In a world increasingly driven by data, Zebra Technologies Corporation stands at the forefront, revolutionizing the way businesses manage their assets and streamline operations. Renowned for its innovative solutions in automatic identification and data capture, Zebra not only enhances efficiency across industries like retail, healthcare, and logistics but also empowers organizations to harness the power of real-time insights. As we assess Zebra’s current market position and growth trajectory, I invite you to consider whether its fundamentals still align with its market valuation and future potential.

Table of contents

Company Description

Zebra Technologies Corporation, founded in 1969 and headquartered in Lincolnshire, Illinois, operates at the forefront of the communication equipment industry. The company specializes in enterprise asset intelligence solutions, offering a diverse range of products including printers, barcode scanners, RFID readers, and mobile computing devices. With a strong presence in retail, healthcare, manufacturing, and logistics, Zebra serves its global market through direct sales and a network of channel partners. The firm is recognized for its innovative approach in automatic identification and data capture solutions, positioning itself strategically as a leader in enhancing operational efficiency and visibility across various sectors.

Fundamental Analysis

In this section, I will analyze Zebra Technologies Corporation’s income statement, key financial ratios, and dividend payout policy to provide insights into its financial health and investment potential.

Income Statement

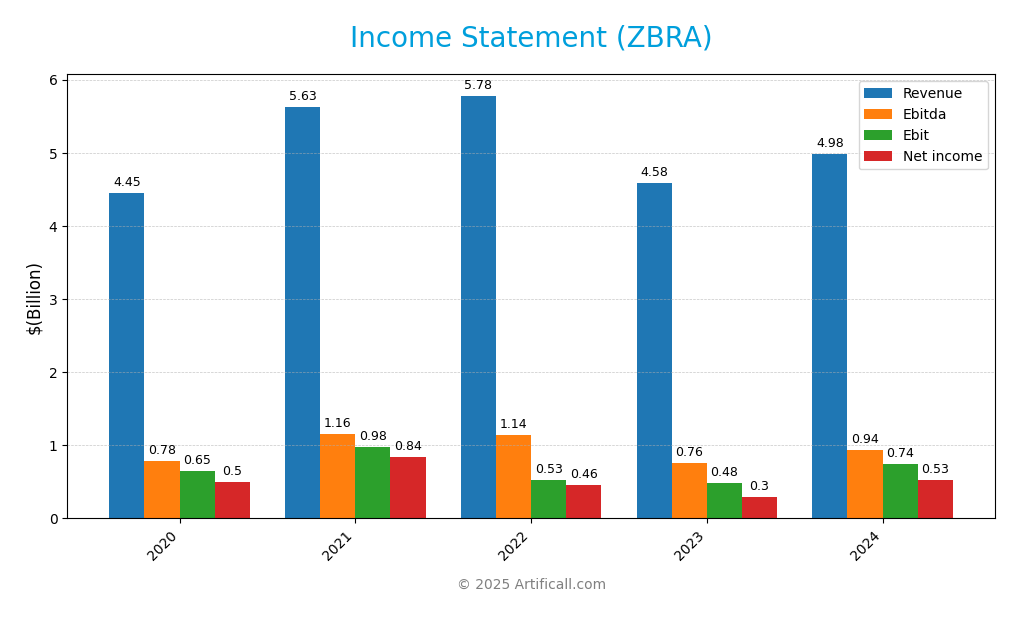

Below is the income statement for Zebra Technologies Corporation, summarizing key financial metrics over the last five years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.45B | 5.63B | 5.78B | 4.58B | 4.98B |

| Cost of Revenue | 2.45B | 2.99B | 3.16B | 2.46B | 2.57B |

| Operating Expenses | 1.35B | 1.65B | 2.10B | 1.64B | 1.67B |

| Gross Profit | 2.00B | 2.63B | 2.62B | 2.12B | 2.41B |

| EBITDA | 0.78B | 1.16B | 1.14B | 0.76B | 0.94B |

| EBIT | 0.65B | 0.98B | 0.53B | 0.48B | 0.74B |

| Interest Expense | 0.06B | 0.01B | 0.06B | 0.13B | 0.13B |

| Net Income | 0.50B | 0.84B | 0.46B | 0.30B | 0.53B |

| EPS | 9.43 | 15.66 | 8.87 | 5.76 | 10.25 |

| Filing Date | N/A | 2022-02-10 | 2023-02-16 | 2024-02-15 | 2025-02-13 |

Over the period from 2020 to 2024, Zebra Technologies Corporation experienced fluctuations in both revenue and net income, with a notable dip in 2023. Revenue peaked in 2022 at 5.78B but declined to 4.58B in 2023, while 2024 showed a recovery to 4.98B. Net income displayed similar trends, with a high of 0.84B in 2021, dropping to 0.30B in 2023, and rebounding to 0.53B in 2024. The gross profit ratio improved over the most recent year, indicating better cost management, despite the challenges faced in revenue generation. The latest performance suggests a cautiously optimistic outlook, but continued monitoring is recommended due to the revenue volatility.

Financial Ratios

The following table outlines the key financial ratios for Zebra Technologies Corporation (ZBRA) over the past five years.

| Financial Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11.33% | 14.87% | 8.01% | 6.46% | 10.60% |

| ROE | 23.51% | 28.05% | 16.94% | 9.75% | 14.72% |

| ROIC | 18.47% | 22.17% | 10.18% | 8.43% | 11.85% |

| P/E | 40.75 | 38.01 | 28.91 | 47.44 | 37.67 |

| P/B | 9.58 | 10.66 | 4.90 | 4.63 | 5.55 |

| Current Ratio | 0.69 | 0.94 | 0.81 | 1.05 | 1.43 |

| Quick Ratio | 0.41 | 0.67 | 0.44 | 0.54 | 1.03 |

| D/E | 0.65 | 0.38 | 0.80 | 0.80 | 0.66 |

| Debt-to-Assets | 26.12% | 18.42% | 29.21% | 33.04% | 29.64% |

| Interest Coverage | 8.57 | 195.80 | 8.82 | 3.62 | 5.75 |

| Asset Turnover | 0.83 | 0.91 | 0.77 | 0.63 | 0.63 |

| Fixed Asset Turnover | 10.88 | 13.96 | 13.32 | 9.59 | 10.55 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In the most recent year, ZBRA shows a net margin of 10.60%, which is a positive sign, indicating it retains a decent percentage of its revenue as profit. However, the return on equity (ROE) is relatively low at 14.72%, suggesting potential concerns in generating shareholder returns. The interest coverage ratio of 5.75 indicates that earnings are sufficient to cover interest expenses, but investors should monitor the increasing trend in debt levels, as evidenced by the D/E ratio of 0.66.

Evolution of Financial Ratios

Over the past five years, ZBRA’s financial ratios displayed a mixed trend. The net margin and ROE have experienced fluctuations, with a notable recovery in 2024. However, the current and quick ratios have improved significantly, indicating enhanced liquidity, while the P/E ratio experienced volatility, reflecting changing market valuations.

Distribution Policy

Zebra Technologies Corporation (ZBRA) does not currently pay dividends, reflecting a strategic focus on reinvesting profits into growth initiatives and research and development. This aligns with their high-growth phase, where capital is allocated towards expansion rather than shareholder distributions. However, the company engages in share buybacks, which can enhance shareholder value. Overall, this distribution strategy may support sustainable long-term value creation, provided that the company maintains its growth trajectory and effectively manages investment risks.

Sector Analysis

Zebra Technologies Corporation operates in the Communication Equipment industry, specializing in enterprise asset intelligence solutions with a robust portfolio of products and services. Key competitors include Honeywell and Datalogic, while Zebra’s strengths lie in its innovative technology and comprehensive service offerings.

Strategic Positioning

Zebra Technologies Corporation (ZBRA) holds a significant position in the automatic identification and data capture industry with a robust market share in enterprise asset intelligence solutions. The company’s diverse product range, including barcode scanners and RFID printers, positions it favorably against competitors amid growing technological disruptions. However, the industry faces heightened competitive pressure as new entrants leverage advanced technologies to capture market segments. With a beta of 1.671, ZBRA reflects moderate volatility compared to the market, emphasizing the importance of careful risk management for investors considering this stock.

Key Products

Zebra Technologies Corporation offers a wide range of products designed to enhance enterprise asset intelligence and improve operational efficiency. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| Printers | Zebra manufactures printers that produce labels, wristbands, tickets, receipts, and plastic cards. |

| Dye-Sublimation Thermal Printers | These printers create high-quality images for personal identification, access control, and transactions. |

| RFID Printers | Devices that encode data into passive RFID transponders, facilitating efficient asset tracking. |

| Barcode Scanners | Tools for capturing barcode data, enhancing inventory management and operational workflows. |

| Rugged Tablets | Enterprise-grade tablets designed for durability in demanding environments, suitable for various applications. |

| Real-Time Location Systems | Solutions that provide accurate tracking of assets and personnel within operational spaces. |

| Temperature-Monitoring Labels | Specialized labels used primarily in vaccine distribution to monitor temperature-sensitive products. |

| Workforce Management Solutions | Software solutions designed to optimize workforce efficiency and task management across various industries. |

| Cloud-Based Software Subscriptions | Subscription services that offer various software solutions for data management and operational analytics. |

| Robotics Automation Solutions | Innovative robotic solutions that enhance productivity and efficiency in various operational contexts. |

These products enable businesses in various sectors, such as retail, healthcare, and logistics, to improve visibility, enhance productivity, and streamline operations.

Main Competitors

Currently, I could not identify any reliable competitor data for Zebra Technologies Corporation. The available information does not provide specific names of competitors, which hinders a comprehensive analysis of the competitive landscape.

Zebra Technologies is estimated to hold a significant market share in the automatic identification and data capture solutions industry, operating in a niche that includes various sectors such as retail, healthcare, manufacturing, and logistics. However, without verified competitor data, I cannot give a complete picture of its competitive position or sector dominance.

Competitive Advantages

Zebra Technologies Corporation (ZBRA) boasts significant competitive advantages in the enterprise asset intelligence sector. Its comprehensive product range—including advanced barcode scanners, RFID solutions, and rugged mobile computing devices—positions it well within key industries like retail, healthcare, and logistics. The company’s commitment to innovation, exemplified by its cloud-based software and robotics automation solutions, opens doors to new markets and applications. Additionally, Zebra’s focus on maintenance and professional services enhances customer loyalty, ensuring a stable revenue stream. As the demand for automation and data capture grows, Zebra is poised for future growth and expansion.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats associated with Zebra Technologies Corporation to guide strategic decision-making.

Strengths

- Strong market presence

- Diverse product portfolio

- Innovation in technology

Weaknesses

- High dependency on specific sectors

- Limited dividend history

- Potential supply chain issues

Opportunities

- Growing demand for automation

- Expansion into emerging markets

- Increased focus on healthcare solutions

Threats

- Intense competition

- Economic downturns

- Rapid technological changes

The overall SWOT assessment indicates that Zebra Technologies has robust strengths and significant opportunities for growth, particularly in automation and healthcare. However, it must address its weaknesses and remain vigilant against competitive and economic threats to maintain its market position.

Stock Analysis

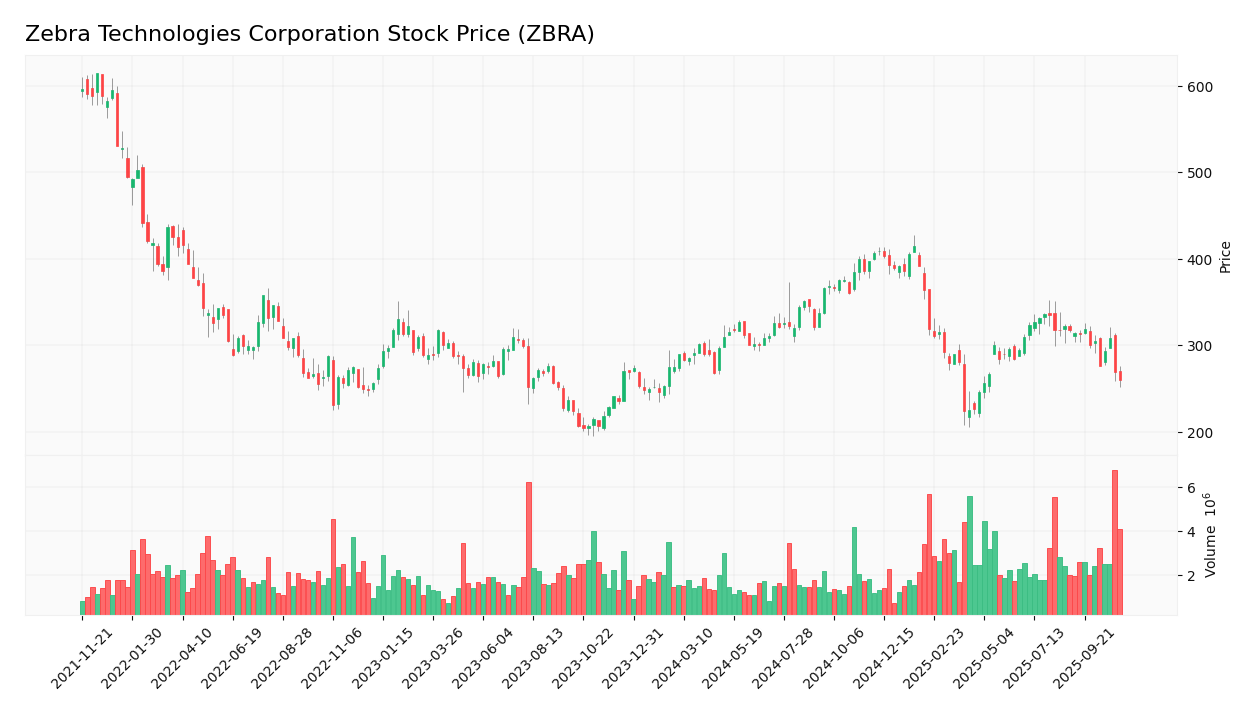

Over the past year, Zebra Technologies Corporation (ZBRA) has exhibited notable price movements characterized by a mix of volatility and trend dynamics, culminating in a current evaluation of its stock performance.

Trend Analysis

In the analyzed period of the past two years, ZBRA has experienced a price change of -3.94%, indicating a bearish trend overall. However, in the more recent timeframe from August 24, 2025, to November 9, 2025, the stock has seen a sharper decline of -19.59%. The trend is currently showing signs of deceleration, with a standard deviation of 46.07 highlighting significant volatility. The highest price recorded was 414.61, while the lowest was 223.49, showcasing a considerable range that investors should take into account.

Volume Analysis

Analyzing trading volumes over the last three months, the average trading volume stands at approximately 2.94M, with a distinct seller-driven activity observed in recent weeks. Buyer activity averaged around 1.20M, while seller activity was higher at about 1.73M, suggesting that sellers have been more dominant in the market. Despite this, the overall volume trend is bullish, indicating an uptick in market participation. The average volume increase reflects a trend slope of 233.62K, which may suggest growing investor interest, albeit with a cautionary note on the prevailing seller dominance.

Analyst Opinions

Recent analyst recommendations for Zebra Technologies Corporation (ZBRA) present a mixed outlook. On November 7, 2025, analysts rated the stock with a “B,” indicating a neutral stance. Key arguments include strong performance in return on equity (ROE) and return on assets (ROA), both rated as “Buy.” However, concerns regarding debt levels and price-to-earnings (PE) ratios led to “Strong Sell” and “Sell” recommendations for those metrics. Overall, the consensus leans towards a “Hold” for the current year, reflecting caution amid mixed financial indicators.

Stock Grades

No verified stock grades were available from recognized analysts for Zebra Technologies Corporation (ZBRA). As a result, I recommend exercising caution when considering investment decisions regarding this stock. It’s essential to keep an eye on market sentiment and any relevant news that could influence its performance.

Target Prices

No verified target price data is available from recognized analysts for Zebra Technologies Corporation (ZBRA). The general market sentiment appears cautious, reflecting uncertainty in the current economic landscape.

Consumer Opinions

Consumer sentiment towards Zebra Technologies Corporation (ZBRA) reflects a mix of appreciation for its innovative solutions and concerns over customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Zebra’s products are reliable and enhance our efficiency.” | “Customer service response times are frustratingly slow.” |

| “The technology is cutting-edge and user-friendly.” | “I faced issues with product compatibility.” |

| “Excellent durability and performance in harsh conditions.” | “Pricing is higher compared to competitors.” |

Overall, consumer feedback highlights Zebra’s strong product reliability and innovation, while pointing out weaknesses in customer service responsiveness and pricing challenges.

Risk Analysis

In evaluating Zebra Technologies Corporation (ZBRA), it’s essential to understand the various risks that could impact its performance. Below is a summary of significant risks to consider.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for hardware and software solutions. | High | High |

| Supply Chain Risk | Disruptions in the supply chain affecting product availability. | Medium | High |

| Regulatory Risk | Changes in regulations impacting operational costs and compliance. | Medium | Medium |

| Technological Risk | Rapid technological advancements could outpace company innovations. | High | High |

| Competitive Risk | Increased competition in the tech and logistics sectors. | High | Medium |

Zebra Technologies faces high market and technological risks, as the industry is rapidly evolving. Recent trends show a surge in demand for automation and data capture solutions, making it crucial for ZBRA to innovate continually to maintain its competitive edge.

Should You Buy Zebra Technologies Corporation?

Zebra Technologies Corporation has showcased a robust net profit margin of 10.60% and a return on invested capital (ROIC) of 11.85%, comfortably exceeding its weighted average cost of capital (WACC), alongside a positive long-term trend in its performance. However, recent seller volumes indicate a cautious market sentiment.

Based on the current financial metrics, Zebra Technologies appears favorable for long-term investors, especially given its solid net margin and ROIC. The long-term trend is positive, signaling potential for growth, although the recent seller volumes suggest that it might be prudent to wait for clearer buyer support before making a significant investment.

The company faces risks associated with competition and market dependence, particularly in its technology and manufacturing sectors.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Andra AP fonden Raises Stake in Zebra Technologies Corporation $ZBRA – MarketBeat (Nov 08, 2025)

- Zebra Technologies (ZBRA) Files Form 8-K with SEC – GuruFocus (Nov 06, 2025)

- Truist Expects Zebra Technologies’ (ZBRA) Q3 To Be A “Mixed Bag” – Yahoo Finance (Oct 23, 2025)

- Zebra Technologies Tops Q3 Views, Guides Above Estimates – Investor’s Business Daily (Oct 28, 2025)

- Zebra Technologies May Be A 2026 Growth Story (Rating Upgrade) (NASDAQ:ZBRA) – Seeking Alpha (Oct 29, 2025)

For more information about Zebra Technologies Corporation, please visit the official website: zebra.com