In the evolving landscape of the energy sector, Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR) emerge as key players in nuclear technology, albeit with distinct focuses. Centrus specializes in providing low-enriched uranium and technical solutions, while NuScale innovates with modular reactor designs aimed at sustainable power generation. As both companies navigate the complexities of the nuclear market, their strategies and innovations raise an important question: Which company is better positioned to capitalize on the future of nuclear energy?

Company Overview

Centrus Energy Corp. Overview

Centrus Energy Corp. operates in the uranium sector, supplying nuclear fuel and services primarily for the nuclear power industry in the United States and internationally. Its mission is to provide reliable and affordable nuclear fuel solutions, contributing to a sustainable energy future. The company is structured into two main segments: Low-Enriched Uranium (LEU) and Technical Solutions. Through the LEU segment, Centrus supplies separative work units and natural uranium to utilities, while the Technical Solutions segment offers engineering and operational services, including American Centrifuge engineering. Founded in 1998, Centrus has established itself as a significant player in the energy sector, aiming to support nuclear energy’s role in achieving energy independence and reducing carbon emissions.

NuScale Power Corporation Overview

NuScale Power Corporation is a leader in the renewable utilities industry, focusing on the development and sale of modular light water reactor nuclear power plants. The company’s mission is to revolutionize the nuclear power landscape by providing safer, scalable, and more efficient energy solutions. NuScale’s flagship product, the NuScale Power Module, offers a modular design that enhances flexibility for various applications, including electricity generation and hydrogen production. Founded in 2007, the company operates as a subsidiary of Fluor Enterprises, emphasizing innovative technology to support clean energy transitions and meet growing energy demands sustainably.

Key Similarities and Differences in Business Models

Both Centrus Energy and NuScale Power are entrenched in the nuclear energy sector, focusing on sustainable energy solutions. However, their business models diverge significantly. Centrus primarily provides fuel and technical services, positioning itself as a supplier to existing nuclear facilities. Conversely, NuScale is focused on the innovation of new modular reactor designs, aiming to expand the market for nuclear energy by appealing to new customers and applications. This distinction highlights Centrus’s role in supporting current infrastructure versus NuScale’s ambition to reshape the future landscape of energy generation.

Income Statement Comparison

In the following table, I present a comparison of the income statements for Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR) for the fiscal year ending December 31, 2024.

| Metric | Centrus Energy Corp. (LEU) | NuScale Power Corporation (SMR) |

|---|---|---|

| Revenue | 442M | 37M |

| EBITDA | 86.5M | -134M |

| EBIT | 75.7M | -135M |

| Net Income | 73.2M | -136.6M |

| EPS | 4.49 | -1.47 |

Interpretation of Income Statement

In 2024, Centrus Energy Corp. demonstrated strong growth with a revenue increase to $442 million, up from $320 million in 2023, resulting in a substantial net income of $73.2 million. In contrast, NuScale Power Corporation faced significant losses, with revenue of only $37 million and a net loss of $136.6 million, reflecting ongoing challenges in their operational model. While LEU’s margins appear stable and even improved, SMR’s negative margins indicate a need for strategic reassessment. The divergent performance highlights the importance of evaluating underlying business models before making investment decisions.

Financial Ratios Comparison

The following table compares the most recent financial metrics and ratios for Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR).

| Metric | Centrus Energy (LEU) | NuScale Power (SMR) |

|---|---|---|

| ROE | 10.59% | N/A |

| ROIC | 7.88% | N/A |

| P/E | 14.84 | N/A |

| P/B | 6.73 | 2.70 |

| Current Ratio | 2.93 | 5.25 |

| Quick Ratio | 2.46 | 5.25 |

| D/E | 0.97 | 0.03 |

| Debt-to-Assets | 14.36% | 1.31% |

| Interest Coverage | 17.78 | N/A |

| Asset Turnover | 0.40 | 0.07 |

| Fixed Asset Turnover | 47.02 | 15.30 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Centrus Energy shows a solid return on equity (ROE) and a reasonable price-to-earnings (P/E) ratio, indicating favorable profitability and valuation. However, its debt levels (D/E ratio) could be a concern. In contrast, NuScale Power demonstrates a robust current ratio, suggesting strong liquidity, but its profitability ratios are currently not applicable, reflecting ongoing challenges. Investors should exercise caution given the high debt levels and the lack of profitability metrics for NuScale.

Dividend and Shareholder Returns

Centrus Energy Corp. (LEU) does not pay dividends, reflecting its focus on reinvesting for growth rather than distributing profits. The company has engaged in share buybacks, which may enhance shareholder value by reducing the number of outstanding shares. Conversely, NuScale Power Corporation (SMR) also avoids dividends, driven by a high growth phase and ongoing investments in research and development. Both companies prioritize long-term value creation, but the absence of dividends may raise concerns about immediate returns for shareholders.

Strategic Positioning

In the nuclear energy sector, Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR) are key players with distinctive market positions. Centrus Energy focuses on supplying low-enriched uranium and related services, holding a significant share in the nuclear fuel market. Meanwhile, NuScale Power, specializing in modular reactor technology, faces competitive pressure as it seeks to establish its innovation in a rapidly evolving industry. Both companies must navigate technological disruptions and shifting regulatory landscapes, which could impact their market shares and operational strategies. As an investor, understanding these dynamics is crucial for informed decision-making.

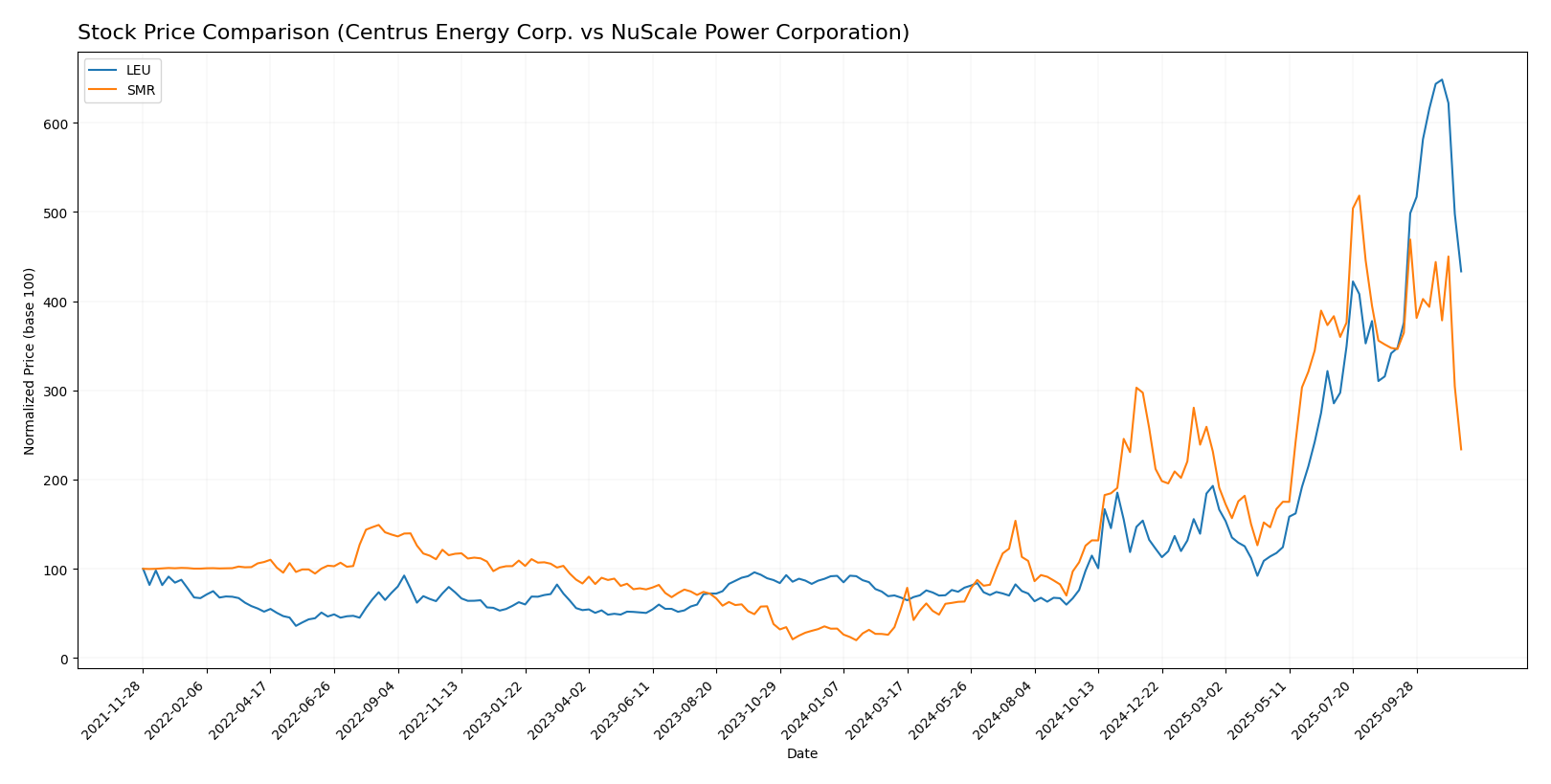

Stock Comparison

In this section, I will analyze the stock price movements of Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR) over the past year, focusing on significant price changes and trading dynamics.

Trend Analysis

Centrus Energy Corp. (LEU) has experienced a remarkable price increase of 372.62% over the past year, indicating a strong bullish trend. Notably, the stock reached a high of 383.0 and a low of 35.36 during this period, with the trend showing acceleration. The recent analysis from August 31, 2025, to November 16, 2025, reveals a further increase of 26.91%, reinforcing the bullish outlook, although with a standard deviation of 64.87, indicating notable volatility.

NuScale Power Corporation (SMR), on the other hand, has shown a price increase of 610.87% over the past year, also reflecting a bullish trend. However, the trend is currently experiencing a deceleration phase. The stock’s price fluctuated between a low of 1.99 and a high of 51.67. In the recent analysis period from August 31, 2025, to November 16, 2025, SMR recorded a decline of 32.71%, which suggests a neutral trend. The standard deviation of 6.24 indicates lower volatility compared to LEU, but the negative variation warrants caution for potential investors.

Analyst Opinions

Recent analyst recommendations for Centrus Energy Corp. (LEU) indicate a “Buy” rating with a solid overall score of 3. Analysts cite strong return on equity and assets as key positive factors. Conversely, NuScale Power Corporation (SMR) has received a “Sell” rating, reflected by an overall score of 1. Analysts attribute this to poor performance across critical metrics. The consensus for the current year favors Centrus Energy with a buy rating, while NuScale Power is advised against for investment.

Stock Grades

In the current market environment, it’s essential to consider the most recent stock ratings from reputable grading companies. Here’s a look at the grades for Centrus Energy Corp. and NuScale Power Corporation.

Centrus Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Neutral | 2025-11-07 |

| JP Morgan | maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-26 |

| Evercore ISI Group | maintain | Outperform | 2025-08-08 |

| B of A Securities | downgrade | Neutral | 2025-08-07 |

| JP Morgan | maintain | Neutral | 2025-08-07 |

| B. Riley Securities | maintain | Buy | 2025-06-23 |

| Evercore ISI Group | maintain | Outperform | 2025-06-18 |

| B. Riley Securities | maintain | Buy | 2024-10-30 |

| Roth MKM | maintain | Neutral | 2024-10-30 |

NuScale Power Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | maintain | Sector Perform | 2025-11-10 |

| Citigroup | downgrade | Sell | 2025-10-21 |

| B of A Securities | downgrade | Underperform | 2025-09-30 |

| Canaccord Genuity | maintain | Buy | 2025-09-03 |

| Canaccord Genuity | maintain | Buy | 2025-08-11 |

| UBS | maintain | Neutral | 2025-08-11 |

| BTIG | downgrade | Neutral | 2025-06-25 |

| Canaccord Genuity | maintain | Buy | 2025-05-29 |

| UBS | maintain | Neutral | 2025-05-29 |

| CLSA | maintain | Outperform | 2025-05-27 |

Overall, Centrus Energy Corp. is maintaining a stable outlook with consistent ratings, primarily around “Neutral” and “Buy,” while NuScale Power Corporation shows a mixed trend with some downgrades, indicating a more cautious investor sentiment. As always, it’s important to consider these grades in the context of your overall investment strategy and risk tolerance.

Target Prices

The consensus target prices from analysts suggest potential upside for both Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Centrus Energy Corp. | 275 | 252 | 263.5 |

| NuScale Power Corporation | 55 | 24 | 37.25 |

Centrus Energy Corp. has a target consensus of $263.5, indicating a positive outlook compared to its current price of $256.02. In contrast, NuScale Power Corporation’s consensus target of $37.25 is significantly higher than its current price of $23.10, which suggests substantial growth potential.

Risk Analysis

In this section, I will outline the key risks associated with two companies: Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR). Understanding these risks is crucial for making informed investment decisions.

| Metric | Centrus Energy Corp. (LEU) | NuScale Power Corporation (SMR) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Very High |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Low | Moderate |

Both companies face significant regulatory risks, particularly in the energy sector, where compliance with stringent regulations is imperative. Recent developments in environmental regulations could further impact SMR, while LEU may experience moderate operational risks due to fluctuating market demands for nuclear fuel.

Which one to choose?

In comparing Centrus Energy Corp. (LEU) and NuScale Power Corporation (SMR), the fundamental analysis suggests a clear differentiation in performance. LEU has demonstrated a robust revenue growth trend, with a recent gross profit margin of 25.23% and an impressive net profit margin of 16.56%. Its stock trend is bullish, showing a 372.62% increase over the past year. Analysts rate LEU with a B- grade, indicating solid fundamentals.

Conversely, SMR has faced challenges, reflected in its D+ rating, negative margins, and a drastic drop in stock price recently. Although SMR’s overall price change is higher at 610.87%, this is coupled with high volatility and declining performance.

Investors focused on growth may prefer LEU, while those seeking potential high-risk returns might consider SMR, aware of its volatility. However, both companies face industry risks, particularly competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Centrus Energy Corp. and NuScale Power Corporation to enhance your investment decisions: