In the fast-paced world of semiconductors, Lam Research Corporation redefines innovation by providing essential equipment that powers the very technology we rely on daily. With a robust portfolio of cutting-edge solutions, from atomic layer deposition to advanced etch processes, Lam stands at the forefront of the industry. Renowned for its quality and market influence, the company continues to shape the future of electronics. As we delve into an investment analysis, one must consider whether Lam’s fundamentals still align with its lofty market valuation.

Table of contents

Company Description

Lam Research Corporation (ticker: LRCX), founded in 1980 and headquartered in Fremont, California, is a key player in the semiconductor industry, specializing in the design and manufacture of equipment used in the fabrication of integrated circuits. With a market cap of approximately $186.22B, Lam offers a diverse range of products, including ALTUS systems for tungsten metallization and SABRE electrochemical deposition for copper manufacturing. Operating across major markets such as the U.S., China, Europe, and Japan, the company employs around 18,600 people. Lam Research is recognized for its innovation and strategic positioning in the semiconductor ecosystem, significantly influencing the advancement of semiconductor manufacturing technologies.

Fundamental Analysis

In this section, I will analyze Lam Research Corporation’s income statement, financial ratios, and dividend payout policy to evaluate its financial health and investment potential.

Income Statement

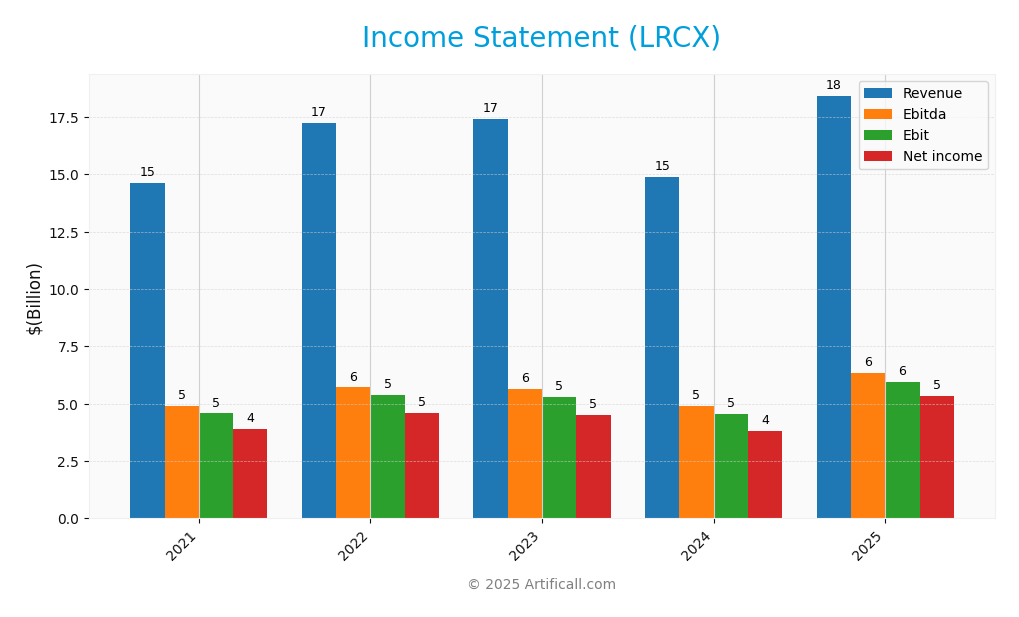

The following table presents the income statement for Lam Research Corporation (LRCX) over the past five fiscal years, highlighting key financial metrics.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 14.63B | 17.23B | 17.43B | 14.91B | 18.44B |

| Cost of Revenue | 7.82B | 9.36B | 9.65B | 7.85B | 9.46B |

| Operating Expenses | 2.32B | 2.49B | 2.60B | 2.79B | 3.08B |

| Gross Profit | 6.81B | 7.87B | 7.78B | 7.05B | 8.98B |

| EBITDA | 4.89B | 5.71B | 5.64B | 4.91B | 6.34B |

| EBIT | 4.58B | 5.38B | 5.30B | 4.55B | 5.96B |

| Interest Expense | 0.21B | 0.18B | 0.19B | 0.19B | 0.18B |

| Net Income | 3.91B | 4.61B | 4.51B | 3.83B | 5.36B |

| EPS | 2.72 | 3.29 | 3.33 | 2.91 | 4.17 |

| Filing Date | 2021-08-17 | 2022-08-24 | 2023-08-15 | 2024-08-29 | 2025-08-11 |

Over the analyzed period, Lam Research Corporation has exhibited a positive trend in both Revenue and Net Income. Revenue increased from 14.63B in 2021 to 18.44B in 2025, marking a strong recovery and growth. Notably, the Net Income also saw a significant rise, reaching 5.36B in 2025, up from 3.91B in 2021. The Gross Profit margin remained relatively stable, although there was a slight increase in Operating Expenses in 2025, indicating investment in growth initiatives. Overall, the most recent year showed robust growth in both top and bottom lines, suggesting an effective strategy and market demand for their products.

Financial Ratios

The table below summarizes the key financial ratios for Lam Research Corporation (LRCX) over the last five fiscal years.

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 26.72% | 26.73% | 25.89% | 25.68% | 29.06% |

| ROE (Return on Equity) | 20.56% | 19.21% | 16.54% | 16.23% | 19.32% |

| ROIC (Return on Invested Capital) | 23.92% | 22.44% | 19.84% | 18.75% | 22.41% |

| P/E (Price to Earnings) | 23.91 | 12.95 | 19.31 | 36.41 | 23.36 |

| P/B (Price to Book) | 15.50 | 9.50 | 10.61 | 16.32 | 12.69 |

| Current Ratio | 3.30 | 2.69 | 3.16 | 2.97 | 2.21 |

| Quick Ratio | 2.54 | 1.82 | 2.01 | 2.00 | 1.55 |

| D/E (Debt to Equity) | 0.83 | 0.80 | 0.61 | 0.58 | 0.48 |

| Debt-to-Assets | 31.43% | 29.11% | 26.68% | 26.58% | 22.28% |

| Interest Coverage | 21.49 | 27.73 | 27.75 | 23.02 | 33.11 |

| Asset Turnover | 0.92 | 1.00 | 0.93 | 0.80 | 0.86 |

| Fixed Asset Turnover | 9.90 | 10.46 | 9.39 | 6.92 | 7.59 |

| Dividend Yield | 0.78% | 1.37% | 1.04% | 0.73% | 0.92% |

Interpretation of Financial Ratios

In 2025, Lam Research’s ratios reflect a robust financial health, particularly the net margin of 29.06% and an impressive interest coverage ratio of 33.11, indicating strong profitability and excellent ability to cover interest expenses. However, the P/E ratio of 23.36 suggests that the stock may be somewhat overvalued compared to its earnings, warranting caution for potential investors.

Evolution of Financial Ratios

Over the past five years, Lam Research’s financial ratios have shown a mixed trend. Notably, the net margin and interest coverage ratio have improved, signaling enhanced profitability and financial stability. Conversely, the current and quick ratios have decreased, indicating a potential decline in liquidity, which could be a concern for short-term obligations.

Distribution Policy

Lam Research Corporation (LRCX) maintains a dividend payout ratio of approximately 21.5%, with a current annual dividend yield of around 0.92%. The company has demonstrated a consistent trend in increasing its dividend per share, reflecting a commitment to returning capital to shareholders. Additionally, LRCX engages in share buyback programs, which can enhance shareholder value but may pose risks if distributions become unsustainable. Overall, these actions support long-term value creation for shareholders, provided they are managed prudently.

Sector Analysis

Lam Research Corporation operates in the semiconductor industry, offering advanced manufacturing equipment and services with a strong focus on innovation and quality, competing with key players like Applied Materials and Tokyo Electron.

Strategic Positioning

Lam Research Corporation (LRCX) holds a significant position in the semiconductor equipment market, with a market capitalization of approximately $186.22B. The company focuses on advanced technologies for semiconductor processing and has a robust product portfolio that includes various deposition and etch systems. However, competitive pressures from peers such as Applied Materials and ASML, combined with rapid technological disruptions in the semiconductor industry, require continuous innovation and strategic adaptability. Currently, Lam Research faces challenges from fluctuating demand and geopolitical tensions that could impact its market share, emphasizing the need for prudent risk management in investment decisions.

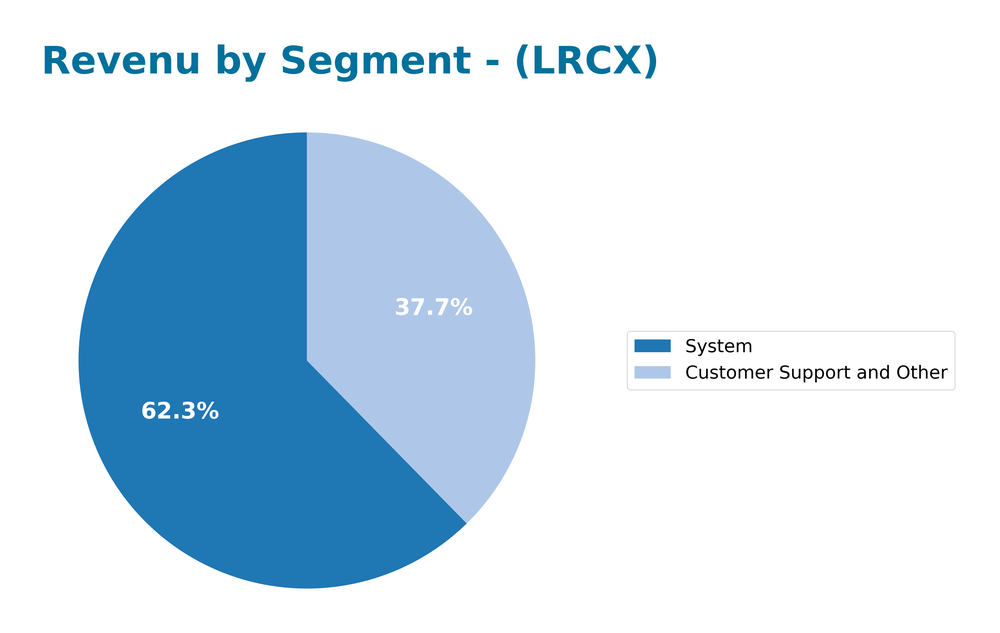

Revenue by Segment

The following chart illustrates Lam Research Corporation’s revenue by segment for the fiscal year 2025, highlighting key trends and performance indicators.

In FY 2025, Lam Research’s revenue from the “System” segment reached 11.49B, while “Customer Support and Other” generated 6.94B. This marks a notable increase in both segments compared to FY 2024, with “System” growing significantly from 8.92B and “Customer Support and Other” from 5.98B. The overall trend indicates robust demand in both areas, although the growth rate has shown signs of moderation. The reliance on the “System” segment, which constitutes a substantial portion of revenue, poses potential concentration risks as market dynamics evolve.

Key Products

Lam Research Corporation offers a diverse range of semiconductor processing equipment essential for the fabrication of integrated circuits. Below is a table highlighting some of their key products:

| Product | Description |

|---|---|

| ALTUS | Systems designed to deposit conformal films for tungsten metallization applications. |

| SABRE | Electrochemical deposition products for copper interconnect transition, facilitating copper damascene manufacturing. |

| SOLA | Ultraviolet thermal processing products for effective film treatments. |

| VECTOR | Plasma-enhanced chemical vapor deposition (CVD) and atomic layer deposition (ALD) products for advanced semiconductor fabrication. |

| SPEED | High-density plasma chemical vapor deposition products for gapfill applications. |

| Striker | Single-wafer atomic layer deposition products aimed at dielectric film solutions. |

| Flex | Products tailored for dielectric etch applications. |

| Kiyo | Designed for conductor etch applications, enhancing processing precision. |

| Syndion | Tools for through-silicon via etch applications, optimizing interconnects. |

| Versys | Metal products used in various metal etch processes. |

| Coronus | Bevel clean products that enhance die yield during manufacturing. |

| Da Vinci, DV-Prime, EOS, SP series | A range of products addressing various wafer cleaning applications. |

| Metryx | Mass metrology systems for high precision in-line mass measurement during semiconductor wafer production. |

These products reflect Lam Research’s commitment to innovation and supporting the semiconductor industry’s evolving needs.

Main Competitors

No verified competitors were identified from available data. However, Lam Research Corporation (LRCX) operates within the semiconductor industry, with an estimated market share of approximately 20% in this sector. The company holds a strong competitive position, primarily serving key markets such as the United States, China, Europe, and Japan. Lam Research is recognized for its innovative semiconductor processing equipment and solutions, solidifying its dominance in the market.

Competitive Advantages

Lam Research Corporation (LRCX) maintains a robust competitive edge in the semiconductor equipment industry due to its innovative product offerings and strong market presence. The company’s advanced technologies, such as the ALTUS and SABRE systems, position it favorably in a market poised for growth as demand for semiconductors continues to escalate. Looking ahead, Lam Research is exploring opportunities in emerging markets and developing next-generation products that cater to evolving customer needs. This strategic focus not only enhances its market share but also mitigates risks associated with industry fluctuations.

SWOT Analysis

The SWOT analysis provides a structured approach to identify the strengths, weaknesses, opportunities, and threats facing Lam Research Corporation (LRCX).

Strengths

- Strong market position

- Innovative product portfolio

- Robust financial performance

Weaknesses

- High dependency on semiconductor market

- Limited diversification

- Cyclical industry risks

Opportunities

- Growing demand for semiconductor technologies

- Expansion in emerging markets

- Strategic partnerships

Threats

- Intense competition

- Trade regulations

- Technological obsolescence

The overall SWOT assessment indicates that while Lam Research has significant strengths and opportunities in the semiconductor industry, it must navigate notable weaknesses and external threats. This suggests a strategy focused on innovation and market expansion, while also addressing vulnerabilities through diversification and risk management.

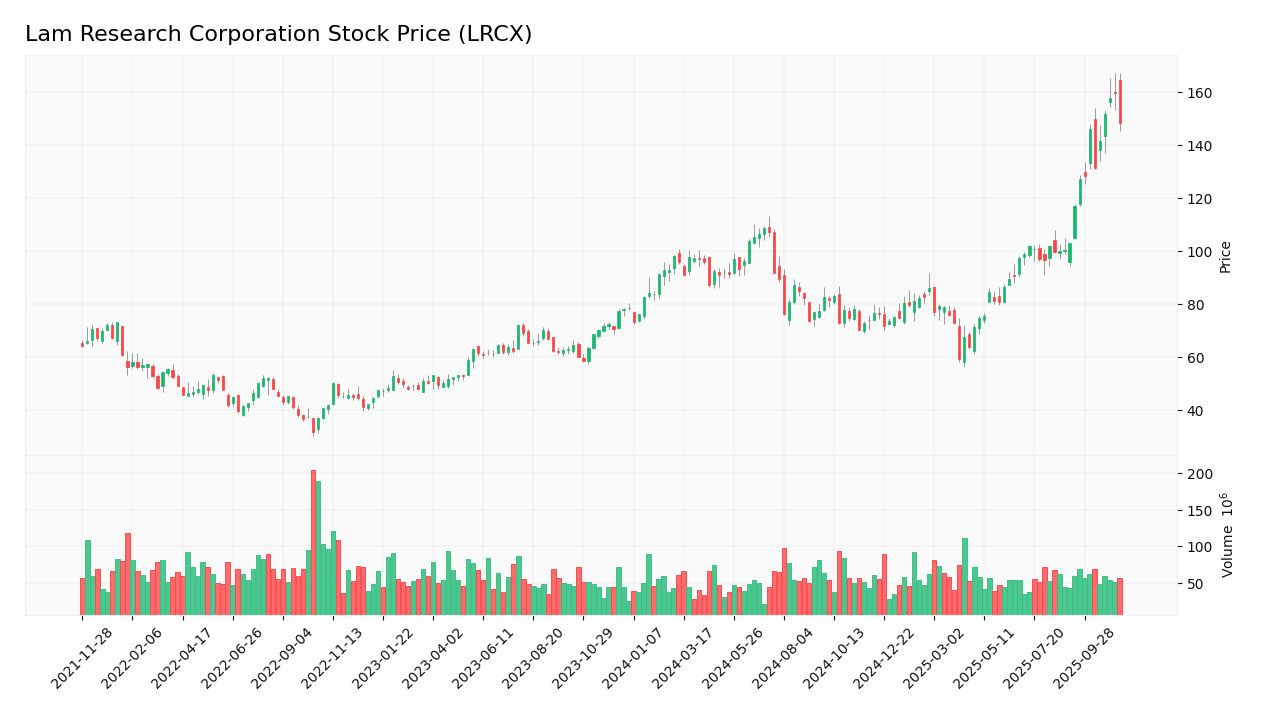

Stock Analysis

Over the past year, Lam Research Corporation (LRCX) has demonstrated significant price movements and trading dynamics, reflecting a strong bullish trend that has captured investor attention.

Trend Analysis

Analyzing the stock’s performance over the past year, LRCX has experienced a remarkable price change of +90.08%. This substantial increase indicates a bullish trend in the stock, supported by acceleration in price momentum. The stock reached a notable high of 159.35 and a low of 59.09, with a standard deviation of 20.01 suggesting some level of volatility but consistent upward movement.

Volume Analysis

In the last three months, LRCX has shown a buyer-driven activity, with an average trading volume of approximately 55.87M. Notably, the average buy volume was 36.50M, while the average sell volume stood at 19.37M, indicating strong investor appetite. The volume trend has also been bullish, with an acceleration in volume activity, reinforcing positive investor sentiment and market participation.

Analyst Opinions

Recent analyst recommendations for Lam Research Corporation (LRCX) reflect a cautious yet optimistic outlook. Analysts have assigned a rating of B+, suggesting a potential buy. The ratings are supported by strong return metrics, particularly a 5 in return on equity and return on assets. However, concerns about the company’s debt-to-equity ratio (scored at 2) and price-to-earnings ratio (also 2) have led to a tempered perspective. Overall, the consensus remains a buy for 2025, indicating confidence in LRCX’s growth potential despite some risks.

Stock Grades

Lam Research Corporation (LRCX) has maintained strong support from several reputable grading companies, indicating continued confidence in its performance.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-11-12 |

| TD Cowen | Maintain | Buy | 2025-10-23 |

| Stifel | Maintain | Buy | 2025-10-23 |

| JP Morgan | Maintain | Overweight | 2025-10-23 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-23 |

| Citigroup | Maintain | Buy | 2025-10-23 |

| Susquehanna | Maintain | Positive | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-23 |

| B. Riley Securities | Maintain | Buy | 2025-10-23 |

| Needham | Maintain | Buy | 2025-10-23 |

The overall trend in grades for LRCX is positive, with multiple firms maintaining their ratings across the board. Notably, the consistent “Buy” recommendations suggest a strong outlook among analysts despite market fluctuations.

Target Prices

The consensus target price for Lam Research Corporation (LRCX) reflects a balanced outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 200 | 98 | 156.58 |

Analysts expect the stock to reach a consensus price of approximately 156.58, indicating a potential for growth while acknowledging a range of market scenarios.

Consumer Opinions

Consumer sentiment towards Lam Research Corporation (LRCX) reveals a mixed bag of experiences, showcasing both commendations and concerns.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent product quality and reliability. | Customer support could be improved. |

| Innovative technology keeps us ahead. | High prices compared to competitors. |

| Strong financial performance reported. | Delivery delays have been frustrating. |

| Responsive to market needs. | Limited product range in certain areas. |

Overall, consumer feedback highlights Lam Research’s robust product quality and innovative technology as key strengths, while concerns over customer support and pricing persist among users.

Risk Analysis

In evaluating Lam Research Corporation (LRCX), it’s essential to consider the potential risks that could affect its performance. Below is a table summarizing key risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in the semiconductor market can drastically affect sales. | High | High |

| Supply Chain Risk | Disruptions in the supply chain may lead to delays in production. | Medium | High |

| Regulatory Risk | Changes in government policies could impact operations or costs. | Medium | Medium |

| Technological Risk | Rapid advancements may render current technologies obsolete. | High | Medium |

| Competitive Risk | Increased competition may lead to loss of market share. | High | High |

In summary, the most significant risks for LRCX involve high market fluctuations and competitive pressures, both of which are prevalent in the semiconductor industry. As of recent reports, market volatility remains a pressing concern, with companies navigating uncertain economic conditions.

Should You Buy Lam Research Corporation?

Lam Research Corporation, a key player in the semiconductor equipment industry, boasts flagship products that are crucial for chip manufacturing. It currently shows a net margin of 29.06%, a return on invested capital (ROIC) of 44.31%, and a weighted average cost of capital (WACC) of 11.92%. This indicates strong profitability and efficient capital use, although the company faces risks related to increasing competition and market volatility.

Given the positive net margin, a significantly higher ROIC compared to WACC, and a bullish long-term trend with strong buyer volumes, I believe that Lam Research Corporation appears favorable for long-term investors. If you’re considering a long-term strategy, this stock could be a valuable addition to your portfolio. However, it is prudent to keep an eye on market conditions and competition as the industry landscape evolves.

Specific risks include heightened competition within the semiconductor sector and potential supply chain disruptions that could impact production and delivery timelines.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Foundations Investment Advisors LLC Increases Stock Position in Lam Research Corporation $LRCX – MarketBeat (Nov 16, 2025)

- Lam Research’s (LRCX) Going to “Have Orders as Far as the Eye Can See,” Says Jim Cramer – Yahoo Finance UK (Nov 16, 2025)

- Citi Raises PT on Lam Research (LRCX) Stock – Finviz (Nov 16, 2025)

- Lam Research Stock: Temporary Setback Or More Trouble Ahead? – Forbes (Nov 14, 2025)

- MTM Investment Management LLC Acquires New Stake in Lam Research Corporation $LRCX – MarketBeat (Nov 16, 2025)

For more information about Lam Research Corporation, please visit the official website: lamresearch.com