In a world where snacking has become an integral part of our daily routines, Mondelez International, Inc. crafts moments of joy through its beloved brands like Oreo and Cadbury. This food confectioner not only leads the global market with a diverse portfolio of indulgent products but also champions innovation in the snack industry. As we analyze Mondelez’s current market position, we must consider whether its robust fundamentals and growth potential continue to justify its market valuation.

Table of contents

Company Description

Mondelez International, Inc. is a leading player in the global snack food industry, specializing in the manufacture and marketing of a diverse array of products, including biscuits, chocolates, and candies. Founded in 2000 and headquartered in Chicago, Illinois, the company operates across Latin America, North America, Asia, the Middle East, Africa, and Europe. Its well-known brands, such as Oreo, Cadbury, and Trident, reflect its strength in both the sweet and savory snack segments. With a workforce of approximately 90K employees, Mondelez employs a multi-channel distribution strategy, utilizing direct store delivery, e-commerce, and various retail outlets. The company’s commitment to innovation and sustainability positions it as a pivotal player in shaping the future of the food industry.

Fundamental Analysis

In this section, I will analyze Mondelez International, Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and performance.

Income Statement

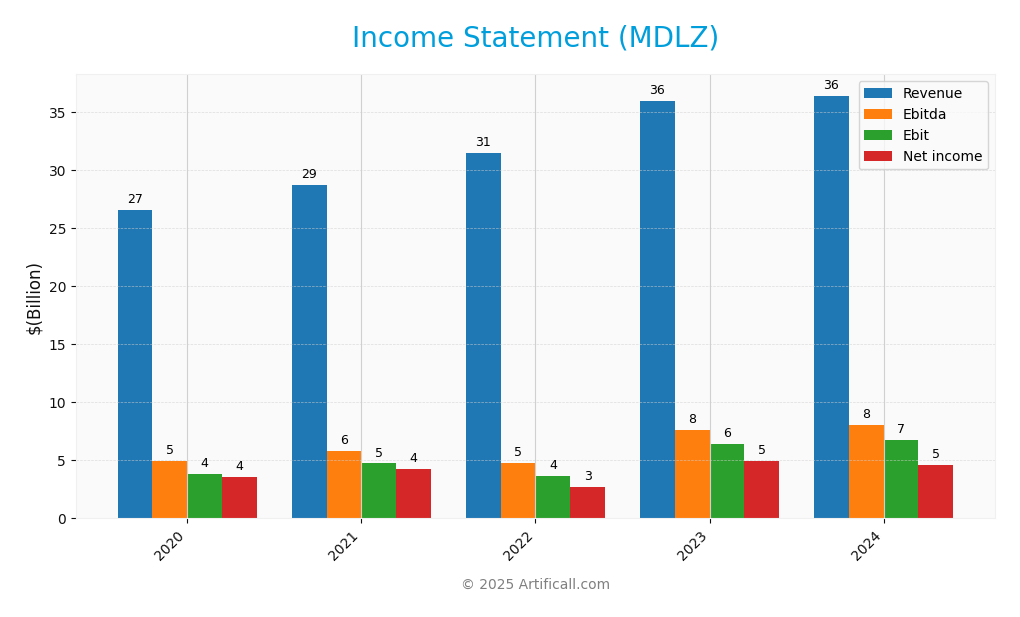

Below is the Income Statement for Mondelez International, Inc. (MDLZ) over the last five fiscal years, illustrating the company’s financial performance and profitability trends.

| Income Statement Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 26.58B | 28.72B | 31.50B | 36.02B | 36.44B |

| Cost of Revenue | 16.14B | 17.47B | 20.18B | 22.25B | 22.18B |

| Operating Expenses | 6.59B | 6.60B | 7.78B | 8.26B | 7.91B |

| Gross Profit | 10.45B | 11.25B | 11.31B | 13.76B | 14.26B |

| EBITDA | 4.92B | 5.85B | 4.76B | 7.65B | 8.07B |

| EBIT | 3.81B | 4.73B | 3.66B | 6.43B | 6.77B |

| Interest Expense | 0.42B | 0.37B | 0.43B | 0.55B | 0.51B |

| Net Income | 3.56B | 4.30B | 2.72B | 4.96B | 4.61B |

| EPS | 2.47 | 3.06 | 1.97 | 3.64 | 3.44 |

| Filing Date | 2021-02-05 | 2022-02-04 | 2023-02-03 | 2024-02-02 | 2025-02-05 |

Over the five-year period, MDLZ has shown a steady increase in Revenue, growing from 26.58B in 2020 to 36.44B in 2024. Net Income also reflects this growth, albeit with some fluctuations, peaking at 4.96B in 2023 before slightly declining to 4.61B in 2024. Margins have remained relatively stable, with slight improvements in Gross Profit and EBITDA margins in the most recent year. However, the reduction in Net Income in 2024 suggests potential challenges in managing operating expenses or interest costs, warranting further examination for investors.

Financial Ratios

The table below summarizes the key financial ratios for Mondelez International, Inc. (MDLZ) over the past five years.

| Financial Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 13.37% | 14.97% | 8.63% | 13.77% | 12.65% |

| ROE | 14.32% | 15.69% | 10.03% | 12.36% | 11.79% |

| ROIC | 11.02% | 11.56% | 8.54% | 9.72% | 9.45% |

| P/E | 23.54 | 21.64 | 33.80 | 19.91 | 17.37 |

| P/B | 3.03 | 3.29 | 3.42 | 3.48 | 2.97 |

| Current Ratio | 0.66 | 0.74 | 0.60 | 0.62 | 0.68 |

| Quick Ratio | 0.48 | 0.54 | 0.40 | 0.43 | 0.48 |

| D/E | 0.74 | 0.71 | 0.88 | 0.70 | 0.68 |

| Debt-to-Assets | 30.25% | 29.77% | 33.08% | 27.94% | 26.82% |

| Interest Coverage | 9.11 | 12.75 | 8.26 | 10.00 | 12.49 |

| Asset Turnover | 0.39 | 0.43 | 0.44 | 0.50 | 0.53 |

| Fixed Asset Turnover | 2.75 | 3.10 | 3.25 | 3.47 | 3.56 |

| Dividend Yield | 2.00% | 1.96% | 2.16% | 2.19% | 2.93% |

Interpretation of Financial Ratios

The most recent year’s ratios indicate a mix of strengths and weaknesses. The net margin of 12.65% indicates a healthy profitability level, while the P/E ratio of 17.37 suggests the stock may be attractively valued. However, the current ratio of 0.68 raises concerns about short-term liquidity, and the decreasing ROE trend may signal potential efficiency issues.

Evolution of Financial Ratios

Over the past five years, MDLZ’s financial ratios have shown mixed trends. While profitability ratios like net margin and ROIC have varied, liquidity ratios remain low, indicating a consistent challenge. The P/E ratio has improved significantly, suggesting a favorable market perception despite fluctuating performance metrics.

Distribution Policy

Mondelez International, Inc. (MDLZ) demonstrates a commitment to returning value to shareholders through dividends, with a payout ratio of 50.9% and a dividend yield of approximately 2.93%. The company has consistently increased its dividend per share, reflecting a stable cash flow position, supported by a free cash flow coverage ratio of 1.31. Additionally, MDLZ engages in share buybacks, which can enhance shareholder value but may pose risks if not managed prudently. Overall, this balanced distribution strategy appears to support sustainable long-term value creation for shareholders.

Sector Analysis

Mondelez International, Inc. operates in the Food Confectioners industry, offering a diverse range of snack products, including well-known brands like Oreo and Cadbury, while facing competition from peers such as Nestlé and Hershey.

Strategic Positioning

Mondelez International, Inc. (MDLZ) holds a significant market share in the global snack food industry, particularly in biscuits and chocolate, where it competes with established brands like Nestlé and Mars. With a market cap of approximately $73.4B, MDLZ faces competitive pressure from both traditional and emerging players, especially as consumer preferences shift towards healthier options. Additionally, the rise of e-commerce has disrupted traditional distribution channels, necessitating strategic adaptations. The company’s strong brand portfolio, including Oreo and Cadbury, positions it well to navigate these challenges while leveraging technological advancements in production and distribution.

Revenue by Segment

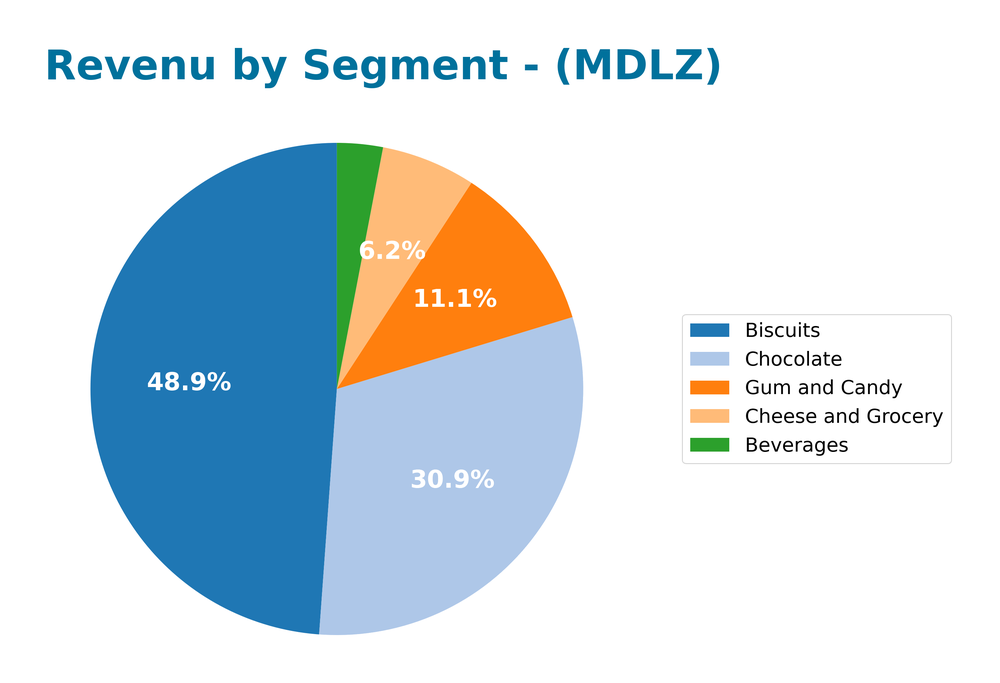

The following chart illustrates Mondelez International’s revenue distribution by segment for the fiscal year ending December 31, 2024.

In 2024, Mondelez’s revenue showcased significant contributions from Biscuits, generating 17.8B, followed by Chocolate at 11.2B. While the revenue from Beverages decreased slightly to 1.1B, the Cheese and Grocery segment saw a modest increase to 2.3B, indicating a stable demand. The Gum and Candy segment also declined to 4B. Overall, while the Biscuits segment continues to drive growth, the slowing revenue in Beverages and Gum and Candy introduces potential margin risks and suggests a need for strategic focus on revitalizing these areas.

Key Products

Mondelez International, Inc. offers a diverse range of snack food and beverage products globally. Below is a table highlighting some of their key products:

| Product | Description |

|---|---|

| Oreo | A popular cream-filled cookie that comes in various flavors and is a staple in many households. |

| Cadbury Chocolate | A well-known brand of chocolate, offering a variety of bars and seasonal products. |

| belVita | Breakfast biscuits designed to provide sustained energy throughout the morning. |

| Trident Gum | A range of sugar-free chewing gum known for its long-lasting flavor. |

| Halls | A brand of cough drops that also offers varieties with menthol and other soothing ingredients. |

| Tang | A powdered beverage mix that can be reconstituted with water, available in multiple flavors. |

| Milka | A chocolate brand famous for its creamy texture and Alpine milk content. |

| Toblerone | A triangular chocolate bar filled with nougat, almond, and honey, often associated with gifts. |

These products exemplify Mondelez’s commitment to providing a wide variety of tasty and convenient snack options for consumers worldwide.

Main Competitors

In the competitive landscape of the food confectionery industry, Mondelez International, Inc. (MDLZ) faces several well-established players. Here’s a summary of its main competitors based on verified data:

| Company | Market Share |

|---|---|

| Nestlé S.A. | 12% |

| The Hershey Company | 10% |

| Mars, Incorporated | 9% |

| Mondelez International, Inc. | 8% |

Mondelez International holds a significant position in the global food confectionery market, with a market share of approximately 8%. Competing primarily in regions such as North America, Europe, and parts of Asia, it faces strong competition from major brands like Nestlé, Hershey, and Mars, all of which command larger market shares.

Competitive Advantages

Mondelez International, Inc. (MDLZ) possesses significant competitive advantages, primarily due to its diverse and well-established brand portfolio, which includes iconic names like Oreo, Cadbury, and Toblerone. The company’s global reach across multiple markets positions it favorably to capitalize on emerging trends in snacking and health-conscious products. Looking ahead, Mondelez’s focus on innovation, such as introducing new flavors and healthier options, combined with its robust e-commerce strategy, presents substantial growth opportunities. Additionally, ongoing expansion into developing markets can further enhance its market share and profitability.

SWOT Analysis

This analysis provides a clear overview of Mondelēz International, Inc.’s current strategic position by identifying its strengths, weaknesses, opportunities, and threats.

Strengths

- Strong brand portfolio

- Global market presence

- Diverse product offerings

Weaknesses

- High competition in the food sector

- Dependence on commodity prices

- Limited presence in health-focused snacks

Opportunities

- Expansion in emerging markets

- Growth in e-commerce

- Increasing demand for healthier snacks

Threats

- Economic downturns affecting consumer spending

- Regulatory changes

- Supply chain disruptions

Overall, Mondelēz International, Inc. possesses significant strengths and opportunities that can drive growth. However, it must address its weaknesses and stay vigilant against external threats to maintain its competitive edge and achieve sustainable success.

Stock Analysis

Over the past year, Mondelez International, Inc. (MDLZ) has experienced notable fluctuations in its stock price, culminating in significant movements that indicate a bearish sentiment in the market.

Trend Analysis

Analyzing the stock’s performance over the past year, the percentage change stands at -20.15%. This indicates a bearish trend, as the stock has lost value significantly over this period. The highest price reached was 76.87, while the lowest was 56.25, showing a notable range. The trend is currently characterized by deceleration, suggesting that the rate of decline is slowing down. Additionally, the standard deviation of 4.82 points to a moderate level of volatility in the stock’s price movements.

Volume Analysis

In the last three months, MDLZ’s trading volume has averaged approximately 39.20M shares. Despite this high volume, the activity has been predominantly seller-driven, with an average sell volume of about 24.98M shares compared to an average buy volume of 14.22M shares, indicating a seller-dominant market sentiment. However, the volume trend shows bullish characteristics with a trend slope of 1.71M, suggesting a growing interest in trading, albeit primarily from sellers. This scenario reflects cautious investor participation amid the stock’s recent decline.

Analyst Opinions

Recent analyst recommendations for Mondelez International, Inc. (MDLZ) indicate a consensus rating of “Buy.” Analysts have highlighted its strong discounted cash flow score of 5 and solid return on equity and assets scores of 4, suggesting robust financial health. However, concerns regarding its debt-to-equity ratio, which scored a 1, were noted by some analysts. The current ratings reflect a positive outlook, with a B+ rating from leading analysts, indicating confidence in the company’s growth potential for 2025.

Stock Grades

The latest stock ratings for Mondelez International, Inc. (MDLZ) indicate a generally stable outlook, with several firms maintaining their previous grades.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | maintain | Neutral | 2025-11-10 |

| Barclays | maintain | Overweight | 2025-10-30 |

| JP Morgan | maintain | Overweight | 2025-10-29 |

| Bernstein | maintain | Outperform | 2025-10-29 |

| Stifel | maintain | Buy | 2025-10-29 |

| B of A Securities | maintain | Buy | 2025-10-29 |

| Mizuho | maintain | Outperform | 2025-10-29 |

| RBC Capital | maintain | Outperform | 2025-10-29 |

| Piper Sandler | maintain | Neutral | 2025-10-29 |

| Wells Fargo | maintain | Overweight | 2025-10-29 |

Overall, the trend shows that analysts are maintaining their ratings, with a significant number of firms rating MDLZ as “Overweight” or “Outperform.” This indicates a positive sentiment towards the stock’s performance in the near term, even as some maintain a neutral outlook.

Target Prices

The consensus target price for Mondelez International, Inc. (MDLZ) indicates a balanced outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 84 | 63 | 69.82 |

Analysts suggest a potential upside for MDLZ, with a consensus target price reflecting moderate expectations in the near term.

Consumer Opinions

Consumer sentiment surrounding Mondelez International, Inc. (MDLZ) reflects a blend of satisfaction and concerns, illustrating the diverse perspectives of its customer base.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent variety of snacks, always fresh.” | “Prices have increased significantly.” |

| “Love the new flavors introduced this year!” | “Packaging is not environmentally friendly.” |

| “Quick delivery and great customer service.” | “Some products are too sweet for my taste.” |

Overall, consumer feedback indicates that while Mondelez excels in product variety and freshness, concerns about pricing and sustainability in packaging persist.

Risk Analysis

In assessing the investment potential of Mondelez International, Inc. (MDLZ), it’s essential to consider various risks that could affect performance. Below is a summary of key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in consumer demand and commodity prices | High | High |

| Regulatory Changes | Changes in food safety regulations | Medium | High |

| Supply Chain Issues | Disruptions due to geopolitical tensions | Medium | Medium |

| Currency Risks | Foreign exchange fluctuations affecting profits | High | Medium |

| Competitive Pressure | Increased competition from private labels | Medium | Medium |

The most pressing risks for MDLZ include market volatility, with consumer trends shifting rapidly, and regulatory changes, as the food industry is under constant scrutiny. These factors could significantly impact profitability in the coming periods.

Should You Buy Mondelez International, Inc.?

Mondelez International, Inc. (MDLZ) has shown a robust net margin of 12.65% and a solid return on invested capital (ROIC) of 6.79%, which exceeds its weighted average cost of capital (WACC) of 5.08%. The company benefits from strong brand recognition and a diverse product portfolio, although it faces risks from increasing competition and supply chain challenges.

Given the current analysis, Mondelez appears favorable for long-term investors. The positive long-term trend, combined with buyer volumes, suggests that now could be a suitable time to add this stock to your portfolio for those with a long-term strategy.

However, it is essential to note that risks such as competition and potential valuation concerns could impact future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Mondelez International, Inc. $MDLZ Shares Sold by Lindsell Train Ltd – MarketBeat (Nov 16, 2025)

- Mondelez (MDLZ) Target Lowered to $62 as Analyst Maintains Neutral Stance – Yahoo! Finance Canada (Nov 16, 2025)

- Mondelez (MDLZ) Target Lowered to $62 as Analyst Maintains Neutral Stance – Insider Monkey (Nov 16, 2025)

- Massachusetts Financial Services Co. MA Sells 1,581,428 Shares of Mondelez International, Inc. $MDLZ – MarketBeat (Nov 16, 2025)

- Mondelez International (MDLZ) Slid in Q3 Due to Management’s Cautious Commentary – Yahoo Finance (Nov 12, 2025)

For more information about Mondelez International, Inc., please visit the official website: mondelezinternational.com