Every flick of a light switch or charge of a device connects us to the powerful networks of American Electric Power (AEP), a cornerstone of the regulated electric utility sector. AEP not only leads in energy generation and distribution but also excels in harnessing a diverse mix of energy sources, from renewables to traditional fuels. With a solid reputation for innovation and reliability, AEP plays a crucial role in shaping America’s energy landscape. As we delve into an analysis of AEP’s financial health and growth prospects, the question remains: do its fundamentals align with its current market valuation?

Table of contents

Company Description

American Electric Power Company, Inc. (AEP) is a major electric public utility holding company engaged in the generation, transmission, and distribution of electricity across the United States. Founded in 1906 and headquartered in Columbus, Ohio, AEP operates in a diverse array of geographic markets, providing power through various energy sources, including coal, natural gas, nuclear, and renewables like solar and wind. With a market capitalization of approximately $64.9B, AEP is a leader in the regulated electric industry, serving both retail and wholesale customers. The company is committed to innovation and sustainability, positioning itself as a pivotal player in shaping the future of energy in the U.S.

Fundamental Analysis

In this section, I will analyze American Electric Power Company, Inc. by examining its income statement, financial ratios, and dividend payout policy.

Income Statement

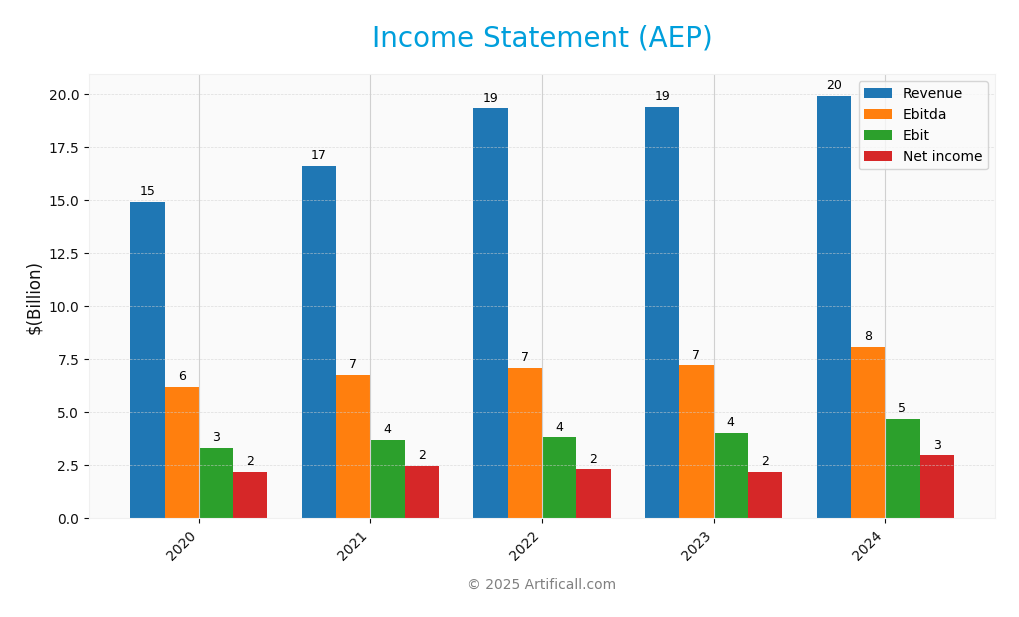

The table below summarizes the income statement of American Electric Power Company, Inc. (AEP) over the past five fiscal years, showcasing key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 14.91B | 16.62B | 19.31B | 19.38B | 19.92B |

| Cost of Revenue | 10.63B | 11.95B | 14.44B | 13.76B | 13.56B |

| Operating Expenses | 12.93B | 14.08B | 15.91B | 14.92B | 15.16B |

| Gross Profit | 4.27B | 4.67B | 4.87B | 5.62B | 6.36B |

| EBITDA | 6.21B | 6.75B | 7.10B | 7.21B | 8.09B |

| EBIT | 3.31B | 3.70B | 3.81B | 4.02B | 4.70B |

| Interest Expense | 1.16B | 1.19B | 1.39B | 1.81B | 1.86B |

| Net Income | 2.20B | 2.49B | 2.31B | 2.21B | 2.97B |

| EPS | 4.44 | 4.97 | 4.51 | 4.26 | 5.60 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-23 | 2024-02-26 | 2025-02-13 |

In analyzing AEP’s income statement, we observe a consistent upward trend in revenue, increasing from 14.91B in 2020 to 19.92B in 2024. This reflects a strong demand for electric power services and efficient management of operational costs. Notably, net income also saw significant growth, rising from 2.20B in 2020 to 2.97B in 2024, indicating improved profitability. The gross profit margin has stabilized, suggesting effective cost control strategies. In 2024, AEP achieved a remarkable EBITDA of 8.09B and an EPS of 5.60, showcasing robust financial health despite rising interest expenses.

Financial Ratios

The table below summarizes the key financial ratios for American Electric Power Company, Inc. (AEP) over the last few years.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 14.76% | 14.97% | 11.95% | 11.39% | 14.90% |

| ROE | 8.23% | 8.23% | 7.85% | 7.15% | 8.53% |

| ROIC | 8.54% | 8.56% | 7.32% | 7.60% | 8.45% |

| P/E | 18.76 | 17.90 | 21.06 | 19.09 | 16.48 |

| P/B | 2.01 | 1.99 | 2.03 | 1.67 | 1.81 |

| Current Ratio | 0.44 | 0.63 | 0.51 | 0.53 | 0.44 |

| Quick Ratio | 0.31 | 0.55 | 0.41 | 0.36 | 0.31 |

| D/E | 1.68 | 1.63 | 1.74 | 1.73 | 1.70 |

| Debt-to-Assets | 42.64% | 41.82% | 44.52% | 45.10% | 44.40% |

| Interest Coverage | 2.57 | 2.74 | 2.44 | 2.28 | 2.56 |

| Asset Turnover | 0.18 | 0.19 | 0.21 | 0.20 | 0.19 |

| Fixed Asset Turnover | 0.23 | 0.25 | 0.26 | 0.25 | 0.24 |

| Dividend Yield | 3.45% | 3.41% | 3.39% | 4.18% | 3.89% |

Interpretation of Financial Ratios

In 2024, AEP’s financial ratios indicate a mixed performance. The net margin of 14.90% and ROE of 8.53% suggest robust profitability. However, the current and quick ratios below 0.5 raise concerns about short-term liquidity. The P/E ratio of 16.48 shows reasonable valuation, while the debt ratios indicate a consistent reliance on leverage, which could pose risks in a rising interest rate environment.

Evolution of Financial Ratios

Over the past five years, AEP’s financial ratios have shown some fluctuations, particularly in net margin and liquidity ratios. While profitability metrics have improved, the liquidity ratios have remained below 0.5, indicating a potential concern for short-term financial health. Additionally, the company has maintained a stable P/E ratio, suggesting consistent investor confidence.

Distribution Policy

American Electric Power Company, Inc. (AEP) maintains a dividend payout ratio of approximately 64% with an annual dividend yield of about 3.89%. The trend of the dividend per share has shown consistent growth, supported by a solid free cash flow coverage ratio, allowing for sustainable distributions. AEP also engages in share buyback programs. However, investors should remain cautious of potential risks associated with high payout ratios, particularly in economic downturns. Overall, AEP’s distribution strategy appears aligned with long-term shareholder value creation.

Sector Analysis

American Electric Power Company, Inc. (AEP) operates in the regulated electric industry, providing diverse energy solutions while facing competition from various utility firms. Its strengths include a broad energy portfolio and a stable market presence, with potential weaknesses stemming from regulatory risks.

Strategic Positioning

American Electric Power Company, Inc. (AEP) occupies a significant position in the regulated electric utility sector, boasting a market capitalization of approximately 64.9B. With a diverse energy generation portfolio that includes coal, natural gas, nuclear, and renewables, AEP effectively mitigates competitive pressures. However, the industry faces technological disruptions, particularly from emerging renewable energy sources. The company’s robust infrastructure and established market share provide a competitive edge, yet vigilance is required to adapt to evolving market dynamics and regulatory changes.

Revenue by Segment

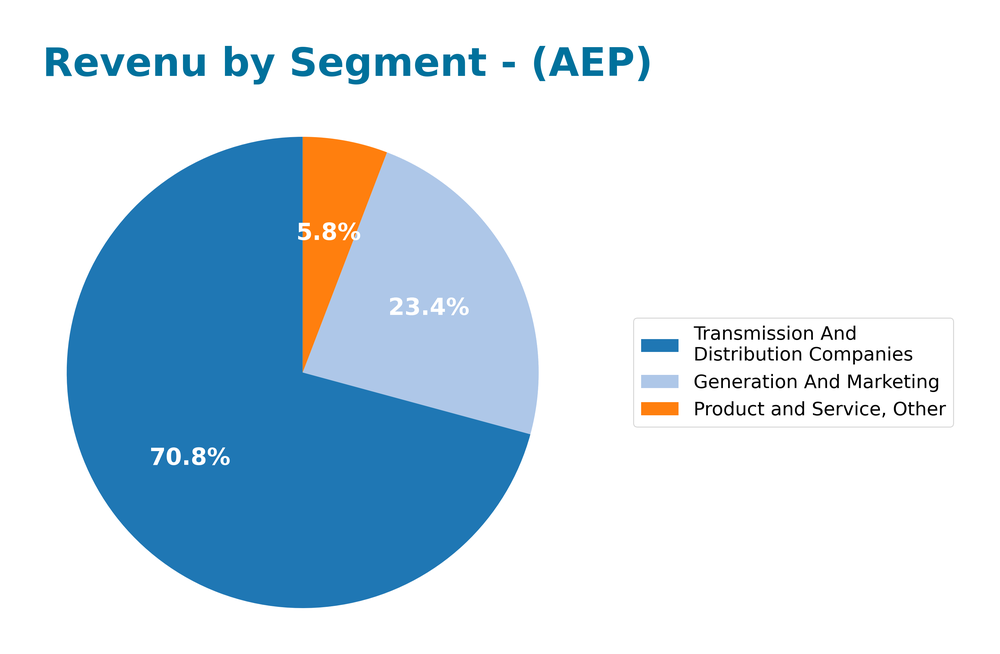

The chart illustrates American Electric Power’s revenue segmentation for the fiscal year 2024, showcasing the diverse sources of income within the business.

In FY 2024, American Electric Power (AEP) generated notable revenues primarily from its Transmission and Distribution Companies segment, contributing $5.88B. The Generation and Marketing segment also remained significant, though it decreased to $1.94B. This decline reflects a broader trend of slowing growth in generation revenues. The Other Products and Services segment, while smaller at $483M, indicates AEP’s diversification efforts. Overall, AEP’s performance in 2024 shows potential concentration risks, especially as traditional generation faces pressures from renewable energy transitions. Careful monitoring of segment performance will be essential for future growth strategies.

Key Products

American Electric Power Company, Inc. (AEP) offers a diverse range of products and services that cater to both retail and wholesale electricity markets. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| Retail Electricity Supply | Provides electricity to residential and commercial customers through regulated rates. |

| Wholesale Electricity | Supplies and markets electric power to other utility companies, cooperatives, and municipalities. |

| Renewable Energy Solutions | Offers solar, wind, and hydroelectric power generation options to promote sustainable energy use. |

| Energy Efficiency Programs | Implements initiatives aimed at reducing energy consumption and promoting energy-efficient practices. |

| Electric Transmission | Operates an extensive network for the transmission of electricity across multiple states. |

| Grid Modernization | Invests in smart grid technology to improve efficiency and reliability of electricity distribution. |

This table highlights AEP’s commitment to providing reliable energy solutions while embracing sustainability and innovation in the utility sector.

Main Competitors

No verified competitors were identified from available data. However, American Electric Power Company, Inc. (AEP) holds a significant market share in the regulated electric utility sector in the United States. As a major player in the industry, AEP operates through various segments, engaging in the generation, transmission, and distribution of electricity, which reinforces its competitive position in the market.

Competitive Advantages

American Electric Power Company, Inc. (AEP) holds a significant edge in the regulated electric utility sector due to its extensive infrastructure and diverse energy generation portfolio. With a market cap of approximately $64.9B, AEP is well-positioned to leverage renewable energy trends, investing in solar and wind projects to meet future demand. The company’s established relationships with wholesale customers and municipalities further enhance its competitive stance. Looking forward, AEP’s focus on sustainable energy solutions and technological advancements in grid management presents substantial growth opportunities, ensuring they remain a key player in the evolving energy landscape.

SWOT Analysis

This analysis aims to evaluate the strengths, weaknesses, opportunities, and threats facing American Electric Power Company, Inc. (AEP) to inform potential investment strategies.

Strengths

- Strong market position

- Diverse energy generation portfolio

- Stable dividend yield

Weaknesses

- High capital expenditure

- Regulatory challenges

- Dependence on fossil fuels

Opportunities

- Growth in renewable energy sector

- Expansion opportunities in emerging markets

- Technological advancements in energy efficiency

Threats

- Increasing competition

- Regulatory risks

- Economic downturns

The overall SWOT assessment indicates that AEP has a solid foundation and growth potential, particularly in renewable energy. However, investors should remain cautious of regulatory challenges and market competition, which could impact future profitability.

Stock Analysis

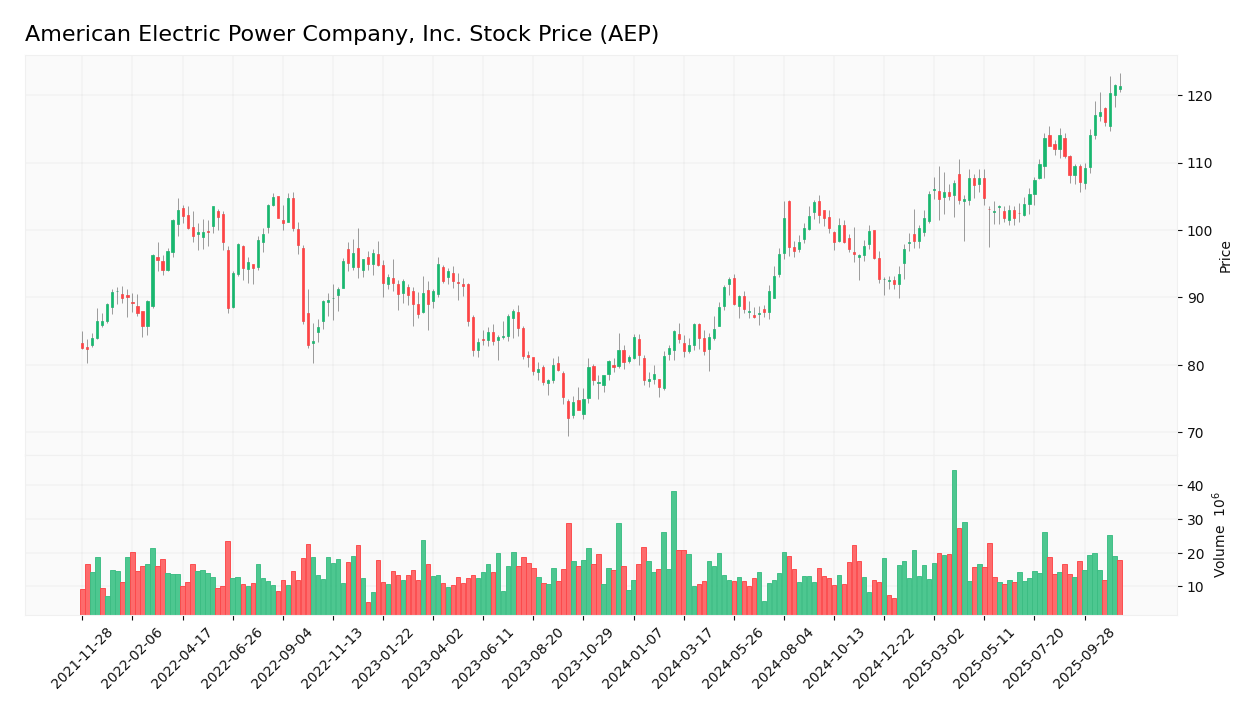

In the past year, American Electric Power Company, Inc. (AEP) has exhibited significant price movements, culminating in a notable bullish trend that reflects strong trading dynamics.

Trend Analysis

Over the past two years, AEP has experienced a price change of +50.91%, indicating a bullish trend. The trend shows acceleration, with a highest price of 121.43 and a lowest price of 76.66. The standard deviation of 10.89 suggests some volatility in the price movements, but overall, the upward trajectory is clear.

Volume Analysis

Analyzing trading volumes over the last three months, AEP has demonstrated a buyer-driven market. The average trading volume has increased to 16.98M, with buy volume averaging 11.99M, representing 70.62% of total volume. This trend further suggests a bullish sentiment among investors, alongside an acceleration in trading activity.

Analyst Opinions

Recent analyst recommendations for American Electric Power Company, Inc. (AEP) indicate a consensus rating of “buy.” Analysts highlight AEP’s strong fundamentals, particularly its return on assets (score of 5) and discounted cash flow score (4). The A- rating reflects confidence in its growth potential, despite a lower debt-to-equity score of 2, suggesting caution regarding leverage. Analysts such as those from major investment firms emphasize the company’s ability to generate consistent returns, making it a favorable addition to investor portfolios.

Stock Grades

Recent evaluations from recognized grading companies indicate a mixed sentiment towards American Electric Power Company, Inc. (AEP). Below is a summary of the latest stock grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Neutral | 2025-10-31 |

| Morgan Stanley | maintain | Overweight | 2025-10-30 |

| Evercore ISI Group | maintain | Outperform | 2025-10-30 |

| Wells Fargo | maintain | Overweight | 2025-10-30 |

| Mizuho | maintain | Neutral | 2025-10-30 |

| BMO Capital | downgrade | Market Perform | 2025-10-30 |

| Scotiabank | maintain | Sector Perform | 2025-10-30 |

| Morgan Stanley | maintain | Overweight | 2025-10-22 |

| Jefferies | maintain | Hold | 2025-10-16 |

| BMO Capital | maintain | Outperform | 2025-10-16 |

Overall, the trend shows a consistent maintenance of grades with a notable downgrade from BMO Capital. Despite this, several firms continue to express confidence in AEP’s performance, especially with multiple “Overweight” ratings indicating a positive outlook from key analysts.

Target Prices

The consensus among analysts for American Electric Power Company, Inc. (AEP) indicates a positive outlook for the stock.

| Target High | Target Low | Consensus |

|---|---|---|

| 138 | 116 | 126.1 |

Overall, analysts expect AEP to perform within a range of 116 to 138, with a consensus target of 126.1, reflecting confidence in the company’s growth potential.

Consumer Opinions

Consumer sentiment regarding American Electric Power Company, Inc. (AEP) reveals a mix of satisfaction and concern among its users.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable power supply during storms. | High electricity rates compared to peers. |

| Responsive customer service. | Frequent outages in rural areas. |

| Commitment to renewable energy initiatives. | Slow response to service complaints. |

Overall, consumer feedback highlights AEP’s reliability and customer service as strengths, while high rates and service issues in certain areas are recurring weaknesses.

Risk Analysis

In evaluating American Electric Power Company, Inc. (AEP), it’s critical to understand the potential risks that could impact its performance. Below is a summarized table of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in energy regulations affecting operational costs. | High | High |

| Market Risk | Fluctuations in energy prices impacting revenue. | Medium | High |

| Environmental Risk | Stricter environmental regulations could increase compliance costs. | Medium | Medium |

| Technological Risk | Rapid advancements in renewable energy technologies may outpace AEP’s capabilities. | Medium | High |

| Cybersecurity Risk | Potential cyber threats to infrastructure and data security. | High | High |

In summary, the most pressing risks for AEP are regulatory and cybersecurity, both of which pose significant threats to operations and financial stability.

Should You Buy American Electric Power Company, Inc.?

American Electric Power Company, Inc. (AEP) has showcased a solid financial performance with a net margin of 14.9%, a return on invested capital (ROIC) exceeding its weighted average cost of capital (WACC) at 5.5%, and a positive long-term trend. The company benefits from strong operational efficiency and a growing customer base but faces risks from competition and regulatory changes.

Based on the current net margin of 14.9% and a favorable ROIC compared to WACC, along with a positive long-term trend and strong buyer volumes, I believe it appears favorable for long-term investors. AEP looks like a solid addition to a long-term investment strategy, especially given its consistent revenue growth and market presence.

However, it’s important to remain cautious due to potential risks associated with competition and market dependency. As always, keep an eye on overall market conditions that could impact the utility sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Will American Electric Power Company Inc. (AEP) stock sustain uptrend momentum – Quarterly Portfolio Report & Free Community Supported Trade Ideas – newser.com (Nov 16, 2025)

- Boston Partners Reduces Stock Position in American Electric Power Company, Inc. $AEP – MarketBeat (Nov 16, 2025)

- How American Electric Power Company Inc. (AEP) stock trades pre earnings – M&A Rumor & Growth Oriented Trade Recommendations – newser.com (Nov 16, 2025)

- Empower Advisory Group LLC Raises Holdings in American Electric Power Company, Inc. $AEP – MarketBeat (Nov 16, 2025)

- How American Electric Power Company Inc. (AEP) stock trades pre earnings – Analyst Upgrade & Smart Allocation Stock Tips – newser.com (Nov 16, 2025)

For more information about American Electric Power Company, Inc., please visit the official website: aep.com