In the rapidly evolving energy sector, the race for dominance in the uranium market is heating up, particularly between two key players: Cameco Corporation (CCJ) and Uranium Energy Corp. (UEC). Both companies are heavily invested in uranium exploration and production, yet they approach innovation and market strategy differently. With the global push for cleaner energy sources, understanding their competitive advantages is crucial. So, which company holds a stronger position to thrive in the future of uranium energy?

Company Overview

Cameco Corporation Overview

Cameco Corporation, listed under the ticker CCJ, is a leading player in the uranium industry, specializing in the production and sale of uranium. The company operates through two main segments: Uranium and Fuel Services. Its Uranium segment focuses on the exploration, mining, and milling of uranium concentrate, while the Fuel Services segment is involved in refining, conversion, and fabrication processes for nuclear fuel. Headquartered in Saskatoon, Canada, Cameco serves various nuclear utilities across the Americas, Europe, and Asia. With a market capitalization of approximately $37.4 billion, Cameco’s strategic positioning in the energy sector emphasizes its commitment to sustainable energy solutions, particularly as global demand for nuclear power grows.

Uranium Energy Corp. Overview

Uranium Energy Corp. (UEC) is an emerging force in the uranium market, primarily focused on the exploration and extraction of uranium and titanium concentrates. Headquartered in Corpus Christi, Texas, UEC operates several projects across the United States, Canada, and Paraguay, including the Palangana mine and the Reno Creek project. With a market capitalization of around $5.4 billion, UEC is dedicated to advancing the development of its uranium assets, leveraging innovative extraction techniques. The company’s strategic vision aligns with the increasing interest in nuclear energy as a viable alternative to fossil fuels, and it aims to play a pivotal role in meeting future energy demands.

Key Similarities and Differences

Both Cameco and Uranium Energy Corp. operate within the uranium sector, focusing on mining and processing uranium. However, their business models diverge significantly. Cameco has a more established presence with a diverse operational structure that includes fuel services, making it a more integrated player in the nuclear fuel supply chain. In contrast, UEC is positioned as a growth-oriented company with a focus on exploration and extraction, primarily in the North American market. This difference highlights Cameco’s long-term stability and market leadership, while UEC’s agile approach may appeal to investors looking for growth opportunities in the evolving energy landscape.

Income Statement Comparison

The table below provides a comparison of the most recent income statements for Cameco Corporation (CCJ) and Uranium Energy Corp. (UEC), illustrating key financial metrics that can aid in investment decisions.

| Metric | Cameco Corporation (CCJ) | Uranium Energy Corp. (UEC) |

|---|---|---|

| Revenue | 3.14B | 67M |

| EBITDA | 789M | -84.5M |

| EBIT | 475M | -88.9M |

| Net Income | 171.9M | -87.7M |

| EPS | 0.40 | -0.20 |

Interpretation of Income Statement

Over the latest fiscal year, Cameco Corporation demonstrated a robust revenue growth of 21.5% compared to the previous year, alongside a decline in net income, which fell by approximately 52.3%. This indicates a significant drop in profitability, likely due to increased operational costs. In contrast, Uranium Energy Corp. faced a challenging year with a modest revenue increase but continued to report substantial net losses, highlighting ongoing operational issues. The negative EBITDA suggests that UEC is not generating sufficient earnings from its core operations, reflecting a need for strategic reassessment. Overall, CCJ shows more stability in terms of revenue and profitability, making it a potentially safer investment compared to UEC.

Financial Ratios Comparison

In this section, I present a comparative table of key financial ratios for Cameco Corporation (CCJ) and Uranium Energy Corp. (UEC) to help you assess their financial health and performance.

| Metric | Cameco Corporation (CCJ) | Uranium Energy Corp. (UEC) |

|---|---|---|

| ROE | 15.00% | -13.00% |

| ROIC | 7.00% | -1.00% |

| P/E | 68.53 | -80.63 |

| P/B | 4.06 | 3.77 |

| Current Ratio | 1.62 | 8.85 |

| Quick Ratio | 0.80 | 5.85 |

| D/E | 0.20 | 0.00 |

| Debt-to-Assets | 0.13 | 0.00 |

| Interest Coverage | 3.98 | -50.71 |

| Asset Turnover | 0.26 | 0.06 |

| Fixed Asset Turnover | 0.77 | 0.09 |

| Payout ratio | 40.52% | 0.00% |

| Dividend yield | 0.22% | 0.00% |

Interpretation of Financial Ratios

Analyzing the ratios, Cameco Corporation (CCJ) demonstrates strong financial metrics, particularly in profitability and leverage, with a healthy ROE and manageable debt levels. In contrast, Uranium Energy Corp. (UEC) exhibits concerning figures, including negative margins and significant losses, indicating substantial operational challenges. Investors should approach UEC with caution given its financial instability and high leverage ratios.

Dividend and Shareholder Returns

Cameco Corporation (CCJ) pays a dividend with a payout ratio of approximately 40.5%, indicating a sustainable distribution backed by free cash flow. The annual dividend yield stands at about 2.17%. In contrast, Uranium Energy Corp. (UEC) does not pay dividends, focusing instead on reinvestment for growth during its high-growth phase. While UEC engages in share buybacks, the lack of dividends may align with long-term value creation if managed prudently. Overall, CCJ’s approach suggests a stable return for shareholders, while UEC’s strategy may offer growth potential but requires careful monitoring of financial health.

Strategic Positioning

Cameco Corporation (CCJ) and Uranium Energy Corp. (UEC) are key players in the uranium market, each holding distinct competitive advantages. Cameco commands a robust market share, largely due to its established operations and extensive global customer base for uranium and fuel services. In contrast, UEC is rapidly growing, focusing on innovative extraction techniques and expanding its project portfolio in the U.S. The competitive pressure in the uranium sector remains high, driven by fluctuating demand for nuclear energy and advancements in technology. As such, both companies must navigate potential technological disruptions while maintaining efficient operations and effective risk management strategies.

Stock Comparison

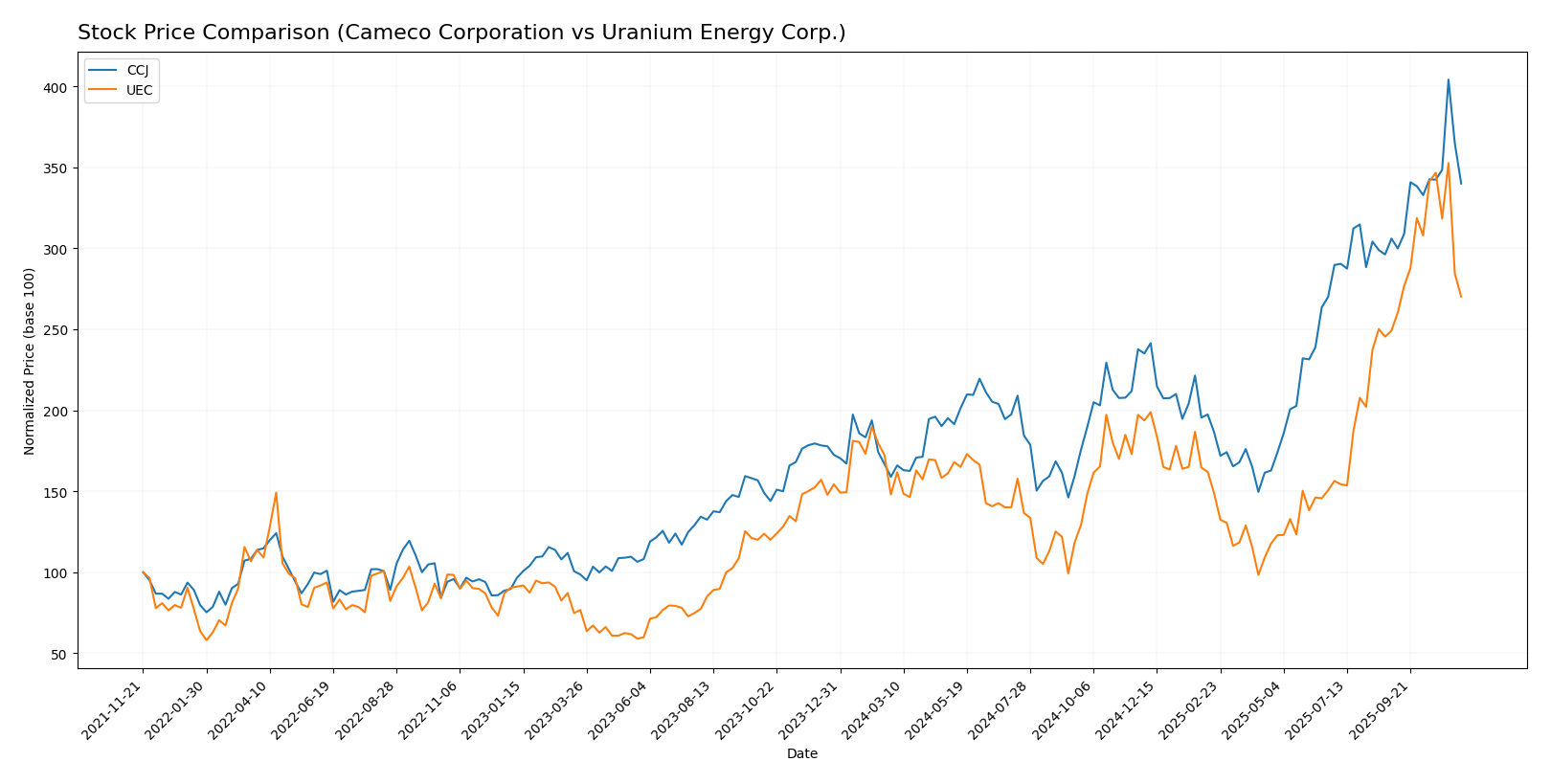

Over the past year, the stock prices of Cameco Corporation (CCJ) and Uranium Energy Corp. (UEC) have exhibited significant movements, reflecting robust trading dynamics and investor interest in the uranium sector.

Trend Analysis

Analyzing the performance over the last 12 months, Cameco Corporation (CCJ) has experienced a remarkable price change of 97.11%, indicating a bullish trend. The stock has shown notable acceleration, with a standard deviation of 14.95, suggesting considerable volatility. The highest price reached was 102.21, while the lowest was 36.96. Recently, from August 31, 2025, to November 16, 2025, CCJ maintained an 11.1% increase, further supporting its bullish momentum.

In contrast, Uranium Energy Corp. (UEC) has also demonstrated a strong price change of 75.08%, categorizing it as bullish as well. The stock has similarly shown acceleration with a standard deviation of 2.41, indicating less volatility compared to CCJ. The peak price was 15.13, and the lowest recorded price was 4.22. From August 31, 2025, to November 16, 2025, UEC’s price increased by 8.42%, confirming its positive trend but at a slower slope of 0.19 compared to CCJ.

Both stocks indicate a favorable outlook, yet investors should remain vigilant about the inherent volatility and potential market fluctuations as they consider adding these equities to their portfolios.

Analyst Opinions

Recent recommendations for Cameco Corporation (CCJ) reflect a cautious optimism, with analysts generally rating it a “B-.” The main arguments supporting this rating include solid return on assets and equity, indicating strong operational efficiency. Notably, analysts see potential growth in the uranium market which supports a buy consensus for the current year. In contrast, Uranium Energy Corp. (UEC) has received a “C-” rating, primarily due to weaker financial metrics and concerns about its return on equity. The consensus for UEC leans towards a hold, given the current market uncertainties.

Stock Grades

In this section, I present the recent stock ratings for two companies, Cameco Corporation (CCJ) and Uranium Energy Corp. (UEC), based on reliable evaluations from well-known grading firms.

Cameco Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| Goldman Sachs | Maintain | Buy | 2025-10-29 |

| RBC Capital | Maintain | Outperform | 2025-08-01 |

| RBC Capital | Maintain | Outperform | 2025-06-20 |

| GLJ Research | Maintain | Buy | 2025-06-12 |

| Goldman Sachs | Maintain | Buy | 2025-06-11 |

| GLJ Research | Maintain | Buy | 2025-03-12 |

| RBC Capital | Maintain | Outperform | 2025-03-04 |

| Scotiabank | Maintain | Outperform | 2024-08-19 |

| GLJ Research | Maintain | Buy | 2024-08-14 |

Uranium Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2025-09-26 |

| BMO Capital | Downgrade | Market Perform | 2025-09-25 |

| Roth Capital | Maintain | Buy | 2025-09-25 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-25 |

| Roth Capital | Maintain | Buy | 2025-09-03 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-06 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-13 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-09 |

| Roth MKM | Maintain | Buy | 2024-10-23 |

| Roth MKM | Maintain | Buy | 2024-09-25 |

Overall, both companies show a strong presence in their respective markets, with Cameco Corporation receiving consistent “Outperform” and “Buy” ratings. Uranium Energy Corp. has seen a recent downgrade but maintains positive ratings from several firms, indicating a mixed outlook that requires careful monitoring.

Target Prices

Based on recent analyst insights, I have gathered the consensus target prices for two companies in the uranium sector.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cameco Corporation (CCJ) | 109 | 70 | 95.75 |

| Uranium Energy Corp. (UEC) | 19.75 | 14 | 17.08 |

For Cameco Corporation, the consensus target price of $95.75 suggests significant upside potential compared to the current stock price of $85.98. Similarly, Uranium Energy Corp. has a target consensus of $17.08, indicating that its stock, currently priced at $11.59, may also offer attractive growth opportunities.

Risk Analysis

In the following table, I outline the key risks associated with two companies in the uranium sector: Cameco Corporation (CCJ) and Uranium Energy Corp. (UEC).

| Metric | Cameco Corporation (CCJ) | Uranium Energy Corp. (UEC) |

|---|---|---|

| Market Risk | High – volatile uranium prices influenced by global demand | High – dependent on market conditions for uranium prices |

| Regulatory Risk | Moderate – subject to strict nuclear regulations in Canada | High – U.S. regulatory environment can impact operations |

| Operational Risk | Moderate – operational challenges in mining and processing | High – operational issues in extraction and processing |

| Environmental Risk | Moderate – environmental regulations and sustainability practices | High – potential environmental impacts from mining activities |

| Geopolitical Risk | Low – primarily operates in stable regions | Moderate – projects in multiple countries can expose to geopolitical tensions |

Both companies face significant market and operational risks. The uranium market is subject to high volatility, affecting profitability. Additionally, UEC’s dependence on various regulatory environments increases operational uncertainties, particularly in the U.S. This landscape necessitates careful consideration for potential investors.

Which one to choose?

In assessing Cameco Corporation (CCJ) and Uranium Energy Corp. (UEC), several factors come into play. CCJ exhibits a strong gross profit margin of 33.9% and a solid return on equity, earning a rating of B-. In contrast, UEC, despite a higher gross profit margin of 36.6%, struggles with significant losses reflected in its C- rating and negative operating margins. Price trends suggest CCJ is in a bullish phase, with a 97.11% overall price increase, compared to UEC’s 75.08%. Analysts favor CCJ for its stability and growth potential.

Investors focused on growth may prefer CCJ for its solid fundamentals and market position, while those willing to take on higher risk may find UEC intriguing due to its potential recovery. However, both companies face risks, particularly market dependence and competition within the uranium sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cameco Corporation and Uranium Energy Corp. to enhance your investment decisions: