In a world where digital commerce is reshaping how we shop, PDD Holdings Inc. stands at the forefront, revolutionizing the retail landscape with its innovative platforms. By seamlessly connecting consumers and businesses through its flagship e-commerce sites like Pinduoduo and Temu, PDD is not just a market player; it’s a transformative force in the specialty retail sector. As we delve into the company’s financials and growth prospects, we must consider whether its robust fundamentals can sustain its current valuation amidst evolving market dynamics.

Table of contents

Company Description

PDD Holdings Inc. is a prominent multinational commerce group headquartered in Dublin, Ireland. Founded in 2015, it operates a diverse portfolio that includes Pinduoduo, a leading e-commerce platform catering to various sectors such as agricultural produce, apparel, and household goods, along with Temu, an online marketplace. With a market capitalization of approximately $183B, PDD stands as a significant player in the specialty retail industry. The company focuses on integrating businesses into the digital economy, showcasing its commitment to innovation and accessibility. Its strategic positioning allows it to shape consumer habits and drive technological advancements within the retail landscape.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of PDD Holdings Inc., focusing on its income statement, key financial ratios, and dividend payout policy.

Income Statement

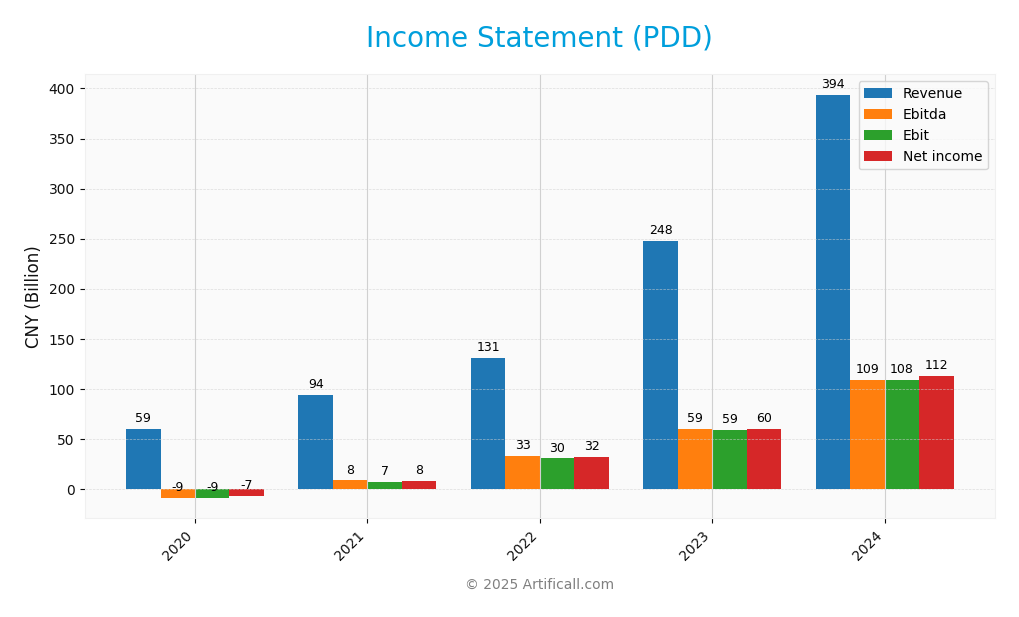

The table below summarizes the income statement for PDD Holdings Inc. over the last five fiscal years, highlighting key financial metrics that are essential for evaluating the company’s performance.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 59.49B | 93.95B | 130.56B | 247.64B | 393.84B |

| Cost of Revenue | 19.28B | 31.72B | 31.46B | 91.72B | 153.90B |

| Operating Expenses | 49.59B | 55.33B | 68.69B | 97.22B | 131.51B |

| Gross Profit | 40.21B | 62.23B | 99.10B | 155.92B | 239.94B |

| EBITDA | -8.73B | 6.90B | 32.63B | 59.48B | 109.13B |

| EBIT | -9.38B | 6.90B | 30.40B | 58.70B | 108.42B |

| Interest Expense | 0.76B | 1.23B | 0.05B | 0.04B | 0 |

| Net Income | -7.18B | 7.77B | 31.59B | 60.03B | 112.43B |

| EPS | -6.04 | 6.20 | 24.96 | 44.32 | 81.24 |

| Filing Date | 2021-04-30 | 2022-04-25 | 2023-04-26 | 2024-04-25 | 2025-04-28 |

Over the five-year period, PDD Holdings has exhibited remarkable growth in revenue and net income. Revenue surged from 59.49B in 2020 to 393.84B in 2024, indicating a strong upward trend. Net income also improved significantly, turning from a loss of 7.18B in 2020 to a robust profit of 112.43B in 2024.

Margins have largely stabilized, with gross profit margin showing a healthy increase, reflecting better cost management. The most recent year (2024) shows an impressive performance with a net income margin that suggests effective operational efficiency, even amid rising operating expenses. This growth trajectory indicates a solid investment potential, although investors should remain cautious of market volatility.

Financial Ratios

The table below summarizes the key financial ratios for PDD Holdings Inc. over the last available years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -0.1207 | 0.0827 | 0.2416 | 0.2424 | 0.2855 |

| ROE | N/A | N/A | N/A | N/A | N/A |

| ROIC | N/A | N/A | N/A | N/A | N/A |

| P/E | -191.94 | 59.74 | 22.55 | 23.32 | 8.71 |

| P/B | 22.90 | 6.18 | 6.04 | 7.47 | 3.13 |

| Current Ratio | 1.78 | 1.72 | 1.85 | 1.93 | 2.21 |

| Quick Ratio | 1.76 | 1.72 | 1.85 | 1.93 | 2.20 |

| D/E | 0.2819 | 0.1699 | 0.1438 | 0.0543 | 0.0339 |

| Debt-to-Assets | 0.1068 | 0.0704 | 0.0714 | 0.0292 | 0.0210 |

| Interest Coverage | -12.39 | 5.60 | 588.56 | 1334.46 | 0 |

| Asset Turnover | 0.3744 | 0.5185 | 0.5506 | 0.7114 | 0.7798 |

| Fixed Asset Turnover | 71.45 | 29.90 | 53.05 | 48.70 | 66.26 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

In 2024, PDD Holdings Inc. shows a strong net margin of 28.55%, indicating efficient cost management and profitability. However, a notable concern is the P/E ratio of 8.71, which, while low, suggests potential undervaluation or market skepticism regarding future growth. The debt ratios are also commendably low, reflecting solid financial health, but the interest coverage ratio of 0 raises concerns about the company’s ability to meet interest obligations.

Evolution of Financial Ratios

Over the past five years, PDD’s financial ratios have shown significant improvement, particularly in profitability metrics like net margin, which rose from -12.07% in 2020 to 28.55% in 2024. The current and quick ratios have also increased, indicating enhanced liquidity, while debt levels have decreased, enhancing the company’s overall financial stability.

Distribution Policy

PDD Holdings Inc. does not currently pay dividends, reflecting a reinvestment strategy aimed at supporting its growth phase. The company prioritizes research and development and acquisitions, which may create long-term shareholder value. Additionally, PDD has engaged in share buybacks, indicating a commitment to return capital to shareholders. This approach may be beneficial if it fosters sustainable growth, but investors should monitor potential risks related to cash flow and market conditions.

Sector Analysis

PDD Holdings Inc. operates in the Specialty Retail sector, primarily through its e-commerce platforms Pinduoduo and Temu, competing against major players like Alibaba and Amazon. Its competitive advantages include a focus on agricultural products and a strong presence in the digital economy.

Strategic Positioning

PDD Holdings Inc. holds a significant position in the specialty retail market, driven primarily by its e-commerce platforms, Pinduoduo and Temu. With a market capitalization of $183B, PDD has captured a notable market share, competing effectively against other giants in the sector. The company faces competitive pressure from established players, yet its unique approach to integrating agricultural products with e-commerce sets it apart. Technological disruption is a constant threat; however, PDD’s commitment to innovation and enhancing user experience positions it well to adapt and thrive in a rapidly evolving marketplace.

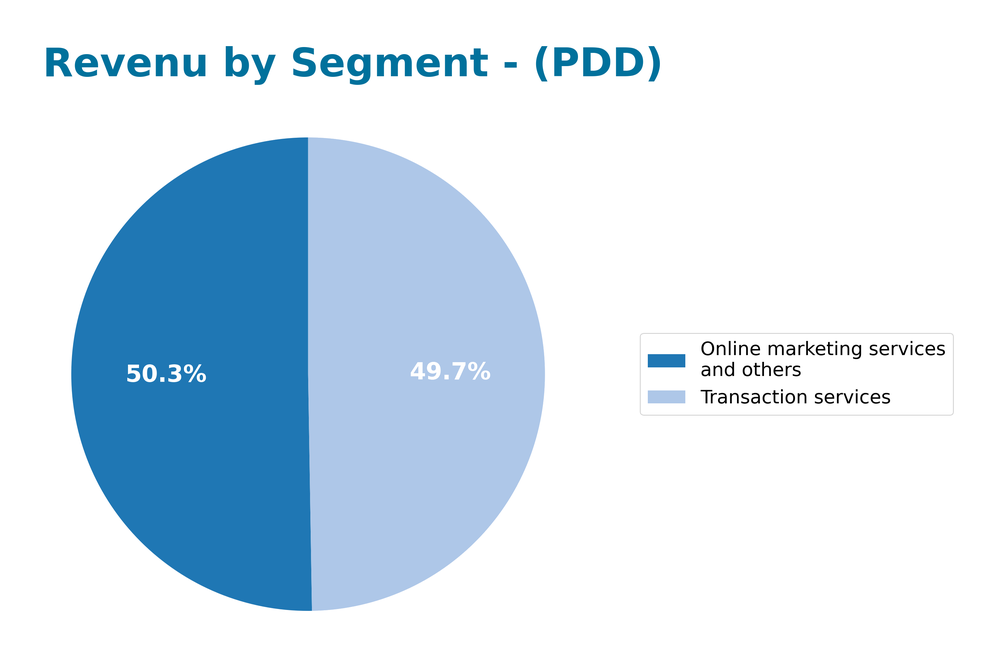

Revenue by Segment

The following chart illustrates PDD Holdings Inc.’s revenue distribution by segment for the fiscal year ending December 31, 2024.

In FY 2024, PDD’s revenue saw significant contributions from two primary segments: Online marketing services and others at 198B CNY, and Transaction services at 196B CNY. The online marketing segment exhibited robust growth, reflecting a strong demand for digital advertising solutions. Transaction services also maintained a solid performance, indicating a stable marketplace. However, compared to FY 2023, growth appears to have decelerated, suggesting potential market saturation or increased competition. Investors should be cautious of margin pressures as the business focuses on optimizing service offerings in a competitive landscape.

Key Products

PDD Holdings Inc. operates a diverse range of products through its e-commerce platforms. Below is a table highlighting some of their key offerings.

| Product | Description |

|---|---|

| Pinduoduo Platform | An e-commerce platform that connects consumers with a wide variety of products, including groceries, apparel, and electronics. |

| Temu Marketplace | An online marketplace featuring a broad selection of goods, from fashion to home appliances, aimed at cost-conscious consumers. |

| Agricultural Produce | A dedicated section on Pinduoduo for fresh and organic agricultural products, promoting local farmers and sustainability. |

| Apparel | A wide range of clothing options for all demographics, focusing on affordability and variety. |

| Household Goods | Includes essential items for home maintenance and improvement, catering to diverse consumer needs. |

| Beauty and Personal Care | A selection of cosmetics and personal care products, targeting health and wellness-conscious shoppers. |

| Sports and Fitness | Products related to fitness and outdoor activities, including apparel, equipment, and accessories. |

| Auto Accessories | A collection of car-related products, including gadgets, maintenance tools, and custom accessories. |

This overview provides insight into the diverse range of products that PDD Holdings Inc. offers, reflecting their commitment to serving various consumer needs.

Main Competitors

No verified competitors were identified from available data. However, I can provide some insights into PDD Holdings Inc.’s estimated market share and competitive position. PDD operates in the specialty retail sector, focusing on e-commerce through platforms like Pinduoduo and Temu. Given its innovative approach and diverse product offerings, the company has carved a significant niche in the digital economy, particularly within the global market.

Competitive Advantages

PDD Holdings Inc. benefits from a strong position in the e-commerce sector through its platforms, Pinduoduo and Temu, which cater to diverse consumer needs across various categories. The company’s focus on integrating businesses into the digital economy gives it a competitive edge. Looking ahead, PDD is poised to explore new markets and expand its product offerings, particularly in the agricultural and lifestyle segments. This strategic direction not only enhances customer engagement but also positions PDD for significant growth opportunities in the rapidly evolving online retail landscape.

SWOT Analysis

The SWOT analysis provides a strategic overview of PDD Holdings Inc. to identify its strengths, weaknesses, opportunities, and threats.

Strengths

- Strong market presence

- Diverse product portfolio

- Innovative technology

Weaknesses

- No dividend payouts

- High dependency on China market

- Regulatory scrutiny

Opportunities

- Expansion into international markets

- Growing e-commerce demand

- Strategic partnerships

Threats

- Intense competition

- Economic downturns

- Supply chain disruptions

The overall SWOT assessment indicates that PDD Holdings Inc. possesses a solid foundation with significant growth opportunities, although it must address its weaknesses and navigate potential threats effectively. A strategic focus on diversification and international expansion could enhance resilience and market positioning.

Stock Analysis

PDD Holdings Inc. (PDD) has experienced significant price movements over the past year, with a notable bearish trend indicating a decline in investor confidence. The stock’s price has fluctuated, reaching a high of 157.57 and a low of 90.5, reflecting ongoing trading dynamics.

Trend Analysis

Over the past year, PDD’s stock price has decreased by approximately 9.36%, indicating a bearish trend. This decline is characterized by acceleration, suggesting that the downward momentum has intensified. The standard deviation of 16.67 indicates a relatively high level of volatility, emphasizing the unpredictability of the stock’s price movements.

Volume Analysis

In the last three months, the average trading volume for PDD has been approximately 42.04M, with an average buy volume of 22.96M and an average sell volume of 19.08M. This data indicates buyer-driven activity, as the buy volume is higher than the sell volume, albeit within a bearish volume trend showing a decline. The deceleration in volume suggests a decrease in market participation, which may reflect waning investor sentiment regarding the stock.

Analyst Opinions

Recent analyst recommendations for PDD Holdings Inc. (PDD) indicate a strong consensus to buy, with an overall rating of A. Analysts have highlighted robust return on equity (5) and return on assets (5) as key strengths, suggesting solid financial performance. The discounted cash flow score (4) also supports growth potential. However, the debt to equity score (2) raises some caution regarding leverage. Overall, the consensus remains optimistic, with analysts advocating for a buy to capitalize on future growth opportunities.

Stock Grades

PDD Holdings Inc. has recently undergone several grade evaluations by recognized analysts, reflecting a mixed outlook.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| New Street Research | Downgrade | Neutral | 2025-08-26 |

| B of A Securities | Maintain | Neutral | 2025-08-26 |

| Benchmark | Maintain | Buy | 2025-08-26 |

| Barclays | Maintain | Overweight | 2025-08-26 |

| JP Morgan | Maintain | Neutral | 2025-05-28 |

| China Renaissance | Downgrade | Hold | 2025-05-28 |

| Benchmark | Maintain | Buy | 2025-05-28 |

| Jefferies | Maintain | Buy | 2025-05-27 |

| Citigroup | Upgrade | Buy | 2025-05-12 |

| Citigroup | Maintain | Neutral | 2025-04-28 |

The overall trend indicates a slight shift towards caution, with some analysts downgrading their ratings while others maintain positive stances. Notably, the recent downgrade from New Street Research may signal a more cautious sentiment in the market for PDD Holdings.

Target Prices

The consensus target price for PDD Holdings Inc. indicates a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 165 | 120 | 149 |

Overall, analysts expect PDD to have a target price around 149, suggesting a balanced view between the high and low estimates.

Consumer Opinions

Consumer sentiment around PDD Holdings Inc. showcases a blend of appreciation and concern, reflecting the diverse experiences of its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great product selection and pricing!” | “Customer service was unresponsive.” |

| “Fast delivery and reliable service.” | “Some items were not as described.” |

| “User-friendly website, easy to navigate.” | “Shipping costs were higher than expected.” |

Overall, consumer feedback reveals that while PDD excels in product variety and delivery speed, challenges in customer service and accuracy of product descriptions persist.

Risk Analysis

In evaluating PDD Holdings Inc. (PDD), I’ve identified several key risks that could impact its performance. Below is a summary of these risks, their probabilities, and potential impacts:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in market demand and competition. | High | High |

| Regulatory Risk | Changes in trade regulations affecting operations. | Medium | High |

| Operational Risk | Supply chain disruptions leading to delays. | Medium | Medium |

| Currency Risk | Exchange rate volatility affecting earnings. | High | Medium |

The most significant risks for PDD currently stem from market fluctuations and regulatory changes, both of which can profoundly affect the company’s profitability and operational capabilities.

Should You Buy PDD Holdings Inc.?

PDD Holdings Inc. showcases a strong market presence with a net profit margin of 28.55%, a return on invested capital (ROIC) significantly exceeding its weighted average cost of capital (WACC) of 4.64%, and a positive long-term trend in performance. However, recent bearish signals in volume and overall trend should be closely monitored.

Based on the most recent net margin and ROIC metrics, PDD appears favorable for long-term investors given its healthy financial ratios and solid profitability. The positive long-term trend, despite current bearish characteristics in volume, suggests that while the stock can be a good addition to a long-term strategy, caution is warranted in the short term due to the volume dynamics.

Specific risks for PDD include increasing competition in its sector, potential supply chain disruptions, and market dependence on consumer sentiment which could affect its financial stability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Candriam S.C.A. Cuts Position in PDD Holdings Inc. Sponsored ADR $PDD – MarketBeat (Nov 16, 2025)

- PDD Holdings Inc. Sponsored ADR (PDD) Stock Moves -1.15%: What You Should Know – Yahoo Finance (Nov 13, 2025)

- PDD Holdings: Dominant Moat In Value Commerce With Years Of Compounding Ahead (NASDAQ:PDD) – Seeking Alpha (Nov 14, 2025)

- PDD Holdings Inc. to Report Q3 2025 Financial Results on November 18, 2025 – Quiver Quantitative (Nov 11, 2025)

- PDD Holdings to Report Third Quarter 2025 Unaudited Financial Results on November 18, 2025 – GlobeNewswire (Nov 11, 2025)

For more information about PDD Holdings Inc., please visit the official website: pddholdings.com