In an era where data drives decisions, MicroStrategy Incorporated stands at the forefront, transforming how businesses harness analytics. With its flagship enterprise platform, the company empowers organizations across diverse sectors to glean actionable insights and navigate their data landscapes with unprecedented ease. Renowned for its innovative approach and commitment to quality, MicroStrategy is not just a software provider; it’s an essential partner in the digital transformation journey. As we delve into its financials, one must consider whether its robust fundamentals still align with the current market valuation and growth trajectory.

Table of contents

Company Description

MicroStrategy Incorporated (NASDAQ: MSTR), founded in 1989 and headquartered in Tysons Corner, Virginia, specializes in enterprise analytics software and services. The company offers a robust platform that delivers modern analytics experiences, enabling users to gain insights across various devices through hyperintelligence products, visualization tools, and custom applications. With a diverse clientele spanning industries such as finance, healthcare, and telecommunications, MicroStrategy stands out as a key player in the software application sector. It also provides consulting and educational services to enhance customer experience and system performance. By emphasizing innovation and data governance, MicroStrategy is strategically positioned to shape the future of enterprise analytics.

Fundamental Analysis

In this section, I will analyze MicroStrategy Incorporated’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

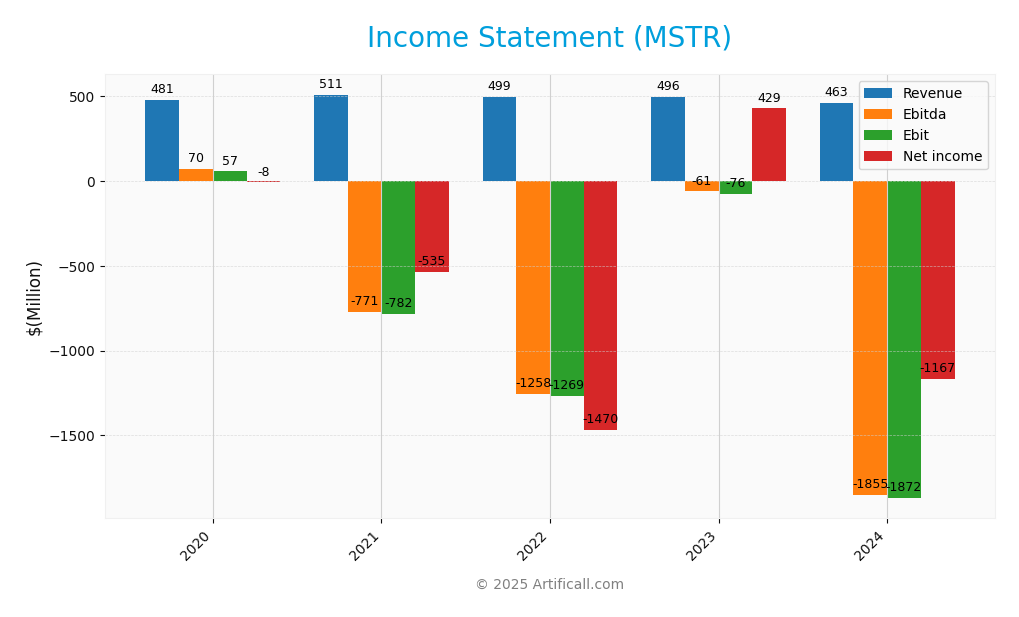

The following table summarizes the income statement for MicroStrategy Incorporated over the past five fiscal years, illustrating the company’s revenue, expenses, and net income figures.

| Income Statement | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 481M | 511M | 499M | 496M | 463M |

| Cost of Revenue | 91M | 92M | 103M | 110M | 129M |

| Operating Expenses | 403M | 1B | 1.67B | 501M | 2.19B |

| Gross Profit | 390M | 419M | 396M | 386M | 334M |

| EBITDA | 70M | -782M | -1.26B | -61M | -1.85B |

| EBIT | 57M | -782M | -1.27B | -76M | -1.87B |

| Interest Expense | 1.8M | 29M | 53M | 49M | 62M |

| Net Income | -7.5M | -535M | -1.47B | 429M | -1.17B |

| EPS | -0.08 | -5.34 | -12.98 | 3.2 | -6.06 |

| Filing Date | 2021-02-12 | 2022-02-16 | 2023-02-16 | 2024-02-15 | 2025-02-18 |

Analyzing the trends from the income statement, MicroStrategy has seen a decline in revenue from 496M in 2023 to 463M in 2024, reflecting a challenging market environment. Despite the drop in revenue, gross profit margins were stable, but operating expenses surged significantly, leading to a drastic negative EBITDA and EBIT. Notably, net income turned from positive in 2023 to a substantial loss in 2024, indicating heightened financial strain and operational inefficiencies. The company’s performance warrants caution, especially given the volatility in its earnings trajectory and the increasing operational costs.

Financial Ratios

The following table summarizes the financial ratios for MicroStrategy Incorporated (MSTR) over the last five years.

| Financial Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -1.57% | -1.05% | -2.94% | 0.86% | -2.52% |

| ROE | -1.36 | -0.83 | -1.06 | 0.20 | -0.07 |

| ROIC | -1.17 | -0.53 | -0.66 | 0.12 | -0.03 |

| P/E | N/A | -10.19 | N/A | 20.12 | -47.80 |

| P/B | 6.80 | 5.57 | -4.18 | 3.99 | 3.06 |

| Current Ratio | 0.95 | 0.86 | 0.83 | 0.83 | 0.71 |

| Quick Ratio | 0.95 | 0.86 | 0.83 | 0.83 | 0.71 |

| D/E | 1.03 | 2.28 | -6.39 | 1.04 | 0.40 |

| Debt-to-Assets | 0.39 | 0.63 | 1.01 | 0.47 | 0.28 |

| Interest Coverage | -7.51 | -26.91 | -24.01 | -2.35 | -29.92 |

| Asset Turnover | 0.33 | 0.14 | 0.21 | 0.10 | 0.02 |

| Fixed Asset Turnover | 4.12 | 4.94 | 5.33 | 5.75 | 5.73 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

In 2024, MicroStrategy’s financial ratios suggest significant challenges. The negative net margin of -2.52% indicates ongoing profitability issues. The P/E ratio of -47.80 highlights a lack of earnings relative to its stock price, raising concerns for investors. Moreover, the current and quick ratios below 1 suggest liquidity challenges, while the low interest coverage ratio of -29.92 indicates difficulties in meeting debt obligations.

Evolution of Financial Ratios

Over the past five years, MicroStrategy’s financial ratios have shown a concerning trend. While the company experienced a brief improvement in profitability in 2023, most ratios have declined, particularly in 2024. The rising debt-to-equity ratio and worsening interest coverage suggest increasing financial risk, which warrants cautious consideration for potential investors.

Distribution Policy

MicroStrategy Incorporated (MSTR) does not pay dividends, reflecting its focus on a reinvestment strategy aimed at bolstering growth during a high-growth phase. The absence of dividends aligns with the company’s prioritization of research and development and strategic acquisitions. Additionally, MSTR engages in share buyback programs, which can enhance shareholder value by reducing share dilution. Ultimately, this strategy appears to support long-term value creation, given the company’s growth ambitions despite current financial challenges.

Sector Analysis

MicroStrategy Incorporated positions itself as a leader in the enterprise analytics software industry, offering comprehensive solutions that empower businesses through data-driven insights. Its key competitive advantages include a robust platform, extensive support services, and a diverse customer base across multiple sectors.

Strategic Positioning

MicroStrategy Incorporated (MSTR) holds a notable position in the enterprise analytics software market, with a market cap of approximately 57.37B. The company specializes in delivering analytics solutions that enable customers from diverse industries to gain insights and improve decision-making. Despite facing competitive pressure from other software providers, MSTR leverages its unique platform features and a robust support system to differentiate itself. However, the rapid pace of technological disruption in analytics and data management necessitates continuous innovation and adaptation to maintain its market share and competitive edge.

Revenue by Segment

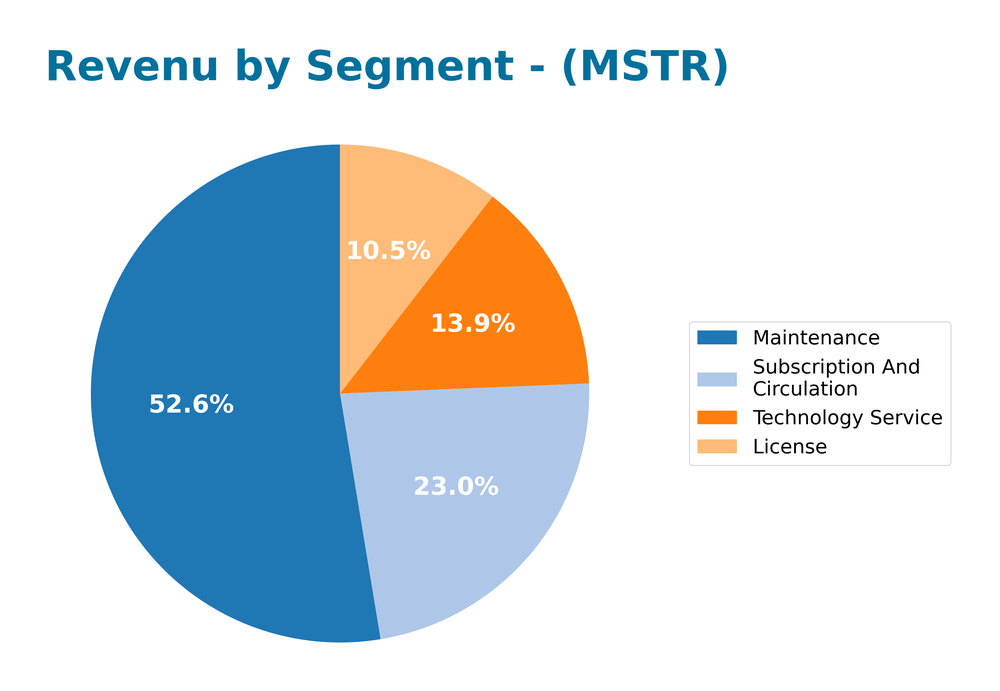

The pie chart illustrates MicroStrategy’s revenue breakdown by segment for the fiscal year 2024, highlighting the key contributors to the company’s overall performance.

In 2024, the revenue segments showed varied performance: Maintenance remains the dominant segment with $243.8M, followed by Subscription and Circulation at $106.8M. However, both License and Technology Service saw declines from the previous year, with License revenue dropping to $48.6M. This shift indicates a growing reliance on subscription-based services, though it raises concentration risks in the Maintenance segment. The decline in License revenue could suggest a challenging environment for new sales, emphasizing the need for strategic adjustments to bolster growth.

Key Products

MicroStrategy Incorporated offers a range of products designed to enhance business analytics and data management. Below is a table summarizing their key products:

| Product | Description |

|---|---|

| MicroStrategy Analytics | An enterprise platform that delivers insights across multiple devices, featuring hyperintelligence products, visualization, and reporting capabilities. |

| MicroStrategy Support | A service aimed at helping customers achieve system availability and uptime goals, providing responsive troubleshooting and proactive technical support. |

| MicroStrategy Consulting | Offers architecture and implementation services to help customers realize results more quickly and achieve returns on investment through effective data management. |

| MicroStrategy Education | Provides a variety of learning options, both free and paid, to ensure users can maximize their use of MicroStrategy products. |

| MicroStrategy Mobility | A solution that enables users to access analytics and business intelligence on mobile devices, ensuring data accessibility on-the-go. |

These products collectively position MicroStrategy as a leader in the enterprise analytics software space, catering to a diverse range of industries.

Main Competitors

No verified competitors were identified from available data. MicroStrategy Incorporated, operating in the application software sector, holds a significant market position with a market capitalization of approximately $57.37B. The company focuses on enterprise analytics software and services, catering to a diverse range of industries including finance, healthcare, and technology.

Competitive Advantages

MicroStrategy Incorporated (MSTR) holds significant competitive advantages through its robust enterprise analytics software, which integrates hyperintelligence and visualization capabilities. With a market cap of $57.37B, the company benefits from strong demand across various sectors, including finance and healthcare. Looking ahead, MicroStrategy is poised to enhance its offerings with innovative products that leverage AI and machine learning, tapping into emerging markets for data analytics. These strategic initiatives present substantial opportunities for growth, making MSTR a compelling consideration for investors focused on technology-driven solutions in the analytics space.

SWOT Analysis

This analysis identifies the strengths, weaknesses, opportunities, and threats related to MicroStrategy Incorporated (MSTR) to guide strategic decision-making.

Strengths

- Strong brand recognition

- Innovative analytics platform

- Diverse customer base

Weaknesses

- High volatility in stock price

- Dependence on a few large clients

- No dividend payouts

Opportunities

- Growing demand for data analytics

- Expansion into new markets

- Potential partnerships and collaborations

Threats

- Intense competition in the software industry

- Economic downturn risks

- Rapid technological changes

Overall, this SWOT assessment highlights MicroStrategy’s robust position within the analytics market but also underscores the need for careful risk management and strategic adaptability to leverage opportunities while mitigating potential threats.

Stock Analysis

In the past year, MicroStrategy Incorporated (MSTR) has experienced significant price movements, characterized by a dramatic increase followed by recent volatility and a notable decline.

Trend Analysis

Over the past two years, MSTR has shown an impressive price change of +222.59%. This indicates a bullish trend in the long term; however, it is important to note that there has been a recent decline of -40.27% from August 31, 2025, to November 16, 2025. This recent movement suggests a bearish sentiment in the short term, with the overall trend showing signs of deceleration. The highest price reached during this period was 434.58, while the lowest was 48.1. The standard deviation of 115.76 reflects considerable volatility.

Volume Analysis

Analyzing the trading volumes over the last three months, the average volume was 57.81M, and the behavior indicates a seller-dominant market with an average sell volume of 39.90M compared to an average buy volume of 17.91M. The volume trend appears to be bearish, as the trend slope is negative at -286K, suggesting decreased investor participation and a cautious sentiment surrounding MSTR. The acceleration in this trend further reinforces the prevailing seller-driven dynamics observed in the market.

Analyst Opinions

Recent analyst recommendations for MicroStrategy Incorporated (MSTR) have been cautious, with a consensus rating of “C.” Analysts emphasize concerns regarding their return metrics and cash flow, with several suggesting a “hold” position due to the company’s current financial performance. Notably, the discounted cash flow and return on equity scores were rated low, indicating potential risks. Analysts seem divided, but the prevailing sentiment leans towards holding rather than buying or selling at this time. As always, I advise careful consideration of these factors before making investment decisions.

Stock Grades

MicroStrategy Incorporated (MSTR) has seen a mix of ratings recently, reflecting evolving analyst sentiments. Below is a summary of the latest stock grades from credible grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Monness, Crespi, Hardt | upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-11-03 |

| BTIG | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-31 |

| Wells Fargo | downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | maintain | Buy | 2025-09-16 |

| Canaccord Genuity | maintain | Buy | 2025-08-26 |

| Mizuho | maintain | Outperform | 2025-08-11 |

Overall, the trend shows a stabilization in ratings, with several firms maintaining their “Buy” recommendations, while a notable upgrade to “Neutral” from a “Sell” rating by Monness, Crespi, Hardt indicates a cautious optimism. However, the downgrade from Wells Fargo suggests some analysts remain wary of the stock’s performance.

Target Prices

The consensus among analysts for MicroStrategy Incorporated (MSTR) indicates a range of expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 705 | 175 | 478.5 |

Overall, analysts anticipate a target price of approximately 478.5, suggesting a positive outlook with significant upside potential compared to the lower estimate.

Consumer Opinions

Consumer sentiment about MicroStrategy Incorporated (MSTR) reveals a landscape filled with both praise and criticism, reflecting the diverse experiences of its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “MSTR’s data analytics solutions are top-notch and highly effective.” | “Customer service response times could be significantly improved.” |

| “The platform’s ease of use is a game-changer for our team.” | “Pricing seems steep compared to competitors.” |

| “Innovative technology that keeps us ahead of the curve.” | “There have been occasional bugs that disrupt usage.” |

Overall, consumer feedback on MicroStrategy is mixed, with strengths in innovative technology and usability, but weaknesses in customer support and pricing concerns frequently mentioned.

Risk Analysis

In evaluating MicroStrategy Incorporated (MSTR), it’s crucial to understand the potential risks that could impact investment performance. The following table outlines key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in cryptocurrency prices can affect valuations. | High | High |

| Regulatory Changes | New regulations on cryptocurrencies may impose restrictions. | Medium | High |

| Operational Risks | Dependence on Bitcoin could lead to operational instability. | High | Medium |

| Competition | Increasing competition in the data analytics space. | Medium | Medium |

| Cybersecurity | Threats to data security can lead to significant losses. | High | High |

The most significant risks for MicroStrategy include market volatility and cybersecurity threats, both of which have the potential for high impact on the company’s financial health.

Should You Buy MicroStrategy Incorporated?

MicroStrategy Incorporated is heavily involved in the business intelligence sector with flagship products centered around analytics and data management. However, the company is currently facing significant financial challenges, reflected in its negative net margin of -2.52%, a ROIC that does not surpass its WACC of 16.86%, and concerning trends in buyer volumes.

Given the negative net margin and the unfavorable financial ratios, I would recommend waiting for MicroStrategy’s fundamentals to improve before considering any investments. The long-term trend is bullish, but the recent acceleration in seller volumes presents a risk that warrants caution.

Specific risks for MicroStrategy include intense competition in the business intelligence field and potential disruptions in market demand, which could further impact its financial health.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Is MicroStrategy Incorporated (MSTR) One of the Best Stocks to Buy With Over 50% Upside Potential? – Yahoo Finance (Nov 04, 2025)

- MicroStrategy Stock (MSTR) Opinions on Bitcoin Holdings and Price Dip – Quiver Quantitative (Nov 16, 2025)

- MSTR – Strategy Inc Stock Price and Quote – Finviz (Nov 14, 2025)

- MicroStrategy Falls Below Net Asset Value Amid Crypto Crash. Should You Buy the Dip in MSTR Stock? – Barchart.com (Nov 14, 2025)

- Strategy Shares Plunge as Bitcoin Retreats—More Pain Ahead? – MarketBeat (Nov 11, 2025)

For more information about MicroStrategy Incorporated, please visit the official website: microstrategy.com