In a world increasingly driven by technology, Marvell Technology, Inc. is at the forefront of the semiconductor revolution, enabling seamless connectivity and data processing that enhances our daily lives. Renowned for its innovative Ethernet solutions and cutting-edge storage products, Marvell’s influence resonates across various industries, solidifying its reputation as a market leader. As we analyze the company’s current standing, the pressing question arises: do Marvell’s robust fundamentals still justify its market valuation and growth potential in an ever-evolving landscape?

Table of contents

Company Description

Marvell Technology, Inc. (NASDAQ: MRVL), founded in 1995 and headquartered in Wilmington, Delaware, is a prominent player in the semiconductor industry. The company specializes in designing and manufacturing a diverse range of integrated circuits, including Ethernet solutions, storage controllers, and application processors. With operations spanning across major markets such as the U.S., China, and Taiwan, Marvell distinguishes itself as a leader in advanced networking and data storage technologies. Employing over 7,000 professionals, Marvell’s commitment to innovation and its robust portfolio positions it strategically in an evolving tech ecosystem, ultimately shaping the future of connectivity and storage solutions.

Fundamental Analysis

In this section, I will analyze Marvell Technology, Inc.’s fundamental aspects, focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

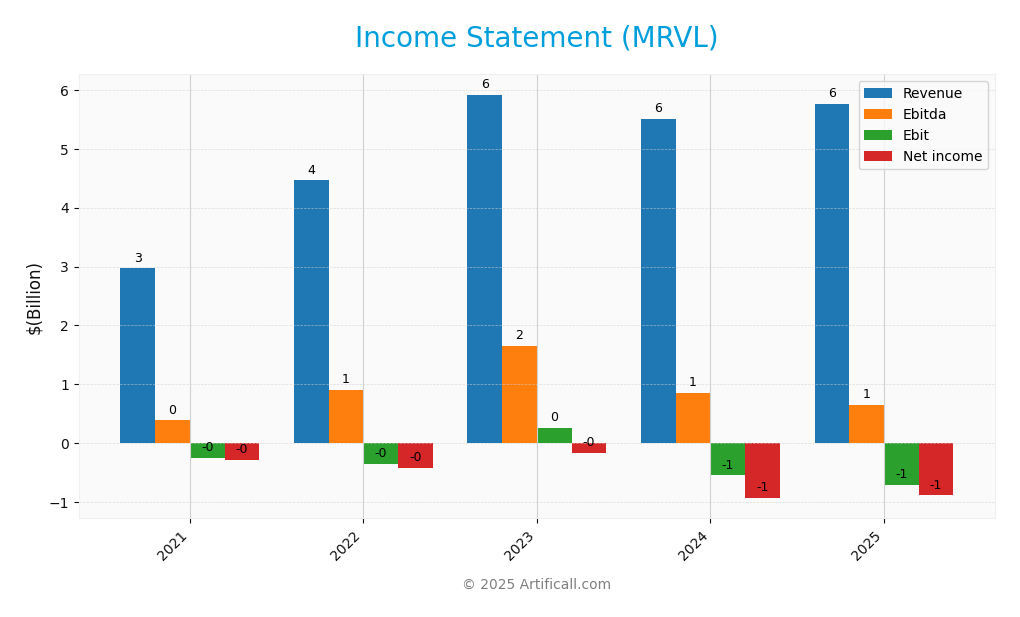

The following table summarizes the income statement for Marvell Technology, Inc. over the last five fiscal years, providing insights into revenue, costs, and profitability.

| Item | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 2.97B | 4.46B | 5.92B | 5.51B | 5.77B |

| Cost of Revenue | 1.48B | 2.40B | 2.93B | 3.21B | 3.39B |

| Operating Expenses | 1.75B | 2.41B | 2.75B | 2.86B | 3.10B |

| Gross Profit | 1.49B | 2.06B | 2.99B | 2.29B | 2.38B |

| EBITDA | 389M | 901M | 1.65B | 851M | 652M |

| EBIT | -253M | -344M | 256M | -547M | -705M |

| Interest Expense | 67M | 139M | 171M | 212M | 189M |

| Net Income | -277M | -421M | -164M | -933M | -885M |

| EPS | -0.41 | -0.53 | -0.19 | -1.08 | -1.02 |

| Filing Date | 2021-01-31 | 2022-01-31 | 2023-01-31 | 2024-01-31 | 2025-01-31 |

Over the five-year period, Marvell’s revenue has shown a general upward trend, peaking in 2023 at 5.92B, before experiencing a slight decrease in the following years. Net income, however, has consistently remained negative, indicating ongoing challenges in profitability. The gross profit margin has fluctuated, with a notable dip in 2024; however, the gross profit rebounded slightly in 2025. In the most recent fiscal year, 2025, while revenue increased to 5.77B, the company reported a significant net loss of 885M. This highlights the importance of assessing cost management and operational efficiency moving forward, particularly as margins have not improved despite higher sales.

Financial Ratios

The following table summarizes the key financial ratios for Marvell Technology, Inc. (MRVL) over the last five available fiscal years.

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -9.34% | -9.43% | -2.76% | -16.95% | -15.35% |

| ROE | -3.29% | -4.10% | -1.05% | -9.99% | -9.22% |

| ROIC | -2.87% | -3.04% | -0.91% | -8.57% | -7.85% |

| P/E | -127.51 | -135.14 | -224.70 | -62.47 | -110.37 |

| P/B | 4.19 | 3.62 | 2.35 | 3.93 | 7.27 |

| Current Ratio | 1.50 | 1.80 | 1.37 | 1.69 | 1.54 |

| Quick Ratio | 1.25 | 1.28 | 0.93 | 1.21 | 1.03 |

| D/E | 0.16 | 0.30 | 0.30 | 0.30 | 0.32 |

| Debt-to-Assets | 0.12 | 0.21 | 0.21 | 0.21 | 0.21 |

| Interest Coverage | -3.73 | -2.50 | 1.40 | -2.68 | -3.80 |

| Asset Turnover | 0.28 | 0.20 | 0.26 | 0.26 | 0.29 |

| Fixed Asset Turnover | 6.94 | 7.38 | 7.51 | 5.74 | 5.56 |

| Dividend Yield | 0.45% | 0.34% | 0.56% | 0.35% | 0.21% |

Interpretation of Financial Ratios

In the most recent year, MRVL’s financial ratios indicate significant challenges. The negative net margin (-15.35%) and poor interest coverage (-3.80) raise concerns about profitability and debt management. The P/E ratio remains negative, suggesting a lack of earnings. On a positive note, the current and quick ratios are above 1, indicating adequate liquidity. However, the rising P/B ratio could signify overvaluation.

Evolution of Financial Ratios

Over the past five years, MRVL’s financial ratios have displayed a downward trend in profitability, with net margins deteriorating from -9.34% in 2021 to -15.35% in 2025. Liquidity ratios have remained stable, but the increasing P/B ratio suggests potential overvaluation amidst declining performance metrics.

Distribution Policy

Marvell Technology, Inc. (MRVL) does not currently pay dividends, reflecting its focus on reinvestment and expansion during a high-growth phase. The company’s negative net income suggests that retaining earnings is crucial for funding operations and potential acquisitions. Notably, Marvell engages in share buybacks, which can enhance shareholder value by reducing share dilution. Assessing these strategies, it appears that Marvell’s approach prioritizes long-term value creation, although it carries inherent risks associated with growth and profitability.

Sector Analysis

Marvell Technology, Inc. operates in the semiconductor industry, offering a diverse portfolio of integrated circuits and Ethernet solutions while facing competition from major players like Intel and Nvidia.

Strategic Positioning

Marvell Technology, Inc. (MRVL) holds a competitive position in the semiconductor industry, boasting a market capitalization of approximately 74.54B. The company’s key products, particularly its Ethernet solutions and storage controllers, account for a significant share of the market, though it faces competitive pressure from established players like Intel and AMD. Benchmarking against peers reveals a robust technological portfolio, yet the rapid pace of innovation and potential disruptions from emerging technologies necessitate continuous adaptation. With a beta of 1.925, MRVL exhibits higher volatility, which investors should consider when assessing risk.

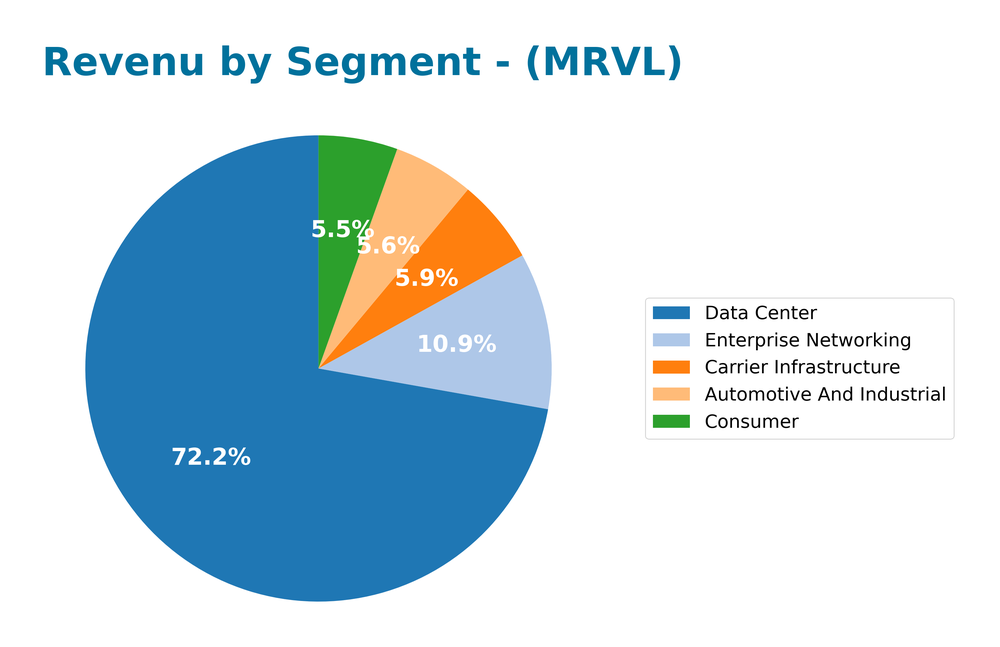

Revenue by Segment

The following chart illustrates Marvell Technology, Inc.’s revenue segmentation for the fiscal year 2025, highlighting the performance of various business segments.

In FY 2025, the Data Center segment continues to dominate with revenues of 4.16B, significantly outpacing other segments. Enterprise Networking follows at 626M, while Carrier Infrastructure and Consumer segments generate 338.2M and 316.1M, respectively. Notably, Automotive and Industrial revenues have decreased to 322.4M compared to FY 2024. Overall, while the Data Center segment’s growth remains robust, the slowdown in Automotive and Industrial reflects potential concentration risks and necessitates careful monitoring of market dynamics moving forward.

Key Products

Marvell Technology, Inc. offers a diverse range of innovative products within the semiconductor industry. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| Ethernet Controllers | High-performance controllers for networking applications, enabling efficient data transfer and connectivity. |

| Network Adapters | Devices that facilitate network connections, supporting various standards for seamless integration. |

| Physical Transceivers | Components that convert electrical signals to optical signals and vice versa, crucial for data transmission in networks. |

| ASIC Solutions | Custom-designed integrated circuits tailored for specific applications, enhancing performance and efficiency. |

| Storage Controllers | Controllers designed for hard disk drives (HDD) and solid-state drives (SSD), supporting multiple host interfaces. |

| NVMe over Fabrics Products | Solutions that optimize storage performance and connectivity in data centers, leveraging NVMe technology. |

| Fiber Channel Products | Components including host bus adapters and controllers, ensuring robust connectivity for server and storage systems. |

| System-on-a-Chip Products | Integrated circuits that combine multiple functions into a single chip, streamlining design and manufacturing processes. |

These products reflect Marvell’s commitment to delivering cutting-edge technology solutions that cater to the evolving demands of the market.

Main Competitors

No verified competitors were identified from available data. However, Marvell Technology, Inc. (MRVL) operates in the highly competitive semiconductor sector, which is characterized by rapid technological advancements and significant investment in research and development. The company holds a notable market share, primarily in North America and Asia, indicating a strong competitive position in the industry.

Competitive Advantages

Marvell Technology, Inc. (MRVL) boasts strong competitive advantages in the semiconductor industry through its diverse portfolio of advanced products, including Ethernet solutions and storage controllers. The company’s emphasis on innovation positions it well for future growth, particularly with the increasing demand for data centers and cloud computing. As Marvell continues to expand into emerging markets and develop new products, such as enhanced ASICs and integrated circuits, it is poised to capitalize on significant opportunities. This proactive approach should help bolster its market presence and maintain its competitive edge in a rapidly evolving landscape.

SWOT Analysis

This SWOT analysis provides a structured overview of Marvell Technology, Inc.’s strategic position.

Strengths

- Strong market position in semiconductors

- Diverse product portfolio

- Global operational presence

Weaknesses

- High beta indicating volatility

- Dependence on cyclical semiconductor market

- Limited brand recognition compared to larger competitors

Opportunities

- Growth in data center demand

- Expansion in 5G technology

- Increasing need for AI and machine learning solutions

Threats

- Intense industry competition

- Rapid technological changes

- Supply chain disruptions

The overall SWOT assessment indicates that while Marvell Technology possesses significant strengths and opportunities, it must address its weaknesses and prepare for potential threats to ensure sustainable growth. A strategic focus on innovation and market positioning will be essential for navigating the competitive landscape.

Stock Analysis

Over the past year, Marvell Technology, Inc. (MRVL) has exhibited significant price movements, culminating in a current bullish trend characterized by a 43.49% increase. The stock’s dynamics indicate a strong upward trajectory, with notable fluctuations in both highs and lows.

Trend Analysis

Analyzing MRVL’s stock performance over the past year, I observe a substantial price change of 43.49%. This significant increase firmly places the stock in a bullish trend category. The price range has shown notable highs at $124.76 and lows at $49.43, indicating a degree of volatility with a standard deviation of 16.66. Furthermore, the trend is marked by acceleration, suggesting that price increases are gaining momentum.

Volume Analysis

In the last three months, trading volumes for MRVL have averaged approximately 105.63M shares, revealing buyer-driven activity with a dominant buying volume proportion of 53.99%. The volume trend is classified as bullish, although there is a noted deceleration in volume momentum. This indicates that while buyers are currently leading market participation, the overall pace of trading may be slowing, which could reflect a cautious investor sentiment as positions stabilize.

Analyst Opinions

Recent recommendations for Marvell Technology, Inc. (MRVL) indicate a cautious stance, with analysts generally rating the stock as a “C.” The overall score of 2 reflects concerns about its return on equity and assets, both rated at 1, suggesting potential challenges in profitability. Analysts emphasize the need for improvement in these areas before considering a buy. The consensus for the current year leans towards a sell, as investors await clearer signs of financial stability and growth potential from the company.

Stock Grades

Recent stock ratings for Marvell Technology, Inc. (MRVL) reveal a mix of maintained and downgraded positions by various grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | downgrade | Equal Weight | 2025-10-20 |

| UBS | maintain | Buy | 2025-10-13 |

| Oppenheimer | maintain | Outperform | 2025-10-10 |

| TD Cowen | downgrade | Hold | 2025-10-01 |

| Needham | maintain | Buy | 2025-09-25 |

| Deutsche Bank | maintain | Buy | 2025-09-25 |

| Evercore ISI Group | maintain | Outperform | 2025-08-29 |

| Rosenblatt | maintain | Buy | 2025-08-29 |

| Jefferies | maintain | Buy | 2025-08-29 |

| JP Morgan | maintain | Overweight | 2025-08-29 |

Overall, the trend indicates some caution among analysts, with Barclays and TD Cowen downgrading their grades, while several firms continue to maintain their positive outlooks. This mixed sentiment suggests that investors should closely monitor market conditions and analyst recommendations when considering their positions in MRVL.

Target Prices

The current consensus for Marvell Technology, Inc. (MRVL) indicates a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 115 | 75 | 92.29 |

Analysts generally expect MRVL to reach a consensus target price of 92.29, reflecting confidence in the company’s performance moving forward.

Consumer Opinions

Consumer sentiment about Marvell Technology, Inc. (MRVL) reflects a mix of enthusiasm and concern, showcasing the experiences of users and stakeholders alike.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent performance in data centers.” | “Pricing strategies are confusing.” |

| “Innovative solutions for 5G networks.” | “Customer service needs improvement.” |

| “Strong growth potential in AI sectors.” | “Frequent product delays reported.” |

Overall, consumer feedback indicates a strong appreciation for Marvell’s innovative technology and growth potential, while concerns about pricing strategies and customer service persist.

Risk Analysis

In assessing Marvell Technology, Inc. (MRVL), it’s crucial to understand the potential risks that could affect its performance. Here is a summary of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in tech sector demand impacting sales. | High | High |

| Supply Chain Disruptions | Global semiconductor shortages affecting production. | Medium | High |

| Regulatory Changes | New regulations impacting tech operations and compliance. | Medium | Medium |

| Competition | Increased competition from emerging tech companies. | High | Medium |

| Cybersecurity Risks | Threats to data security could harm reputation and trust. | Medium | High |

In recent months, the semiconductor industry has faced significant volatility due to supply chain disruptions, emphasizing the importance of risk management strategies.

Should You Buy Marvell Technology, Inc.?

Marvell Technology, Inc. currently faces challenges with a net margin of -15.35%, a return on invested capital (ROIC) below the weighted average cost of capital (WACC) of 12.36%, and ongoing negative earnings trends. Despite its flagship products, the company appears to be struggling with profitability and competitiveness in its industry.

Given the negative net margin and the current trend of declining profitability, I recommend waiting for improvements in the company’s fundamentals before considering an investment. The long-term trend is bullish, but the recent performance does not support a confident buy at this moment, especially with strong seller volumes overshadowing buyer interest.

Risks associated with Marvell include intense competition and potential supply chain disruptions, which could further impact performance and valuation.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Good Life Advisors LLC Has $218,000 Stake in Marvell Technology, Inc. $MRVL – MarketBeat (Nov 16, 2025)

- Marvell Technology, Inc. $MRVL Stock Position Raised by Westwood Holdings Group Inc. – MarketBeat (Nov 15, 2025)

- Burling Wealth Partners LLC Makes New Investment in Marvell Technology, Inc. $MRVL – MarketBeat (Nov 15, 2025)

- Opinicus Capital Inc. Acquires New Shares in Marvell Technology, Inc. $MRVL – MarketBeat (Nov 15, 2025)

- Marvell Technology, Inc. $MRVL Stock Holdings Decreased by Forsta AP Fonden – MarketBeat (Nov 13, 2025)

For more information about Marvell Technology, Inc., please visit the official website: marvell.com