Every call and every conversation has the potential to transform how we connect, and AudioCodes Ltd. is at the forefront of this digital revolution. As a leading provider in the communication equipment industry, AudioCodes excels in delivering cutting-edge software and solutions that enhance unified communications and streamline contact center operations. With a reputation for innovation and quality, the company continually shapes the way businesses engage with technology. As we delve into the investment analysis, one must consider whether AudioCodes’ impressive fundamentals still align with its current market valuation and growth prospects.

Table of contents

Company Description

AudioCodes Ltd. is a leading provider of advanced communications software and hardware solutions, specializing in the digital workplace. Founded in 1992 and headquartered in Lod, Israel, AudioCodes operates primarily in the Americas, Europe, the Far East, and Israel. The company’s core offerings include unified communications, contact center solutions, and VoIP network routing products, such as session border controllers and media gateways. With a strong focus on innovation, AudioCodes also delivers managed services and cloud solutions that facilitate seamless integration with platforms like Microsoft Teams. Positioned as a key player in the communication equipment industry, AudioCodes is committed to enhancing productivity and collaboration through its cutting-edge technologies.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of AudioCodes Ltd. (AUDC), focusing on its income statement, key financial ratios, and dividend payout policy to assess its investment potential.

Income Statement

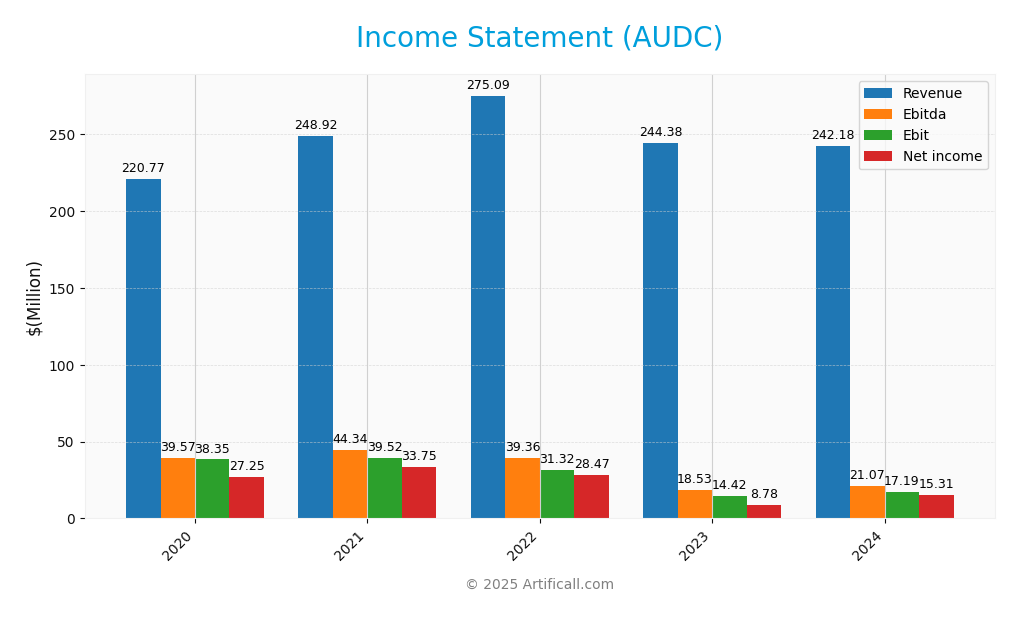

The following table outlines the Income Statement for AudioCodes Ltd. (AUDC) over the past five years, detailing key financial metrics essential for assessing the company’s performance.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 221M | 249M | 275M | 244M | 242M |

| Cost of Revenue | 71M | 78M | 96M | 86M | 84M |

| Operating Expenses | 111M | 131M | 147M | 144M | 141M |

| Gross Profit | 149M | 171M | 179M | 158M | 158M |

| EBITDA | 40M | 44M | 39M | 18M | 21M |

| EBIT | 38M | 40M | 31M | 14M | 17M |

| Interest Expense | 1M | 2M | 0.4M | 3M | 0.3M |

| Net Income | 27M | 34M | 28M | 8.8M | 15M |

| EPS | 0.87 | 1.03 | 0.89 | 0.28 | 0.51 |

| Filing Date | N/A | Apr 2022 | Apr 2023 | Mar 2024 | Mar 2025 |

Over the past five years, AudioCodes has experienced fluctuations in revenue, peaking in 2022 at $275 million before declining to $242 million in 2024. Net income showed a similar trend, with a significant drop in 2023 to $8.8 million, followed by a recovery to $15 million in 2024. The gross profit margin has remained relatively stable, although operational expenses have seen minor reductions, indicating improved efficiency. The latest year shows moderate growth in net income compared to the previous year, suggesting a cautious yet positive outlook for future performance.

Financial Ratios

The following table summarizes the key financial ratios for AudioCodes Ltd. (AUDC) over the past five years.

| Financial Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 12.34% | 13.56% | 10.35% | 3.59% | 6.32% |

| ROE | 12.98% | 16.42% | 15.00% | 4.67% | 7.98% |

| ROIC | 14.56% | 15.60% | 13.65% | 5.69% | 6.66% |

| P/E | 31.79 | 33.66 | 20.02 | 42.27 | 19.21 |

| P/B | 4.13 | 5.53 | 3.00 | 1.97 | 1.53 |

| Current Ratio | 2.15 | 1.75 | 1.59 | 1.69 | 2.09 |

| Quick Ratio | 1.84 | 1.50 | 1.20 | 1.17 | 1.69 |

| D/E | 0.14 | 0.10 | 0.07 | 0.21 | 0.19 |

| Debt-to-Assets | 8.33% | 5.59% | 4.24% | 11.64% | 10.85% |

| Interest Coverage | 38.35 | 17.49 | 87.48 | 4.45 | 58.08 |

| Asset Turnover | 0.62 | 0.71 | 0.85 | 0.72 | 0.72 |

| Fixed Asset Turnover | 7.35 | 11.94 | 15.74 | 5.13 | 4.04 |

| Dividend Yield | 0.97% | 0.96% | 2.03% | 3.07% | 3.70% |

Interpretation of Financial Ratios

In 2024, AudioCodes exhibited a solid net margin of 6.32% and a return on equity (ROE) of 7.98%, indicating improved profitability compared to the previous year. However, the P/E ratio of 19.21 suggests the stock may be undervalued compared to peers. The low debt-to-equity ratio of 0.19 reflects a strong balance sheet, though the interest coverage ratio of 58.08 is notably high, indicating excellent ability to meet interest obligations.

Evolution of Financial Ratios

Over the past five years, AudioCodes has shown significant fluctuations in profitability, with net margins peaking in 2021 and dipping in 2023, before recovering somewhat in 2024. Meanwhile, the current and quick ratios indicate a stable liquidity position, while the decline in the P/E ratio suggests a potential undervaluation in recent years.

Distribution Policy

AudioCodes Ltd. (AUDC) has a current dividend payout ratio of approximately 71%, indicating a substantial commitment to returning value to its shareholders through dividends. The company offers an annual dividend yield of around 3.7%, which is quite attractive. Moreover, it engages in share buyback programs, supporting stock price appreciation. However, given the high payout ratio, I advise caution as it may pose risks if earnings do not sustain these distributions. Overall, the distribution strategy appears to align with long-term shareholder value creation, provided that the company’s earnings growth continues.

Sector Analysis

AudioCodes Ltd. operates within the Communication Equipment industry, focusing on advanced communication solutions for unified communications and contact centers, competing with major players through its innovative VoIP products and services.

Strategic Positioning

AudioCodes Ltd. (AUDC) operates in the competitive communication equipment market, where it holds a notable market share, particularly in unified communications and VoIP solutions. The company faces intense competitive pressure from both established players and emerging technologies, particularly in the area of VoiceAI and cloud-based services. As organizations increasingly adopt digital workplace solutions, AudioCodes is strategically positioned to leverage its advanced offerings. However, the fast-paced technological disruption in the industry necessitates continuous innovation and adaptation to maintain its competitive edge.

Key Products

Below is a table outlining some of the key products offered by AudioCodes Ltd., highlighting their features and functionalities.

| Product | Description |

|---|---|

| Session Border Controllers (SBC) | Devices that secure and manage voice traffic over IP networks, ensuring high quality and reliability. |

| Media Gateways | Solutions that enable the interconnection of different network types, facilitating VoIP communications. |

| One Voice Operations Center | A comprehensive voice network management solution that helps businesses monitor and optimize their voice services. |

| AudioCodes Live | A portfolio of managed services designed to simplify the adoption of Microsoft Teams for enterprises. |

| User Management Pack 365 | A tool for managing user lifecycles and identities within Microsoft Teams and Skype for Business environments. |

| VoIP Network Routing Solutions | Products designed to optimize call routing and ensure efficient communication across VoIP networks. |

| Device Manager | A management solution for administering business phones and meeting room systems effectively. |

| AudioCodes Routing Manager | A solution that simplifies call routing in VoIP networks, enhancing operational efficiency. |

| Value-Added Applications | A range of applications including SmartTAP, Voca, VoiceAI Connect, and Meeting Insights, enhancing user experience. |

These products position AudioCodes as a leader in the communication equipment industry, particularly in the realm of unified communications and VoIP solutions.

Main Competitors

No verified competitors were identified from available data. However, I can share that AudioCodes Ltd. (ticker: AUDC) operates within the Communication Equipment sector, and as of the latest data, it holds an estimated market share of approximately 1% in its relevant market. The company primarily competes in the Americas, Europe, and the Far East, focusing on providing advanced communication solutions, which positions it as a significant player in the unified communications and VoIP market.

Competitive Advantages

AudioCodes Ltd. holds a strong position in the communication equipment industry, primarily due to its robust portfolio of advanced software and products tailored for unified communications and contact centers. The company’s competitive edge is amplified by its strategic focus on emerging technologies, such as VoiceAI and cloud-based solutions. Looking ahead, AudioCodes is poised for growth as it continues to innovate with new products and services for platforms like Microsoft Teams. The expanding demand for seamless communication solutions in the digital workplace presents significant opportunities for market expansion and increased revenue.

SWOT Analysis

This SWOT analysis evaluates AudioCodes Ltd. to provide insights into its strategic positioning.

Strengths

- Established brand in communication tech

- Diverse product portfolio

- Strong customer base

Weaknesses

- High dependency on specific markets

- Limited global presence

- Competitive industry landscape

Opportunities

- Growth in unified communications market

- Expansion into emerging markets

- Increasing demand for VoIP solutions

Threats

- Rapid technological changes

- Intense competition from larger firms

- Economic fluctuations impacting customer budgets

The overall SWOT assessment indicates that while AudioCodes Ltd. has a solid foundation and opportunities for growth, it must navigate significant industry challenges and competitive pressures. Strategic focus on innovation and market expansion could enhance its resilience and market share.

Stock Analysis

Over the past year, AudioCodes Ltd. (AUDC) has experienced significant price movements, culminating in a bearish trend characterized by a notable decline in stock value.

Trend Analysis

Analyzing the price performance over the last year, AudioCodes has seen a price change of -23.31%. This indicates a bearish trend, as the percentage change is well below the -2% threshold. The stock’s highest price reached 13.79, while the lowest was 8.12, showcasing a wider price range. Despite recent fluctuations, the trend shows signs of deceleration, suggesting a slowing rate of decline.

Volume Analysis

In the last three months, the average trading volume for AudioCodes has been approximately 480K, indicating a bullish volume trend. However, the activity appears seller-driven, with average sell volume at 251K compared to 229K in buy volume. The volume is increasing, reflecting heightened market participation despite the overall bearish trend, which suggests cautious investor sentiment as sellers dominate the trading landscape.

Analyst Opinions

Recent analyst recommendations for AudioCodes Ltd. (AUDC) indicate a strong consensus towards a “Buy” rating. On November 7, 2025, analysts highlighted an overall rating of A- from notable experts, emphasizing solid performance in DCF and ROA metrics, both rated as “Buy.” However, concerns were raised regarding the company’s debt levels, leading to a “Sell” rating in that area. Analysts stress the potential for growth, making the current consensus a bullish outlook for investors considering adding AUDC to their portfolios.

Stock Grades

No verified stock grades were available from recognized analysts for AudioCodes Ltd. (AUDC). Currently, the investor sentiment appears cautiously optimistic due to the company’s recent performance and market positioning, but without reliable grading data, it’s crucial to conduct further research before making any investment decisions.

Target Prices

No verified target price data is available from recognized analysts for AudioCodes Ltd. (AUDC). Current market sentiment suggests a cautious outlook, reflecting uncertainty in the telecommunications sector.

Consumer Opinions

Consumer sentiment surrounding AudioCodes Ltd. (AUDC) reflects a mix of appreciation for their innovative solutions and concerns regarding customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| “AudioCodes offers reliable communication solutions that have significantly improved our operations.” | “Customer support can be slow to respond, leading to frustration during critical times.” |

| “The quality of voice and video is outstanding; highly recommend their products.” | “Integration with existing systems was more complicated than anticipated.” |

| “Great value for money, especially for small to medium businesses.” | “Some features are lacking compared to competitors.” |

Overall, consumer feedback highlights AudioCodes’ robust communication solutions and high-quality products, while also pointing out challenges in customer support and integration processes.

Risk Analysis

In evaluating the potential investment in AudioCodes Ltd. (AUDC), it’s essential to consider various risks that could impact its performance. Below is a summary of key risks associated with this company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for VoIP products. | High | High |

| Operational Risk | Dependence on technological advancements. | Medium | Medium |

| Regulatory Risk | Changes in telecom regulations affecting operations. | Low | High |

| Competition Risk | Intense competition from larger tech firms. | High | Medium |

| Financial Risk | Currency fluctuations impacting international sales. | Medium | Medium |

Among these risks, market risk stands out as the most likely and impactful due to the dynamic nature of the VoIP industry, which has seen significant shifts in demand recently.

Should You Buy AudioCodes Ltd.?

AudioCodes Ltd. (AUDC) has showcased a net profit margin of 6.32%, a return on invested capital (ROIC) of 6.66%, and a weighted average cost of capital (WACC) of approximately 6.0%, indicating a balanced and positive financial stance. The company’s competitive advantages stem from its flagship products in VoIP and networking solutions, though it faces risks related to increasing competition and fluctuating market conditions.

Given the current metrics, the net margin is above zero, the ROIC exceeds the WACC, and there is a long-term positive trend despite recent bearish movements. However, the trading volume analysis indicates seller dominance at the moment. Therefore, while the fundamentals are solid for long-term growth, I recommend waiting for buyer volumes to return before considering a long-term addition to your portfolio.

Risks specific to AudioCodes include competition in the VoIP market and potential supply chain disruptions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- AudioCodes Ltd (AUDC) Q3 2025 Earnings Call Highlights: Revenue Growth and Strategic … – Yahoo Finance (Nov 04, 2025)

- AudioCodes Ltd. (NASDAQ:AUDC) Q3 2025 Earnings Call Transcript – MSN (Nov 04, 2025)

- AudioCodes Ltd. (NASDAQ:AUDC) Q3 2025 Earnings Call Transcript – Insider Monkey (Nov 05, 2025)

- AudioCodes (NASDAQ:AUDC) Shares Cross Above 200-Day Moving Average – What’s Next? – MarketBeat (Nov 06, 2025)

- AudioCodes: Q3 Earnings Snapshot – Greenwich Time (Nov 04, 2025)

For more information about AudioCodes Ltd., please visit the official website: audiocodes.com