Vertex Pharmaceuticals is revolutionizing the biotechnology landscape by developing cutting-edge therapies that transform the lives of cystic fibrosis patients. With flagship products like TRIKAFTA and a robust pipeline addressing various serious conditions, Vertex stands out for its commitment to innovation and quality. As we delve deeper into this analysis, the pivotal question remains: do Vertex’s fundamentals continue to justify its current market valuation and growth prospects in an ever-evolving healthcare sector?

Table of contents

Company Description

Vertex Pharmaceuticals Incorporated (NASDAQ: VRTX), founded in 1989 and headquartered in Boston, Massachusetts, is a leading player in the biotechnology industry, primarily focused on developing and commercializing innovative therapies for cystic fibrosis (CF). The company’s flagship products include SYMDEKO/SYMKEVI, ORKAMBI, and KALYDECO, alongside TRIKAFTA, which addresses specific genetic mutations in CF patients. With a robust pipeline targeting conditions such as AAT deficiency and Type 1 Diabetes, Vertex operates mainly in the U.S. and international markets through specialty pharmacies and distributors. The company’s collaborations with notable biotech firms further enhance its innovation capabilities, positioning Vertex as a key influencer in advancing therapeutic solutions that shape the future of healthcare.

Fundamental Analysis

In this section, I will analyze Vertex Pharmaceuticals Incorporated’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

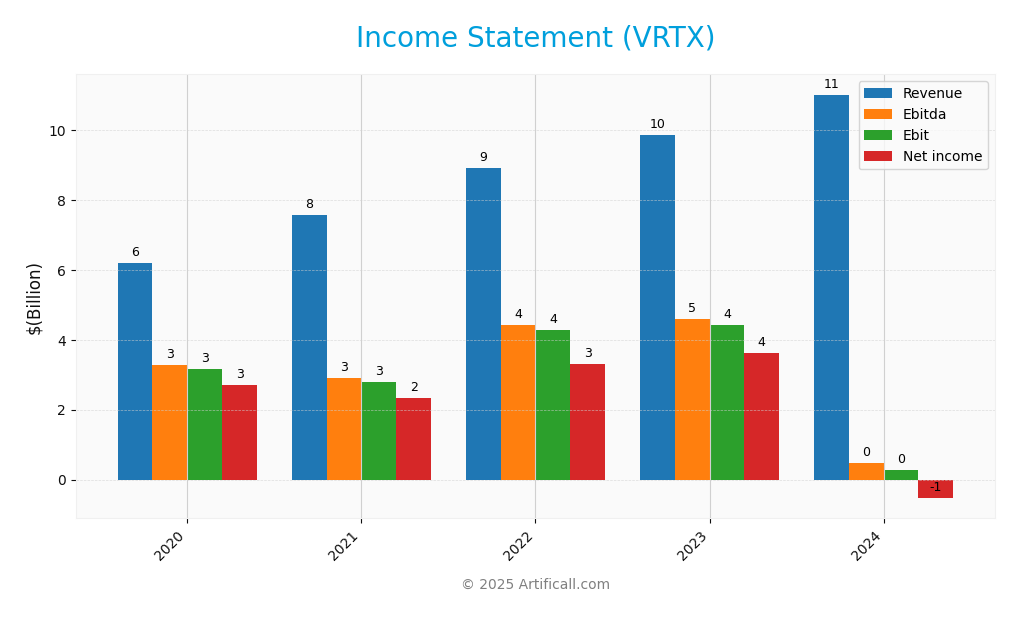

The following table summarizes the income statement for Vertex Pharmaceuticals Incorporated over the past five fiscal years, highlighting key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 6.21B | 7.57B | 8.93B | 9.87B | 11.02B |

| Cost of Revenue | 736M | 904M | 1.08B | 1.26B | 1.53B |

| Operating Expenses | 2.61B | 3.89B | 3.54B | 4.78B | 9.72B |

| Gross Profit | 5.47B | 6.67B | 7.85B | 8.61B | 9.49B |

| EBITDA | 3.28B | 2.91B | 4.44B | 4.61B | 486M |

| EBIT | 3.17B | 2.79B | 4.29B | 4.42B | 279M |

| Interest Expense | 58M | 61M | 55M | 44M | 30M |

| Net Income | 2.71B | 2.34B | 3.32B | 3.62B | -536M |

| EPS | 10.44 | 9.09 | 12.97 | 14.05 | -2.08 |

| Filing Date | 2021-02-11 | 2022-02-09 | 2023-02-10 | 2024-02-15 | 2025-02-13 |

Over the five-year period, Vertex Pharmaceuticals has demonstrated strong revenue growth, increasing from 6.21B in 2020 to 11.02B in 2024. However, 2024 saw a significant downturn in net income, dropping to -536M, primarily due to sharply rising operating expenses, which ballooned to 9.72B. This indicates a shift in cost management, leading to lower margins compared to previous years. The most recent year reflects a troubling trend of escalating costs outpacing revenue growth, suggesting the need for strategic adjustments to enhance profitability and stabilize EPS.

Financial Ratios

The following table presents the financial ratios of Vertex Pharmaceuticals over the last five fiscal years, illustrating the company’s performance metrics.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 43.70% | 30.92% | 37.20% | 36.68% | -4.86% |

| ROE | 71.80% | 42.10% | 37.00% | 20.50% | -3.45% |

| ROIC | 60.00% | 33.00% | 36.00% | 19.00% | -3.40% |

| P/E | 22.65 | 24.16 | 22.26 | 28.97 | -193.61 |

| P/B | 7.07 | 5.60 | 5.32 | 5.96 | 6.32 |

| Current Ratio | 4.33 | 4.46 | 4.83 | 3.99 | 2.69 |

| Quick Ratio | 4.18 | 4.30 | 4.66 | 3.78 | 2.35 |

| D/E | 0.11 | 0.10 | 0.06 | 0.05 | 0.11 |

| Debt-to-Assets | 7.93% | 10.73% | 4.96% | 3.56% | 7.76% |

| Interest Coverage | 49.12 | 45.24 | 78.60 | 86.89 | -7.61 |

| Asset Turnover | 0.53 | 0.56 | 0.49 | 0.43 | 0.49 |

| Fixed Asset Turnover | 4.83 | 5.32 | 6.13 | 6.79 | 4.26 |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Interpretation of Financial Ratios

In 2024, Vertex Pharmaceuticals exhibits concerning financial health, indicated by a negative net margin of -4.86% and a very high P/E ratio of -193.61. The decline in profitability metrics and the negative interest coverage ratio (-7.61) raise red flags about the company’s ability to manage its debt. While liquidity ratios remain solid, the overall profitability trend necessitates close monitoring.

Evolution of Financial Ratios

Over the past five years, Vertex Pharmaceuticals has seen a decline in profitability metrics, particularly in net margin and return ratios, which have turned negative in 2024. Conversely, liquidity ratios have remained strong, although they are trending downward, suggesting a potential shift in financial stability.

Distribution Policy

Vertex Pharmaceuticals does not pay dividends, reflecting its focus on reinvesting in research and development during its high-growth phase. The lack of dividends is consistent with its strategy to prioritize innovation and acquisitions. Despite not returning capital to shareholders via dividends, the company engages in share buybacks, indicating a commitment to enhancing shareholder value. This approach may foster sustainable long-term growth, albeit it carries risks associated with reinvestment strategies that require careful management.

Sector Analysis

Vertex Pharmaceuticals, a leader in the biotechnology sector, specializes in therapies for cystic fibrosis, competing against notable firms while leveraging strong product offerings and strategic collaborations.

Strategic Positioning

Vertex Pharmaceuticals (VRTX) holds a strong position in the biotechnology sector, focusing on therapies for cystic fibrosis (CF). The company commands a significant market share with its flagship product, TRIKAFTA, which is a cornerstone in CF treatment for patients with specific genetic mutations. Despite competitive pressure from emerging biopharmaceutical firms and potential technological disruptions, Vertex’s robust pipeline, including treatments for AAT deficiency and Type 1 Diabetes, positions it well for sustained growth. With a market cap of $112B and a beta of 0.322, VRTX demonstrates relative stability in a volatile market.

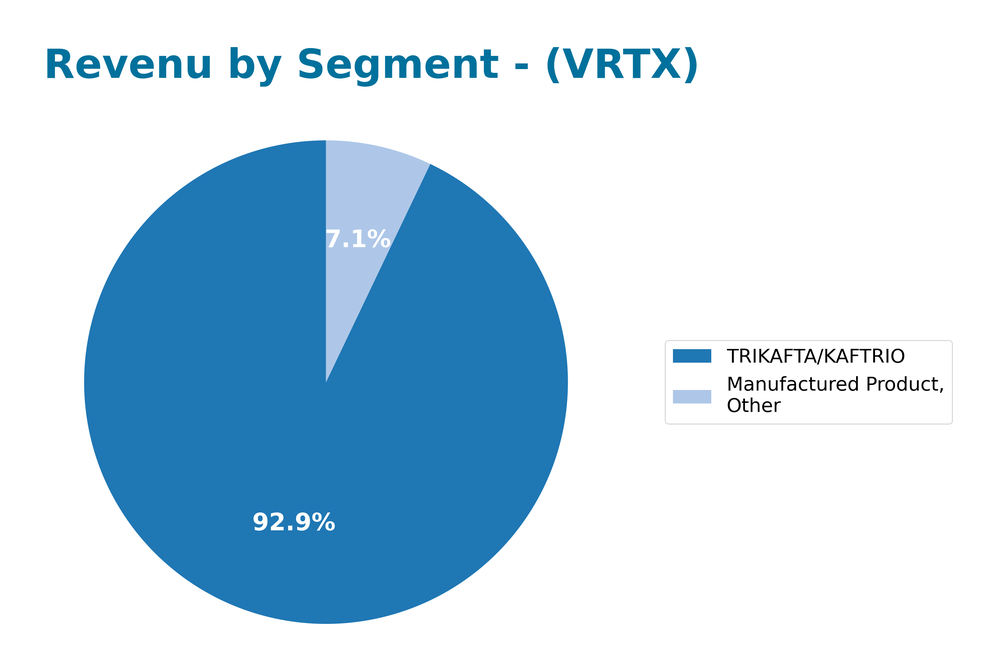

Revenue by Segment

The following chart illustrates Vertex Pharmaceuticals’ revenue distribution by segment for the fiscal year 2024, highlighting the performance of key products.

In fiscal year 2024, Vertex Pharmaceuticals showcased a strong performance, with TRIKAFTA/KAFTRIO leading at 10.24B, followed by Manufactured Products, Other at 781.5M. Notably, TRIKAFTA/KAFTRIO has solidified its position as the primary revenue driver, reflecting a consistent upward trend. However, this growth indicates potential concentration risks, as the company’s revenue heavily relies on this single product. Overall, while the revenue remains robust, the slowing growth may necessitate strategic diversification to mitigate risks associated with over-dependence on a few products.

Key Products

Vertex Pharmaceuticals specializes in innovative therapies for cystic fibrosis and other serious diseases. Below is a table of their key products:

| Product | Description |

|---|---|

| SYMDEKO/SYMKEVI | A combination therapy for cystic fibrosis patients with specific mutations in the CFTR gene. |

| ORKAMBI | Designed for patients with a specific mutation (F508del) in the CFTR gene to improve lung function. |

| KALYDECO | Targets a small subset of cystic fibrosis patients with specific mutations in the CFTR gene, enhancing chloride transport. |

| TRIKAFTA | A groundbreaking treatment for patients 6 years and older with at least one F508del mutation, significantly improving lung function. |

| VX-864 | Currently in Phase 2 trials for treating Alpha-1 Antitrypsin (AAT) deficiency. |

| VX-147 | Undergoing Phase 2 trials for treating APOL1-mediated focal segmental glomerulosclerosis (FSGS) and other serious kidney diseases. |

| VX-880 | A treatment for Type 1 Diabetes in Phase 1/2 clinical trials. |

| VX-548 | A NaV1.8 inhibitor in Phase 2 trials aimed at treating various pain types, including neuropathic and musculoskeletal pain. |

| CTX001 | In Phase 3 trials for treating severe sickle cell disease (SCD) and beta-thalassemia (TDT). |

I hope this overview helps you understand Vertex Pharmaceuticals’ current offerings and pipeline, allowing you to make informed decisions about your investments.

Main Competitors

No verified competitors were identified from available data. Vertex Pharmaceuticals Incorporated operates predominantly in the biotechnology sector, focusing on developing therapies for cystic fibrosis. With a market cap of approximately $112.18B, the company holds a significant competitive position and is recognized for its innovation in treatments for rare genetic diseases.

Competitive Advantages

Vertex Pharmaceuticals (VRTX) boasts a strong position in the biotechnology industry, primarily through its innovative therapies for cystic fibrosis and an expanding pipeline targeting various high-need conditions. Key competitive advantages include a robust portfolio of FDA-approved products and ongoing clinical trials for treatments in areas like Type 1 diabetes and kidney diseases. Future outlooks appear promising, with potential new products in advanced stages of development and collaborations with leading biotech firms. This strategic focus on niche markets and innovative treatments can drive growth and enhance shareholder value.

SWOT Analysis

This SWOT analysis evaluates Vertex Pharmaceuticals Incorporated (VRTX) to identify key strengths, weaknesses, opportunities, and threats that may influence its strategic direction.

Strengths

- Strong market position in cystic fibrosis treatments

- Robust pipeline with multiple candidates in clinical trials

- Strategic collaborations with leading biotech firms

Weaknesses

- Dependence on cystic fibrosis products for revenue

- High R&D costs impacting profitability

- Regulatory risks in drug approvals

Opportunities

- Expansion into new therapeutic areas (e.g., Type 1 Diabetes)

- Increasing global prevalence of target diseases

- Potential for new partnerships and collaborations

Threats

- Intense competition in biotechnology sector

- Market volatility affecting stock performance

- Changes in healthcare regulations and pricing pressures

Overall, the SWOT assessment indicates that Vertex Pharmaceuticals has a solid foundation with significant growth potential while facing challenges that require strategic management. Leveraging its strengths and opportunities will be crucial for navigating the competitive landscape and mitigating risks effectively.

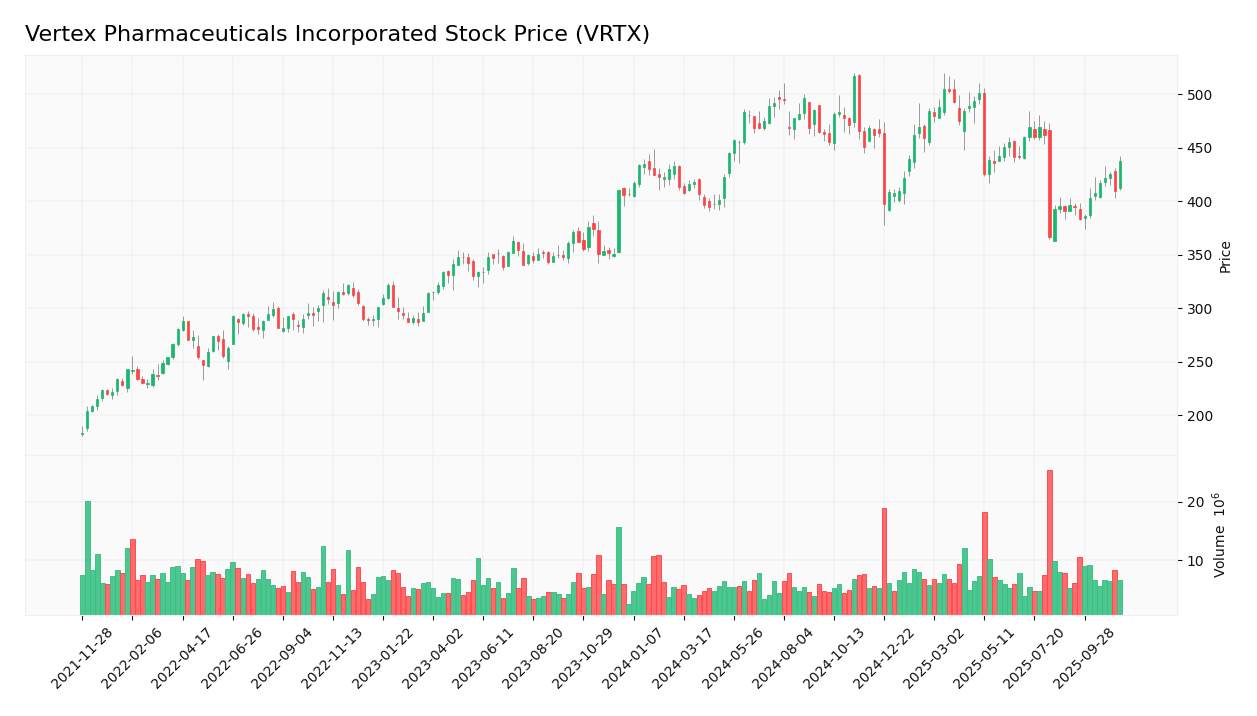

Stock Analysis

Vertex Pharmaceuticals Incorporated (VRTX) has experienced notable price movements over the past year, with key dynamics reflecting both bullish and bearish trends. This analysis will provide insight into the stock’s performance, focusing on significant price changes and trading patterns.

Trend Analysis

Over the past two years, the stock has shown a percentage change of +7.87%, indicating a bullish trend. Notably, the stock reached a high of 516.74 and a low of 366.54 during this period. The trend exhibits signs of acceleration, which may suggest growing investor interest. The standard deviation of 34.91 highlights a degree of volatility, indicating that price movements have been relatively wide-ranging.

Volume Analysis

In the last three months, VRTX has seen an average trading volume of approximately 7.39M shares, with a buyer-driven activity pattern. The average buy volume was 4.65M shares, compared to an average sell volume of 2.74M shares, indicating a bullish volume trend. However, this trend is experiencing deceleration, as the volume trend slope is negative at -51,202.52. The buyer volume proportion is approximately 62.93%, reflecting strong investor sentiment towards buying the stock.

Analyst Opinions

Recent analyst recommendations for Vertex Pharmaceuticals Incorporated (VRTX) indicate a strong consensus for a buy. Analysts have rated the stock as A-, highlighting its robust discounted cash flow and return on assets scores, both rated at 5. Notably, analysts emphasize the company’s solid performance in the biotech sector and its potential for growth. Given these insights, I believe the consensus remains a buy for 2025, reflecting confidence in Vertex’s innovative pipeline and market position.

Stock Grades

Vertex Pharmaceuticals Incorporated (VRTX) has received consistent evaluations from several reputable financial institutions. Below is a summary of the most recent stock ratings:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-11-04 |

| Barclays | Maintain | Equal Weight | 2025-11-04 |

| Stifel | Maintain | Hold | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-10 |

| JP Morgan | Maintain | Overweight | 2025-10-08 |

| Citigroup | Maintain | Buy | 2025-10-02 |

| Leerink Partners | Upgrade | Outperform | 2025-09-25 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-11 |

| Citigroup | Maintain | Buy | 2025-08-07 |

The overall trend in grades for VRTX indicates a stable outlook among major analysts, with multiple firms maintaining their ratings. Notably, the upgrade from Leerink Partners to “Outperform” suggests a growing confidence in the company’s performance, despite some analysts opting for more cautious positions like “Hold” or “Sector Perform.”

Target Prices

According to reliable analyses, there is a consensus on the target prices for Vertex Pharmaceuticals Incorporated (VRTX).

| Target High | Target Low | Consensus |

|---|---|---|

| 553 | 414 | 470.4 |

Overall, analysts expect VRTX to perform within a range of approximately 414 to 553, with a consensus target around 470.4. This indicates a positive outlook for the stock.

Consumer Opinions

Consumer sentiment around Vertex Pharmaceuticals (VRTX) reveals a mix of enthusiasm for their innovative treatments and concerns about pricing strategies.

| Positive Reviews | Negative Reviews |

|---|---|

| “Vertex’s treatments have significantly improved my quality of life.” | “The prices of their medications are prohibitively high.” |

| “I appreciate their commitment to rare disease research.” | “Customer service could be more responsive.” |

| “Innovative therapies that truly make a difference.” | “Limited availability of some treatments.” |

Overall, consumer feedback highlights Vertex Pharmaceuticals’ strong reputation for effective therapies and a dedication to research, while concerns about medication costs and customer service responsiveness persist.

Risk Analysis

Understanding the potential risks associated with investing in Vertex Pharmaceuticals Incorporated (VRTX) is crucial for informed decision-making. Below is a summary of key risks to consider:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in drug approval processes or regulations. | High | High |

| Market Competition | Increased competition from emerging biotech firms. | Medium | High |

| Financial Risk | Revenue fluctuations due to reliance on key products. | Medium | Medium |

| Research & Development | Delays in clinical trials or failure to meet milestones. | High | High |

| Economic Conditions | Economic downturn affecting healthcare spending. | Medium | Medium |

In my analysis, regulatory changes and research & development risks are currently the most significant, given Vertex’s heavy investment in its pipeline and dependence on product approvals. With a market cap of approximately 55B, these factors could substantially affect future growth.

Should You Buy Vertex Pharmaceuticals Incorporated?

Vertex Pharmaceuticals has a strong portfolio focused on innovative treatments primarily for cystic fibrosis, with impressive financial ratios such as a net margin of -4.86% and a WACC of 5.22%. However, the company currently faces challenges, as indicated by a negative net margin and a bearish long-term trend.

Given that the net margin is negative, I recommend waiting for the fundamentals to improve before considering an investment in Vertex Pharmaceuticals. The ongoing negative trend coupled with seller volumes suggests a cautious approach is warranted.

Furthermore, potential risks include strong competition in the biotech sector and reliance on a narrow range of products, which may impact future growth.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Why Vertex Skidded Despite Its Beat-And-Raise Quarter – Investor’s Business Daily (Nov 04, 2025)

- Home – Vertex Pharmaceuticals (Jun 02, 2025)

- Vertex Pharmaceuticals’ (NASDAQ:VRTX) Performance Is Even Better Than Its Earnings Suggest – simplywall.st (Nov 11, 2025)

- Vertex Pharmaceuticals Incorporated (VRTX) Is a Trending Stock: Facts to Know Before Betting on It – Yahoo Finance (Oct 22, 2025)

- Vertex Pharmaceuticals Remains A Buy Heading Into Q3 Earnings (VRTX) – Seeking Alpha (Oct 28, 2025)

For more information about Vertex Pharmaceuticals Incorporated, please visit the official website: vrtx.com