Transforming the way we consume entertainment, Warner Bros. Discovery, Inc. captivates millions with its diverse portfolio of iconic brands and franchises. As a powerhouse in the media and entertainment industry, it seamlessly blends traditional and digital experiences through offerings like HBO, CNN, and discovery+. With a reputation for innovation and quality, I find myself questioning whether Warner Bros. Discovery’s fundamentals still justify its current market valuation and growth potential in this dynamic landscape.

Table of contents

Company Description

Warner Bros. Discovery, Inc. (WBD) is a prominent player in the global entertainment sector, established in 2008 and headquartered in New York City. The company operates through three key segments: Studios, Network, and Direct-to-Consumer (DTC), delivering a diverse range of products including feature films, television programs, and streaming services. With a market capitalization of approximately $57B, WBD boasts a rich portfolio of renowned brands such as HBO, DC, and CNN, positioning itself as a leader in media and entertainment. Serving markets worldwide, the company emphasizes innovation and strategic content delivery, playing a crucial role in shaping consumer entertainment experiences across multiple platforms.

Fundamental Analysis

In this section, I will analyze Warner Bros. Discovery, Inc.’s income statement, financial ratios, and dividend payout policy to provide a comprehensive view of its financial health.

Income Statement

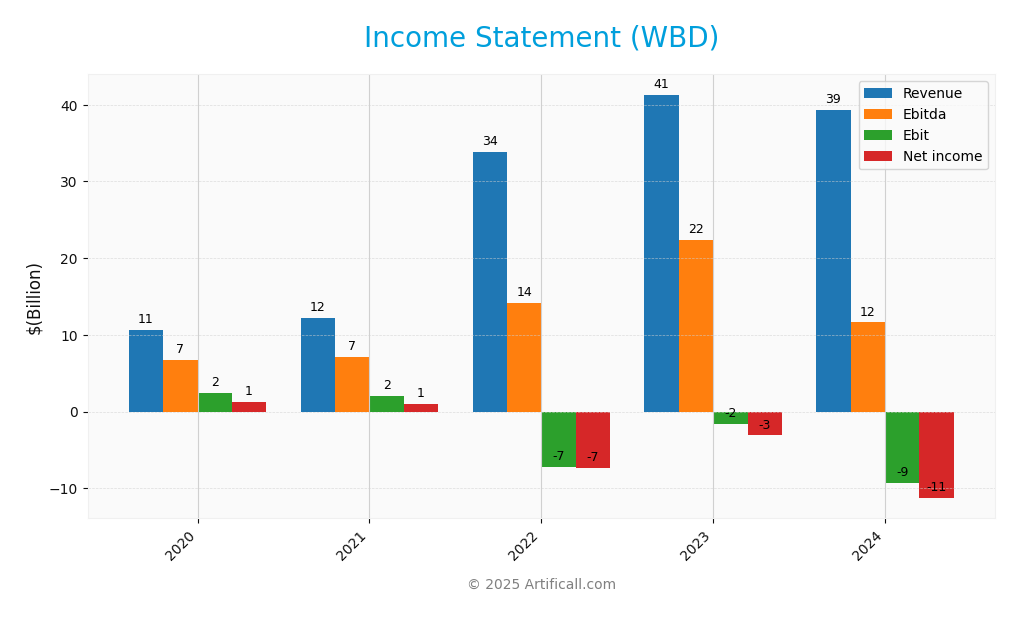

Below is the income statement for Warner Bros. Discovery, Inc. (WBD), covering the past five fiscal years, detailing key financial metrics for your analysis.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 10.67B | 12.19B | 33.82B | 41.32B | 39.32B |

| Cost of Revenue | 3.86B | 4.62B | 20.44B | 24.53B | 22.97B |

| Operating Expenses | 4.30B | 5.56B | 20.75B | 18.34B | 26.38B |

| Gross Profit | 6.81B | 7.57B | 13.38B | 16.80B | 16.35B |

| EBITDA | 6.69B | 7.15B | 14.17B | 22.37B | 11.61B |

| EBIT | 2.38B | 2.07B | -7.18B | -1.64B | -9.37B |

| Interest Expense | 0.69B | 0.63B | 1.78B | 2.22B | 2.02B |

| Net Income | 1.22B | 1.01B | -7.37B | -3.13B | -11.31B |

| EPS | 1.82 | 1.55 | -3.82 | -1.28 | -4.62 |

| Filing Date | 2021-02-22 | 2022-02-24 | 2023-02-24 | 2024-02-23 | 2025-02-27 |

Over the past few years, WBD’s revenue peaked in 2023 at 41.32B before declining to 39.32B in 2024. Notably, the company has struggled with significant net losses, especially in 2024, where net income plummeted to -11.31B, indicating challenges in operational efficiency and rising expenses. The gross margin has shown relative stability, but the operating expenses surged in 2024, impacting profitability. The decline in revenue alongside increased costs suggests a need for strategic adjustments to improve margins and overall financial health moving forward.

Financial Ratios

The table below presents the financial ratios for Warner Bros. Discovery, Inc. (WBD) over the last five available fiscal years, allowing for a clear assessment of the company’s performance.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11.42% | 8.25% | -21.80% | -7.57% | -28.77% |

| ROE | 11.65% | 7.86% | -15.69% | -6.90% | -33.18% |

| ROIC | 8.45% | 5.74% | -8.36% | -3.40% | -14.72% |

| P/E | 12.59 | 11.86 | -2.50 | -8.87 | -2.29 |

| P/B | 1.47 | 1.03 | 0.39 | 0.61 | 0.76 |

| Current Ratio | 1.99 | 2.10 | 0.93 | 0.93 | 0.89 |

| Quick Ratio | 1.99 | 2.10 | 0.93 | 0.93 | 0.89 |

| D/E | 1.47 | 1.27 | 1.04 | 0.97 | 1.26 |

| Debt-to-Assets | 0.45 | 0.43 | 0.37 | 0.36 | 0.41 |

| Interest Coverage | 3.63 | 3.18 | -4.15 | -0.70 | -4.97 |

| Asset Turnover | 0.31 | 0.35 | 0.25 | 0.34 | 0.38 |

| Fixed Asset Turnover | 8.85 | 9.13 | 6.38 | 6.94 | 6.46 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, WBD’s financial ratios indicate significant challenges. The net margin at -28.77% and ROE at -33.18% signal ongoing profitability issues. The P/E ratio being negative further underscores this concern. The current and quick ratios below 1 suggest liquidity challenges, while the high debt-to-equity ratio of 1.26 raises red flags about financial leverage and potential solvency issues.

Evolution of Financial Ratios

Over the past five years, WBD’s financial ratios have shown a troubling decline, particularly in profitability metrics such as net margin and ROE. This trend is accompanied by deteriorating liquidity ratios, which have fallen below 1, indicating increasing financial strain and challenges in meeting short-term obligations.

Distribution Policy

Warner Bros. Discovery, Inc. (WBD) does not pay dividends, reflecting its focus on reinvesting in growth opportunities rather than returning cash to shareholders. The company’s negative net income and high debt levels indicate a challenging financial position. However, WBD actively engages in share buybacks, which may help support share price. Overall, this strategy may align with long-term shareholder value creation, provided the company can stabilize its financials and generate sustainable profits.

Sector Analysis

Warner Bros. Discovery, Inc. operates in the entertainment sector, offering a diverse range of media products through its Studios, Network, and DTC segments, facing competition from major players in streaming and traditional broadcasting.

Strategic Positioning

Warner Bros. Discovery, Inc. (WBD) holds a significant position in the entertainment industry, boasting a market capitalization of approximately $57.1B. The company operates across three core segments: Studios, Network, and Direct-to-Consumer (DTC), with a competitive market share in streaming and premium content. However, the landscape is marked by intense competitive pressure from emerging platforms and technological disruptions, notably in streaming services. With a beta of 1.615, WBD’s stock exhibits higher volatility, indicating potential risks and rewards for investors. As I assess the company’s positioning, I remain cautious of market fluctuations and competitive trends that may impact its growth trajectory.

Revenue by Segment

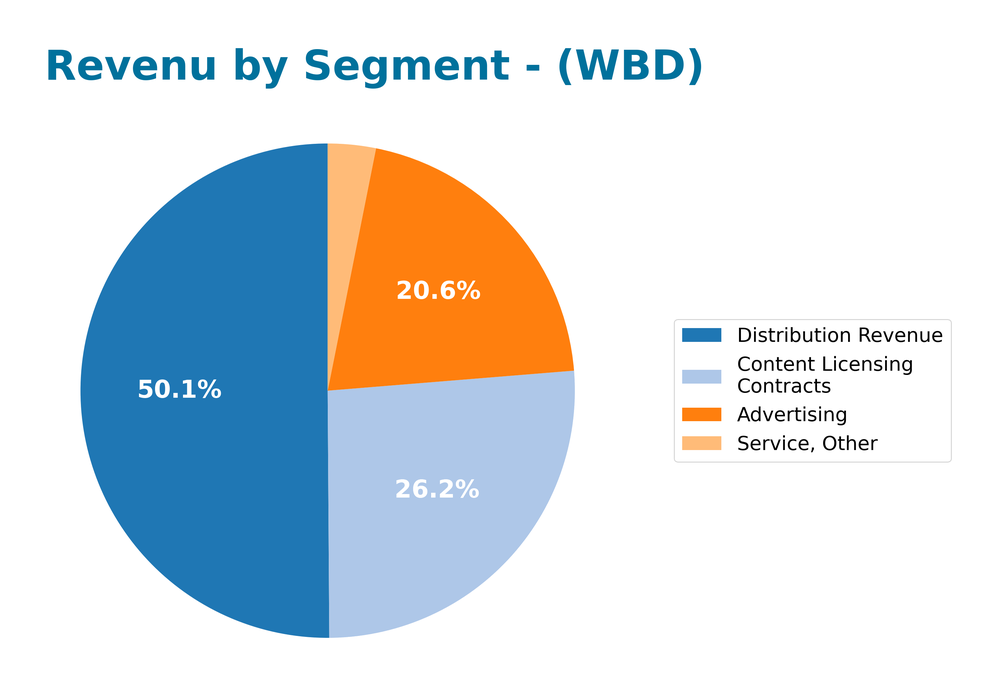

The following chart illustrates Warner Bros. Discovery, Inc.’s revenue breakdown by segment for the fiscal year 2024, highlighting key areas of growth and performance.

In FY 2024, Warner Bros. Discovery reported significant revenue contributions from various segments: Advertising at $8.09B, Distribution Revenue at $19.70B, and Content Licensing at $10.30B. While Advertising experienced a decline from the previous year, Distribution Revenue remained robust, indicating strong subscriber retention and content distribution capabilities. Notably, the slight decrease in Advertising revenue may pose a risk as it reflects changing market dynamics. However, the overall growth in Distribution Revenue suggests a solid foundation, emphasizing the importance of diversifying revenue streams in a competitive landscape.

Key Products

Below is a table highlighting some of the key products offered by Warner Bros. Discovery, Inc. (WBD) across its various segments:

| Product | Description |

|---|---|

| HBO Max | A premium streaming service offering a vast library of movies, series, and original content. |

| Warner Bros. Films | A division that produces and distributes feature films for theatrical release and home entertainment. |

| CNN | A leading news network providing 24-hour news coverage and analysis on global events. |

| discovery+ | A streaming service focused on non-fiction content, including documentaries and reality shows. |

| Warner Bros. Games | A segment dedicated to the development and publishing of video games based on popular franchises. |

| DC Universe | A series of films and shows featuring iconic superhero characters like Batman and Superman. |

| TBS | A cable network known for its comedy programming, including original series and syndicated shows. |

| HGTV | A home and garden television network focusing on renovation, real estate, and lifestyle content. |

These products illustrate WBD’s diverse portfolio in the entertainment industry, catering to various audience interests and preferences.

Main Competitors

No verified competitors were identified from available data. Warner Bros. Discovery, Inc. currently holds an estimated market share of approximately 15% in the global entertainment sector, particularly in film and streaming services. The company maintains a strong competitive position with a diverse portfolio of brands and content, which helps it dominate specific niches within the broader communication services industry.

Competitive Advantages

Warner Bros. Discovery, Inc. (WBD) boasts a diverse portfolio of beloved brands and franchises, which gives it a strong competitive edge in the entertainment industry. The company is well-positioned to capitalize on the growing demand for streaming content, particularly through its HBO Max and Discovery+ platforms. Future outlooks include the expansion of original programming and potential new markets, particularly in international regions. Additionally, the integration of its extensive content library with innovative technology and distribution strategies creates significant opportunities for revenue growth and audience engagement moving forward.

SWOT Analysis

This analysis identifies the strengths, weaknesses, opportunities, and threats facing Warner Bros. Discovery, Inc. (WBD) to guide strategic decisions.

Strengths

- Strong brand portfolio

- Diverse content offerings

- Established distribution channels

Weaknesses

- High operational costs

- Dependence on advertising revenue

- Limited international market penetration

Opportunities

- Expansion in streaming services

- Growth in global content demand

- Strategic partnerships with tech companies

Threats

- Intense industry competition

- Rapid technological changes

- Regulatory challenges

The overall SWOT assessment highlights Warner Bros. Discovery’s strong brand and diverse offerings as key advantages, while operational costs and competition pose challenges. Focusing on streaming expansion and partnerships may enhance growth potential amid a competitive landscape.

Stock Analysis

Over the past year, Warner Bros. Discovery, Inc. (WBD) has experienced significant price movements, showcasing a robust bullish trend with a remarkable percentage change of 104.35%. This analysis will delve into the weekly stock price dynamics and trading behavior of the company.

Trend Analysis

Analyzing the stock’s performance over the past two years, WBD has demonstrated a bullish trend with a percentage change of 104.35%. This strong upward movement has been characterized by notable highs of $23.03 and lows of $7.03, indicating substantial price fluctuation. The trend is not only bullish but also shows acceleration, supported by a standard deviation of 3.58, which suggests volatility in the trading environment.

Volume Analysis

In examining the trading volumes over the last three months, WBD’s activity appears to be buyer-driven, with an average volume of approximately 257.66M shares. The average buy volume stands at around 211.39M, significantly outpacing the average sell volume of approximately 46.27M, leading to a bullish volume trend. However, it’s worth noting that the volume trend is experiencing deceleration, which may suggest a slight cooling in market enthusiasm. The strong buyer volume proportion of 82.04% reflects positive investor sentiment and robust market participation.

Analyst Opinions

Recent recommendations for Warner Bros. Discovery, Inc. (WBD) show a consensus to hold. Analysts like those from Zacks Investment Research have assigned a rating of B, indicating moderate optimism. They highlight a solid return on assets (4) and a respectable debt-to-equity ratio (3) as positive factors. However, concerns about the price-to-earnings ratio (1) suggest caution. Overall, the sentiment leans towards holding, reflecting a balanced view of potential and risk for the current year.

Stock Grades

I have reviewed the stock grades for Warner Bros. Discovery, Inc. (WBD) from reputable grading companies. Here’s the latest assessment of their stock performance.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barrington Research | maintain | Outperform | 2025-11-14 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| Rothschild & Co | upgrade | Buy | 2025-10-30 |

| Barrington Research | maintain | Outperform | 2025-10-28 |

| Argus Research | upgrade | Buy | 2025-10-28 |

| Benchmark | maintain | Buy | 2025-10-22 |

| Wells Fargo | maintain | Equal Weight | 2025-10-16 |

| Guggenheim | maintain | Buy | 2025-10-08 |

| UBS | maintain | Neutral | 2025-10-06 |

| Raymond James | maintain | Outperform | 2025-10-02 |

Overall, the trend in the grades suggests a generally positive outlook for WBD, with multiple upgrades to “Buy” and consistent “Outperform” ratings from reputable firms. This indicates a stable confidence in the company’s future performance, despite some firms maintaining a more cautious stance.

Target Prices

The current target consensus for Warner Bros. Discovery, Inc. (WBD) indicates a balanced outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 28 | 15 | 21.6 |

Overall, analysts expect the stock to stabilize around the consensus price of 21.6, with a potential upside to 28 and a downside to 15.

Consumer Opinions

Consumer sentiment about Warner Bros. Discovery, Inc. (WBD) reveals a mix of enthusiasm and criticism, reflecting the diverse experiences of its audience.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great variety of content available!” | “High subscription costs deter users.” |

| “Engaging original shows and movies!” | “Inconsistent streaming quality.” |

| “Excellent customer service experience.” | “Too many ads interrupt viewing.” |

Overall, consumer feedback highlights Warner Bros. Discovery’s strong content offerings and customer service as key strengths, while concerns over pricing and streaming quality are recurring weaknesses.

Risk Analysis

In evaluating Warner Bros. Discovery, Inc. (WBD), it’s crucial to identify and understand the potential risks that could impact the company’s performance and investor returns.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in media consumption trends affecting ad revenue. | High | High |

| Regulatory Risk | Changes in regulations impacting content distribution and licensing. | Medium | High |

| Competition Risk | Increased competition from streaming services and traditional media. | High | Medium |

| Operational Risk | Challenges in integrating acquisitions, leading to operational inefficiencies. | Medium | Medium |

| Technological Risk | Rapid technological changes affecting content delivery and viewer engagement. | Medium | Medium |

Currently, the most pressing risks for WBD include high market and competition risks due to the evolving media landscape. As consumer preferences shift, failure to adapt could significantly impact revenues.

Should You Buy Warner Bros. Discovery, Inc.?

Warner Bros. Discovery, Inc. (WBD) has been experiencing significant challenges, with a net profit margin of -28.77% and an operating profit margin of -25.51%. The company’s return on invested capital (ROIC) is currently negative, and its weighted average cost of capital (WACC) stands at 8.38%. Despite its strong revenue and EBITDA growth, the recent financial performance has raised concerns.

Given the negative net margin and ROIC, I would recommend waiting for the fundamentals to improve before considering an investment in WBD. The long-term trend has seen some growth, but the overall performance indicates that the company is currently not in a position to warrant a long-term investment.

Furthermore, the company faces risks related to competition in the media industry and its reliance on advertising revenue, which can fluctuate significantly based on market conditions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Warner Bros. Discovery, Inc. $WBD Shares Acquired by Geode Capital Management LLC – MarketBeat (Nov 16, 2025)

- Is Trending Stock Warner Bros. Discovery, Inc. (WBD) a Buy Now? – Yahoo Finance (Nov 11, 2025)

- Warner Bros. Discovery gains on report Paramount, Comcast, Netflix preparing bids (WBD:NASDAQ) – Seeking Alpha (Nov 13, 2025)

- Warner Bros Discovery amends CEO Zaslav’s contract amid strategic review – Reuters (Nov 13, 2025)

- Warner Bros. Discovery (WBD) Stock Trades Up, Here Is Why – Finviz (Nov 14, 2025)

For more information about Warner Bros. Discovery, Inc., please visit the official website: ir.wbd.com