In a world increasingly driven by digital transactions, PayPal Holdings, Inc. transforms how consumers and businesses manage their payments, seamlessly connecting millions across the globe. With its innovative platform featuring services like Venmo, Braintree, and PayPal Credit, the company has established itself as a key player in the financial technology sector. As we analyze PayPal’s current market position, we must consider whether its strong reputation for quality and innovation continues to justify its market valuation and growth potential.

Table of contents

Company Description

PayPal Holdings, Inc. is a leading player in the digital payments industry, founded in 1998 and headquartered in San Jose, California. The company operates a comprehensive technology platform that facilitates secure online transactions for both merchants and consumers across approximately 200 markets and in around 100 currencies. Its diverse portfolio includes well-known brands such as PayPal, Venmo, Braintree, and Xoom, offering a variety of payment solutions. With a market capitalization of $58.8B, PayPal is strategically positioned to innovate in the rapidly evolving financial services sector, continuously enhancing its ecosystem to meet the demands of a digital-first economy.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of PayPal Holdings, Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

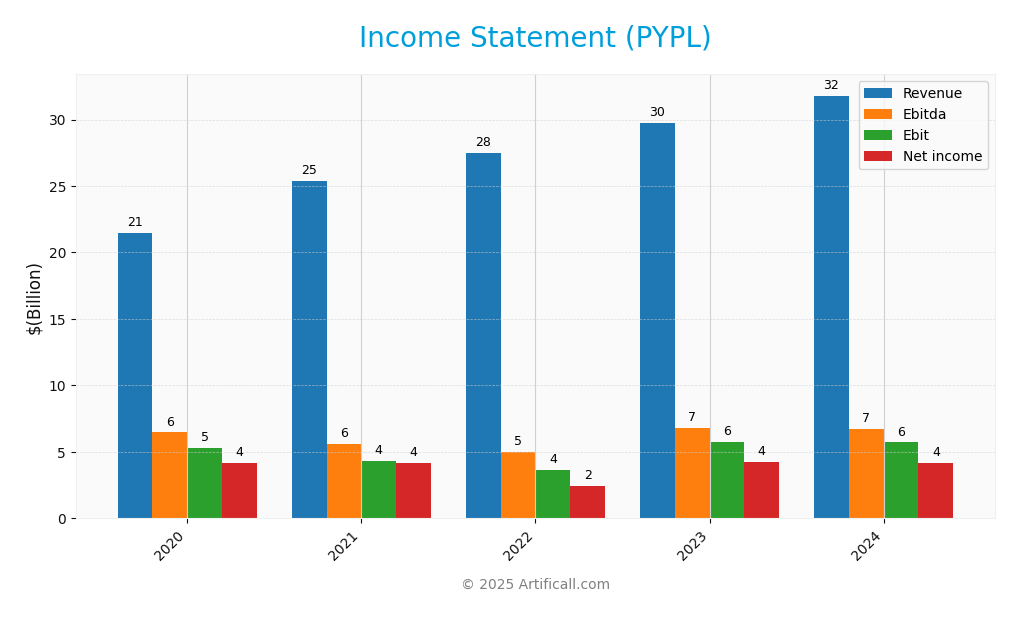

Below is the Income Statement for PayPal Holdings, Inc. (PYPL), which outlines the company’s financial performance over the last five fiscal years.

| Income Statement | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Revenue | 31.80B | 29.77B | 27.52B | 25.37B | 21.45B |

| Cost of Revenue | 17.14B | 16.07B | 13.75B | 11.38B | 9.68B |

| Operating Expenses | 9.33B | 8.68B | 9.94B | 9.73B | 8.49B |

| Gross Profit | 14.66B | 13.70B | 13.77B | 13.99B | 11.78B |

| EBITDA | 6.74B | 6.83B | 4.99B | 5.60B | 6.46B |

| EBIT | 5.71B | 5.76B | 3.67B | 4.33B | 5.27B |

| Interest Expense | 0.38B | 0.35B | 0.30B | 0.23B | 0.21B |

| Net Income | 4.15B | 4.25B | 2.42B | 4.17B | 4.20B |

| EPS | 4.03 | 3.85 | 2.10 | 3.55 | 3.58 |

| Filing Date | 2025-02-04 | 2024-02-08 | 2023-02-10 | 2022-02-03 | 2021-02-05 |

Over the past five years, PayPal’s revenue has shown a steady upward trajectory, increasing from 21.45B in 2020 to 31.80B in 2024, reflecting a strong demand for digital payments. However, net income has fluctuated, peaking at 4.25B in 2023 and slightly declining to 4.15B in 2024. This indicates a potential concern regarding profitability margins, particularly with operating expenses rising significantly. In 2024, while revenue growth persisted, the slight decrease in net income suggests that cost management may have become more challenging, warranting close monitoring in future quarters.

Financial Ratios

Below is a summary of key financial ratios for PayPal Holdings, Inc. (PYPL) over the last five fiscal years:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 19.59% | 16.43% | 8.79% | 14.26% | 13.04% |

| ROE | 10.29% | 8.58% | 7.86% | 11.24% | 9.27% |

| ROIC | 9.75% | 8.92% | 7.01% | 10.23% | 8.15% |

| P/E | 65.38 | 53.10 | 33.98 | 15.95 | 21.18 |

| P/B | 13.72 | 10.19 | 4.05 | 3.22 | 4.30 |

| Current Ratio | 1.33 | 1.22 | 1.28 | 1.29 | 1.26 |

| Quick Ratio | 1.33 | 1.22 | 1.28 | 1.29 | 1.26 |

| D/E | 0.45 | 0.42 | 0.51 | 0.46 | 0.48 |

| Debt-to-Assets | 12.70% | 11.94% | 13.25% | 11.78% | 12.10% |

| Interest Coverage | 15.74 | 18.37 | 12.62 | 14.49 | 13.94 |

| Asset Turnover | 0.30 | 0.33 | 0.35 | 0.36 | 0.39 |

| Fixed Asset Turnover | 11.87 | 13.29 | 15.91 | 20.01 | 21.09 |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Interpretation of Financial Ratios

In the most recent year, PayPal’s ratios indicate a mixed performance. The net margin at 13.04% and ROE at 9.27% are relatively strong, but the P/E ratio of 21.18 suggests the stock may be overvalued compared to earnings. A decline in the net margin from previous years raises concerns about profitability. The current and quick ratios remain stable, indicating good short-term liquidity.

Evolution of Financial Ratios

Over the past five years, PayPal’s financial ratios show a decline in profitability metrics, such as net margin and ROE, while the P/E ratio has fluctuated significantly. However, liquidity ratios have remained stable, suggesting the company maintains a solid short-term financial position despite challenges in profitability.

Distribution Policy

PayPal Holdings, Inc. (PYPL) does not pay dividends, opting instead to reinvest its earnings to fuel growth initiatives and enhance its competitive position. This approach aligns with its strategy of prioritizing R&D and acquisitions, supporting long-term shareholder value creation. Additionally, PayPal engages in share buybacks, indicating a commitment to returning value to shareholders. Overall, the lack of dividends appears to support sustainable growth, although it may involve higher risks associated with market volatility and investment execution.

Sector Analysis

PayPal Holdings, Inc. is a key player in the Financial – Credit Services industry, providing a diverse range of digital payment solutions while facing competition from firms like Square and Stripe. Its competitive advantages include a strong brand presence and a wide global reach.

Strategic Positioning

PayPal Holdings, Inc. (PYPL) commands a significant market share in the digital payments sector, driven by its comprehensive platform catering to both consumers and merchants. As of now, it faces intense competitive pressure from emerging fintech companies and established players like Square and Stripe, which are innovating rapidly. Additionally, the company must navigate technological disruptions, such as blockchain-based payment solutions and decentralized finance. This environment necessitates continuous adaptation to maintain its leading position and capitalize on growth opportunities. With a market cap of approximately $58.8B, PayPal remains a pivotal player in the financial services industry.

Revenue by Segment

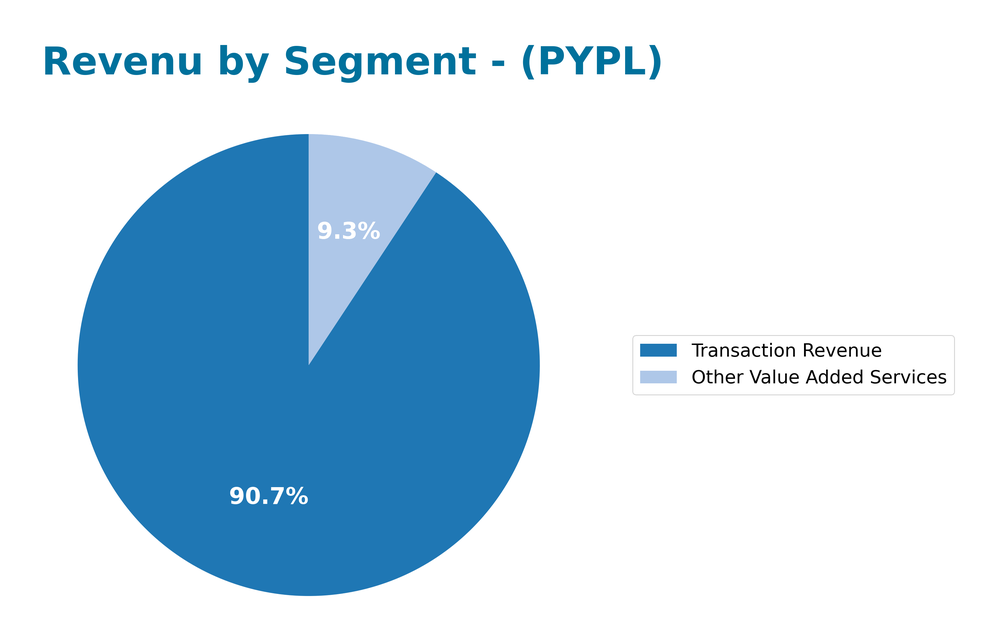

The chart below illustrates PayPal’s revenue segmentation for the fiscal year 2024, highlighting key contributions from various business segments.

In FY 2024, PayPal’s revenue from Transaction Revenue reached 28.84B, while Other Value Added Services generated 2.96B. Overall, the company has shown consistent growth in Transaction Revenue, increasing from 26.86B in FY 2023, indicating strong demand for its core payment services. However, the growth rate in Other Value Added Services has decelerated slightly, suggesting potential saturation or increased competition in this segment. The mix between these segments reflects a diversified revenue base, but the reliance on transaction fees may pose margin risks in a changing economic landscape.

Key Products

PayPal Holdings, Inc. offers a range of innovative digital payment solutions that cater to both consumers and merchants. Below is a table summarizing their key products:

| Product | Description |

|---|---|

| PayPal | A widely recognized digital wallet that allows users to send and receive payments online securely. |

| PayPal Credit | A line of credit that provides customers with flexible payment options for online purchases. |

| Braintree | A payment processing platform that enables merchants to accept mobile and web payments seamlessly. |

| Venmo | A social payment app that allows users to send money to friends and make purchases at select merchants. |

| Xoom | A fast and secure way to send money internationally, typically for remittances and bill payments. |

| Zettle | A point-of-sale solution that helps businesses accept card payments and manage sales. |

| Hyperwallet | A global payout platform designed for businesses to disburse funds to recipients in various countries. |

| Honey | A browser extension that helps users find and apply coupon codes while shopping online. |

| Paidy | A payment service that allows consumers in Japan to make purchases online and pay later. |

These products enhance PayPal’s ability to facilitate digital transactions across various markets and customer needs, solidifying its position in the financial services sector.

Main Competitors

No verified competitors were identified from available data. However, I can provide some insights into PayPal Holdings, Inc.’s estimated market share and competitive position. PayPal currently holds a significant market share in the digital payments sector, estimated at around 20% globally. The company maintains a dominant position in North America, where it benefits from strong brand recognition and a broad range of payment solutions, including PayPal, Venmo, and Braintree.

Competitive Advantages

PayPal Holdings, Inc. (PYPL) boasts a strong competitive edge due to its established technology platform that facilitates seamless digital payments globally. With a presence in approximately 200 markets and support for 100 currencies, PayPal is well-positioned to capitalize on the growing trend of digital transactions. Future opportunities include expanding its product offerings, such as integrating advanced financial services and enhancing partnerships with e-commerce platforms. This strategic focus, combined with its recognized brand and extensive user base, positions PayPal for sustained growth in the evolving financial landscape.

SWOT Analysis

The SWOT analysis provides a strategic overview of PayPal Holdings, Inc. (PYPL), highlighting its strengths, weaknesses, opportunities, and threats.

Strengths

- Strong brand recognition

- Extensive global reach

- Diverse payment solutions

Weaknesses

- Increased competition

- Regulatory challenges

- Dependence on third-party platforms

Opportunities

- Growth in digital payments

- Expansion into emerging markets

- Innovation in fintech solutions

Threats

- Economic downturns

- Cybersecurity threats

- Rapid technological changes

Overall, the SWOT assessment indicates that PayPal possesses significant strengths that can be leveraged for growth, particularly in the expanding digital payments market. However, the company must address its weaknesses and remain vigilant against external threats to maintain its competitive edge and strategic direction.

Stock Analysis

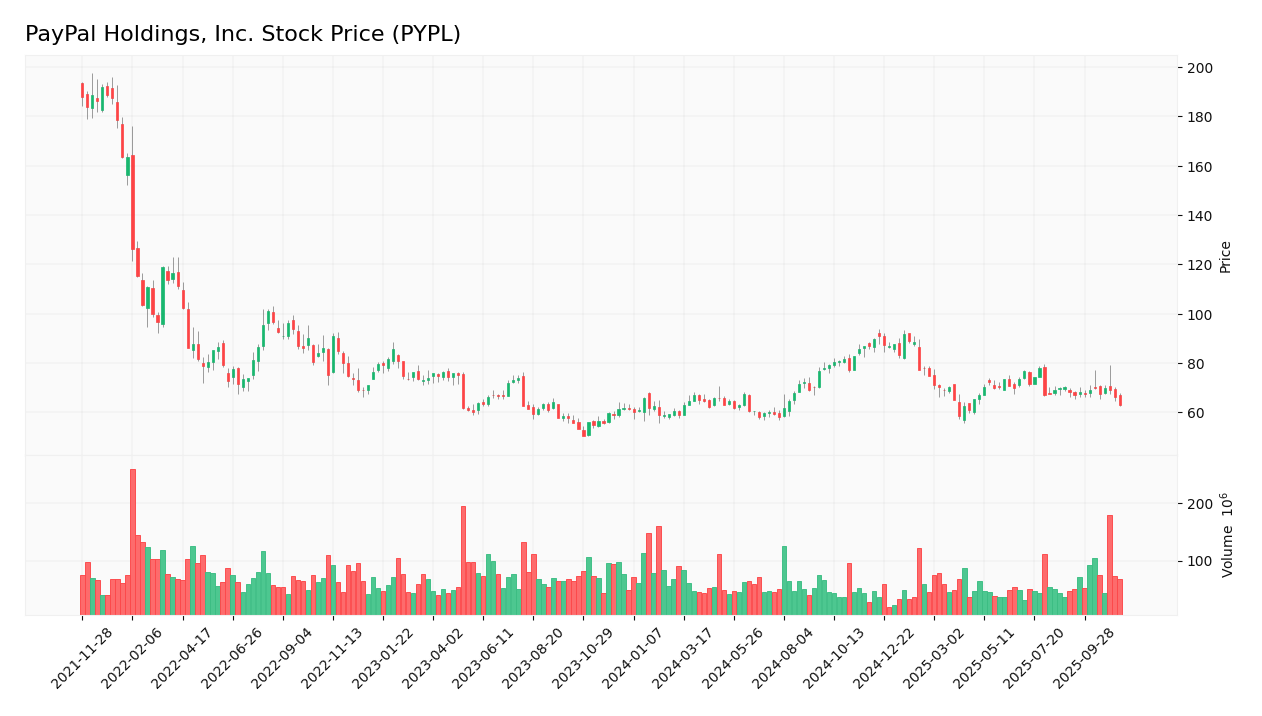

Over the past year, PayPal Holdings, Inc. (PYPL) has experienced notable price movements, reflecting a mix of volatility and investor sentiment that warrants careful observation.

Trend Analysis

Analyzing the stock’s performance over the last 12 months, PYPL has exhibited a price change of +1.57%. While this indicates a bullish trend overall, the trend has shown signs of deceleration, with notable highs at $91.81 and lows at $58.03. The standard deviation of 8.81 suggests moderate volatility, indicating the potential for price fluctuations.

Volume Analysis

In the last three months, PayPal’s trading volumes averaged approximately 74.3M shares, with sell volume dominating at around 53.9M shares compared to buy volume of 20.4M shares. This seller-dominant activity, combined with a bearish volume trend and a slight decrease in overall volume, suggests a cautious investor sentiment and reduced market participation.

Analyst Opinions

Recent analyst recommendations for PayPal Holdings, Inc. (PYPL) indicate a consensus to “hold” the stock. Analysts such as those from Zacks have given it a B+ rating, driven by solid return metrics like a 5/5 score in both return on equity and return on assets. However, concerns about its price-to-book and price-to-earnings ratios, scoring only 1 and 2 respectively, suggest caution. Overall, while the company shows promise in terms of cash flow, the mixed ratings imply a balanced approach for current investors.

Stock Grades

PayPal Holdings, Inc. (PYPL) has recently received various stock ratings from reputable grading companies. Here’s a summary of the latest grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Sell | 2025-11-04 |

| Canaccord Genuity | Maintain | Buy | 2025-10-29 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-29 |

| UBS | Maintain | Neutral | 2025-10-29 |

| Argus Research | Maintain | Buy | 2025-10-29 |

| RBC Capital | Maintain | Outperform | 2025-10-28 |

| Goldman Sachs | Downgrade | Sell | 2025-10-13 |

| Wolfe Research | Downgrade | Peer Perform | 2025-10-03 |

| Morgan Stanley | Maintain | Equal Weight | 2025-07-30 |

| JMP Securities | Maintain | Market Outperform | 2025-07-30 |

Overall, the trend for PayPal indicates a mixed sentiment from analysts. While some firms maintain “Buy” or “Outperform” ratings, others have downgraded their assessments to “Sell” or “Peer Perform,” reflecting cautious sentiment in the current market environment.

Target Prices

The current consensus for PayPal Holdings, Inc. (PYPL) indicates a range of target prices from various analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 100 | 65 | 78.69 |

Overall, analysts expect the stock to perform within this range, with a consensus target suggesting potential upside.

Consumer Opinions

Consumer sentiment regarding PayPal Holdings, Inc. (PYPL) reveals a mixed bag of experiences, reflecting both satisfaction and frustration among users.

| Positive Reviews | Negative Reviews |

|---|---|

| “PayPal makes online payments incredibly easy!” | “Customer service can be unresponsive.” |

| “I love the security features; I feel safe using it.” | “Fees can be high for international transactions.” |

| “Great for sending money to friends and family!” | “The app can be glitchy at times.” |

Overall, consumer feedback highlights PayPal’s user-friendly interface and security as strengths, while issues with customer service and fees are notable weaknesses.

Risk Analysis

In evaluating PayPal Holdings, Inc. (PYPL), it is crucial to consider various risks that could affect its performance. Below is a summary of the key risks associated with investing in PayPal.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in payment regulations could affect operations. | High | High |

| Competition Risk | Increased competition from fintech companies and traditional banks. | High | High |

| Cybersecurity Risk | Potential breaches could compromise customer data and trust. | Medium | High |

| Economic Risk | Economic downturns can reduce consumer spending and transaction volumes. | Medium | Medium |

| Technology Risk | Rapid technological changes may require continuous investment. | Medium | Medium |

The most likely and impactful risks for PayPal are regulatory and competition risks, especially as the fintech landscape evolves rapidly. Recent trends indicate a growing number of players in the digital payment space, which could significantly affect PayPal’s market share and profitability.

Should You Buy PayPal Holdings, Inc.?

PayPal Holdings, Inc. (PYPL) has shown strong profitability with a net margin of 13.04% and an ROIC exceeding its WACC of 9.54%. The company’s flagship services continue to dominate the digital payment sector, but it faces competitive pressures and recent declines in buyer volumes.

Given that PayPal’s net margin is positive at 13.04%, and the ROIC is higher than the WACC, coupled with a long-term bullish trend, the current conditions indicate a favorable signal for long-term investment. However, the recent trend shows a decline in buyer volumes, suggesting that I should monitor the situation before making any significant additions to my portfolio.

The main risks include intensified competition in the digital payments arena, potential supply chain issues, and valuation pressures that may arise from economic fluctuations.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- PayPal Holdings, Inc. (PYPL) is Attracting Investor Attention: Here is What You Should Know – Yahoo Finance (Nov 14, 2025)

- PayPal: A Solid GARP Stock Trapped In Consolidation (Technical Analysis And Downgrade) – Seeking Alpha (Nov 14, 2025)

- PayPal (NASDAQ:PYPL) Stock Price Down 3.9% After Analyst Downgrade – MarketBeat (Nov 14, 2025)

- PayPal Holdings’s Options Frenzy: What You Need to Know – PayPal Holdings (NASDAQ:PYPL) – Benzinga (Nov 14, 2025)

- PayPal (PYPL) Having A Good CEO Hasn’t Meant Much, Says Jim Cramer – Yahoo Finance (Nov 16, 2025)

For more information about PayPal Holdings, Inc., please visit the official website: paypal.com