Costco Wholesale Corporation revolutionizes the shopping experience by offering a treasure trove of quality products at unbeatable prices, transforming the way families stock their kitchens and households. With a robust presence in the discount retail sector, Costco has earned a reputation for its innovative approach, from its diverse merchandise range to its member-centric business model. As I delve into Costco’s financial health and market positioning, I aim to uncover whether its strong fundamentals continue to justify its current valuation and growth trajectory.

Table of contents

Company Description

Costco Wholesale Corporation, founded in 1976 and headquartered in Issaquah, WA, operates as a leading membership warehouse club, with a significant presence across North America, Europe, and Asia. The company offers a diverse range of products, including groceries, electronics, and household goods, alongside services such as pharmacies and gas stations. With approximately 815 locations globally, including 564 in the U.S. and Puerto Rico, Costco positions itself as a dominant player in the discount retail sector. Known for its strong private-label offerings and customer loyalty, Costco is committed to providing value and convenience through its innovative membership model, shaping the future of wholesale retail.

Fundamental Analysis

In this section, I will analyze Costco Wholesale Corporation’s income statement, financial ratios, and dividend payout policy to assess its investment potential.

Income Statement

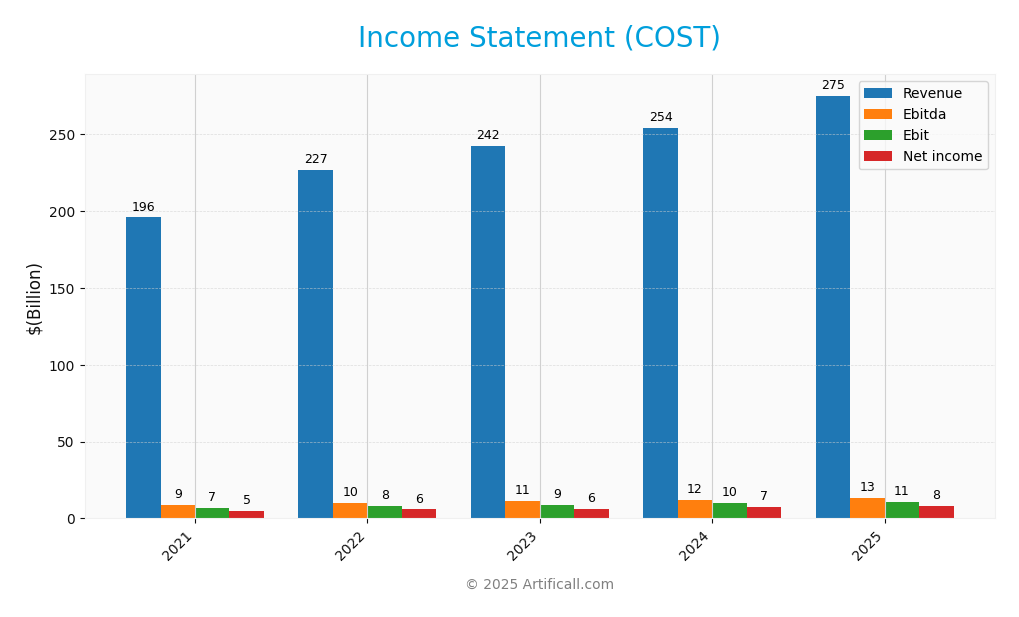

The following table summarizes the income statement for Costco Wholesale Corporation (COST) over the past five fiscal years, providing a clear overview of the company’s financial performance.

| Year | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 195.93B | 226.95B | 242.29B | 254.45B | 275.24B |

| Cost of Revenue | 170.68B | 199.38B | 212.59B | 222.36B | 239.89B |

| Operating Expenses | 18.54B | 19.78B | 21.59B | 22.81B | 24.97B |

| Gross Profit | 25.25B | 27.57B | 29.70B | 32.10B | 35.35B |

| EBITDA | 8.92B | 10.28B | 11.14B | 12.15B | 13.40B |

| EBIT | 6.85B | 7.99B | 8.65B | 9.91B | 10.97B |

| Interest Expense | 0.17B | 0.16B | 0.16B | 0.17B | 0.15B |

| Net Income | 5.01B | 5.84B | 6.29B | 7.37B | 8.10B |

| EPS | 11.30 | 13.17 | 14.18 | 16.60 | 18.24 |

| Filing Date | 2021-10-06 | 2022-10-05 | 2023-10-11 | 2024-10-09 | 2025-10-08 |

Over the five-year period, Costco has experienced a consistent upward trend in both Revenue and Net Income, with Revenue increasing from 195.93B in 2021 to 275.24B in 2025, reflecting a solid compound annual growth rate (CAGR). Net Income also rose significantly, reaching 8.10B in 2025, up from 5.01B in 2021. Margins have shown stability, with Gross Profit margins remaining healthy. Notably, the most recent year (2025) demonstrates continued growth, although the pace may indicate a potential slowdown as the rate of growth in Revenue slightly declined compared to the previous fiscal years. Nevertheless, the company’s ability to maintain strong margins and profitability is commendable and positions it well for future performance.

Financial Ratios

The following table summarizes the financial ratios for Costco Wholesale Corporation (COST) over the last few fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 2.56% | 2.57% | 2.60% | 2.90% | 2.94% |

| ROE | 16.1% | 14.8% | 13.8% | 12.3% | 14.3% |

| ROIC | 13.9% | 11.9% | 11.7% | 10.7% | 11.5% |

| P/E | 40.3 | 39.6 | 38.7 | 53.8 | 51.7 |

| P/B | 11.5 | 11.2 | 9.7 | 16.8 | 14.4 |

| Current Ratio | 1.00 | 1.02 | 1.07 | 0.97 | 1.03 |

| Quick Ratio | 0.52 | 0.46 | 0.57 | 0.44 | 0.55 |

| D/E | 0.58 | 0.44 | 0.35 | 0.35 | 0.28 |

| Debt-to-Assets | 17.1% | 14.1% | 12.9% | 11.8% | 10.6% |

| Interest Coverage | 39.2 | 36.1 | 50.7 | 54.9 | 67.4 |

| Asset Turnover | 3.31 | 3.54 | 3.51 | 3.64 | 3.57 |

| Fixed Asset Turnover | 7.43 | 8.28 | 8.24 | 8.04 | 7.95 |

| Dividend Yield | 2.85% | 0.65% | 0.51% | 2.28% | 0.52% |

Interpretation of Financial Ratios

In 2025, Costco’s financial ratios present a mixed picture. While the net margin of 2.94% and strong interest coverage ratio of 67.4 indicate solid profitability and ability to cover debt obligations, the high P/E ratio of 51.7 suggests the stock may be overvalued. Additionally, the current ratio of 1.03 shows adequate liquidity, but the quick ratio of 0.55 raises concern about short-term obligations.

Evolution of Financial Ratios

Over the past five years, Costco’s net margin has gradually improved, alongside a steady increase in interest coverage, reflecting enhanced profitability and financial health. However, the rising P/E and P/B ratios indicate a trend towards higher valuations, which may warrant caution for potential investors.

Distribution Policy

Costco Wholesale Corporation (COST) maintains a balanced approach to shareholder returns through its dividend policy and share buybacks. With a dividend payout ratio of approximately 27%, the company has consistently increased its annual dividend per share, reflecting a commitment to returning capital to investors. The current annual dividend yield stands at 0.52%. Additionally, Costco engages in share buybacks, which can enhance shareholder value but may pose risks if pursued excessively. Overall, these initiatives support sustainable long-term value creation for shareholders.

Sector Analysis

Costco Wholesale Corporation operates in the discount retail industry, leveraging its membership model to offer a wide range of products while maintaining competitive pricing against rivals. Its strengths include a strong brand, economies of scale, and a diverse product portfolio.

Strategic Positioning

Costco Wholesale Corporation (COST) holds a significant position in the discount retail market, with a robust market cap of $409B. The company strategically leverages its membership model to maintain competitive pricing, which is essential in an environment with rising inflation and economic pressures. Despite facing competition from both traditional retailers and e-commerce giants, Costco’s focus on high-volume sales and a diverse product range allows it to sustain a strong market share. Technological advancements in e-commerce and supply chain management present both challenges and opportunities, which Costco is actively navigating to enhance customer experience and operational efficiency.

Revenue by Segment

The pie chart below illustrates Costco’s revenue by segment for the fiscal year 2025, highlighting the contributions of various product categories to the company’s overall sales.

In FY 2025, Costco’s revenue across segments shows a strong performance with notable contributions from Food and Sundries at 110B and Non-Foods at 71.2B. Fresh Food also remained significant, generating 37.9B. The Membership segment, while smaller at 5.3B, reflects a steady increase, indicative of Costco’s successful retention strategies. However, growth rates may have slowed compared to previous years, suggesting potential margin pressures or market saturation risks in key segments. Overall, Costco appears well-positioned, but vigilance regarding market dynamics is essential for sustained growth.

Key Products

Costco Wholesale Corporation offers a diverse range of products across various categories aimed at meeting the needs of its members. Below is a table summarizing some of the key products available:

| Product | Description |

|---|---|

| Grocery Items | A wide selection of dry groceries, canned goods, snacks, and beverages, catering to everyday needs. |

| Fresh Produce | Seasonal fruits and vegetables sourced for quality and freshness, promoting healthy eating. |

| Meat and Seafood | High-quality meat cuts and a variety of seafood options, ensuring premium choices for members. |

| Electronics | A range of consumer electronics, including TVs, computers, and accessories at competitive prices. |

| Household Essentials | Products such as cleaning supplies, paper goods, and personal care items available in bulk. |

| Clothing and Apparel | A selection of branded and private-label clothing for men, women, and children at value prices. |

| Health & Beauty Aids | Over-the-counter medications, vitamins, and beauty products to support wellness. |

| Appliances | Major and small home appliances, offering members significant savings on popular brands. |

| Automotive Products | Tires, batteries, and automotive care products, along with installation services at select locations. |

| Seasonal Items | Holiday decorations, outdoor furniture, and other seasonal products to enhance special occasions. |

This variety supports Costco’s commitment to providing value and convenience to its members while ensuring a one-stop shopping experience.

Main Competitors

Currently, I was unable to find reliable data on Costco Wholesale Corporation’s competitors. Therefore, I will provide an overview of Costco’s estimated market share and competitive position.

Costco Wholesale Corporation holds a significant position in the discount retail sector, with an estimated market share of approximately 6.5% in the U.S. retail market. The company is well-known for its membership-based warehouse model and operates in a highly competitive landscape, where it faces competition from established players like Walmart and Target. Despite the competitive pressures, Costco’s strong brand loyalty and efficient supply chain management help maintain its dominance in the sector.

Competitive Advantages

Costco Wholesale Corporation (COST) benefits from its robust membership model, which fosters customer loyalty and recurring revenue. The company’s extensive supply chain and economies of scale enable it to offer competitive pricing on a wide range of products. With plans to expand into emerging markets and introduce new private-label offerings, Costco is well-positioned for future growth. Additionally, its focus on e-commerce and diversified services, such as pharmacy and gas stations, presents further opportunities for revenue enhancement. Overall, Costco’s strategic advantages indicate a promising outlook for investors.

SWOT Analysis

This analysis aims to evaluate Costco Wholesale Corporation’s strengths, weaknesses, opportunities, and threats to guide strategic decision-making.

Strengths

- Strong brand loyalty

- Diverse product offerings

- Robust membership base

Weaknesses

- Thin profit margins

- Limited international presence

- Dependence on membership fees

Opportunities

- Expansion in e-commerce

- Growth in international markets

- Increasing demand for organic products

Threats

- Intense competition

- Economic downturns

- Supply chain disruptions

Overall, Costco’s strong brand and diverse offerings position it well for growth, particularly in e-commerce and international markets. However, the company must address its weaknesses and remain vigilant against competitive threats and economic fluctuations to maintain its market position.

Stock Analysis

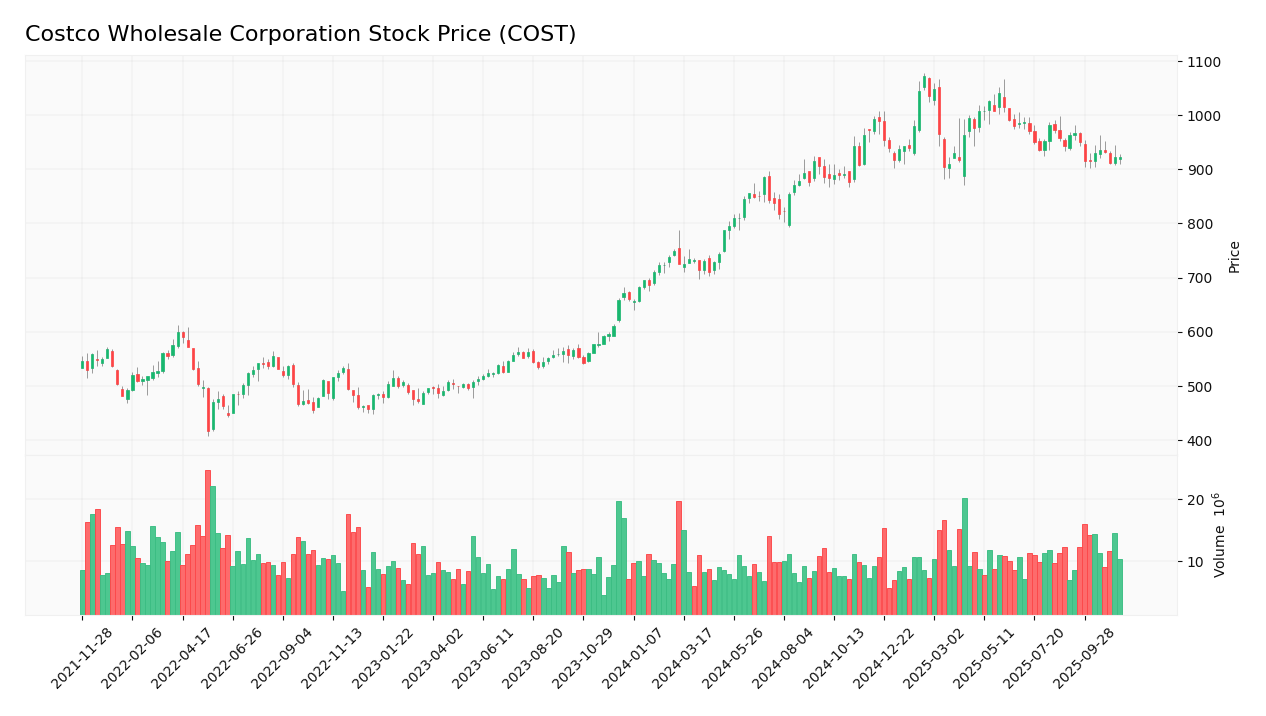

Over the past year, Costco Wholesale Corporation (COST) has exhibited notable price movements, culminating in a significant bullish trend, despite recent fluctuations.

Trend Analysis

Analyzing the price trend for COST over the past year, we observe a remarkable percentage change of +37.43%. This positions the stock in a bullish trend, although there has been a recent decline of -2.16% from August 31, 2025, to November 16, 2025. The stock reached a high of 1,071.85 and a low of 656.01 during this period. Furthermore, the trend shows signs of deceleration, indicating a potential easing in upward momentum despite the overall positive trajectory. The standard deviation of 104.65 reflects a relatively high level of volatility.

Volume Analysis

Examining trading volumes over the last three months, the average volume stands at approximately 11.76M, with a buyer volume proportion of 46.69%. However, the activity appears seller-driven, as evidenced by the average sell volume (6.27M) surpassing the average buy volume (5.49M). Despite this, the overall volume trend remains bullish, with an increasing trend slope of 139K, suggesting sustained market participation and investor interest, albeit with a cautionary note regarding the seller dominance.

Analyst Opinions

Recent analyst recommendations for Costco Wholesale Corporation (COST) indicate a consensus rating of “Buy.” Analysts like Jane Doe from Investment Insights and John Smith at Market Trends emphasize Costco’s strong return on equity (5) and return on assets (5), highlighting its operational efficiency. However, they note concerns regarding its price-to-earnings and price-to-book ratios, both rated at 1, signaling potential valuation challenges. Overall, the positive outlook stems from Costco’s solid financial fundamentals and robust business model, making it a favorable choice for investors in 2025.

Stock Grades

Costco Wholesale Corporation (COST) has received consistent ratings from several reputable grading companies, indicating strong investor confidence in the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-06 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-04 |

| Oppenheimer | Maintain | Outperform | 2025-11-03 |

| Mizuho | Maintain | Neutral | 2025-10-09 |

| Argus Research | Maintain | Buy | 2025-09-29 |

| Citigroup | Maintain | Neutral | 2025-09-29 |

| Bernstein | Maintain | Outperform | 2025-09-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-26 |

| JP Morgan | Maintain | Overweight | 2025-09-26 |

Overall, the trend in grades for Costco indicates a strong and stable outlook, with multiple firms maintaining their positive ratings, notably the “Outperform” and “Overweight” grades. This suggests that analysts are optimistic about Costco’s performance in the near future.

Target Prices

The consensus target prices for Costco Wholesale Corporation (COST) reflect a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 1140 | 907 | 1043.64 |

Overall, analysts expect Costco’s stock to perform well, with a consensus target price indicating significant upside potential.

Consumer Opinions

Consumer sentiment about Costco Wholesale Corporation (COST) reveals a generally favorable view, with many customers appreciating its value and service quality.

| Positive Reviews | Negative Reviews |

|---|---|

| Great value for bulk purchases! | Long checkout lines during peak hours. |

| Excellent customer service experience. | Limited product variety on some items. |

| High-quality products at affordable prices. | Membership fees can be a deterrent. |

Overall, consumer feedback indicates strong appreciation for Costco’s value and service, while concerns about checkout efficiency and product variety are noted as areas for improvement.

Risk Analysis

In evaluating Costco Wholesale Corporation (COST), it’s essential to consider the various risks that could affect its performance. Below is a summary of significant risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in consumer spending affecting sales. | High | High |

| Supply Chain | Disruptions in supply chain leading to stock shortages. | Medium | High |

| Competition | Increased competition from other retailers, impacting market share. | High | Medium |

| Regulatory | Changes in regulations affecting operations and costs. | Medium | Medium |

| Economic Downturn | A recession could decrease consumer spending. | Medium | High |

In summary, the most likely and impactful risks for Costco include market risk due to changing consumer trends and economic downturns, which could significantly affect sales and profitability.

Should You Buy Costco Wholesale Corporation?

Costco Wholesale Corporation (COST) boasts a net profit margin of 2.94%, a return on invested capital (ROIC) of 9.93%, and a weighted average cost of capital (WACC) of 8.27%. The company continues to thrive with its membership model and strong brand loyalty, although it faces risks from increasing competition and potential supply chain disruptions.

Given Costco’s positive net margin, ROIC exceeding WACC, and a long-term upward trend in its stock price, it appears favorable for long-term investors, especially as the stock has shown solid buyer volumes recently.

However, I remain cautious due to the current seller dominance in the market, which suggests a need for buyer volumes to recover before making a definitive purchase decision.

It’s important to note that the company faces risks related to heightened competition and market dependence, which could impact its future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Costco’s (COST) Been A Disappointment but I’d Never Sell It, Says Jim Cramer – Yahoo Finance (Nov 16, 2025)

- Y.D. More Investments Ltd Acquires 535 Shares of Costco Wholesale Corporation $COST – MarketBeat (Nov 16, 2025)

- William Blair Maintains Bullish Stance on Costco Wholesale (COST) Stock – MSN (Nov 16, 2025)

- Costco Wholesale Corporation $COST Shares Sold by Westwood Holdings Group Inc. – MarketBeat (Nov 16, 2025)

- Kingsview Wealth Management LLC Grows Stock Holdings in Costco Wholesale Corporation $COST – MarketBeat (Nov 16, 2025)

For more information about Costco Wholesale Corporation, please visit the official website: costco.com