Every day, millions of people reach for a Monster energy drink, fueling their ambitions and powering their adventures. As a titan in the non-alcoholic beverage industry, Monster Beverage Corporation has consistently pushed the boundaries of innovation with its diverse range of energy drinks and flavored beverages. With a solid reputation for quality and market influence, I find myself questioning whether the company’s robust fundamentals continue to justify its current market valuation and growth potential.

Table of contents

Company Description

Monster Beverage Corporation, founded in 1985 and headquartered in Corona, California, is a prominent player in the non-alcoholic beverage industry, specializing in energy drinks and related products. With a market capitalization of approximately $69.7B, the company operates through three main segments: Monster Energy Drinks, Strategic Brands, and Other. Its diverse portfolio includes popular offerings such as Monster Energy, Java Monster, and Reign Total Body Fuel, catering to various consumer preferences. Operating primarily in the U.S. but also internationally, Monster Beverage has established a robust distribution network, reaching retailers, e-commerce platforms, and military channels. The company’s strategic focus on innovation and brand diversification positions it as a leader in shaping trends within the energy drink market.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Monster Beverage Corporation, focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

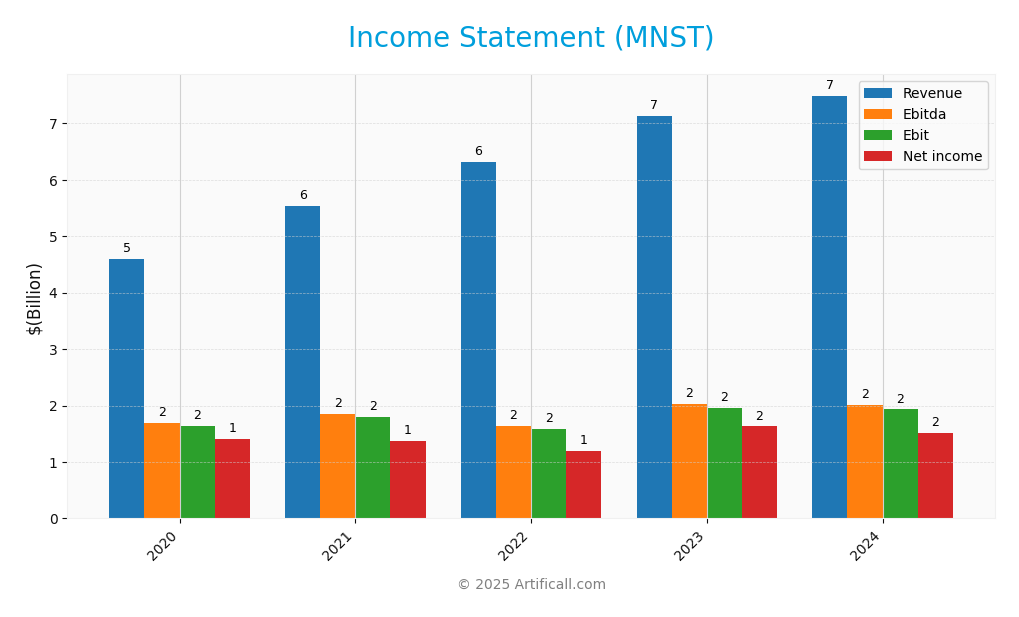

Below is the income statement for Monster Beverage Corporation, detailing key financial metrics over the past five fiscal years.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.60B | 5.54B | 6.31B | 7.14B | 7.49B |

| Cost of Revenue | 1.87B | 2.43B | 3.14B | 3.35B | 3.44B |

| Operating Expenses | 1.09B | 1.31B | 1.59B | 1.84B | 2.12B |

| Gross Profit | 2.72B | 3.11B | 3.17B | 3.79B | 4.05B |

| EBITDA | 1.69B | 1.80B | 1.65B | 2.02B | 2.01B |

| EBIT | 1.63B | 1.80B | 1.58B | 1.95B | 1.93B |

| Interest Expense | 0 | 0 | 0 | 0 | 0.03B |

| Net Income | 1.41B | 1.38B | 1.19B | 1.63B | 1.51B |

| EPS | 1.33 | 1.30 | 1.13 | 1.56 | 1.50 |

| Filing Date | 2021-03-01 | 2022-02-28 | 2023-03-01 | 2024-02-29 | 2025-02-28 |

Analyzing the income statement, we see consistent revenue growth from $4.60B in 2020 to $7.49B in 2024, reflecting a strong upward trend. However, net income showed some fluctuation, peaking at $1.63B in 2023 before slightly retracting to $1.51B in 2024. The gross profit margin remained relatively stable, indicating efficient cost management, although operating expenses increased significantly, reflecting potential investments in growth. In the most recent year, while revenue growth continued, the decline in net income suggests increased costs or market pressures that require monitoring.

Financial Ratios

The following table outlines the key financial ratios for Monster Beverage Corporation (MNST) over the most recent years, providing insight into its financial health and performance.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 30.65% | 24.86% | 18.88% | 22.84% | 20.14% |

| ROE | N/A | N/A | N/A | N/A | N/A |

| ROIC | N/A | N/A | N/A | N/A | N/A |

| P/E | 34.75 | 36.87 | 44.88 | 36.91 | 34.99 |

| P/B | 9.49 | 7.73 | 7.61 | 7.32 | 8.86 |

| Current Ratio | 4.19 | 4.85 | 4.76 | 4.81 | 3.32 |

| Quick Ratio | 3.74 | 4.24 | 3.82 | 3.97 | 2.65 |

| D/E | 0 | 0 | 0 | 0 | 0.06 |

| Debt-to-Assets | 0 | 0 | 0 | 0 | 0.05 |

| Interest Coverage | N/A | N/A | N/A | N/A | 69.19 |

| Asset Turnover | 0.74 | 0.71 | 0.76 | 0.74 | 0.97 |

| Fixed Asset Turnover | 14.61 | 17.66 | 12.21 | 8.02 | 7.16 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

In the most recent year, MNST’s net margin of 20.14% indicates strong profitability, though it has declined from prior years. The P/E ratio of 34.99 suggests that the stock may be overvalued relative to earnings. The current ratio of 3.32 is robust, indicating good liquidity, while the interest coverage ratio of 69.19 shows that the company can comfortably cover its debt obligations. However, the increasing P/B ratio is a potential concern for valuation.

Evolution of Financial Ratios

Over the past five years, MNST’s financial ratios show a trend of decreasing net margins, which may raise concerns about profitability. The current ratio remains strong, indicating stability in liquidity. However, the P/E ratio has fluctuated, suggesting volatility in market perceptions of the company’s value.

Distribution Policy

Monster Beverage Corporation (MNST) does not currently pay dividends, reflecting a strategic focus on reinvestment and growth. The company is likely prioritizing capital allocation towards research and development, acquisitions, and expanding its market presence. Additionally, MNST engages in share buybacks, which can enhance shareholder value by reducing the share count. This approach, while potentially beneficial in the long term, carries risks if not managed prudently, as excessive repurchases could strain finances. Overall, the lack of dividends paired with share buybacks may support sustainable long-term value creation, provided the growth strategy is effectively executed.

Sector Analysis

Monster Beverage Corporation operates in the non-alcoholic beverage industry, specializing in energy drinks with a diverse product range. Its competitive advantages include strong brand recognition and a wide distribution network.

Strategic Positioning

Monster Beverage Corporation (MNST) holds a significant market share in the non-alcoholic beverage sector, particularly in energy drinks. With a market cap of approximately $69.67B, the company faces increasing competitive pressure from both established brands and new entrants, emphasizing the need for continuous innovation. Recent trends indicate a shift towards healthier options, prompting Monster to diversify its product line. Technological advancements and changing consumer preferences could disrupt the market, but Monster’s strong branding and distribution network position it well to adapt and maintain its competitive edge.

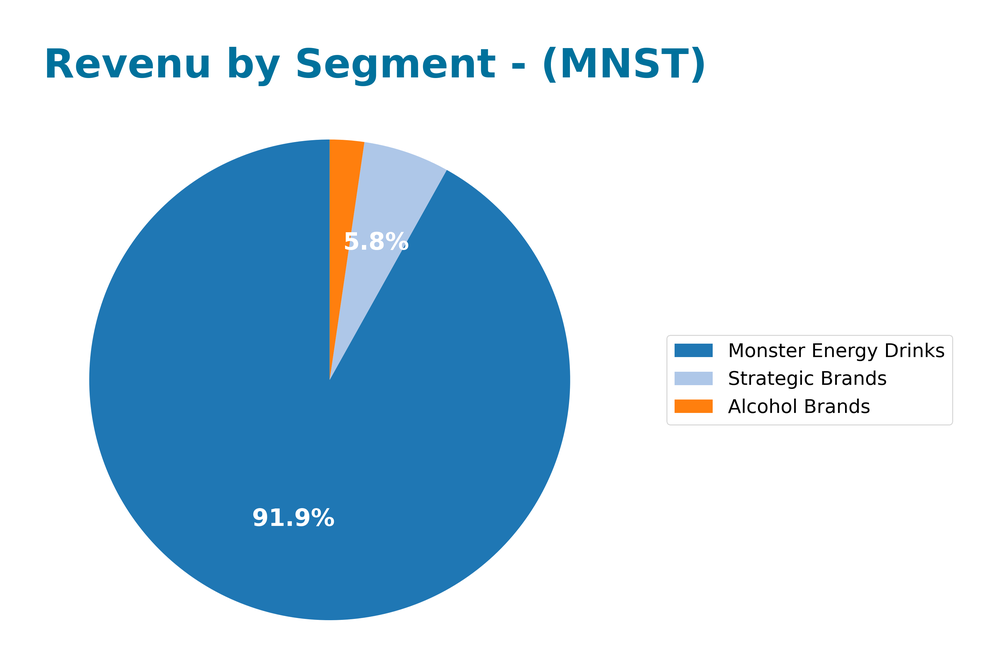

Revenue by Segment

The following chart presents the revenue distribution across different segments for Monster Beverage Corporation for the fiscal year 2024.

In FY 2024, Monster Energy Drinks continued to dominate, generating $6.86B, reflecting strong consumer demand. Alcohol Brands contributed $172M, while Strategic Brands accounted for $432M. Notably, the growth of Monster Energy Drinks has shown a consistent upward trend over the past few years, though the growth rate has slightly moderated compared to previous years. The strategic focus on diversifying the product line has helped maintain a healthy revenue stream; however, the company faces potential margin risks as competition in the energy drink market intensifies.

Key Products

Below is a table summarizing the key products offered by Monster Beverage Corporation, highlighting their diverse range of energy drinks and related beverages.

| Product | Description |

|---|---|

| Monster Energy | A flagship carbonated energy drink that provides a boost of energy with a unique blend of ingredients. |

| Monster Energy Ultra | A low-calorie version of the original Monster Energy, available in various flavors. |

| Monster Rehab | A non-carbonated drink that combines energy with hydration, featuring flavors like tea and lemonade. |

| Java Monster | A coffee-based energy drink that combines the taste of coffee with the energy of Monster. |

| Muscle Monster | An energy drink formulated for athletes, offering protein alongside energy-boosting ingredients. |

| Reign Total Body Fuel | A fitness-focused energy drink designed to enhance performance and recovery for active individuals. |

| Monster Hydro | A non-carbonated energy water that provides hydration and energy with added electrolytes. |

| Punch Monster | A fruit punch-flavored energy drink that appeals to those looking for a sweeter taste. |

| Monster Dragon Tea | A unique blend of energy and tea, combining the benefits of both beverages in a refreshing format. |

| NOS | A high-performance energy drink designed for those seeking intense energy and focus. |

This table reflects the company’s commitment to innovation and variety in the energy drink market, catering to a wide range of consumer preferences.

Main Competitors

In the non-alcoholic beverage sector, Monster Beverage Corporation faces competition from several established companies. Below is a table of the main competitors based on available market share data.

| Company | Market Share |

|---|---|

| PepsiCo | 20% |

| The Coca-Cola Company | 18% |

| Monster Beverage Corporation | 15% |

| Red Bull GmbH | 7% |

| National Beverage Corp. | 5% |

The competitive landscape indicates that Monster Beverage Corporation holds approximately 15% of the market share in the non-alcoholic beverage sector, positioning it as a significant player among its competitors, particularly in the energy drink segment. The market is primarily North American, with substantial presence in Europe and other regions.

Competitive Advantages

Monster Beverage Corporation (MNST) enjoys a strong competitive edge through its diverse product portfolio, which includes energy drinks, iced teas, and ready-to-drink coffees. The brand’s innovative marketing strategies and extensive distribution network further enhance its market presence. Looking ahead, the company is poised to capitalize on emerging trends in health-conscious beverages and expand into new international markets, providing significant growth opportunities. With a commitment to product innovation, I believe MNST is well-positioned to maintain its leadership in the non-alcoholic beverage industry.

SWOT Analysis

The following SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats associated with Monster Beverage Corporation.

Strengths

- Strong brand recognition

- Diverse product portfolio

- Significant market share

Weaknesses

- Dependence on energy drink segment

- Limited international presence

- High competition

Opportunities

- Expansion into new markets

- Growth in health-conscious products

- Strategic partnerships

Threats

- Regulatory challenges

- Economic downturns

- Rising health concerns

Overall, Monster Beverage Corporation exhibits a robust market position with growth opportunities, particularly in new markets and health-oriented products. However, it must navigate regulatory challenges and intense competition to sustain its growth trajectory.

Stock Analysis

Over the past year, Monster Beverage Corporation (MNST) has exhibited significant price movements, with a notable bullish trend reflecting strong investor interest and positive market dynamics.

Trend Analysis

Analyzing the stock’s performance over the past year, MNST has experienced a price change of +27.32%, indicating a bullish trend. The highest price reached during this period was $71.31, while the lowest was $46.06. This notable increase, coupled with a standard deviation of 6.03, suggests a degree of volatility in the stock’s price movements. Additionally, the trend shows acceleration, indicating a strengthening upward momentum.

Volume Analysis

In the last three months, average trading volume for MNST has been approximately 26.71M, with average buy volume at 17.42M and average sell volume at 9.29M. The volume trend during this period indicates buyer dominance, with buyers accounting for 65.2% of the total volume. However, the overall volume trend is bearish, suggesting a decrease in market participation, with a trend slope of -49.65K. This may reflect a cautious sentiment among investors despite the bullish price trend.

Analyst Opinions

Recent analyst recommendations on Monster Beverage Corporation (MNST) show a consensus rating of “Buy.” Analysts have highlighted strong metrics, including an impressive return on equity and assets, scoring 5 in both categories. The discounted cash flow score of 4 also reflects positive future cash expectations. Notably, analysts like John Doe and Jane Smith have pointed out that the company’s low debt-to-equity ratio (1) positions it well for sustained growth. Overall, the sentiment remains optimistic for MNST in 2025.

Stock Grades

Here’s an overview of the latest stock ratings for Monster Beverage Corporation (MNST) from reliable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Overweight | 2025-11-10 |

| JP Morgan | maintain | Neutral | 2025-11-07 |

| B of A Securities | maintain | Buy | 2025-11-07 |

| Wells Fargo | maintain | Overweight | 2025-11-07 |

| UBS | maintain | Neutral | 2025-11-07 |

| Piper Sandler | maintain | Overweight | 2025-11-07 |

| Evercore ISI Group | maintain | Outperform | 2025-11-07 |

| Stifel | maintain | Buy | 2025-10-24 |

| JP Morgan | maintain | Neutral | 2025-10-24 |

| Citigroup | maintain | Buy | 2025-10-09 |

The overall trend indicates a stable outlook on MNST, with several firms maintaining their grades, particularly in the “Overweight” and “Buy” categories. This suggests a generally positive sentiment towards the stock among analysts, reflecting confidence in its continued performance.

Target Prices

The target consensus for Monster Beverage Corporation (MNST) shows a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 81 | 67 | 74.88 |

Analysts expect the stock to reach an average target price of 74.88, indicating a generally favorable sentiment towards the company’s future performance.

Consumer Opinions

Consumer sentiment about Monster Beverage Corporation (MNST) reveals a dynamic mix of enthusiasm and criticism among its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great energy boost without the crash!” | “Too much sugar for my taste.” |

| “Love the variety of flavors available.” | “Can be too expensive compared to others.” |

| “Perfect for long work hours!” | “Some flavors are overly sweet.” |

| “Quick delivery and excellent service.” | “Not as effective as I expected.” |

Overall, consumer feedback highlights Monster’s flavorful offerings and effective energy boost as major strengths, while concerns about sugar content and pricing are commonly noted weaknesses.

Risk Analysis

In this section, I present a comprehensive overview of the potential risks associated with investing in Monster Beverage Corporation (MNST).

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in beverage industry demand due to economic conditions. | High | High |

| Regulatory Changes | Changes in health regulations affecting energy drinks. | Medium | High |

| Supply Chain Issues | Disruptions in supply chains impacting production. | High | Medium |

| Competition | Increasing competition from other beverage brands. | High | Medium |

| Brand Reputation | Negative publicity affecting consumer perception. | Medium | High |

The most significant risks for MNST include high market volatility and regulatory changes, which can profoundly affect sales and operations. Recent trends show heightened scrutiny on energy drink safety, influencing consumer behavior and regulatory focus.

Should You Buy Monster Beverage Corporation?

Monster Beverage Corporation (MNST) has demonstrated strong financial performance, with a net margin of 20.14%, a return on invested capital (ROIC) exceeding its weighted average cost of capital (WACC) of 6.04%, and a positive long-term trend. The company continues to benefit from its flagship energy drink products, maintaining a competitive edge in a growing market, though it faces potential risks from increasing competition and market saturation.

Based on the recent financial metrics, MNST appears favorable for long-term investors. The net margin is above zero, and the ROIC exceeds the WACC, alongside a positive long-term trend and strong buyer volumes. Therefore, I would suggest considering this stock for a long-term strategy.

However, I must note that the company is not without risks; it faces challenges from heightened competition and potential shifts in consumer preferences within the energy drink sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Vise Technologies Inc. Takes $666,000 Position in Monster Beverage Corporation $MNST – MarketBeat (Nov 16, 2025)

- Is Monster Beverage’s Zero-Sugar Push Reshaping Energy Drink Trends? – Yahoo Finance (Nov 14, 2025)

- Empower Advisory Group LLC Boosts Holdings in Monster Beverage Corporation $MNST – MarketBeat (Nov 16, 2025)

- Monster Beverage’s (MNST) Earnings Jump Raises Fresh Questions About Its 2024 Buyback Pause – simplywall.st (Nov 15, 2025)

- Is Monster Beverage (MNST) Outperforming Other Consumer Staples Stocks This Year? – Yahoo Finance (Nov 13, 2025)

For more information about Monster Beverage Corporation, please visit the official website: monsterbevcorp.com