Tesla, Inc. doesn’t just manufacture electric vehicles; it revolutionizes how we think about transportation and energy consumption on a global scale. As a powerhouse in the auto manufacturing industry, Tesla is synonymous with innovation, delivering cutting-edge products that redefine our daily commuting experience. With a diverse portfolio that includes electric cars and energy storage solutions, Tesla’s reputation for quality and forward-thinking technology sets it apart. As we delve into the investment landscape, I question whether Tesla’s fundamentals still align with its lofty market valuation and growth potential.

Table of contents

Company Description

Tesla, Inc. is a frontrunner in the electric vehicle (EV) and energy solutions markets, designing, developing, and manufacturing a range of electric vehicles and energy generation and storage systems. Founded in 2003 and headquartered in Austin, Texas, Tesla operates primarily in the U.S. and China, with a growing international presence. Its core activities are divided into two segments: Automotive, which includes electric vehicles and related services, and Energy Generation and Storage, focusing on solar energy solutions and battery storage. With a market cap of $1.3T, Tesla’s strategic emphasis on innovation and sustainability positions it as a transformative force in the auto industry, shaping the future of transportation and renewable energy.

Fundamental Analysis

In this section, I will analyze Tesla, Inc.’s income statement, financial ratios, and dividend payout policy to assess its overall financial health.

Income Statement

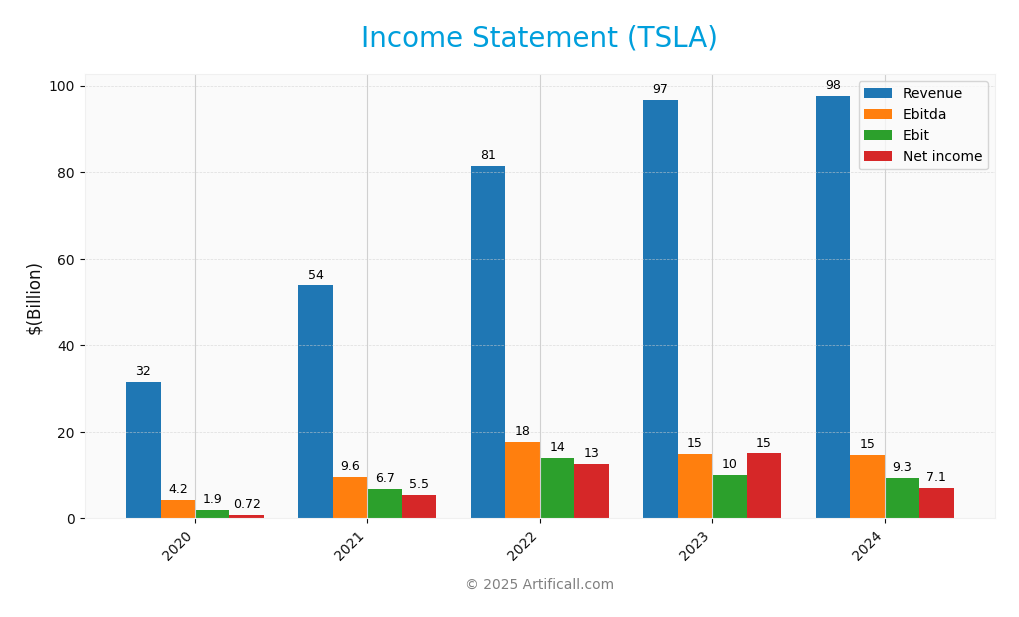

The following table summarizes Tesla, Inc.’s income statement over the last few fiscal years, highlighting key financial metrics and their evolution.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 31.54B | 53.82B | 81.46B | 96.77B | 97.69B |

| Cost of Revenue | 24.91B | 40.22B | 60.61B | 79.11B | 80.24B |

| Operating Expenses | 4.64B | 7.11B | 7.20B | 8.77B | 10.37B |

| Gross Profit | 6.63B | 13.61B | 20.85B | 17.66B | 17.45B |

| EBITDA | 4.22B | 9.63B | 17.66B | 14.80B | 14.71B |

| EBIT | 1.90B | 6.71B | 13.91B | 10.13B | 9.34B |

| Interest Expense | 0.75B | 0.37B | 0.19B | 0.16B | 0.35B |

| Net Income | 0.72B | 5.52B | 12.58B | 14.99B | 7.13B |

| EPS | 0.25 | 1.87 | 4.02 | 4.73 | 2.23 |

| Filing Date | 2021-02-08 | 2022-02-07 | 2023-01-31 | 2024-01-29 | 2025-01-30 |

Interpretation of Income Statement

In reviewing Tesla’s income statement, I observe that revenue has steadily increased from 31.54B in 2020 to 97.69B in 2024, reflecting robust growth. However, net income has fluctuated, peaking at 14.99B in 2023 before declining to 7.13B in 2024. This decline indicates a significant change in profitability, alongside a notable increase in operating expenses which outpaced revenue growth. The gross profit margin has remained relatively stable, though the recent year shows signs of compression. Overall, while Tesla is maintaining strong revenue growth, the decrease in net income and the rising costs warrant careful observation moving forward.

Financial Ratios

Below is a summary of Tesla, Inc.’s financial ratios over recent fiscal years. This data can help investors assess the company’s performance and make informed decisions.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 2.29% | 10.26% | 15.45% | 15.50% | 7.30% |

| ROE | 3.24% | 18.30% | 28.15% | 23.95% | 9.78% |

| ROIC | 3.69% | 13.08% | 21.75% | 16.50% | 5.83% |

| P/E | 913.15 | 188.69 | 30.64 | 52.57 | 181.08 |

| P/B | 29.62 | 34.53 | 8.62 | 12.59 | 17.71 |

| Current Ratio | 1.88 | 1.38 | 1.53 | 1.73 | 2.02 |

| Quick Ratio | 1.59 | 1.08 | 1.05 | 1.25 | 1.61 |

| D/E | 0.60 | 0.29 | 0.13 | 0.15 | 0.19 |

| Debt-to-Assets | 25.46% | 14.28% | 6.98% | 8.98% | 11.16% |

| Interest Coverage | 2.67 | 17.58 | 71.50 | 56.99 | 20.22 |

| Asset Turnover | 0.60 | 0.87 | 0.99 | 0.91 | 0.80 |

| Fixed Asset Turnover | 1.35 | 1.73 | 2.22 | 2.14 | 1.90 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In evaluating Tesla, Inc. (TSLA) based on the latest financial ratios from 2024, I observe a solid liquidity position with a current ratio of 2.02 and a quick ratio of 1.61, indicating good short-term financial health. However, the solvency ratio at 0.26 suggests potential concerns regarding long-term financial stability. Profitability metrics are mixed; the gross profit margin stands at 17.86%, while the net profit margin is lower at 7.30%. Efficiency ratios are robust, notably with a receivables turnover of 22.11, indicating effective asset management. However, the high price-to-earnings ratio of 181.08 raises concerns about valuation relative to earnings, suggesting that the stock may be overvalued at current prices.

Evolution of Financial Ratios

Over the past five years, Tesla’s financial ratios show a considerable evolution, particularly in profitability, which peaked in 2023 but has since seen a decline in margins. The company’s liquidity ratios have improved, reflecting enhanced short-term financial stability, while solvency ratios have shown volatility, indicating fluctuating long-term financial health.

Distribution Policy

Tesla, Inc. (TSLA) does not pay dividends, reflecting its focus on reinvestment and growth. The absence of dividends allows the company to allocate capital toward research, development, and expansion, which may enhance long-term shareholder value. Additionally, Tesla engages in share buybacks, indicating a commitment to returning value to shareholders. This strategy aligns with its high-growth phase, although it comes with risks associated with the sustainability of such growth. Overall, this approach supports long-term value creation, provided growth remains robust.

Sector Analysis

Tesla, Inc. operates in the automotive industry, focusing on electric vehicles and energy solutions, positioning itself as a leader against competitors like Ford and General Motors. Its competitive advantages include innovation, brand recognition, and a robust charging infrastructure.

Strategic Positioning

Tesla, Inc. (TSLA) holds a dominant position in the electric vehicle (EV) market, with a significant market share driven by its innovative technology and expanding product line. As of 2025, the company has maintained a competitive edge despite rising pressures from traditional automotive manufacturers and new entrants in the EV sector. Technological advancements, particularly in battery efficiency and autonomous driving, continue to propel Tesla ahead. Nevertheless, I must remain cautious, as competitive threats and potential regulatory changes could impact Tesla’s growth trajectory in this rapidly evolving market.

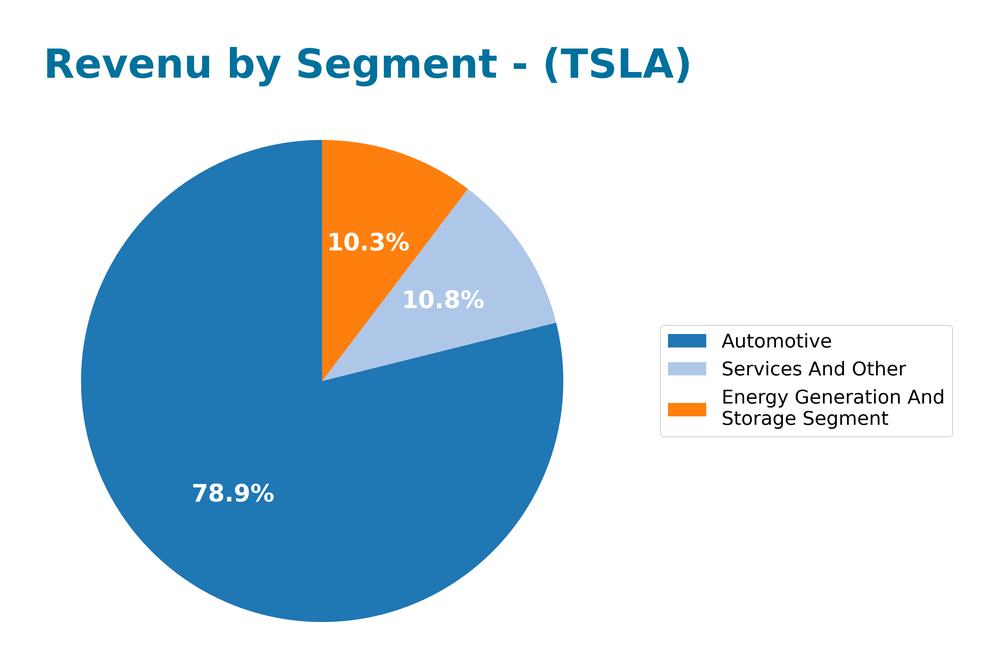

Revenue by Segment

The following chart illustrates Tesla’s revenue by segment for the fiscal year ending December 31, 2024.

In 2024, Tesla’s revenue trends demonstrate a notable shift, particularly in the Automotive segment, which generated $77.1B, a decline from $82.4B in 2023. The Energy Generation and Storage segment grew to $10.1B, up from $6.0B, reflecting strong demand in renewable energy solutions. Services and Other also increased to $10.5B from $8.3B. The overall performance indicates a slowdown in automotive growth, raising concerns about margin risks as competition intensifies in the EV market, while the energy and services segments show promise in diversifying revenue sources.

Key Products

Below is a table summarizing Tesla, Inc.’s key products, which showcase the company’s commitment to innovation in the automotive and energy sectors.

| Product | Description |

|---|---|

| Model S | A luxury all-electric sedan known for its high performance, long range, and advanced technology features. |

| Model 3 | An affordable all-electric sedan aimed at the mass market, offering a balance of performance and efficiency. |

| Model X | An all-electric SUV featuring distinctive falcon-wing doors, spacious interior, and top safety ratings. |

| Model Y | A compact all-electric SUV designed for versatility and comfort, with ample cargo space and advanced safety. |

| Powerwall | A home battery system that stores energy from solar or the grid for later use, enhancing energy independence. |

| Solar Roof | A solar energy solution integrated into roof shingles, allowing homeowners to generate clean energy seamlessly. |

| Megapack | A large-scale energy storage solution designed for utility companies and large commercial applications. |

| Supercharger Network | A global network of fast-charging stations for Tesla vehicles, enabling long-distance travel with ease. |

Tesla continues to lead the charge in electric vehicle technology and renewable energy solutions, making it a compelling choice for investors interested in sustainable innovation.

Main Competitors

No verified competitors were identified from available data. However, Tesla, Inc. (TSLA) currently holds a substantial market share in the electric vehicle sector, estimated at approximately 19% as of the latest reports. Tesla operates primarily in the United States, China, and other international markets, maintaining a dominant position in the electric automotive and energy generation sectors. The company’s innovative technology and strong brand recognition contribute to its competitive edge.

Competitive Advantages

Tesla, Inc. boasts significant competitive advantages in the electric vehicle (EV) market, primarily due to its strong brand recognition and innovative technology. The company is a leader in battery technology, enabling longer range and faster charging times than many competitors. Moreover, Tesla’s vertical integration allows for better control over production and supply chains. Looking ahead, the launch of new models and expansion into global markets, including energy solutions, presents substantial growth opportunities. Additionally, advancements in autonomous driving technology could further enhance Tesla’s market position and profitability.

SWOT Analysis

This analysis aims to identify and evaluate the strengths, weaknesses, opportunities, and threats related to Tesla, Inc. (TSLA).

Strengths

- strong brand recognition

- innovative technology

- diverse product range

Weaknesses

- high production costs

- regulatory scrutiny

- reliance on key personnel

Opportunities

- growing electric vehicle market

- expansion into renewable energy

- global market penetration

Threats

- intense competition

- supply chain disruptions

- economic downturns

The overall SWOT assessment indicates that while Tesla possesses significant strengths and opportunities that can propel growth, it must also address its weaknesses and navigate potential threats effectively. This strategic awareness will be crucial for maintaining its market position and achieving sustainable profitability.

Stock Analysis

In the past year, Tesla, Inc. (TSLA) has demonstrated significant price movements, culminating in a remarkable bullish trend, characterized by a 63.49% increase in stock price.

Trend Analysis

Over the past year, TSLA has experienced a percentage change of +63.49%, indicating a strong bullish trend. The stock has shown acceleration in its upward movement, with notable highs reaching 456.56 and lows at 147.05. The standard deviation of 87.83 suggests considerable price volatility, which is typical for high-growth stocks like Tesla.

Volume Analysis

Analyzing the trading volumes over the last three months, it appears that the activity is slightly buyer-driven, with buyer volume at 2.84B and seller volume at 2.28B. However, overall volume trends are decreasing, which may reflect waning market participation or caution among investors. The recent buyer dominance percentage of 55.48 indicates a prevailing positive sentiment among investors, yet the declining volume trend warrants attention for potential shifts in market dynamics.

Analyst Opinions

Recent analyst recommendations for Tesla, Inc. (TSLA) show a consensus of caution, leaning towards a “hold” position. Analysts, including those from major firms, have assigned a C+ rating, citing concerns over the company’s high debt-to-equity ratio and low price-to-earnings score. While some analysts see potential in Tesla’s return on equity and assets, the current market conditions suggest a more conservative approach. For 2025, the overall sentiment remains neutral, indicating that investors might want to monitor the stock closely before making any significant moves.

Stock Grades

Tesla, Inc. (TSLA) continues to receive consistent evaluations from several reputable grading companies. Here are the latest stock ratings:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Buy | 2025-11-17 |

| Wedbush | maintain | Outperform | 2025-11-07 |

| Wedbush | maintain | Outperform | 2025-11-05 |

| B of A Securities | maintain | Neutral | 2025-10-29 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-27 |

| Freedom Capital Markets | upgrade | Hold | 2025-10-24 |

| Canaccord Genuity | maintain | Buy | 2025-10-23 |

| Needham | maintain | Hold | 2025-10-23 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-23 |

| Truist Securities | maintain | Hold | 2025-10-23 |

Overall, the trend in grades for TSLA shows a stable outlook, with multiple firms maintaining their positive assessments such as “Buy” and “Outperform.” Notably, there has been an upgrade from “Sell” to “Hold” by Freedom Capital Markets, which indicates a shift in sentiment towards the stock.

Target Prices

The consensus target price for Tesla, Inc. (TSLA) reflects a mix of optimism and caution from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 600 | 247 | 429.53 |

Overall, analysts expect TSLA to have a strong upside potential, with the consensus target indicating a balanced view on its future performance.

Consumer Opinions

Consumer sentiment towards Tesla, Inc. remains a mix of enthusiasm for innovation and frustration over service issues.

| Positive Reviews | Negative Reviews |

|---|---|

| “Tesla’s electric vehicles are game-changers for sustainability.” | “Customer service has been inconsistent and slow.” |

| “The technology and performance are unmatched.” | “Long wait times for delivery can be frustrating.” |

| “I love the frequent software updates that improve my car.” | “Some repairs take too long to get resolved.” |

| “Supercharger network makes long trips easy.” | “Interior quality doesn’t match the price.” |

Overall, consumer feedback highlights Tesla’s innovative technology and performance as strong points, while service delays and quality concerns are recurring weaknesses.

Risk Analysis

In evaluating Tesla, Inc. (TSLA), it’s crucial to understand the various risks that could impact the company and its stock performance. Below is a comprehensive table outlining these risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in global markets affecting sales | High | High |

| Regulatory Changes | New regulations on EVs impacting operations | Medium | High |

| Supply Chain Disruptions | Shortages in key components like semiconductors | High | Medium |

| Competition | Increased competition from other EV manufacturers | High | Medium |

| Technological Advances | Rapid tech changes could render current models obsolete | Medium | High |

Synthesis: The most likely and impactful risks for TSLA include market volatility and regulatory changes, both of which have the potential to significantly affect sales and operational efficiency in the current economic climate.

Should You Buy Tesla, Inc.?

Tesla, Inc. reported a positive net margin of 0.07299, indicating profitability. The company has a manageable debt level with a debt-to-equity ratio of 0.1868. The fundamentals have evolved positively, reflected in an overall rating of C+.

Favorable signals The company exhibits a strong cash position with total cash amounting to 50.04B, which represents 37.82% of its total capital. Additionally, the total debt is relatively low at 13.62B, indicating prudent leverage.

Unfavorable signals The stock is currently overvalued with a price-to-earnings (PER) ratio of 181.08, which is significantly higher than 40. Moreover, the return on invested capital (ROIC) stands at 5.83%, which is below the weighted average cost of capital (WACC) of 12.45%, indicating value destruction. Recent trends show that the company has experienced a seller volume greater than buyer volume, suggesting a bearish sentiment in the market.

Conclusion Considering these signals, I might interpret that it would be prudent to wait for more favorable market conditions before making an investment in Tesla, Inc. However, the high PER indicates that the stock is overvalued, and the lack of growth in net income raises a risk of correction.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- You’re Probably Wrong In What You Think You’re Betting On With Tesla Stock (NASDAQ:TSLA) – Seeking Alpha (Nov 18, 2025)

- Cantor Fitzgerald Boosts Tesla (TSLA) Price Target as New Production Plans Accelerate Growth Outlook – Yahoo Finance (Nov 19, 2025)

- Peter Thiel Just Slashed His Stake in Tesla Stock by 76%. Should You Sell TSLA Too? – Barchart.com (Nov 18, 2025)

- Elon Musk Thinks Microsoft Co-Founder Bill Gates Should Close Out ‘Crazy’ Tesla Short Position – Benzinga (Nov 17, 2025)

- Jim Cramer Comments On Tesla (TSLA)’s Share Price Drop – Yahoo Finance (Nov 17, 2025)

For more information about Tesla, Inc., please visit the official website: tesla.com