In a world increasingly driven by automation, UiPath Inc. stands at the forefront, revolutionizing how businesses operate and enhancing efficiency across various sectors. As a prominent player in the software infrastructure industry, UiPath’s innovative robotic process automation (RPA) solutions empower organizations to streamline workflows, minimize errors, and maximize productivity. With a reputation for cutting-edge technology and a commitment to quality, the company has carved out a significant niche in banking, healthcare, and government services. As we delve into a comprehensive investment analysis, the critical question remains: do UiPath’s fundamentals still support its current market valuation and growth trajectory?

Table of contents

Company Description

UiPath Inc., founded in 2005 and headquartered in New York City, is a prominent player in the software infrastructure industry, specializing in robotic process automation (RPA). The company delivers a comprehensive automation platform that integrates artificial intelligence with user-friendly tools for both attended and unattended automation. Primarily operating in the United States, Romania, and Japan, UiPath serves diverse sectors, including banking, healthcare, and government. With a focus on low-code development, the company empowers users to automate processes without extensive coding expertise. UiPath’s commitment to innovation and ecosystem strength positions it as a leader in shaping the future of workplace automation.

Fundamental Analysis

In this section, I will analyze UiPath Inc.’s income statement, key financial ratios, and payout policy to provide insights into its financial health and investment potential.

Income Statement

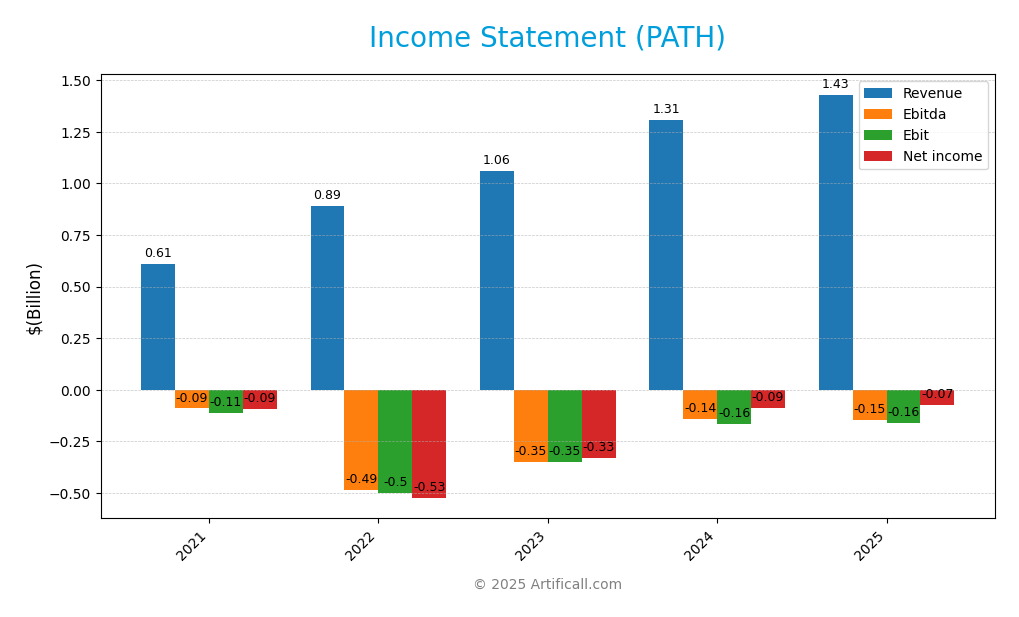

The following table summarizes the income statement for UiPath Inc. (PATH) over the last five fiscal years, providing insights into revenue, expenses, and profitability metrics.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 608M | 892M | 1.058B | 1.308B | 1.430B |

| Cost of Revenue | 66M | 169M | 180M | 196M | 247M |

| Operating Expenses | 652M | 1.224B | 1.227B | 1.277B | 1.345B |

| Gross Profit | 542M | 723M | 879M | 1.112B | 1.182B |

| EBITDA | -91M | -486M | -348M | -142M | -145M |

| EBIT | -110M | -501M | -348M | -165M | -163M |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | -93M | -526M | -328M | -90M | -74M |

| EPS | -0.18 | -0.97 | -0.6 | -0.16 | -0.13 |

| Filing Date | – | 2022-04-04 | 2023-03-24 | 2024-03-27 | 2025-03-24 |

Over the five-year period, UiPath has shown a consistent upward trend in revenue, increasing from $608 million in 2021 to $1.430 billion in 2025. Despite this growth, the company has struggled with profitability, as indicated by persistent negative net income and EBITDA values, particularly severe in 2022. The most recent year (2025) reflects a slight improvement in net loss and revenue growth, but operating expenses continue to rise, impacting profitability margins. This highlights the ongoing challenge UiPath faces in managing costs while scaling its operations. As an investor, one should remain cautious and closely monitor the company’s ability to achieve sustainable profitability.

Financial Ratios

The table below presents the financial ratios for UiPath Inc. (PATH) over the last five available years, allowing for a comparative analysis of the company’s performance.

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -15.21% | -58.91% | -31.02% | -6.87% | -5.15% |

| ROE | -22.09% | -27.35% | -17.10% | -4.46% | -3.99% |

| ROIC | -22.01% | -24.50% | -16.52% | -7.34% | -7.87% |

| P/E | -387.71 | -85.64 | -25.64 | -144.16 | -108.04 |

| P/B | 85.64 | 10.29 | 4.38 | 6.43 | 4.31 |

| Current Ratio | 2.01 | 4.32 | 3.74 | 3.63 | 2.93 |

| Quick Ratio | 2.01 | 4.32 | 3.74 | 3.63 | 2.93 |

| D/E | 0.048 | 0.027 | 0.033 | 0.033 | 0.042 |

| Debt-to-Assets | 2.32% | 1.99% | 2.32% | 2.27% | 2.72% |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.70 | 0.35 | 0.39 | 0.44 | 0.50 |

| Fixed Asset Turnover | 18.94 | 13.49 | 13.05 | 16.34 | 14.41 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2025, UiPath’s financial ratios indicate a challenging landscape. The net margin remains negative at -5.15%, reflecting ongoing profitability issues. Return on equity (ROE) at -3.99% and return on invested capital (ROIC) at -7.87% signify that the company is struggling to generate returns for shareholders. The high P/E ratio of -108.04 suggests that investors have high expectations despite the company’s current losses. Overall, these ratios highlight potential concerns regarding profitability and efficiency.

Evolution of Financial Ratios

Over the past five years, the financial ratios of UiPath have shown a deterioration in profitability, with both net margin and ROE consistently negative. However, the current and quick ratios indicate strong liquidity, suggesting that the company is managing its short-term obligations effectively despite its operational challenges.

Distribution Policy

UiPath Inc. does not currently pay dividends, which aligns with its strategy of reinvesting earnings to drive growth and innovation. The company is in a high-growth phase, focusing on expanding its market presence and enhancing its technology offerings. Notably, UiPath engages in share buybacks, which could signal confidence in its future prospects. This approach, while prioritizing growth over immediate returns, may support sustainable long-term value creation for shareholders if managed effectively.

Sector Analysis

UiPath Inc. operates within the Software – Infrastructure industry, specializing in robotic process automation (RPA) solutions. The company competes with major players while leveraging its innovative platform and low-code capabilities for a competitive edge.

Strategic Positioning

UiPath Inc. holds a significant share in the robotic process automation (RPA) market, driven by its comprehensive automation platform that integrates artificial intelligence and user-friendly tools. With a market capitalization of approximately $7.59 billion, the company competes against established players and new entrants that constantly push for innovation. Despite facing competitive pressure, UiPath’s focus on low-code development and centralized management tools positions it favorably against rivals. However, the ongoing technological disruption in the software industry necessitates continuous adaptation to maintain its market relevance and capitalize on emerging opportunities.

Key Products

UiPath Inc. offers a comprehensive range of products designed to enhance automation within organizations. Below is a table summarizing the key products provided by the company.

| Product | Description |

|---|---|

| UiPath Studio | A low-code development environment where users can design and build automation workflows without extensive coding knowledge. |

| UiPath Orchestrator | A centralized platform for managing, monitoring, and deploying automation, enabling seamless collaboration between humans and robots. |

| UiPath Robots | Software robots that automate repetitive tasks, available in attended and unattended modes to suit various business needs. |

| UiPath AI Fabric | Integrates AI capabilities into automation processes, allowing users to utilize machine learning models within their workflows. |

| UiPath Insights | An analytics tool that provides insights into automation performance, helping organizations measure ROI and optimize processes. |

| UiPath Connectors | Pre-built connectors for popular business applications that simplify the integration of automation within existing workflows. |

| UiPath Academy | An educational platform offering training and resources for individuals and organizations to enhance their automation skills. |

These products are structured to cater to diverse industries, including banking, healthcare, and government, ensuring that UiPath remains a leader in the robotic process automation space.

Main Competitors

No verified competitors were identified from available data. However, UiPath Inc. is positioned as a significant player in the robotic process automation (RPA) market, with an estimated market share that reflects its strong presence in key regions such as the United States, Romania, and Japan. The company’s competitive position is bolstered by its comprehensive automation platform, which serves various sectors including banking, healthcare, and government entities. As a result, UiPath occupies a dominant role in the technology sector, particularly within the software infrastructure space.

Competitive Advantages

UiPath Inc. holds a strong position in the robotic process automation (RPA) market due to its comprehensive end-to-end automation platform, which integrates artificial intelligence with user-friendly tools. This allows businesses across various sectors, including banking and healthcare, to streamline operations efficiently. Looking ahead, UiPath plans to expand its product offerings and penetrate new markets, enhancing its competitive edge. The company’s focus on low-code development environments and robust support services positions it well to capitalize on the growing demand for automation solutions, providing significant opportunities for future growth.

SWOT Analysis

In this section, I will provide a SWOT analysis for UiPath Inc. (Ticker: PATH) to help investors understand the company’s current position and strategic direction.

Strengths

- Strong brand recognition

- Innovative automation solutions

- Diverse customer base

Weaknesses

- High dependency on US market

- Limited profitability

- Competition from established firms

Opportunities

- Growing demand for automation

- Expansion into emerging markets

- Potential for strategic partnerships

Threats

- Market volatility

- Rapid technological changes

- Increased competition

Overall, this SWOT assessment suggests that UiPath has solid strengths and opportunities to leverage but should address its weaknesses and remain vigilant against external threats. This balanced approach can guide strategic initiatives aimed at sustainable growth.

Stock Analysis

Over the past year, UiPath Inc. (PATH) has experienced significant price fluctuations, culminating in a bearish trend characterized by a notable decline of 44.31%. This analysis will delve into the stock’s weekly price movements and trading dynamics to provide insight into its current market position.

Trend Analysis

Analyzing the stock’s performance over the past two years, we observe a price change of -44.31%, indicating a bearish trend. The stock has shown signs of acceleration in its downward trajectory, with a standard deviation of 4.46, reflecting heightened volatility. The highest price recorded was $26.35, while the lowest dipped to $10.04. This volatility suggests that while there may be short-term fluctuations, the overall direction remains downward.

Volume Analysis

In the last three months, trading volumes have demonstrated a bullish trend, with an average volume of 112.56M shares. Notably, buyer-dominant activity is evident, with an average buy volume of 71.80M shares compared to an average sell volume of 40.76M shares. This suggests a positive investor sentiment, as buyers have been more active, accounting for 63.79% of total volume. The increasing volume trend, with a slope of 9.86M, indicates heightened market participation and potential interest in the stock despite the broader bearish trend.

Analyst Opinions

Recent analyst recommendations for UiPath Inc. (PATH) indicate a cautious stance. On November 7, 2025, analysts assigned a “B-” rating, suggesting a neutral outlook. While the overall recommendation remains neutral, the return on equity (ROE) received a “sell” rating, and the price-to-earnings (PE) ratio was marked as a “strong sell.” Analysts emphasize concerns about profitability and valuation. Given this mixed feedback, the consensus leans towards a hold strategy for investors considering their positions in UiPath.

Stock Grades

No verified stock grades were available from recognized analysts for UiPath Inc. (PATH). As such, I cannot provide a grading table. However, it’s important to note that investor sentiment around UiPath has shown some fluctuations recently, which could indicate varying expectations regarding the company’s future performance in the automation sector. Always consider market trends and individual research before making investment decisions.

Target Prices

No verified target price data is available from recognized analysts for UiPath Inc. (PATH). Currently, the market sentiment appears mixed, reflecting uncertainty about the company’s growth prospects in the automation sector.

Consumer Opinions

Consumer sentiment about UiPath Inc. reveals a mixed bag of experiences, showcasing both commendable strengths and notable weaknesses in their offerings.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional automation capabilities!” | “Customer support needs significant improvement.” |

| “User-friendly interface that simplifies tasks.” | “Integration with existing systems can be challenging.” |

| “Great ROI on investment in automation.” | “Updates sometimes lead to unexpected issues.” |

| “Innovative solutions that enhance productivity.” | “Pricing can be a barrier for smaller businesses.” |

Overall, consumer feedback highlights UiPath’s strong automation capabilities and user-friendly design, while pointing out areas for improvement in customer support and integration challenges.

Risk Analysis

In evaluating the investment potential of UiPath Inc. (PATH), it’s crucial to understand the associated risks. Below is a comprehensive overview of the risks that could affect the company’s performance.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for automation solutions. | High | High |

| Competitive Risk | Intense competition from established tech companies. | High | High |

| Regulatory Risk | Changes in data protection and AI regulations. | Medium | High |

| Technological Risk | Rapid advancements could outpace UiPath’s offerings. | Medium | Medium |

| Economic Risk | Economic downturns affecting IT budgets. | Medium | High |

In summary, the most significant risks for UiPath are market and competitive risks, which are highly probable and could severely impact the company’s growth trajectory.

Should You Buy UiPath Inc.?

UiPath Inc. is a leader in robotic process automation (RPA), offering advanced software solutions aimed at automating repetitive tasks. Despite its strong gross profit margin of 82.73%, the company currently faces challenges with a net profit margin of -5.15%, a return on invested capital (ROIC) of -7.87%, and a weighted average cost of capital (WACC) that remains unreported.

Given the negative net margin and the overall bearish trend in its stock performance, I recommend waiting for fundamentals to improve before considering an investment in UiPath. The company’s long-term trajectory appears uncertain, and buyer volumes must return to signal a more favorable buying environment.

Specific risks to be aware of include intense competition in the RPA sector and the potential for continued volatility in market demand for automation solutions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- UiPath (NYSE:PATH) Shares Down 3% After Insider Selling – MarketBeat (Nov 06, 2025)

- William Blair Maintains a Hold Rating on UiPath Inc (PATH) – Yahoo Finance (Oct 21, 2025)

- UiPath Shares Fall Amid Legal Scrutiny and Insider Trades – StocksToTrade (Nov 04, 2025)

- UiPath (NYSE: PATH) plans Fiscal Q3 results call on Dec. 3; webcast available – Stock Titan (Nov 05, 2025)

- Insider Sell: Daniel Dines Sells 45,000 Shares of UiPath Inc (PA – GuruFocus (Nov 06, 2025)

For more information about UiPath Inc., please visit the official website: uipath.com