In a world increasingly reliant on data, Super Micro Computer, Inc. stands at the forefront of the computer hardware industry, crafting high-performance server and storage solutions that empower enterprises and fuel innovations in cloud computing, AI, and 5G. With a reputation for modular design and cutting-edge technology, Super Micro has revolutionized how businesses manage and process information. As I analyze the company’s recent performance, I am left to ponder: do its robust fundamentals still justify its current market valuation and growth prospects?

Table of contents

Company Description

Super Micro Computer, Inc. (NASDAQ: SMCI), founded in 1993 and headquartered in San Jose, California, specializes in high-performance server and storage solutions. The company operates within the technology sector, particularly in the computer hardware industry, catering to markets such as enterprise data centers, cloud computing, artificial intelligence, and 5G. Its extensive product range includes modular blade servers, full racks, networking devices, server management software, and integrated services. With a strong presence in North America, Europe, and Asia, Super Micro has positioned itself as a leader in innovation, leveraging modular and open architecture to meet evolving customer needs. The company’s commitment to application-optimized solutions solidifies its role in shaping industry standards and driving technological advancement.

Fundamental Analysis

In this section, I will provide a comprehensive analysis of Super Micro Computer, Inc. (SMCI) by examining its income statement, financial ratios, and payout policy to gauge its overall financial health.

Income Statement

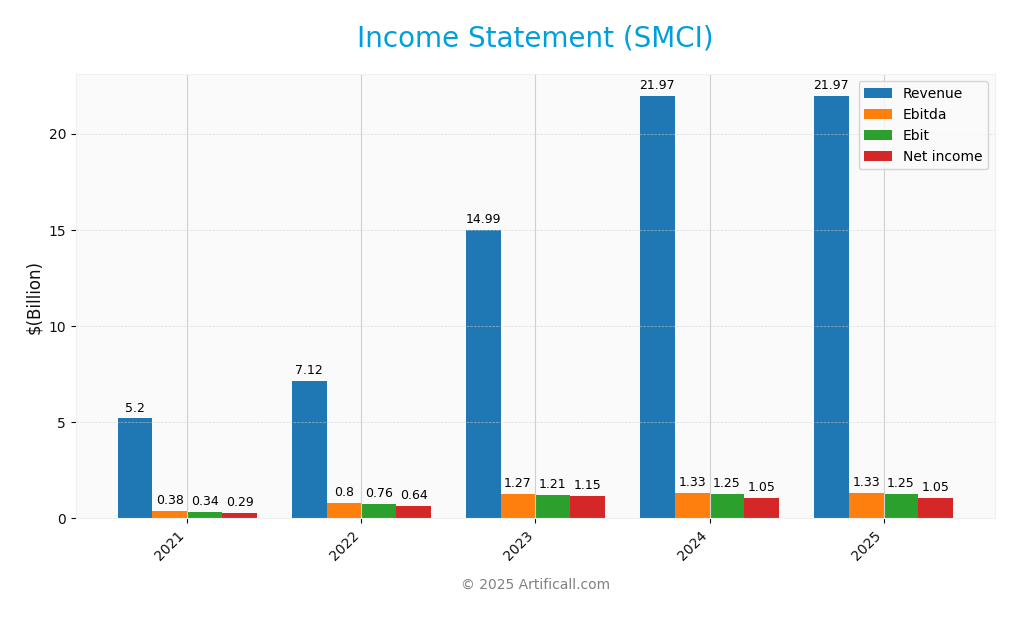

The following table summarizes the income statement for Super Micro Computer, Inc. (SMCI) over the past five years, providing insight into revenue, expenses, and profitability.

| Item | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 5.20B | 7.12B | 14.99B | 21.97B | 21.97B |

| Cost of Revenue | 4.40B | 5.84B | 12.93B | 19.54B | 19.54B |

| Operating Expenses | 0.46B | 0.52B | 0.85B | 1.18B | 1.18B |

| Gross Profit | 0.80B | 1.28B | 2.06B | 2.42B | 2.42B |

| EBITDA | 0.38B | 0.80B | 1.27B | 1.33B | 1.33B |

| EBIT | 0.34B | 0.76B | 1.21B | 1.25B | 1.25B |

| Interest Expense | 0.01B | 0.01B | 0.02B | 0.06B | 0.06B |

| Net Income | 0.29B | 0.64B | 1.15B | 1.05B | 1.05B |

| EPS | 0.55 | 1.21 | 2.17 | 1.77 | 1.77 |

| Filing Date | 2025-08-28 |

Over the five-year period, Super Micro Computer, Inc. has shown substantial growth in revenue, particularly between 2022 and 2023, where revenue nearly doubled. However, in 2024 and 2025, revenue plateaued at approximately $21.97 billion. The net income followed a similar pattern, peaking in 2023, with a slight decline in the subsequent two years. Gross profit margins and operating margins displayed stability, indicating effective cost management. In the most recent year, while revenue growth slowed, profitability remained robust, suggesting the company has managed to maintain its operational efficiency amidst market fluctuations.

Financial Ratios

Below is a summary of key financial ratios for Super Micro Computer, Inc. (SMCI) over the last five fiscal years:

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.14% | 5.49% | 8.98% | 7.69% | 4.77% |

| ROE | 10.20% | 20.00% | 32.45% | 21.28% | 16.64% |

| ROIC | 7.30% | 19.32% | 33.09% | 16.19% | 10.73% |

| P/E | 16.10 | 7.46 | 20.62 | 40.58 | 27.74 |

| P/B | 1.64 | 1.46 | 6.69 | 8.63 | 4.62 |

| Current Ratio | 1.93 | 1.91 | 2.31 | 3.81 | 5.25 |

| Quick Ratio | 0.85 | 0.86 | 1.26 | 1.96 | 3.25 |

| D/E | 0.11 | 0.44 | 0.15 | 0.40 | 0.76 |

| Debt-to-Assets | 5.31% | 19.36% | 7.90% | 22.22% | 34.09% |

| Interest Coverage | 37.40 | 52.26 | 72.55 | 62.57 | 21.03 |

| Asset Turnover | 1.59 | 1.62 | 1.94 | 1.53 | 1.57 |

| Fixed Asset Turnover | 12.07 | 18.17 | 24.54 | 36.21 | 27.53 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In the most recent year, SMCI’s net margin of 4.77% indicates a slight decline, suggesting profitability concerns. The return on equity (ROE) remains strong at 16.64%, showing efficient use of shareholder equity. However, the high P/E ratio of 27.74 may indicate overvaluation. The current ratio of 5.25 suggests excellent liquidity, but the rising debt-to-assets ratio of 34.09% raises caution regarding financial leverage.

Evolution of Financial Ratios

Over the past five years, SMCI has shown a generally positive trend in profitability and liquidity, with significant improvements in the current and quick ratios. However, the increasing debt levels and fluctuating net margins may warrant closer scrutiny moving forward.

Distribution Policy

Super Micro Computer, Inc. (SMCI) does not pay dividends, reflecting a strategy focused on reinvestment and growth. This approach is typical for companies in high-growth phases, allowing them to allocate resources toward research and development and acquisitions. Despite the absence of dividends, SMCI engages in share buybacks, which can signal confidence in its own valuation. Overall, this strategy appears aligned with long-term shareholder value creation, provided the company maintains strong operational performance and cash flow management.

Sector Analysis

Super Micro Computer, Inc. operates in the computer hardware industry, specializing in high-performance server and storage solutions. Its competitive advantages include innovative modular designs and a diverse product range catering to various market segments.

Strategic Positioning

Super Micro Computer, Inc. (SMCI) holds a competitive position in the rapidly evolving computer hardware market, particularly in high-performance server and storage solutions. As of 2025, the company boasts a market capitalization of approximately $23.6 billion, reflecting a significant market share in its sector. With ongoing technological disruptions, such as advancements in artificial intelligence, cloud computing, and edge computing, SMCI faces competitive pressure from established players and emerging startups alike. Benchmarking against key competitors indicates that while SMCI is well-positioned, maintaining innovation and operational efficiency will be crucial for sustaining its market presence and mitigating risks associated with market volatility.

Key Products

Super Micro Computer, Inc. (SMCI) offers a diverse range of high-performance server and storage solutions. Below is a summary of their key products:

| Product | Description |

|---|---|

| Complete Server Solutions | Comprehensive server systems designed for various applications, including enterprise data centers and cloud computing. |

| Modular Blade Servers | High-density blade servers that allow for easy scalability and efficient resource management in data center environments. |

| Storage Systems | Advanced storage solutions that ensure high availability and performance for critical data workloads. |

| Networking Devices | Equipment that enhances connectivity and communication within data centers, supporting high-speed data transfers. |

| Server Management Software | Tools such as Supermicro Server Manager and SuperCloud Composer that enable users to monitor, manage, and optimize server performance efficiently. |

| Server Subsystems | Components including server boards, chassis, and power supplies that are essential for building and maintaining server infrastructures. |

| Technical Support Services | Ongoing maintenance and technical support services provided to ensure optimal performance and reliability of server and storage systems. |

| Custom Integration Services | Tailored solutions that include system configuration, software upgrades, and project management, catering to specific customer needs and industry requirements. |

These products are tailored to meet the demands of various markets including artificial intelligence, 5G, and edge computing, making Super Micro Computer, Inc. a key player in the technology sector.

Main Competitors

Currently, I was unable to identify any reliable competitors for Super Micro Computer, Inc. (SMCI) based on the available data. Therefore, I will provide a brief overview of the company’s estimated market share and competitive position.

Super Micro Computer, Inc. holds a significant position in the computer hardware sector, particularly in high-performance server and storage solutions. With a market cap of approximately $23.63 billion, the company is well-regarded for its innovative products tailored for enterprise data centers, cloud computing, and artificial intelligence markets. While I cannot provide specific competitor names, it is evident that SMCI operates in a highly competitive landscape dominated by major players in the technology sector.

Competitive Advantages

Super Micro Computer, Inc. (SMCI) holds several competitive advantages that position it well for future growth. With a focus on high-performance server and storage solutions, the company benefits from a modular and open architecture design that enhances customization and scalability for clients. As demand for cloud computing, artificial intelligence, and 5G technology continues to rise, SMCI is poised to expand its market presence. Upcoming product innovations and strategic partnerships could unlock new opportunities, solidifying its status as a leader in the computer hardware industry.

SWOT Analysis

This analysis aims to provide a clear overview of Super Micro Computer, Inc. (SMCI) by identifying its internal strengths and weaknesses, as well as external opportunities and threats.

Strengths

- Strong market presence

- Diverse product range

- Innovative technology solutions

Weaknesses

- High dependency on specific markets

- Limited brand recognition compared to competitors

- Fluctuating profit margins

Opportunities

- Growing demand for cloud computing

- Expansion into AI and 5G markets

- Potential for strategic partnerships

Threats

- Intense competition

- Rapid technological changes

- Economic downturns affecting IT budgets

The overall SWOT assessment indicates that while SMCI has significant strengths and opportunities for growth, it must address its weaknesses and remain vigilant against external threats. This balanced approach will be crucial for the company’s strategic planning and long-term success.

Stock Analysis

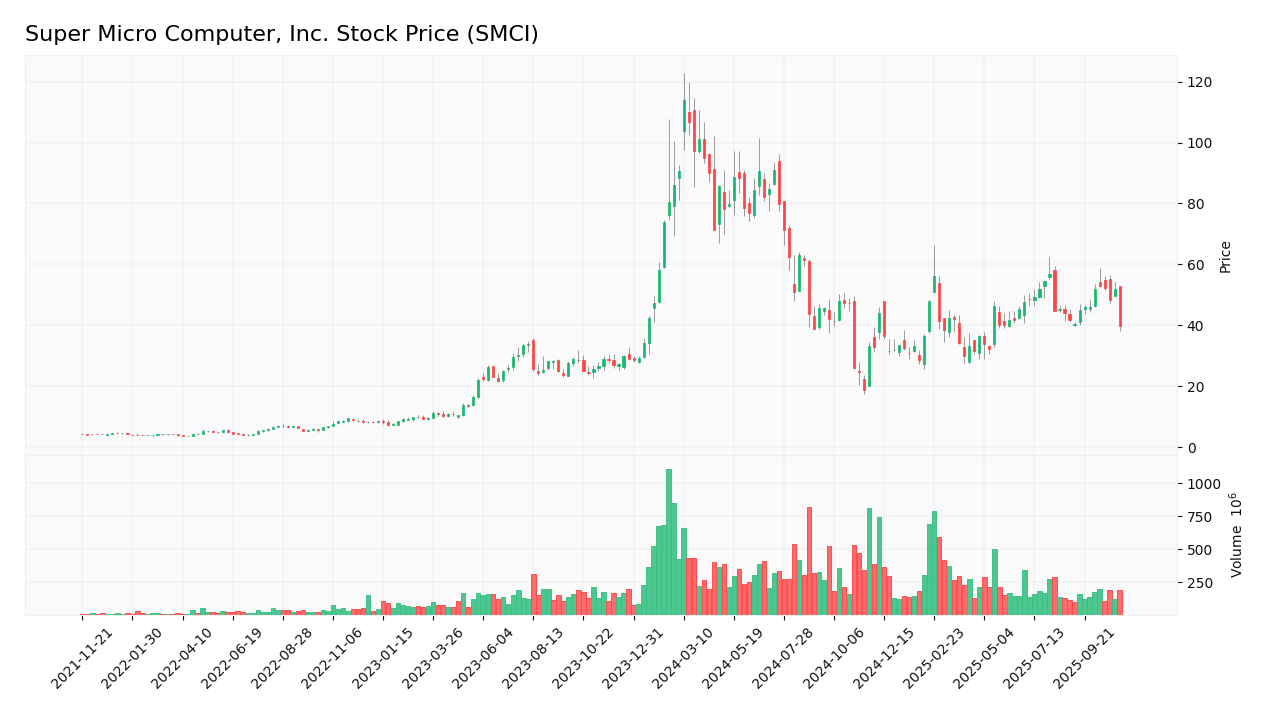

In examining Super Micro Computer, Inc. (SMCI), the stock price chart reveals significant price movements and trading dynamics over the past year, characterized by notable highs and lows.

Trend Analysis

Over the past year, SMCI has experienced a percentage price change of +32.49%, indicating a bullish trend overall. However, a closer look at the recent trend shows a decline of -9.39% from August 24, 2025, to November 9, 2025, which categorizes this shorter-term trend as bearish. The highest price reached during this period was $114.0, while the lowest was $18.58. The trend shows acceleration, suggesting that the recent downward momentum may continue. Additionally, the standard deviation of 21.73 indicates a relatively high level of volatility in the stock’s price movements.

Volume Analysis

Analyzing trading volumes over the last three months, the average volume stands at approximately 144M, with a trend identified as bearish. The average buy volume is around 67M, while the average sell volume is about 77M, indicating that the activity appears to be seller-driven. The volume trend suggests decreasing market participation, reflecting a cautious sentiment among investors during this period.

Analyst Opinions

Recent analyst recommendations for Super Micro Computer, Inc. (SMCI) indicate a mixed outlook. On November 7, 2025, analysts rated the stock as “Neutral” with a score of 3. The DCF analysis suggests a “Buy” rating, while the ROA also supports this, reflecting positive operational efficiency. However, the debt-to-equity ratio received a “Strong Sell,” and both the P/E and P/B ratios were rated as “Sell,” indicating concerns over valuation. Overall, the consensus leans towards a cautious stance, positioning SMCI as a “Hold” for the current year.

Stock Grades

No verified stock grades were available from recognized analysts for Super Micro Computer, Inc. (SMCI). As such, I cannot provide an analysis based on reliable grading data. However, it’s important to note that the company has been gaining attention in the tech sector, and investor sentiment appears cautiously optimistic as the market continues to evolve.

Target Prices

No verified target price data is available from recognized analysts for Super Micro Computer, Inc. (SMCI). The general market sentiment is currently mixed, reflecting varying opinions on the company’s future performance.

Consumer Opinions

Consumer sentiment regarding Super Micro Computer, Inc. (SMCI) reveals a mixed but generally optimistic outlook, with customers appreciating its innovative solutions while voicing concerns about service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Super Micro’s servers are incredibly reliable and efficient.” | “Customer service can be slow to respond, which is frustrating.” |

| “I love the wide range of customizable options available.” | “Occasional hardware issues have caused downtime.” |

| “Their technology is cutting-edge and ahead of competitors.” | “Pricing can be a bit steep compared to other brands.” |

Overall, consumer feedback highlights Super Micro’s advanced technology and reliability as key strengths, while issues with customer service and pricing are recurring weaknesses.

Risk Analysis

In assessing the potential risks associated with investing in Super Micro Computer, Inc. (SMCI), it’s crucial to understand the various factors that could affect the company’s performance. Below is a table outlining the key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in the tech market affecting stock prices. | High | High |

| Supply Chain | Disruptions in the supply chain impacting production. | Medium | High |

| Competition | Increased competition from other tech firms. | High | Medium |

| Regulatory | Changes in regulations affecting operations. | Medium | Medium |

| Cybersecurity | Threats to data security that could harm reputation. | High | High |

The most critical risks for SMCI include market volatility and cybersecurity threats, both of which can significantly impact stock performance and investor confidence. Given the rapid evolution in technology, these factors are particularly relevant today.

Should You Buy Super Micro Computer, Inc.?

Super Micro Computer, Inc. (SMCI) is notable for its innovative server and storage solutions, demonstrating a robust financial performance with a net margin of 4.77%. It boasts a return on invested capital (ROIC) of 10.73%, significantly exceeding its weighted average cost of capital (WACC) of 8.53%. However, the company’s stock is currently facing bearish trends and seller dominance in trading volumes.

Given the recent financial ratios, SMCI’s net margin is positive, and its ROIC is above WACC while also displaying a long-term positive trend. However, the recent market behavior indicates a seller-dominant environment with a significant drop in buyer volumes. Therefore, while the fundamentals appear strong, the current trading environment suggests it may be prudent to wait for a bullish reversal before considering adding SMCI to your portfolio.

Additionally, the company faces risks from increased competition in the tech sector, which could impact its market share and profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Super Micro: Better Value Than Investors Think (NASDAQ:SMCI) – Seeking Alpha (Nov 07, 2025)

- SMCI Q1 Earnings Surpass Expectations, Revenues Decline Y/Y – Yahoo Finance (Nov 06, 2025)

- Why Super Micro Computer Still Holds Promise For Aggressive Growth Investors (NASDAQ:SMCI) – Seeking Alpha (Nov 08, 2025)

- SMCI Stock To $60? – Forbes (Nov 06, 2025)

- Super Micro Computer: A Bad Habit Of Overpromising And Underdelivering – Buy (NASDAQ:SMCI) – Seeking Alpha (Nov 06, 2025)

For more information about Super Micro Computer, Inc., please visit the official website: supermicro.com