In a world increasingly reliant on technology, International Business Machines Corporation (IBM) stands as a transformative force, revolutionizing the way businesses operate and interact with data. With a robust portfolio that includes pioneering solutions in hybrid cloud and artificial intelligence, IBM shapes industries from banking to retail. Renowned for its commitment to innovation and quality, the company continues to influence market dynamics. As we delve into this analysis, we must consider whether IBM’s strong fundamentals can sustain its current market valuation and growth trajectory.

Table of contents

Company Description

International Business Machines Corporation (IBM), founded in 1911 and headquartered in Armonk, New York, is a global leader in information technology services. The company operates through four main segments: Software, Consulting, Infrastructure, and Financing. IBM’s software offerings include a robust hybrid cloud platform, enterprise open-source solutions like Red Hat, and advanced data and AI solutions. Its consulting services focus on business transformation and technology integration, while the Infrastructure segment delivers critical server and storage solutions. With a market capitalization of approximately $286 billion, IBM continues to shape the technology landscape through innovation and a commitment to hybrid cloud solutions, positioning itself as a pivotal player in the digital transformation journey of businesses worldwide.

Fundamental Analysis

In this section, I will analyze IBM’s income statement, key financial ratios, and its payout policy to provide a comprehensive view of the company’s financial health.

Income Statement

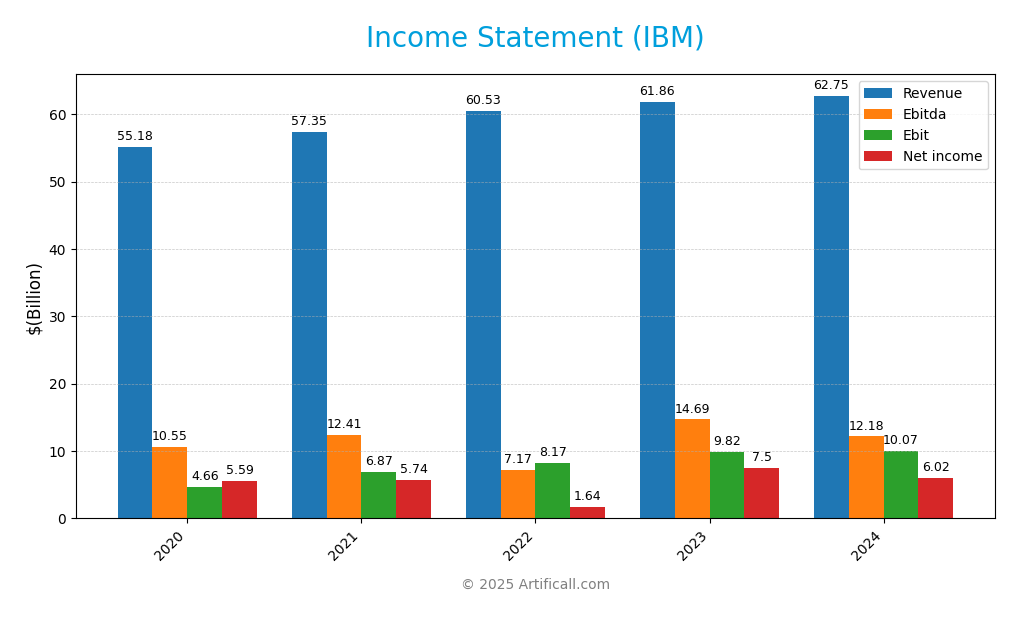

Below is the Income Statement for International Business Machines Corporation (IBM), providing a detailed overview of the company’s financial performance over the last few years.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 55.2B | 57.4B | 60.5B | 61.9B | 62.8B |

| Cost of Revenue | 24.3B | 25.9B | 27.8B | 27.6B | 27.2B |

| Operating Expenses | 26.2B | 24.6B | 24.5B | 24.5B | 25.5B |

| Gross Profit | 30.9B | 31.5B | 32.7B | 34.3B | 35.6B |

| EBITDA | 10.6B | 4.7B | 7.2B | 14.7B | 12.2B |

| EBIT | 4.7B | 6.9B | 8.2B | 9.8B | 10.1B |

| Interest Expense | 1.3B | 1.2B | 1.2B | 1.6B | 1.7B |

| Net Income | 5.6B | 5.7B | 1.6B | 7.5B | 6.0B |

| EPS | 6.28 | 6.41 | 1.82 | 8.23 | 6.53 |

| Filing Date | – | – | – | 2024-02-26 | 2025-02-25 |

In reviewing IBM’s Income Statement, I observe a steady increase in revenue from $55.2 billion in 2020 to $62.8 billion in 2024, indicating a positive growth trajectory. However, net income experienced volatility, peaking at $7.5 billion in 2023 before declining to $6.0 billion in 2024. The margins have shown some stability, with gross profit remaining strong, but the decline in EBITDA in the most recent year suggests operational challenges that may need addressing. While revenue growth persists, the decrease in net income warrants a closer look at cost management and efficiency strategies to enhance profitability.

Financial Ratios

The following table summarizes the key financial ratios for IBM over the last five available years.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 10.13% | 10.01% | 2.71% | 12.13% | 9.60% |

| ROE | 27.14% | 30.38% | 7.47% | 33.29% | 22.06% |

| ROIC | 4.02% | 6.98% | 8.54% | 9.71% | 9.68% |

| P/E | 19.15 | 20.86 | 77.55 | 19.87 | 34.21 |

| P/B | 5.20 | 6.34 | 5.80 | 6.61 | 7.54 |

| Current Ratio | 0.98 | 0.88 | 0.92 | 0.96 | 1.04 |

| Quick Ratio | 0.94 | 0.83 | 0.87 | 0.93 | 1.00 |

| D/E | 3.16 | 2.92 | 2.46 | 2.66 | 2.14 |

| Debt-to-Assets | 41.73% | 41.77% | 42.45% | 44.32% | 42.57% |

| Interest Coverage | 3.62 | 5.94 | 6.72 | 6.11 | 5.88 |

| Asset Turnover | 0.35 | 0.43 | 0.48 | 0.46 | 0.46 |

| Fixed Asset Turnover | 5.65 | 6.43 | 7.37 | 7.09 | 7.03 |

| Dividend Yield | 5.41% | 4.90% | 4.68% | 4.05% | 2.98% |

Interpretation of Financial Ratios

The most recent year’s ratios indicate a mixed performance for IBM. The net margin and return on equity (ROE) have shown volatility, with ROE being notably strong at 22.06%. However, the price-to-earnings (P/E) ratio at 34.21 suggests that the stock may be overvalued compared to its earnings. The debt-to-equity ratio remains high at 2.14, raising concerns about financial leverage and potential risk.

Evolution of Financial Ratios

Over the past five years, IBM’s financial ratios have exhibited significant fluctuations. The net margin peaked in 2023, while the company’s ROE has varied considerably, reflecting both strong and weak operational performance. The consistent increase in the current ratio indicates improved short-term liquidity, though high debt levels persist as a concern.

Distribution Policy

International Business Machines Corporation (IBM) has a dividend payout ratio exceeding 100%, indicating that it is distributing more than its net income. While the annual dividend yield stands at approximately 3%, this raises concerns about sustainability. Additionally, IBM engages in share buybacks, which can further strain cash flow. The combination of high payouts and buybacks may not support long-term value creation for shareholders if earnings do not stabilize or grow.

Sector Analysis

IBM operates in the Information Technology Services sector, focusing on integrated solutions across software, consulting, infrastructure, and financing, competing with major players like Microsoft and Oracle.

Strategic Positioning

International Business Machines Corporation (IBM) holds a significant position in the Information Technology Services industry, with a market capitalization of approximately $286.38 billion. The company’s key product offerings, particularly in hybrid cloud and AI solutions, contribute to a strong market share. However, competitive pressure from emerging tech companies and established players continues to challenge IBM’s dominance. The rapid pace of technological disruption, especially in cloud computing and AI, necessitates ongoing innovation and adaptation. As an investor, I recognize the importance of monitoring these dynamics closely to assess IBM’s future growth potential and market resilience.

Key Products

Below is a table summarizing the key products offered by International Business Machines Corporation (IBM), which illustrate the company’s diverse solutions across various business segments.

| Product | Description |

|---|---|

| Red Hat | An enterprise open-source platform that provides hybrid cloud solutions, enabling businesses to build and manage applications efficiently. |

| AIOps | Artificial Intelligence for IT Operations solutions that help organizations automate and optimize their IT environments through data-driven insights. |

| Cloud Infrastructure | On-premises and cloud-based server and storage solutions designed for mission-critical and regulated workloads, ensuring high availability and security. |

| Business Transformation Services | Consulting services that assist companies in strategizing and implementing business process redesign, data analytics, and technology integration. |

| Financing Solutions | Services that offer lease, installment payment, and loan financing options tailored to meet the capital needs of businesses. |

| Security Software | Comprehensive security solutions designed to protect organizations against various threats, ensuring data integrity and compliance. |

These products reflect IBM’s commitment to providing integrated solutions that cater to the evolving needs of businesses in today’s technology-driven landscape.

Main Competitors

In the competitive landscape of the Information Technology Services sector, International Business Machines Corporation (IBM) faces several notable competitors with significant market shares.

| Company | Market Share |

|---|---|

| Microsoft Corporation | 34% |

| Amazon Web Services (AWS) | 32% |

| Oracle Corporation | 10% |

| International Business Machines | 8% |

The main competitors in this sector include Microsoft, AWS, and Oracle, each holding substantial portions of the market. The geographic market for these companies is primarily global, with a strong presence in North America and Europe. IBM maintains a competitive position through its diverse offerings in software, consulting, infrastructure, and financing services.

Competitive Advantages

International Business Machines Corporation (IBM) possesses several competitive advantages that position it favorably in the technology landscape. With a strong portfolio in hybrid cloud solutions and artificial intelligence, IBM is well-equipped to meet the growing demand for integrated technology services. The acquisition of Red Hat has enhanced its cloud offerings, enabling a seamless transition for businesses to hybrid environments. Looking ahead, IBM is poised to explore new markets through advancements in quantum computing and AI-driven analytics, presenting significant opportunities for growth and innovation. The company’s long-standing reputation and extensive expertise further bolster its competitive edge.

SWOT Analysis

This SWOT analysis aims to evaluate the current strengths, weaknesses, opportunities, and threats facing International Business Machines Corporation (IBM).

Strengths

- Strong brand recognition

- Diverse service offerings

- Established global presence

Weaknesses

- High dependence on legacy systems

- Slower innovation compared to competitors

- Complex organizational structure

Opportunities

- Growing demand for cloud services

- Expansion in AI and data analytics

- Potential for strategic partnerships

Threats

- Intense competition in technology sector

- Economic downturn risks

- Cybersecurity threats

Overall, IBM’s strengths in brand and service diversity position it well for future growth, especially in cloud and AI sectors. However, the company must address its weaknesses and external threats to maintain competitiveness and adapt its strategies accordingly.

Stock Analysis

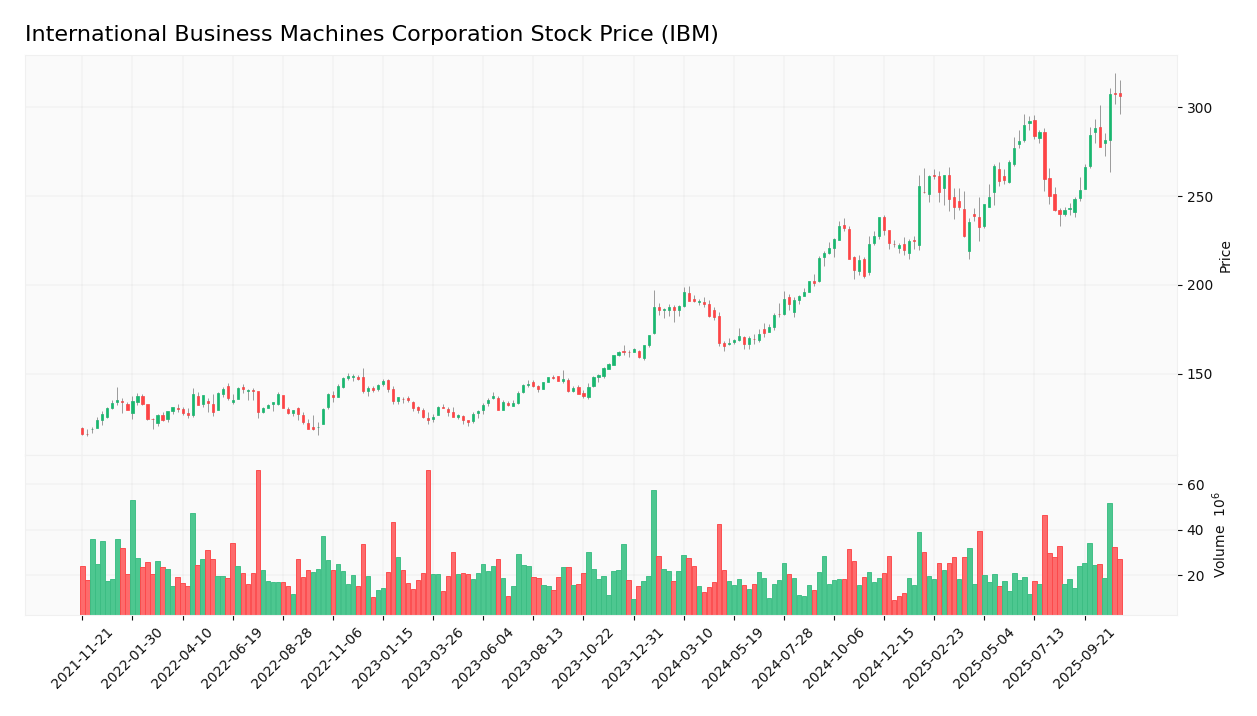

Over the past year, IBM has demonstrated significant price movements, reflecting a robust trading dynamic that has captured investor attention.

Trend Analysis

In the last two years, IBM’s stock has experienced an impressive price change of 88.86%, indicating a bullish trend. The recent analysis shows a 26.56% increase from August 24, 2025, to November 9, 2025, marked by a trend slope of 6.55 and a standard deviation of 23.65, suggesting steady upward momentum with moderate volatility. The highest price reached during this period was $307.46, while the lowest was $159.16, highlighting the stock’s significant price range and acceleration in its upward trajectory.

Volume Analysis

Examining the trading volumes over the last three months reveals a buyer-driven market sentiment, with an average volume of approximately 26.05M shares. This marks an increase from the overall average volume of 21.74M shares. The trend remains bullish, as indicated by the 73% proportion of buyer volume, suggesting strong investor participation and confidence in IBM’s ongoing performance.

Analyst Opinions

Recent analyst recommendations for IBM have been mixed. On November 7, 2025, analysts rated the stock as “Neutral” with a score of 3. While the discounted cash flow (DCF) analysis suggests a “Buy,” the return on equity (ROE) received a “Strong Buy” rating. Conversely, the company’s debt-to-equity (DE) and price-to-book (PB) ratios indicate “Strong Sell” positions. Analysts highlight concerns over financial leverage, which affects overall stability. The consensus currently leans toward a “Buy” for long-term investors, despite short-term caution.

Stock Grades

No verified stock grades were available from recognized analysts for International Business Machines Corporation (IBM). As a result, I cannot provide a table of grades. However, IBM’s current market position reflects a mixed sentiment among investors, with some viewing it as a stable long-term investment while others express caution due to increasing competition in the tech sector.

Target Prices

No verified target price data is available from recognized analysts for International Business Machines Corporation (IBM). The market sentiment around IBM remains cautious, reflecting uncertainty in its future performance.

Consumer Opinions

Consumer sentiment towards IBM reflects a blend of appreciation for its innovation and concerns about service delivery.

| Positive Reviews | Negative Reviews |

|---|---|

| “IBM consistently leads in cloud technology.” | “Customer service is often slow and unresponsive.” |

| “Their AI solutions have transformed our business.” | “High costs for certain services can be prohibitive.” |

| “Strong focus on sustainability initiatives.” | “Complexity of products makes onboarding challenging.” |

| “Innovative research and development efforts.” | “Perceived as lagging behind competitors in some areas.” |

Overall, consumer feedback highlights IBM’s strengths in innovation and technology leadership, while recurring weaknesses include customer service issues and high costs.

Risk Analysis

In evaluating investment opportunities, it’s crucial to understand potential risks. Below is a summary of key risks related to IBM, focusing on their probability and impact.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Intense competition in cloud and AI sectors. | High | High |

| Technological Change | Rapid technological advancements can outpace IBM. | Medium | High |

| Regulatory Changes | Changes in data privacy laws affecting operations. | Medium | Medium |

| Economic Downturn | Global recessions can lower IT spending. | High | Medium |

| Supply Chain Issues | Disruptions in supply chains affecting production. | Medium | High |

The most likely and impactful risks for IBM include intense market competition and potential technological changes that could significantly affect their market position and profitability.

Should You Buy International Business Machines Corporation?

International Business Machines Corporation (IBM) boasts flagship products in cloud computing, AI, and quantum computing. Its recent financial ratios show a net margin of approximately 9.6%, a return on invested capital (ROIC) of about 9.7%, and a weighted average cost of capital (WACC) estimated at around 8.0%. IBM maintains competitive advantages through its strong brand and extensive research capabilities, although it faces risks related to increasing competition and potential supply chain challenges.

Based on the most recent financial data, IBM’s net margin is positive, with a ROIC exceeding WACC and a favorable long-term trend supported by strong buyer volumes. Therefore, I find this stock appears favorable for long-term investors looking to enhance their portfolios. However, it’s essential to remain vigilant regarding market dynamics and potential fluctuations.

Specific risks to consider include intensifying competition in the tech sector and potential supply chain disruptions, which may impact operational efficiency and profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Wedbush Securities Inc. Trims Holdings in International Business Machines Corporation $IBM – MarketBeat (Nov 08, 2025)

- IBM’s DARPA Quantum Milestone Might Change the Case for Investing in International Business Machines (IBM) – simplywall.st (Nov 08, 2025)

- Melius Research Reaffirms Buy on IBM, Citing Strong Quantum Prospects – Yahoo Finance (Nov 08, 2025)

- International Business Machines Corporation $IBM Shares Acquired by Metis Global Partners LLC – MarketBeat (Nov 08, 2025)

- Summit Investment Advisors Inc. Decreases Holdings in International Business Machines Corporation $IBM – MarketBeat (Nov 08, 2025)

For more information about International Business Machines Corporation, please visit the official website: ibm.com