In a world increasingly powered by clean energy, Uranium Energy Corp. stands at the forefront of the uranium industry, providing essential resources that enable sustainable energy solutions. With a robust portfolio of mining projects across North America and a commitment to innovation, UEC is reshaping energy production and influencing market trends. As we delve into the current state of UEC, we must consider whether its fundamentals continue to support its market valuation and growth potential in this dynamic sector.

Table of contents

Company Description

Uranium Energy Corp. (ticker: UEC), founded in 2003 and headquartered in Corpus Christi, Texas, operates within the uranium sector, focusing on the exploration, extraction, and processing of uranium and titanium concentrates. With a market capitalization of approximately $5.68 billion, UEC holds interests in various projects across the United States, Canada, and Paraguay, including notable sites in Texas and Arizona. The company, which rebranded from Carlin Gold Inc. in early 2005, positions itself as a significant player within the uranium industry, emphasizing sustainable energy solutions. By leveraging its diverse project portfolio, UEC aims to enhance energy security and contribute to the global transition towards cleaner energy sources.

Fundamental Analysis

In this section, I will analyze Uranium Energy Corp.’s income statement, key financial ratios, and dividend payout policy to provide a comprehensive overview of its financial health.

Income Statement

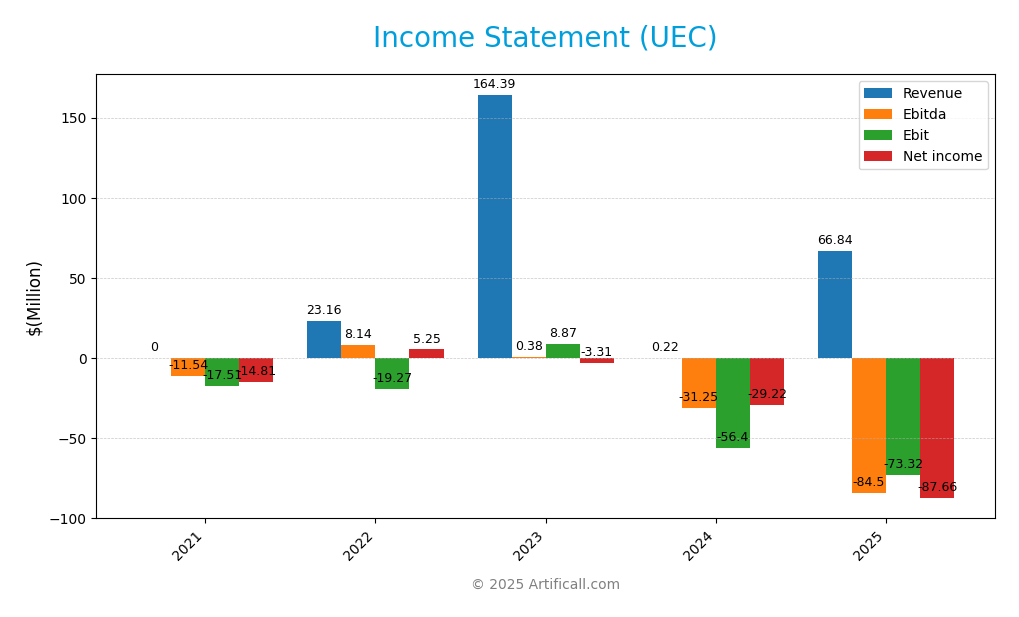

The following table provides a comprehensive overview of Uranium Energy Corp.’s income statement across the last five fiscal years, highlighting key financial metrics.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 0 | 23.2M | 164.4M | 224K | 66.8M |

| Cost of Revenue | 4.5M | 15.9M | 133.3M | 187K | 42.4M |

| Operating Expenses | 13.0M | 26.6M | 22.1M | 56.4M | 97.8M |

| Gross Profit | -4.5M | 7.3M | 31.1M | 37K | 24.5M |

| EBITDA | -11.5M | 8.1M | 375K | -31.2M | -84.5M |

| EBIT | -17.5M | -19.3M | 8.9M | -56.4M | -73.3M |

| Interest Expense | 2.9M | 1.5M | 0.8M | 0.8M | 1.4M |

| Net Income | -14.8M | 5.2M | -3.3M | -29.2M | -87.7M |

| EPS | -0.070 | 0.0194 | -0.0091 | -0.0735 | -0.2 |

| Filing Date | 2021-10-28 | 2023-04-03 | 2024-04-02 | 2024-09-27 | 2025-09-24 |

In analyzing the trends from 2021 to 2025, Uranium Energy Corp. experienced significant fluctuations in revenue, peaking in 2023 at $164.4M before dropping dramatically in the following years. The net income also reflected a troubling trend, with losses deepening in 2025 to -$87.7M. Notably, the gross profit margin showed some recovery in 2025 compared to the previous year, but operational inefficiencies have led to inflated operating expenses, which continue to weigh heavily on profitability. Overall, while there was a brief period of revenue growth, the recent performance indicates a concerning decline with worsened margins, suggesting the need for strategic adjustments to stabilize the company’s financial health.

Financial Ratios

The table below summarizes the key financial ratios for Uranium Energy Corp. over the last available years, allowing for a clear comparison of its financial health.

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 0.00% | 22.68% | -2.01% | -130.45% | -131.15% |

| ROE | -9.78% | 1.61% | -0.52% | -3.76% | -8.91% |

| ROIC | -11.21% | -5.57% | 1.22% | -6.55% | -6.78% |

| P/E | -30.81 | 3.36 | -397.11 | -80.63 | -42.30 |

| P/B | 3.01 | 3.36 | 2.08 | 3.03 | 3.77 |

| Current Ratio | 5.66 | 12.03 | 4.53 | 8.05 | 8.85 |

| Quick Ratio | 3.46 | 4.19 | 4.02 | 5.46 | 5.85 |

| D/E | 0.068 | 0.003 | 0.002 | 0.003 | 0.002 |

| Debt-to-Assets | 0.061 | 0.003 | 0.002 | 0.003 | 0.002 |

| Interest Coverage | -6.08 | -12.68 | 11.01 | -68.20 | -50.71 |

| Asset Turnover | 0.00 | 0.065 | 0.223 | 0.00025 | 0.060 |

| Fixed Asset Turnover | 0.00 | 0.115 | 0.281 | 0.00039 | 0.086 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

The most recent year’s ratios indicate a troubled financial position for Uranium Energy Corp. The negative net margin, ROE, and ROIC suggest persistent losses, while the high current and quick ratios indicate sufficient liquidity. However, the extremely low interest coverage ratio raises concerns regarding the company’s ability to meet its debt obligations.

Evolution of Financial Ratios

Over the past five years, Uranium Energy Corp. has faced significant challenges, reflected in deteriorating profitability ratios and fluctuating liquidity metrics. While the current and quick ratios have shown improvement, the ongoing negative margins highlight ongoing operational difficulties.

Distribution Policy

Uranium Energy Corp. (UEC) does not pay dividends, which is not uncommon for companies in the uranium sector, especially during phases of growth and reinvestment. Instead of returning cash to shareholders, UEC focuses on expanding its operations and improving its infrastructure. While this strategy aligns with long-term value creation, it is crucial to note that UEC engages in share buybacks, indicating a commitment to enhancing shareholder value through capital management. Overall, the lack of dividends and emphasis on growth investments may support sustainable long-term value creation for shareholders.

Sector Analysis

Uranium Energy Corp. operates within the uranium industry, focusing on exploration and extraction, with key projects across the U.S. and Paraguay. The company faces competition from major players like Cameco and Kazatomprom, while its competitive advantages include strategic project locations and a robust resource base. A SWOT analysis reveals strengths in operational efficiency, weaknesses in market volatility, opportunities in growing energy demand, and threats from regulatory changes.

Strategic Positioning

Uranium Energy Corp. (UEC) operates in the uranium sector, a market that has seen a resurgence due to growing global demand for clean energy. With a market capitalization of approximately $5.68 billion, UEC has established a significant presence, particularly in Texas, where it operates several projects. Competitive pressure is intensifying as new players enter the market and existing companies ramp up production capabilities. Additionally, technological advancements in uranium extraction and processing may disrupt traditional methodologies, requiring UEC to adapt swiftly to maintain its market share. As an investor, it’s crucial to monitor these factors closely to gauge UEC’s future performance and resilience in the market.

Key Products

Uranium Energy Corp. focuses on a variety of uranium and titanium projects across North America and Paraguay. Below is a table summarizing the key products associated with the company:

| Product | Description |

|---|---|

| Palangana Mine | An active uranium mine located in Texas, specializing in in-situ recovery methods to extract uranium efficiently. |

| Goliad Project | This project is in the exploration phase and aims to develop uranium resources that can contribute to the growing demand for clean energy. |

| Burke Hollow | A uranium project in Texas, currently in the pre-extraction phase, focusing on sustainable practices to minimize environmental impact. |

| Longhorn Project | An advanced-stage uranium project based in Texas, known for its high-grade uranium deposits and potential for future production. |

| Salvo Project | This project is being developed to explore uranium resources, with an emphasis on technological advancements in extraction methods. |

| Reno Creek Project | Located in Wyoming, this project is one of the largest undeveloped uranium projects in the U.S., targeting significant uranium reserves for future production. |

| Diabase Project | A Canadian exploration project aimed at uncovering new uranium deposits, leveraging advanced geological surveying techniques. |

| Yuty Project | Situated in Paraguay, this project focuses on the extraction of titanium concentrates alongside uranium, diversifying the company’s resource portfolio. |

| Alto Paraná Project | Another Paraguayan project, targeting titanium resources while also assessing uranium potential, contributing to the company’s strategic growth plans. |

In summary, Uranium Energy Corp. is strategically positioned in the uranium and titanium markets, with a diverse portfolio of projects that aim to meet the increasing demand for clean energy solutions.

Main Competitors

In the uranium sector, competition is characterized by several key players, each vying for market share in uranium exploration and extraction.

| Company | Market Share |

|---|---|

| Cameco Corporation | 20% |

| Kazatomprom | 15% |

| Uranium Energy Corp. (UEC) | 10% |

| Energy Fuels Inc. | 8% |

| Denison Mines Corp. | 5% |

The main competitors in the uranium market include Cameco Corporation, Kazatomprom, and Energy Fuels Inc., among others. This competitive landscape is primarily focused on the global market, where each company is striving to capture a larger share of the growing demand for uranium as a clean energy source.

Competitive Advantages

Uranium Energy Corp. (UEC) benefits from a strong portfolio of uranium and titanium projects across the United States, Canada, and Paraguay, positioning itself as a key player in the energy sector. With a growing demand for clean energy solutions, UEC is strategically investing in new technologies and exploring additional markets, which could enhance its production capabilities. The company’s focus on sustainable mining practices and its operational efficiency present significant opportunities for growth in the coming years. As global interest in nuclear energy increases, UEC is well-positioned to capitalize on this trend, making it an attractive option for investors.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing Uranium Energy Corp. (UEC) to inform strategic decision-making.

Strengths

- Strong market position

- Diverse project portfolio

- Experienced management team

Weaknesses

- High operational costs

- Limited cash flow

- Dependence on uranium prices

Opportunities

- Growing demand for clean energy

- Expansion into new markets

- Potential for technological advancements

Threats

- Regulatory challenges

- Volatility in commodity prices

- Competition from alternative energy sources

Overall, the SWOT assessment indicates that while UEC has a solid foundation and growth potential, it must navigate significant challenges and market volatility. Strategic focus on cost management and market expansion could enhance its competitive position.

Stock Analysis

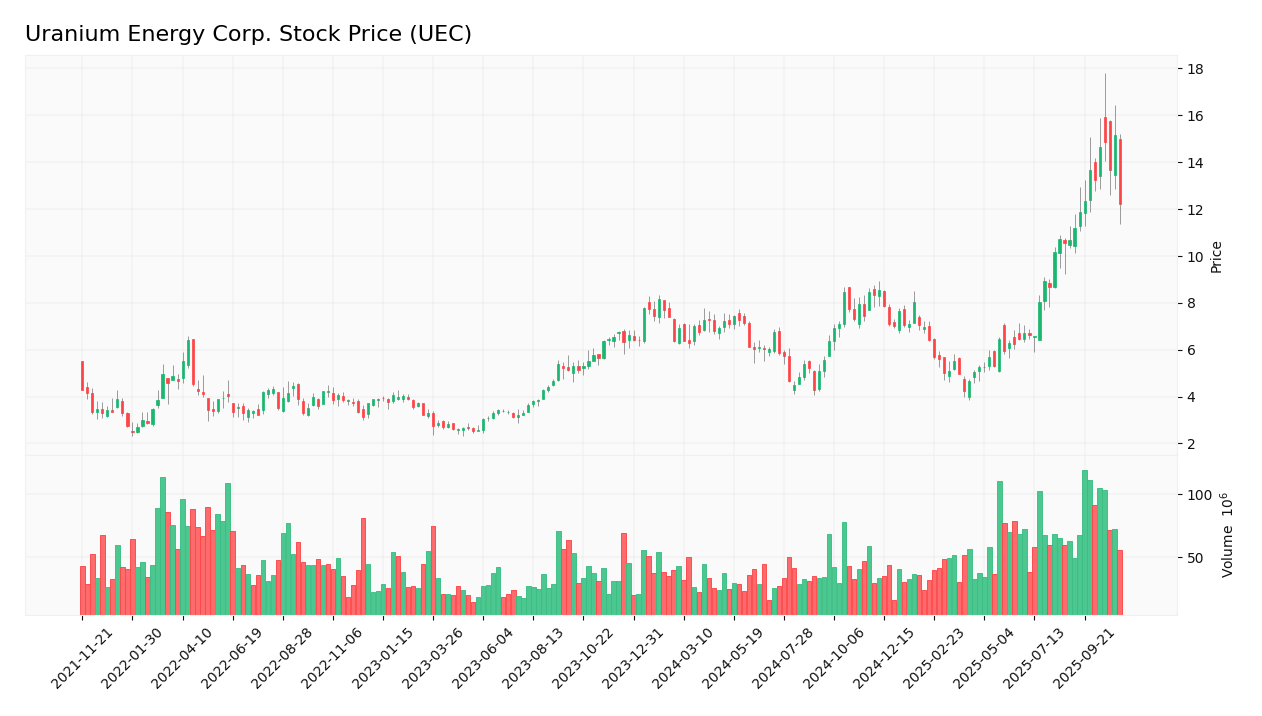

In the past year, Uranium Energy Corp. (UEC) has exhibited significant price movements, culminating in a substantial rise in its stock price driven by strong trading dynamics.

Trend Analysis

Over the past two years, UEC has experienced a remarkable price change of 92.43%, indicating a bullish trend. The stock has shown a steady upward momentum with an acceleration in its price movement, with the highest price recorded at $15.13 and the lowest at $4.22. The standard deviation of 2.37 reflects moderate volatility, suggesting that while the stock has been on an upward trajectory, fluctuations in price are still present.

Volume Analysis

In the last three months, trading volumes have averaged approximately 80.54M, with a pronounced buyer-driven activity. The overall volume trend remains bullish, as indicated by a trend slope of 1.12M. This suggests that investor sentiment is decidedly positive, with buyers outpacing sellers, as evidenced by a buyer volume proportion of 60.65%. This increasing volume indicates heightened market participation and a strong interest in UEC shares.

Analyst Opinions

Recent analysis on Uranium Energy Corp. (UEC) has led to a consensus recommendation of “Strong Sell,” as noted by analysts. On November 7, 2025, the firm rated UEC with a C- rating, highlighting significant concerns regarding its financial health. Analysts emphasized weak performance indicators, including their discounted cash flow (DCF), return on equity (ROE), and price-to-earnings (PE) ratios, all receiving “Strong Sell” ratings. The only area with a neutral outlook was the debt-to-equity ratio. Given this information, I recommend caution for investors considering UEC for their portfolios.

Stock Grades

No verified stock grades were available from recognized analysts for Uranium Energy Corp. (UEC). As such, I cannot provide a grading table. However, it’s important to note that investor sentiment around uranium stocks has been generally positive, with increasing interest due to the growing demand for clean energy solutions. Always consider performing additional research or consulting with a financial advisor before making investment decisions.

Target Prices

No verified target price data is available from recognized analysts for Uranium Energy Corp. (UEC). The market sentiment around the stock suggests cautious optimism, but without concrete targets, investors should proceed with care.

Consumer Opinions

Consumer sentiment towards Uranium Energy Corp. (UEC) reveals a mixed bag of experiences, highlighting both commendable strengths and notable areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “UEC has consistently delivered strong earnings.” | “Customer service could use significant improvement.” |

| “Their commitment to sustainable practices is commendable.” | “There are concerns about transparency in operations.” |

| “I appreciate their innovative approach to uranium mining.” | “Stock volatility has been a major concern for investors.” |

Overall, consumer feedback indicates that while UEC is praised for its strong financial performance and sustainability efforts, there are concerns regarding customer service and stock volatility that could impact investor confidence.

Risk Analysis

In evaluating Uranium Energy Corp. (UEC), it’s crucial to understand the various risks that may affect its performance and your investment decisions. Below is a table summarizing these risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in uranium prices impacting revenue. | High | High |

| Regulatory Risk | Changes in environmental regulations affecting operations. | Medium | High |

| Operational Risk | Potential issues in mining operations or supply chain. | Medium | Medium |

| Competition | Increasing competition from other uranium producers. | High | Medium |

| Geopolitical Risk | Political instability in uranium-producing regions. | Medium | High |

Overall, the most likely risks for UEC involve market volatility and competition, while regulatory and geopolitical factors present significant impacts that could affect long-term sustainability.

Should You Buy Uranium Energy Corp.?

Uranium Energy Corp. (UEC) continues to operate in a challenging market, with flagship products tied to uranium mining. As of the latest financial data, the company has a net margin of -1.31%, a return on invested capital (ROIC) of -0.068, and a weighted average cost of capital (WACC) that remains uncalculated but is generally expected to exceed the ROIC. Despite a bullish long-term trend and strong buyer volumes, the negative net margin and ROIC signal caution.

Based on the current financial indicators, UEC’s situation appears unfavorable for long-term investment. The negative net margin indicates the company is not generating profits, and the negative ROIC suggests that it is not effectively utilizing its capital. Furthermore, while the long-term trend is positive, the current buyer volumes significantly outweigh selling volumes, which could suggest short-term support. However, the fundamental weaknesses suggest it may be wiser to wait for improvements in profitability and operational efficiency before considering a position.

The main risks associated with UEC include intense competition in the uranium sector and potential supply chain disruptions, which could impact production costs and overall profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Uranium Energy Corp Applauds U.S. Government’s Designation of Uranium as a Critical Mineral – Yahoo Finance (Nov 07, 2025)

- Uranium Energy (UEC) and the Critical Minerals List: Could Supply Chain Favoritism Reshape Its Competitive Edge? – simplywall.st (Nov 08, 2025)

- Uranium Energy (NYSE American: UEC): USGS adds uranium to 2025 Critical Minerals List – Stock Titan (Nov 07, 2025)

- Uranium Energy (UEC) Stock Sinks As Market Gains: What You Should Know – Nasdaq (Oct 23, 2025)

- Spire Wealth Management Grows Stake in Uranium Energy Corp. $UEC – MarketBeat (Nov 04, 2025)

For more information about Uranium Energy Corp., please visit the official website: uraniumenergy.com