In a world increasingly driven by sustainable energy solutions, Constellation Energy Corporation stands at the forefront, redefining how we power our lives. With a robust portfolio that encompasses nuclear, wind, solar, and natural gas, this company not only leads the renewable utilities sector but also shapes the energy landscape across the U.S. As I analyze its market position and growth trajectory, I can’t help but question whether Constellation’s impressive fundamentals still align with its current valuation and future potential.

Table of contents

Company Description

Constellation Energy Corporation (NASDAQ: CEG), founded in 2021 and headquartered in Baltimore, Maryland, operates as a prominent player in the renewable utilities sector. With a robust generating capacity of 32.4G megawatts, the company delivers electricity across the Mid-Atlantic, Midwest, New York, and ERCOT regions, specializing in a diverse portfolio that includes nuclear, wind, solar, natural gas, and hydroelectric power. It serves a wide array of customers, from distribution utilities to residential clients, while also providing natural gas and energy-related services. Constellation Energy is strategically positioned to lead the energy transition, focusing on sustainable practices and innovation in the rapidly evolving energy landscape.

Fundamental Analysis

In this section, I will provide a fundamental analysis of Constellation Energy Corporation, covering its income statement, financial ratios, and dividend payout policy.

Income Statement

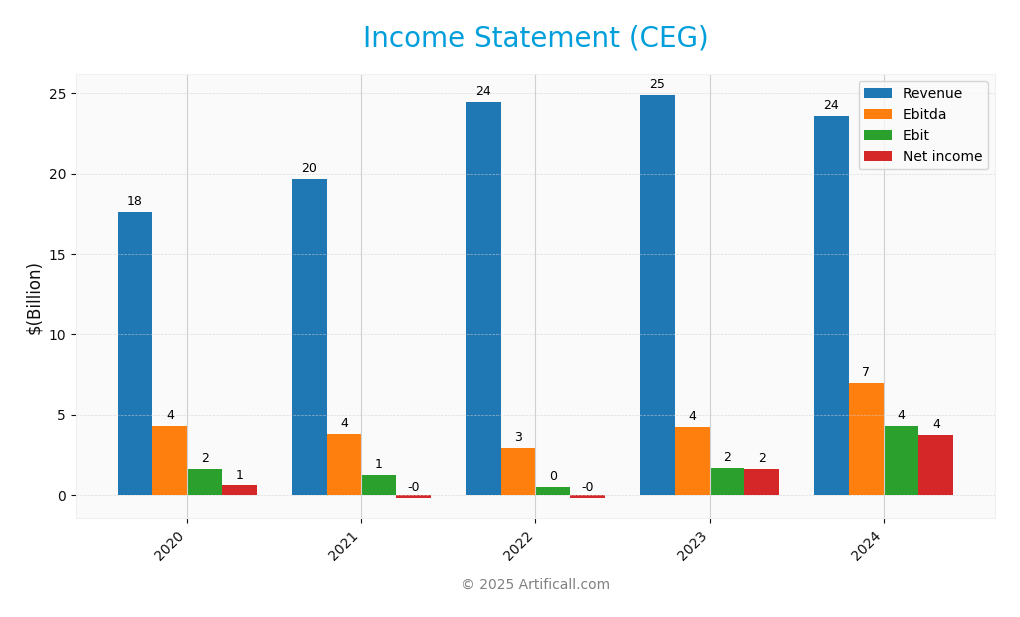

Here is the Income Statement for Constellation Energy Corporation (CEG) over the past five fiscal years, highlighting key financial metrics to aid in your investment decision-making.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 17.60B | 19.65B | 24.44B | 24.92B | 23.57B |

| Cost of Revenue | 14.33B | 16.90B | 22.30B | 21.62B | 17.58B |

| Operating Expenses | 3.02B | 3.09B | 2.34B | 1.69B | 1.64B |

| Gross Profit | 3.27B | 2.75B | 2.14B | 3.30B | 5.99B |

| EBITDA | 4.31B | 1.63B | 2.92B | 4.22B | 6.97B |

| EBIT | 1.63B | 0.12B | 0.49B | 1.71B | 4.27B |

| Interest Expense | 0.36B | 0.30B | 0.25B | 0.43B | 0.51B |

| Net Income | 0.59B | -0.21B | -0.16B | 1.62B | 3.75B |

| EPS | 1.80 | -0.63 | -0.47 | 5.02 | 11.90 |

| Filing Date | N/A | 2022-02-25 | 2023-02-16 | 2024-02-27 | 2025-02-18 |

Over the five-year period, Constellation Energy Corporation has shown fluctuating revenue, peaking at 24.92B in 2023 before declining to 23.57B in 2024. However, the most noteworthy trend is the significant recovery in net income, soaring from a loss of 0.21B in 2021 to a robust profit of 3.75B in 2024. This recovery aligns with improved gross profit margins, which jumped to 25.4% in 2024. This indicates a strong operational performance despite the slight dip in revenue, suggesting effective cost management strategies are in place.

Financial Ratios

Below is a summary of Constellation Energy Corporation’s key financial ratios for the last available years.

| Ratios | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Net Margin | 15.91% | 6.51% | -0.65% | -1.04% | 3.35% |

| ROE | 4.99% | 8.79% | -1.44% | -2.29% | 4.76% |

| ROIC | 7.61% | 5.51% | 1.15% | -0.46% | 1.53% |

| P/E | 18.80 | 23.26 | N/A | N/A | 23.29 |

| P/B | 5.35 | 3.46 | 2.57 | 1.22 | 1.11 |

| Current Ratio | 1.57 | 1.31 | 1.19 | 0.99 | 1.33 |

| Quick Ratio | 1.34 | 1.08 | 1.00 | 0.84 | 1.10 |

| D/E | 0.64 | 0.85 | 0.52 | 0.73 | 0.58 |

| Debt-to-Assets | 15.89% | 18.25% | 12.30% | 17.04% | 14.99% |

| Interest Coverage | 8.60 | 3.74 | 1.97 | -1.16 | 0.72 |

| Asset Turnover | 0.45 | 0.49 | 0.52 | 0.41 | 0.37 |

| Fixed Asset Turnover | 1.11 | 1.13 | 1.23 | 1.00 | 0.79 |

| Dividend Yield | 0.63% | 0.97% | 0.65% | 13.35% | 12.64% |

Interpretation of Financial Ratios

For the most recent year, Constellation Energy shows a mixed performance. While the net margin (15.91%) and interest coverage (8.60) are strong, the P/E ratio of 18.80 suggests potential overvaluation. The increase in debt-to-equity ratio (0.64) raises concerns about financial leverage. However, a current ratio of 1.57 indicates adequate liquidity, which is a positive sign.

Evolution of Financial Ratios

Over the past five years, Constellation Energy has demonstrated a gradual improvement in profitability metrics, notably the net margin, which moved from negative territory to a positive 15.91%. However, the increase in the debt-to-equity ratio indicates growing reliance on debt, which may present risks in a rising interest rate environment.

Distribution Policy

Constellation Energy Corporation (CEG) does pay dividends, with a current annual dividend yield of approximately 0.63% and a dividend payout ratio of 11.84%. The trend indicates a steady increase in dividends, although the sustainability of these distributions could be challenged by the company’s negative free cash flow. CEG also engages in share buybacks, which can indicate confidence in future growth. Overall, its dividend policy reflects a cautious approach that aligns with long-term shareholder value creation, but investors should monitor cash flow closely.

Sector Analysis

Constellation Energy Corporation operates in the Renewable Utilities sector, focusing on electricity generation and sales, with a diverse portfolio of energy sources and a strong market presence.

Strategic Positioning

Constellation Energy Corporation (CEG) currently holds a competitive position in the renewable utilities market, with a robust market capitalization of $105.72B. The company has diversified its energy generation capabilities across nuclear, wind, solar, natural gas, and hydroelectric assets, totaling 32,400 MW. As it continues to expand its footprint in the renewable sector, it faces competitive pressure from both established players and new entrants leveraging technological advancements. The current market dynamics demand vigilance against potential disruptions, especially as consumers increasingly prioritize sustainable energy solutions.

Revenue by Segment

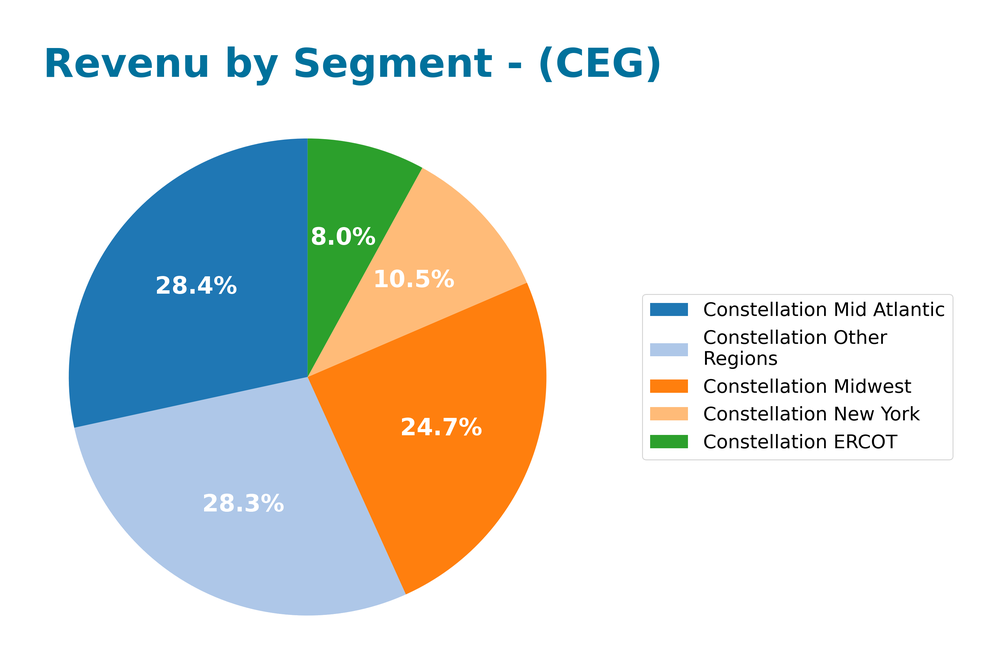

The pie chart illustrates Constellation Energy Corporation’s revenue distribution by segment for the fiscal year 2024, showcasing the company’s performance across its various operational areas.

In 2024, Constellation Mid Atlantic remains the leading segment with $5.5B in revenue, followed closely by Constellation Other Regions at $5.5B as well. Notably, Constellation ERCOT and Constellation New York saw increases to $1.55B and $2.05B, respectively, while Constellation Midwest’s revenue slightly decreased to $4.81B. The overall trend indicates stable growth across major segments, although there are signs of margin pressure in the Midwest and ERCOT, which could pose risks if market conditions shift.

Key Products

Below is a table summarizing the key products offered by Constellation Energy Corporation:

| Product | Description |

|---|---|

| Electricity Generation | Constellation generates electricity through a diverse mix of sources, including nuclear, wind, solar, and natural gas, totaling 32.4GW of capacity. |

| Natural Gas | The company provides natural gas solutions for residential, commercial, and industrial customers across various regions. |

| Renewable Energy Solutions | Constellation offers renewable energy products, including solar energy options and renewable energy credits, to promote sustainable practices. |

| Energy Management Services | These services help businesses optimize their energy consumption, reduce costs, and implement sustainability initiatives. |

| Retail Energy Supply | Constellation sells electricity and natural gas directly to consumers, providing competitive pricing and flexible plans. |

This concise overview should assist investors in understanding the core offerings of Constellation Energy and how they align with current energy trends.

Main Competitors

No verified competitors were identified from available data. However, Constellation Energy Corporation (Ticker: CEG) operates in the Renewable Utilities sector, holding an estimated market share that reflects its significant role in generating and selling electricity across various regions in the United States. The company is positioned as a key player within the renewable energy space, leveraging a diverse portfolio of energy sources including nuclear, wind, solar, natural gas, and hydroelectric assets.

Competitive Advantages

Constellation Energy Corporation (CEG) stands out in the renewable utilities sector with its diverse energy portfolio, including nuclear, wind, solar, natural gas, and hydroelectric assets. With a generating capacity of 32.4GW, the company is well-positioned to meet increasing energy demands. Looking ahead, CEG has opportunities to expand into emerging markets and launch new renewable energy products, aiming to capitalize on the growing demand for clean energy. This strategic direction not only enhances its competitive edge but also aligns with global sustainability goals, making it a compelling choice for investors.

SWOT Analysis

This analysis evaluates Constellation Energy Corporation’s internal strengths and weaknesses, as well as external opportunities and threats.

Strengths

- Strong market position

- Diverse energy portfolio

- Robust generating capacity

Weaknesses

- High operational costs

- Regulatory challenges

- Limited geographical presence

Opportunities

- Growth in renewable energy demand

- Expansion into new markets

- Government incentives for clean energy

Threats

- Intense competition

- Fluctuating energy prices

- Economic downturn risks

The overall SWOT assessment indicates that Constellation Energy Corporation possesses significant strengths and opportunities that can be leveraged for growth. However, it must also navigate its weaknesses and external threats carefully to maintain a competitive edge and ensure sustainable profitability.

Stock Analysis

Over the past year, Constellation Energy Corporation (CEG) has experienced significant price movements, showcasing a remarkable bullish trend characterized by a substantial percentage increase.

Trend Analysis

Analyzing the stock’s performance over the past two years, I observe a striking price change of +193.52%. This clearly indicates a bullish trend, with the stock accelerating in its upward movement. The highest price recorded was 389.19, while the lowest was 112.91, suggesting strong upward momentum despite the inherent volatility, as evidenced by a standard deviation of 70.5.

In the recent analysis period from August 31, 2025, to November 16, 2025, the stock has also appreciated by +9.92%, further supporting the bullish outlook with an upward trend slope of 5.9. The volatility during this period is reflected in the standard deviation of 28.45, indicating some fluctuation but overall stability in the upward trajectory.

Volume Analysis

Looking at trading volumes over the last three months, the average volume stands at approximately 12.71M, with a notable buyer-driven activity trend. However, the recent volume analysis indicates a shift towards seller dominance, with average buy volume at 6.21M and average sell volume at 6.50M. This suggests that while there is still robust market participation, the sentiment may be cautious as sellers are slightly outweighing buyers. The volume trend remains bullish, with an acceleration noted in the volume slope at 601255.61, indicating a potential shift in investor sentiment that warrants close monitoring.

Analyst Opinions

Recent recommendations for Constellation Energy Corporation (CEG) have largely favored a “hold” position, reflecting a cautious outlook amidst rising market volatility. Analyst assessments indicate a solid return on equity and assets, yet concerns over debt management and valuation metrics persist. Notably, analysts have rated CEG with an overall score of 3, which suggests a balanced view. As of now, the consensus leans towards a hold rather than a buy or sell, indicating that while there’s potential, investors should proceed with caution.

Stock Grades

Here are the most recent stock ratings for Constellation Energy Corporation (CEG) from reliable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2025-11-10 |

| Mizuho | Maintain | Neutral | 2025-10-27 |

| JP Morgan | Maintain | Overweight | 2025-10-20 |

| Keybanc | Maintain | Overweight | 2025-10-15 |

| Seaport Global | Upgrade | Buy | 2025-10-08 |

| Jefferies | Maintain | Hold | 2025-09-09 |

| BMO Capital | Maintain | Outperform | 2025-08-11 |

| Raymond James | Maintain | Outperform | 2025-08-11 |

| Keybanc | Maintain | Overweight | 2025-08-08 |

| JP Morgan | Maintain | Overweight | 2025-07-28 |

The overall trend shows a consistent rating of “Neutral” from multiple analysts, with a notable upgrade to “Buy” from Seaport Global. Most firms maintain their previous grades, indicating a stable outlook for the stock with some optimism from select analysts.

Target Prices

The consensus among analysts for Constellation Energy Corporation (CEG) indicates a positive outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 478 | 375 | 406.14 |

Overall, analysts expect CEG to reach around 406.14, suggesting a favorable market perspective on the stock’s future performance.

Consumer Opinions

Consumer sentiment regarding Constellation Energy Corporation (CEG) reflects a mix of appreciation and concern, indicating a diverse range of experiences among its clientele.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent customer service and support.” | “High rates compared to competitors.” |

| “Reliable energy supply with minimal outages.” | “Difficulty reaching customer service.” |

| “Sustainable energy options are impressive.” | “Billing issues have been frustrating.” |

Overall, consumer feedback on Constellation Energy Corporation highlights strong customer service and reliability as key strengths, while concerns about pricing and billing processes have emerged as notable weaknesses.

Risk Analysis

In evaluating Constellation Energy Corporation (CEG), it’s essential to consider various risks that could affect its performance. Below is a summary of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Changes | Changes in energy regulations could impact operations. | High | High |

| Market Volatility | Fluctuations in energy prices can affect profitability. | Medium | High |

| Cybersecurity Threats | Increased cyber threats could disrupt services. | High | Medium |

| Environmental Risks | Climate change regulations may impose new costs. | Medium | High |

| Technological Changes | Advances in renewable energy could outpace current offerings. | Medium | Medium |

The most significant risks for CEG include regulatory changes and market volatility, both of which are highly probable and can severely impact the company’s profitability.

Should You Buy Constellation Energy Corporation?

Constellation Energy Corporation (CEG) boasts strong flagship products in the energy sector, underpinned by a net profit margin of 15.91%, a return on invested capital (ROIC) significantly exceeding the weighted average cost of capital (WACC) of 8.63%, and a positive long-term trend in performance. However, the company’s recent financials show some volatility in buyer volumes, signaling potential caution for short-term investors.

Based on the recent net margin, ROIC, WACC, and a positive long-term trend, I find that CEG presents a favorable signal for long-term investors looking to diversify their portfolios. While the buyer volumes have experienced fluctuations, the overall trajectory indicates potential for growth, making it suitable for those with a long-term investment strategy.

That said, investors should remain aware of specific risks, including market competition and the potential for supply chain disruptions within the energy sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Here is What to Know Beyond Why Constellation Energy Corporation (CEG) is a Trending Stock – Yahoo Finance (Nov 14, 2025)

- Constellation Reports Third Quarter 2025 Results – constellationenergy.com (Nov 07, 2025)

- Analysts’ Top Utilities Picks: Constellation Energy Corporation (CEG), Oklo Inc (OKLO) – The Globe and Mail (Nov 13, 2025)

- How to Play With Constellation Energy Stock After Mixed Q3 Results? – TradingView (Nov 14, 2025)

- Why Constellation Energy Corporation (CEG) is a Top Growth Stock for the Long-Term – Nasdaq (Nov 10, 2025)

For more information about Constellation Energy Corporation, please visit the official website: constellationenergy.com