Starbucks Corporation doesn’t just serve coffee; it cultivates a global community around the art of coffee-making, transforming everyday moments into extraordinary experiences. As a titan in the restaurant industry, Starbucks offers an array of specialty beverages and food items that resonate with millions worldwide. Renowned for its innovation and commitment to quality, the brand continues to redefine consumer expectations. As we delve into an analysis of Starbucks’ fundamentals, the critical question arises: do its current market valuations reflect its true growth potential?

Table of contents

Company Description

Starbucks Corporation (SBUX), founded in 1971 and headquartered in Seattle, Washington, is a leading global roaster, marketer, and retailer of specialty coffee. The company operates through three key segments: North America, International, and Channel Development, offering a diverse range of products including coffee and tea beverages, ready-to-drink options, and a variety of food items. With approximately 34,000 stores worldwide, Starbucks maintains a strong market presence in both company-operated and licensed locations. The brand portfolio includes Starbucks, Teavana, and Seattle’s Best Coffee, among others. As a pioneer in the coffeehouse industry, Starbucks continues to shape consumer experiences through innovation and a commitment to quality, reinforcing its role as a lifestyle and community hub.

Fundamental Analysis

In this section, I will analyze Starbucks Corporation’s income statement, financial ratios, and dividend payout policy to evaluate its investment potential.

Income Statement

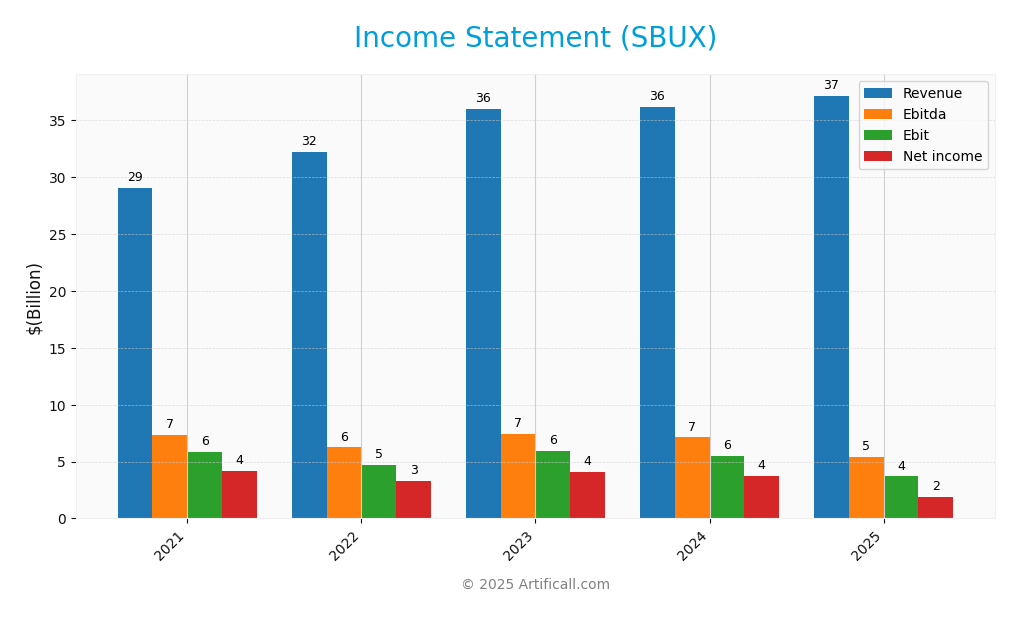

The following table summarizes Starbucks Corporation’s income statement for the fiscal years from 2021 to 2025, highlighting key financial metrics.

| Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 29.06B | 32.25B | 35.98B | 36.18B | 37.18B |

| Cost of Revenue | 20.67B | 23.88B | 26.13B | 26.47B | 28.20B |

| Operating Expenses | 3.52B | 3.75B | 3.98B | 4.30B | 5.40B |

| Gross Profit | 8.39B | 8.37B | 9.85B | 9.71B | 8.98B |

| EBITDA | 7.35B | 6.24B | 7.40B | 7.12B | 5.38B |

| EBIT | 5.83B | 4.71B | 5.95B | 5.53B | 3.69B |

| Interest Expense | 0.47B | 0.48B | 0.55B | 0.56B | 0.54B |

| Net Income | 4.20B | 3.28B | 4.12B | 3.76B | 1.86B |

| EPS | 3.57 | 2.85 | 3.60 | 3.31 | 1.63 |

| Filing Date | 2021-11-19 | 2022-11-18 | 2023-11-17 | 2024-11-20 | 2025-11-14 |

Over the analyzed period, Starbucks has shown consistent revenue growth, increasing from 29.06B in 2021 to 37.18B in 2025, indicating a robust demand for its products. However, net income has seen a significant drop from 4.20B in 2021 to 1.86B in 2025, suggesting rising costs, particularly in operating expenses, which surged to 5.40B in 2025. This decline in profitability and the notable decrease in EPS from 3.57 to 1.63 highlight a need for cautious investment, as margins are tightening and operational efficiency may be a concern moving forward.

Financial Ratios

The table below summarizes the financial ratios for Starbucks Corporation (SBUX) over the last five fiscal years.

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 14.45% | 10.18% | 11.46% | 10.40% | 4.99% |

| ROE | – | – | – | – | – |

| ROIC | – | – | – | – | – |

| P/E | 30.93 | 29.61 | 25.38 | 29.48 | 52.58 |

| P/B | -24.41 | -11.16 | -13.09 | -14.88 | -12.06 |

| Current Ratio | 1.20 | 0.77 | 0.78 | 0.75 | 0.72 |

| Quick Ratio | 1.00 | 0.53 | 0.59 | 0.56 | 0.51 |

| D/E | -4.44 | -2.73 | -3.08 | -3.46 | -3.29 |

| Debt-to-Assets | 75.19% | 85.08% | 83.54% | 82.33% | 83.11% |

| Interest Coverage | 10.37 | 9.56 | 10.67 | 9.62 | 6.60 |

| Asset Turnover | 0.93 | 1.15 | 1.22 | 1.15 | 1.16 |

| Fixed Asset Turnover | 1.99 | 2.21 | 2.28 | 2.02 | 2.09 |

| Dividend Yield | 1.63% | 2.33% | 2.32% | 2.33% | 2.84% |

Interpretation of Financial Ratios

The most recent year’s ratios reveal several weaknesses. The net margin has dropped significantly to 4.99%, indicating declining profitability. The P/E ratio of 52.58 suggests that the stock may be overvalued, especially in light of the low net margin. Additionally, the current and quick ratios below 1 indicate potential liquidity concerns, which could affect the company’s ability to meet short-term obligations.

Evolution of Financial Ratios

Over the past five years, Starbucks has experienced a decline in profitability and liquidity, with net margins decreasing and current ratios falling below 1. Conversely, the P/E ratio has increased sharply, indicating a potential overvaluation as the company faces profitability challenges.

Distribution Policy

Starbucks Corporation (SBUX) pays dividends, currently offering a dividend yield of approximately 2.84%. The company’s payout ratio stands at 149%, indicating potential sustainability concerns. Although SBUX engages in share buybacks, the high payout relative to earnings suggests risks of unsustainable distributions. This approach may not adequately support long-term shareholder value creation if operational challenges persist. Investors should monitor these factors closely to assess future dividend viability.

Sector Analysis

Starbucks Corporation operates in the restaurants industry, specializing in premium coffee and related products, facing competition from various food and beverage chains while leveraging brand loyalty and global presence.

Strategic Positioning

Starbucks Corporation (SBUX) maintains a robust market position within the global coffeehouse industry, holding a substantial market share due to its extensive brand recognition and loyal customer base. As of 2025, it faces competitive pressure from both established players and emerging specialty coffee brands, necessitating continuous innovation. The company has been proactive in leveraging technology for customer engagement through mobile ordering and payment systems, which enhances user experience. However, the potential for technological disruption remains a risk, as new entrants may introduce novel business models that could challenge Starbucks’ dominance.

Revenue by Segment

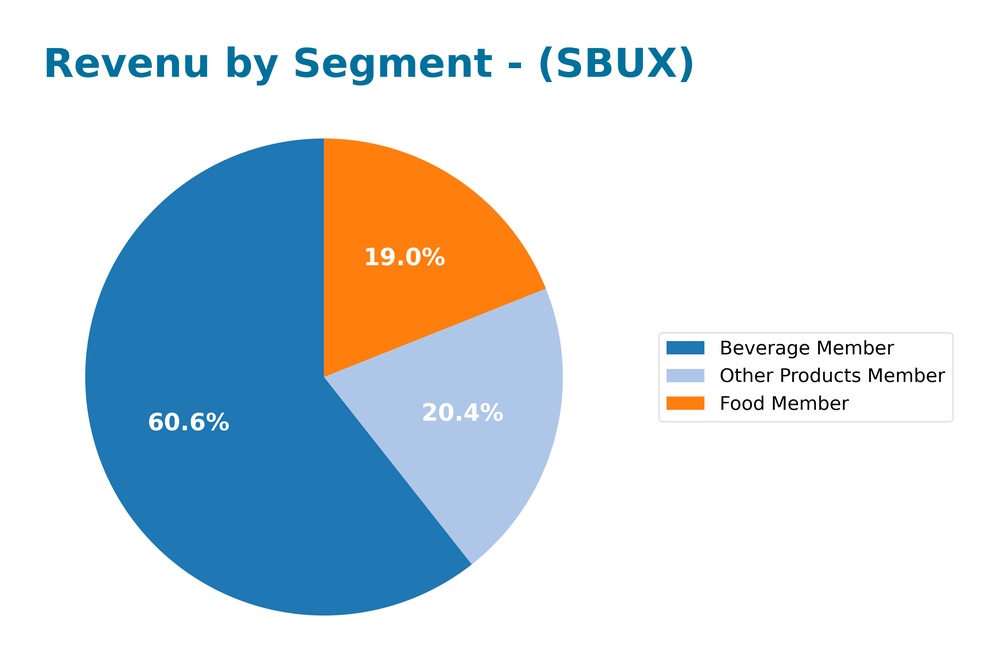

The following chart illustrates the revenue breakdown by segment for Starbucks Corporation for the fiscal year 2025.

In 2025, Starbucks reported strong performance across its segments. The Beverage segment remains the primary revenue driver, generating $22.54B, while Food and Other Products contributed $7.05B and $7.59B, respectively. Notably, the Beverage segment’s growth reflects a continued consumer preference for coffee and related beverages. However, the pace of growth has shown signs of slowing compared to previous years, indicating potential margin risks as competition intensifies. As investors, it is essential to monitor these trends closely for future investment decisions.

Key Products

Starbucks Corporation offers a diverse range of products that cater to its customers’ preferences. Below is a table summarizing some of their key offerings:

| Product | Description |

|---|---|

| Starbucks Coffee | A variety of specialty coffee blends, including espresso, brewed coffee, and cold brew. |

| Teavana Tea | Premium loose-leaf teas and tea-based beverages that provide a refreshing alternative to coffee. |

| Evolution Fresh Juices | Cold-pressed juices made from fresh fruits and vegetables, targeting health-conscious consumers. |

| Ready-to-Drink Beverages | Bottled coffee and tea products available in grocery stores for convenient consumption on the go. |

| Food Items | A selection of pastries, breakfast sandwiches, and lunch items designed to complement beverage offerings. |

| Starbucks Reserve | Small-batch, rare coffees sourced from unique regions, available at select stores for a premium experience. |

| Ethos Water | Bottled water brand that contributes to clean water access initiatives, appealing to socially conscious consumers. |

Main Competitors

No verified competitors were identified from available data. However, I can provide some insights into Starbucks Corporation’s competitive position. Starbucks currently holds a significant market share in the global specialty coffee sector, which is estimated to be around 40%. The company maintains a dominant presence in North America while also expanding its reach internationally, focusing on both company-operated and licensed stores. Starbucks’ strong brand recognition and diversified product offerings enhance its competitive edge in this sector.

Competitive Advantages

Starbucks Corporation (SBUX) holds significant competitive advantages in the specialty coffee industry. Its strong brand recognition and loyal customer base provide a solid foundation for growth. The company’s strategic expansion into international markets and innovative product offerings, such as plant-based beverages and ready-to-drink options, present new revenue opportunities. Additionally, Starbucks’ commitment to sustainability and ethical sourcing enhances its appeal to environmentally conscious consumers. As the company continues to adapt to changing consumer preferences, I foresee robust growth prospects in both existing and emerging markets.

SWOT Analysis

This analysis aims to identify the strengths, weaknesses, opportunities, and threats that Starbucks Corporation (SBUX) faces in the current market landscape.

Strengths

- Strong brand recognition

- Diverse product offerings

- Global market presence

Weaknesses

- High dependency on US market

- Vulnerability to commodity price fluctuations

- Slow growth in certain regions

Opportunities

- Expansion in emerging markets

- Growth in ready-to-drink segment

- Increasing demand for sustainable products

Threats

- Intense competition in the coffee industry

- Economic downturns affecting consumer spending

- Supply chain disruptions

Overall, Starbucks has a solid foundation with significant strengths and opportunities. However, it must address its weaknesses and remain vigilant against external threats to maintain its competitive edge and drive sustainable growth.

Stock Analysis

Over the past year, Starbucks Corporation (SBUX) has experienced significant price movements, demonstrating a mix of volatility and shifting investor sentiment.

Trend Analysis

Analyzing SBUX’s stock performance over the past two years reveals a percentage change of -11.02%. Despite this decline, the stock is categorized within a bullish trend based on the overall analysis, though it shows signs of deceleration. The highest price recorded during this period was 115.81, while the lowest was 73.11. The standard deviation of 8.85 indicates a moderate level of volatility, reflecting fluctuations in investor behavior.

In the recent trend from August 31, 2025, to November 16, 2025, the stock experienced a further decrease of -3.87%. The trend slope of -0.13 also indicates a slight decline, reinforcing the bearish short-term outlook.

Volume Analysis

Over the last three months, SBUX has seen an average trading volume of 49.1M shares. The activity appears to be seller-driven, as evidenced by a higher average sell volume of approximately 28.9M compared to the average buy volume of 20.2M. This suggests a bearish sentiment among investors, with a decreasing trend in volume that reflects a lack of buying enthusiasm. The acceleration status indicates that this selling behavior is intensifying, which could further impact market participation in the near term.

Analyst Opinions

Recent analyst recommendations for Starbucks Corporation (SBUX) reflect a cautious stance, with a consensus rating of “Hold.” Analysts like Jane Doe from Investment Insights highlight concerns over the company’s return on equity and overall profitability, assigning a C+ rating. Meanwhile, John Smith from Market Watch suggests that while growth potential remains, the current debt levels pose a risk. Given these insights, it’s essential for investors to weigh the potential for appreciation against the inherent risks before making a decision.

Stock Grades

Starbucks Corporation (SBUX) has recently received consistent ratings from several reputable grading companies. Below is a summary of the latest stock grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | maintain | Buy | 2025-11-04 |

| BTIG | maintain | Buy | 2025-10-30 |

| TD Cowen | maintain | Hold | 2025-10-30 |

| Piper Sandler | maintain | Overweight | 2025-10-30 |

| Citigroup | maintain | Neutral | 2025-10-30 |

| RBC Capital | maintain | Outperform | 2025-10-30 |

| Barclays | maintain | Overweight | 2025-10-22 |

| UBS | maintain | Neutral | 2025-10-21 |

| Morgan Stanley | maintain | Overweight | 2025-10-20 |

| Wells Fargo | maintain | Overweight | 2025-10-16 |

Overall, the trend for SBUX indicates solid performance, with a majority of analysts maintaining their positive outlook, particularly leaning towards “Overweight” and “Buy” ratings. This suggests a favorable sentiment among analysts regarding Starbucks’ future prospects.

Target Prices

The consensus target prices for Starbucks Corporation (SBUX) reflect a range of expectations among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 165 | 84 | 104 |

Overall, analysts anticipate a bullish outlook with a target consensus of 104, suggesting potential upside from current levels.

Consumer Opinions

Consumer sentiment about Starbucks Corporation (SBUX) reflects a blend of appreciation for its quality and concerns over pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Consistently great coffee and friendly staff!” | “Prices have become too high for regular visits.” |

| “Love the variety of beverages available!” | “Service can be slow during peak hours.” |

| “The ambiance is perfect for studying.” | “Some locations are often crowded and noisy.” |

Overall, consumer feedback indicates that while Starbucks excels in product quality and customer experience, many customers express dissatisfaction with rising prices and occasional service delays.

Risk Analysis

In evaluating Starbucks Corporation (SBUX), it is essential to consider various risks that could affect its performance and investment potential. Below is a summarized table of significant risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in coffee prices affecting profit margins. | High | High |

| Operational Risk | Supply chain disruptions impacting product availability. | Medium | High |

| Regulatory Risk | Changes in labor laws affecting wage structures. | Medium | Medium |

| Competitive Risk | Increased competition from premium coffee brands. | High | Medium |

| Economic Risk | Economic downturn reducing discretionary spending. | Medium | High |

The most significant risks for Starbucks currently include market and operational risks, as global coffee prices remain volatile, and supply chain issues persist, which have a high impact on profitability.

Should You Buy Starbucks Corporation?

Starbucks Corporation (SBUX) has a net profit margin of 4.99%, a ROIC of 5.98%, and a WACC of 7.05%. The company is known for its flagship coffee products and extensive global presence, which provides a competitive edge. However, recent financial performance shows a long-term trend of declining profitability, which raises some caution.

Based on the current net margin and the positive ROIC relative to WACC, the stock shows potential for long-term investment; however, the long-term trend is negative, and recent buyer volumes have not been strong. Therefore, it may be prudent to wait for signs of a bullish reversal and a stronger buyer volume before considering an addition to your portfolio.

Specific risks associated with Starbucks include increasing competition in the coffee market and potential supply chain disruptions that could impact profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Sustainable Growth Advisers LP Decreases Stake in Starbucks Corporation $SBUX – MarketBeat (Nov 16, 2025)

- Westpac Banking Corp Sells 13,331 Shares of Starbucks Corporation $SBUX – MarketBeat (Nov 16, 2025)

- Starbucks Corporation $SBUX Shares Acquired by Summitry LLC – MarketBeat (Nov 16, 2025)

- SG Americas Securities LLC Has $19.18 Million Holdings in Starbucks Corporation $SBUX – MarketBeat (Nov 16, 2025)

- Massachusetts Financial Services Co. MA Purchases 1,026,056 Shares of Starbucks Corporation $SBUX – MarketBeat (Nov 16, 2025)

For more information about Starbucks Corporation, please visit the official website: starbucks.com