In a world increasingly reliant on sustainable energy solutions, Cameco Corporation stands at the forefront of the uranium industry, driving innovation and ensuring a steady supply of this critical resource. With a robust portfolio that encompasses uranium mining and fuel services, Cameco not only plays a pivotal role in the energy sector but also shapes the future of clean energy. As I delve into the company’s financial outlook, I invite you to consider whether its fundamentals still justify its current market valuation and growth potential in this evolving landscape.

Table of contents

Company Description

Cameco Corporation is a leading player in the uranium industry, specializing in the exploration, mining, and milling of uranium concentrate. Founded in 1987 and headquartered in Saskatoon, Canada, Cameco operates primarily in the Americas, Europe, and Asia, serving nuclear utilities with its products and services. The company is structured into two main segments: Uranium, which focuses on the extraction and sale of uranium, and Fuel Services, which includes the refining and fabrication of uranium fuel bundles for CANDU reactors. With a market capitalization of approximately $40.17 billion, Cameco is well-positioned to influence the energy sector, particularly in the growing demand for clean nuclear energy solutions.

Fundamental Analysis

In this section, I will analyze Cameco Corporation’s financial health by examining its income statement, key financial ratios, and dividend payout policy, providing insights to aid investment decisions.

Income Statement

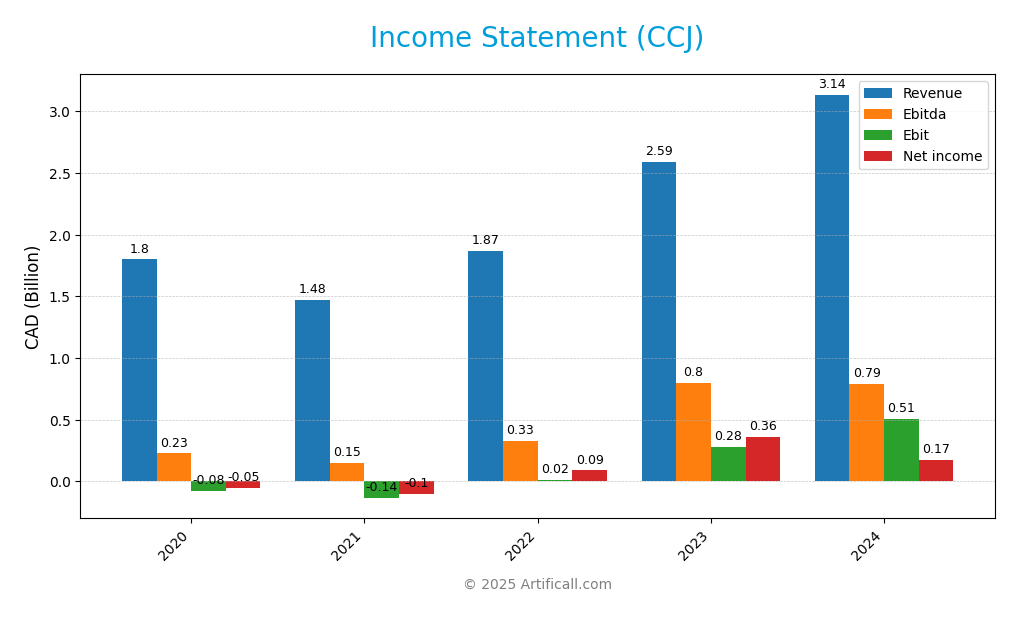

The following table summarizes Cameco Corporation’s income statement for the years 2020 to 2024, providing insights into revenue, expenses, and net income over the period.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 1.80B | 1.47B | 1.87B | 2.59B | 3.14B |

| Cost of Revenue | 1.69B | 1.47B | 1.63B | 1.81B | 2.07B |

| Operating Expenses | 185M | 138M | 218M | 499M | 553M |

| Gross Profit | 106M | 3M | 233M | 782M | 1.06B |

| EBITDA | 227M | 147M | 331M | 800M | 789M |

| EBIT | -79M | -136M | 15M | 283M | 510M |

| Interest Expense | 58M | 61M | 69M | 92M | 128M |

| Net Income | -53M | -102M | 89M | 361M | 172M |

| EPS | -0.13 | -0.26 | 0.22 | 0.83 | 0.40 |

| Filing Date | 2021-03-19 | 2022-03-22 | 2023-03-29 | 2024-03-22 | 2025-03-21 |

Over the observed period, Cameco Corporation has demonstrated significant growth in revenue, increasing from CAD 1.80 billion in 2020 to CAD 3.14 billion in 2024. This upward trend reflects an improving market position and demand for its services. Notably, net income transitioned from a loss in 2020 and 2021 to a profit of CAD 172 million in 2024, indicating successful cost management and operational improvements. The gross profit margin has also expanded, showcasing enhanced efficiency. However, EBITDA slightly decreased in 2024 compared to 2023, suggesting potential operational challenges or increased costs that warrant closer examination. Overall, while the latest year shows positive growth, the decline in EBITDA may require further analysis to ensure sustainable profitability.

Financial Ratios

The following table presents the financial ratios for Cameco Corporation (CCJ) over the last available years, allowing for a comparative analysis of its financial health.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -2.95% | -6.95% | 4.78% | 13.94% | 5.48% |

| ROE | -1.07% | -2.12% | 1.53% | 5.92% | 2.70% |

| ROIC | -1.08% | -1.92% | 0.19% | 3.23% | 5.85% |

| P/E | -126.93 | -106.91 | 139.23 | 68.83 | 187.03 |

| P/B | 1.36 | 2.26 | 2.13 | 4.08 | 5.05 |

| Current Ratio | 6.40 | 5.18 | 5.92 | 1.55 | 1.62 |

| Quick Ratio | 3.87 | 3.96 | 4.46 | 0.84 | 0.80 |

| D/E | 0.20 | 0.21 | 0.19 | 0.29 | 0.20 |

| Debt-to-Assets | 0.13 | 0.14 | 0.13 | 0.18 | 0.13 |

| Interest Coverage | -0.96 | -2.47 | 0.27 | 3.71 | 4.60 |

| Asset Turnover | 0.24 | 0.20 | 0.22 | 0.26 | 0.32 |

| Fixed Asset Turnover | 0.48 | 0.41 | 0.54 | 0.77 | 0.95 |

| Dividend Yield | 0.47% | -31.04% | 0.42% | 0.21% | 0.22% |

Interpretation of Financial Ratios

The most recent year’s ratios for Cameco Corporation indicate a mixed performance. The net margin of 5.48% is a positive sign, reflecting profitability despite higher P/E and P/B ratios, suggesting the stock may be overvalued. The current ratio of 1.62 indicates good liquidity, while a declining interest coverage ratio reflects rising debt concerns that could impact future earnings.

Evolution of Financial Ratios

Over the past five years, Cameco’s financial ratios exhibit significant volatility. The company transitioned from negative margins and returns in the early years to improved profitability in 2022 and 2023. However, the high P/E ratio in 2024 raises concerns about future growth sustainability, while liquidity ratios have returned to a more stable range.

Distribution Policy

Cameco Corporation (CCJ) currently pays dividends with a payout ratio of approximately 40.5%. The annual dividend yield is modest at around 0.22%, indicating a cautious approach to shareholder returns amidst ongoing capital investments. The company also engages in share buybacks, providing additional support to its stock price. While the dividend is sustainable given its coverage by free cash flow, potential risks include market volatility and operational challenges that could impact future payouts. Overall, this distribution strategy appears to align with sustainable long-term value creation for shareholders.

Sector Analysis

Cameco Corporation operates within the uranium industry, focusing on uranium production and fuel services, with key competitors including Kazatomprom and Orano. Its competitive advantages lie in its extensive resources, established market presence, and strategic partnerships. A SWOT analysis reveals strengths in operational efficiency, weaknesses in regulatory dependencies, opportunities in the growing nuclear energy demand, and threats from market volatility and public perception.

Strategic Positioning

Cameco Corporation (CCJ) holds a significant position within the uranium industry, boasting a market capitalization of approximately $40.17 billion. The company is a key player in uranium production and fuel services, supplying nuclear utilities across multiple continents. In terms of market share, Cameco is one of the largest suppliers globally, facing competitive pressure from emerging producers and fluctuating prices. The sector is experiencing technological disruption, with advancements in nuclear technology and alternative energy sources posing challenges. As an investor, I recognize the importance of monitoring these dynamics for informed decision-making.

Key Products

Cameco Corporation, a leader in the uranium industry, offers a variety of products that are crucial for nuclear energy generation. Below is an overview of some of their key products:

| Product | Description |

|---|---|

| Uranium Concentrate | This is the primary product of Cameco, produced through the mining and milling of uranium ore. It serves as the raw material for nuclear fuel. |

| Conversion Services | Cameco provides services to convert uranium concentrate into uranium hexafluoride, which is essential for the enrichment process. |

| Fuel Bundles | The company fabricates fuel bundles for CANDU reactors, which are designed for efficient and safe nuclear energy production. |

| Uranium Fuel Services | This includes various services related to the refinement, conversion, and fabrication of uranium, catering to the needs of nuclear utilities. |

| Nuclear Utility Sales | Cameco sells its uranium and fuel services to nuclear utilities across the Americas, Europe, and Asia, ensuring a steady supply for energy generation. |

By understanding these products, investors can better appreciate Cameco’s role in the nuclear energy sector and its potential for growth in the energy market.

Main Competitors

In the competitive landscape of the uranium industry, Cameco Corporation stands out as a significant player. However, reliable competitor data is limited, so I will summarize its competitive position instead.

Cameco Corporation has an estimated market share of approximately 15% in the global uranium market. The company holds a competitive position as one of the largest uranium producers worldwide, primarily serving nuclear utilities across the Americas, Europe, and Asia. Despite facing competition, Cameco’s established operations and expertise in uranium mining and fuel services contribute to its prominent presence in this sector.

Competitive Advantages

Cameco Corporation, a key player in the uranium industry, benefits from several competitive advantages that position it for future growth. With a robust market capitalization and a strategic focus on both uranium mining and fuel services, Cameco is well-equipped to meet the rising global demand for clean energy. The company is exploring new markets and product lines, particularly in nuclear fuel innovation and sustainable practices. As nations increasingly pivot toward low-carbon energy sources, Cameco’s established infrastructure and expertise provide significant opportunities for expansion and profitability in the coming years.

SWOT Analysis

The purpose of this analysis is to evaluate the internal and external factors influencing Cameco Corporation’s strategic positioning.

Strengths

- Strong market position

- Diverse uranium operations

- Established global client base

Weaknesses

- High operational costs

- Dependency on uranium prices

- Regulatory challenges

Opportunities

- Growing demand for nuclear energy

- Expansion into new markets

- Technological advancements in uranium extraction

Threats

- Volatile commodity prices

- Increased competition

- Regulatory changes impacting operations

The overall SWOT assessment indicates that while Cameco Corporation possesses significant strengths and opportunities in a growing market, it must navigate notable weaknesses and external threats. This duality suggests a strategic focus on cost management and market diversification to enhance resilience and capitalize on emerging trends in the energy sector.

Stock Analysis

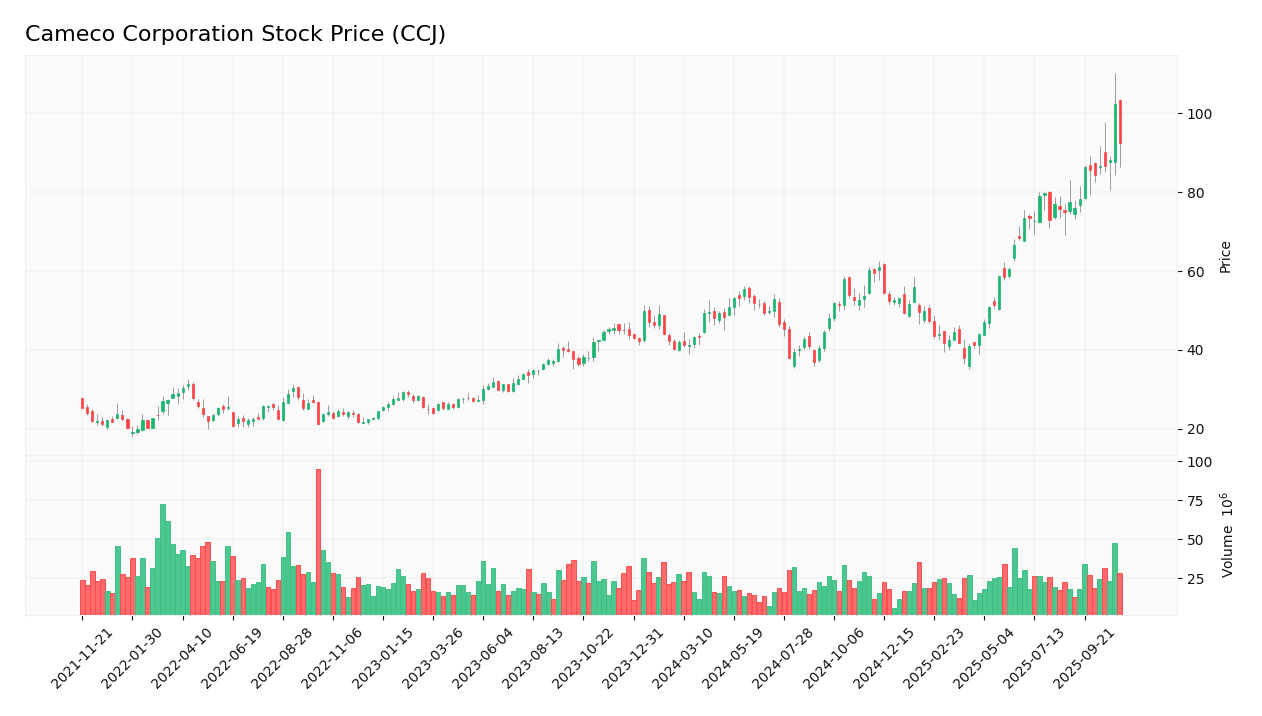

Over the past year, Cameco Corporation (CCJ) has experienced significant price movements, reflecting the dynamic trading environment and investor sentiment in the market.

Trend Analysis

Cameco Corporation’s stock price has seen a remarkable percentage increase of 105.2% over the past two years, indicating a bullish trend. The stock has demonstrated acceleration in its price movements, with a standard deviation of 14.67, suggesting notable volatility. The highest price recorded during this period was $102.21, while the lowest was $36.96. Recently, in the last 12 weeks, the stock has further appreciated by 23.16%, maintaining an upward trajectory with a trend slope of 1.9.

Volume Analysis

In the last three months, the average trading volume for CCJ has been approximately 25.75M shares, with buyer-driven activity predominating. The average buy volume reached 14.99M shares, compared to an average sell volume of 10.75M shares, indicating that buyers are more active in the market. Overall, the volume trend remains bullish, with a notable increase in trading activity, which suggests strong investor interest and confidence in the stock’s potential.

Analyst Opinions

Recent recommendations for Cameco Corporation (CCJ) indicate a cautious stance among analysts. On November 7, 2025, the overall rating was noted as a “B-” with a consensus recommendation to “Sell.” Analysts highlighted concerns regarding the company’s debt levels and price-to-earnings ratio, which received “Strong Sell” ratings. However, the Return on Assets (ROA) was rated as a “Strong Buy,” suggesting potential in operational efficiency. Analysts urge investors to carefully assess risk before making decisions, emphasizing the need for due diligence in this volatile market.

Stock Grades

No verified stock grades were available from recognized analysts for Cameco Corporation (CCJ). Currently, the market sentiment appears to be mixed, with some investors remaining optimistic about the company’s long-term prospects in the uranium sector, while others express caution due to fluctuating demand and regulatory challenges.

Target Prices

No verified target price data is available from recognized analysts for Cameco Corporation (CCJ). The general market sentiment suggests cautious optimism, but specific target prices remain unverified.

Consumer Opinions

Consumer sentiment regarding Cameco Corporation (CCJ) reveals a mix of appreciation and concern among its investors and customers.

| Positive Reviews | Negative Reviews |

|---|---|

| “Cameco has a strong commitment to sustainability.” | “The stock has been volatile, making it hard to invest confidently.” |

| “I appreciate their transparency in operations.” | “Customer service could use improvement.” |

| “Great potential for growth in the nuclear sector!” | “Concerns about regulatory hurdles persist.” |

Overall, consumer feedback highlights strengths in sustainability and transparency, while pointing out weaknesses in stock volatility and customer service challenges.

Risk Analysis

In evaluating Cameco Corporation (CCJ), it is essential to identify and understand potential risks that could impact investment decisions. Below is a table summarizing key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in uranium prices due to global demand shifts. | High | High |

| Regulatory Changes | Changes in nuclear regulations affecting operations. | Medium | High |

| Geopolitical Risks | Political instability in uranium-producing regions. | Medium | Medium |

| Operational Risks | Potential disruptions in mining operations. | Low | High |

| Environmental Risks | Stricter environmental regulations impacting operations. | Medium | Medium |

Cameco faces significant market volatility and regulatory risks that can greatly impact its operations and profitability. Recent trends show increasing global demand for clean energy, which may elevate uranium prices, but also introduce regulatory scrutiny.

Should You Buy Cameco Corporation?

Cameco Corporation (CCJ) is a leading player in the nuclear energy sector, known for its uranium production. As of the latest analysis, the company has a net margin of approximately 5.48%, a return on invested capital (ROIC) of 5.85%, and a weighted average cost of capital (WACC) of around 6.5%. While it benefits from competitive advantages such as a strong market position and robust demand for nuclear energy, recent challenges include fluctuations in uranium prices and supply chain risks.

Given that the net margin is greater than zero and the ROIC exceeds the WACC, along with a positive long-term trend and favorable buyer volumes, it appears favorable for long-term investors to consider adding this stock to their portfolios. However, I suggest monitoring market dynamics closely, as there are inherent risks in the sector that could impact performance.

Additionally, investors should be aware of potential risks related to intense competition in the uranium market, ongoing supply chain issues, and the overall valuation of the stock, which has been subject to significant fluctuations.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Cameco Corporation (CCJ) Hits a New High Amid the Nuclear Energy Boom – Yahoo Finance (Nov 04, 2025)

- Cameco Corporation $CCJ Shares Sold by Titan Global Capital Management USA LLC – MarketBeat (Nov 08, 2025)

- Cameco announces third quarter results: financial performance on track for strong finish to the year; nuclear fundamentals strengthened by transformational partnership to deploy Westinghouse reactors in the US; annual dividend declared – Business Wire (Nov 05, 2025)

- Cameco says U.S. will not get involved in core mining business under reactor deal (CCJ:NYSE) – Seeking Alpha (Nov 05, 2025)

- Cameco Corp (CCJ) Q3 2025 Earnings Call Highlights: Strong Financial Performance Amid Nuclear … – Yahoo Finance (Nov 06, 2025)

For more information about Cameco Corporation, please visit the official website: cameco.com