NVIDIA Corporation doesn’t just create products; it revolutionizes how we interact with technology daily. As a powerhouse in the semiconductor industry, NVIDIA fuels gaming, professional visualization, and advanced computing with its cutting-edge graphics processing units and artificial intelligence solutions. Renowned for its innovative spirit and commitment to quality, NVIDIA consistently sets benchmarks that others aspire to meet. But as we delve into the investment potential of NVIDIA, we must ask: do its robust fundamentals still align with its soaring market valuation?

Table of contents

Company Description

NVIDIA Corporation, founded in 1993 and headquartered in Santa Clara, California, is a leading player in the semiconductor industry, specializing in graphics processing units (GPUs) and artificial intelligence (AI) computing solutions. The company operates primarily in the United States, Taiwan, and China, offering a diverse range of products including GeForce GPUs for gamers, data center platforms for AI and high-performance computing, and advanced automotive solutions for autonomous vehicles. With a robust market capitalization of approximately $4.58 trillion, NVIDIA is well-positioned as an innovator, continuously shaping the future of technology through its commitment to AI, gaming, and visualization ecosystems.

Fundamental Analysis

In this section, I will provide a detailed fundamental analysis of NVIDIA Corporation, focusing on its income statement, key financial ratios, and dividend payout policy.

Income Statement

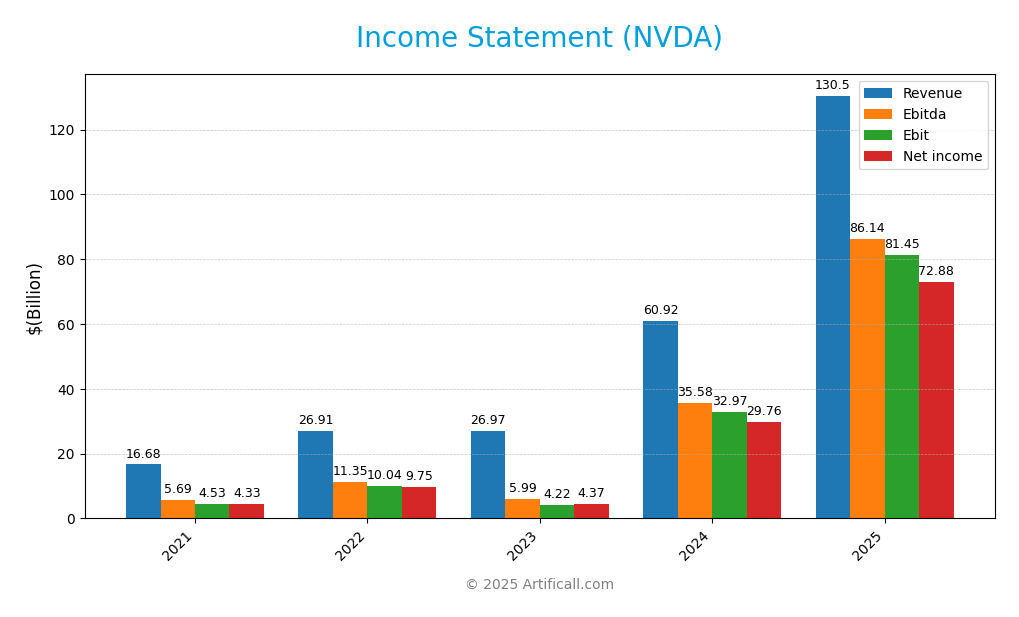

The following table summarizes NVIDIA Corporation’s income statement for the fiscal years, highlighting key financial metrics that investors should consider.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 16.68B | 26.91B | 26.97B | 60.92B | 130.50B |

| Cost of Revenue | 6.28B | 9.44B | 11.62B | 16.62B | 32.64B |

| Operating Expenses | 5.86B | 7.43B | 11.13B | 11.33B | 16.41B |

| Gross Profit | 10.40B | 17.48B | 15.36B | 44.30B | 97.86B |

| EBITDA | 5.69B | 11.35B | 5.99B | 35.58B | 86.14B |

| EBIT | 4.53B | 10.04B | 4.22B | 32.97B | 81.45B |

| Interest Expense | 0.18B | 0.24B | 0.26B | 0.26B | 0.25B |

| Net Income | 4.33B | 9.75B | 4.37B | 29.76B | 72.88B |

| EPS | 0.18 | 0.39 | 0.18 | 1.21 | 2.97 |

| Filing Date | 2021-02-26 | 2022-03-18 | 2023-02-24 | 2024-02-21 | 2025-02-26 |

Over the analyzed period, NVIDIA’s revenue and net income have shown remarkable growth, especially in 2025, where revenue soared to approximately $130.5 billion, nearly double that of 2024. This surge is accompanied by a significant increase in gross profit, reflecting improved margins. Notably, the gross profit ratio has also seen an upward trend, indicating better efficiency in cost management. The most recent year’s performance reveals a robust expansion, with net income reaching $72.88 billion, suggesting not only sustained growth but also effective control of operating expenses, which have increased at a slower pace compared to revenue. This positions NVIDIA favorably for continued investor interest.

Financial Ratios

The table below summarizes the key financial ratios for NVIDIA Corporation (NVDA) over the last four years, providing a snapshot of its financial health and operational efficiency.

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 25.98% | 36.23% | 16.19% | 48.85% | 55.85% |

| ROE | 25.64% | 36.65% | 19.76% | 69.25% | 91.87% |

| ROIC | 18.23% | 25.20% | 12.20% | 59.84% | 87.07% |

| P/E | 75.43 | 62.68 | 109.09 | 51.83 | 39.90 |

| P/B | 19.34 | 22.97 | 21.56 | 35.89 | 36.66 |

| Current Ratio | 4.09 | 6.65 | 3.52 | 4.17 | 4.44 |

| Quick Ratio | 3.63 | 6.05 | 2.73 | 3.67 | 3.88 |

| D/E | 0.46 | 0.44 | 0.54 | 0.26 | 0.13 |

| Debt-to-Assets | 26.81% | 26.77% | 29.21% | 16.82% | 9.20% |

| Interest Coverage | 24.63 | 42.55 | 16.12 | 128.30 | 329.77 |

| Asset Turnover | 0.58 | 0.61 | 0.65 | 0.93 | 1.17 |

| Fixed Asset Turnover | 5.84 | 7.46 | 5.57 | 11.58 | 16.16 |

| Dividend Yield | 0.12% | 0.07% | 0.08% | 0.03% | 0.03% |

Interpretation of Financial Ratios

In 2025, NVIDIA exhibits strong financial ratios, particularly in profitability with a net margin of 55.85% and an ROE of 91.87%, indicating exceptional efficiency in generating profits from equity. However, the P/E ratio at 39.90 suggests that the stock might be overvalued compared to its earnings potential. The low debt ratios highlight strong financial stability, but the declining dividend yield may concern income-focused investors.

Evolution of Financial Ratios

Over the past five years, NVIDIA’s financial ratios have shown a significant improvement, particularly in profitability and efficiency metrics. The decline in debt ratios alongside a substantial rise in ROE and net margins indicates a strong operational performance and effective capital management. However, the high P/E ratio reflects a growing concern around stock valuation amidst these positive trends.

Distribution Policy

NVIDIA Corporation has a minimal dividend payout, with a payout ratio of only 1.14%. Instead, the company focuses on reinvesting profits into growth initiatives and research and development, which aligns with its high-growth strategy. Additionally, NVIDIA engages in share buybacks, indicating a commitment to returning value to shareholders. This approach suggests a focus on long-term value creation, although investors should remain cautious about the sustainability of such low dividend distributions amid potential market fluctuations.

Sector Analysis

NVIDIA Corporation operates in the semiconductor industry, renowned for its GeForce GPUs and AI solutions, facing competition from companies like AMD and Intel while leveraging strong brand loyalty and innovation. A SWOT analysis reveals strengths in technological leadership and opportunities in AI markets, alongside threats from intense competition and market volatility.

Strategic Positioning

NVIDIA Corporation holds a significant market share in the semiconductor industry, particularly in graphics processing units (GPUs) for gaming and data centers. With a market capitalization exceeding $4.5 trillion, the company faces competitive pressure from rivals like AMD and Intel, which are also advancing their technologies. However, NVIDIA’s strong focus on artificial intelligence and accelerated computing positions it well amid ongoing technological disruptions. The company’s innovative offerings, such as the GeForce NOW game streaming service and advanced AI platforms, continue to enhance its competitive edge in a rapidly evolving market landscape.

Key Products

Below is a summary of NVIDIA Corporation’s key products, highlighting their diverse offerings across various markets.

| Product | Description |

|---|---|

| GeForce GPUs | High-performance graphics processing units designed for gaming, professional visualization, and creative applications, enhancing the visual experience on PCs. |

| GeForce NOW | A cloud gaming service that allows users to stream games directly from the cloud, enabling gaming on various devices without the need for high-end hardware. |

| Quadro/NVIDIA RTX GPUs | Specialized graphics cards intended for professional workstations, offering advanced rendering capabilities for design, animation, and simulation tasks. |

| NVIDIA AI Enterprise | A suite of software tools and frameworks designed to accelerate the deployment of AI applications in the enterprise sector, facilitating machine learning projects. |

| Jetson Platform | An embedded computing platform designed for robotics and AI applications, supporting developers in creating intelligent machines and systems. |

| Mellanox Networking Solutions | High-performance networking and interconnect solutions that enhance data transfer speeds and efficiency in data centers and cloud environments. |

| Automotive AI Solutions | Comprehensive platforms for automotive applications, including infotainment systems and autonomous driving technologies aimed at enhancing vehicle intelligence. |

| Omniverse Software | A collaborative platform for building 3D designs and virtual worlds, empowering creators and designers to work together in real-time across various applications. |

These products exemplify NVIDIA’s commitment to innovation and its strategic focus on key technology sectors such as gaming, professional visualization, data centers, and automotive industries.

Main Competitors

No verified competitors were identified from available data. However, I can provide insight into NVIDIA Corporation’s competitive position. NVIDIA holds a significant market share in the semiconductor industry, particularly in graphics processing units (GPUs) and AI computing solutions. The company’s innovative products have positioned it as a leader in both the gaming and data center markets, indicating strong competitive dominance in these sectors.

Competitive Advantages

NVIDIA Corporation boasts significant competitive advantages, primarily due to its leadership in the semiconductor industry and innovation in graphics processing units (GPUs). The company’s diverse product portfolio, including GeForce GPUs for gaming and advanced data center solutions for AI and high-performance computing, positions it well for future growth. Additionally, NVIDIA’s strategic collaborations, such as with Kroger Co., open new avenues in automotive AI and cloud computing. Looking ahead, opportunities in emerging markets and the ongoing demand for AI solutions suggest a robust growth trajectory for NVIDIA, making it a compelling choice for investors seeking long-term value.

SWOT Analysis

The SWOT analysis aims to provide a clear understanding of NVIDIA Corporation’s strengths, weaknesses, opportunities, and threats in the current market landscape.

Strengths

- Strong market position

- Innovative product offerings

- Robust financial performance

Weaknesses

- High dependency on gaming sector

- Supply chain vulnerabilities

- Rising competition

Opportunities

- Growth in AI and machine learning

- Expansion in cloud computing

- Strategic partnerships

Threats

- Regulatory challenges

- Market volatility

- Rapid technological changes

Overall, NVIDIA’s strengths and opportunities position it well for future growth, although it must address its weaknesses and remain vigilant against external threats. A balanced strategy focusing on innovation and diversification will be crucial for sustained success.

Stock Analysis

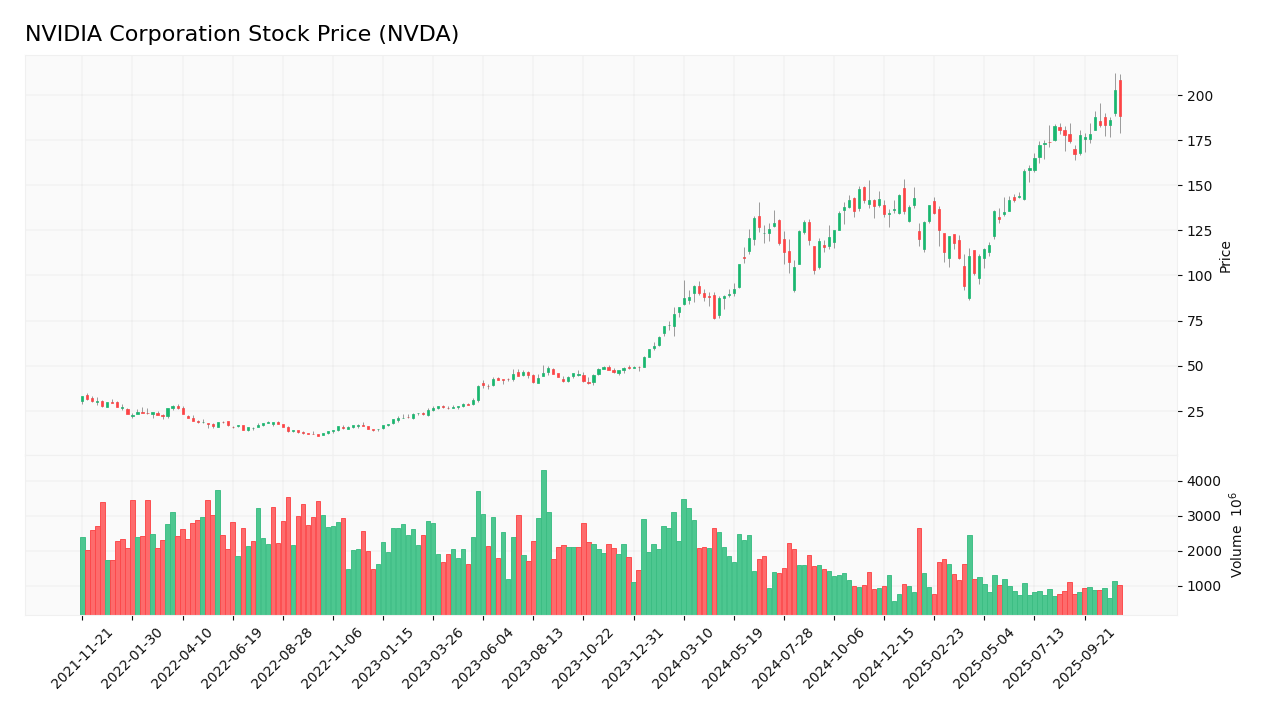

Over the past year, NVIDIA Corporation (NVDA) has exhibited significant price movements, characterized by a remarkable bullish trend and notable trading dynamics.

Trend Analysis

In analyzing NVIDIA’s stock performance, we observe an impressive price increase of 284.84% over the past year. This bullish trend has been marked by an acceleration in price, with the stock reaching a high of $202.49 and a low of $48.83, indicating substantial growth potential. The standard deviation of 36.2 suggests a level of volatility that, while moderate, reflects investor confidence as the stock continues to show steady upward momentum.

Volume Analysis

Examining trading volumes over the last three months, the average volume stands at approximately 907M shares, revealing a seller-dominant market. The overall trading volume has been on a bearish trend, decreasing at a slope of about 16.9M shares. This suggests a cautious investor sentiment, as the proportion of buyer volume has been close to 49.17%, indicating a near-equilibrium in market participation. The slight acceleration in recent buyer activity may hint at potential shifts in sentiment, but the prevailing trend remains cautious.

Analyst Opinions

Recent analyst recommendations for NVIDIA Corporation (NVDA) suggest a mixed outlook. On November 7, 2025, analysts rated NVDA with a “B+” and a neutral recommendation overall. While the return on equity (ROE) and return on assets (ROA) received strong buy signals, the price-to-earnings (PE) and price-to-book (PB) ratios were marked as strong sells. This divergence indicates caution among analysts, with a consensus leaning towards a neutral stance rather than a definitive buy or sell for the current year.

Stock Grades

NVIDIA Corporation (NVDA) continues to receive strong endorsements from several reputable grading companies, indicating a solid outlook for the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Loop Capital | Maintain | Buy | 2025-11-03 |

| Rosenblatt | Maintain | Buy | 2025-11-03 |

| Goldman Sachs | Maintain | Buy | 2025-11-03 |

| B of A Securities | Maintain | Buy | 2025-10-29 |

| UBS | Maintain | Buy | 2025-10-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-29 |

| DA Davidson | Maintain | Buy | 2025-10-29 |

| HSBC | Upgrade | Buy | 2025-10-15 |

| Mizuho | Maintain | Outperform | 2025-10-13 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-09 |

The overall trend shows a consistent “Buy” or “Overweight” rating across various firms, suggesting that analysts are optimistic about NVIDIA’s performance in the near future. The recent upgrades and maintained grades reflect a strong confidence in the company’s growth trajectory.

Target Prices

Reliable target price data indicates that analysts have a consensus regarding NVIDIA Corporation’s potential performance.

| Target High | Target Low | Consensus |

|---|---|---|

| 350 | 200 | 250.65 |

Overall, analysts expect NVIDIA’s stock to reach a consensus target of approximately $250.65, reflecting a balanced outlook between the high and low estimates.

Consumer Opinions

Consumer sentiment towards NVIDIA Corporation has been largely favorable, reflecting confidence in its innovative technology and market leadership.

| Positive Reviews | Negative Reviews |

|---|---|

| “NVIDIA’s GPUs are the best for gaming!” | “Customer service could be improved.” |

| “Their technology is always ahead of the curve.” | “High prices make it inaccessible for some.” |

| “Excellent performance in AI and machine learning.” | “Limited availability during peak demand.” |

| “Consistently delivers top-notch products.” | “Software issues can be frustrating.” |

Overall, consumer feedback highlights NVIDIA’s cutting-edge technology and strong performance, while also pointing out concerns regarding pricing and customer service experiences.

Risk Analysis

In evaluating NVIDIA Corporation (NVDA), understanding the potential risks is crucial for informed investment decisions. Below is a summary of key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in the tech sector can significantly affect stock prices. | High | High |

| Supply Chain Issues | Disruptions in semiconductor supply chains can impact production. | Medium | High |

| Regulatory Risks | Increased scrutiny on AI and tech companies may lead to stricter regulations. | Medium | Medium |

| Competitive Pressure | Rapid advancements by competitors could erode market share. | High | Medium |

| Cybersecurity Threats | Risks of data breaches could damage reputation and trust. | Medium | High |

In recent months, market volatility has surged, largely due to geopolitical tensions and inflation concerns, which makes it imperative for investors to remain vigilant.

Should You Buy NVIDIA Corporation?

NVIDIA Corporation’s flagship products include its leading graphics processing units (GPUs) and AI computing solutions, which continue to dominate the market. As of the latest financials, NVIDIA boasts a net margin of approximately 55.85%, a return on invested capital (ROIC) of 87.07%, and a weighted average cost of capital (WACC) of 14.36%. These figures reflect robust profitability and effective capital management, although the company faces risks such as intense competition and market dependence.

Given that NVIDIA’s net margin is greater than zero and ROIC significantly exceeds WACC, alongside a positive long-term trend and favorable buyer volumes, the current situation appears favorable for long-term investors seeking to add this stock to their portfolios. However, the recent bearish trend in volume suggests caution, indicating a possible wait for stronger buyer momentum.

The specific risks associated with NVIDIA include the potential for increased competition in the semiconductor industry and fluctuations in demand driven by market conditions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Nvidia: Now Is The Time To Double Down (Upgrade) (NASDAQ:NVDA) – Seeking Alpha (Nov 06, 2025)

- Nvidia Stock 2026 Prediction: Can NVDA’s Gravity-Defying Rally Continue? – Yahoo Finance (Nov 07, 2025)

- Nvidia (NASDAQ: NVDA) Bull, Base, & Bear Price Prediction and Forecast (Nov 7) – 24/7 Wall St. (Nov 07, 2025)

- NVIDIA Corporation (NVDA) Partners with Deutsche Telekom on €1B Data Center Project in Europe – Yahoo Finance (Nov 06, 2025)

- NVIDIA (NASDAQ:NVDA) Stock Price Down 3.7% on Insider Selling – MarketBeat (Nov 06, 2025)

For more information about NVIDIA Corporation, please visit the official website: nvidia.com