In the heart of the energy sector, Ur-Energy Inc. is redefining the landscape of uranium production, powering not just industries but also the future of clean energy. With its flagship Lost Creek project, the company stands at the forefront of innovation, boasting a reputation for high-quality resource extraction and sustainable practices. As we delve into Ur-Energy’s current market position, we must consider: do its fundamentals still justify its valuation in today’s dynamic energy market?

Table of contents

Company Description

Ur-Energy Inc. is a prominent player in the uranium industry, specializing in the acquisition, exploration, development, and operation of uranium mineral properties. Founded in 2004 and headquartered in Littleton, Colorado, the company operates primarily in the United States, with its flagship Lost Creek project encompassing approximately 1,800 unpatented mining claims across 48,000 acres in Wyoming’s Great Divide Basin. With a market capitalization of approximately $452 million, Ur-Energy is strategically positioned as a challenger in the energy sector, focusing on sustainable uranium production. The company’s commitment to responsible mining practices and its innovative approaches to uranium extraction play a vital role in shaping the future of nuclear energy and its role in a sustainable energy landscape.

Fundamental Analysis

In this section, I will analyze Ur-Energy Inc.’s income statement, financial ratios, and payout policy to provide insights into the company’s financial health and investment potential.

Income Statement

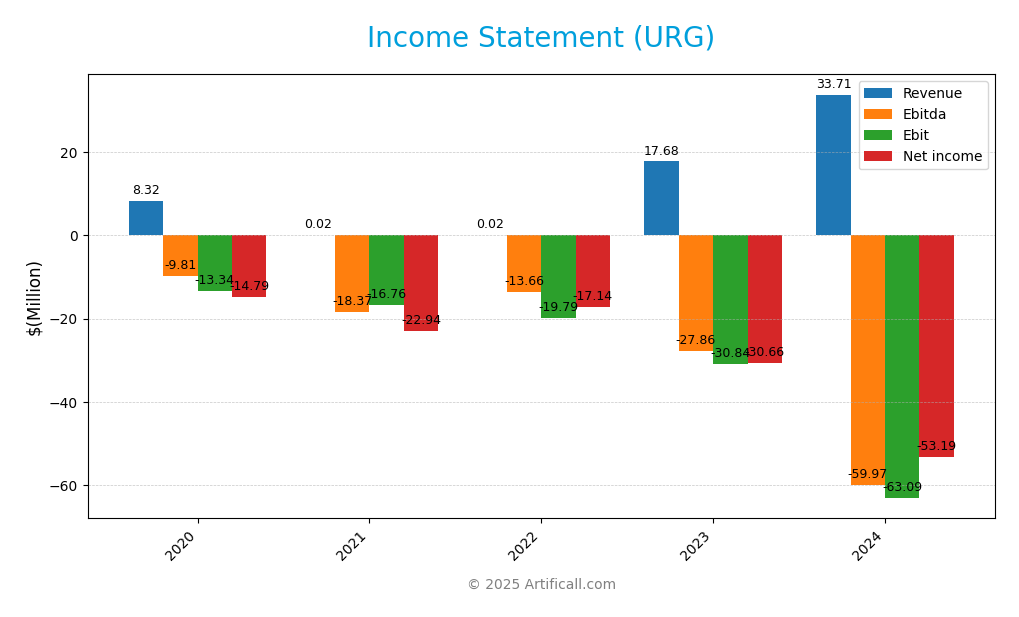

Below is the Income Statement for Ur-Energy Inc. (URG), highlighting key financial figures over the last five years.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 8.32M | 16.00K | 19.00 | 17.68M | 33.71M |

| Cost of Revenue | 12.97M | 7.00M | 6.86M | 19.37M | 42.68M |

| Operating Expenses | 8.69M | 9.77M | 12.95M | 29.16M | 54.12M |

| Gross Profit | -4.65M | -6.98M | -6.84M | -1.69M | -8.97M |

| EBITDA | -9.81M | -18.37M | -13.66M | -27.86M | -59.97M |

| EBIT | -13.34M | -16.76M | -19.79M | -30.84M | -63.09M |

| Interest Expense | 0 | -0.73M | -0.46M | 0 | 0 |

| Net Income | -14.79M | -22.94M | -17.14M | -30.66M | -53.19M |

| EPS | -0.09 | -0.12 | -0.08 | -0.12 | -0.17 |

| Filing Date | 2021-02-26 | 2022-09-21 | 2023-03-06 | 2024-03-12 | 2025-04-11 |

Over the last five years, Ur-Energy’s revenue has shown significant growth, particularly from 2023 to 2024, where it nearly doubled. However, the cost of revenue and operating expenses have also surged, leading to persistent net losses. In 2024, the company reported a net income loss of $53.19M, exacerbating its financial challenges. Despite the growth in revenue, the company’s margins remain under pressure, indicating a need for improved efficiency and cost management. The most recent year’s performance reflects a troubling trend, as EBITDA losses have widened significantly, suggesting critical operational issues that investors should monitor closely.

Financial Ratios

The table below summarizes the financial ratios for Ur-Energy Inc. (ticker: URG) over the last five available years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -1.87 | -1.54 | -902.11 | -1.73 | -1.58 |

| ROE | -0.45 | -0.35 | -0.27 | -0.41 | -0.40 |

| ROIC | -0.17 | -0.15 | -0.20 | -0.26 | -0.36 |

| P/E | -8.48 | -9.71 | -14.79 | -13.06 | -6.87 |

| P/B | 3.86 | 3.44 | 4.06 | 5.35 | 2.75 |

| Current Ratio | 1.42 | 7.81 | 6.66 | 6.35 | 5.99 |

| Quick Ratio | -0.76 | 6.54 | 5.16 | 6.09 | 4.91 |

| D/E | 0.39 | 0.18 | 0.18 | 0.09 | 0.01 |

| Debt-to-Assets | 0.16 | 0.10 | 0.10 | 0.05 | 0.01 |

| Interest Coverage | -18.79 | -22.86 | -42.75 | 0 | 0 |

| Asset Turnover | 0.10 | 0.00 | 0.00 | 0.14 | 0.17 |

| Fixed Asset Turnover | 0.14 | 0.00 | 0.00 | 0.32 | 0.00 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

In the most recent year (2024), Ur-Energy Inc. exhibits a concerning financial position. The negative net margin and returns on equity (ROE) signal ongoing losses, while the current and quick ratios indicate a strong liquidity position. However, the lack of profitability and interest coverage raises significant red flags regarding its operational viability and financial health.

Evolution of Financial Ratios

Over the past five years, Ur-Energy’s financial ratios show a trend of improving liquidity but persistent losses. The current and quick ratios have remained high, indicating good short-term financial health, while the negative margins and returns highlight ongoing operational challenges that investors should closely monitor.

Distribution Policy

Ur-Energy Inc. does not pay dividends, which aligns with its current strategy focused on reinvestment and growth during a challenging phase. The company’s negative net income and operational losses indicate that it prioritizes funding for research and development, as well as potential acquisitions. Importantly, Ur-Energy is also engaging in share buybacks, which signals a commitment to returning value to shareholders. Evaluating these actions suggests a cautious approach to long-term value creation, as they may enhance share price while the company navigates its growth trajectory.

Sector Analysis

Ur-Energy Inc. operates in the uranium industry, focusing on the acquisition and development of uranium properties, notably the Lost Creek project in Wyoming. The company faces competition from established uranium producers but leverages its strategic locations and exploration capabilities as competitive advantages.

Strategic Positioning

Ur-Energy Inc. (ticker: URG) operates within the uranium industry, focusing on the acquisition, exploration, development, and operation of uranium properties, primarily in the United States. Currently, Ur-Energy holds a significant market share in its sector, particularly through its flagship Lost Creek project. The competitive landscape is characterized by rising technological advancements in uranium extraction and processing, which may pressure traditional mining operations. Additionally, with increasing global demand for nuclear energy, Ur-Energy is well-positioned to leverage opportunities, although it must navigate potential market fluctuations and regulatory challenges effectively.

Key Products

In this section, I will provide an overview of the key products offered by Ur-Energy Inc. This information will help you understand the company’s core operations and its potential in the uranium market.

| Product | Description |

|---|---|

| Lost Creek Project | The flagship property of Ur-Energy, comprising approximately 1,800 unpatented mining claims and three mineral leases in Wyoming’s Great Divide Basin, covering around 48,000 acres. |

| Shirley Basin Project | A significant uranium project in Wyoming, focusing on the development of uranium extraction capabilities and potential future production. |

| Pathfinder Project | This project aims to explore and develop uranium resources in the highly prospective areas of Wyoming, enhancing the company’s portfolio. |

| Uranium Sales | Ur-Energy engages in the sale of uranium to utility companies, providing a crucial revenue stream while leveraging its mining capabilities. |

| Exploration Projects | The company conducts various exploration activities across its multiple projects, aiming to identify and assess additional uranium reserves. |

Understanding these key products will give you insight into Ur-Energy’s operations and its positioning within the uranium industry.

Main Competitors

No verified competitors were identified from available data. Ur-Energy Inc. operates primarily in the uranium sector and is focused on the acquisition, exploration, and development of uranium mineral properties in the United States. The company holds a significant position with a market cap of approximately $452 million, indicating a competitive stance within its niche.

Competitive Advantages

Ur-Energy Inc. possesses several competitive advantages in the uranium sector, primarily driven by its strategic focus on sustainable mining and advanced extraction technologies. The company’s flagship Lost Creek project, with substantial mineral claims, positions it well to capitalize on increasing global demand for uranium, especially as the energy transition accelerates. Looking ahead, Ur-Energy is exploring opportunities to expand its project portfolio and potentially enter new markets. By enhancing operational efficiency and focusing on environmentally responsible practices, the company is well-equipped to leverage future growth opportunities in the energy sector.

SWOT Analysis

The purpose of this SWOT analysis is to evaluate Ur-Energy Inc.’s strategic position and identify key factors that can influence its future performance.

Strengths

- Strong market position in uranium sector

- Diverse project portfolio

- Experienced management team

Weaknesses

- Limited geographical presence

- Dependence on uranium prices

- No dividend payments

Opportunities

- Growing demand for nuclear energy

- Potential for new project development

- Increased government support for clean energy

Threats

- Regulatory changes

- Market volatility

- Competition from alternative energy sources

This SWOT analysis indicates that while Ur-Energy has a solid foundation and growth potential, it must navigate significant market risks and operational challenges. A strategic focus on diversifying its market presence and enhancing its project pipeline will be essential for sustainable growth.

Stock Analysis

In the past year, Ur-Energy Inc. (URG) has experienced notable price movements, with a bearish trend that highlights the dynamics of investor sentiment and market conditions.

Trend Analysis

Over the past two years, Ur-Energy’s stock has seen a percentage decline of 16.78%, indicating a bearish trend. The stock has exhibited an acceleration in its downward momentum, with significant price fluctuations; the highest price reached was $2.01, while the lowest dropped to $0.60. The volatility is moderate, as evidenced by the standard deviation of 0.33, reflecting a consistent pattern of price decreases.

Volume Analysis

Analyzing the trading volumes over the last three months reveals a buyer-driven activity trend. The average volume during this period stands at approximately 49.10M, with a significant portion coming from buyers at 26.46M compared to sellers at 20.81M. This bullish volume trend, characterized by a slight acceleration of 2.88M, suggests that investor sentiment is increasingly positive, with buyers dominating market participation.

Analyst Opinions

Recent analyst recommendations for Ur-Energy Inc. (ticker: URG) indicate a consensus of a strong sell for 2025. On November 7, an analyst rated the company with a C-, highlighting significant concerns across multiple metrics. The analyst, who prefers to remain unnamed, pointed out strong sell ratings based on discounted cash flow, return on equity, and price-to-earnings ratios. With such negative assessments, it is crucial for potential investors to exercise caution before considering any positions in URG.

Stock Grades

No verified stock grades were available from recognized analysts for Ur-Energy Inc. (ticker: URG). As a result, I cannot provide any grading data to inform investment decisions. It’s essential to keep an eye on market sentiment and the company’s performance, especially in the context of the broader uranium sector, as it may influence future grading updates from analysts.

Target Prices

No verified target price data is available from recognized analysts for Ur-Energy Inc. (URG). Currently, general market sentiment around the stock suggests caution, reflecting uncertainty in its future performance.

Consumer Opinions

Consumer sentiment towards Ur-Energy Inc. reflects a mix of optimism and caution, showcasing both the strengths and areas for improvement of the company.

| Positive Reviews | Negative Reviews |

|---|---|

| “Ur-Energy has a strong commitment to sustainability.” | “Customer service needs significant improvement.” |

| “The company’s transparency in operations is commendable.” | “Product prices are higher than competitors.” |

| “I appreciate their focus on innovation.” | “I experienced delays in product delivery.” |

Overall, consumer feedback on Ur-Energy Inc. highlights its dedication to sustainability and transparency as key strengths, while pointing out weaknesses in customer service and pricing.

Risk Analysis

In evaluating Ur-Energy Inc. (ticker: URG), it’s crucial to understand the various risks that could affect investment decisions. Below is a table summarizing the key risks associated with this company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in uranium prices affecting revenue | High | High |

| Regulatory Risk | Changes in environmental regulations impacting operations | Medium | High |

| Operational Risk | Potential operational disruptions in mining activities | Medium | Medium |

| Financial Risk | Dependence on external financing for expansion | High | Medium |

In summary, the most pressing risks for Ur-Energy are market and regulatory risks, as they are both highly probable and can significantly impact the company’s financial health. Staying informed on uranium market trends and regulatory changes is essential for prudent investment.

Should You Buy Ur-Energy Inc.?

Ur-Energy Inc. has faced significant challenges in recent years, with a net profit margin of -1.58% and considerable operational losses. The company has not achieved a positive return on invested capital (ROIC) as it stands at a negative value, and its weighted average cost of capital (WACC) remains an important factor to consider. Despite these hurdles, Ur-Energy operates in the uranium sector, which could provide future opportunities if market conditions improve.

Given that the net margin is negative and the long-term trend appears bearish, it would be prudent to recommend waiting for fundamental improvements. The recent buyer volume trends are promising, but without a reversal in profitability and a positive long-term trend, it is not advisable to add this stock to your portfolio at this time.

Moreover, the company faces risks from intense competition in the uranium industry, as well as potential supply chain disruptions and challenges in achieving favorable valuations.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Ur Energy (URG) Reports Q3 Loss, Lags Revenue Estimates – Yahoo Finance (Nov 04, 2025)

- Ur-Energy Inc (URG) Reports Q3 2025 Earnings: EPS Matches Estima – GuruFocus (Nov 04, 2025)

- Ur-Energy Inc. Reports Increased Quarterly Loss – The Globe and Mail (Nov 06, 2025)

- HC Wainwright & Co. Maintains Ur-Energy (URG) Buy Recommendation – Nasdaq (Nov 04, 2025)

- Ur Energy: Q3 Earnings Snapshot – San Antonio Express-News (Nov 04, 2025)

For more information about Ur-Energy Inc., please visit the official website: ur-energy.com