In a world increasingly reliant on digital infrastructure, Datadog, Inc. is redefining how businesses monitor and optimize their cloud environments. This innovative leader in the application software industry offers a comprehensive suite of tools that empower developers and IT operations teams to achieve real-time visibility into their technology stacks. With a strong reputation for quality and a commitment to integrating advanced analytics, Datadog is positioned at the forefront of digital transformation. As we explore the current investment landscape, I invite you to consider whether Datadog’s fundamentals still align with its market valuation and growth potential.

Table of contents

Company Description

Datadog, Inc. is a prominent player in the software application industry, specializing in monitoring and analytics solutions tailored for developers, IT operations teams, and business users. Founded in 2010 and headquartered in New York City, Datadog offers a comprehensive SaaS platform that seamlessly integrates infrastructure monitoring, application performance monitoring, log management, and security monitoring. With a strong presence in North America and international markets, the company employs around 6,500 professionals. Datadog’s strategic positioning as a leader in real-time observability empowers organizations to enhance their technology stack’s performance, ultimately shaping industry standards through innovation and robust data analytics capabilities.

Fundamental Analysis

In this section, I will analyze Datadog, Inc.’s income statement, key financial ratios, and payout policy to provide a comprehensive understanding of its financial health and investment potential.

Income Statement

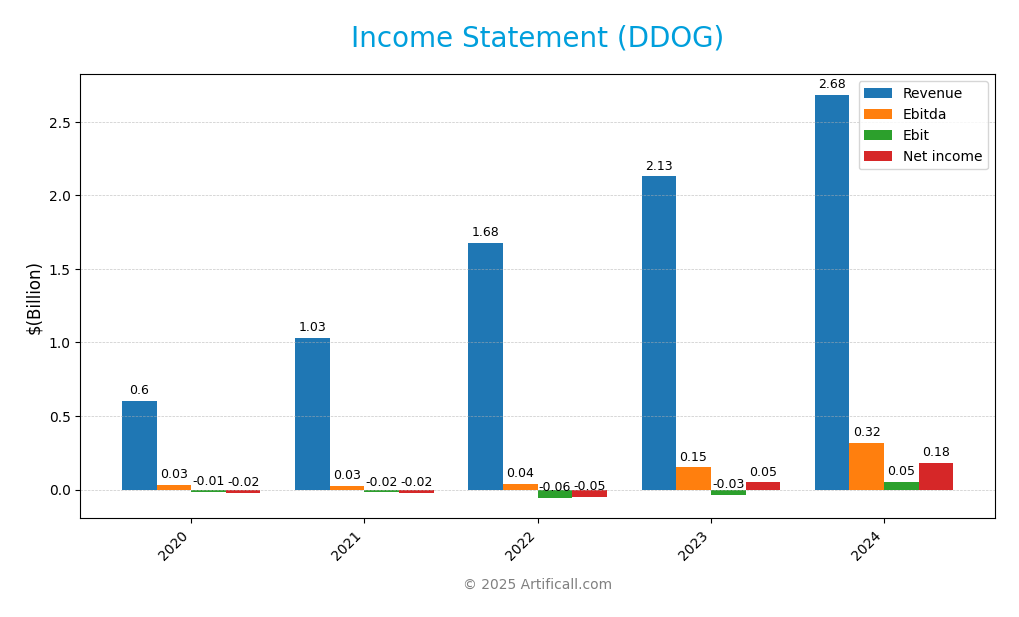

The following table summarizes the Income Statement for Datadog, Inc. (DDOG) over the last few fiscal years, highlighting key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 603M | 1.03B | 1.68B | 2.13B | 2.68B |

| Cost of Revenue | 130M | 235M | 348M | 411M | 516M |

| Operating Expenses | 487M | 813M | 1.39B | 1.75B | 2.11B |

| Gross Profit | 473M | 794M | 1.33B | 1.72B | 2.17B |

| EBITDA | 34M | 26M | 41M | 150M | 318M |

| EBIT | -14M | -19M | -59M | -33M | 54M |

| Interest Expense | 30M | 21M | 16M | 6M | 7M |

| Net Income | -25M | -21M | -50M | 49M | 184M |

| EPS | -0.08 | -0.07 | -0.16 | 0.15 | 0.55 |

| Filing Date | 2021-03-01 | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-20 |

The analysis of Datadog’s income statement reveals a robust upward trend in revenue, increasing from $603 million in 2020 to $2.68 billion in 2024. Net income transitioned from losses in earlier years to a significant profit of $184 million in 2024, indicating strong operational improvements. Gross profit margins have remained stable, hovering around 80%, which reflects consistent efficiency in managing cost of revenue. The latest year showed substantial revenue growth and a remarkable recovery in net income, suggesting that the company’s strategies are beginning to yield positive results, despite elevated operating expenses.

Financial Ratios

The following table summarizes the financial ratios for Datadog, Inc. (DDOG) over the past five years, providing insight into the company’s financial health and performance trends.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -4.07% | -2.02% | -2.99% | 2.28% | 6.85% |

| ROE | -2.56% | -1.99% | -3.56% | 2.40% | 6.77% |

| ROIC | -0.86% | -1.03% | -2.61% | -1.14% | 1.38% |

| P/E | -1204.48 | -2653.39 | -462.17 | 809.82 | 261.42 |

| P/B | 30.88 | 52.87 | 16.44 | 19.42 | 17.70 |

| Current Ratio | 5.77 | 3.54 | 3.09 | 3.17 | 2.64 |

| Quick Ratio | 5.77 | 3.54 | 3.09 | 3.17 | 2.64 |

| D/E | 0.67 | 0.78 | 0.59 | 0.45 | 0.68 |

| Debt-to-Assets | 34.05% | 33.93% | 27.87% | 22.92% | 31.84% |

| Interest Coverage | -0.45 | -0.91 | -3.55 | -5.31 | 7.68 |

| Asset Turnover | 0.32 | 0.43 | 0.56 | 0.54 | 0.46 |

| Fixed Asset Turnover | 5.75 | 7.54 | 7.87 | 7.13 | 6.72 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, Datadog’s financial ratios show significant improvement, particularly in net margin and return on equity (ROE), indicating enhanced profitability. However, the high P/E ratio suggests that the stock may be overvalued, and the interest coverage ratio of 7.68 is a positive sign for debt sustainability. A cautious approach is warranted given the fluctuations in profitability and valuation metrics.

Evolution of Financial Ratios

Over the past five years, Datadog’s financial ratios have generally improved, with notable recovery in profitability metrics such as net margin and ROE. However, the P/E ratio remains high, indicating market expectations of future growth, which could pose risks if those expectations are not met.

Distribution Policy

Datadog, Inc. does not currently pay dividends, reflecting a strategy focused on reinvestment for growth and expansion. The company’s emphasis on research and development, alongside strategic acquisitions, aims to enhance long-term shareholder value. Notably, Datadog also engages in share buybacks, which can indicate confidence in its future prospects. Overall, this approach appears to support sustainable value creation for shareholders, provided that growth initiatives are effectively managed.

Sector Analysis

Datadog, Inc. operates in the Software – Application sector, providing a comprehensive monitoring and analytics platform that enhances observability for cloud-based applications. Key competitors include Splunk and New Relic, while Datadog’s competitive advantages lie in its extensive feature set and integrations. A SWOT analysis reveals strengths in innovation, weaknesses in market saturation, opportunities in expanding cloud adoption, and threats from emerging competitors.

Strategic Positioning

Datadog, Inc. currently holds a significant position in the cloud monitoring and analytics market, with a robust market share driven by its comprehensive SaaS platform. The company faces competitive pressure from established players in the software industry, but its innovative features, such as real-time observability and integrated monitoring tools, set it apart. Technological disruption remains a constant threat; however, Datadog’s continuous evolution and adaptation to emerging trends position it well against competitors. As of now, it is essential to monitor these dynamics to assess potential risks and opportunities in investing in Datadog.

Key Products

In this section, I present an overview of the key products offered by Datadog, Inc., which provide valuable monitoring and analytics capabilities for various technology stacks.

| Product | Description |

|---|---|

| Infrastructure Monitoring | A solution that provides real-time visibility into the performance of cloud infrastructure and servers, allowing users to identify and resolve issues swiftly. |

| Application Performance Monitoring | This product helps developers and IT teams monitor the performance of applications, providing insights into user interactions and backend processes. |

| Log Management | A centralized solution for managing log data from various sources, enabling users to search, analyze, and visualize logs efficiently. |

| Security Monitoring | A comprehensive security solution that helps organizations detect and respond to threats in their cloud environments, ensuring data protection and compliance. |

| User Experience Monitoring | This tool tracks user interactions and performance metrics, enabling businesses to enhance user satisfaction and application usability. |

| Cloud Security | A product focused on securing cloud environments by automating security measures and providing insights into potential vulnerabilities. |

| Incident Management | A system that streamlines incident response processes, allowing teams to collaborate effectively and resolve issues faster. |

These products are integral to Datadog’s mission of providing comprehensive observability for modern cloud applications, ensuring that businesses can operate smoothly and effectively in increasingly complex environments.

Main Competitors

No verified competitors were identified from available data. However, I can provide some insights into Datadog, Inc.’s estimated market share and competitive position. Datadog operates in the Software – Application sector and is known for its comprehensive monitoring and analytics platform. Given its innovative solutions and strong presence in the cloud monitoring space, Datadog holds a significant competitive position in North America and internationally.

Competitive Advantages

Datadog, Inc. holds significant competitive advantages in the cloud monitoring and analytics sector, primarily due to its comprehensive SaaS platform that seamlessly integrates various functionalities such as infrastructure monitoring, application performance monitoring, and security monitoring. This integration allows for real-time observability, which is crucial for businesses navigating complex technology stacks. Looking ahead, Datadog is well-positioned to capitalize on emerging markets and trends, including expanding its offerings in cloud security and user experience monitoring. With a growing demand for observability solutions and a commitment to innovation, the company’s future outlook appears promising.

SWOT Analysis

The SWOT analysis helps to identify the key strengths, weaknesses, opportunities, and threats facing Datadog, Inc. (DDOG) in the current market landscape.

Strengths

- Strong market position

- Comprehensive SaaS platform

- High customer satisfaction

Weaknesses

- Dependence on cloud market

- Limited dividend history

- Competitive industry

Opportunities

- Growing demand for cloud solutions

- Expansion into new markets

- Increasing focus on cybersecurity

Threats

- Intense competition

- Market volatility

- Rapid technological changes

Overall, the SWOT assessment suggests that Datadog has a solid foundation to capitalize on market opportunities, but it must remain vigilant to competitive pressures and market dynamics to sustain its growth trajectory.

Stock Analysis

Over the past year, Datadog, Inc. (ticker: DDOG) has exhibited significant price movements, characterized by a notable bullish trend that reflects the company’s growing market presence and investor confidence.

Trend Analysis

During the analyzed period of the past year, Datadog’s stock has achieved a remarkable price change of 55.99%. This strong upward trend is classified as bullish, indicating robust buying interest. The stock has experienced steady upward momentum with moderate volatility, demonstrated by a standard deviation of 16.99. Key price points include a high of $191.24 and a low of $87.93, with acceleration in the trend suggesting potential for continued growth.

Volume Analysis

In the last three months, trading volumes for Datadog have shown a clear buyer-driven pattern. The average trading volume stands at approximately 22.03M, with buy volume averaging 20.50M, indicating strong demand among investors. This bullish volume trend, characterized by an acceleration in activity, suggests heightened investor sentiment and participation, further supporting the stock’s positive outlook.

Analyst Opinions

Recent analyst recommendations for Datadog, Inc. (DDOG) indicate a cautious outlook. On November 7, 2025, a prominent analyst rated the stock with a “C+” and recommended a “Sell,” citing concerns over its financial metrics, particularly a “Strong Sell” rating on price-to-earnings and price-to-book ratios. The overall consensus among analysts currently leans towards a “Sell,” reflecting apprehensions about the company’s growth prospects amidst a challenging market environment. As an investor, I advise careful consideration of these insights before making any investment decisions.

Stock Grades

No verified stock grades were available from recognized analysts for Datadog, Inc. (DDOG). As such, I cannot provide specific grading data at this time. However, it’s important to consider the company’s recent performance, market position, and general investor sentiment when making investment decisions.

Target Prices

No verified target price data is available from recognized analysts for Datadog, Inc. (DDOG). Current market sentiment suggests a cautious approach as investors await clearer guidance on future performance.

Consumer Opinions

Consumer sentiment about Datadog, Inc. is a mix of enthusiasm for its innovative solutions and concerns regarding customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| “Datadog has significantly improved our monitoring capabilities.” | “Customer support can be slow to respond at times.” |

| “The platform is user-friendly and integrates well with our existing tools.” | “Pricing structure is a bit confusing.” |

| “Excellent performance and real-time analytics.” | “Some features are lacking compared to competitors.” |

Overall, consumer feedback highlights Datadog’s strong performance and user-friendly interface as key strengths, while customer support and pricing clarity are common areas of concern.

Risk Analysis

In evaluating Datadog, Inc. (ticker: DDOG), understanding the various risks involved is crucial for informed investment decisions. Below is a summary of the key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Intense competition from other cloud monitoring services. | High | High |

| Cybersecurity | Risk of data breaches or cyberattacks affecting trust. | Medium | High |

| Regulatory Changes | Potential changes in data privacy regulations impacting operations. | Medium | Medium |

| Economic Downturn | Economic instability affecting customer budgets for IT spending. | High | Medium |

| Technological Change | Rapid technological advancements requiring constant innovation. | High | High |

The most likely and impactful risks for Datadog stem from fierce competition and the necessity for continuous innovation, especially as the tech landscape evolves rapidly.

Should You Buy Datadog, Inc.?

Datadog, Inc. has showcased a strong gross profit margin of 80.76% in its latest financials, alongside a net profit margin of 6.85%. However, its return on invested capital (ROIC) remains low at 1.38%, while the weighted average cost of capital (WACC) is not explicitly mentioned but inferred to be higher given current market conditions. Although the company has demonstrated a bullish long-term price trend and satisfactory buyer volumes, it faces risks from high valuations and competitive pressures.

Based on the current financial indicators, Datadog’s net margin is positive, but its ROIC does not exceed WACC, suggesting a cautious approach. The long-term trend appears favorable, supported by strong buyer volumes indicating investor interest. Therefore, it seems prudent for long-term investors to consider adding Datadog to their portfolios, albeit with caution due to its low ROIC.

That said, Datadog’s risks include ongoing competition in the tech industry, potential supply chain issues, and its high valuation metrics, which could impact future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Datadog Inc (DDOG) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and Expanding AI … – Yahoo Finance (Nov 06, 2025)

- Datadog soars after Q3 beat, raises 2025 outlook – Seeking Alpha (Nov 06, 2025)

- Datadog’s Momentum: Can It Keep Rising? – StocksToTrade (Nov 06, 2025)

- Datadog Posts ‘Great’ Q3 Beat, Analysts Praise ‘Compounding Growth Ahead’ – Benzinga (Nov 07, 2025)

- Datadog’s Stock Jumps 23% After Earnings. Its Results Got a Boost From AI Customers – Investopedia (Nov 06, 2025)

For more information about Datadog, Inc., please visit the official website: datadoghq.com