Imagine a world where businesses can seamlessly manage their workforce and streamline HR processes with just a few clicks. Automatic Data Processing, Inc. (ADP) is at the forefront of this transformation, revolutionizing the staffing and employment services industry through innovative, cloud-based human capital management solutions. Renowned for its comprehensive offerings, including payroll and talent management, ADP continues to set the standard for quality and efficiency. As we delve into this analysis, we must consider whether ADP’s robust fundamentals can sustain its current market valuation and growth trajectory.

Table of contents

Company Description

Automatic Data Processing, Inc. (ADP), founded in 1949 and headquartered in Roseland, New Jersey, is a leader in the Staffing & Employment Services industry. With a market capitalization of $102.36B, ADP specializes in cloud-based human capital management solutions, offering a comprehensive suite of services that includes payroll, benefits administration, and workforce management. The company operates primarily across the U.S. but has a significant global footprint. Its services cater to a diverse clientele, particularly small and mid-sized businesses through its Professional Employer Organization (PEO) segment. As an innovator in HR outsourcing, ADP is strategically positioned to shape the future of workforce management and compliance, enhancing operational efficiency for businesses worldwide.

Fundamental Analysis

In this section, I will analyze Automatic Data Processing, Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

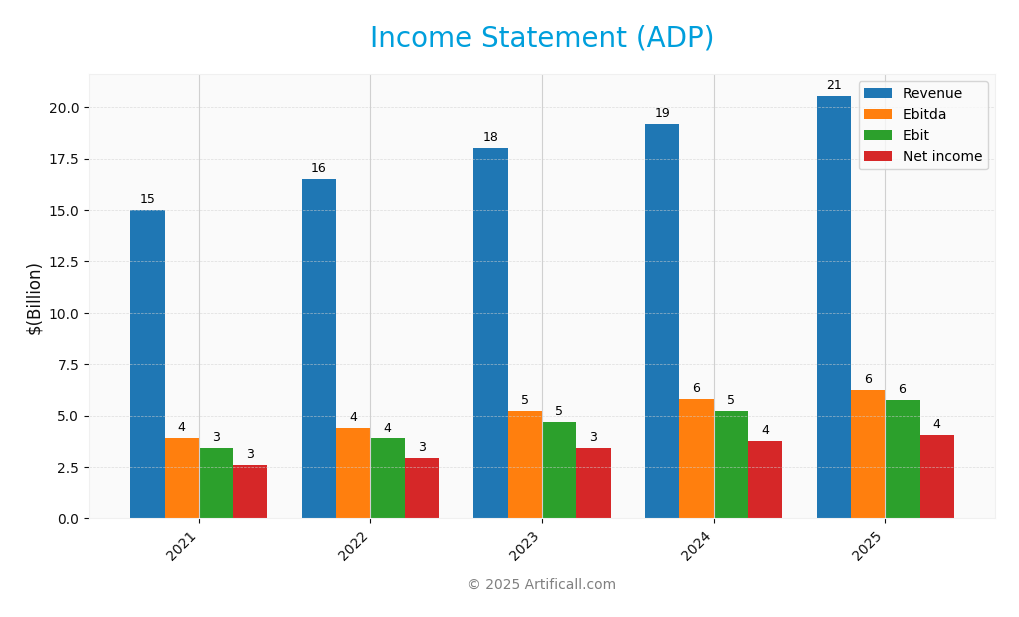

The following table provides a detailed overview of Automatic Data Processing, Inc. (ADP)’s income statements for recent fiscal years, showcasing key financial metrics.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 15.00B | 16.50B | 18.01B | 19.20B | 20.56B |

| Cost of Revenue | 8.03B | 8.77B | 9.21B | 9.61B | 10.11B |

| Operating Expenses | 3.65B | 3.93B | 4.30B | 4.65B | 5.04B |

| Gross Profit | 6.97B | 7.73B | 8.81B | 9.59B | 10.45B |

| EBITDA | 3.93B | 4.41B | 5.24B | 5.80B | 6.24B |

| EBIT | 3.42B | 3.89B | 4.70B | 5.24B | 5.76B |

| Interest Expense | 0.06B | 0.09B | 0.26B | 0.37B | 0.46B |

| Net Income | 2.60B | 2.95B | 3.41B | 3.75B | 4.08B |

| EPS | 6.10 | 7.04 | 8.25 | 9.14 | 10.02 |

| Filing Date | 2021-08-04 | 2022-08-03 | 2023-08-03 | 2024-08-07 | 2025-08-06 |

Over the five-year period, ADP has shown a consistent upward trend in both Revenue and Net Income, with Revenue increasing from 15B in 2021 to 20.56B in 2025, reflecting a robust growth trajectory. The Net Income also rose significantly from 2.60B to 4.08B, indicating improved profitability. Margins have remained relatively stable, with Gross Profit consistently around 50% of Revenue. In 2025, while growth continued, it appears to have slowed slightly compared to the previous year, with a marginal increase in costs impacting overall earnings. However, the incremental EPS growth to 10.02 suggests that the company has maintained its profitability effectively in a competitive environment.

Financial Ratios

The following table summarizes the key financial ratios for Automatic Data Processing, Inc. (ADP) over the last available years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 17.32% | 17.87% | 18.94% | 19.54% | 19.84% |

| ROE | 24.72% | 19.84% | 17.60% | 18.64% | 19.94% |

| ROIC | 14.11% | 12.78% | 12.39% | 12.56% | 12.88% |

| P/E | 32.58 | 29.83 | 26.65 | 25.79 | 30.77 |

| P/B | 14.93 | 27.27 | 25.91 | 21.28 | 20.29 |

| Current Ratio | 1.07 | 0.99 | 0.99 | 1.01 | 1.05 |

| Quick Ratio | 1.07 | 0.99 | 0.99 | 1.01 | 1.05 |

| D/E | 0.59 | 1.08 | 0.98 | 0.81 | 1.46 |

| Debt-to-Assets | 6.87% | 5.54% | 6.76% | 6.82% | 16.99% |

| Interest Coverage | 55.69 | 44.07 | 17.49 | 13.51 | 11.87 |

| Asset Turnover | 0.31 | 0.26 | 0.35 | 0.35 | 0.39 |

| Fixed Asset Turnover | 13.09 | 14.95 | 16.62 | 18.18 | 19.97 |

| Dividend Yield | 1.86% | 1.89% | 2.09% | 2.26% | 1.91% |

Interpretation of Financial Ratios

In the most recent year, ADP’s financial ratios indicate strong profitability, evidenced by a net margin of 19.84% and a solid return on equity (ROE) of 19.94%. However, the price-to-earnings (P/E) ratio of 30.77 suggests that the stock might be overvalued. The increasing debt-to-equity (D/E) ratio, now at 1.46, could raise concerns about financial leverage and risk.

Evolution of Financial Ratios

Over the past five years, ADP’s financial ratios have generally trended positively, with improvements in net margin and asset turnover. However, the rising D/E ratio signals increased reliance on debt, which may pose risks if not managed properly. Overall, the company demonstrates resilience, but vigilance is required regarding its increasing leverage.

Distribution Policy

Automatic Data Processing, Inc. (ADP) currently maintains a dividend payout ratio of approximately 59%, reflecting a commitment to returning value to shareholders. The annual dividend yield stands at around 1.91%, with a consistent trend of increasing the dividend per share over recent years. Additionally, ADP engages in share buyback programs, enhancing shareholder value. However, it is essential to monitor for potential risks, such as unsustainable distributions amid economic fluctuations. Overall, ADP’s distribution strategy appears to support long-term value creation for shareholders.

Sector Analysis

Automatic Data Processing, Inc. (ADP) is a key player in the Staffing & Employment Services industry, offering cloud-based human capital management solutions. Its competitive advantages include a strong brand, comprehensive service offerings, and a robust client base.

Strategic Positioning

Automatic Data Processing, Inc. (ADP) holds a significant market share in the staffing and employment services industry, particularly in cloud-based human capital management solutions. With a market cap of approximately $102.36B, ADP faces competitive pressures from both established firms and emerging tech disruptors. Its robust Employer Services segment, which includes payroll and HR outsourcing, positions it well against competitors. However, the rapid evolution of technology necessitates constant innovation to maintain its leadership and mitigate risks associated with market fluctuations and shifting client needs.

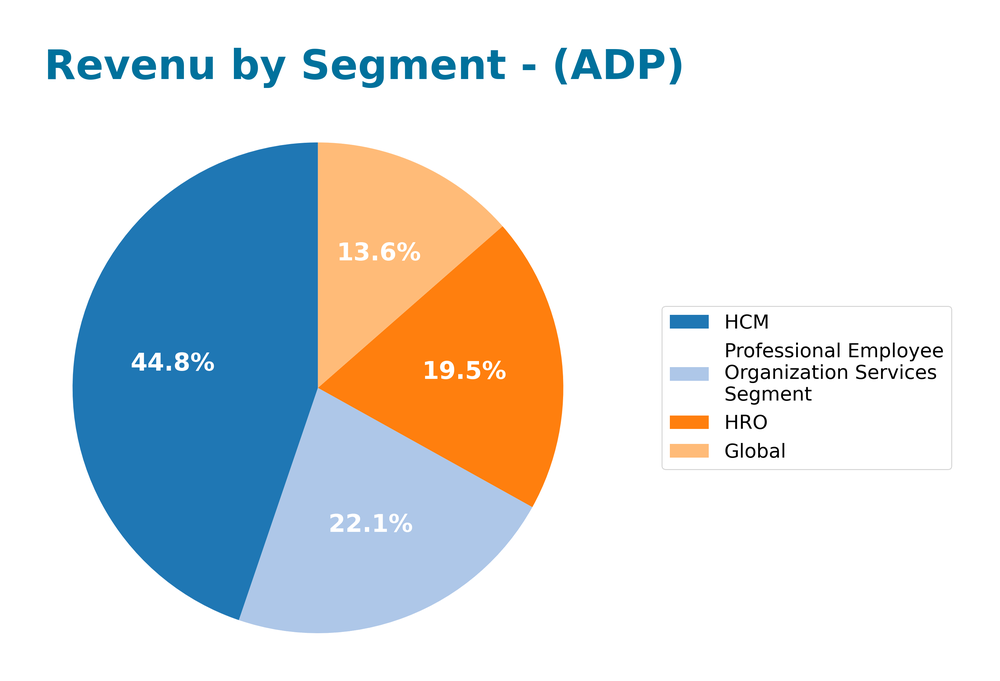

Revenue by Segment

The following chart illustrates the revenue distribution across different segments for Automatic Data Processing, Inc. (ADP) in the fiscal year 2025.

In 2025, ADP’s revenue segmentation shows notable contributions from various segments. The Human Capital Management (HCM) segment led with $8.67B, followed by the Professional Employee Organization Services Segment at $4.29B. While HCM continues to be the primary driver, the Human Resource Outsourcing (HRO) segment at $3.78B and Global services at $2.63B reflect stable demand. Compared to previous years, growth in HCM has accelerated, but potential risks in margin concentration and competition warrant cautious observation as market dynamics evolve.

Key Products

Below is a table outlining some of the key products offered by Automatic Data Processing, Inc. (ADP), which provide significant value to their clients in the realm of human capital management.

| Product | Description |

|---|---|

| Payroll Services | Comprehensive payroll processing solutions that ensure accurate and timely payments to employees. |

| Talent Management | Tools designed to help organizations attract, develop, and retain top talent within their workforce. |

| HR Management | Integrated solutions that streamline HR tasks, enhancing efficiency in employee management. |

| Benefits Administration | Services facilitating the management of employee benefits programs, ensuring compliance and efficiency. |

| Workforce Management | Solutions that optimize workforce planning and scheduling to improve productivity and reduce costs. |

| Compliance Services | Assistance in navigating and adhering to labor laws and regulations, minimizing legal risks. |

| Professional Employer Organization (PEO) | HR outsourcing solutions providing small and mid-sized businesses with comprehensive HR support through a co-employment model. |

This table reflects ADP’s commitment to providing robust and innovative solutions that cater to a wide range of human capital management needs, making it a strong choice for businesses looking to enhance their HR capabilities.

Main Competitors

No verified competitors were identified from available data. However, I can provide insight into Automatic Data Processing, Inc. (ADP). With a market capitalization of approximately 102B USD, ADP holds a significant position in the Staffing & Employment Services industry. The company is known for its cloud-based human capital management solutions, catering to a diverse clientele, including small and mid-sized businesses. ADP’s competitive position remains strong, particularly in the U.S. market, where it has established itself as a leader in HR outsourcing and related services.

Competitive Advantages

Automatic Data Processing, Inc. (ADP) boasts strong competitive advantages in the staffing and employment services industry through its robust cloud-based human capital management solutions. The company’s established brand and extensive service offerings, including payroll, benefits administration, and HR outsourcing, provide a comprehensive solution for businesses. Looking ahead, ADP is poised for growth with plans to innovate and expand its product portfolio, particularly in AI-driven HR technologies and entering emerging markets. These initiatives position ADP to capitalize on new opportunities and further enhance its market leadership.

SWOT Analysis

This SWOT analysis aims to evaluate Automatic Data Processing, Inc. (ADP) to aid investors in understanding its strategic positioning.

Strengths

- Strong market position

- Diverse service offerings

- Robust technological infrastructure

Weaknesses

- Dependence on US market

- High competition

- Complexity of services

Opportunities

- Growth in HR technology sector

- Expansion into emerging markets

- Increased demand for outsourcing

Threats

- Economic downturns

- Regulatory challenges

- Cybersecurity risks

The overall SWOT assessment indicates that while ADP has a strong market presence and opportunities for growth, it must navigate significant threats and weaknesses. This insight can inform strategic decisions regarding investment and operational focus.

Stock Analysis

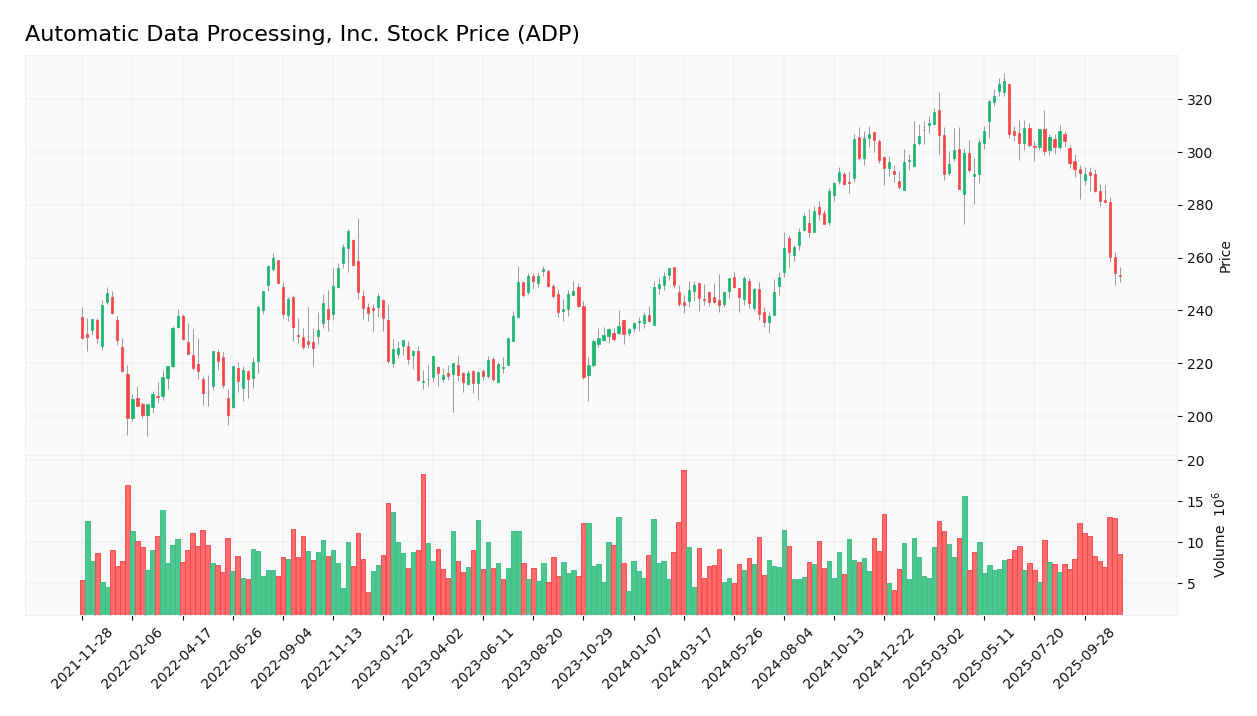

In this analysis, I will review Automatic Data Processing, Inc. (ADP) and its stock price movements over the past year, highlighting key dynamics and price fluctuations.

Trend Analysis

Over the past year, ADP’s stock has demonstrated a 9.58% increase, indicating a bullish trend. The stock reached a high of 326.81 and a low of 230.97, suggesting notable price variations. However, the trend shows signs of deceleration, with a standard deviation of 27.09. This indicates that while the stock has appreciated, the momentum may be slowing.

Volume Analysis

Analyzing the trading volumes over the last three months reveals an average volume of approximately 9.49M shares, with 856K shares sold on average and 927K shares bought. The activity appears seller-dominant, as evidenced by the higher average sell volume. Furthermore, the volume trend is classified as bullish, suggesting increased market participation despite the seller-driven activity. The volume’s acceleration, with a trend slope of 229.64, implies that the trading activity is becoming more pronounced, reflecting heightened investor sentiment.

Analyst Opinions

Recent analyst recommendations for Automatic Data Processing, Inc. (ADP) indicate a consensus to hold. Analysts have rated the company with a B+ rating, reflecting solid performance in return on equity and assets. For instance, analysts appreciate its strong financial health, highlighted by a low debt-to-equity ratio of 1. However, concerns about its price-to-earnings and price-to-book ratios have led to a more cautious stance. Notable analysts contributing to this view include those from prominent financial institutions, signaling a balanced outlook for 2025.

Stock Grades

The latest stock ratings for Automatic Data Processing, Inc. (ADP) indicate a consistent sentiment among major grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Underweight | 2025-10-30 |

| Wells Fargo | maintain | Underweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-09-17 |

| Morgan Stanley | maintain | Equal Weight | 2025-07-31 |

| Stifel | maintain | Hold | 2025-07-31 |

| Morgan Stanley | maintain | Equal Weight | 2025-06-17 |

| Mizuho | maintain | Outperform | 2025-06-13 |

| UBS | maintain | Neutral | 2025-06-13 |

| RBC Capital | maintain | Sector Perform | 2025-06-05 |

| TD Securities | maintain | Hold | 2025-05-21 |

The overall trend in grades for ADP reflects a cautious outlook, with several firms maintaining lower ratings such as “Underweight” and “Neutral.” Notably, Mizuho stands out with an “Outperform” rating, suggesting some optimism amidst the generally conservative sentiment.

Target Prices

The consensus target prices for Automatic Data Processing, Inc. (ADP) indicate a promising outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 290 | 245 | 278.25 |

Overall, analysts expect ADP’s stock to reach approximately 278.25, reflecting a balanced view between the high and low estimates.

Consumer Opinions

Consumer sentiment around Automatic Data Processing, Inc. (ADP) reflects a mix of appreciation for its services and concerns about pricing and customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| “ADP streamlines payroll processes effectively.” | “Customer service response times are slow.” |

| “The software is user-friendly and intuitive.” | “Pricing can be higher compared to competitors.” |

| “Great reporting features for analytics.” | “Issues with software updates have been frustrating.” |

Overall, consumers appreciate ADP’s user-friendly technology and robust reporting capabilities, but they frequently mention concerns about pricing and the need for improved customer support.

Risk Analysis

In assessing the investment potential of Automatic Data Processing, Inc. (ADP), it’s crucial to consider the various risks that could affect its performance. Below is a table summarizing key risks associated with ADP.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in economic conditions affecting demand for services. | High | High |

| Regulatory Risk | Changes in labor laws and data protection regulations impacting operations. | Medium | High |

| Competitive Risk | Increasing competition from new entrants in payroll and HR tech. | High | Medium |

| Technological Risk | Cybersecurity threats that could compromise client data. | Medium | High |

| Operational Risk | Disruptions in service delivery due to system outages. | Low | Medium |

Among these, market and regulatory risks are particularly significant, as they can profoundly influence ADP’s revenue and operational framework. Recent trends indicate a heightened focus on data privacy, making regulatory compliance increasingly critical.

Should You Buy Automatic Data Processing, Inc.?

Automatic Data Processing, Inc. (ADP) showcases strong financial performance with a net margin of 19.84%, a return on invested capital (ROIC) of 8.7%, and a weighted average cost of capital (WACC) of 7.47%. The company benefits from a solid competitive position in the payroll and human resources services market, although it faces risks related to increasing competition and potential market dependence.

Considering the current net margin and the positive long-term trend, along with a favorable ROIC exceeding WACC, I find that ADP appears favorable for long-term investors. However, the recent decline in buyer volume suggests a cautious approach; it may be prudent to wait for a more significant buyer presence before adding this stock to your portfolio.

Specific risks facing ADP include heightened competition in the HR services sector and dependency on economic conditions that may affect client budgets and spending.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Why Automatic Data Processing Inc. (ADP) stock could rally strongly – New Guidance & Smart Investment Allocation Insights – newser.com (Nov 14, 2025)

- Automatic Data Processing, Inc. Stock (ADP) Opinions on Recent Dividend Hike and Price Drop – Quiver Quantitative (Nov 14, 2025)

- Should You Be Excited About Automatic Data Processing, Inc.’s (NASDAQ:ADP) 65% Return On Equity? – Yahoo Finance (Nov 12, 2025)

- Automatic Data Processing (NASDAQ:ADP) Will Pay A Larger Dividend Than Last Year At $1.70 – simplywall.st (Nov 15, 2025)

- Automatic Data Processing: Double-Digit Dividend Hike Proves This Is A Dividend King Worth Owning – Seeking Alpha (Nov 13, 2025)

For more information about Automatic Data Processing, Inc., please visit the official website: adp.com