equipment & Services sector, Baker Hughes Company (BKR) faces several notable competitors. However, I was unable to identify any reliable competitors with verifiable names from the available data.

Currently, Baker Hughes holds a significant position in its market, with an estimated market share that reflects its strong competitive position within the energy sector. The company’s diverse portfolio and global reach enable it to maintain a dominant presence in various segments of the industry, particularly in oilfield services and equipment.

Competitive Advantages

Baker Hughes Company (BKR) leverages its extensive portfolio of technologies and services across the energy sector, positioning itself as a leader in the Oil & Gas Equipment & Services industry. With innovative segments like Digital Solutions and Turbomachinery, the company is well-prepared to capitalize on emerging trends, including the shift towards renewable energy and digital transformation. Future opportunities include expanding into new markets and developing advanced solutions for sustainability, which could enhance profitability and market share in an evolving energy landscape.

SWOT Analysis

This analysis aims to provide a clear overview of Baker Hughes Company’s strengths, weaknesses, opportunities, and threats.

Strengths

- Strong market presence

- Diversified service portfolio

- Established reputation in energy sector

Weaknesses

- Exposure to oil price volatility

- High operational costs

- Dependence on global energy demand

Opportunities

- Growth in renewable energy solutions

- Expansion into emerging markets

- Innovations in digital solutions

Threats

- Intense competition

- Regulatory challenges

- Economic downturns affecting investment

The overall SWOT assessment indicates that Baker Hughes Company has a solid foundation to capitalize on emerging opportunities in the energy transition while addressing its vulnerabilities. A strategic focus on innovation and market expansion will be essential to navigate the competitive landscape and mitigate potential threats.

Stock Analysis

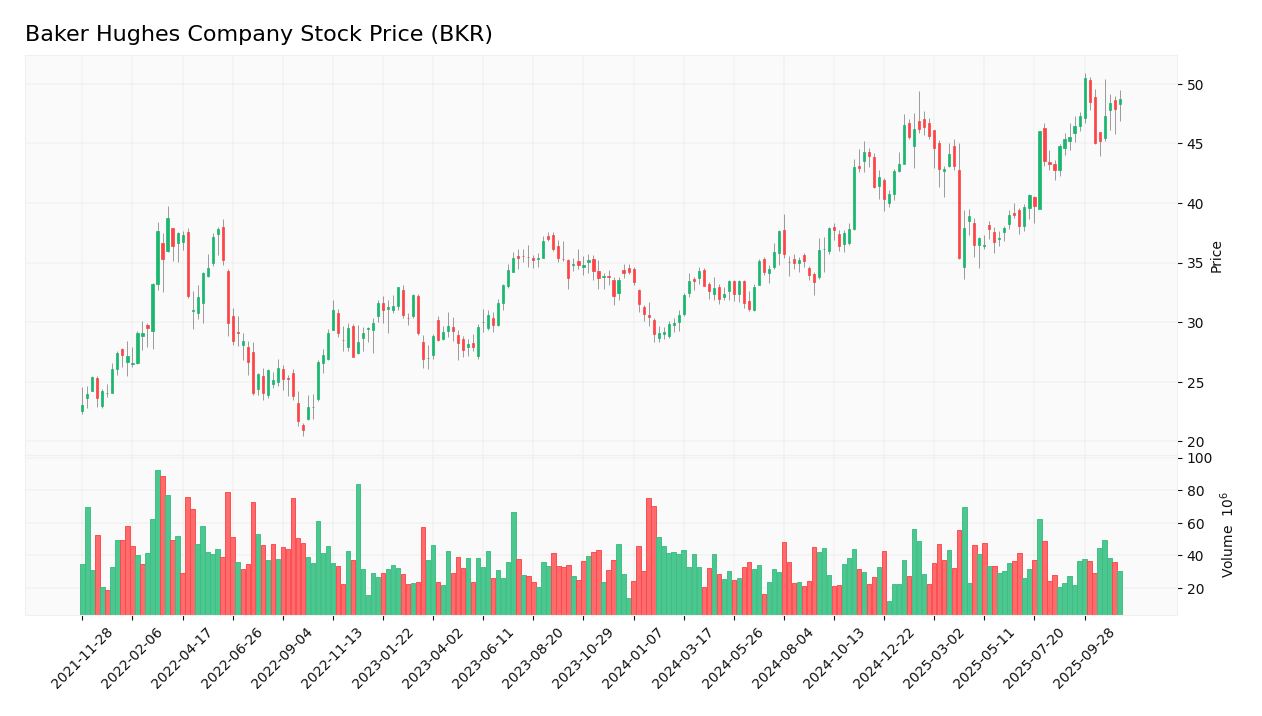

Over the past year, Baker Hughes Company (BKR) has exhibited significant price movements, reflecting a bullish trend characterized by notable highs and an overall acceleration in price dynamics.

Trend Analysis

Analyzing the stock’s performance over the past year, the percentage change stands at +42.82%. This indicates a bullish trend, supported by an acceleration in price movement. The stock reached a high of 50.52 and a low of 28.99, demonstrating considerable volatility, as evidenced by a standard deviation of 5.63. The recent trend from August 31, 2025, to November 16, 2025, shows a price change of +7.33%, further confirming the bullish sentiment with an acceleration in the trend slope.

Volume Analysis

In the last three months, Baker Hughes has shown a buyer-dominant activity pattern, with an average volume of 34.17M shares. This volume indicates increasing participation from buyers, as reflected in the average buy volume of 22.01M compared to the average sell volume of 12.16M. Despite this positive sentiment, the overall volume trend appears bearish, suggesting some caution among investors, even as buyer momentum accelerates.

Analyst Opinions

Recent analyst recommendations for Baker Hughes Company (BKR) indicate a consensus rating of “Buy” for 2025. Analysts have highlighted the company’s solid return on assets (5) and return on equity (4), suggesting strong operational efficiency. Despite a moderate debt-to-equity score (2) and price-to-earnings score (2), the overall B+ rating reflects confidence in BKR’s growth potential. Notably, analysts emphasize the company’s robust cash flow as a key factor in their positive outlook.

Stock Grades

Baker Hughes Company (BKR) has received consistent ratings from several reputable grading companies, indicating a stable outlook.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-10-28 |

| Barclays | Maintain | Overweight | 2025-10-27 |

| TD Cowen | Maintain | Buy | 2025-10-27 |

| Stifel | Maintain | Buy | 2025-10-27 |

| Piper Sandler | Maintain | Overweight | 2025-10-16 |

| Citigroup | Maintain | Buy | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-06 |

| BMO Capital | Maintain | Outperform | 2025-07-30 |

| UBS | Maintain | Neutral | 2025-07-30 |

| Evercore ISI Group | Maintain | Outperform | 2025-07-30 |

Overall, the trend in grades for BKR shows a strong commitment from analysts to maintain their ratings, with several firms indicating a positive or neutral outlook. The consistency in grades suggests a stable investment environment for Baker Hughes.

Target Prices

The consensus target price for Baker Hughes Company (BKR) reflects positive analyst sentiment.

| Target High | Target Low | Consensus |

|---|---|---|

| 58 | 48 | 53.14 |

Overall, analysts expect BKR to trade around $53.14, indicating a balanced outlook between higher and lower expectations.

Consumer Opinions

Consumer sentiment about Baker Hughes Company (BKR) reveals a mixed bag of experiences, reflecting both satisfaction and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Innovative technology solutions | Slow customer service response |

| Strong commitment to sustainability | Occasional product reliability issues |

| Excellent technical support | Pricing perceived as high |

| Effective project management | Limited product range in specific sectors |

Overall, consumer feedback on Baker Hughes indicates strong appreciation for their innovative technologies and commitment to sustainability, while concerns about customer service and pricing persist.

Risk Analysis

In assessing the investment potential of Baker Hughes Company (BKR), I have compiled a table to highlight key risks that could affect its performance.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in oil and gas prices can significantly impact BKR’s revenue. | High | High |

| Regulatory Changes | New environmental regulations may increase operational costs. | Medium | High |

| Technological Risk | Rapid advancements in alternative energy could outpace BKR’s offerings. | Medium | Medium |

| Geopolitical Risks | Instability in oil-producing regions could disrupt supply chains. | High | Medium |

| Competition | Increased competition from both traditional and renewable energy companies. | High | Medium |

In recent months, the volatility in oil prices has been pronounced, largely driven by geopolitical tensions, which heightens the risk for BKR. I recommend investors consider these factors carefully as they weigh their options.

Should You Buy Baker Hughes Company?

Baker Hughes Company (BKR) has established itself with a strong portfolio of energy technology products and services, boasting a net margin of 10.7%, a return on invested capital (ROIC) of 7.27%, and a weighted average cost of capital (WACC) of 7.27%. The company has shown resilience in a competitive landscape but faces risks related to market dependence and fluctuating energy prices.

Given the current financial metrics, Baker Hughes appears to have favorable conditions for a long-term investment. The positive net margin, combined with an ROIC matching the WACC, indicates that the company is generating sufficient returns on its investments, while the long-term trend is bullish. Additionally, recent buyer volumes suggest a strong interest in the stock.

However, I must note that the company is still navigating risks such as fluctuating energy demand and competition within the sector, which could impact its future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- What Baker Hughes (BKR)’s Expanded Rio Grande LNG Role Means for Shareholders – simplywall.st (Nov 16, 2025)

- Vise Technologies Inc. Invests $639,000 in Baker Hughes Company $BKR – MarketBeat (Nov 16, 2025)

- What Makes Baker Hughes (BKR) a Good Investment? – Yahoo Finance (Nov 14, 2025)

- Baker Hughes to supply Alaska LNG project with key equipment – Reuters (Nov 10, 2025)

- BKR – Baker Hughes Co Latest Stock News & Market Updates – Stock Titan (Nov 10, 2025)

For more information about Baker Hughes Company, please visit the official website: bakerhughes.com