In a world where surgical precision can make all the difference, Intuitive Surgical, Inc. revolutionizes healthcare with its cutting-edge da Vinci Surgical System. By enabling minimally invasive procedures, the company not only enhances the quality of care but also transforms the surgical landscape. With a strong reputation for innovation and a robust portfolio that now includes the Ion endoluminal system, Intuitive Surgical is poised for continued growth. However, as we analyze this dynamic entity, the critical question remains: do its fundamentals still support its current market valuation?

Table of contents

Company Description

Intuitive Surgical, Inc., established in 1995 and headquartered in Sunnyvale, California, is a prominent player in the Medical Instruments & Supplies industry. The company specializes in developing, manufacturing, and marketing innovative products that enhance minimally invasive surgical procedures. Its flagship product, the da Vinci Surgical System, revolutionizes complex surgeries, while the Ion endoluminal system broadens its offerings into diagnostic procedures for lung biopsies. With a strong presence in both the U.S. and international markets, Intuitive Surgical employs over 15,600 professionals, providing a comprehensive suite of instruments and services to healthcare providers. As a leader in surgical robotics, the company continues to shape the industry through its commitment to technological advancement and improved patient care.

Fundamental Analysis

In this section, I will provide an in-depth analysis of Intuitive Surgical, Inc. (ISRG) by examining its income statement, key financial ratios, and payout policy to assess its overall financial health and investment potential.

Income Statement

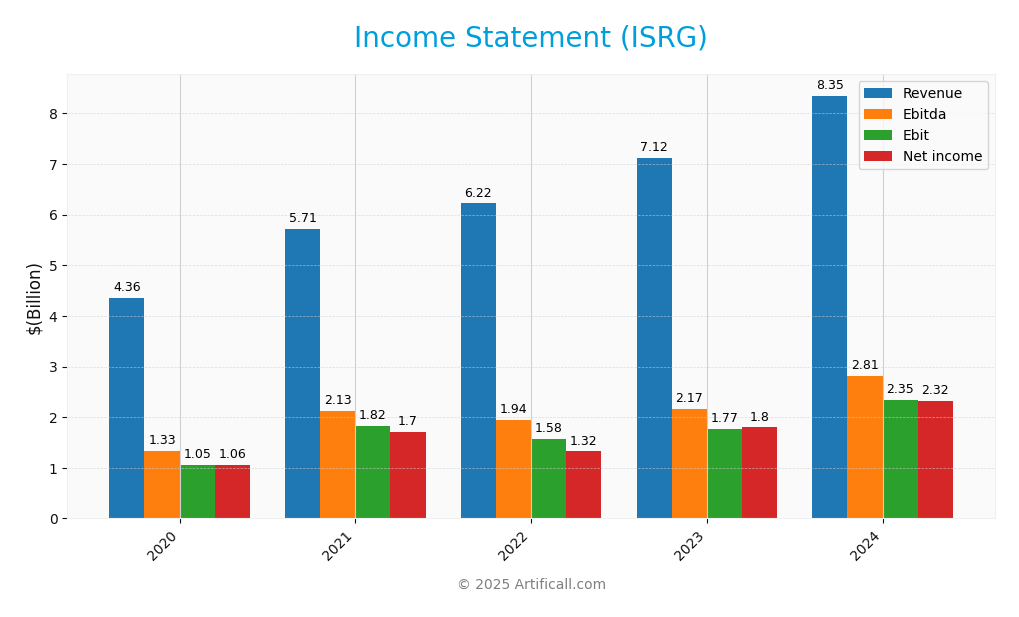

The following table summarizes the income statement for Intuitive Surgical, Inc. (ISRG) over the past five years, providing key insights into its financial performance.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.36B | 5.71B | 6.22B | 7.12B | 8.35B |

| Cost of Revenue | 1.50B | 1.75B | 2.03B | 2.39B | 2.72B |

| Operating Expenses | 1.81B | 2.14B | 2.62B | 2.96B | 3.29B |

| Gross Profit | 2.86B | 3.96B | 4.20B | 4.73B | 5.63B |

| EBITDA | 1.33B | 2.13B | 1.94B | 2.17B | 2.81B |

| EBIT | 1.05B | 1.82B | 1.58B | 1.77B | 2.35B |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 1.06B | 1.70B | 1.32B | 1.80B | 2.32B |

| EPS | 3.02 | 4.79 | 3.72 | 5.12 | 6.54 |

| Filing Date | 2021-02-10 | 2022-02-03 | 2023-02-10 | 2024-01-31 | 2025-01-31 |

Over the five-year period, Intuitive Surgical has demonstrated strong revenue growth, increasing from $4.36 billion in 2020 to $8.35 billion in 2024. Net income has followed a similar upward trajectory, rising from $1.06 billion to $2.32 billion. The gross profit margin has remained relatively stable, indicating effective cost management alongside revenue growth. In the most recent year, 2024, a marked increase in both revenue and net income showcases the company’s resilience and ability to capitalize on market opportunities, despite potential economic headwinds. The growth rate has slightly slowed compared to previous years, but overall, the financial health of Intuitive Surgical appears robust.

Financial Ratios

Below is a summary table of the financial ratios for Intuitive Surgical, Inc. (ISRG) over the last five years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 24.3% | 29.9% | 21.3% | 25.2% | 27.8% |

| ROE | 10% | 14.3% | 12% | 13.5% | 14.1% |

| ROIC | 10.3% | 14.7% | 13.7% | 12.8% | 13.7% |

| P/E | 90.2 | 75.1 | 71.4 | 65.9 | 79.8 |

| P/B | 9.8 | 10.7 | 8.5 | 8.9 | 11.3 |

| Current Ratio | 6.9 | 5.1 | 4.4 | 4.8 | 4.1 |

| Quick Ratio | 6.2 | 4.6 | 3.8 | 4.0 | 3.2 |

| D/E | 0 | 0 | 0 | 0 | 0 |

| Debt-to-Assets | 0 | 0 | 0 | 0 | 0 |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.39 | 0.42 | 0.48 | 0.46 | 0.44 |

| Fixed Asset Turnover | 2.8 | 3.0 | 2.6 | 2.0 | 1.7 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, ISRG’s financial ratios reflect a generally strong performance. The net margin of 27.8% indicates efficient cost management, while a return on equity (ROE) of 14.1% shows effective use of shareholder capital. However, the high P/E ratio of 79.8 may indicate overvaluation, signaling a potential risk for investors. Additionally, the lack of debt showcases a conservative financial structure, but it may also limit growth opportunities.

Evolution of Financial Ratios

Over the past five years, ISRG’s financial ratios demonstrate a positive trend in profitability, with net margins and ROE increasing consistently. However, the price-to-earnings ratio has risen significantly, suggesting that while the company performs well, it is becoming increasingly expensive for investors.

Distribution Policy

Intuitive Surgical, Inc. does not currently pay dividends, reflecting a strategy that prioritizes reinvestment and growth. This approach is typical for companies in a high-growth phase, where cash is allocated to research and development and acquisitions rather than direct payouts to shareholders. However, the company does engage in share buybacks, which can enhance shareholder value by reducing the number of outstanding shares. This strategy aligns with long-term value creation, provided that investments drive sustainable growth.

Sector Analysis

Intuitive Surgical, Inc. operates in the medical instruments and supplies industry, focusing on minimally invasive surgical technologies with a competitive edge in innovation and customer support.

Strategic Positioning

Intuitive Surgical, Inc. (ISRG) holds a significant position in the medical instruments and supplies market, primarily through its flagship product, the da Vinci Surgical System. Currently, the company commands a substantial market share, benefitting from its pioneering technology in minimally invasive surgery. Competitive pressure is considerable, with emerging players in the robotic surgery space, but Intuitive’s established reputation and continuous innovation help maintain its lead. Additionally, the company faces potential technological disruption, as advancements in AI and robotics may reshape the landscape. However, Intuitive’s commitment to R&D and integrated digital capabilities positions it well for future challenges.

Key Products

In this section, I will outline the key products offered by Intuitive Surgical, Inc. to help you understand their role in the company’s growth and market positioning.

| Product | Description |

|---|---|

| da Vinci Surgical System | A robotic-assisted surgical system that enables minimally invasive surgeries with enhanced precision and control, used across various surgical specialties. |

| Ion Endoluminal System | A system designed for diagnostic procedures that allows for minimally invasive biopsies in the lung, expanding the company’s offerings beyond traditional surgery. |

| Surgical Stapling Instruments | A suite of stapling products that are used in conjunction with the da Vinci system to facilitate tissue approximation and secure closure during surgeries. |

| Energy Instruments | Advanced tools that provide thermal energy for cutting and coagulating tissues during surgical procedures, enhancing safety and efficiency. |

| Digital Integration Solutions | A range of integrated digital capabilities that provide hospitals with data analytics and performance insights to improve surgical outcomes and operational efficiency. |

Each of these products plays a crucial role in enhancing the quality and accessibility of minimally invasive care, which is a key focus area for Intuitive Surgical.

Main Competitors

No verified competitors were identified from available data. Intuitive Surgical, Inc. holds a significant position in the medical instruments and supplies sector, with an estimated market share that underscores its dominance in minimally invasive surgical technologies. The company primarily operates in the United States but also has a presence in international markets, focusing on enhancing the quality and accessibility of surgical care.

Competitive Advantages

Intuitive Surgical, Inc. stands out in the medical instruments and supplies industry due to its innovative da Vinci Surgical System, which enables minimally invasive surgeries, enhancing patient recovery times and reducing hospital stays. Looking ahead, the company is poised to expand its product offerings with the Ion endoluminal system, broadening its reach into diagnostic procedures. Additionally, Intuitive is focusing on integrated digital capabilities, providing hospitals with enhanced performance insights. These advancements not only solidify its market position but also open new revenue streams, positioning the company well for future growth.

SWOT Analysis

This analysis evaluates the strengths, weaknesses, opportunities, and threats associated with Intuitive Surgical, Inc. (ISRG).

Strengths

- Innovative technology

- Strong market position

- Comprehensive support services

Weaknesses

- High product costs

- Dependence on a limited product line

- Regulatory challenges

Opportunities

- Growing demand for minimally invasive surgery

- Expansion into international markets

- Advancements in robotic surgery

Threats

- Intense competition

- Economic downturns affecting healthcare budgets

- Regulatory changes impacting operations

The overall SWOT assessment indicates that Intuitive Surgical has significant strengths and opportunities that can be leveraged for growth. However, the company must address its weaknesses and prepare for potential threats in the competitive healthcare landscape to maintain its leadership in the market.

Stock Analysis

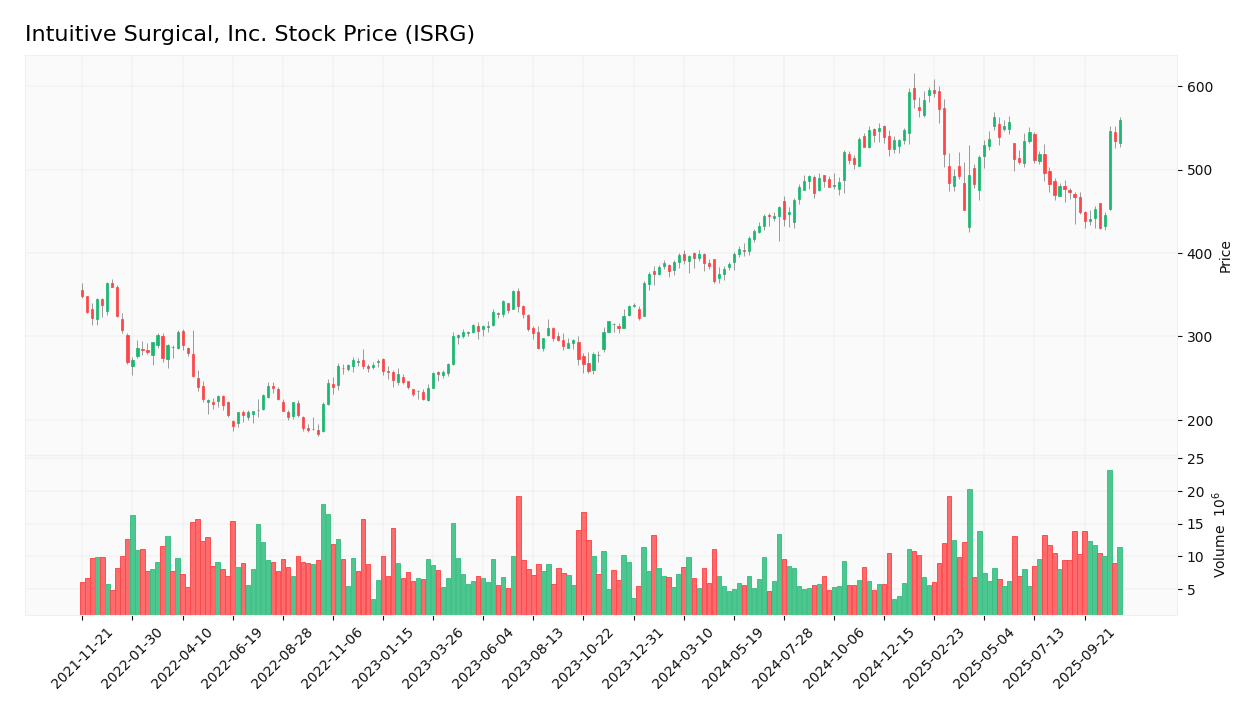

Over the past year, Intuitive Surgical, Inc. (ISRG) has experienced significant price movements, culminating in a notable bullish trend characterized by a robust percentage change and increased trading activity.

Trend Analysis

Analyzing the stock’s performance over the past year, ISRG has seen a remarkable price change of +72.65%. This significant increase indicates a bullish trend, supported by an acceleration in price momentum. The stock has fluctuated between a high of $595.55 and a low of $322.50, with a standard deviation of 68.33, suggesting considerable volatility in its price movements. The recent trend shows a price change of +17.61% from August 24, 2025, to November 9, 2025, further reinforcing the bullish outlook.

Volume Analysis

In reviewing trading volumes over the last three months, the average volume stands at approximately 12.11M, with a notable shift towards seller dominance as the average sell volume exceeds the buy volume (6.37M vs. 5.74M). Despite this, the overall volume trend has been bullish, indicating increasing market participation. The acceleration in volume suggests persistent investor interest, although the current seller-driven activity may reflect cautious sentiment among traders.

Analyst Opinions

As of November 7, 2025, analysts have provided a mixed outlook for Intuitive Surgical, Inc. (ISRG). The overall rating stands at a “B-” with a neutral recommendation. Analyst reviews highlight strong buy sentiments on the company’s Return on Assets (ROA) and a buy recommendation for Return on Equity (ROE), reflecting solid operational efficiency. However, concerns regarding high debt levels and price-to-earnings ratios have led to strong sell ratings in those areas. Overall, the consensus leans towards a neutral stance for investors considering entry points this year.

Stock Grades

No verified stock grades were available from recognized analysts for Intuitive Surgical, Inc. (ticker: ISRG). As such, it’s essential to consider the company’s recent performance, market position, and investor sentiment when making decisions. If you’re looking to invest in ISRG, I recommend staying updated on news and market trends as they can significantly influence stock performance.

Target Prices

No verified target price data is available from recognized analysts for Intuitive Surgical, Inc. (ISRG). The current market sentiment appears to reflect cautious optimism, but specific target prices remain undisclosed.

Consumer Opinions

Consumer sentiment towards Intuitive Surgical, Inc. reflects a blend of enthusiasm for its innovative products and some concerns about accessibility and pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “The da Vinci system revolutionized my surgical practice!” | “The cost of these systems is prohibitively high.” |

| “Exceptional support and training from the team.” | “I wish the maintenance fees were more transparent.” |

| “Incredibly precise technology, improving patient outcomes.” | “Limited availability in some regions affects access.” |

| “User-friendly interface makes surgeries easier.” | “The learning curve can be steep for new users.” |

Overall, consumer feedback highlights strengths in the technology’s precision and support services, while concerns about cost and accessibility remain prevalent among users.

Risk Analysis

In assessing Intuitive Surgical, Inc. (ticker: ISRG), it’s essential to understand the potential risks that could impact its performance. Below is a summary of key risks to consider.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in healthcare spending affecting sales. | High | High |

| Regulatory Risk | Changes in regulatory policies impacting product approval. | Medium | High |

| Competitive Risk | Increased competition from emerging robotic surgery companies. | High | Medium |

| Supply Chain Risk | Disruptions in the supply chain affecting production. | Medium | Medium |

| Technological Risk | Potential obsolescence of existing technology. | Medium | High |

In recent years, the healthcare sector has faced significant funding challenges, which can directly impact Intuitive Surgical’s sales, making market risk particularly pressing.

Should You Buy Intuitive Surgical, Inc.?

Intuitive Surgical, Inc. (ISRG) boasts flagship products in minimally invasive robotic surgical systems, leading the market with strong financial ratios: a net margin of 27.81%, a return on invested capital (ROIC) of 13.74%, and a weighted average cost of capital (WACC) that is lower than its ROIC. Despite these strengths, the company faces risks such as increased competition and high valuation metrics.

Given the recent performance indicators, Intuitive Surgical appears favorable for long-term investors. The net margin is positive at 27.81%, and the ROIC exceeds the WACC, indicating effective capital use. Additionally, the long-term trend is bullish, and while recent buyer volumes are somewhat lower than seller volumes, the overall trend suggests potential for continued growth. Therefore, ISRG could be considered a suitable addition for those with a long-term investment strategy.

However, one must remain cautious of specific risks, including competitive pressures and high valuation relative to earnings, which could impact future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Investors Heavily Search Intuitive Surgical, Inc. (ISRG): Here is What You Need to Know – Yahoo Finance (Nov 07, 2025)

- Intuitive Surgical: Earnings Prove Leadership Is Stronger Than Tariffs (NASDAQ:ISRG) – Seeking Alpha (Oct 22, 2025)

- Intuitive Surgical Stock To $700? – Forbes (Nov 04, 2025)

- Intuitive Surgical Pre-Q3 Analysis: Buy, Hold or Sell ISRG Stock Now? – Nasdaq (Oct 17, 2025)

- Buy the Post-Earnings Surge in Intuitive Surgical (ISRG) Stock? – Zacks Investment Research (Oct 23, 2025)

For more information about Intuitive Surgical, Inc., please visit the official website: intuitive.com