In a world increasingly reliant on seamless connectivity, QUALCOMM Incorporated stands at the forefront of the semiconductor industry, powering innovations that shape our daily lives. With its cutting-edge technologies driving everything from smartphones to autonomous vehicles, its influence is profound and far-reaching. Renowned for its commitment to quality and relentless innovation, the company not only leads in wireless communication but also diversifies into groundbreaking sectors like AI and IoT. As we delve into this investment analysis, I invite you to consider whether fundamentals continue to justify its current market valuation and growth prospects.

Table of contents

Company Description

QUALCOMM Incorporated, founded in 1985 and headquartered in San Diego, California, is a pivotal player in the global semiconductor industry. The company specializes in the development and commercialization of foundational technologies for wireless communication, operating primarily through three segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). QCT focuses on creating integrated circuits and software for mobile and data communications, while QTL manages licensing for its vast intellectual property portfolio related to wireless technologies, including 5G. With a workforce of approximately 49,000 and a market capitalization of around $183 billion, QUALCOMM is strategically positioned to influence the evolution of wireless technology and contribute to advancements in sectors like artificial intelligence and IoT, thereby shaping the industry’s future.

Fundamental Analysis

In this section, I will analyze QUALCOMM Incorporated’s income statement, financial ratios, and payout policy to provide insights into its financial health and investment potential.

Income Statement

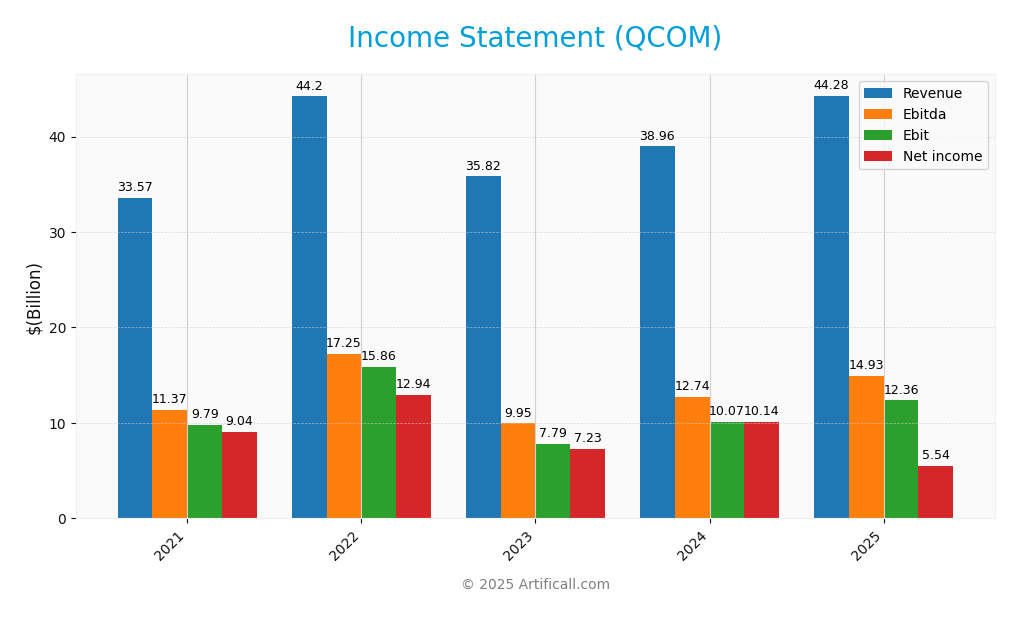

The following table summarizes the income statement for QUALCOMM Incorporated (QCOM) over the last five fiscal years, highlighting key financial metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 33.57B | 44.20B | 35.82B | 38.96B | 44.28B |

| Cost of Revenue | 14.26B | 18.64B | 15.87B | 17.06B | 19.74B |

| Operating Expenses | 9.52B | 9.70B | 12.16B | 11.83B | 12.19B |

| Gross Profit | 19.30B | 25.57B | 19.95B | 21.90B | 24.55B |

| EBITDA | 11.37B | 17.25B | 9.95B | 12.74B | 14.93B |

| EBIT | 9.79B | 15.86B | 7.79B | 10.07B | 12.36B |

| Interest Expense | 0.56B | 0.49B | 0.69B | 0.70B | 0.66B |

| Net Income | 9.04B | 12.94B | 7.23B | 10.14B | 5.54B |

| EPS | 8.00 | 11.52 | 6.47 | 9.09 | 5.06 |

| Filing Date | 2021-11-03 | 2022-11-02 | 2023-11-01 | 2024-11-06 | 2025-11-05 |

In reviewing QUALCOMM’s income statement from 2021 to 2025, we observe a significant growth in revenue, peaking at $44.28 billion in 2025. However, net income has shown volatility, decreasing sharply to $5.54 billion in 2025 from $10.14 billion in 2024. This decline indicates an increase in costs, particularly operating expenses, which have risen to $12.19 billion. Despite the overall revenue growth, the compression of margins suggests that the company is facing higher operational challenges. The most recent year reflects a potential slowdown in earnings growth, emphasizing the need for careful monitoring of cost management strategies moving forward.

Financial Ratios

Below is a table of key financial ratios for QUALCOMM Incorporated (QCOM) over the last five years. These ratios provide insights into the company’s profitability, efficiency, liquidity, and leverage.

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 26.94% | 29.27% | 20.19% | 26.03% | 12.51% |

| ROE | 90.88% | 71.81% | 33.51% | 38.60% | 26.13% |

| ROIC | 33.42% | 42.69% | 18.81% | 22.56% | 30.13% |

| P/E | 16.13 | 9.81 | 17.15 | 18.71 | 32.70 |

| P/B | 14.66 | 7.04 | 5.75 | 7.22 | 8.54 |

| Current Ratio | 1.68 | 1.75 | 2.33 | 2.40 | 2.82 |

| Quick Ratio | 1.41 | 1.15 | 1.67 | 1.79 | 2.10 |

| D/E | 1.64 | 0.90 | 0.74 | 0.59 | 0.70 |

| Debt-to-Assets | 39.52% | 32.97% | 31.48% | 27.99% | 29.54% |

| Interest Coverage | 17.51 | 32.37 | 11.22 | 14.45 | 18.61 |

| Asset Turnover | 0.81 | 0.90 | 0.70 | 0.71 | 0.88 |

| Fixed Asset Turnover | 7.36 | 8.55 | 7.10 | 8.35 | 9.44 |

| Dividend Yield | 2.06% | 2.53% | 2.79% | 1.94% | 2.10% |

Interpretation of Financial Ratios

The most recent year’s ratios present a mixed picture. The net margin has decreased significantly to 12.51%, suggesting potential concerns regarding profitability. While the return on equity (ROE) and return on invested capital (ROIC) are still respectable at 26.13% and 30.13% respectively, the high P/E ratio of 32.70 may indicate that the stock is overvalued. Additionally, the decrease in the current ratio to 2.82 shows a healthy liquidity position, but the decline in net margin requires monitoring.

Evolution of Financial Ratios

Over the past five years, the financial ratios of QUALCOMM have shown notable fluctuations. Most ratios indicate a decline in profitability, particularly in net margin, while liquidity ratios have improved, suggesting an enhanced short-term financial position. The overall trends indicate a need for investors to remain vigilant regarding profitability while appreciating the company’s liquidity strengths.

Distribution Policy

QUALCOMM Incorporated maintains a dividend payout ratio of approximately 68.67%, indicative of a robust commitment to returning value to shareholders. The annual dividend yield stands at around 2.1%, reflecting a consistent trend in dividend payments. Additionally, the company has been actively engaging in share buybacks, which can enhance shareholder value. However, I remain cautious regarding the sustainability of these distributions and the potential risks posed by elevated payout ratios in changing market conditions. Overall, these actions appear to support long-term value creation for shareholders.

Sector Analysis

QUALCOMM Incorporated is a leading player in the semiconductor industry, specializing in wireless technologies and integrated circuits, facing competition from firms like Intel and Broadcom.

Strategic Positioning

QUALCOMM Incorporated holds a significant market share in the semiconductor industry, particularly with its advanced technologies for wireless communication, such as 5G. The company’s competitive position is bolstered by its strong intellectual property portfolio, which secures its market presence against competitors. However, it faces increasing pressure from emerging players and technological disruptions that could shift market dynamics. With a market capitalization of approximately $183 billion, QUALCOMM must continuously innovate to maintain its edge and respond adeptly to the evolving landscape of wireless communication technologies.

Key Products

QUALCOMM Incorporated is renowned for its innovative technologies in the wireless industry. Below is a table highlighting some of its key products that play a crucial role in the company’s operations.

| Product | Description |

|---|---|

| Snapdragon Processors | High-performance mobile processors that power smartphones, tablets, and other devices, enabling advanced functionalities such as AI processing and gaming experiences. |

| 5G Modems | Integrated modems that facilitate 5G connectivity, providing faster data speeds and improved network reliability for mobile devices and IoT applications. |

| Qualcomm CDMA Technologies | A suite of technologies that support various wireless communication standards, including 3G/4G/5G, essential for modern mobile communications. |

| Automotive Solutions | Technologies designed to enhance connectivity and safety in vehicles, including telematics, infotainment systems, and advanced driver assistance systems (ADAS). |

| IoT Solutions | A range of products and services tailored for the Internet of Things, enabling seamless connectivity and data exchange between devices across various industries. |

| Qualcomm Technology Licensing | Licensing of intellectual property related to wireless technologies, allowing manufacturers to use QUALCOMM’s patents in their products, driving innovation in the sector. |

These products represent just a fraction of QUALCOMM’s extensive portfolio, which continues to evolve in response to technological advancements and market demands. As I analyze the company’s potential, these offerings highlight its strength in driving future growth within the technology sector.

Main Competitors

In the semiconductor industry, QUALCOMM Incorporated faces competition from several key players. Below is a table of the main competitors along with their respective market shares:

| Company | Market Share |

|---|---|

| No verified competitors were identified from available data. |

QUALCOMM is estimated to hold a significant position in the semiconductor market, particularly in wireless technology, but without reliable competitor data, a detailed analysis of its competitive landscape is limited. The company has a strong competitive position due to its extensive intellectual property portfolio and involvement in various technology sectors, including 5G and IoT.

Competitive Advantages

QUALCOMM Incorporated boasts several competitive advantages that position it favorably in the semiconductor industry. Its strong portfolio of intellectual property, particularly in wireless communication technologies, allows it to dominate in licensing revenue through its Qualcomm Technology Licensing segment. Looking ahead, the company is well-poised to capitalize on the growing demand for 5G technology and its applications across various sectors, including automotive and artificial intelligence. Furthermore, its investments in early-stage companies through Qualcomm Strategic Initiatives provide opportunities for innovation and expansion into emerging markets. This robust foundation supports QUALCOMM’s future growth and resilience in a competitive landscape.

SWOT Analysis

The SWOT analysis aims to evaluate the strengths, weaknesses, opportunities, and threats associated with Qualcomm Incorporated (QCOM) to inform investment decisions.

Strengths

- Strong market position in semiconductors

- Diverse technology portfolio

- Robust patent portfolio

Weaknesses

- High dependency on mobile markets

- Intense competition

- Regulatory challenges

Opportunities

- Growth in 5G technology adoption

- Expansion into AI and IoT markets

- Strategic partnerships and investments

Threats

- Market volatility and economic downturns

- Rapid technological changes

- Geopolitical risks

The overall SWOT assessment indicates that Qualcomm holds a strong competitive edge in the semiconductor industry, although it faces significant challenges that could impact its market position. Investors should consider both the growth opportunities and potential risks when developing their strategies for investing in QCOM.

Stock Analysis

Over the past year, QUALCOMM Incorporated (QCOM) has experienced significant price movements, characterized by notable highs and lows, alongside fluctuating trading dynamics that provide insight into investor sentiment.

Trend Analysis

Analyzing the stock’s performance over the past year, I note a percentage change of +19.39%. This indicates a bullish trend, despite the recent analysis period showing a more modest increase of +8.15% from August 24, 2025, to November 9, 2025. The highest price reached during this timeframe was $215.33, while the lowest was $127.46. Given the current trend slope of 1.24 and an acceleration status indicating upward momentum, it suggests that the stock is not only on a positive trajectory but gaining speed. The standard deviation of 17.12 reveals that there has been considerable volatility, reinforcing the need for cautious trading strategies.

Volume Analysis

In the last three months, trading volumes have averaged approximately 46.89M shares, with a significant buyer-driven activity characterized by an average buy volume of 35.07M shares compared to an average sell volume of 11.82M shares. This bullish volume trend, with a buyer volume proportion of 74.79%, reflects strong investor confidence and market participation. The increasing volume trend, alongside an acceleration in buyer activity, suggests a favorable sentiment among investors, which could further support the stock’s upward momentum.

Analyst Opinions

Recent analyst recommendations for QUALCOMM Incorporated (QCOM) present a mixed outlook. On November 7, 2025, analysts rated QCOM with a B+ and suggested a neutral position overall. While the discounted cash flow (DCF) analysis indicates a “Buy” recommendation, the return on equity (ROE) and return on assets (ROA) scores both suggest a “Strong Buy.” However, the debt-to-equity and price-to-earnings ratios received “Strong Sell” and “Sell” ratings, respectively. The consensus appears to lean towards a cautious approach, with a balanced view between potential growth and existing risks in the current year.

Stock Grades

No verified stock grades were available from recognized analysts for QUALCOMM Incorporated (QCOM). This absence of reliable grading data makes it challenging to assess the current sentiment among investors. However, it is essential to consider QUALCOMM’s position in the semiconductor market and its recent performance, which may influence investor sentiment moving forward.

Target Prices

No verified target price data is available from recognized analysts for QUALCOMM Incorporated (QCOM). The general market sentiment surrounding the stock appears cautious, reflecting ongoing industry challenges and competitive pressures.

Consumer Opinions

Consumer sentiment towards QUALCOMM Incorporated reveals a mixed bag of experiences, showcasing both strong support and notable criticisms.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent performance in 5G technology.” | “Customer service could be improved.” |

| “Innovative products that lead the market.” | “High prices compared to competitors.” |

| “Reliable and strong brand reputation.” | “Issues with software compatibility.” |

Overall, consumer feedback reflects a strong appreciation for QUALCOMM’s innovation and market leadership, while concerns about customer service and pricing persist.

Risk Analysis

In evaluating QUALCOMM Incorporated (QCOM), it is crucial to understand the various risks that could impact its performance. Below is a summary of the most pertinent risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in semiconductor demand affecting sales. | High | High |

| Regulatory Risk | Potential antitrust actions impacting operations. | Medium | High |

| Technological Risk | Rapid innovation leading to obsolescence of products. | High | Medium |

| Supply Chain Risk | Disruptions due to geopolitical tensions or pandemics. | Medium | High |

| Competition Risk | Intense competition from other tech firms. | High | Medium |

In recent months, supply chain disruptions have been a significant concern for many semiconductor companies, including QUALCOMM, emphasizing the importance of effective risk management strategies.

Should You Buy Qualcomm Incorporated?

Qualcomm Incorporated (QCOM) has a diverse product portfolio, primarily focusing on semiconductor technologies and wireless telecommunications. Currently, the company boasts a net profit margin of 12.51%, a return on invested capital (ROIC) of 30.13%, and a weighted average cost of capital (WACC) that remains competitive. However, recent trends indicate a bearish market condition, accompanied by significant seller volumes, which raises concerns.

Given the current net margin above 0 and a ROIC that significantly exceeds WACC, coupled with a long-term trend that remains negative, it would be prudent to exercise caution. The seller volumes indicate a lack of buying interest, which suggests that it may be wise to wait for a more favorable market environment or a bullish reversal before considering an investment in Qualcomm.

Additionally, it’s important to note the specific risks surrounding Qualcomm, including intense competition within the semiconductor industry, potential disruptions in the supply chain, and fluctuations in market demand affecting valuations.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Midwest Trust Co Takes Position in QUALCOMM Incorporated $QCOM – MarketBeat (Nov 09, 2025)

- Qualcomm: Strong Results, Wrong Selloff – Why I’m Going Strong Buy – Seeking Alpha (Nov 06, 2025)

- Earnings call transcript: Qualcomm Q4 2025 beats forecasts, stock rises – Investing.com (Nov 05, 2025)

- QUALCOMM Incorporated $QCOM Shares Bought by Profund Advisors LLC – MarketBeat (Nov 09, 2025)

- Qualcomm slips even as Q4 results, guidance top estimates (QCOM:NASDAQ) – Seeking Alpha (Nov 05, 2025)

For more information about QUALCOMM Incorporated, please visit the official website: qualcomm.com